GBP/JPY SELL SETUP 250 PIPS1️⃣ Macro Fundamental Analysis (GBP vs. JPY)

🔹 Interest Rate Differentials (Carry Trade Impact)

Bank of England (GBP)

The BoE has kept rates high to fight inflation.

Higher GBP rates → capital inflows into GBP assets.

Bullish for GBP/JPY.

Bank of Japan (JPY)

BoJ is still ultra-dovish, keeping negative/low interest rates.

Japan’s government wants a weak yen to support exports.

Bearish for JPY, Bullish for GBP/JPY (carry trade flows into GBP).

📊 Institutional View:

Hedge funds & large investors prefer long GBP/JPY due to high interest rate spreads.

GBP/JPY remains fundamentally bullish due to carry trade inflows.

🔹 Global Risk Sentiment (Risk-On vs. Risk-Off)

GBP/JPY is a "risk-on" pair → it rises when markets are bullish and falls when investors seek safety.

If stock markets are bullish, GBP/JPY tends to rise.

If there’s a global crisis, investors move into JPY (safe-haven), causing GBP/JPY to fall.

Current Market Sentiment:

Stock markets are uncertain, but no full risk-off move yet.

Watch equity markets & US bond yields for risk sentiment confirmation.

📊 Institutional View:

Mild risk-on bias → GBP/JPY has support, but volatility remains high.

🔹 Institutional Positioning (COT Data & Hedge Fund Flows)

Hedge funds have been buying GBP against JPY due to the rate differential.

Commitment of Traders (COT) Report:

Shows institutional investors are still net long GBP/JPY but reducing positions.

Some profit-taking could lead to short-term downside.

📊 Institutional View:

Long-term institutional bias is bullish, but hedge funds may reduce positions if risk-off sentiment increases.

2️⃣ Technical Analysis (ITPM Style) – Multi-Timeframe Breakdown

🔹 GBP/JPY (Daily Timeframe)

📈 Trend: Still in an uptrend, but approaching resistance.

📌 Key Resistance: 195.00 - 196.00

📌 Key Support: 191.00 - 190.00

🔹 Price is struggling at resistance near 194.00.

🔹 Possible pullback to 191.50 - 192.00 before resuming higher.

🔹 GBP/JPY (H4 Timeframe)

📉 Short-Term Weakness, but Still in an Uptrend Channel

📌 Key Level to Watch: 192.50 - 193.00

🔹 Bearish Rejection at 194.00, but still inside an uptrend structure.

🔹 If price breaks below 192.50, a deeper correction to 191.00 is likely.

🔹 GBP/JPY (H1 Timeframe)

📉 Intraday Weakness, Watch 192.50 for Breakdown

📌 Key Levels:

Resistance: 193.50 - 194.00

Support: 192.50 (short-term support), 191.50 (stronger support)

📊 Institutional View:

Intraday traders may take short positions below 192.50, targeting 191.50 - 191.00.

3️⃣ Institutional Trade Setup (ITPM Style)

🔴 Bearish Scenario (Short-Term Correction)

Entry: Sell below 192.50 (Break of key support).

Target: 191.50 → 190.00 (support zone).

Stop-Loss: Above 193.50.

Rationale: Short-term hedge funds taking profits → minor pullback in bullish trend.

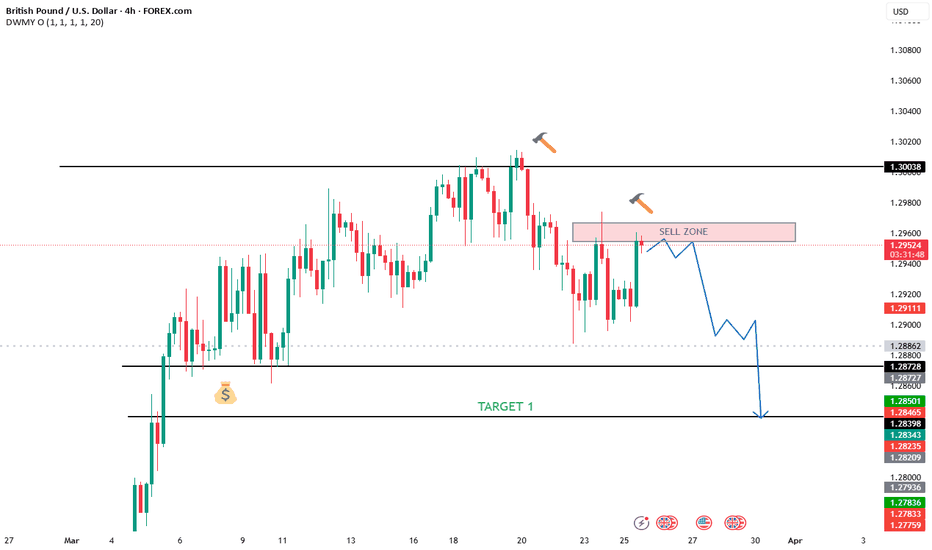

Pound

GBPUSD Is due a correctionThe GBP/USD pair has been in a sustained uptrend for some time, and while I maintain a bullish outlook, a pullback or correction appears likely. Below, I’ve outlined key target levels where I anticipate potential price movements.

