Fundamental Market Analysis for August 1, 2025 GBPUSDThe pound remains under pressure due to the strengthening of the dollar and expectations of further easing of the Bank of England's policy at its meeting on August 7. The regulator's rhetoric in June-July pointed to a “gradual and cautious” course of rate cuts amid weak growth, and the market is pricing in the likelihood of another move at the next meeting. The situation is complicated by the fact that July inflation in Britain unexpectedly accelerated, but the regulator interprets it as a temporary consequence of tariff and price shocks, not wanting to tighten financial conditions excessively.

The external environment is also unfavorable for the GBP: the US has imposed new tariffs on a number of trading partners, strengthening demand for the dollar as a risk-free asset. For the UK, the trade implications are mixed: part of the supply chain is focused on the dollar zone, and industry is sensitive to global demand, which, in the context of prolonged uncertainty, is hitting investment and employment expectations. The risks of a decline in private sector business activity remain elevated.

Today, attention is focused on US employment data: if the labor market confirms its stability, the likelihood of a Fed rate cut in September will decrease further, which will keep the dollar in the ascendancy. All these factors combined create a bearish bias for GBPUSD in the short term, with any brief rebounds from local oversold conditions typically being used for selling.

Trading recommendation: SELL 1.32000, SL 1.32500, TP 1.31000

Pounddollar

GBP/USD Professional Analysis – “Trap Trigger at Support”GBP/USD Professional Analysis – “Trap Trigger at Support”

📈 Market Overview:

• Pair: GBP/USD

• Timeframe: Likely 1H or 2H based on candle spacing

• Date: July 28, 2025

• Current Price: 1.33529

⸻

🔍 Technical Breakdown

🔴 Resistance Zone: 1.35800 – 1.36200

• Strong supply area where the last bullish impulse failed.

• Price got rejected hard, initiating a new downtrend.

• Sell-side pressure was confirmed with Supertrend turning red.

🟤 Support Zone: 1.32860 – 1.33400

• Major demand area where price previously reversed sharply.

• Currently being tested again after a clean sweep into the Trap Trigger zone.

⚠ Trap Trigger Zone (Liquidity Sweep Area):

• Price wicked just below support, tapping into a low-volume/high-liquidity area.

• This wick likely cleared sell-side liquidity and trapped breakout sellers.

• Followed by a bullish rejection wick, implying smart money accumulation.

⸻

🛠 Indicators & Tools:

• Supertrend (10,3): Currently red, indicating short-term bearish momentum.

• However, if price closes above 1.34032 (Supertrend level), it could flip bullish.

• Volume Profile (VRVP):

• Low-volume node under support suggests a quick “stop hunt” move, not genuine selling.

• High-volume acceptance area sits higher, near 1.34500–1.35000.

⸻

🎯 Forecast:

🔴 Bearish Invalidations:

• Price closing below 1.32860 with volume would invalidate this setup.

• That could signal continuation to deeper liquidity (1.32500 or below).

⸻

🧠 Smart Money Perspective:

• Liquidity engineered beneath support

• Trap Trigger activated — ideal for institutional reversal setups

• This is a classic “Stop Hunt → Reclaim → Expand” model

Fundamental Market Analysis for July 23, 2025 GBPUSDSterling is struggling to hold above 1.35 as fundamentals tilt against it. US CPI has accelerated to 2.7 % y/y, reinforcing expectations that the Fed will delay its easing cycle, whereas in the UK subdued GDP growth and a cooling labour market have revived talk of a Bank of England rate cut as early as August.

Political noise adds to the pressure: London must balance the US’s hard‑line trade stance with the need to mend ties with the EU, heightening uncertainty for businesses. Meanwhile, capital is flowing toward higher‑yielding US Treasuries, sapping demand for UK assets.

The situation is compounded by Britain’s persistent current‑account deficit, which—amid a stronger dollar—requires ever‑higher risk premia to finance. All told, short positions in cable with a tight stop above 1.35750 look attractive in the short run.

