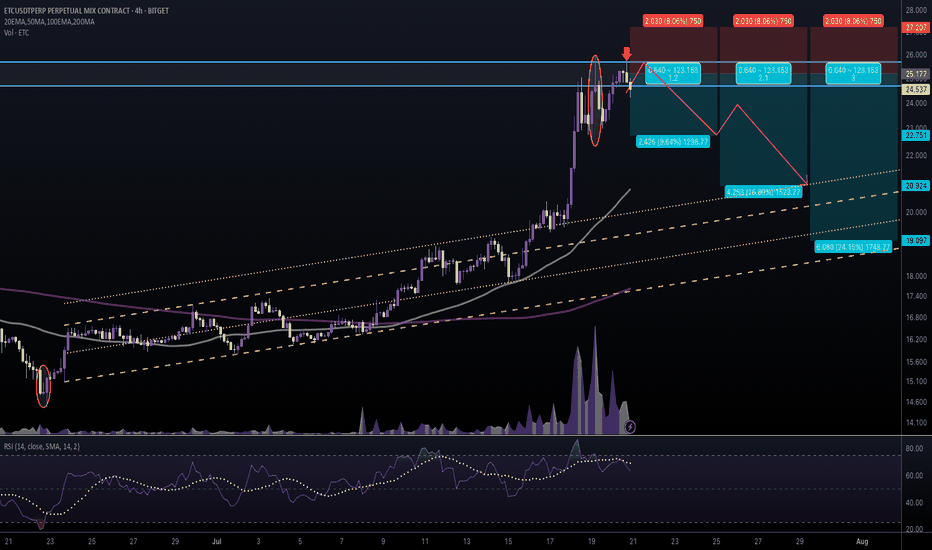

#ETCUSDT #4h (Bitget Futures) Ascending channel retestEthereum Classic printed two evening stars in a row, looks locally topped and ready for correction towards 50MA & 200MA supports.

⚡️⚡️ #ETC/USDT ⚡️⚡️

Exchanges: Bitget Futures

Signal Type: Regular (Short)

Leverage: Isolated (5.0X)

Amount: 5.0%

Entry Zone:

24.679 - 25.675

Take-Profit Targets:

1) 22.751

2) 20.924

3) 19.097

Stop Targets:

1) 27.207

Published By: @Zblaba

CRYPTOCAP:ETC BITGET:ETCUSDT.P #4h #EthereumClassic #PoW #L1 ethereumclassic.org

Risk/Reward= 1:1.2 | 1:2.1 | 1:3.0

Expected Profit= +48.2% | +84.5% | +120.7%

Possible Loss= -40.3%

Estimated Gaintime= 1-2 weeks

POW

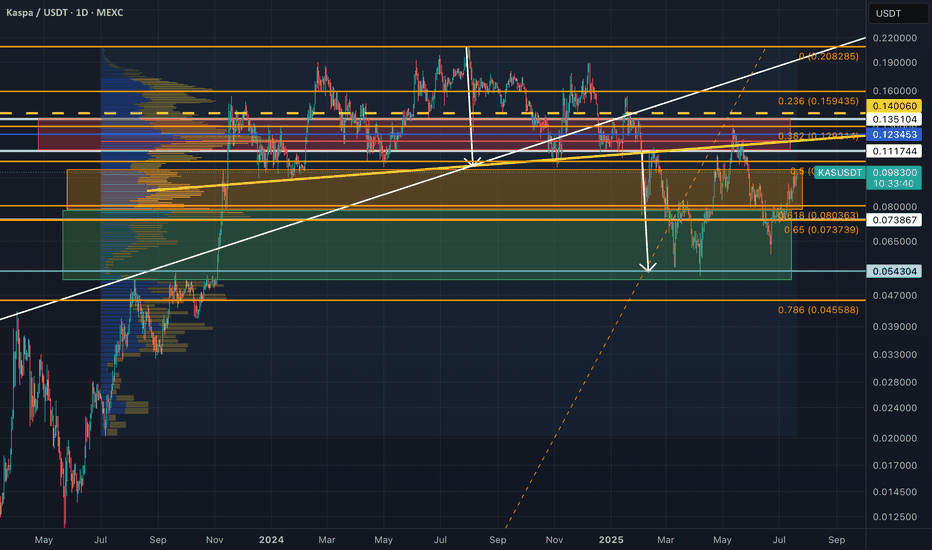

Last chance to reaccumulate Kaspa while it is below 10 cents?Second chance to accumulate CSE:KAS at below 10 cents after its correction down to 5 cents from its 20 cents ATH is coming to an end?

