Exclusive: GBP/USD Swing Heist – Limited-Time Opportunity!🏴☠️ GBP/USD HEIST ALERT: Bullish Loot Grab Before the Cops Arrive! 🚨💰

🌟 Attention, Market Pirates & Profit Raiders! 🌟

"The vault is unlocked—time to swipe those pips!"

🔥 THIEF TRADING STRATEGY (Swing/Day) 🔥

Based on high-risk, high-reward technical & fundamental analysis, here’s the master plan to plunder GBP/USD ("The Cable")!

📈 ENTRY (Bullish Heist Zone)

"The vault is OPEN!" – Long at any price, but for precision:

Buy Limit orders preferred (15m-30m timeframe).

Pullback entries from recent swing lows/highs = sneakiest loot grab!

🛑 STOP LOSS (Escape Route)

Thief SL: Nearest swing low (4H chart).

Adjust based on: Risk tolerance, lot size, & number of orders.

"A good thief always has an exit plan!"

🎯 TARGETS

1.37500 (or escape early if the cops 🚓 (bearish traps) show up!).

Scalpers: Only long-side raids! Use trailing SL to lock profits.

💥 WHY THIS HEIST? (Bullish Momentum)

Technicals + Fundamentals align for a potential breakout.

Overbought? Risky? Yes—but the best loot is guarded!

📢 TRADING ALERT (News & Risk Mgmt)

Avoid new trades during high-impact news (volatility = police sirens!).

Trailing stops = Your getaway car. Protect profits!

🚀 BOOST THE HEIST!

💖 Hit "Like" & "Boost" to fuel our next raid!

💬 Comment your loot tally below!

"Stay sharp, thieves—see you at the next heist! 🤑🔥"

Poundsterling

GBPUSD: The Big Short Opportunity?(Breakout Confirmation Needed)🚨 GBP/USD BANK HEIST ALERT: The Bearish Robbery Plan (Swing/Day Trade) 🚨

🔥 Steal Pips Like a Pro – Thief Trading Strategy Inside! 🔥

🌟 GREETINGS, MARKET PIRATES! 🌟

🤑 To all the Money Makers, Risk Takers & Midnight Breakers!

Based on our 🔥Thief Trading Style🔥 (a deadly mix of technical + fundamental + intermarket analysis), we’re plotting a massive bearish heist on GBP/USD ("The Cable").

This is not financial advice—just a strategic robbery plan for those who dare to trade smart.

📉 THE HEIST STRATEGY (SHORT ENTRY FOCUS)

🎯 Target Zone: 1.32300 (or escape earlier if the market turns)

⚡ High-Risk, High-Reward Play: Oversold market, consolidation, trend reversal setup.

💣 Trap Level: Where bullish traders get wrecked.

🔑 ENTRY RULES:

"The Heist is ON!" – Wait for breakout confirmation at 1.33800 before striking.

Sell Stop Orders below breakout MA OR Sell Limit Orders (15-30 min timeframe).

Retest Entry? Ideal if price retraces to recent low/high before dropping.

📌 ALERT SETUP: Don’t miss the breakout—set a chart alert!

🛑 STOP LOSS (Risk Management):

Thief SL at 1.34800 (Swing/Day Trade basis – 3H period).

🚨 Pro Tip: "Yo, rebels! You can place SL wherever you want… but if you ignore this level, don’t cry later. Your risk, your rules."

🎯 PROFIT TARGET:

First Take-Profit: 1.32300 (or bail earlier if momentum fades).

Scalpers: Ride the short side only. Use trailing SL to lock profits.

📰 FUNDAMENTAL BACKUP (Why This Heist Works)

Before executing, check:

✅ COT Report (Are big players dumping GBP?)

✅ Macro News (UK vs. USD economic strength)

✅ Intermarket Analysis (DXY, Bonds, Equities correlation)

✅ Sentiment & Seasonality (Is the crowd too bullish?)

⚠️ WARNING: NEWS & VOLATILITY ALERTS

Avoid new trades during high-impact news (unless you love gambling).

Use trailing stops to protect profits if the market flips.

💥 BOOST THIS HEIST! 💥

🚀 Like & Share to strengthen our Thief Trading Squad!

💸 More heists = More profits. Stay tuned for the next robbery plan!