Trade recommendation: SELL 1.35250, SL 1.35750, TP 1.34750

GBPUSD: Bearish > Bullish Order FlowAlright, we are approaching some Higher Timeframe Points of Interests. We got a Potential Bullish Bat Pattern Pattern this align with this Bullish H4 Order Block, that's right in the middle of an whole number 1.34. We could expect some spikes around the area, some complex pullbacks, but we must remain steady.

Will The Prospect of a BoE Rate Cut Continue to Dampen GBPUSD?Macro approach:

- GBPUSD has weakened since last week, pressured by disappointing UK economic data and rising expectations of a BoE rate cut. Meanwhile, the US dollar found support amid cautious risk sentiment and anticipation of key US inflation data.

- UK GDP contracted for a second consecutive month in May, and recent labor market surveys signaled further cooling, reinforcing the case for the BoE's monetary easing. Governor Bailey reiterated that the path for rates is "downward," with markets now pricing in a high probability of a cut at the Aug meeting.

- Meanwhile, the US dollar was buoyed by safe-haven flows and firm inflation expectations ahead of the US CPI release, highlighting policy divergence between the Fed and BoE.

- GBPUSD may remain under pressure as traders await UK inflation and employment data, which could influence the BoE's next move. The pair could see further volatility with US CPI and Fed commentary also on the radar as potential catalysts.

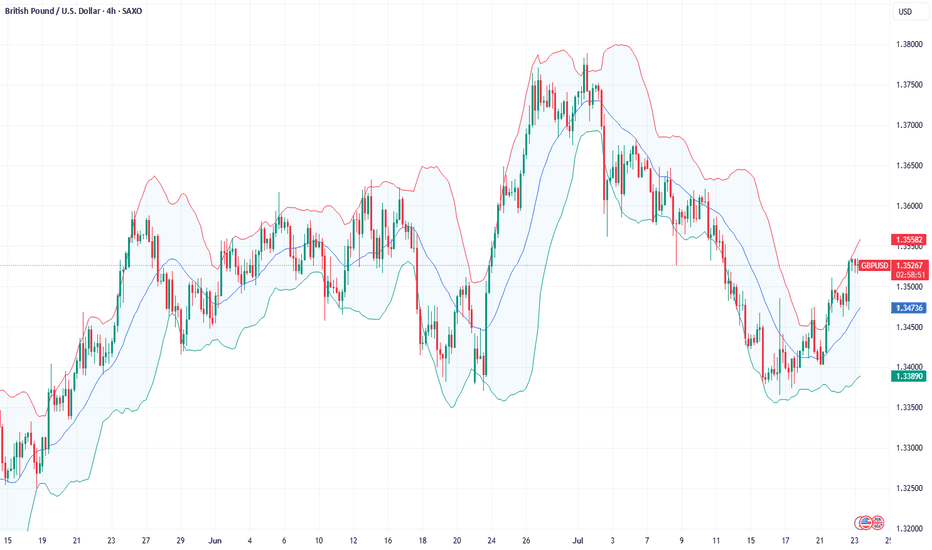

Technical approach:

- GBPUSD is retesting the ascending channel's lower bound, confluence with the key support at 1.3420. The price is between both EMAs, indicating a sideways movement. GBPUSD awaits an apparent breakout to determine the short-term trend.

- If GBPUSD breaches below the support at 1.3420, the price may plunge toward the following support at 1.3175.

- On the contrary, holding above 1.3420 may prompt a short correction to retest EMA21.

Analysis by: Dat Tong, Senior Financial Markets Strategist at Exness

GBP/USD Shorts from 3hr/5hr supply zoneMy analysis this week centers around the continuation of the bearish trend we've been observing. Recently, there was a break of structure, and a new supply zone has formed—indicating a potential continuation of the downtrend.