I’d love to hear your thoughts—let me know your perspective. If you found this analysis valuable, consider giving it a boost!

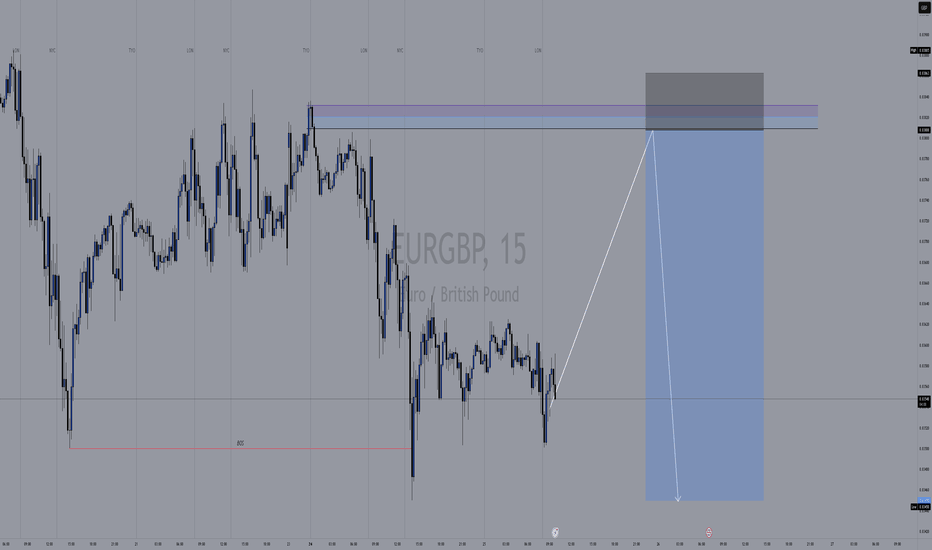

EURGBP SELLTracking EUR/GBP on the 15-minute timeframe, we see a potential short opportunity from a key supply zone.

Key Zones & Setup:

🟣 Bearish Order Block (Supply Zone): 0.83800 - 0.83830

This area acted as strong resistance, where institutional traders likely positioned sell orders.

Expecting price to push into this zone before reversing lower.

Break of Structure (BOS) on lower timeframes (M5/M1) is needed for confirmation.

🔵 Target Area (Demand Zone): 0.83450

If the supply zone holds, price could drop toward this key demand level.

This zone aligns with previous BOS levels and price reactions.

Trade Plan:

📈 Waiting for price to push into the supply zone (0.83800 - 0.83830).

🔎 Looking for BOS on lower timeframes (M5/M1) before shorting.

✅ Entering a sell position upon confirmation.

🎯 Targeting the 0.83450 demand zone.

⚠️ Stop-loss above 0.83830 to manage risk.

Market Outlook:

If price fails to break structure, we avoid shorts and reassess.

This setup follows smart money concepts (SMC) with a focus on BOS and order blocks.

💬 What do you think? Are you seeing the same setup? 🚀🔥

GBPUSD - Chasing the Bulls!!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈GBPUSD has been overall bullish trading within the rising channel marked in red.

Moreover, the blue zone is a major daily support.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of daily support zone and lower red trendline acting as a non-horizontal support.

📚 As per my trading style:

As #GBPUSD approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Dollar Pressure Support GBP/USD at 1.2915GBP/USD is trading around 1.2915, supported by a weaker U.S. dollar and steady investor sentiment. The pound benefits from political stability and steady UK economic expectations with the focus on the upcoming April 2 U.S. tariff announcement. The pair is rebounding from recent lows but remains range-bound as traders await new drivers, especially from U.S. trade actions and global growth indicators.

If GBP/USD breaks above 1.3050, the next resistance levels are 1.3100 and 1.3150. On the downside, support stands at 1.2860, with further levels at 1.2800 and 1.2715 if selling pressure increases.

Fundamental Market Analysis for March 24, 2025 GBPUSDThe GBP/USD pair continues to hold below the round 1.2900 mark and is attracting buyers in the Asian session on Monday.

