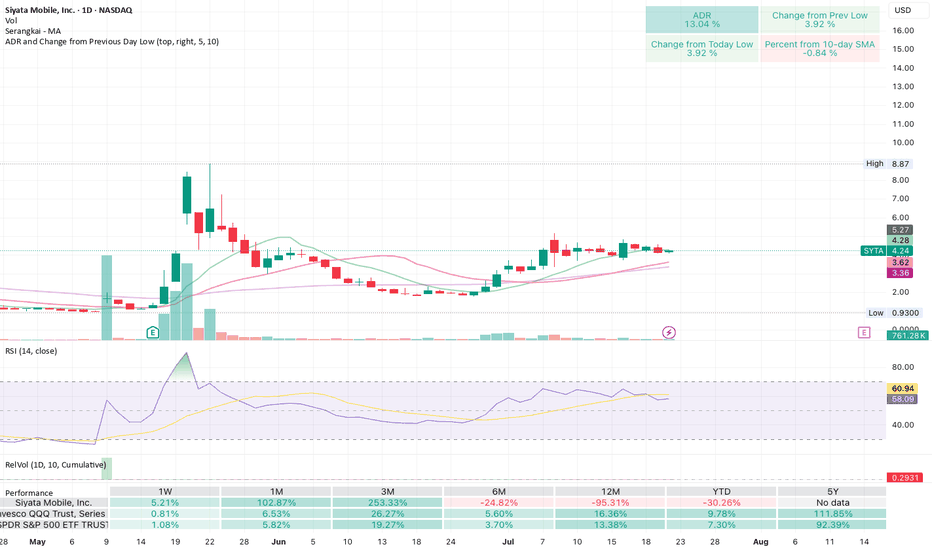

Getting ready to blow! Cup and handle after positive surprisesSiyata makes 2-way telecoms for things like first responders, miltary, construction crews.

Had big earnings and revenue surprises a few weeks ago, and now looks to be forming a cup and handle. Low volume yesterday shows a squeeze pattern like it's getting ready to go.

Positive

United Airlines Holdings, IncKey arguments in support of the idea.

International routes continue to experience high demand. While the U.S. domestic market is in a less favorable position, especially the low-cost carrier (LCC) segment, the company is benefiting from foreign tourists. However, it's worth noting that the U.S. Travel Association (USTA) reports the opposite: demand from U.S. citizens for domestic tourism remains strong. We expect the situation in domestic flights to improve by summer 2025. During the reporting period, United emphasized that its premium offerings continue to drive revenue growth, with demand from American tourists for international flights remaining stable.

Our 12-month forecast maintains the possibility of a positive surprise for the company. UAL’s pricing power is generally stronger than that of competitors, allowing the company to maintain a high level of revenue per passenger mile and profit margins.

Progress in tariff negotiations has given a strong boost to the stock. Currently, UAL shares are trading above their 200-day moving average with an RSI near overbought levels. However, if political progress continues, this momentum could persist. The 2-month target price for UAL is $97, and we recommend setting a stop loss at $72.8.

The 2-month target price for UAL is $97. We recommend setting a stop loss at $72.

TMGH Rising Trend AnalysisTMG Holding trend is still in progress in its upward trend between the support line 53.823 and the resistance line 52.573, up by 0.19%. It is expected to keep rising till breaking the 1st resistance line at 53.6115 and then the 2nd one at 53.719 points because of positive news about the announcement of SothMed's second phase launch of on Mediterranean, which generated EGP 70 Billion sales.

Nice squeeze ETHWe're still in a negative trend from December, but as you can see the situation is becoming a squeeze, what happens often after this is, if the green indicator breaks this line, there is a good chance that the next consolidation will be around 2000

Normally when that happens, people react and buy because they think its going to continue, and this brings more liquidity to the market

its is what is called FOMO - fear of losing out, and it can affect the actual trajectory big time

causing it to continue its climb until no one has any more funds to put in

but looking at the previous years of Eth and whats been happening this year, its the lowest eth has been in three years at this time of year

its an indicator too that anyone who is actually interested in eth will get on board, because of these trend signs.

So what ever your ideas or choices, know that Eth has a very strong buying price point right now. It can't really get much better.

POSI 1H Investment Long Aggressive Trend TradeAggressive Trend Trade

- short impulse

+ exhaustion volume

- resistance level

+ long volume distribution

Calculated affordable stop limit

1/2 1M take profit

1D Trend

"+ long impulse

+ support level

+ T2 level?