🤑 See you on the profitable side, bandits! 🏴☠️

🔴 DISCLAIMER: This is entertainment, not financial advice. Trade at your own risk.

#Forex #GBPUSD #TradingStrategy #ThiefTrading #BankHeist #SwingTrading #DayTrading

💬 COMMENT BELOW: Are you joining the heist or waiting for a better setup? 🚨👇

STEAL THIS TRADE! GBP/JPY Long Setup(Thief Trader’s Secret Plan)💰 Thief Trader’s GBP/JPY Heist Alert – Stealthy Long Setup Loading!

🌍 Greetings, Profit Raiders!

Hola, Konnichiwa, Ni Hao, Privyet, Hallo, Bonjour!

📢 Attention Market Bandits & Chart Pirates—the GBP/JPY Beast is ripe for plunder! Time to execute the next Thief Trader Masterplan.

🎯 Entry Zone – Loot the Dip!

Current price = Open vault. Fire longs now or snipe pullbacks (15M/30M charts recent swing low level).

Pro Thief Move: Stack buy limits near swing lows/highs. Chart alerts = your secret weapon. 🔫

🛑 Stop Loss – Guard the Treasure!

Swing Thieves: Hide SL below 4H swing low (~190.000).

Day Raiders: Adjust SL to your risk size & order count. No free rides!

🎯 Profit Target – Escape with the Gold!

Take the 200.000 bag or exit early if momentum fades.

🔪 Scalpers vs. Swingers – Choose Your Weapon!

Scalpers (Quick Strikes): Longs only. No distractions.

Swing Traders (Patient Hunters): Trail stops & lock in gains.

🌪️ Market Pulse – Bullish Winds Blowing!

Price battling MA Resistance? No panic. Bulls still rule thanks to:

Fundamentals + Macro Trends

COT Data + Sentiment Shift

Quant Scores & Intermarket Alignments

(Check Linkss for the full heist blueprint.)

⚠️ News Trap Warning!

Upcoming high-impact events? Freeze trades or tighten stops. Trailing SL = your escape route.

🚨 Join the Thief Trading Crew!

Like 👍 or Boost 🚀 this idea to fuel our next raid.

Thief Trader Tactics = Daily Market Domination. Your support keeps the heists alive! 💰❤️

🤑 Stay Locked In – The Next Big Score is Coming…

Timing is everything. Watch the charts. Strike hard. Exit smarter.

EURGBP Potential Bullish Reversal OpportunityEURGBP price action seems to exhibit signs of a potential Bullish Reversal on the shorter timeframes if the price action forms (and sustains) a credible Higher High with multiple confluences from key Fibonacci and Support levels.

Trade Plan :

Entry @ 0.8459

Stop Loss @ 0.8375

TP 0.9 - 1 @ 0.8534 - 0.8540

"GBP/NZD: The Perfect Long Trade (Risk-Managed Heist Plan)"🏦💰 GBP/NZD BANK HEIST: The Ultimate Sterling vs. Kiwi Money Grab! 💰🏦

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Attention all Money Makers & Market Robbers! 🤑💸✈️

Based on the 🔥Thief Trading Style🔥 (technical + fundamental analysis), here’s our master plan to loot the GBP/NZD "Sterling vs Kiwi" Forex Bank Heist!

📜 THE HEIST BLUEPRINT:

✅ Entry Strategy (Long Only!) 📈

"The heist is ON! Wait for the breakout above the previous high (2.25500) – then strike! Bullish profits await!"

Option 1: Place Buy Stop orders above the Moving Average.

Option 2: Use Buy Limit orders near recent swing lows (15-30 min timeframe) for pullback entries.

📌 Pro Tip: Set an ALERT for the breakout entry—don’t miss the robbery window!

🛑 Stop Loss (Listen Up!)

"Yo, thieves! 🗣️ If you’re entering on a Buy Stop, DO NOT set your SL until after the breakout! 🚀 Place it where I say (or wherever you dare 😈), but remember—your risk, your rules! ⚠️🔥"

📍 Thief SL Placement: Nearest swing low (1H timeframe) – 2.23700 (adjust based on risk & lot size).

🎯 Profit Target: 2.28700 (Time to escape with the loot!)

