Market Analysis: GBP/USD Eyes Fresh GainsMarket Analysis: GBP/USD Eyes Fresh Gains

GBP/USD started a fresh increase above the 1.2900 zone.

Important Takeaways for GBP/USD Analysis Today

- The British Pound is eyeing more gains above the 1.2970 resistance.

- There is a key bearish trend line forming with resistance at 1.2935 on the hourly chart of GBP/USD at FXOpen.

GBP/USD Technical Analysis

On the hourly chart of GBP/USD at FXOpen, the pair formed a base above the 1.2870 level. The British Pound started a steady increase above the 1.2900 resistance zone against the US Dollar, as discussed in the previous analysis.

The pair surpassed the 50% Fib retracement level of the downward move from the 1.2972 swing high to the 1.2879 low. The pair is now consolidating near the 1.2925 zone and the 1.2420 level and the 50-hour simple moving average.

If there is another decline, the pair could find support near the 1.2900 level. The first major support sits near the 1.2880 zone. The next major support is 1.2870.

If there is a break below 1.2870, the pair could extend the decline. The next key support is near the 1.2820 level. Any more losses might call for a test of the 1.2800 support.

Conversely, the bulls might aim for more gains. The RSI moved above the 50 level on the GBP/USD chart and the pair is now approaching a major hurdle at 1.2935 and the 61.8% Fib retracement level of the downward move from the 1.2972 swing high to the 1.2879 low.

There is also a key bearish trend line forming with resistance at 1.2935. An upside break above the 1.2935 zone could send the pair toward 1.2970. Any more gains might open the doors for a test of 1.2995.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Pounddollar

Fundamental Market Analysis for April 1, 2025 GBPUSDOn Monday, the GBP/USD pair was traversing the charts in familiar territory, passing a familiar accumulation zone as investors awaited the latest iteration of US President Donald Trump's tariff threats. The Trump administration intends to enact a broad catalog of tariffs against virtually all US trading partners starting April 2.

Specific details of the Trump administration's tariff plans this week remain vague and elusive, but the main tariff threats remain “retaliatory” tariffs on all countries that have their own tariffs on imports of U.S. goods, regardless of the economic context. Retaliatory tariffs on Canada and the European Union are also expected, as well as additional flat tariffs on copper and automobiles.

The UK economic data release schedule remains loose this week, however, fresh US Nonfarm Payrolls (NFP) employment data is due out later this week. The release of NFP could be an important factor for the markets as the US economy transitions into a post-tariff economic environment, and the March labor data will serve as an “indicator” of the impact of the Trump team's tariff plans.

Trading recommendation: SELL 1.29250, SL 1.30000, TP 1.28650

GBP/USD Longs from 1.28900 back up to 1.30000I’m looking for long opportunities around the 5-hour demand zone, aiming to take price back up to the 6-hour supply zone, where I will then look for potential sell setups.

Since price is currently positioned between these key levels, I will wait to see where it starts to slow down and how it reacts. Ideally, I want to see accumulation in the demand zone and distribution in the supply zone before making any decisions. However, overall, my bias for GU remains bullish, especially as the U.S. dollar continues to weaken.

Confluences for GU Buys:

- A clear 5-hour demand zone presents a potential buying opportunity.

- Liquidity remains to the upside, which price may target before a reversal.

- DXY has shifted bearish, indicating a potential bullish move for GBP/USD.

- Price has been consistently bullish on the higher timeframe over the past few weeks.

Note: If price breaks below the nearby demand zone, I will expect a temporary bearish trend to form.

Pound Slips to $1.29 on Soft InflationThe British pound dipped to around $1.29 as traders reacted to softer inflation data and looked ahead to the Spring Statement. UK annual inflation eased to 2.8% in February, below the 2.9% forecast but in line with the BoE's outlook. Services inflation remained at 5%.

The BoE expects inflation to rise toward 4% later this year. Markets see a 92% chance of a 25bps rate cut in August and about a 60% chance of another by year-end. Chancellor Rachel Reeves is set to outline the economic outlook and announce major government spending cuts.

If GBP/USD breaks above 1.3050, the next resistance levels are 1.3100 and 1.3150. On the downside, support stands at 1.2860, with further levels at 1.2800 and 1.2715 if selling pressure increases.