+ 1/ 2 correction

+ weak approach"

1M Trend

"+ long impulse

+ 1/2 correction

+ biggest volume expanding T1

+ support level

+ biggest volume manipulation"

1Y Impulse

+ long impulse

POSI 1H Swing Long Conservative Trend TradeConservative Trend Trade

+ long impulse?

+ exhaustion volume

+ support level

+ long volume distribution

Calculated affordable stop limit

1/2 1M take profit

1D Trend

"+ long impulse

+ support level

+ T2 level?

+ 1/ 2 correction

+ weak approach"

1M Trend

"+ long impulse

+ 1/2 correction

+ biggest volume expanding T1

+ support level

+ biggest volume manipulation"

1Y Trend

+ long impulse

Gold price trades with mild positive bias, upside potential seem

OANDA:XAUUSD Gold price trades with mild positive bias, upside potential seems limited

4 January 2024

•Gold price ticks higher and moves further away from over a one-week trough touched on Wednesday.

•An uptick in US bond yields acts as a tailwind for the USD and might cap any meaningful upside.

•Traders now look to the US ADP report for a fresh impetus ahead of the key NFP data on Friday.

Gold price (XAU/USD) dived to a one-and-half-week low on Wednesday in the wake of rising US Treasury bond yields and a stronger US Dollar. The US bond yields, however, started losing traction after minutes of the December 12-13 FOMC meeting reflected a consensus among policymakers that inflation is under control and the downside risks to the economy associated with an overly restrictive stance. This, along with a generally weaker tone around the equity markets, allowed the precious metal to attract some buyers near the $2,030 area and gain some follow-through traction during the Asian session on Thursday.

The minutes, however, did not provide any clues about the timing of when the Fed will start cutting interest rates. This comes on the back of Richmond Fed President Thomas Barkin's remarks that interest rate hikes remain on the table and act as a tailwind for the US bond yields, which should limit any meaningful downside for the Greenback and cap the Gold price. Meanwhile, traders are seeking more clarity on the Fed's policy outlook. Hence, the focus will remain glued to the release of the closely-watched US monthly employment details – popularly known as Nonfarm Payrolls (NFP) report on Friday.

In the meantime, Thursday's US economic docket, featuring the ADP report on private-sector employment and the usual Initial Jobless Claims, will be looked upon for short-term trading opportunities later during the early North American session. Nevertheless, doubts over the possibility of early interest rate cuts by the Fed might hold back traders from placing aggressive bullish bets around the non-yielding Gold price, warranting some caution before confirming that a one-week-old downtrend has run its course.

Daily Digest Market Movers: Gold price attracts some dip-buying, albeit lacks bullish conviction

•Bets that the Federal Reserve will cut rates in March, along with geopolitical tensions, help the Gold price to build on the overnight bounce from over a one-week low.

•The December FOMC meeting minutes revealed that members generally viewed the addition of 'any' to the statement as an indication that policy rates are likely near peak.

•Policymakers observed progress on inflation, though noted that circumstances might warrant keeping interest rates at the current level longer than they currently anticipate.

•Moreover, the minutes did not provide direct clues about the timing of when a series of interest rate cuts in 2024 might commence.

•Richmond Fed President Thomas Barkin on Wednesday expressed confidence that the economy is on its way to a soft landing and said that rate hikes remain on the table.

•The yield on the benchmark 10-year US government bond holds steady below 4.0%, which should act as a tailwind for the US Dollar and cap the non-yielding yellow metal.

•The Institute for Supply Management (ISM) said on Wednesday that the pace of decline in the US manufacturing sector slowed amid a modest rebound in production.

•The US ISM Manufacturing PMI improved to 47.4 last month from 46.7 in November, though remained in contraction territory for the 14th consecutive month.

•The Labor Department’s Job Openings and Labor Turnover Survey (JOLTS) showed that employment listings fell to 8.79 million in November – the lowest since March 2021.

•Traders now look to the US ADP report, which is expected to show that private-sector employers added 115K jobs in December as compared to the 103K in the previous month.

•The market focus, however, will remain glued to the official monthly employment details – popularly known as the Nonfarm Payrolls (NFP) report on Friday.

Technical Analysis: Gold price might now face resistance near the $2,048-2,050 horizontal zone

From a technical perspective, the overnight breakdown and acceptance below the $2,050-$2,048 resistance-turned-support favours bearish traders. That said, oscillators on the daily chart are still holding in the positive territory and warrant some caution. Hence, it will be prudent to wait for some follow-through selling below the overnight swing low, around the $2,030 area before positioning for any further depreciating move.

The Gold price might then accelerate the slide towards the 50-day Simple Moving Average (SMA), currently around the $2,012-2,011 area, en route to the $2,000 psychological mark. A sustained break below the latter might shift the near-term bias in favour of bearish traders.

