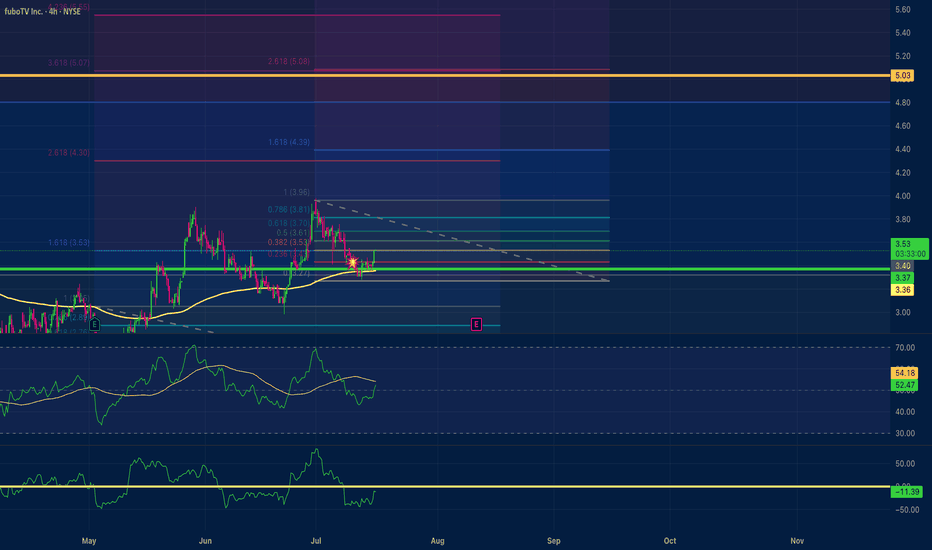

fuboTV $5.00 price target Positive Divergence Multi time frameMy trade on fuboTV has a $5.00 price target. With positive divergence multiple time frames 15,1hr, 4hr. An RSI scoop where the hrly RSI with a length setting of 36 shows upward momentum? The Chande momentum oscillator with a setting of 24 indicates the price may not stall at $4.50.

Positivedivergence

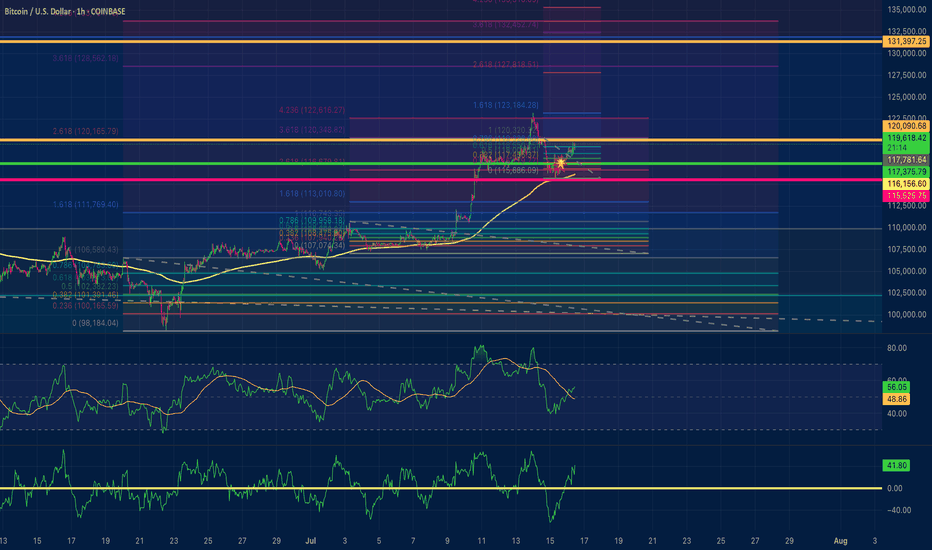

Bitcoin positive diversion to $131,000Using fibonacci retracements for price targets based off of positive divergences on the 15 min time frame and hourly time frame. I am utilizing 2 ioscilating indicators: RSI length is 36 with smma at 50 and the Chande momentum oscillator with a length of 24. My conservative estimate is $131,000 for a safe trade close. $132,400 exact area for pullback to $128,500?

