GOLD - Buy the dips toward the 50% / 61% retracement...the decline from the 22nd of April is in a very clear 3 waves with a perfect 100% retracement. the subsequent rally from the 15th of May is in a clear motive sequence. negative RSI divergence signals that some sort of 5th wave is complete.

the characteristics of this motive rally seems like a wave (i) of V is complete and we are now looking for a drop to complete wave (ii) of V.

buying dips toward the 50% / 61% retracement is my preferred strategy for now.

a rally and daily close above 3400 would invalidate this analysis. keep in mind possible volatility due to upcoming event risk.

Preciousmetals

Wheaton precious Metals can push on to $90It could be a HOT summer for the gold and silver bugs

And the speculators in the mining sector!

WPM ( formerly Silver Wheaton #SLW)

Has a broken out of a inverse head and shoulders

Two targets provided

Also important to note this inv head and shoulders is a continuation pattern not a bottom pattern.

XPD/Palladium Profit Raid: Steal Gains with This Blueprint!🔥 Chart Heist Blueprint: Snag Profits in XPD/Palladium! 🚀💰

Crafted for sharp traders ready to raid the XPD/Palladium market, this sleek strategy fuses razor-sharp technicals with savvy fundamentals to maximize your gains. 📊🕵️♂️ Surf the bullish surge, but watch for traps in the White Moving Average Zone where bears could strike! 🐻 Lock in your loot before the tide turns. 🌊

- 🎯 **Entry Tactics: Hit the Sweet Spot**

- Long on pullbacks near 1020.00 or the Market Makers Zone at 980.00. 🏹

- Set alerts for breakouts or pullbacks to strike in real-time. 🔔

- 🛡️ **Stop Loss Hacks: Guard Your Gains**

- Place stops below the nearest 4-hour swing low or candle wick. 🔧

- Tailor stops to your risk and lot size—precision over recklessness! ⚡

- 💸 **Profit Goals: Cash In Big**

- Bullish traders aim for 1070.00 or exit early if momentum dips. 📈

- Scalpers focus on long-side quick wins, trailing stops behind big players. 🚀

- 📡 **Market Edge: Why This Plan Wins**

- XPD/Palladium is charging bullish, driven by COT data, macro shifts, sentiment outlook, and intermarket flows. 🔍

- Check the linkss for deeper insights. 🌐

- ⚠️ **News Alert: Dodge the Chaos**

- Skip new trades during major news releases. 📰

- Use trailing stops to secure profits on active trades. 🔒

- 🤝 **Join the Profit Crew**

- Boost this plan, share the vibe, and let’s raid the markets together! 🤑

- Stay sharp for the next big score in the XPD/Palladium heist! 💥

Happy trading, chart bandits! 🎭📉

Platinum: The New Gold for the Next Decade?For centuries, Gold has been the ultimate store of value, a safe haven in times of economic uncertainty. However, as Gold potentially enters a multi-year distribution phase, investors may need to look elsewhere for the next big opportunity. Enter Platinum, a metal that is rarer, more versatile, and increasingly relevant in the modern industrial landscape.

Gold’s Distribution Phase and Bitcoin’s Speculative Nature

Gold has historically been a hedge against inflation and economic downturns, but recent trends suggest it may be topping out. Central banks have been stockpiling Gold, yet its price movements indicate a possible stagnation. Meanwhile, Bitcoin, once hailed as "digital gold," has shown extreme volatility, largely driven by speculation and relentless social media hype. Unlike Gold, Bitcoin lacks intrinsic value, and its future remains uncertain as institutional interest fluctuates.

Why Platinum Stands Out

Platinum is 30 times rarer than gold and has been in an accumulation phase since 2015. Unlike Palladium, which is highly volatile, Platinum maintains a more stable price structure. Its industrial applications make it indispensable in sectors such as:

Automotive Industry : Used in catalytic converters to reduce emissions.

Clean Energy & Hydrogen Economy : Essential in fuel cells for green energy.

Cloud Computing & Electronics : Platinum’s conductivity makes it valuable in advanced computing.

Space Exploration & Aerospace : Its resistance to extreme temperatures makes it ideal for high-tech applications.

Medical & Biomedical Uses : Found in cancer treatments and medical implants.