On the flip side, momentum back above the $2,050 region now seems to confront stiff resistance near the $2,064-2,065 area. The next relevant hurdle is pegged near the $2,077 horizontal zone, which if cleared decisively should allow the Gold price to aim back towards reclaiming the $2,100 mark.

US Dollar price this week

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the Japanese Yen.

USD EUR GBP CAD AUD JPY NZD CHF

USD 1.16% 0.44% 0.66% 1.08% 1.64% 0.84% 0.91%

EUR -1.01% -0.55% -0.36% 0.08% 0.49% -0.17% -0.16%

GBP -0.46% 0.55% 0.22% 0.63% 1.27% 0.38% 0.38%

CAD -0.66% 0.33% -0.03% 0.41% 0.98% 0.16% 0.19%

AUD -1.09% -0.08% -0.63% -0.44% 0.38% -0.26% -0.22%

JPY -1.65% -0.44% -1.12% -0.79% -0.40% -0.65% -0.79%

NZD -0.83% 0.19% -0.38% -0.17% 0.27% 0.65% 0.03%

CHF -0.85% 0.17% -0.37% -0.17% 0.25% 0.78% 0.01%

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

ADBE - Rising Trend Channel [MID TERM]- ADBE is in a rising trend channel in the medium long term.

- ADBE is approaching's resistance at 390 , which may give a negative reaction.

- However, a break upwards through 390 will be a positive signal.

- ADBE is assessed as technically neutral for the medium long term.

*EP: Enter Price, SL: Support, TP: Take Profit, CL: Cut Loss, TF: Time Frame, RST: Resistance, RTS: Resistance to be Support LT TP: Long Term Target Price

*Chart Pattern:

DT - Double Top | BEARISH | RED

DB - Double Bottom | BULLISH | GREEN

HNS - Head & Shoulder | BEARISH | RED

REC - Rectangle | BLUE

iHNS - inverse head & Shoulder | BULLISH | GREEN

Verify it first and believe later.

WavePoint ❤️

$NNOX Receives FDA 510K, Next Big Catalyst?The stock that I like so much finally received FDA 510K on the Nanox.ARC X-ray system. As much as it been short-selled into the ground, I am still heavily invested in it, and I think many of the catalyst in terms of early market and tech validation have already passed. It may not be smooth sailing, but I am still interested in Nanox for the long term, and am still here. That said, none of this is financial or investment advice. Information provided is "as-is". Do your own due-diligence.

XLK- Rising Trend Channel [MID TERM]- XLK shows strong development within a rising trend channel in the medium long term.

- The stock has broken a resistance level in the short term and given a positive signal for the short-term trading range.

- XLK is testing resistance at 151.

- This could give a negative reaction, but an upward breakthrough of 151 means a positive signal.

- Volume tops and volume bottoms correspond badly with tops and bottoms in the price.

- This weakens the rising trend and could be an early signal of a coming trend break.

- RSI diverges negatively against the price, which indicates danger of a reaction downwards.

- Overall assessed as technically neutral for the medium long term.

*EP: Enter Price, SL: Support, TP: Take Profit, CL: Cut Loss, TF: Time Frame, RST: Resistance, RTS: Resistance to be Support LT TP: Long Term Target Price

*Chart Pattern:

DT - Double Top | BEARISH | RED

DB - Double Bottom | BULLISH | GREEN

HNS - Head & Shoulder | BEARISH | RED

REC - Rectangle | BLUE

iHNS - inverse head & Shoulder | BULLISH | GREEN

Verify it first and believe later.

WavePoint ❤️

QQQ - Rising Trend Channel [MID TERM]- QQQ has given a positive signal from the double bottom formation by a break up through the resistance at 294.

- Further rise to 327 or more is signaled.

- The stock is between support at 318 and resistance at 334.

- A definitive break through of one of these levels predicts the new direction.

- Volume has previously been low at price tops and high at price bottoms.

- Overall assessed as technically positive for the medium long term.

*EP: Enter Price, SL: Support, TP: Take Profit, CL: Cut Loss, TF: Time Frame, RST: Resistance, RTS: Resistance to be Support LT TP: Long Term Target Price

*Chart Pattern:

DT - Double Top | BEARISH | RED

DB - Double Bottom | BULLISH | GREEN

HNS - Head & Shoulder | BEARISH | RED

REC - Rectangle | BLUE

iHNS - inverse head & Shoulder | BULLISH | GREEN

Verify it first and believe later.