I’ll be waiting for price to retrace back into these Points of Interest (POIs), where I’ll look for lower time frame confirmations to catch potential sell entries and ride the move down.

I believe there’s still some bearish pressure left, and I expect price to continue falling until it reaches the 6-hour demand zone. Once we approach that area, I’ll begin looking for Wyckoff accumulation patterns as a signal for a potential reversal or rally to the upside.

Confluences for GBP/USD Sells:

✅ GBP/USD has been bearish over the past few weeks, and this trend may continue.

✅ Breaks of structure have occurred, forming fresh supply zones ideal for entries.

✅ Liquidity exists below current price, which may get swept before a reversal.

✅ The lower demand zone still needs to be mitigated, suggesting more downside movement first.

📌 If price fails to react properly at the 3-hour supply, I’ll be watching for a move into the 5-hour supply zone, which sits in a more premium area and may offer a cleaner reaction.

Let’s stay patient and focused — wishing everyone a profitable trading week ahead! 📉💼

GBP/USD Climbs as Trump Targets 14 NationsGBP/USD edged higher to around 1.3630 during Tuesday’s Asian session, posting a modest recovery after two straight days of losses. The British Pound found support as the US Dollar weakened in response to heightened market caution following President Donald Trump’s announcement of new tariff rates targeting 14 countries that have not yet finalized trade agreements with the US.

The Trump administration introduced a 25% tariff on imports from Japan and South Korea, warning of further escalation if these countries retaliate. Other nations affected include Malaysia, Kazakhstan, and Tunisia, each facing a 25% tariff, while South Africa will face a 30% tariff. Tariffs on Laos and Myanmar will rise to 40%, Indonesia faces 32%, Bangladesh 35%, and both Thailand and Cambodia will see tariffs of 36%.

Additionally, Trump signed an executive order delaying the enforcement of these new tariffs until August 1, allowing more time for negotiations, according to Bloomberg.

On social media, Trump issued a firm warning that any country aligning with the anti-American stance of the BRICS bloc would face an extra 10% tariff, stating unequivocally: “There will be no exceptions to this policy.”

Resistance is at 1.3640, while support holds at 1.3500.

Pound Holds Gains on UK Fiscal StabilityGBP/USD held around 1.3660 during Friday’s Asian session, marking a second day of consolidation as the dollar weakened on caution over Trump’s planned tariffs. Trump said he would start sending tariff letters Friday, targeting ten countries with rates of 20–30%. The pound was supported after PM Starmer backed Chancellor Reeves, easing market concerns over a possible replacement with looser fiscal policies.

The BoE is expected to cut rates in August, likely to 4%, following dovish signals from officials, including Governor Bailey, who said rates should gradually decline as inflation eases.

Resistance is at 1.3700, while support holds at 1.3600.

GBP/USD Potential Shorts from 1.37000This week, my analysis for GBP/USD focuses on the continuation of the bearish order flow. I currently have a clean 16-hour supply zone that remains unmitigated, where we may see a potential bearish reaction in alignment with the prevailing downtrend. If price breaks through this zone, I will shift focus to an extreme 2-hour supply zone higher up.

There are several imbalances and pools of liquidity resting below that serve as potential downside targets. Additionally, I’m noticing the formation of engineered liquidity beneath current price, which further supports the bearish outlook.

Confluences for GBP/USD Sells:

The U.S. Dollar has reacted from a strong demand zone, suggesting we could see continued bullish pressure on the dollar, which may weigh on GBP/USD.

GBP/USD has shown a clear change of character to the downside, confirming bearish market structure—this is a pro-trend trade setup.

We have both a clean 16-hour and an extreme 2-hour supply zone, offering high-probability entry points for potential shorts.

Multiple liquidity targets below, including Asia session lows and unfilled imbalances, align well with the bearish narrative.

