#PORTAL/USDT Medium-term Bullish potential#PORTAL

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the ascending channel, at 0.0515.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.0512, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.0518.

First target: 0.0544.

Second target: 0.0566.

Third target: 0.0595.

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

Portal

#PORTAL/USDT#PORTAL

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on track to break it strongly upwards and retest it.

We have support from the lower boundary of the ascending channel, at 0.0414.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.0413, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.0448

First target: 0.0467

Second target: 0.0486

Third target: 0.0508

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

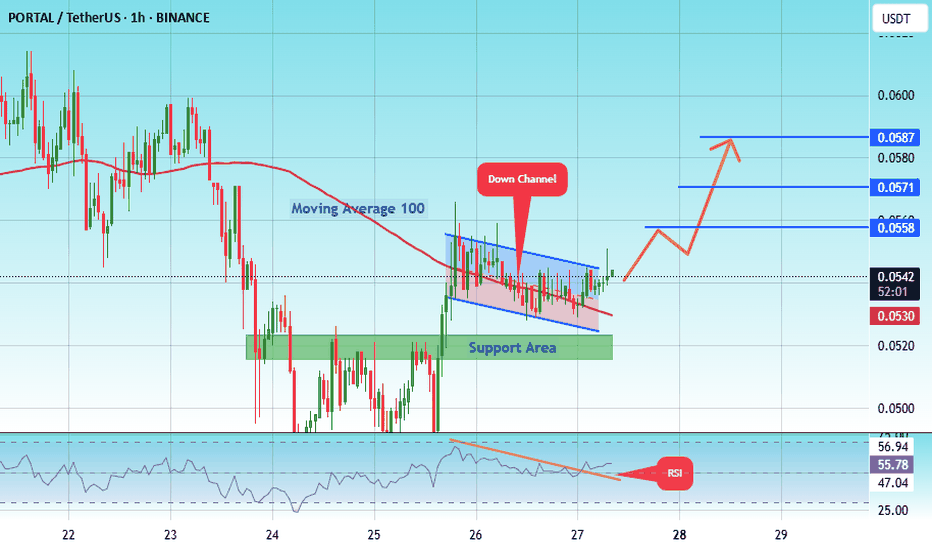

#PORTAL/USDT Medium-term Bullish potential#PORTAL

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel, at 0.0527.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.0520, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.0543

First target: 0.0558

Second target: 0.0571

Third target: 0.0587

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#PORTAL/USDT#PORTAL

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bounce from the lower boundary of the descending channel. This support is at 0.0494.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 0.0461, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.0584

First target: 0.0648

Second target: 0.0727

Third target: 0.0840

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

$PORTAL / PORTALUSDTGOOD LUCK >>>

• Warning •

Any deal I share does not mean that I am forcing you to enter into it, you enter in with your full risk, because I'll not gain any profits with you in the end.

The risk management of the position must comply with the stop loss.

(I am not sharing financial or investment advice, you should do your own research for your money.)

PORTAL (SPOT)BINANCE:PORTALUSDT

#PORTAL/ USDT

Entry .0385

SL 4H close below .0354

T1 0.0525

T2 0.0642

_______________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

PORTALUSDT Forming Descending TrianglePORTALUSDT is drawing significant attention from crypto traders and investors as this project shows signs of explosive potential. With an expected gain ranging from 240% to 250%+, PORTALUSDT stands out as one of the most promising altcoins to watch in the current market environment. Although there is no confirmed pattern on the chart yet, the consistent price action hints at a potential accumulation phase that could lead to a breakout once momentum shifts decisively to the upside.

The trading volume for PORTALUSDT remains strong and supportive, indicating that large market participants may already be positioning themselves ahead of the next big move. This increase in volume is often an early indicator of heightened interest and liquidity, which can create the perfect conditions for a powerful price rally. Investors are paying close attention to this pair, and any confirmation of a breakout could quickly trigger a surge in demand.

What makes PORTALUSDT especially appealing is the growing investor interest in the project itself. As the crypto community continues to search for high-reward opportunities, coins like PORTALUSDT with solid fundamentals and a committed community are positioned to attract fresh capital inflows. This could serve as a major catalyst for the projected gains and support a sustained bullish trend in the weeks ahead.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

PORTAL / PORTALUSDTBack again with this monster chart>>>

Let’s see how it plays out!

