A Sleeping Giant in the Energy Sector?While everyone’s chasing the next hot AI stock, a quiet opportunity might be taking shape in the energy sector; and it could be a big one.

🔋 As AI data centers explode in size and number, the demand on our power grid is rising fast. Nuclear is still years away, and renewables are struggling to scale in time. That leaves oil and gas as the most reliable players; and one U.S. company may be perfectly positioned to ride that wave.

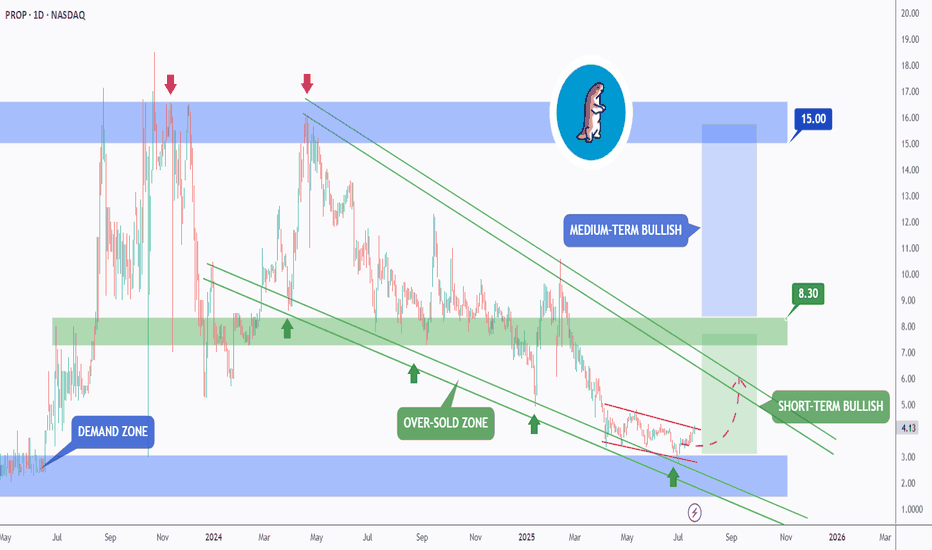

📊 Technical Analysis

NASDAQ:PROP PROP has been in a steady downtrend, moving within a falling wedge pattern (marked in green). Right now, it’s retesting the bottom of that wedge, typically where things get oversold.

Even more interesting, PROP bounced off a major monthly demand zone last week, a signal that buyers may be stepping in.

In the short term, if the blue demand zone holds, we could see a push toward the $7 mark, which lines up with the top of the wedge.

But to really confirm a medium-term reversal, we’ll need a clean break above the $8.3 resistance. If that happens, the door could open to a rally toward $15, a key level from early 2024.

🛢️ Why PROP? A Hidden Play With Room to Run

Prairie Operating Co. (NASDAQ: PROP) isn’t your typical small-cap oil stock. They own 65,000 acres in Colorado’s DJ Basin and use modern drilling tech to stay lean and efficient. That means they can still make money even when oil prices dip.

As energy demand continues to climb, PROP could be sitting in the sweet spot , especially with the world so focused on tech stocks. But behind every AI boom is a growing energy need, and companies like PROP are the ones powering it.

One well-known Wall Street firm recently gave PROP a Buy rating with a $21.75 price target; that’s a potential 281% upside from where it stands today. And that’s not even counting the potential boost from energy-friendly policies under the current administration.

📌 One to Watch in 2025

PROP might just be one of the most under-the-radar energy plays going into the new year.

The biggest moves often start quietly; and this one has all the ingredients to surprise.

➡️ As always, speak with your financial advisor and do your own research before making any investment decisions.

📚 Always follow your trading plan => including entry, risk management, and trade execution.

Good luck!

All strategies are good, if managed properly.

~ Richard Nasr

Potential

USD JPY 1Day Ascending Confirms Way UpUSD JPY Confirms Way Up

OANDA:USDJPY FOREXCOM:USDJPY CAPITALCOM:USDJPY

⏰ TimeFrame 1 day

👉 Ascending Triangle Confirms Way Up

👉 Green Trace or Blue Trace

👉 Confirms Way Up (166,6 / 138)

👉 Potential +8% 💎

👉 Fibo Measure

✔️Logarithmic (Log) Chart & Fib

✔️ (Log)MACD

ES1! - TIME TO LOOK FOR SHORT ENTRIES OPPORTUNITIES - WEEKLYThank you for the likes, shares and follows. Really appreciate!

