Positiontrade

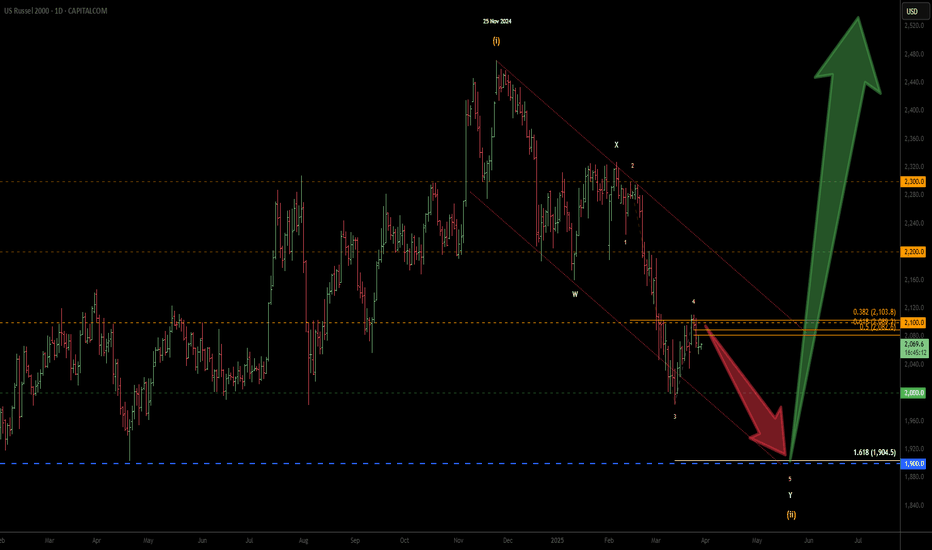

Russell 2000 - C wave to complete correction?I have been bearish on the Russell for a long time. nothing has changed. the wave count is getting clearer... at least for now.

price action as of late has been like watching paint dry on the wall, still waiting for a catalyst... coming soon, i believe.

this count would only be invalidated with a sustained break above resistance zone.

**minor change from my previous charts - i have simplified the wave counts from a (WXYZ) to (ABC).

Russell 2000 - Sell till late May & Buy in Early June?

Wave (ii) is still in progress. Slight update to the primary wave count from the previous one below.

200 & 100 SMA's are sloping firmly to the downside therefore I will continue to keep selling at technical levels. Late May or early June would be a good time to go long...

Support levels are shown in green.

Russell 2000 - one more drop to complete the correction?Looking for the double zig zag correction to complete (Y) leg in the blue zone. Will be looking for five waves to the downside for the target.

Updated the wave count from my previous chart below...

This drop from the 25th November 2024 to the expected target zone would be more or less similar to the Covid drop in terms of percentage.

Russell 2000 - 5th wave of Y leg may already be in progress... The rejection at 2100 price level also happens to be the 38.2% Fib of the decline from the 14th of February 2025. The decline from 6th of February 2025 counts beautifully as waves 1, 2, 3 & 4. If this wave count is correct, then the Russell is currently in wave 1 of 5 of Y of (ii).

This is my primary wave count as long as the 2100 resistance is not breached.

This changes my initial wave count from a complex WXYXZ to a simple WXY.

Click on the link to see the previous wave count which is still valid and is now an alternate wave count if the 2100 resistance is breached:

Only updating the wave count. My bias and direction remain the same.

Wave Y is possibly in progress. Looks like we are going to have a bearish April & possibly May as well. Selling corrective rally is still the way to trade for now. Take profit at 1905/1900, which is where technically, the Russell 2000 will possibly turn up for wave (iii).

Stop Loss can be placed above wave 4, well out of the way in case of any wild swing on this PCE Friday.

Russell 2000 - time to Buy pullbacks...Shorts were good while it lasted... looks like a good time to buy pullbacks.

It would be wise to wait for a clear 3 wave correction though.

Elliot Wave Analysis shows a larger degree wave IV was completed in March 2020.

Since then, the Russell 2000 has been nesting within a bullish rectangle chart pattern, possibly working its way up to the larger degree wave V.

Seasonality Chart shows a bullish April with a possible correction in May.

Nevertheless, I will not commit to long trades till the chart clearly shows that we are out of the woods. A clear 3 waves move down closer to 1800 in the hourly/4 hourly time frame would be a good setup.