NGLFINE: Signs of reversal.NGLFINE appears to have bottomed out, now showing strong signs of a potential reversal:

1. RSI is strengthening.

2. Positive divergence is visible in RSI.

3. The stock is now trading above the 20EMA band.

A minor pullback to retest the 20EMA band is possible before the stock resumes its journey toward its all-time high.

As a Stoploss. either you can use 20EMA band or previous swing low, marked in the chart.

Disclaimer: This analysis is based on personal observations and is for educational purposes only. Please conduct your own research or consult a financial advisor before making any investment decisions.

@@ Always adhere to your risk-reward ratio before entering any trade.

@@ Maintain discipline in all trading activities.

@@ Ensure strict compliance with the marked stop loss.

TRIL Showing Again Bullish Mood at All Time High ZoneCompany has reduced debt.

Company has delivered good profit growth of 57.2% CAGR over last 5 years

Most preferred Indian Brand, known for manufacturing High Voltage Transformers viz. 220 kV 400 kV, 765

kV, 1200 kV indigenously

❑ Expertise in designing and manufacturing transformers from 5kV up to 1,200kV voltage class

transformers and from 0.5MVA to 500MVA capacity; thereby having presence across the value chain

❑ Manufactures entire range of transformers viz. Power, Distribution, Furnace, Rectifier Transformers &

Shunt Reactors, creating a unique positioning for itself in the transformer industry

❑ Supported by backward integrated manufacturing facilities housed in Gujarat

❑ International presence in 25+ countries

New Order Received during the year ₹ 2,050 crore

Order from Solar Power Plants:

❑ Received order for Solar Power Plants for 4 nos. 250 MVA 2x33 kV/400 kV from a reputed EPC Company

❑ Received order for 8 nos. 315 MVA 2x33/400 kV from a Maharatna PSU

Order from Private Sector Industry:

❑ Received maiden order for 400 kV Single Phase Generator transformers of 6 nos. 210 MVA from a steel plant

Order from Metro Projects/ Railways:

❑ Received order for Delhi Metro (DMRC) and Chennai Metro Projects

Order from Central Power Utility:

❑ Received order for 72 nos. Transformers & Reactors from a leading Central Power Utility in India

❑ Received order for 2 nos. 250 MVA ICT from one of the PPP model Company

❑ Received order of 4 nos. 60 MVA Traction Power Transformer (Scott Connected)

❑ Received an order of 220 MVA EAF transformer for Exports to be used in steel melting application, it

is second biggest rating in the world. Unit to be export in Q1FY25.

Other Achievements:

❑ Successfully tested the most stringent Dynamic Short Circuit test on multiple transformers of various voltage

ratings. With this company has crossed a commendable milestone of successful Dynamic short circuit test on

a record 150 plus transformers in last two decades.

❑ Technology for 765 kV class shunt reactors has been fully absorbed

Q4FY24 revenue ₹ 500 crore; FY24 revenue ₹ 1,273 crore

❑ Q4FY24 EBIDTA ₹ 65 crore; FY24 EBIDTA ₹ 129 crore

❑ Q4FY24 EBIDTA margin 12.9%; FY24 EBIDTA margin 10.0%

❑ Revenue improvement due to faster execution of major orders, better production planning, improved

receivables, internal control systems, etc.

❑ Export Contribution as a % of Revenue 11%

❑ Average monthly collection from customers during H2FY24 was Rs.144 crore which indicates stringent

internal controls systems in place.

❑ Tailwind to continue & company expects much higher profit margins in years to come.

“

Radix is down at the support lineAfter a major swing upside, Radix is coming down to the support level. On the daily it's likely(!) you will see positive divergence on the RSI in the upcoming hours/days.

Even the cup-and-handle formation is still in charge to be formed although it will be take longer then I primarily thought it would take to create. A lot depends on how the whole economy and crypto-market will develop.

NDX / QQQ: Broader Picture for Nasdaq 100 in Six ChartsPrimary Chart: Potential for Symmetrical Pattern in Two Major Segments of Decline Shown by Roughly Parallel Price Paths in Orange

Many recent posts have contained a great deal of written analysis and explanation. This post is intended to be a chart-heavy weekend update on the NDX as reflected by its well-known ETF ( NASDAQ:QQQ ). This post will be far more concise and contain mostly charts and brief descriptions.