_________________________________________________________

This is a zoome out from the latest analysis of the ES1! Mini S&P500 Market.

A little bit adjusted with some interesting points to consider.

in the upper side we potentially won't be surprised in proach futrue see the price rising to $5637.5.

It is time probably to think at holding long short positions as there are some potential lower price point interesting to consider:

- The red horizontal line range area

- And lower there the blue dashed horizontal line

next week candle could probably do the same as this week but in the short side.

Where is the price going and what is the upper side limit? We don't know, we can only make some assumptions based on the technical analysis of the chart.

The issue is that we see that some historicl correlations are not being respected anymore.

FILUSDT - weekly green rectangular (potential zone to buy!) FIL in good price to buy in weekly chart

Weekly green rectangular is a zone which many supports are gathering together

(The major trend, lower side of ascending channel and 0.5 Fibonacci support)

That's make the green rectangular a potential zone to buy

Must considerd: just 4 days remaining for bitcoin halving!

Thank u , for more ideas hit "follow" and "like" for supporting us🎯

ATOMic Impulse Soon 💣Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 ATOM has been overall bullish, trading within the flat rising wedge pattern in black.

Currently, ATOM is in a correction phase, approaching the lower bound of the wedge.

Moreover, it is retesting a strong support and round number $10 in gray.

🏹 Thus, the highlighted Atom logo with the blue arrow is a strong area to look for buy setups as it is the intersection of the gray support and lower black trendline.

📚 As per my trading style:

As #ATOM approaches the blue arrow zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

ES1! S&P500 PREPARE NEXT WEEK - IMPORTANT PRICE POINTS - DAILYThanks a lot you the likes, really appreciate! It is not financial advice just recreational trading idea sharing

____________________________________________________________________

- 5332.5: price point identified as potential optimal entry for short direction trade. Depends on the velovity of the market when if hitting that price point again.

- 5168.75 to 5190.75: probable important zone where the price can pullback up or break with strength.

- 4938.25: Possible down important price point as we can only look behind and in prices lower than the actual price. Above the actual price it is not possible to see where the market can go. So market will do what it has to do if evolving above 5332.5 .

- Some other zone down there but it is not to analyze yet has there is too many important price points above it.

Probably observing what the market does from Monday to Wednesday and see which entries can be done on Thursday/Friday for next week.

MPC - Wait For The Bulls 📈Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📦 After finding support around the $0.5 round number, MPC has been hovering within a narrow range.

📈 As long as the $0.5 support holds, we anticipate a movement towards the upper bound of the range at $0.7 , which would also be a strong supply zone.

🏹 For the bulls to confirm medium-term control, a break above the red trendline is needed.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Lookin long on PM in the very near future! Thank you as always for watching my analysis. I hope you can learn something very educational on this video. Also one thing I did not mention on this stock is the fact that the fundamental analysis on this stock looks underrated as well so that just adds more confluence. Have a blessed January!

Gold price trades with mild positive bias, upside potential seem

OANDA:XAUUSD Gold price trades with mild positive bias, upside potential seems limited

4 January 2024

•Gold price ticks higher and moves further away from over a one-week trough touched on Wednesday.

•An uptick in US bond yields acts as a tailwind for the USD and might cap any meaningful upside.

•Traders now look to the US ADP report for a fresh impetus ahead of the key NFP data on Friday.

Gold price (XAU/USD) dived to a one-and-half-week low on Wednesday in the wake of rising US Treasury bond yields and a stronger US Dollar. The US bond yields, however, started losing traction after minutes of the December 12-13 FOMC meeting reflected a consensus among policymakers that inflation is under control and the downside risks to the economy associated with an overly restrictive stance. This, along with a generally weaker tone around the equity markets, allowed the precious metal to attract some buyers near the $2,030 area and gain some follow-through traction during the Asian session on Thursday.

The minutes, however, did not provide any clues about the timing of when the Fed will start cutting interest rates. This comes on the back of Richmond Fed President Thomas Barkin's remarks that interest rate hikes remain on the table and act as a tailwind for the US bond yields, which should limit any meaningful downside for the Greenback and cap the Gold price. Meanwhile, traders are seeking more clarity on the Fed's policy outlook. Hence, the focus will remain glued to the release of the closely-watched US monthly employment details – popularly known as Nonfarm Payrolls (NFP) report on Friday.