P.S. My next potential long opportunity lies at the 6-hour demand zone near 1.34400. From there, I’ll be watching for price to slow down, accumulate orders, and potentially shift structure to the upside.

Wishing everyone a successful and profitable trading week!

GBP/USD Slides with Fiscal WorriesGBP/USD edged lower toward 1.3625 in Asian trading, pressured by a sharp selloff in UK government bonds and growing fiscal concerns.

Gilts suffered their biggest drop since October 2022 after the government’s decision to cut welfare benefits and mounting doubts over the Chancellor’s political future.

Marc Chandler, Chief Market Strategist at Bannockburn Global Forex LLC, noted: “The drop isn’t limited to the British Pound, UK gilts are also under heavy selling. It seems to be a broader crisis of confidence in the Labour government.”

Resistance is at 1.3675, while support holds at 1.3570.

Fundamental Market Analysis for July 2, 2025 GBPUSDOn Wednesday, during the Asian trading session, the GBP/USD pair is trading unchanged at around 1.37450. However, dovish statements by US Federal Reserve Chairman Jerome Powell and growing concerns about the budget may put pressure on the dollar in the near term. Investors are awaiting the ADP report on US employment for June, which will be released later on Wednesday, in the hope of new momentum.

Powell said on Tuesday that the US central bank would be patient about further interest rate cuts, but did not rule out a rate cut at its July meeting, although the decision would depend on incoming data. According to the CME FedWatch tool, short-term interest rate futures now price in the probability of a rate cut in July at almost 1 in 4, up from less than 1 in 5 previously.

Investors are concerned about US President Donald Trump's massive tax and spending bill, which could increase the national debt by $3.3 trillion. The bill will return to the House of Representatives for final approval. Fiscal concerns could dampen optimism and contribute to a decline in the US dollar.

As for the pound sterling, Bank of England (BoE) Governor Andrew Bailey said last week that there are currently signs of a weakening UK labor market and stressed that interest rates are likely to continue to fall. The UK central bank is expected to cut interest rates three times by the end of 2025, bringing them to 3.5% to combat sluggish economic growth and a weakening labor market. Rate cuts are expected in August, September, and November 2025, with possible quarterly reductions.

Trading recommendation: SELL 1.37450, SL 1.37900, TP 1.36750

Exclusive: GBP/USD Swing Heist – Limited-Time Opportunity!🏴☠️ GBP/USD HEIST ALERT: Bullish Loot Grab Before the Cops Arrive! 🚨💰

🌟 Attention, Market Pirates & Profit Raiders! 🌟

"The vault is unlocked—time to swipe those pips!"

🔥 THIEF TRADING STRATEGY (Swing/Day) 🔥

Based on high-risk, high-reward technical & fundamental analysis, here’s the master plan to plunder GBP/USD ("The Cable")!

📈 ENTRY (Bullish Heist Zone)

"The vault is OPEN!" – Long at any price, but for precision:

Buy Limit orders preferred (15m-30m timeframe).

Pullback entries from recent swing lows/highs = sneakiest loot grab!

🛑 STOP LOSS (Escape Route)

Thief SL: Nearest swing low (4H chart).

Adjust based on: Risk tolerance, lot size, & number of orders.

"A good thief always has an exit plan!"

🎯 TARGETS

1.37500 (or escape early if the cops 🚓 (bearish traps) show up!).

Scalpers: Only long-side raids! Use trailing SL to lock profits.

💥 WHY THIS HEIST? (Bullish Momentum)

Technicals + Fundamentals align for a potential breakout.

Overbought? Risky? Yes—but the best loot is guarded!

📢 TRADING ALERT (News & Risk Mgmt)

Avoid new trades during high-impact news (volatility = police sirens!).

Trailing stops = Your getaway car. Protect profits!

🚀 BOOST THE HEIST!

💖 Hit "Like" & "Boost" to fuel our next raid!

💬 Comment your loot tally below!