⚡ Scalpers’ Note: Only scalp LONG! Big wallets? Go all in. Small wallets? Ride the swing. Use trailing SL to protect your stolen cash! 💰

📰 WHY THIS HEIST? (Fundamental Edge)

GBP/NZD is showing bullish momentum due to:

Macroeconomic factors

COT Report insights

Sentiment shifts & intermarket trends

🔗 Full analysis? Check our bio0 for the deep dive!

⚠️ Trading Alert: News = Danger Zone! 📰🚫

Avoid new trades during high-impact news.

Use trailing stops to lock in profits & dodge volatility traps.

💥 BOOST THE HEIST!

💖 Support the robbery crew—SMASH THAT LIKE BUTTON! 💖

🚀 More heists coming soon—stay tuned, thieves! 🏆🤝🎉

GBPCHF BULLISH TRADE IDEAThis chart shows the British Pound / Swiss Franc (GBP/CHF) on a 2-hour Heikin Ashi timeframe, and it highlights a potential bullish breakout scenario. Here's a breakdown:

🔍 Key Observations:

Descending Channel:

Price was trading within a downward-sloping parallel channel, defined by two blue trendlines.

This pattern often signals a bullish continuation when it forms as a correction in an uptrend.

Breakout Confirmation:

Price has just broken above the upper boundary of the descending channel — a strong bullish signal.

This suggests that selling pressure is weakening and buyers are taking control.

Bullish Projection:

The blue projection arrow outlines a potential bullish continuation pattern (possible retest of breakout and rally).

This could lead to higher highs, targeting areas above 1.1200 and potentially 1.1250+.

Heikin Ashi Candles:

Recent candles are large and green, indicating strong upward momentum and trend clarity.

📈 Bullish Bias Justification:

Break of Structure: Clean breakout from the descending channel.

Momentum Shift: Strong bullish Heikin Ashi candles with minimal lower wicks.

Trend Continuation Pattern: The entire structure resembles a bull flag, a classic continuation signal.

✅ Possible Trading Implications:

Entry Opportunity: Traders may look to enter on a retest of the breakout zone (around 1.1130–1.1150).

Targets: Near-term: 1.1200 | Mid-term: 1.1250+

Stop Loss Zone: Below 1.1100 (inside the channel), to invalidate the breakout.

⚠️ Watch for:

False Breakouts: Confirm the breakout with continued bullish candles or volume (if available).

CHF Strength: Any sudden CHF strength (safe-haven flows) could invalidate bullish expectations.

GBP/USD: The Pound Rebounds Back Above 1.33000During the last trading session, the GBP/USD pair posted a gain of more than 0.5% in favor of the pound, as U.S. dollar weakness continues, even after some positive remarks regarding the U.S.–China trade war. For now, it seems that investors are viewing European currencies as a potential safe haven amid the current wave of economic uncertainty across markets. This shift in sentiment has helped to sustain consistent bullish pressure on the pound in the short term.

Broad Ascending Channel

Since mid-January, the pair has been forming a strong ascending channel, with price now trading above the 200-period simple moving average, reinforcing long-term bullish momentum. So far, no bearish correction has been strong enough to break the channel, which remains the most relevant technical formation to monitor for upcoming GBP/USD moves.

RSI

Despite strong bullish momentum, a notable divergence has begun to form on the RSI, as the pair continues to post higher highs in price, while the RSI shows flat peaks in the short term. In addition, the RSI line is hovering near the 70 level, which marks the overbought zone. Both signals suggest a potential imbalance in market forces, possibly opening the door to short-term bearish corrections.

Key Levels:

1.33763 – Key Resistance: This level represents the most recent highs reached by GBP/USD. A sustained move above this area could confirm strong bullish momentum and lead to an acceleration within the current channel.

1.30448 – Near Support: This area corresponds to a consolidation zone seen over the past few months. It may serve as a tentative barrier where short-term pullbacks could occur.

1.28248 – Major Support: This is a critical level, aligned with the 200-period simple moving average. A decisive move below this support could invalidate the current bullish formation and potentially trigger a long-term bearish shift.

Written by Julian Pineda, CFA – Market Analyst

GBPUSD - Will the dollar go up?!The GBPUSD pair is above the EMA200 and EMA50 on the 4-hour timeframe and is moving in its ascending channel. If the pair corrects down towards the demand zone, it can be bought in the direction of its rise.