In the meantime, Thursday's US economic docket, featuring the ADP report on private-sector employment and the usual Initial Jobless Claims, will be looked upon for short-term trading opportunities later during the early North American session. Nevertheless, doubts over the possibility of early interest rate cuts by the Fed might hold back traders from placing aggressive bullish bets around the non-yielding Gold price, warranting some caution before confirming that a one-week-old downtrend has run its course.

Daily Digest Market Movers: Gold price attracts some dip-buying, albeit lacks bullish conviction

•Bets that the Federal Reserve will cut rates in March, along with geopolitical tensions, help the Gold price to build on the overnight bounce from over a one-week low.

•The December FOMC meeting minutes revealed that members generally viewed the addition of 'any' to the statement as an indication that policy rates are likely near peak.

•Policymakers observed progress on inflation, though noted that circumstances might warrant keeping interest rates at the current level longer than they currently anticipate.

•Moreover, the minutes did not provide direct clues about the timing of when a series of interest rate cuts in 2024 might commence.

•Richmond Fed President Thomas Barkin on Wednesday expressed confidence that the economy is on its way to a soft landing and said that rate hikes remain on the table.

•The yield on the benchmark 10-year US government bond holds steady below 4.0%, which should act as a tailwind for the US Dollar and cap the non-yielding yellow metal.

•The Institute for Supply Management (ISM) said on Wednesday that the pace of decline in the US manufacturing sector slowed amid a modest rebound in production.

•The US ISM Manufacturing PMI improved to 47.4 last month from 46.7 in November, though remained in contraction territory for the 14th consecutive month.

•The Labor Department’s Job Openings and Labor Turnover Survey (JOLTS) showed that employment listings fell to 8.79 million in November – the lowest since March 2021.

•Traders now look to the US ADP report, which is expected to show that private-sector employers added 115K jobs in December as compared to the 103K in the previous month.

•The market focus, however, will remain glued to the official monthly employment details – popularly known as the Nonfarm Payrolls (NFP) report on Friday.

Technical Analysis: Gold price might now face resistance near the $2,048-2,050 horizontal zone

From a technical perspective, the overnight breakdown and acceptance below the $2,050-$2,048 resistance-turned-support favours bearish traders. That said, oscillators on the daily chart are still holding in the positive territory and warrant some caution. Hence, it will be prudent to wait for some follow-through selling below the overnight swing low, around the $2,030 area before positioning for any further depreciating move.

The Gold price might then accelerate the slide towards the 50-day Simple Moving Average (SMA), currently around the $2,012-2,011 area, en route to the $2,000 psychological mark. A sustained break below the latter might shift the near-term bias in favour of bearish traders.

On the flip side, momentum back above the $2,050 region now seems to confront stiff resistance near the $2,064-2,065 area. The next relevant hurdle is pegged near the $2,077 horizontal zone, which if cleared decisively should allow the Gold price to aim back towards reclaiming the $2,100 mark.

US Dollar price this week

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the Japanese Yen.

USD EUR GBP CAD AUD JPY NZD CHF

USD 1.16% 0.44% 0.66% 1.08% 1.64% 0.84% 0.91%

EUR -1.01% -0.55% -0.36% 0.08% 0.49% -0.17% -0.16%

GBP -0.46% 0.55% 0.22% 0.63% 1.27% 0.38% 0.38%

CAD -0.66% 0.33% -0.03% 0.41% 0.98% 0.16% 0.19%

AUD -1.09% -0.08% -0.63% -0.44% 0.38% -0.26% -0.22%

JPY -1.65% -0.44% -1.12% -0.79% -0.40% -0.65% -0.79%

NZD -0.83% 0.19% -0.38% -0.17% 0.27% 0.65% 0.03%

CHF -0.85% 0.17% -0.37% -0.17% 0.25% 0.78% 0.01%

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

RBN/USDT 1D. Accumulation. Fake-out. Back to the channel.Ribbon Finance Secondary and main trends.

As on many cryptos from the beginning of trading history - downtrend. Then breakout of this downtrend and horizontal accumulation channel started to form(stop of price drop).

This channel is lasting for more than 400 days already. This is more than a year already.

Notice that there was a fake-out of this accumulation channel and then price turned back to it. This is a very positive sign for potential bullish price movements.

As for now there has been a downtrend in a secondary trend formed which can be noticed by downtrend line(red on the chart) in this secondary trend.

This downtrend was recently broke above and now we can observe the retest of it.