• Warning •

Any deal I share does not mean that I am forcing you to enter into it, you enter in with your full risk, because I'll not gain any profits with you in the end.

The risk management of the position must comply with the stop loss.

(I am not sharing financial or investment advice, you should do your own research for your money.)

PORTALUSDT Forming Descending TrianglePORTALUSDT is catching traders’ eyes as it forms a classic descending triangle pattern, which is known for its clear breakout potential. While this pattern is typically seen as a bearish continuation, in certain market conditions with strong volume and investor backing, a descending triangle can flip to produce explosive bullish moves. The good volume levels seen recently suggest that large players are accumulating positions quietly, setting the stage for a major breakout that could deliver impressive returns.

Technical traders watching PORTALUSDT should keep an eye on the horizontal support line of the triangle and the downward-sloping trendline acting as resistance. A confirmed breakout above this resistance with strong volume could unlock a massive price surge, with an expected gain ranging from 190% to 200%+. Such setups attract both pattern traders and momentum investors looking to capitalize on sharp moves.

Fundamentally, investors are showing renewed interest in the PORTAL project, adding more credibility to the technical setup. Positive sentiment and fresh capital flowing into the project can be the driving force behind a big breakout rally. For swing traders and position traders, this could be an ideal setup to ride the next big move with clearly defined risk levels below the support zone.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

#PORTALbullish confirmation#PORTAL

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.0283.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.0281, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.0317

First target: 0.0295

Second target: 0.0305

Third target: 0.0317

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#PORTALUSDT NEXT MOVE ?#PORTAL

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 0.0284, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.02750.

Entry price: 0.0288.

First target: 0.0297.

Second target: 0.0310.

Third target: 0.0325.

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

#PORTAL/USDT#PORTAL

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, which supports the upward move by breaking it upward.

We have a support area at the lower limit of the channel at 0.0328, acting as strong support from which the price can rebound.

Entry price: 0.0335

First target: 0.0346

Second target: 0.0358

Third target: 0.0370

#PORTAL/USDT#PORTAL

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.0347.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading for stability above the 100 Moving Average.

Entry price: 0.0355

First target: 0.0366

Second target: 0.0384

Third target: 0.0400

#PORTAL/USDT#PORTAL

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, which supports the upward move by breaking it upward.

We have a support area at the lower limit of the channel at 0.0420, acting as strong support from which the price can rebound.

Entry price: 0.0431

First target: 0.0438

Second target: 0.0448

Third target: 0.0460

#PORTAL/USDT#PORTAL

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.0480.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are heading toward stability above the 100 Moving Average.

Entry price: 0.0486

First target: 0.0494

Second target: 0.0501

Third target: 0.0510

#PORTAL/USDT#PORTAL

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.0622.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.0698

First target: 0.0742

Second target: 0.0799

Third target: 0.0864

#PORTAL/USDT#PORTAL

The price is moving within an ascending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, which supports the upward move by breaking it upward.

We have a support area at the lower limit of the channel at 0.0600, which acts as strong support from which the price can rebound.

Entry price: 0.0616

First target: 0.0654

Second target: 0.0700

Third target: 0.0750

PORTAL: Close Stop-Loss, High Targets#PORTAL, listed on Binance in Feb 2024, faced heavy selling pressure, crashing over -95% since launch, raising concerns about Binance's integrity.

However, maintaining $0.0666 is critical as it opens the door for a strong recovery, but losing it risks new ATLs.

#Portal

#PORTAL/USDT#PORTAL

The price is moving within a descending channel on the 1-hour frame and is expected to continue lower.

We have a trend to stabilize below the 100 moving average once again.

We have a downtrend on the RSI indicator, supporting the upward move with a break above it.

We have a resistance area at the upper limit of the channel at 0.0880.

Entry price: 0.0866

First target: 0.0850

Second target: 0.0823

Third target: 0.0788

#PORTAL/USDT#PORTAL

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, which supports the upward move by breaking it upward.

We have a support area at the lower limit of the channel at 0.0871, acting as strong support from which the price can rebound.

Entry price: 0.0950

First target: 0.991

Second target: 0.1022

Third target: 0.1060

#PORTAL/USDT#PORTAL

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.0690.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.0732

First target: 0.0735

Second target: 0.0770

Third target: 0.0795

#PORTAL/USDT#PORTAL

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.1070

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.1100

First target 0.1182

Second target 0.1247

Third target 0.1334