Previously, technicals looked great for CSE:KAS (and other ALTs too) with a breakout from a cup-&-handle pattern in July/Aug2024, but market says otherwise with gloomy economic report. >> For the small portion of capital assigned to trading crypto: I got stopped out from my (manually adjusted) trailing stoploss, with an approx. 6.8%avg loss from my BTC and ETH DCA spot injections into CSE:KAS from 10 cents all the way to 20 cents ATH.

For my long-term investment hold, I had bought from 2 cents all the way to almost ATH (at ~15 cents) and still holding and adding to it now as long as KAS is below. 10 cents. Had started accumulating aggressively again within the green zone, and probably gonna stop soon once KAS leaves the orange zone.

Last cycle, my main Altcoin investment focus was in ADA (POS and UTXO based chain based on academic research and peer-reviewed design), eventually selling most of other ALTs into ADA. This cycle, my personal investment focus is in Kaspa — and probably holding 15%(?) through the bear market correction after blow-off-top into the next cycle together with BTC and some ETH as well. Fingers crossed with regards to price; although the technology, decentralization ethos, and general fundamentals behind it is IMO extremely sound, and has a high probability (though not certain) to eventually establish itself to become one of the (if not THE) top L1s into the future.

———————————————

My reply re. the past YTD price performance of CSE:KAS , which I feel might be worth sharing here.

"For Kaspa, on the YTD timeframe, it has corrected ~50% down, after a ~10x rise from about 2 cents (when I first got in, in 2023) all the way to 20 cents. It is still an early tech about 3 years old and still not widely know; hence as an investment, it is definitely risky and high volatility is to be expected (not listed in high liquidity Tier1 exchanges yet), just like BTC in 2017 where I first bought at ~3kUSD, and a lot more significantly at 5k, and all the way to its ATH at 20kUSD, and stupidly held when it dropped all the way to 3kUSD, and kept on buying with a long-term view.

I view Kaspa in the same light as BTC (different from other cryptos), the only two that I will probably still hold a small but significant portion of, after the blow off top of this cycle due to its fundamentals that I am personally drawn towards -- e.g. POW but 6000x faster than BTC in bps, and ultimately will be 60000x faster once the DAGKnight protocol is implemented in 2026 (trilemma solved); protocol are based on peer-reviewed published research; fair-launched with no-VCs pre-allocation nor pre-mine; no central controlling figure; no DAG/Chain bloating due to implementation of pruning and where 0% TX-archival nodes are needed to maintain the security of mining, and are only necessary for explorers and institutions that intends to track TXs; (soon to come in Q4) Two Layer 2 implementations that will eventually be "Based-Zkrollups" (something that Ethereum planned to implement but was not feasible due to speed and cost issues, even after its POS-fork) -- where L2 TXs are instantly settled onto L1 without security compromising batching of TXs and delayed settlement that Eth-L2s currently does, and more.

But KAS is just a crypto project that I am personally interest in; and I am certainly not recommending anyone to buy as an investment, well unless they see something interesting in it too as I do. ;)"

#BTCEUR #1D (Binance) Bull-flag breakout and retestBitcoin looks very good for bullish continuation after regaining 50MA support on daily, against the Euro.

⚡️⚡️ #BTC/EUR ⚡️⚡️

Exchanges: Binance

Signal Type: Regular (Long)

Amount: 12.0%

Entry Targets:

1) 93017.86

Take-Profit Targets:

1) 108422.28

Stop Targets:

1) 85296.36

Published By: @Zblaba

CRYPTOCAP:BTC BINANCE:BTCEUR #Bitcoin #PoW bitcoin.org

Risk/Reward= 1:2.0

Expected Profit= +16.6%

Possible Loss= -8.3%

Estimated Gaintime= 1-2 months

#BSVUSDT #1D (ByBit) Falling wedge breakoutBitcoin Satoshi Vision is pulling back to 100EMA daily support where it seems likely to bounce and resume bullish, mid-term.