WavePoint ❤️

For Me MSFT Looks Bullish As It is Shown on the chart I think $MSFT is going to go up to reach 262$ in the Mid-term and to 280$ As a next target

Keep in mind that it has an earning forecast today ( and I think it will be positive ) as appears on the price action on the chart.

This is my Humble opinion

Please left a comment about What do you think

Tip toe around a Christmas Rally this yearSo here we are not to many deviations away from the last post on Hedged Equity funds being firmly in positive gamma territory.

Overall gamma for the S&P 500 options chain has been positive 15 straight trading days.

This indicates a 0.20% daily distribution along with a VIX that continues to compress into 2023.

However, there are indicators suggesting VIX is now oversold and may test higher ranges over the next month.

This would reflect a rug pull in December for JHEQX reset at the end of Dec.

There is only 1 man capable of such a rug pull.

Here are some economic event dates to prepare for.

Nov 30th Jerome Powell speech at 2pm

Dec 9th is PPI (before CPI may hint to next headline CPI)

Dec 13th is CPI

Dec 13/14 FOMC

us30 analysis (09 aug - 13 aug)similar to my nas100 analysis, us30 has been in an uptrend but on here the downward trendline has not been broken but my bias is still strongly bullish with the possibility of a bearish move

1. firstly i'll be waiting for a break and close above the trendline to go long

2. or a break below the previous higher low point to go short

3. but there's a correlation between nas100 and us30 so if i'll just wait and see and what happens

Crazy Times for Nasdaq what next?Good day great traders it is once more with my greatest delight to be serving you insights on Nasdaq today

Now what's been happening with this market

Weekly our trend still has been bearish since 27 Dec 2021

Again, we have recently approached the 13000-price level which has a weekly support that has 4 touches holding support since 8 March 2021 so it is a strong support area

On the daily we got a close below this support level Tuesday however we did engulf back into this 13000-price support level

What does this mean? we are likely starting to range after or great impulse down

H4 h1 they do not seem promising to be taking trades on them because we recognize lack of momentum

What is the verdict? Wait for the market to break below the 13000-level close successfully there then we should catch further retracements on lower timeframes why are we to sell? the higher timeframe still is bearish and till we maybe push above the 13600-level creating higher lows and new higher lows then have the weekly close above the price too then trends should continue up but for now I will be selling be sure to comment positively till we meet again God bless

Speak Life into what you want speaking on what we say to our self and what we speak aloud tune in to what you say and fine tune it to better you self and the world around you

challenge

today listen to what people say and find the negative words they say and write the sentence down and restructure the sentence to be a positive and that is spoken in a way that is moving forward.

Ripple Notches Another Legal VictoryThe latest development in the SEC v. Ripple case could be welcomed by the XRP Army as a positive sign.

The regulator had cited a similar case that it had brought against blockchain content platform LBRY. In the said case, a New Hampshire magistrate judge ruled on the pleadings on unconnected “selective enforcement” defense.

Ripple’s attorneys, however, argued that the SEC shouldn’t be allowed to boost its case against the firm’s fair notice defense by referencing “out of circuit” recently-decided cases. Ripple also indicated that LBRY pled a fair notice defense but the SEC didn’t move to strike it, and the omission of this in the proposed Sur-Sur-Reply is “remarkable”.

And fortunately for Ripple, Judge Analisa Torres has denied SEC’s request to file its Sur-Sur-Reply, in a conspicuous one-word order.

NKLA - Is a (dark) Phenix?If we look at the consequent lower maximum price for NASDAQ:NKLA , we can see that the trading pressure is lowering too: indeed, the time between each max-price and the following is increasing.

Usually, when this happens means that the traders are liquidating their positions and then not coming back. Considering all the scandals in which this company was involved in, that's quite reasonable.

--- BUT ---

Will they come back?

In my opinion, it depends on the next earnings:

EARNING +: If the company will provide proofs of good conduit, reaching the targets and being in line with their schedule, we can see a huge bounce up in the price of the company;

EARNING =: If it will release a just below the line results, essentially the bull-bear match will be rescheduled to the next earnings; in this case we will see a price ranging from recent max-min prices;

EARNING -: If it won't meet most of the targets, we will see falling the price probably under 4$.

However, I believe in the new management, so I prepend for the EARNING + exit; let's go!

Shib-usdt rough idea as volume slowly returnsShib-usdt rough idea as volume slowly returns and strange bot action lets up. Bots have been selling down to keep the price stagnant or declining, frustrating to watch.

Change coming, looking positive movement, but possible major dump. Decision time in the next 2-30 hours.

Good luck and dyo research for safety . Just an idea😊🎉