The US Dollar (USD) started the new week on a weak note and halted its three-day recovery from multi-month lows, which in turn is seen as a key factor acting as a tailwind for the GBP/USD pair. Despite the Federal Reserve (Fed) raising its inflation forecast, investors seem convinced that a tariff-induced slowdown in the US economy could force the central bank to resume its rate-cutting cycle in the near future.

In fact, the UK central bank has cautioned against assumptions of rate cuts and has also raised its forecast for inflation to peak this year. This suggests that the Bank of England will reduce borrowing costs more slowly than other central banks, including the Fed, which lends further support to the GBP/USD pair.

Moving forward, traders are awaiting the release of flash PMI indices from the UK and the US for meaningful momentum. In addition, speeches from influential FOMC members will stimulate demand for the dollar, which, along with comments from Bank of England Governor Andrew Bailey, should create short-term trading opportunities for the GBP/USD pair.

Trading recommendation: BUY 1.2930, SL 1.2850, TP 1.3060

Ultimate 2025 Forex Prop Trading FAQ + Strategy Guide🧠 Forex Prop Trading: What Is It?

Prop trading (proprietary trading) is when a trader uses a firm’s capital to trade the markets (instead of their own), and keeps a share of the profits – usually 70–90%.

✅ Low startup cost

✅ No personal risk (firm takes the loss)

✅ Big upside potential with scaling plans

📋 Step-by-Step Action Plan to Get Started (2025)

🔍 1. Understand the Prop Firm Model

🏦 Prop firms fund skilled traders with $10K to $500K+

🎯 You pass a challenge or evaluation phase to prove your skills

💵 Once funded, you earn a profit split (70%–90%)

🧪 2. Choose a Top Prop Firm (2025)

Look for reliable and regulated firms with transparent rules:

FTMO 🌍 – Trusted globally, up to $400K scaling

MyFundedFX 📊 – Up to 90% profit split, no time limit

E8 Funding ⚡ – Fast scaling and instant funding

FundedNext 💼 – 15% profit share during challenge phase

The Funded Trader 🏰 – Up to $600K with leaderboard bonuses

🔎 Compare features: fees, drawdown limits, trading style freedom

💻 3. Train & Master Your Strategy

🧠 Pick a clear, rule-based strategy (e.g. trend following, breakout, supply/demand)

📅 Backtest over 6–12 months of data

💡 Use AI tools & trade journals like Edgewonk or MyFXBook

🎯 Focus on:

Win rate (above 50–60%)

Risk-reward ratio (1:2 or better)

Consistency, not wild profits

🧪 4. Pass the Evaluation Phase

🔐 Follow risk rules strictly (daily & max drawdown)

⚖️ Use proper risk management (0.5–1% risk per trade)

🧘♂️ Trade calmly, avoid overtrading or revenge trades

📈 Most challenges:

Hit 8–10% profit target

Stay under 5–10% total drawdown

Trade for at least 5–10 days

🧠 Tip: Pass in a demo environment first before going live!

💵 5. Get Funded & Start Earning

🟢 Once approved, you trade real firm capital

💰 You keep up to 90% of profits, with withdrawals every 2 weeks to 1 month

🚀 Many firms offer scaling plans to grow your account over time

💬 FAQ – Prop Trading in 2025

❓ How much can you make?

🔹 Small accounts ($50K): $2K–$8K/month with 4–8% returns

🔹 Large accounts ($200K+): $10K+/month possible for consistent traders

💡 Many traders start part-time and scale as they build trust with the firm

❓ How much do I need to start?

💳 Challenge fees range from:

$100 for $10K

$250–$350 for $50K

$500–$700 for $100K+

⚠️ No need to deposit trade capital – just the challenge fee

❓ What are the risks?

You can lose the challenge fee if you break rules or over-leverage

You won’t owe money to the firm

The biggest risk is psychological – many fail from overtrading or emotional decisions

🚀 Final Tips to Succeed

✅ Trade like a robot, think like a CEO

✅ Journal every trade – self-awareness is key

✅ Avoid over-leveraging and gambling mindset

✅ Stick to one strategy and master it

✅ Focus on consistency over quick wins

GBP/USD Analysis: Pair Fails to Hold Above Psychological LevelGBP/USD Analysis: Pair Fails to Hold Above Psychological Level

As shown in today’s GBP/USD chart, the pair failed to maintain its position above the psychological level of 1.3000 USD per pound, where it had reached its highest point since early 2025. The decline followed recent central bank decisions and statements, with both the Bank of England and the Federal Reserve keeping interest rates unchanged.