From the ATL(all time low) - price has moved for 70% already. More of 70% potential is hidden above to the resistance of this horizontal channel.

Then the middle-long term potential is about 400%. I would say about half a year-year for such potential quite real.

The project is going to fully rebrend on AEVO which is why i paid my attention to it and it's certainly a bullish sign also.

The asset can be traded on coinbase, gate and bitget.

APTOS Potential : Falling Wedge 📉📈Understanding the Falling Wedge Pattern:

The falling wedge pattern is a bullish reversal pattern that occurs after a downtrend.

It's characterized by converging trendlines, with the upper trendline (resistance) sloping downward at a steeper angle than the lower trendline (support).

This pattern often suggests that selling pressure is weakening, potentially paving the way for a bullish move.

The Case for APT:

APT, like many cryptocurrencies, experienced a downtrend or consolidation phase.

The falling wedge pattern on the APT chart indicates that the price is trapped within this pattern, but it's essential to consider the broader context.

Potential Price Target:

The primary price target in a falling wedge pattern is often set at the highest point within the wedge.

This represents a critical resistance level that, if breached, can trigger a significant bullish move.

Key Considerations:

Patterns are valuable tools, but they are not guarantees of future price action.

Always use additional indicators and fundamental analysis to confirm your trading decisions.

Risk management is crucial; set stop-loss orders to protect your investments.

Conclusion:

The falling wedge pattern in APT presents an intriguing opportunity for traders and investors. While patterns can offer insights, it's essential to combine them with a comprehensive analysis of market conditions and news events.

Keep a watchful eye on APT as it approaches the upper trendline of the falling wedge pattern. If the price can break through this resistance level, it may signify a bullish reversal and potential opportunities for growth.

Remember that cryptocurrency markets are inherently volatile, and trading involves risk. Exercise caution, do your research, and stay informed about APT's developments in the crypto space.

As the market unfolds, APT's falling wedge pattern could be the key to unlocking its true potential. Stay tuned for further updates and price action, and always trade responsibly.

❗See related ideas below❗

Like, share, and leave your thoughts in the comments! Your engagement fuels our crypto discussions. 💚🚀💚

$REE - 126M in cash, 52M marketcap, no debt - TRIPLE BOTTOM BOOMREE Automotive has been in a downtrend for a while. VERY LOW RSI. Initial vehicles produced and certified by EOY. Massive market with a revolutionary technology. Low total cost of ownership and expected EBITDA positive by 2025. NASDAQ:TSLA , NYSE:F , $GM. This is my own opinion, and you should not take this as financial advice. Own your own trades.

Breakout!?!?$esco is a hidden gem with a potential of 100x, they now support staking at their website with a very lovely apy

DOT Watchout for Resistance LvelDOT is near its Resistance level at $5.65. There is 2 Possible scenarios, Yellow and Red.

Yellow: DOT created double top pattern and if $5.65 Resistance will be broken it can move to its next Resistance as a trend line + EMA 200 from where I am expecting a continuation of bullish trend.

Red: Coin's price will keep moving inside the triangle until we eventually will see a break out.

In both scenarios DOT has the next target at $7.3.

Trade safely.

XRP possible end of the correction The 61.8% retracement level is considered significant because it represents a deep retracement that often occurs before the price resumes its trend in the original direction. However, it's important to note that no retracement level is foolproof and that traders should always use additional analysis and risk management techniques when making trading decisions.

Possible good entry since the RR in this scenario is going to be quite high

AUD/USD 1H Technical.Recently there was a bearish CHoCH made on the 1H time-frame for AUD/USD. We might see double sided trade opportunities potentially.

Reason for potential long entry; We see that the price recently was consolidating the past days, we might see a jump from the Order block that the price is right now and filling the FVG recently made, retest the S/R area and continuing the consolidation trend by moving up.

Reason for potential short entry. The price broke the recent Support level at 0.66550, me might see the continuation of the bearish trend because it was recently discovered a "Change of Character" . It might potentially move lower after retesting the 0.66550 Resistance level (previous support). By any means, moving the price below the Anchored VWAP line and strengthening of the US Dollar, we might be looking for shorts.

REMINDER; Always make your own analysis and before taking any kind of trades, make sure you have a solid confirmation about the move that your willing to take.

FUNDAMENTAL REMINDER; Watch out for the interest rate decision on 22/03/2023. It will have a really important impact on the US Dollar.

Looking forward for your comments on this idea.