⚡️⚡️ #BSV/USDT ⚡️⚡️

Exchanges: ByBit USDT

Signal Type: Regular (Long)

Leverage: Isolated (2.0X)

Amount: 4.5%

Entry Targets:

1) 38.05

Take-Profit Targets:

1) 63.54

Stop Targets:

1) 29.54

Published By: @Zblaba

AMEX:BSV BYBIT:BSVUSDT.P #BitcoinSatoshiVision #PoW

Risk/Reward= 1:3.0

Expected Profit= +134.0%

Possible Loss= -44.7%

Estimated Gain-time= 2 months

Final Minutes of Overtime - LTC - POW + Ready for One?**Final Minutes of Overtime - LTC - POW: Is the Market Ready for One Last Move?**

As the market continues to move through uncertain and volatile conditions, many investors and analysts are beginning to wonder: Are we approaching the final minutes of overtime? In the world of cryptocurrency, the game feels like it’s in its final stretch, with significant movements happening across assets like Litecoin (LTC) and Proof of Work (PoW) consensus mechanisms. The question on everyone's minds: Is the market gearing up for one final, significant move?

### The Current State of the Market

We’re witnessing a market that has undergone substantial fluctuations over the past months, with assets like Litecoin (LTC) showing resilience despite periodic downturns. LTC, in particular, has been on the radar of many long-term investors due to its potential for significant growth, bolstered by an increasing demand for privacy and decentralized transactions. With its unique position in the crypto ecosystem, LTC’s price has been heavily influenced by both macroeconomic trends and the movement of Bitcoin, often seen as a bellwether for the broader market.

On the other hand, Proof of Work (PoW) systems, while facing increasing scrutiny due to energy consumption concerns, still remain at the heart of the crypto world. The debate between Proof of Stake (PoS) and PoW has been a hot topic, but despite this, PoW remains a tried-and-true consensus mechanism, with Bitcoin, Litecoin, and Ethereum (prior to its transition to PoS) all operating on this model. As institutional interest grows, the market is at a crossroads, with many wondering if PoW systems will continue to dominate, or if PoS alternatives will ultimately take over.

### Overtime in the Market: A Final Push?

The analogy of "overtime" is fitting here, as the cryptocurrency market often feels like a game of high stakes, constantly on the edge of dramatic swings. Historically, the final minutes of an overtime game in sports tend to be the most intense, as teams push for one final victory. Could the market be poised for a similar finale?

Many are looking at the current market indicators — from on-chain analysis to price movements — and asking if there is one last rally in store. While we’ve seen some signs of stabilization in recent weeks, there’s an underlying sense of uncertainty. Will Litecoin make another push upwards, leveraging its unique use cases? Will institutional investors begin to take greater positions in PoW-based coins as regulations become clearer? These are the questions that are driving market sentiment.

### The Role of Institutional Investors

Institutions are becoming an increasingly important part of the crypto landscape, and their involvement could be a decisive factor in this final move. As more established financial institutions dive into the cryptocurrency space, they may help provide the liquidity and stability needed for another price surge. However, institutional involvement also brings the possibility of increased regulation, which could dampen the explosive potential the market has seen in the past.

In particular, Litecoin has seen growing attention from institutions due to its low transaction fees and relatively faster transaction times compared to Bitcoin. As more legacy financial systems explore ways to integrate blockchain technology, could Litecoin’s relatively light energy footprint and established infrastructure make it an attractive option for institutional adoption?

### Technological Developments: Will They Catalyze the Last Move?

As the market moves toward its final minutes of overtime, several technological developments could help to catalyze that final, dramatic move. Key among them are scalability solutions, interoperability enhancements, and increased privacy features. For instance, the potential launch of Layer 2 scaling solutions for Litecoin could boost its usability, allowing the coin to be used for daily transactions more efficiently.

In addition, Proof of Work systems are still at the core of many projects, with developers continuously working on ways to make them more energy-efficient and less controversial. If these advancements gain traction, they may alleviate concerns surrounding the environmental impact of PoW, potentially boosting investor confidence and causing a rally.

### The Final Push: What to Expect?

As we move into the final moments of overtime in the cryptocurrency market, the future remains uncertain. While some analysts predict a final surge, others believe the market may be due for a cooling period. What we do know is that Litecoin (LTC), along with Proof of Work systems, will continue to play an important role in shaping the market’s direction.

The question isn’t necessarily whether the market is ready for one last move — it’s how that move will unfold. Will the market rally as we’ve seen in previous cycles, or will it cool off and take a step back for further consolidation?