GBP/USD Stable at $1.292: Budget AwaitedGBP/USD is trading steadily around $1.292 as markets await British finance minister Rachel Reeves’ spring budget update. Despite dollar strength from solid U.S. data and rising Treasury yields, the pound remains resilient, supported by cautious optimism over the UK’s fiscal outlook. Traders are watching the upcoming budget for clues on spending and economic forecasts, which could impact GBP/USD in the near term.

If GBP/USD breaks above 1.3050, the next resistance levels are 1.3100 and 1.3150. On the downside, support stands at 1.2860, with further levels at 1.2800 and 1.2715 if selling pressure increases.

GBP/USD Analysis: Pair Fails to Hold Above Psychological LevelGBP/USD Analysis: Pair Fails to Hold Above Psychological Level

As shown in today’s GBP/USD chart, the pair failed to maintain its position above the psychological level of 1.3000 USD per pound, where it had reached its highest point since early 2025. The decline followed recent central bank decisions and statements, with both the Bank of England and the Federal Reserve keeping interest rates unchanged.

On one side, the Bank of England:

→ Warned of inflation risks, partly driven by external factors such as US trade tariffs.

→ Indicated a potential rate cut in the coming months.

On the other hand, the US dollar strengthened on Thursday after the Federal Reserve signalled reluctance to rush further rate cuts this year, despite uncertainties surrounding US tariffs.

These statements highlighted the challenges market participants face in assessing the risks posed by tariffs on global trade.

Technical Analysis of GBP/USD

In March, the pound followed an upward trend against the US dollar, forming an ascending channel (marked in blue). However, once the price moved above the key 1.3000 level, the upper boundary of the channel appeared out of reach—possibly signalling weakening buying momentum.

As a result, the price broke below the lower boundary of the channel, which has now shown signs of resistance (indicated by an arrow). If bearish pressure persists, the price could fall towards the dotted trendline below the channel, at a distance equal to its height. Additionally, a test of the previous local low around 1.2911 cannot be ruled out.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Sterling Stays Firm as Fed Highlights GrowthGBP/USD held near 1.3000 as sentiment stayed upbeat after the Fed reaffirmed 2025 rate cuts, though delayed. Markets still expect a 25 bps cut in June, with Powell highlighting strong US growth and a healthy labor market.

The Fed lowered its 2025 GDP forecast to 1.7% from 2.1% and acknowledged trade policy risks but sees inflationary effects as short-lived.

Focus now shifts to the BoE’s Thursday rate decision, with no changes expected. On Friday, the UK’s GfK Consumer Confidence is projected to fall to -21.0 from -20.0.

If GBP/USD breaks above 1.3050, the next resistance levels are 1.3100 and 1.3150. On the downside, support stands at 1.2860, with further levels at 1.2800 and 1.2715 if selling pressure increases.

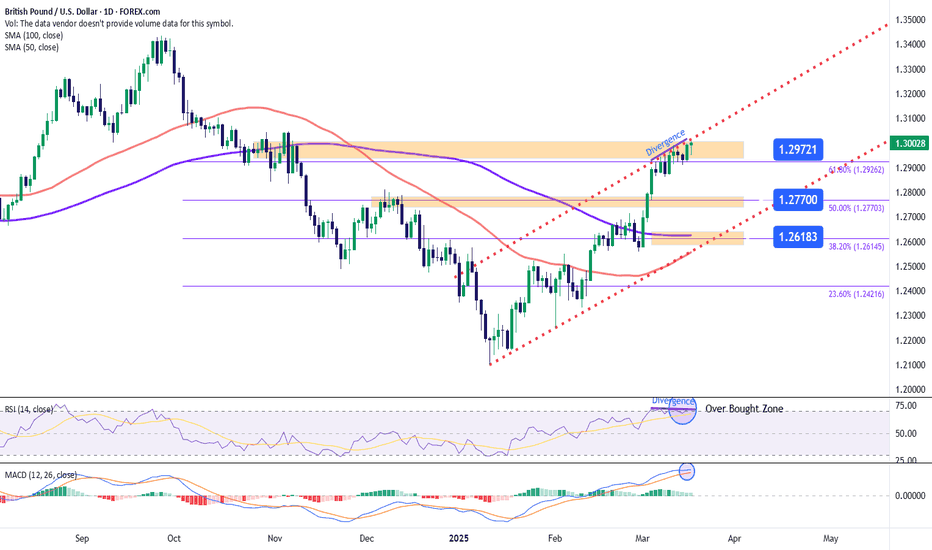

GBP/USD: Bullish Channel Meets Overbought Zone in RSISince March 3, an unprecedented bullish movement has emerged on the GBP/USD daily chart, with the pair accumulating a gain of over 3% during this period. The bullish pressure continues to be driven by uncertainty surrounding the trade war, which has gradually weakened the U.S. dollar, prompting investors to seek refuge in European currencies.

