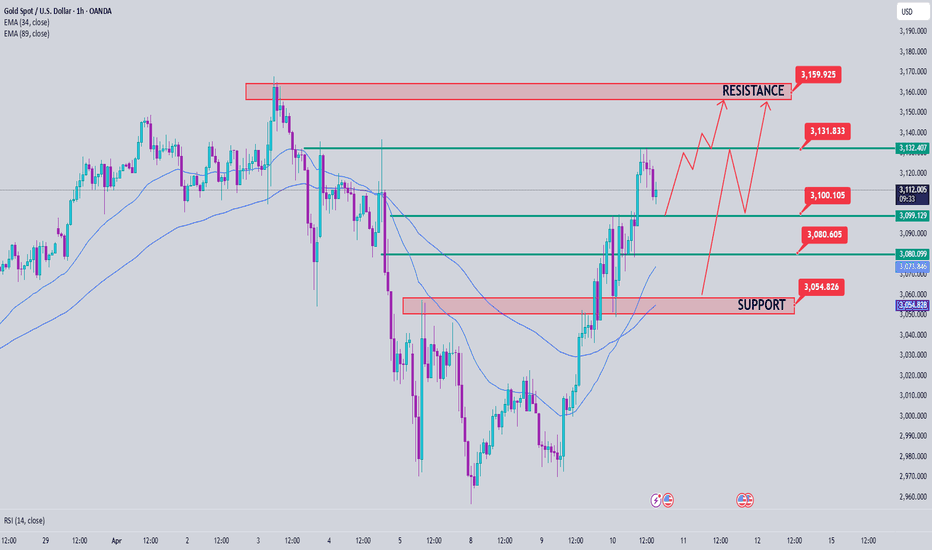

Gold Price Analysis April 10D1 candle confirms that the buyers have returned to the market with an increase of more than 100 prices. The retest points are considered buying opportunities to break ATH

3100 is a notable point for the Buy signal in this European trading session. Today's trading strategy is quite simple when a strong uptrend has just formed, we will wait for the retest points to 3100-3080-3056 for the BUY signal to break ATH. On the other hand, if gold does not test before, we can Sell Scalp around 3133 again, when it breaks, do not SELL anymore but wait for the retest of 3133 to buy up to 3162.

Have a nice day everyone

Prceaction

AVAXUSDT 1DHi everyone

The closing of the candle above the trend line of this technical pattern indicates the beginning of the uptrend. However, investors will have to wait again for the candle to close above $ 61.09 to ensure the uptrend begins

In this scenario, the price reaches $ 79.68

Lowering the price below the support level of $ 50.58 causes the sellers to dominate the buyers and the price reaches a lower floor. This will invalidate the uptrend scenario

In such a situation, market participants can expect avax to drop to $ 42.40

Thankful

LTCUSDT 4HPossible routes of LTC movement

The market has not yet provided a clear sign of the end of the correction process that we can be sure of recovering

Assuming a steady sell-off in the market, a strong Kendall close below $ 160.86 a day could push LTC to the bottom and support the bearish sentiment

In the event of such a decline, market participants can expect a 10% drop in LTC to the immediate support level at $ 145.40 and then the $ 135.49 level

On the other hand, if the LTC price can cross the $ 160.86 demand barrier, it will face the $ 188.99 resistance barrier

A sharp daily closing above this level puts LTC back on track to $ 211

If LTC can turn the resistance level into its support, the downtrend scenario will be nullified and the price could potentially rise 40% to $ 294.21

have a nice day

Gold Possible Sell Signal Gold has been on a bullish run after reaching the trend line in the previous post I outlined for you all. I need to see some exhaustion and price action failing to break above the sell off (1757.919) which is looking like the head of a head and shoulder pattern. The illustration reveals a possible right shoulder forming which is a bearish signal. Remember, JP Morgan is still manipulating the metals market. Why is this important? The dollar has been gaining some strength, but when the price of gold goes up, it makes it harder for those using dollars. Due to the dollar is currently the world reserve currency, gold price needs to be manipulated, until interest rates spike. However, that is another story for another day. I will continue to monitor this setup for us. Be sure to like and leave a comment below and tell us what you see gold doing. We appreciate you for checking out our post and remember, we will see you on the other side.

Rodrick (CEO)

Third Eye Traders

ADIL - Retrace To Support - Good Entry?ADIAL saw an increase in volume and runup to 3.30 after which we saw a retrace to the 2.18 support level that held nicely. The upward trendline has been holding consistently on the daily and weekly charts. I am looking for a bullish engulfing or gap up opening with retrace to higher low to confirm the breakout continuation to test resistance at 2.82. If we can break through the 2.82 resistance level, I am looking for a price target of 3.30.

BUYING WITH THE INSTITUTIONPrice has been in a strong uptrend however two strong supply levels have been identified as circled and price has been struggling to go beyond them .The good part price is approaching a fairly reliable zone which is not fresh however we might look for buy confirmation and take 35 pips .

Weekly analysis: would Bullish wave continue?Midterm forecast:

While the price is above the support 6000.00, resumption of uptrend is expected.

We make sure when the resistance at 9774.80 breaks.

If the support at 6000.00 is broken, the short-term forecast -resumption of uptrend- will be invalid.

Technical analysis:

While the RSI uptrend #1 is not broken, bullish wave in price would continue.

Price is below WEMA21, if price rises more, this line can act as a dynamic resistance against more gains.

Relative strength index (RSI) is 34.

Trade Setup:

We opened 10 BUY trade(s) @ 6715.85 based on 'Hammer' entry method at 2018.04.01.

Total Profit: 1144505 pip

Closed trade(s): 770015 pip Profit

Open trade(s): 374490 pip Profit

Closed Profit:

TP1 @ 7556.25 touched at 2018.04.12 with 84040 pip Profit.

TP2 @ 8180.60 touched at 2018.04.15 with 146475 pip Profit.

TP3 @ 9051.90 touched at 2018.04.24 with 233605 pip Profit.

TP4 @ 9774.80 touched at 2018.05.05 with 305895 pip Profit.

84040 + 146475 + 233605 + 305895 = 770015 pip

Open Profit:

Profit for one trade is 7340.00(current price) - 6715.85(open price) = 62415 pip

6 trade(s) still open, therefore total profit for open trade(s) is 62415 x 6 = 374490 pip

Take Profits:

TP5= @ 11600.00

TP6= @ 12670.65

TP7= @ 15308.00

TP8= @ 17095.65

TP9= @ 19704.20

TP10= Free