According to the latest Reuters survey of economists, U.S.-imposed trade tariffs have had a significant negative impact on the business environment in the United Kingdom. The assessment suggests that global trade tensions, combined with America’s protectionist policies, have undermined the confidence of British companies and investors in the country’s economic outlook. Market pricing reflects expectations that the Bank of England will cut interest rates by 0.84% over the course of this year.

The survey indicates that the UK’s GDP growth for 2025 is expected to average 0.9%, down from the previous estimate of 1%. Growth for 2026 is now projected at 1.2%, also lower than the 1.4% forecast made in March.

In terms of monetary policy, there is a strong consensus among economists that the Bank of England is on a gradual path toward easing interest rates. Projections suggest that the base rate will decline by 25 basis points each quarter throughout 2025, reaching 3.75% by year-end. Notably, all 67 economists participating in the poll expect the Bank of England to cut rates by 25 basis points at its May 8 meeting, bringing the rate down to 4.25%.

Meanwhile, the U.S.Federal Reserve, in its latest Beige Book release, reported that economic activity across the country has shown “little change.” The report detailed that only five districts experienced “modest growth,” three noted activity was “about flat,” and four reported “slight to moderate declines.” The Fed stated, “The outlook in several districts deteriorated notably due to heightened economic uncertainty, particularly stemming from tariffs.”

On employment, most districts experienced “little to slight” increases. One district noted a “modest increase,” four reported “slight gains,” another four observed no change, and three recorded “slight declines” in employment levels.

At the same time, prices continued to rise across the country. Six districts described price growth as “modest,” while the other six reported it as “moderate.” The Fed explained that most districts expected input costs to rise further due to tariffs.

UBS has issued a warning that Donald Trump’s calls for rate cuts may erode confidence in the Federal Reserve’s independence and fuel greater uncertainty in financial markets.

UBS analysts believe that reduced investment and consumption in the U.S. economy are primarily driven by increased economic uncertainty, rather than restrictive monetary policy. They emphasize that markets are highly sensitive to any perceived threats against the Fed’s autonomy, and in the current climate, it is this economic volatility—more than interest rate levels—that is harming the economy.

GBP/USD Maintains a Consistent Upward ChannelThe bearish bias seen in previous sessions appears to have paused temporarily, giving way to a notable bullish momentum, which has driven gains of over 1% in the short term in favor of the British pound. Today’s White House announcement to temporarily pause tariffs on several previously threatened countries—excluding China, which could face tariffs of up to 125%—has weakened the U.S. dollar in the short term. This shift has allowed the British pound to regain ground, supporting a steady bullish bias in the GBP/USD pair.

Upward Channel

Since January 14 of this year, bullish strength has been dominant, forming a clear ascending channel that has repeatedly pushed the price above the 200-period moving average. Recent bearish swings have failed to break through the ascending trendline, which remains intact, making this bullish channel the most important formation to monitor for now.

TRIX

Despite recent declines in the TRIX line, the indicator continues to oscillate above the zero level. This suggests that buying momentum remains intact when averaging recent moving periods. As long as the TRIX line continues to hold above the neutral level, bullish strength may become increasingly consistent in the short term.

RSI

The RSI line is approaching the 50 level, which marks the neutral zone on the indicator. However, if a significant breakout above this level occurs, bullish impulses could become dominant in the market—potentially strengthening upward pressure on GBP/USD.

Key Levels:

1.29275 – Near Resistance: This level represents the recent weekly high. Bullish moves above this level could reinforce the short-term buying bias and lead to more sustained upward momentum.

1.27772 – Near Barrier: This level aligns with the 200-period moving average. Continued price action around this zone may lead to neutral consolidation and the formation of a short-term sideways range.

1.26183 – Final Support: This level corresponds to late February lows. A confirmed break below this support could signal the end of the current bullish channel.

By Julian Pineda, CFA – Market Analyst

GBPJPY GJ looks bullish

194.764 is a major zone looking at the 1w, 1d, 4h, and the 1h. If GJ currently find support. We possibly going to experience the bullish power, as the trend is changing.

Another bullish confirmations will be:

- moving average forming dynamic support on 4h

- bullish candlestick formation in the 4h

- bullish continuation pattern on the 1h

- lower time frame (15m and 5m) for entry

Buying tp zone is 198.00

GBP/USD LONGHi !

Based on the current price action and I have prepared 2 trades for next week.