Today, the market is showing a strong neutral candle, partly due to the expectation surrounding the Federal Reserve’s interest rate decision, which will be announced tomorrow, along with the Bank of England’s decision on Thursday. Until the outcomes of both central bank meetings are known, the neutral bias is likely to dominate short-term movements in GBP/USD.

Bullish Channel

Since mid-January, a consistent bullish pressure has developed in the pair, forming a short-term ascending channel. Currently, price movements are testing the upper boundary of this channel. If buying pressure remains strong, the bullish trend could accelerate in the coming sessions, leading to a steeper channel in the short term.

RSI (Relative Strength Index)

However, the RSI presents a different scenario. The upper boundary of the bullish channel coincides with the overbought zone, as the RSI oscillates near 70 . Additionally, higher highs in price and lower highs in the RSI indicate a persistent divergence. These two signals suggest that buying momentum may be slowing down, potentially leading to short-term bearish corrections.

MACD (Moving Average Convergence Divergence)

The MACD is showing a similar trend to the RSI. The signal line and MACD line are at levels not seen since August 2024, and a potential crossover could occur in the coming sessions. This indicates that the recent bullish momentum in moving averages is gradually fading, which could create room for selling corrections in the upcoming sessions.

Key Levels to Watch:

1.29721 – Current Resistance: This significant resistance level sits at the upper boundary of the bullish channel and coincides with the 61.8% Fibonacci retracement level. Sustained breakouts above this level could accelerate buying pressure, leading to a stronger bullish move.

1.27700 – Near-Term Support: This support zone aligns with the 50% Fibonacci retracement level and could serve as a potential area for short-term bearish corrections.

1.26183 – Distant Support: This critical support aligns with the 50- and 100-period moving averages and the lower boundary of the larger bullish channel. A break below this level could jeopardize the current bullish formation, potentially triggering a stronger bearish move.

By Julian Pineda, CFA – Market Analyst

Pound Steady Near Four-Month Low Amid BoE Rate Hold ExpectationsThe pound traded at $1.294, near a four-month low, as investors awaited the BoE's Thursday decision. The central bank is expected to hold rates at 4.5%, balancing weak growth and inflation risks. Despite forecasts for 2025 rate cuts, none are expected now. The UK labor market is weakening, with unemployment set to hit 4.5% and wage growth slowing. Markets also await Chancellor Reeves’ Spring Statement on March 26 for economic updates. In trade talks, the UK is taking a softer stance with the US than the EU.

If GBP/USD breaks above 1.3050, the next resistance levels are 1.3100 and 1.3150. On the downside, support stands at 1.2860, with further levels at 1.2800 and 1.2715 if selling pressure increases.

Pound Drops to $1.29 After Unexpected ContractionThe British pound fell to $1.29 after UK GDP unexpectedly shrank by 0.1% in January, missing forecasts of 0.1% growth, mainly due to weakness in the production sector.

The Bank of England recently cut its Q1 growth forecast to 0.1% from 0.4%, with rates expected to stay at 4.5% in next week’s policy decision. Markets also await Chancellor Rachel Reeves' fiscal plans and the OBR’s economic outlook on March 26. Meanwhile, US economic concerns and trade tensions have limited the pound’s losses.

If GBP/USD breaks above 1.2980, the next resistance levels are 1.3050 and 1.3100. On the downside, support stands at 1.2860, with further levels at 1.2760 and 1.2660 if selling pressure increases.

Fundamental Market Analysis for March 17, 2025 USDJPYThe Japanese yen (JPY) fluctuated between moderate gains and minor losses against its US counterpart during Monday's Asian session amid mixed fundamentals. Optimism driven by China's stimulus measures announced over the weekend is evident in the overall positive tone in Asian stock markets. This, in turn, is seen as a key factor undermining the safe-haven yen.

Nevertheless, a significant yen depreciation remains elusive amid diverging policy expectations between the Federal Reserve (Fed) and the Bank of Japan (BoJ). In addition, geopolitical risks and concerns over the economic impact of US President Donald Trump's tariffs are supporting the yen. In addition, bearish sentiment around the US Dollar (USD) should restrain the USD/JPY pair.