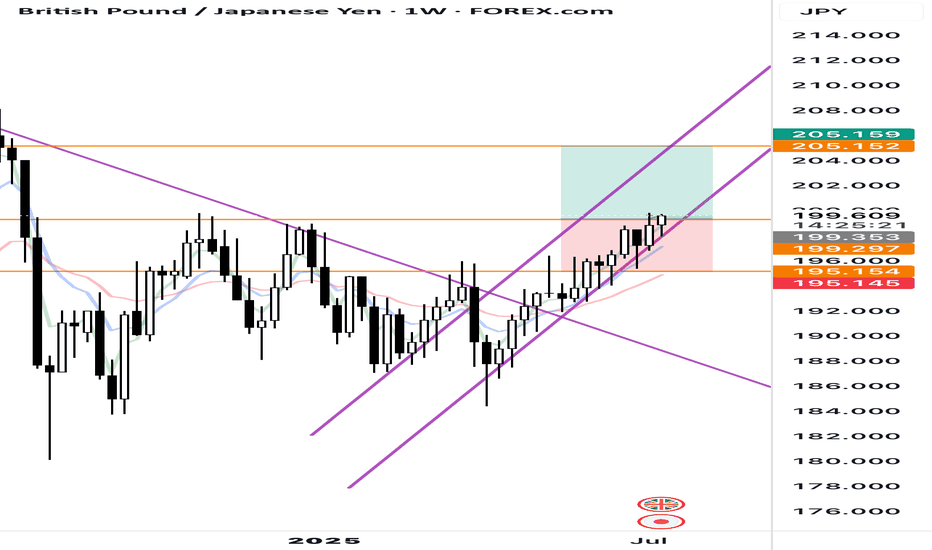

GBPMXN LONG OUTLOOK BULLISHstarting from a 3 month view of currency pair and dissecting it to monthly and lastly the weekly chart. Outlook is showing some support and is showing potential move to upside as you can see from analysis where my support and resistant areas are also trend channels, what do you guys think?

EUR USD - the battle of parityG'day traders,

Welcome back to a new trading year.

First up, i'll be taking a look at the EURO/USD as it is still in a strong downward to the right pattern respecting the strong curve of the weekly trendline.

Please see below the Daily and weekly charts marked up.

Follow along the video and hope it assists with your trading.

I'll be looking for sells upon daily closes, weekly set and forget supply limits. Demand limits.

Master Key for zones

Red = Three Month

Blue = Monthly

Purple = weekly

Pink = Consolidative box example (Daily)

Orange = Daily

Risk Warning

Trading leveraged products such as Forex, commodities and CFDs, carries with it a high level of risk and so may not be suitable for every investor. Prior to trading the foreign exchange, commodity or CFD market, consider your investment objectives, level of experience and risk appetite. You should never risk more than you can afford to lose. If you fail to understand or are uncertain of the risks involved, please seek independent advice and remember to conduct due diligence as criteria varies to suit the individual.

Below are some of the take aways from the video - please listen again incase any detail is missed.

Previous charts

Daily Chart

Weekly Chart

Updated in line with the video:

Daily

Weekly

Do you enjoy the setups?

Professional analyst with 8+ years experience in the capital markets

Focus on technical output not fundamentals

Focus on investing for long term positional moves

Provide updates where necessary - with new updated ideas tracking the progress.

If you like the idea, please leave a like or comment.

To all the followers, thank you for your continued support.

LVPA

MMXXV

$ETHUSD Head and Shoulders UpdateThis chart of Ethereum (ETH/USD) on the 12-hour timeframe presents several key technical analysis insights that suggest a potential bullish trend. Notably, an inverse Head and Shoulders (H&S) pattern is visible, with the left shoulder, head, and right shoulder clearly defined. This formation typically signals a bullish reversal when confirmed. The head represents a significant lower low compared to the shoulders, while the right shoulder aligns symmetrically with the left, indicating recovery behavior.

The volume profile on the right side of the chart reveals significant trading activity between $3,000 and $3,500, forming a high-volume node. Above $3,700, there are volume gaps that could result in rapid price movements if the price breaks out upward. Resistance at $3,700 aligns with the top of a wedge pattern, while a larger breakout target zone is identified between $6,000 and $7,000, suggesting significant upward potential if the bullish momentum persists.

Several break-of-structure (BOS) levels are marked on the chart, which highlight pivotal price action shifts. These levels serve as dynamic support and resistance points. A descending trendline, in place since November, has recently been broken, aligning with the inverse H&S pattern to reinforce the bullish outlook. The Stochastic Oscillator at the bottom of the chart shows a clear downtrend in momentum over a 72-hour and 4-hour window, but bullish divergence is forming. While momentum continues to make lower lows, the price action is showing higher lows, indicating a potential upward breakout in the near term.

Finally, support zones are evident around $2,400–$2,700, based on historical lows and high-volume trading activity. If the bullish momentum weakens, these areas could provide a safety net for price action. However, with the current alignment of bullish patterns, the focus remains on breaking the $3,700 resistance level, which could open the door to significant upward movement toward the $6,000–$7,000 target.

How to Trade a Platform: Position-Style Entry and Exit SignalsPlatform Position Style Trading is a trading style that is ideal for those of you who have a career and can only trade once a week to a few times a week. It is also great for retirees who do not want to sit all day monitoring your stocks.