First is a long position from 1.287 where is VAL , price has respected this area, making it a good level for initiating a smaller long position with limited risk.

Forward I am looking at 1.3 area and looking to scaling in after confirmation above 1.302 ensures that I participate in the trend continuation without overexposing prematurely.

Step 1: Small Entry at 1.287

Entry: Long position at 1.287.

Stop Loss: Below 1.2800.

Take Profit: Partial profit near resistance at 1.3000, or hold until breakout confirmation.

Step 2: Scale In After Breakout

Entry Trigger: Wait for price action to break and hold above 1.302 (confirmed by strong candlestick close or volume spike).

Entry Price: Enter larger position at 1.302.

Stop Loss: Below recent breakout level (~1.295).

Take Profit Levels:

First Target: 1.3200.

Second Target: 1.3400.

FX:GBPUSD

GBP/USD Analysis: Pair Fails to Hold Above Psychological LevelGBP/USD Analysis: Pair Fails to Hold Above Psychological Level

As shown in today’s GBP/USD chart, the pair failed to maintain its position above the psychological level of 1.3000 USD per pound, where it had reached its highest point since early 2025. The decline followed recent central bank decisions and statements, with both the Bank of England and the Federal Reserve keeping interest rates unchanged.

On one side, the Bank of England:

→ Warned of inflation risks, partly driven by external factors such as US trade tariffs.

→ Indicated a potential rate cut in the coming months.

On the other hand, the US dollar strengthened on Thursday after the Federal Reserve signalled reluctance to rush further rate cuts this year, despite uncertainties surrounding US tariffs.

These statements highlighted the challenges market participants face in assessing the risks posed by tariffs on global trade.

Technical Analysis of GBP/USD

In March, the pound followed an upward trend against the US dollar, forming an ascending channel (marked in blue). However, once the price moved above the key 1.3000 level, the upper boundary of the channel appeared out of reach—possibly signalling weakening buying momentum.

As a result, the price broke below the lower boundary of the channel, which has now shown signs of resistance (indicated by an arrow). If bearish pressure persists, the price could fall towards the dotted trendline below the channel, at a distance equal to its height. Additionally, a test of the previous local low around 1.2911 cannot be ruled out.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

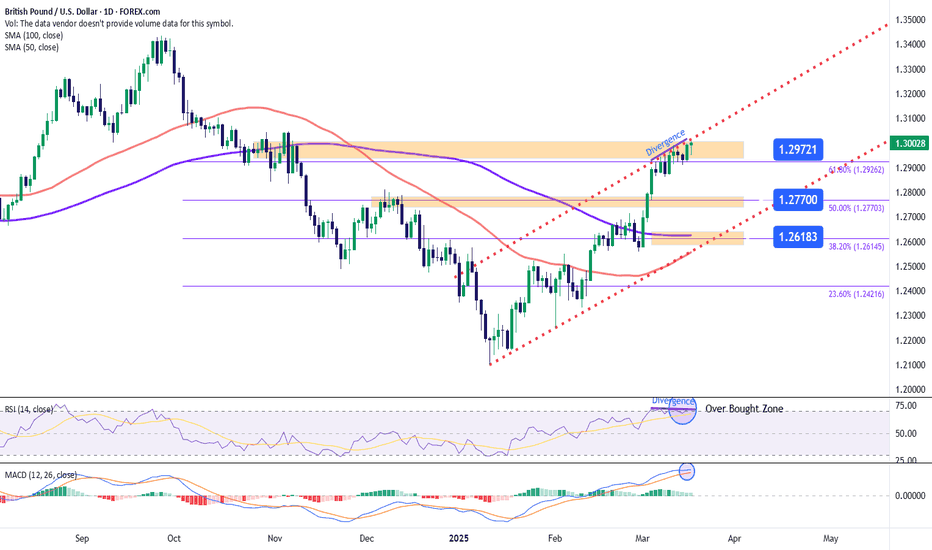

GBP/USD: Bullish Channel Meets Overbought Zone in RSISince March 3, an unprecedented bullish movement has emerged on the GBP/USD daily chart, with the pair accumulating a gain of over 3% during this period. The bullish pressure continues to be driven by uncertainty surrounding the trade war, which has gradually weakened the U.S. dollar, prompting investors to seek refuge in European currencies.