### Conclusion

The final minutes of overtime in the cryptocurrency market present a fascinating and nerve-wracking scenario for investors, with assets like Litecoin and PoW mechanisms positioned for what could be one last push. As the market navigates these uncertain waters, only time will tell whether we’ll see a dramatic finish or a slower, more controlled progression toward stability. Whatever the outcome, it’s clear that the next move will have significant implications for the future of cryptocurrency.

For now, all eyes are on the market, waiting for the final whistle to blow.

#ETHWUSDT #1W (ByBit) Descending channel breakoutEthereum PoW regained 50MA weekly support and seems to be in full bullish mode, continuation is on.

⚡️⚡️ #ETHW/USDT ⚡️⚡️

Exchanges: ByBit USDT, Binance Futures, OKX Futures

Signal Type: Regular (Long)

Leverage: Isolated (1.0X)

Amount: 5.0%

Current Price:

3.665

Entry Zone:

3.524 - 2.904

Take-Profit Targets:

1) 5.119

1) 7.030

1) 8.941

Stop Targets:

1) 1.940

Published By: @Zblaba

AMEX:ETHW BYBIT:ETHWUSDT.P #1W #Ethereum #PoW ethereumpow.org

Risk/Reward= 1:1.5 | 1:3.0 | 1:4.5

Expected Profit= +59.3% | +118.7% | +178.2%

Possible Loss= -39.6%

Estimated Gaintime= 3-6 months

#ETCUSDT #1D (Bybit) Descending wedge breakout & retestEthereum Classic regained 50MA support and seems to be heading towards 200MA resistance, probably after a pull-back.

⚡️⚡️ #ETC/USDT ⚡️⚡️

Exchanges: ByBit USDT

Signal Type: Regular (Long)

Leverage: Isolated (3.0X)

Amount: 4.6%

Current Price:

20.620

Entry Targets:

1) 19.256

Take-Profit Targets:

1) 24.837

Stop Targets:

1) 16.459

Published By: @Zblaba

CRYPTOCAP:ETC BYBIT:ETCUSDT.P #1D #EthereumClassic #PoW ethereumclassic.org

Risk/Reward= 1:2.0

Expected Profit= +86.9%

Possible Loss= -43.6%

Estimated Gaintime= 1-2 months

#LTCUSDT #1D (ByBit) Ascending wedge breakdown and retestLitecoin lost 100EMA acting as resistance now and is pulling back towards it, more retracement down seems likely on daily.

⚡️⚡️ #LTC/USDT ⚡️⚡️

Exchanges: ByBit USDT

Signal Type: Regular (Short)

Leverage: Isolated (5.0X)

Amount: 5.0%

Current Price:

64.32

Entry Targets:

1) 65.78

Take-Profit Targets:

1) 55.34

Stop Targets:

1) 71.01

Published By: @Zblaba

CRYPTOCAP:LTC BYBIT:LTCUSDT.P #Litecoin #PoW litecoin.org

Risk/Reward= 1:2.0

Expected Profit= +79.4%

Possible Loss= -39.8%

Estimated Gaintime= 1 month

#LTCUSDT #4h (ByBit) Broadening wedge breakout & retestLitecoin pulled back to 50MA support where a bounce seems likely, eventually leading to a bullish continuation.

⚡️⚡️ #LTC/USDT ⚡️⚡️

Exchanges: ByBit USDT

Signal Type: Regular (Long)

Leverage: Isolated (7.0X)

Amount: 4.8%

Current Price:

72.06

Entry Targets:

1) 71.83

Take-Profit Targets:

1) 80.39

Stop Targets:

1) 67.54

Published By: @Zblaba

CRYPTOCAP:LTC BYBIT:LTCUSDT.P #4h #Litecoin #PoW litecoin.org

Risk/Reward= 1:2.0

Expected Profit= +83.4%

Possible Loss= -41.8%

Estimated Gaintime= 5-10 days

ETH Trade Ideas! Pick Your Poison.After a nice bounce from the GP, Trendline confluence, we are struggling to move higher. I would expect a move lower to test the untested POC and sweep the last low before moving higher.

If we lose the POC, the VAL & Daily would be my next target. #Ethereum

Calculate Your Risk/Reward so you don't lose more than 1% of your account per trade.

Every day the charts provide new information. You have to adjust or get REKT.