"Stay sharp, thieves—see you at the next heist! 🤑🔥"

GBPUSD: The Big Short Opportunity?(Breakout Confirmation Needed)🚨 GBP/USD BANK HEIST ALERT: The Bearish Robbery Plan (Swing/Day Trade) 🚨

🔥 Steal Pips Like a Pro – Thief Trading Strategy Inside! 🔥

🌟 GREETINGS, MARKET PIRATES! 🌟

🤑 To all the Money Makers, Risk Takers & Midnight Breakers!

Based on our 🔥Thief Trading Style🔥 (a deadly mix of technical + fundamental + intermarket analysis), we’re plotting a massive bearish heist on GBP/USD ("The Cable").

This is not financial advice—just a strategic robbery plan for those who dare to trade smart.

📉 THE HEIST STRATEGY (SHORT ENTRY FOCUS)

🎯 Target Zone: 1.32300 (or escape earlier if the market turns)

⚡ High-Risk, High-Reward Play: Oversold market, consolidation, trend reversal setup.

💣 Trap Level: Where bullish traders get wrecked.

🔑 ENTRY RULES:

"The Heist is ON!" – Wait for breakout confirmation at 1.33800 before striking.

Sell Stop Orders below breakout MA OR Sell Limit Orders (15-30 min timeframe).

Retest Entry? Ideal if price retraces to recent low/high before dropping.

📌 ALERT SETUP: Don’t miss the breakout—set a chart alert!

🛑 STOP LOSS (Risk Management):

Thief SL at 1.34800 (Swing/Day Trade basis – 3H period).

🚨 Pro Tip: "Yo, rebels! You can place SL wherever you want… but if you ignore this level, don’t cry later. Your risk, your rules."

🎯 PROFIT TARGET:

First Take-Profit: 1.32300 (or bail earlier if momentum fades).

Scalpers: Ride the short side only. Use trailing SL to lock profits.

📰 FUNDAMENTAL BACKUP (Why This Heist Works)

Before executing, check:

✅ COT Report (Are big players dumping GBP?)

✅ Macro News (UK vs. USD economic strength)

✅ Intermarket Analysis (DXY, Bonds, Equities correlation)

✅ Sentiment & Seasonality (Is the crowd too bullish?)

⚠️ WARNING: NEWS & VOLATILITY ALERTS

Avoid new trades during high-impact news (unless you love gambling).

Use trailing stops to protect profits if the market flips.

💥 BOOST THIS HEIST! 💥

🚀 Like & Share to strengthen our Thief Trading Squad!

💸 More heists = More profits. Stay tuned for the next robbery plan!

🤑 See you on the profitable side, bandits! 🏴☠️

🔴 DISCLAIMER: This is entertainment, not financial advice. Trade at your own risk.

#Forex #GBPUSD #TradingStrategy #ThiefTrading #BankHeist #SwingTrading #DayTrading

💬 COMMENT BELOW: Are you joining the heist or waiting for a better setup? 🚨👇

Risk Sentiment Improves, GBP/USD Nears 1.3650GBP/USD extended its rally for a third session, trading around 1.3620 and holding close to Tuesday’s high of 1.3648, its strongest level since February 2022. The pair continues to benefit from improved risk appetite as Middle East tensions ease following Trump’s announcement of a ceasefire between Iran and Israel.

Despite the initial increase, investors remain cautious as doubts persist over the ceasefire’s durability and potential nuclear negotiations with Iran. Focus is also on Iran’s enriched uranium stockpile, which continues to raise geopolitical concerns.

Meanwhile, Powell, in his congressional testimony, signaled that rate cuts are unlikely before Q4. He acknowledged that new tariffs could push inflation higher from June but maintained that the Fed is prepared to ease policy once conditions allow.

Resistance is seen at 1.3655, while support holds at 1.3540.