Today, the market is showing a strong neutral candle, partly due to the expectation surrounding the Federal Reserve’s interest rate decision, which will be announced tomorrow, along with the Bank of England’s decision on Thursday. Until the outcomes of both central bank meetings are known, the neutral bias is likely to dominate short-term movements in GBP/USD.

Bullish Channel

Since mid-January, a consistent bullish pressure has developed in the pair, forming a short-term ascending channel. Currently, price movements are testing the upper boundary of this channel. If buying pressure remains strong, the bullish trend could accelerate in the coming sessions, leading to a steeper channel in the short term.

RSI (Relative Strength Index)

However, the RSI presents a different scenario. The upper boundary of the bullish channel coincides with the overbought zone, as the RSI oscillates near 70 . Additionally, higher highs in price and lower highs in the RSI indicate a persistent divergence. These two signals suggest that buying momentum may be slowing down, potentially leading to short-term bearish corrections.

MACD (Moving Average Convergence Divergence)

The MACD is showing a similar trend to the RSI. The signal line and MACD line are at levels not seen since August 2024, and a potential crossover could occur in the coming sessions. This indicates that the recent bullish momentum in moving averages is gradually fading, which could create room for selling corrections in the upcoming sessions.

Key Levels to Watch:

1.29721 – Current Resistance: This significant resistance level sits at the upper boundary of the bullish channel and coincides with the 61.8% Fibonacci retracement level. Sustained breakouts above this level could accelerate buying pressure, leading to a stronger bullish move.

1.27700 – Near-Term Support: This support zone aligns with the 50% Fibonacci retracement level and could serve as a potential area for short-term bearish corrections.

1.26183 – Distant Support: This critical support aligns with the 50- and 100-period moving averages and the lower boundary of the larger bullish channel. A break below this level could jeopardize the current bullish formation, potentially triggering a stronger bearish move.

By Julian Pineda, CFA – Market Analyst

GBPUSD - Dollar’s view on jobs data!The GBPUSD pair is above the EMA200 and EMA50 on the 4-hour timeframe and is moving in its ascending channel. In case of a downward correction, the pair can be sold to narrow it.

Last week ended with an unexpected shock for economists: estimates pointed to a significant trade imbalance in the United States for January, primarily driven by a sharp surge in imports. The data indicated that U.S. businesses had made extensive efforts to ramp up foreign purchases ahead of the imposition of new tariffs. Economic analysts expressed concerns that this trend could negatively impact U.S. GDP growth in the first quarter of 2025, as increased imports are typically subtracted from gross domestic product calculations.

However, Goldman Sachs experts presented a different perspective. They argue that the unexpected surge in imports was mainly due to an influx of gold bars into the U.S.—a trend that reflects the dynamics of the global precious metals market and the price disparity between gold in London and New York.

According to data cited by Goldman Sachs, the U.S. imported approximately $25 billion worth of gold in January, meaning that a substantial portion of the commodity trade deficit was driven by gold transactions. Since gold is generally considered a financial asset, these imports are not factored into GDP calculations.

As a result, the actual economic impact of this growing trade deficit may be significantly lower than initially perceived.

Currently, financial markets anticipate a 77-basis-point rate cut by the Federal Reserve this year. However, this expectation largely hinges on the trajectory of inflation. At the same time, uncertainty surrounding tariff policies remains high.

A new report from the New York Federal Reserve indicates that inflation expectations among businesses have risen. According to the report, projected inflation for the next year has increased from 3% to 3.5% among manufacturing firms and from 3% to 4% among service-based companies. Additionally, many businesses foresee a significant rise in operational costs in 2025.

Meanwhile, market pricing suggests that traders no longer expect the Bank of England to implement two rate cuts this year. Taylor, a member of the central bank, stated that every policy meeting carries great importance. He noted that the output gap—the difference between actual and potential production—may be larger than previous Bank of England estimates. Taylor emphasized that monetary policies should gradually return to normal and that a cautious approach is necessary when dealing with multiple price shocks.

Furthermore, Andrew Bailey, Governor of the Bank of England, stressed that the economic outlook remains uncertain, with risks moving in both directions. He stated that while inflation is expected to rise, it will not resemble the severe inflationary periods of recent years. According to Bailey, decisions on rate cuts will depend on inflation trends, which have so far remained within an acceptable range. He also noted that the likelihood of second-round inflationary effects—where slowing economic growth leads to renewed price pressures—has diminished.