Love it or hate it, hit that thumbs up and share your thoughts below!

This is not financial advice. This is for educational purposes only.

#LTCUSDT #2h (OKX Futures) Broadening wedge breakout and retestCRYPTOCAP:LTC regained 50MA support and looks good for bullish continuation from here.

⚡️⚡️ #LTC/USDT ⚡️⚡️

Exchanges: OKX Futures

Signal Type: Regular (Long)

Leverage: Isolated (7.0X)

Amount: 5.0%

Current Price:

73.13

Entry Targets:

1) 72.05

Take-Profit Targets:

1) 76.19

Stop Targets:

1) 69.98

Published By: @Zblaba

CRYPTOCAP:LTC OKX:LTCUSDT.P #2h #Litecoin #PoW litecoin.org

Risk/Reward= 1:2.0

Expected Profit= +40.2%

Possible Loss= -20.1%

Estimated Gaintime= 3-4 days

KASPS #KAS don't be surprised if it hits 20c by ChirstmasI already have one target that's outstanding @14.3c

But as you can this breakout move is actually after 7 months consolidating in a rising bullish pennant.

This train is leaving people behind and people may jump off the train after achieving 40-50% returns. --- scarred by the bear market , but actually missing the Multiples that this move is making.

#BTCUSDT #4h (OKX Futures) Descending trendline break and retestBitcoin just regained 50MA support and is pulling back to it, looks ready for short-term recovery towards 200MA resistance, especially after that bullish hammer.

⚡️⚡️ #BTC/USDT ⚡️⚡️

Exchanges: OKX Futures

Signal Type: Regular (Long)

Leverage: Isolated (5.0X)

Amount: 4.9%

Current Price:

57886.5

Entry Targets:

1) 57738.1

Take-Profit Targets:

1) 62483.9

Stop Targets:

1) 55359.4

Published By: @Zblaba

CRYPTOCAP:BTC OKX:BTCUSDT.P #4h #Bitcoin #PoW bitcoin.org

Risk/Reward= 1:2.0

Expected Profit= +41.1%

Possible Loss= -20.6%

Estimated Gaintime= 1 week

#BTCUSDT #1h (ByBit) Descending trendline breakoutBitcoin seems to have found bottom and is forming a local uptrend, looks good for bullish continuation after regaining 100EMA support.

⚡️⚡️ #BTC/USDT ⚡️⚡️

Exchanges: ByBit USDT

Signal Type: Regular (Long)

Leverage: Isolated (13.0X)

Amount: 4.9%

Current Price:

57720.9

Entry Targets:

1) 57411.4

Take-Profit Targets:

1) 60987.5

Stop Targets:

1) 55618.9

Published By: @Zblaba

CRYPTOCAP:BTC BYBIT:BTCUSDT #1h #Bitcoin #PoW bitcoin.org

Risk/Reward= 1:2.0

Expected Profit= +81.0%

Possible Loss= -40.6%

Estimated Gaintime= 2-3 days

#BTCUSDT #4h (ByBit) Falling broadening wedge breakout & retestBitcoin regained 50MA support and is pulling back to it, seems ready to pump towards 200MA resistance after.

⚡️⚡️ #BTC/USDT ⚡️⚡️

Exchanges: ByBit USDT

Signal Type: Regular (Long)

Leverage: Isolated (12.0X)

Amount: 5.1%

Current Price:

62917.6

Entry Targets:

1) 61920.3

Take-Profit Targets:

1) 65955.6

Stop Targets:

1) 59897.6

Published By: @Zblaba

CRYPTOCAP:BTC BYBIT:BTCUSDT.P #Bitcoin #PoW bitcoin.org

Risk/Reward= 1:2.0

Expected Profit= +78.2%

Possible Loss= -39.2%

Estimated Gaintime= 1 week

#BTCUSDT #1D (Binance Futures) Descending channel break & retestBitcoin is pulling back to 50MA daily support after forming a big bull flag, a bounce towards new ATH seems likely next.