Traders may also refrain from aggressive directional bets and prefer to step aside ahead of this week's key central bank events - the Bank of Japan and Fed decisions on Wednesday. This calls for caution from the yen bears and positioning for a continuation of the recent rebound in the USD/JPY pair from the multi-month low around 146.550-146.500 reached last Tuesday.

Trading recommendation: BUY 148.900, SL 148.400, TP 150.100

Fundamental Market Analysis for March 14, 2025 GBPUSDThe GBP/USD pair continues to decline for the second consecutive session, trading near 1.29400 during the Asian session on Friday. The pair faces challenges as the Pound Sterling (GBP) struggles amid weakening risk sentiment, exacerbated by concerns over global trade after US President Donald Trump threatened to impose 200% tariffs on European wines and champagne, which worried markets.

Traders are now awaiting the UK's monthly gross domestic product (GDP) and factory data for January, which will be released on Friday. Investors will be keeping a close eye on the UK GDP data as the Bank of England (BoE) has expressed concerns about the outlook for the economy. At its February meeting, the Bank of England revised its GDP growth forecast for the year to 0.75%, up from the 1.5% projected in November.

The US Dollar (USD) is appreciating amid growing concerns about a slowdown in the global economy, with traders' attention focused on Friday's Michigan Consumer Sentiment Index data. The US Dollar Index (DXY), which tracks the dollar against six major currencies, strengthened after Thursday's positive jobless claims report and weaker-than-expected Producer Price Index (PPI) data. At the time of writing, the DXY is trading near 104.00.

U.S. initial jobless claims for the week ended March 7 came in at 220,000, below the 225,000 expected. Jobless claims fell to 1.87 million, below the forecast of 1.90 million, indicating a resilient U.S. labor market.

Inflationary pressures in the US showed signs of easing. The producer price index rose 3.2% year-on-year in February, down from 3.7% in January and below the market forecast of 3.3%. The core producer price index, which excludes food and energy, rose 3.4% on a year-over-year basis, up from 3.8% in January. On a monthly basis, the core price index was unchanged, while the underlying price index declined 0.1%.

Trading recommendation: SELL 1.29400, SL 1.29900, TP 1.28600

GBP/USD Climbs to 1.2960, Dollar Under PressureGBP/USD trades around 1.2960 in Thursday’s Asian session, extending gains for a third day as the US Dollar weakens with recession fears linked to Trump’s policies.

The dollar faces further pressure after February inflation slowed more than expected, raising speculation of an earlier Fed rate cut. Headline inflation fell from 0.5% to 0.2% monthly and from 3.0% to 2.8% yearly, while core inflation dropped to 0.2% monthly and 3.1% yearly. Markets now await US PPI and jobless claims data for further economic signals.

If GBP/USD breaks above 1.2980, the next resistance levels are 1.3050 and 1.3100. On the downside, support stands at 1.2860, with further levels at 1.2760 and 1.2660 if selling pressure increases.

Dollar Weakness Supports GBP Near HighsThe British pound held around $1.29, near a four-month high, as dollar weakness persisted on US economic concerns and tariff risks. Sterling was supported by expectations that UK rates will stay higher for longer, with traders pricing in only 52bps of BoE cuts in 2025.

UK’s monthly GDP data for January and the Office for Budget Responsibility’s economic and borrowing forecasts on March 26 are now awaited, which could impact market sentiment.

If GBP/USD breaks above 1.2950, the next resistance levels are 1.2980 and 1.3050. On the downside, support stands at 1.2860, with further levels at 1.2760 and 1.2660 if selling pressure increases.

Fundamental Market Analysis for March 11, 2025 GBPUSDThe GBP/USD pair is recovering the previous session's losses, trading near 1.28900 during Asian hours on Tuesday. The pair is rising on the back of a weaker US dollar amid concerns that tariff policy uncertainty could lead the US economy into recession.

Weaker-than-expected U.S. employment data for February reinforced expectations of multiple rate cuts by the Federal Reserve (Fed) this year. LSEG data shows that traders now expect a total of 75 basis points (bps) in rate cuts, with the June rate cut already fully priced in.

However, Fed Chairman Jerome Powell reassured markets that the central bank sees no immediate need to adjust monetary policy despite growing uncertainty. San Francisco Fed Chair Mary Daly supported that view on Sunday, noting that rising uncertainty in the business environment may reduce demand but is not a reason to change the interest rate.