GBPUSD - Dollar’s eye on the Fed?!The GBPUSD pair is above the EMA200 and EMA50 on the 4-hour timeframe and is moving in its ascending channel. In case of a downward correction, the pair can be bought within the specified demand range.

The Federal Reserve of the United States has embarked on a process that could have profound implications for the global economy: a reassessment of the framework used to determine interest rates. These rates influence borrowing costs and prices not only in the U.S. but also across much of the world.To implement this reform effectively, the Federal Reserve must first identify the core issue. During the January meeting of the Federal Open Market Committee, central bank policymakers emphasized that the new framework must be “resilient to a wide range of conditions.” This marks a step in the right direction, given that the current framework, established in 2020, proved inadequate in responding to the economic disruptions caused by the COVID-19 pandemic.

The 2020 framework was introduced at a time when inflation consistently remained below the Fed’s 2% target. To compensate for this shortfall, policymakers committed to allowing inflation to run above target. Specifically, the Fed pledged to keep short-term interest rates near zero until three conditions were met:

• The economy achieved maximum sustainable employment,

• Inflation reached 2%,

• Inflation was expected to remain above 2% for some time.

Additionally, interest rate hikes could not begin until the central bank had concluded its asset purchase program, known as quantitative easing (QE)—a process that itself depended on substantial progress toward meeting the three stated conditions.

As a result, the Federal Reserve was significantly delayed in responding to a strong economy, a tight labor market, and accelerating inflation. When rate hikes finally began in March 2022, real GDP growth remained robust, unemployment was below the level deemed sustainable by policymakers, and the Fed’s preferred inflation gauge had already exceeded 5%.

Despite these clear signals, debates persist about whether the Fed’s policy framework was to blame. Some argue that the central bank merely made a forecasting error, later compensating with aggressive monetary tightening. Fed Chair Jerome Powell has echoed this view, calling the framework “useless.”

However, had the Federal Reserve disregarded this framework and instead adhered to traditional policy rules, it likely would have started raising short-term rates about a year earlier.

Another argument is that the inflation surge, which was observed globally, was beyond the Fed’s control. However, in the U.S., surging demand for goods—bolstered by a massive fiscal stimulus—played a significant role in driving up global prices.

Additionally, while many other countries faced dramatic increases in energy prices, this factor played a relatively minor role in the U.S. inflation spike.

A third perspective holds that the Biden administration’s $1.9 trillion stimulus package was excessively large. While this undoubtedly contributed to economic overheating, it was still the Fed’s responsibility to account for its effects and respond with tighter monetary policy.

Identifying these missteps is crucial. Otherwise, how can we be confident that the Federal Reserve won’t repeat them? Credibility is essential; without it, policymakers will struggle to influence financial markets and the broader economy effectively.

To restore confidence, the Fed must address the shortcomings of the 2020 framework. It should abandon policies that kept interest rates artificially low for too long and adopt a more cautious approach to quantitative easing (QE) and quantitative tightening (QT). Finally, it should reconsider whether interbank interest rates remain the best policy tool or if focusing on the interest rate banks pay on reserves would be more effective.

GBP/USD: Bank of England's Cautious Tone Sparks DeclineThe British pound has retreated from its recent gains, succumbing to downward pressure as Bank of England (BoE) Governor Andrew Bailey voiced his apprehensions regarding the economic outlook. This cautious stance from the BoE's leadership has cast a shadow over the currency, prompting investors to reassess their positions.

From a technical analysis perspective, the GBP/USD pair is currently navigating a critical zone, characterized by a supply area that has historically acted as a barrier to upward movement. Notably, the latest Commitments of Traders (COT) report reveals that retail traders are predominantly positioned on the bullish side of the market, suggesting a potential mismatch between market sentiment and the underlying fundamentals.

Furthermore, seasonal patterns indicate that the pound may be on the cusp of a bearish momentum shift. This confluence of technical and seasonal factors has created a high-probability setup for a potential reversal, with the price action poised to challenge the recent uptrend.

In light of these developments, we are actively seeking a short setup, anticipating that the pound's decline may gain momentum in the near term. The alignment of technical, fundamental, and seasonal forces suggests that the GBP/USD pair may be vulnerable to a corrective move, presenting an opportunity for traders to capitalize on the potential downturn. As the market continues to evolve, careful monitoring of the price action and trading sentiment will be crucial in determining the optimal entry and exit points for this potential short trade.