⚡️⚡️ #BTC/USDT ⚡️⚡️

Exchanges: Binance Futures

Signal Type: Regular (Long)

Leverage: Isolated (10.0X)

Amount: 5.4%

Current Price:

66989.1

Entry Targets:

1) 66666.6

Take-Profit Targets:

1) 75891.7

Stop Targets:

1) 62969.2

Published By: @Zblaba

CRYPTOCAP:BTC BINANCE:BTCUSDT.P #Bitcoin #PoW bitcoin.org

Risk/Reward= 1:2.5

Expected Profit= +138.4%

Possible Loss= -55.5%

Estimated Gaintime= 1 month

#LTCUSDT #1h (OKX Futures) Descending trendline breakoutLitecoin printed a dragonfly doji on 50MA support, looks bullish for the days to come.

⚡️⚡️ #LTC/USDT ⚡️⚡️

Exchanges: OKX Futures

Signal Type: Regular (Long)

Leverage: Isolated (9.0X)

Amount: 4.8%

Current Price:

78.97

Entry Targets:

1) 78.32

Take-Profit Targets:

1) 81.98

Stop Targets:

1) 76.49

Published By: @Zblaba

CRYPTOCAP:LTC OKX:LTCUSDT.P #Litecoin #PoW litecoin.org

Risk/Reward= 1:2.0

Expected Profit= +42.1%

Possible Loss= -21.0%

Estimated Gaintime= 2-3 days

#BTC/USDT 3D (Binance Futures) Ascending channel on resistanceBitcoin is facing historical supply zone and RSI about to enter overbought territory.

Local top seems near and price may retrace down to 50MA, mid-term.

⚡️⚡️ #BTC/USDT ⚡️⚡️

Exchanges: Binance Futures

Signal Type: Regular (Short)

Leverage: Isolated (5.0X)

Amount: 5.5%

Current Price:

51926.9

Entry Targets:

1) 52197.8

Take-Profit Targets:

1) 40814.3

Stop Targets:

1) 57903.8

Published By: @Zblaba

CRYPTOCAP:BTC BINANCE:BTCUSDT.P #Bitcoin #PoW #P2P bitcoin.org

Risk/Reward= 1:2.0

Expected Profit= +109.0%

Possible Loss= -54.7%

Estimated Gaintime= 2-4 months

#RVN/USDT 1W (Binance Futures) Descending wedge on supportRavencoin just printed a morning star on weekly TF, looks promising for mid/long-term recovery towards 50MA resistance.

⚡️⚡️ #RVN/USDT ⚡️⚡️

Exchanges: Binance Futures

Signal Type: Regular (Long)

Leverage: Isolated (1x)

Amount: 10.1%

Current Price:

0.01924

Entry Targets:

1) 0.01703

Take-Profit Targets:

1) 0.02713

Stop Targets:

1) 0.01198

Published By: @Zblaba

NGM:RVN #RVNUSDT #Ravencoin #PoW #P2P

Risk/Reward= 1:2

Expected Profit= +59.3%

Possible Loss= -29.7%

ravencoin.org

#BTC/USDT 1h (OKX Futures) Parabolic channel on resistanceBitcoin just printed a shooting star and seems likely to retrace down with that overbought RSI, very short-term.

⚡️⚡️ #BTC/USDT ⚡️⚡️

Exchanges: OKX Futures

Signal Type: Regular (Short)

Leverage: Isolated (9.0X)

Amount: 5.0%

Current Price:

47555.0

Entry Targets:

1) 47643.2

Take-Profit Targets:

1) 45534.1

Stop Targets:

1) 48700.3

Published By: @Zblaba

CRYPTOCAP:BTC OKX:BTCUSDT.P #Bitcoin #P2P bitcoin.org

Risk/Reward= 1:2.0

Expected Profit= +39.8%

Possible Loss= -20.0%

Estimated Gaintime= 2-4 days

#BTC/USDT 1h (OKX Futures) Broadening wedge breakout & retestBitcoin just regained 50MA support and seems to be heading towards 200MA resistance after a pull-back.

⚡️⚡️ #BTC/USDT ⚡️⚡️

Exchanges: OKX Futures

Signal Type: Regular (Long)

Leverage: Isolated (9.5X)

Amount: 5.0%

Current Price:

40232.0

Entry Targets:

1) 39834.3

Take-Profit Targets:

1) 41499.4

Stop Targets:

1) 38999.7

Published By: @Zblaba

CRYPTOCAP:BTC OKX:BTCUSDT.P #Bitcoin #PoW bitcoin.org

Risk/Reward= 1:2.0

Expected Profit= +39.7%

Possible Loss= -19.9%

Estimated Gaintime= 1-2 days