British Pound Slips to One-Month LowGBP/USD briefly climbed to 1.3560 in early European trading, supported by dollar softness and anticipation of upcoming speeches from BoE Governor Bailey and Fed Chair Powell. However, the pair remains under pressure, as market doubts linger around the ceasefire’s durability, especially after new missile activity by Israel’s IDF.

Fed rate cut expectations continue to build: odds for July are now at 23%, and 78% for September, fueled by dovish remarks from Governor Bowman.

Resistance is seen at 1.3600, while support holds at 1.3500.

Fundamental Market Analysis for June 24, 2025 GBPUSDThe GBP/USD pair is strengthening to 1.3560 in the early European session on Tuesday, helped by a weaker US Dollar (USD).

Federal Reserve (Fed) Governor Michelle Bowman said on Monday that she would favor an interest rate cut at the next meeting in July if inflationary pressures remain muted. Bowman's comments echoed those of Fed chief Christopher Waller, who said on Friday that he believes the U.S. central bank may consider a rate cut in July.

Traders now put the probability of a rate change at the July meeting at nearly 23%, and the probability that the Fed will cut rates in September at about 78%.

On the other hand, uncertainty surrounding the ceasefire between Israel and Iran and renewed tensions in the Middle East could increase safe-haven flows, supporting the Pound Sterling (GBP). The Israel Defense Forces said early Tuesday it had detected rockets launched from Iran towards southern Israel, despite US President Donald Trump saying a “full and final” ceasefire between Israel and Iran would take effect.

Trading recommendation: SELL 1.3545, SL 1.3645, TP 1.3345

GBP/USD Weakens Ahead of PMI ReleasesGBP/USD fell to around 1.3405 during Monday’s Asian session as safe-haven flows strengthened the US dollar amid rising Middle East tensions. Fears of Iranian retaliation after US airstrikes on three nuclear sites lifted demand for the Greenback. Trump said Iran’s facilities were “totally obliterated” and warned of stronger attacks unless peace is reached. Iran vowed to respond, saying it “reserves all options.”

Investors await June PMI data from the UK and US due later Monday. The Pound remains under pressure after UK retail sales dropped 2.7% MoM in May, well below the expected 0.5% decline and April’s revised 1.3% gain.

The BoE held rates at 4.25% last Thursday. Governor Bailey said rates are on a gradual downward path but warned of global unpredictability. Reuters expects 25 bps cuts in both August and Q4.

Resistance is seen at 1.3500, while support holds at 1.3415.

Sterling Flat Before BoE and Fed Policy DecisionsGBP/USD trades near 1.3435 on Wednesday, steadying after a 1.2% drop Tuesday amid rising geopolitical tensions and safe-haven dollar demand.

The pound stays under pressure ahead of today’s UK inflation report and tomorrow’s BoE decision, where rates are expected to remain at 4.25%. Any inflation surprise could shift market expectations.

Ongoing Middle East conflict continues to support the dollar, while traders also await the Fed’s policy announcement later today, which could influence GBP/USD further.

Resistance is at 1.3600, with support around 1.3425.

Pound Stable as Markets Eye BoE, Fed MovesGBP/USD remains below Friday’s three-year high, trading around the mid-1.3500s in a narrow range during Monday’s Asian session. The pair shows limited downside as traders await a busy week of key data and central bank decisions.

Markets are watching the UK CPI on Wednesday and the Bank of England’s policy announcement on Thursday, both crucial for the Pound. The US Federal Reserve will also decide on rates Wednesday, likely guiding the dollar’s short-term path.

Friday’s UK GDP showed a 0.3% contraction in April, increasing bets on faster BoE rate cuts. The USD is supported by safe-haven flows due to Middle East tensions, though soft US inflation data has raised expectations for Fed cuts by September. A broadly positive global risk mood is offering some support to GBP/USD.

Resistance is at 1.3600, with support around 1.3425.