✅ Please share your thoughts about GBP/USD in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

POUNDS CLIMBS amid Eco Growth & Slower Inflation. What's Next?A week ago BOE just cut it's rate by 25 bps and still have possibility to continue it's normalization cycle. Yesterday we saw GDP m/m actual data higher than expected and it's good for currency. YoY inflation rate also still in control and it's also good for currency.

Technically, the bullish momentum just paused by trendline resistance and classical resistance. Pounds may have correction movement before he continue it's uptrend. Traders may use 1.25000 and see buy chance with a stoploss at 1.24440

GBPUSD - Will the dollar return to the bullish trajectory?!US President Donald Trump has once again shown his mastery of political bluffs. He pushed negotiations with Mexico and Canada to the brink of crisis, there were numerous reports of increased tariffs and tougher measures, but in the end, he canceled everything. Instead, only a few symbolic measures were announced at the border, many of which had been discussed before. Now it seems that this scenario will be repeated again in the next 30 days.

That this was a bluff was predictable from the beginning, but it was a challenging experience for analysts and markets. If you didn’t have a moment of doubt during this process, you probably weren’t paying close enough attention. But that’s the Trump strategy: in the market you have to have a strong belief that you are on the right track. When everyone is panicking, you have to stay calm and watch the process from the outside. The trade war has caused significant volatility in financial markets, and it’s not easy to make a profit in this environment.

One of the main challenges was the timing. Last week, Trump announced that Mexico and Canada could do nothing to prevent the tariffs. But just days later, the two countries made almost no concessions and no tariffs were imposed.

The signs of a shift in direction were already clear. The most important sign was the comments of Kevin Hassett, the White House economic adviser, who indicated that the talks were changing direction. He shifted the focus of the discussion to the problem of drugs and fentanyl, a shift that indicated that the Trump administration was looking to declare a victory in the negotiations.

When even CNBC analysts noticed the change, it was clear that the direction of the talks had changed. “It doesn’t seem like you believe that these tariffs are going to happen, or that they will last very long,” one of the network’s hosts told Hassett in an interview.

How did the financial markets react? The currency market was one of the best indicators to understand developments. While the stock markets were volatile, the trends in Forex were more transparent and occurred without random disturbances.

The focus of attention on financial markets today is the Bank of England’s monetary policy decision. The Bank of England is expected to cut interest rates by 25 basis points, starting the new year. The decision will not come as a surprise, as OIS market data shows that traders have priced in a cut with a probability of around 92%. The cut will take the Bank of England’s policy rate to 4.50%, while policymakers continue to gradually reduce interest rates.

However, the most important part of the decision will be the central bank’s statement and tone. The results of the December vote showed that there is a division among BoE policymakers. Dhingra, Ramsden and Taylor had voted for a 25 basis point cut earlier in the same meeting.

The Bank of England continues to insist that “a gradual approach to removing monetary policy constraints remains appropriate.” This will remain the watchword for monetary policy today, even if interest rate cuts are implemented.

But economic uncertainties remain. The December inflation report showed that price pressures have eased, but the trend is not sustainable.

Analysts have made a few key points:

• The decline in inflation has been driven largely by falling service prices.

• But a closer look suggests that the decline may be temporary. Rob Wood of Pantheon Economics explained that the ONS’s calculation method has led to a drop in airline prices on December 10. The drop came before the Christmas break, when prices would normally have been expected to rise.

Overall, the disinflationary trend remains unsustainable. With core inflation still above 3%, the Bank of England remains committed to keeping price pressures in check.

Future Forecast:

• The Bank of England will cut interest rates today as expected, but will emphasize that future actions will depend on economic data.

• Traders do not expect interest rate cuts in February and March, but have forecast the next cut for May 2025.

• In total, interest rate cuts for 2025 are estimated at around 83 basis points.

Since the Bank of England is unlikely to make any clear commitments on the future course of its policies, the impact of this decision on the value of the pound and government bonds (Gilts) is expected to be limited.

The GBPUSD currency pair is located between the EMA200 and EMA50 on the 4-hour timeframe and is moving in its ascending channel. In case of a downward correction, the pair can be bought within the specified demand zone.