On one side, the Bank of England:

→ Warned of inflation risks, partly driven by external factors such as US trade tariffs.

→ Indicated a potential rate cut in the coming months.

On the other hand, the US dollar strengthened on Thursday after the Federal Reserve signalled reluctance to rush further rate cuts this year, despite uncertainties surrounding US tariffs.

These statements highlighted the challenges market participants face in assessing the risks posed by tariffs on global trade.

Technical Analysis of GBP/USD

In March, the pound followed an upward trend against the US dollar, forming an ascending channel (marked in blue). However, once the price moved above the key 1.3000 level, the upper boundary of the channel appeared out of reach—possibly signalling weakening buying momentum.

As a result, the price broke below the lower boundary of the channel, which has now shown signs of resistance (indicated by an arrow). If bearish pressure persists, the price could fall towards the dotted trendline below the channel, at a distance equal to its height. Additionally, a test of the previous local low around 1.2911 cannot be ruled out.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

GBP Retreats as BoE Maintains PolicyThe pound dipped below $1.30, retreating from a four-month high after the BoE held rates at 4.5% and signaled a cautious approach to easing policy, despite recent inflation progress.

Global trade tensions added pressure, with new U.S. tariffs prompting retaliatory moves and raising inflation risks.

UK data showed weak growth, steady 4.4% unemployment, and wage growth easing to 5.8%, in line with forecasts. In the U.S., the Fed kept rates steady but reaffirmed plans for two cuts this year.

If GBP/USD breaks above 1.3050, the next resistance levels are 1.3100 and 1.3150. On the downside, support stands at 1.2860, with further levels at 1.2800 and 1.2715 if selling pressure increases.

Sterling Stays Firm as Fed Highlights GrowthGBP/USD held near 1.3000 as sentiment stayed upbeat after the Fed reaffirmed 2025 rate cuts, though delayed. Markets still expect a 25 bps cut in June, with Powell highlighting strong US growth and a healthy labor market.

The Fed lowered its 2025 GDP forecast to 1.7% from 2.1% and acknowledged trade policy risks but sees inflationary effects as short-lived.

Focus now shifts to the BoE’s Thursday rate decision, with no changes expected. On Friday, the UK’s GfK Consumer Confidence is projected to fall to -21.0 from -20.0.

If GBP/USD breaks above 1.3050, the next resistance levels are 1.3100 and 1.3150. On the downside, support stands at 1.2860, with further levels at 1.2800 and 1.2715 if selling pressure increases.

Sterling Struggles Amid Risk Aversion and US Tariff ThreatsGBP/USD extends its decline for the second consecutive session, hovering around 1.2940 during Friday's Asian trading hours. The currency pair faces difficulties as the Pound Sterling (GBP) weakens due to a negative risk sentiment, which has been further worsened by worries over global trade following US President Donald Trump's threat to impose a 200% tariff on European wines and champagne, creating market instability.

If GBP/USD breaks above 1.2980, the next resistance levels are 1.3050 and 1.3100. On the downside, support stands at 1.2860, with further levels at 1.2760 and 1.2660 if selling pressure increases.

GBP/USD Climbs to 1.2960, Dollar Under PressureGBP/USD trades around 1.2960 in Thursday’s Asian session, extending gains for a third day as the US Dollar weakens with recession fears linked to Trump’s policies.

The dollar faces further pressure after February inflation slowed more than expected, raising speculation of an earlier Fed rate cut. Headline inflation fell from 0.5% to 0.2% monthly and from 3.0% to 2.8% yearly, while core inflation dropped to 0.2% monthly and 3.1% yearly. Markets now await US PPI and jobless claims data for further economic signals.

If GBP/USD breaks above 1.2980, the next resistance levels are 1.3050 and 1.3100. On the downside, support stands at 1.2860, with further levels at 1.2760 and 1.2660 if selling pressure increases.

Dollar Weakness Supports GBP Near HighsThe British pound held around $1.29, near a four-month high, as dollar weakness persisted on US economic concerns and tariff risks. Sterling was supported by expectations that UK rates will stay higher for longer, with traders pricing in only 52bps of BoE cuts in 2025.

UK’s monthly GDP data for January and the Office for Budget Responsibility’s economic and borrowing forecasts on March 26 are now awaited, which could impact market sentiment.

If GBP/USD breaks above 1.2950, the next resistance levels are 1.2980 and 1.3050. On the downside, support stands at 1.2860, with further levels at 1.2760 and 1.2660 if selling pressure increases.