Fundamental Market Analysis for June 11, 2025 GBPUSDThe GBP/USD pair continues to decline to around 1.34750 during Wednesday's Asian trading session. The pound sterling (GBP) is weakening against the US dollar (USD) due to a weaker UK employment report. Later on Wednesday, attention will shift to the US Consumer Price Index (CPI) for May.

The ILO unemployment rate in the UK rose to 4.6% in the three months to April from 4.5% previously, the British Office for National Statistics said on Tuesday. The figure was in line with expectations. Meanwhile, the change in the number of applicants for unemployment benefits in May was 33,100, compared with -21,200 previously (revised from 5,200), which is below the consensus of 9,500.

In addition, average earnings excluding bonuses in the UK rose 5.2% year-on-year (3M YoY) in April, compared with a revised 5.5% increase in the previous reading. The market forecast was 5.4%. Average earnings including bonuses rose 5.3% over the same period after accelerating to a revised 5.6% in the quarter to March. The data fell short of the forecast of 5.5%.

These figures indicate that the UK labor market is losing momentum under pressure from tax increases and the minimum wage hike by the government. This, in turn, may put some pressure on the pound sterling in the near term. “This gradual slowdown in wage growth may reassure the Bank of England after inflation unexpectedly jumped to its highest level in more than a year last month,” said Paige Tao, an economist at PwC UK.

Trading recommendation: SELL 1.34800, SL 1.35100, TP 1.34100

GBP/USD Buys from 1.34800 This week’s analysis focuses on capitalising on the strong bullish structure forming on GU. After a clear break of structure to the upside, price has been forming consistent higher highs and higher lows.

From this move, a key Point of Interest has been left around the 1.34800 level, which aligns with a clean 9H demand zone. As price now needs to retrace after the recent bullish push, this 9H zone becomes a likely area for accumulation and a potential continuation rally.

Confluences for GU Buys:

- GU has been very bullish overall on the higher timeframes

- The 9H demand zone caused the latest break of structure to the upside

- There’s plenty of liquidity and imbalance above that needs to be taken

- The DXY is moving bearish, supporting GU upside

P.S. If price pushes higher before retracing, it may enter a premium supply zone, where I’ll be watching for any significant reaction. Either way, patience is key — don’t hesitate to wait for your setup to fully form.

Wishing you a focused and profitable trading week!

GBPUSD: Potential Reversal After Strong RallyThe British Pound has shown strong gains against the US Dollar, approaching a key resistance area. After such an extended move, a correction or reversal would be a logical expectation.

Technical Setup

There is a clear series of bearish divergences on the CCI (14) indicator. Price is forming a narrowing rising wedge, which often signals trend exhaustion.

Trade Plan

Sell limit orders: 1.3690 and 1.3850

Market entry: Only after confirmation — either a trendline break or a moving average crossover

Conclusion

GBPUSD shows signs of weakening at the top. I remain focused on short setups from resistance areas, waiting for confirmation to act.

Fundamental Market Analysis for June 3, 2025 GBPUSDThe GBP/USD pair attracted sellers during Tuesday's Asian session and broke part of a strong overnight move up towards the 1.3560 area, or multi-day peak.

The U.S. Dollar Index (DXY), which tracks the dollar against a basket of currencies, rebounded from a six-week low reached on Monday and proved to be a key factor putting downward pressure on the GBP/USD pair.

In addition, concerns over the deteriorating US fiscal situation and renewed trade tensions between the US and China should help limit USD gains. The British Pound (GBP), on the other hand, may continue to receive support from expectations that the Bank of England (BoE) will take a pause at its next meeting on June 18 and will not rush to cut interest rates further.

Traders may also prefer to wait for the hearing of the Bank of England's monetary policy report in Parliament. Investors will be closely watching comments from Bank of England Governor Andrew Bailey and other members of the Monetary Policy Committee (MPC) for information on the policy outlook, which in turn will influence the GBP exchange rate.

Trading recommendation: SELL 1.3495, SL 1.3595, TP 1.3295