It is a very low-risk trading style with higher profit potential, as the hold time is a week to a few weeks.

The platform is the Buy Zone for Dark Pools who trade OFF the public exchanges on unlit Alternative Trading Venues. There are 50 ATS venues. There are 15 public exchanges where all retail trading is transacted.

The Dark Pools create small incremental price action that is always horizontal as they control price to the penny spread and have a tight price range that pings their TWAP orders and other professional types of orders not available to retail traders.

Professional traders who trade as a business independently, search for the liquidity draw and the tight price action so they can nudge an HFT or MEME group to drive price up speculatively while the pros take huge profits.

If you learn to get in with the professional traders, then your profits will be significantly higher. Risk is minimal because Dark Pools accumulate over several months, often 3 - 6 months, and that provides you with the time to enter. Then, you can ride the momentum or velocity run up with the professionals. The TT Accum/Dist and Volume Oscillators provide entry confirmation signals before the price moves up and exit signals BEFORE the price moves down. Hybrid Leading Indicators are important for trading the modern stock market which is automated and transacts on the millisecond scale on the professional side.

BTCUSDT, Still in Down trend until Day Close above 99540BTCUSTD, market structure update:

It is in Down trend and ranging market until Day Close above 99540 as shown.

Trade Idea:

For Long entry:

1. Waiting for a retest on H4 timeframe (a higher Low formed) within 3 days OR

2. Breakout D1 chart Key Resistance level.

Golden Horizons: Technical Precision Meets Fundamental PowerOANDA:XAUUSD - Daily

Gold’s Bullish Breakout Shines Bright!

Gold (XAU/USD) has confirmed a strong breakout from a Falling Wedge and Rounding Bottom, rebounding off the 50% Fibonacci level (2,533.75). With the next target at the 161.8% extension (3,107.09), this setup offers a potential 16.49% gain in just 77 days. Ideal for position traders seeking long-term growth and swing traders capitalising on interim moves. 🚀✨

🌟 Technical Highlights: Gold’s Bullish Setup in Focus

Gold (XAU/USD) is setting the stage for a remarkable upward journey, supported by two key bullish patterns that signal strong momentum ahead:

1. Falling Wedge

The recent breakout from a falling wedge pattern is a textbook example of a bullish continuation. This move signals the end of a consolidation phase, where sellers lose control and buyers step in decisively. The breakout is accompanied by strong momentum, confirming that the bulls are in command and driving prices higher.

2. Rounding Bottom Formation

Adding to the bullish case is a clear rounding bottom pattern, a powerful long-term reversal signal. This pattern reflects steady accumulation by buyers, often seen as the market transitions from bearish sentiment to a confident bullish trend. It provides a solid base for sustained upward movement.

After retracing to the 50% Fibonacci level (2,533.75), the price rebounded strongly, breaking out with conviction. The next key target lies at the 161.8% Fibonacci extension (3,107.09), representing a potential 16.49% gain over the next 77 days.

This setup combines technical precision with a clear path for growth, making it a compelling opportunity for traders to watch. Gold’s journey upward is gaining momentum—don’t miss the move!

🌍 Fundamental Insights: Gold’s Shining Role

Gold continues to solidify its status as the ultimate safe-haven asset, thriving on a combination of global uncertainties and supportive monetary policies. The Federal Reserve’s dovish stance, characterised by steady interest rates, has reduced the appeal of fixed-income investments, making gold a preferred alternative for investors seeking stability in a low-yield environment.

Simultaneously, persistent inflationary pressures and geopolitical tensions are driving investors toward gold as a hedge against declining purchasing power and economic instability. As crises in key regions escalate, gold’s reputation as a reliable store of value during turbulent times becomes even more pronounced. This blend of factors is propelling gold’s bullish momentum, appealing to both long-term investors and short-term traders eager to capitalise on its growing demand. Gold isn’t just performing; it’s standing out as a pillar of strength in today’s unpredictable financial landscape.

📆 Seasonal Boost: The Golden Demand Wave

Gold traditionally enjoys heightened demand in the first quarter, driven by cyclical buying patterns in key markets like India and China. In India, the wedding season and festivals fuel a surge in gold purchases, while in China, the Lunar New Year celebrations see gold as a symbol of wealth and prosperity. These cultural and seasonal factors consistently create upward pressure on prices during this period.

This seasonal demand perfectly aligns with gold’s current technical breakout and strong fundamental support. The convergence of these factors strengthens the bullish outlook, making the first quarter a historically proven and timely opportunity for traders and investors to capitalise on gold’s momentum.

🙏✨ Thank You for Reading!

Wishing you incredible success on your trading journey! 🌟 Always remember, proper risk management is the cornerstone of sustainable growth in the markets. Stay disciplined, stay confident, and let the charts guide your path.

📈💼 Good luck with your trades—may profits be ever in your favor! 🚀💰