As the Federal Reserve enters the black period ahead of its March 19 meeting, the central bank's comments this week will be limited. Investors now await the release of the February Consumer Price Index (CPI) on Wednesday to get further insight into inflation trends.

Trading recommendation: SELL 1.28900, SL 1.29500, TP 1.27800

GBP/USD at 1.2880, Awaits NFP ReportGBP/USD holds modest gains around 1.2880 in Friday’s Asian session, recovering from the previous decline as investors await the US Nonfarm Payrolls (NFP) report. Meanwhile, the US Dollar Index (DXY) extends its five-day decline, pressured by falling Treasury yields, with the 2-year at 3.94% and the 10-year at 4.24%. Markets increasingly expect the Federal Reserve to adopt a more aggressive rate-cutting stance due to economic growth concerns.

Analysts at MUFG Bank suggest the Fed may shift focus from inflation control to economic growth, especially amid tariff uncertainties. Consumer confidence has weakened, reflecting rising household concerns.

In the UK, expectations for BoE rate cuts in 2025 have dropped below 50 basis points. BoE’s Catherine Mann stated that gradual rate changes are ineffective in volatile markets, advocating for larger cuts to provide clearer policy signals.

If GBP/USD breaks above 1.2920, the next resistance levels are 1.2980 and 1.3050. On the downside, support stands at 1.2860, with further levels at 1.2760 and 1.2660 if selling pressure increases.

Pound Surges on BoE Policy OutlookThe British pound climbed to 1.289, its highest since November 12, increased by a weaker dollar, US economic concerns, and tariff effects. Expectations of prolonged high UK rates also supported the pound. BoE Deputy Governor Ramsden warned of persistent wage-driven inflation but noted rate cuts could accelerate if needed. The pound appears less exposed to US tariffs after Trump hinted at a possible UK trade deal.

If GBP/USD breaks above 1.2920, the next resistance levels are 1.2980 and 1.3050. On the downside, support stands at 1.2860, with further levels at 1.2760 and 1.2660 if selling pressure increases.

GBP/USD Longs from 1.25800 up to the 7hr supplyFor this week, I expect GBP/USD to retrace back to the clean, unmitigated 18-hour demand zone before pushing back up toward the 7-hour supply zone that I previously marked. If this move doesn’t play out as expected, I anticipate price will first mitigate the 7-hour supply zone before slowing down and distributing within my point of interest (POI).

From there, I’ll be watching for a short move back to the 18-hour demand zone, where I plan to enter buys and continue trading in alignment with the overall market trend. Since price is currently near both POIs, I’ll be keeping a close eye on this setup.

Confluences for GU Buys:

✅ Strong bullish trend with consistent breakouts to the upside.

✅ 18-hour demand zone remains unmitigated and was the origin of the last bullish move.

✅ 7-hour supply zone above that also needs to be mitigated.

✅ The Dollar Index (DXY) has been very bearish, further supporting GBP strength.

Alternative Scenario:

If price reacts strongly from the 7-hour supply zone and breaks below the 18-hour demand, I’ll shift my focus to my next buy zone around 1.25200.

Wishing everyone a profitable trading week—let’s finish it in BLUES! 🔵

Fundamental Market Analysis for February 21, 2025 GBPUSDThe GBP/USD pair declined after hitting a two-month high of 1.26740 on Friday and was trading near 1.26700 at the time of writing during the Asian session. However, the pair strengthened as the US Dollar (USD) struggled amid weak jobless claims data and mixed signals from the Federal Reserve (Fed).

Initial jobless claims in the US rose to 219,000 in the week ended February 14, above the expected 215,000. Jobless claims also rose slightly to 1.869 million, just below the forecast of 1.87 million.

Additionally, GBP/USD rose amid improving market sentiment after US President Donald Trump signaled potential progress in trade talks with China, easing market fears over tariffs.

On Thursday, Fed chief Adriana Kugler said U.S. inflation still has “some way to go” before it reaches its 2% target, acknowledging uncertainty in the future, Reuters reported.

Meanwhile, St. Louis Fed President Alberto Musalem emphasized the potential risks of stagflation and rising inflation expectations. Atlanta Fed President Rafael Bostic left open the possibility of two rate cuts this year depending on economic conditions.

Trading recommendation: SELL 1.26700, SL 1.27300, TP 1.25600

GBP.USD Longs from 1.25600 back upI expect GBP/USD to continue its bullish momentum and push higher. Following the previous break of structure, I am looking for price to mitigate the 2-hour demand zone to maintain this upward trend. If price does not react from this level, I have also identified a 3-hour demand zone as a secondary point of interest.