Supplementary Chart A. The two month downward trendline from the mid-August 2022 peaks has been broken, a shift in shorter-term trend degree. Bears don't need to be told that something has shifted in the short-term. Like other squeezes this year, this one probably hurts. But note the yellow Anchored VWAP from 2018 lows, currently at $282.45—price looks like it will confront this level this week. Price will also confront a longer-term Fibonacci level at $286. These levels could be a spot where price could stall and consolidate a bit, perhaps into the FOMC presser on November 2, 2022.

Supplementary Chart B.The weekly chart of the Nasdaq 100 shows the downward trendline very much intact throughout this entire bear market. Note the long-term VWAPs have now begun to slope downward. The long-term VWAPs are anchored to the Covid 2020 low and the December 2018 low. Price will confront the 2018 VWAP again in the coming days. The first test of that VWAP was repelled this past week after FAANG earnings largely missed (except for AAPL). The Covid 2020 VWAP approximately coincides with the down trendline from the all-time high.

Supplementary Chart C. The next chart zooms in a bit on the December 2018 VWAP. This VWAP aligns quite well with the .382 retracement of the major decline from August 16 to October 13, 2022. This area of confluence is $282.32, and price may consolidate or whipsaw around this level before continuing in whatever direction it chooses after FOMC, though the rally appears as if it may have a bit more steam. Unless the Fed presser completely squishes the rally (a distinct possibility), a reasonable target is the .50 retracement at $291.60, but only if this .382 level and 2018 VWAP at $282 can be relcaimed.

Supplementary Chart D. A derivative of the Bollinger Bands, the %B indicator distinctly shows a W-bottom pattern. As price made lower lows in October 2022, the relative lows were higher than September 2022 lows (relative means in terms of standard deviation from a mean).

Supplementary Chart E. Weekly RSI shows a major positive divergence (also known as a bullish divergence). This has not yet been conrfirmed. Sometimes, weekly divergences can take quite a will to take effect—notice that the weekly negative divergences—starting with the RSI peak in late 2019) took about 2 years to result in a major bear market. In other words, even though there were negative divergences on weekly RSI, higher highs continued in the index until late 2021 where the final negative divergence was formed. This means don't front run a weekly RSI negative divergence, but keep it in mind, especially when they begin to add up.

Analysis and Discussion. Short-term trends have clearly shifted, but longer-term downtrends remain intact with the bearish structure unaffected by the short-term noise. But as stated in my recent SPY analysis, don't fight the rally. Rallies are an inevitable part of downtrends, which by definition include lower *highs* and lower lows. There are reasons for a multi-week rally, though it won't be in a straight line. Plenty of resistance lies overhead, however. And the longer-term downtrend remains intact on logarithmic and linear charts. Maybe the Nasdaq 100 makes new lows next year in the first half of 2023.

One possibility, however, is that the two major segments of this decline are roughly parallel. See the orange price paths on the Primary Chart, the first one of which follows price, and the second one of which follows price and then projects the hypothetical path that would be parallel to the first path.

________________________________________

Author's Comment: Thank you for reviewing this post and considering its charts and analysis. The author welcomes comments, discussion and debate (respectfully presented) in the comment section. Shared charts are especially helpful to support any opposing or alternative view. This article is intended to present an unbiased, technical view of the security or tradable risk asset discussed.

Please note further that this technical-analysis viewpoint is short-term in nature. This is not a trade recommendation but a technical-analysis overview and commentary with levels to watch for the near term. This technical-analysis viewpoint could change at a moment's notice should price move beyond a level of invalidation. Further, proper risk-management techniques are vital to trading success. And countertrend or mean-reversion trading, e.g., trading a rally in a bear market, is lower probability and is tricky and challenging even for the most experienced traders.

DISCLAIMER: This post contains commentary published solely for educational and informational purposes. This post's content (and any content available through links in this post) and its views do not constitute financial advice or an investment or trading recommendation, and they do not account for readers' personal financial circumstances, or their investing or trading objectives, time frame, and risk tolerance. Readers should perform their own due diligence, and consult a qualified financial adviser or other investment / financial professional before entering any trade, investment or other transaction.

Resistance Levels Where AMD Could Fail in a Bear RallyPrimary Chart: Bollinger Bands (Yellow Shaded Volatility Channel) with Fibonacci Levels, Downward TL and VWAPs

1. As discussed earlier this month, AMD remains in a severe downtrend at the primary degree of trend. This means that the path of least resistance on higher time frames remains lower unless and until AMD can do a substantial amount of price work and recover into the mid $80s (the area of the downward trendline shown on the Primary Chart) and preferably the $100.60 level (the .50 retracement of the 2020-2022 rally).