UK Budget Forecasts and GDP Data Set to Shape Pound’s Next MoveThe pound hovered around $1.29, staying near a four-month high as dollar weakness persisted amid U.S. economic concerns and tariff risks. Sterling remained supported by expectations that UK interest rates will stay high, with traders adjusting BoE rate cut forecasts to 52 bps for 2025. Investors now await January GDP data for economic insights, while the UK’s budget watchdog will release updated economic and borrowing forecasts on March 26, potentially influencing market sentiment.

If GBP/USD breaks above 1.2920, the next resistance levels are 1.2980 and 1.3050. On the downside, support stands at 1.2860, with further levels at 1.2760 and 1.2660 if selling pressure increases.

SHORT ON GBPUSDGBPUSD has reached a key supply area and has given a change of character from up to down on the hour timeframe.

There is plenty imbalance/fvgs to the downside that I expect price to go and fill.

The Dollar Index is currently shifting to up from down, this should aid in this pair falling.

I will be selling GBPUSD to the next demand level for 300 pips.

GBPUSD: Bullish Outlook For Next Week Explained 🇬🇧🇺🇸

GBPUSD broke and closed above a key daily horizontal

resistance this week.

The next strong historic structure is 1.3.

It will most likely be the next goal for the buyers the following week.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SHORT ON GBP/CADGBP/CAD is rejecting a key supply area on the 15min after continuing to make (Lower Highs) on the Higher Time Frames.

There has been a change in market structure from Up to down on the lower timeframe signaling a possible drop.

GBP/CAD is highly over brought and I believe its ready to fall.

I will be selling GBP/CAD to the next swing low for about 100-150 pips. OANDA:GBPCAD

GBP/USD at 1.2880, Awaits NFP ReportGBP/USD holds modest gains around 1.2880 in Friday’s Asian session, recovering from the previous decline as investors await the US Nonfarm Payrolls (NFP) report. Meanwhile, the US Dollar Index (DXY) extends its five-day decline, pressured by falling Treasury yields, with the 2-year at 3.94% and the 10-year at 4.24%. Markets increasingly expect the Federal Reserve to adopt a more aggressive rate-cutting stance due to economic growth concerns.

Analysts at MUFG Bank suggest the Fed may shift focus from inflation control to economic growth, especially amid tariff uncertainties. Consumer confidence has weakened, reflecting rising household concerns.

In the UK, expectations for BoE rate cuts in 2025 have dropped below 50 basis points. BoE’s Catherine Mann stated that gradual rate changes are ineffective in volatile markets, advocating for larger cuts to provide clearer policy signals.

If GBP/USD breaks above 1.2920, the next resistance levels are 1.2980 and 1.3050. On the downside, support stands at 1.2860, with further levels at 1.2760 and 1.2660 if selling pressure increases.

GBPUSD - Retracement to the trendline?The GBP/USD pair has exhibited a strong bullish trend since its January lows, currently trading at 1.2876. After reaching recent highs, the price is now at a critical decision point as shown by the chart's resistance area (upper red box) and ascending trendline. The sharp upward movement followed by the recent pullback suggests potential exhaustion of buying momentum, with the red downward-pointing arrows indicating a possible corrective phase ahead.

Two scenarios appear most likely from this technical formation: either price continues higher to break above the upper resistance box before initiating a correction, or an immediate correction begins from current levels. In both cases, the lower orange box around the 1.2700-1.2720 area serves as a reasonable target, as does the ascending trendline (marked by the red dashed line) that has supported the uptrend since January. Traders should watch for potential reversal signals or consolidation patterns to confirm which scenario is unfolding. As always don't jump into trades and wait for confirmation!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Fundamental Market Analysis for March 6, 2025 GBPUSDThe GBP/USD pairing pressed the accelerator pedal and produced another strong session on Wednesday, rising a further 0.85% and marking a third consecutive session of solid gains.

Despite warnings that the UK economy as a whole is weakening, markets rose following Wednesday's Bank of England (BoE) monetary policy hearing. Bank of England Governor Andrew Bailey said inflation is expected to rise moderately despite weaker growth figures, prompting markets to adjust expectations of a rate cut before the end of 2025. Rates markets now expect less than 50bp of overall interest rate cuts before the end of the year.

ADP's employment change for February showed just 77k new jobs, well below the forecast of 140k and March's 186k. Despite this, ADP results have not consistently correlated with Non-Farm Payrolls (NFP) since the reporting change in 2022, so the low reading is of little significance.

There is little of note on the UK side of the economic data list this week, so the key data for traders remains US Non-Farm Payrolls (NFP), which will be released this Friday.

Trading recommendation: BUY 1.2900, SL 1.2820, TP 1.3050