If price reacts bullishly from either of these zones, my next selling opportunity will be at the refined 1-hour supply zone around 1.26600. Once price reaches this level, I will look for signs of distribution to confirm a potential short setup.

Confluences for GU Buys:

- For price to continue higher, it must mitigate a strong demand zone to gain momentum.

- Liquidity remains above, providing a natural target for price.

- The higher time frame trend is still bullish.

- Clean 2-hour, 3-hour, and 11-hour demand zones are in close proximity.

- DXY has been bearish, which aligns with this bullish GU outlook.

P.S. If price drops instead, I have an extreme discounted zone marked at the 11-hour demand zone at the bottom as a potential long entry.

GBP/USD Analysis by zForex Research TeamGBP/USD Recovers as Trump Pauses Tariffs, But Risks Persist

The British pound rebounded above $1.24 after falling to $1.225, following Trump’s deal with Mexico’s President Sheinbaum to pause tariffs for a month. Uncertainty remains as Trump imposed 25% tariffs on Canada and Mexico, 10% on China, and threatened the EU and UK. Growing trade tensions have fueled expectations of Bank of England rate cuts, with markets pricing in 81bps of cuts by December and a 95% chance of a 25bps cut to 4.5% this Thursday.

The first resistance level for the pair will be 1.2450. In the event of this level's breach, the next levels to watch would be 1.2500 and 1.2600. On the downside 1.2265 will be the first support level. 1.2100 and 1.1900 are the next levels to monitor if the first support level is breached.

GBP/USD Longs from 1.22400 to fill market gapI expect GBP/USD to start the week with a bullish move, as price has gapped down significantly, altering my initial perspective from Sunday. This gap has also led to a break of structure to the downside.

Looking at the current price action, I’ve identified a clean 3-hour demand zone nearby. Price has already shown an initial bullish reaction from this level, but if it fails to hold, there is a deeper 4-hour demand zone where we could also expect a reaction.

Confluences for GU Buys:

- The price gap has left a significant imbalance that needs to be filled.

- Price is currently in a 3-hour demand zone that previously caused a Break of Structure (BOS),

making it a valid POI.

- There is a large pool of liquidity to the upside that needs to be taken.

- The setup aligns well with the DXY correlation.

Note: If price reacts as expected, I will look for potential shorting opportunities around the 1.2400 region, where a 2-hour supply zone is located.

Have a great trading week ahead, everyone!

Fundamental Market Analysis for January 30, 2025 GBPUSDThe GBP/USD pair is trading slightly higher around 1.24450 in the early hours of European trading on Thursday. The moderate decline in the US dollar is providing some support to the major pair. Investors will be keeping a close eye on the preliminary US gross domestic product (GDP) data for the fourth quarter (Q4), due for release later today.

GBP/USD spun in a tight circle on Wednesday, briefly dipping into the 1.24000 area after the Federal Reserve (Fed) left interest rates unchanged. Interest rate futures markets generally predicted no movement on interest rates as the Fed sees little reason to rush into further rate cuts. The second half of the trading week will see the release of key U.S. data to see if the Fed did the right thing.

On Wednesday, the Federal Reserve (Fed) left rates unchanged as futures markets had predicted, with Fed Chairman Jerome Powell reiterating that the Fed takes a data-dependent approach when adjusting rates. Fed Chairman Powell noted that the Federal Open Market Committee (FOMC) is closely watching what policies US President Donald Trump will pursue, but denied that the newly elected US President has been in direct contact with the Fed.

Fed Chairman Powell said that the Federal Open Market Committee (FOMC) is closely monitoring what policies US President Donald Trump will pursue, but denied that the newly elected US president has had direct contact with the Fed. As an independent federal agency, the White House has little influence over policy recommendations made by the Federal Reserve.

Fed Chairman Powell also noted that while inflation is still trending toward the medium target level, the current economic landscape, as well as some concerns about the sweeping trade policies pursued by US President Trump, mean that the Fed is in no hurry to adjust the restrictive nature of rates. Betting markets have lowered their bets on a Fed rate cut in 2025. According to CME's FedWatch tool, rate futures markets are pricing in no change in the federal funds rate until June at the earliest.

Trading recommendation: Watch the level of 1.24500, when fixing above it consider Buy positions, when rebounding consider Sell positions.