Supplementary Chart A: AMD's Linear Regression Channel Reflects Severe Downtrend

2. In every trend, however, corrective retracements and mean reversions will occur. In a downtrend, market participants commonly attempt to pick bottoms especially in former market leaders and darlings—and when this bottom-picking is combined with heavy short positioning that requires covering when major downside moves exhaust, ferocious bear rallies ensue. On October 11, 2022, SquishTrade prepared the following chart showing some of the powerful bear rallies that have occurred since November 30, 2022 (all-time high date):

Supplementary Chart B: Percentage Gains for Bear Rallies in AMD Since All-Time High

3. The VWAP anchored to the all-time high on November 30, 2022, shown on the Primary Chart, reveals that the downtrend at the primary degree of trend remains in effect. The lower highs and lower lows on daily and weekly charts support this conclusion, and the downward trendline—also shown on the Primary Chart in orange—has not been broken. Price remains significantly below both the orange downward TL and the all-time-high VWAP, showing the profound weakness in this former market leader.

4. Price has even fallen beneath the April 2018 anchored VWAP (shown in red on the Primary Chart above) having a price value of $61.95 on October 20, 2022. AMD's rapid decline since August 4, 2022 peaks appears to have stalled just after breaking below this VWAP. This 4.5 year VWAP provides strong near-term resistance at $61.95. This level of interest should be monitored during any bear rally and on any subsequent decline. Price may rally and whipsaw above it during a mean reversion only to fail and slice back below it.

5. Price has fallen beneath the .786 and .618 retracements of the entire rally from the Covid 2020 lows. These levels are at $64.08 and $85.54 respectively. This is significant because it reflects the strength of this downtrend. Any bear rally will meet strong resistance when rising back to these levels. Before considering these levels as resistance however, price must first break above the April 2018 VWAP (about $61-$62), and the 21-day EMA at about $63.31 as of October 20, 2022. Until the 21-day EMA and the April 2018 VWAP are reclaimed ($61-$63 approximately, the higher retracement levels remain irrelevant.

6. Some evidence of downside exhaustion appears on AMD's charts. These suggest that a short-covering and FOMO-driven rally may occur in the coming weeks between now and year end. SquishTrade hinted at this possibility recently with the following chart, showing how AMD was approaching the bottom of its downtrend channel:

Supplementary Chart C: October 11, 2022, Post Showing Higher Risk For Shorts Near Downtrend-Channel Support

7. On AMD's daily chart, RSI now shows a positive divergence despite price making lower lows. This is further evidence that shorts should be cautious and wary of a bear rally or, at a minimum, choppy action over the next few weeks.

Supplementary Chart D: RSI Positive Divergence on Daily Chart

8. The Bollinger Bands also suggest that the downward price move from August 4, 2022, swing highs may be nearing exhaustion. Note how the bands (set at two standard deviations) are contracting now, which suggests either chop or mean reversion in the coming days or weeks. The %B indicator in the subgraph also shows weakening downside price action. As price made lower lows over the past two months, the %B indicator made higher lows. This reflects that price moves were less powerful even though they made lower lows on the main price chart—when price cannot pierce the bands as deeply with each subsequent low, and when price eventually cannot even tag the band with a new low in October 2022, this shows price may be ready to consolidate or mean revert.

Supplementary Chart E: Bollinger Bands Signaling Exhaustion and Temporary Pause in Downtrend

9. For anyone trying to catch the bear rallies, watch out for false breakouts above resistance as discussed in the following linked post, showing a false breakout this month above a shorter-term trendline. When the primary trend is down, countertrend moves can be challenging and tricky, so tight stops make sense.

Supplementary Chart F: False Breakout above Resistance—Example from October 6, 2022

________________________________________

Author's Comment: Thank you for reviewing this post and considering its charts and analysis. The author welcomes comments, discussion and debate (respectfully presented) in the comment section. Shared charts are especially helpful to support any opposing or alternative view. This article is intended to present an unbiased, technical view of the security or tradable risk asset discussed.

Please note further that this technical-analysis viewpoint is short-term in nature. This is not a trade recommendation but a technical-analysis overview and commentary with levels to watch for the near term. This technical-analysis viewpoint could change at a moment's notice should price move beyond a level of invalidation. Further, proper risk-management techniques are vital to trading success. And countertrend or mean-reversion trading, e.g., trading a rally in a bear market, is lower probability and is tricky and challenging even for the most experienced traders.

DISCLAIMER: This post contains commentary published solely for educational and informational purposes. This post's content (and any content available through links in this post) and its views do not constitute financial advice or an investment or trading recommendation, and they do not account for readers' personal financial circumstances, or their investing or trading objectives, time frame, and risk tolerance. Readers should perform their own due diligence, and consult a qualified financial adviser or other investment / financial professional before entering any trade, investment or other transaction.

Positive Divergences: NVDA, SYNH, ZMPositive Divergences are developing in many stocks as they reach strong support levels.

NVDA, SYNH and ZM are examples that showed signs of the run down ending as volume indicators diverged upward against the decline. This is an early buy to cover signal for short positions.

GravitaThis stock has given good breakout from decending parallel channel with good intensity of volume, also positive divergences in RSI and Macd signaled on daily time frame before breakout. RK's mass psychological Cloud buy activated and RK's buy signal activated, Rsi breakout also making scenario more powerful, adx showing good strength along with positive Dmi, Overall looking good to go long, with respected levels.

Breakout along with good intensity of volume

Positive divergence in macd

Positive divergence in RSI

RK's mass psychological Cloud buy activated along with breakout also along with buy signal

Macd in daily positive crossover and Uptick and also above zero line

Macd in weekly uptick now

Breakout in RSI of daily time frame

Price challenging upper bollinger band

Dmi adx also positive on daily time frame

Most investors treat trading as a hobby because they have a full-time job doing something else. However, If you treat trading like a business, it will pay you like a business. If you treat like a hobby, hobbies don't pay, they cost you.

Disclaimer

I am not sebi registered analyst

My studies are Educational purpose only

Consult with your Financial advisor before trading or investing

SAM - changing of trendSAM- Boston beer company might be turning its course. After dipping to covid lows and giving all the 400% gains back it's coming back to live and today was up 6.19%. Earnings were much better than the past three Qs. Interesting to observe this one and see if confirms the uptrend in the next weeks. Positive divergence present.

NAS100 Weekly Positive DivergenceNasdaq showing positive weekly divergence suggesting that the Nasdaq will

likely change trends from down to up or sideways at the least.

This fits well with my other SPX hypothesis that there is an Elliott corrective

pattern that shows some promise of being finished. Add to this the USDJPY weekly

negative divergence and strong sell off, this paints a good picture for the NAS100 to

be a buy here or soon. Stops would go below the lowest low.

Bullish Divergence vs Bearish Flag on BitcoinCurrently, EMA21 appears as resistance in the 4-hour timeframe. The Bear Flag formation we are in also carries the targets further down.

However, although the positive dissonance in the Relative Strength Index correlation gives us hope, the trend formed for the RSI is a harbinger of probing the lower band within the channel.

Also, another negative indicator is that the Stochastic Relative Strength Index is blinking down from the tops.

AUDUSD Positive Divergence DailyPostive divergence on the daily time frame for AUD and NZD against the USD suggest that there is

a trend change in progress. We have sufficient evidence to support this in looking at other

"risk on" assets such as the SnP500 and the Nasdaq as their monthly oscillators are oversold

and trying to generate a buy signal. These two hypothesis combined gives us enough evidence

that the markets have likely bottomed for now. The daily divergence is to be respected as it can

lead to strong moves lasting up to several weeks in trend continuation.

EOSUSDTThe price levels, which are currently 3.81, may fall further because it has broken the blue dotted line. If prices fall 12% lower and fall to the $3.2 levels (Yellow dotted line) and rise up from there, that is, if it makes a bottom again at this level, there may be a new rise. Because the RSI was 35 at the level when the price was $3.2, and it's 36 now, and it looks like we're going to fall more at this rate. The formation I briefly mentioned is a Positive Hidden Divergence. Prices are expected to rise after a positive confidential divergence.

We will see if there will be this discrepancy in about a week or two. In short, it can be expected without processing right now

IT IS NOT INVESTMENT ADVICE