The Future of Platinum

With global trends shifting toward industrialization and sustainability, platinum’s demand is set to rise. Supply constraints, primarily due to limited mining operations in South Africa, further add to its scarcity. As gold enters a distribution phase, platinum is positioned to take off, potentially becoming a new standard for wealth preservation and industrial utility.

TVC:PLATINUM TVC:PALLADIUM TVC:GOLD TVC:SILVER MARKETSCOM:BITCOIN TVC:DXY SP:SPX EURONEXT:N100 BITSTAMP:BTCUSD OANDA:XAUUSD OANDA:XPTUSD OANDA:XPDUSD OANDA:XAGUSD

Technical Analysis for FX,Indices and many More!(5May-9May2025)Hello fellow traders , my regular and new friends!

Which pairs or instruments should we keep a look out for?

For me I am looking at :

GbpAud and probably EurAud for shorts

BTC likely to continue upwards move

Majors to turn lower against USD

Precious metals like copper and silver to bear more, Gold too.

This coming week is packed with interest rate decision, how?What to do?

Do check out my recorded video for more insights!

Do Like and Boost if you have learnt something and enjoyed the content, thank you!

-- Get the right tools and an experienced Guide, you WILL navigate your way out of this "Dangerous Jungle"! --

Gold chart showing interesting dataInteresting chart on GOLD futures.

Always wise to WAIT until end of day/week.

Daily Chart

Heavy selling has not meant much BUT the movement today is....... different.

Weekly Chart

RSI is not bad but it is weaker than Oct 24.

$ Flow is down a significant amount compared to last top.

First Majestic Silver Corp. (AG) – Shining Bright in 2025 Company Snapshot:

First Majestic NYSE:AG is emerging as a top-tier silver producer, with a strong focus on sustainable mining and community alignment. Operational discipline, paired with rising commodity prices and robust ESG scores, positions AG for long-term upside.

Key Catalysts:

Record Silver Output 📈

Q1 2025: 3.7M ounces of silver, up 88% YoY

Operational turnaround across four Mexican mines driving momentum

Efficiency gains enhance margins as silver prices rally

Silver Market Tailwinds ⚡

Rising demand for silver in green energy, EVs, and inflation hedging

AG is well-leveraged to price appreciation with a pure-play silver exposure

ESG Excellence 🌍

Ranked in top 20% of global miners by ISS

Strong ratings from S&P, Sustainalytics, and LSEG

$1.2M in community investments = 89% drop in local complaints—a key to operational stability

Strategic Appeal to ESG Investors 📊

Increasing alignment with institutional mandates for sustainable resource extraction

Low controversy score enhances potential for index inclusion and fund flows

Investment Outlook:

✅ Bullish Above: $5.75–$6.00

🚀 Target Range: $9.50–$10.00

🔑 Growth Drivers: Operational scale-up, ESG leadership, and tailwinds from rising silver demand

📢 AG: Where high-grade output meets high-impact sustainability.

#SilverStocks #ESGMining #AG #Commodities #PreciousMetals #GreenEnergy

GOLD v DXY in breakout move --- HVF hunt volatility funnelAlways good to measure against the DXY not just the USD value

Not perfect of course as it is mainly the Euro and Yen but still insightful.

Been watching the relationship for a while

currently breaking out to the upside

HVF theory means this should be a violent expansion

Target 1 coming up.

Markets next move will depend on its interaction with Key LevelsGold Analysis

MSS & FVG+Breaker Zone

Gold has given an MSS (Market Structure Shift) and touched the FVG+Breaker Zone, followed by a downward move. Given the current market structure, potential areas to watch for a stop and potential upside pump could be:

Possible Downside Targets:

1. $3321 liquidity level

2. Higher Time Frame (HTF) PD Arrays

Potential Upside Pump

If the market reaches these areas, we might see a pump upwards, driven by liquidity and market structure.

Key Levels to Watch:

- $3321 liquidity level

- HTF PD Arrays

Market Direction

The market's next move will depend on its interaction with these key levels. A potential bounce from these areas could signal an upside pump.

Let's monitor the market's movement and adjust our analysis accordingly.

GLD: in resistance zone to form mid-term top Price reached and important resistance levels to start forming the top of upward trend since 2022 bottom.

In precious metals fifth waves tend to extend beyond standard fib levels. So if price moves beyond 300, the door opens for a move to 308-330 resistance zone.

Wishing you successful trading and investing decision and thank you for attention!

GOLD & SILVER Weekly Market Forecast: Wait For Buys!In this video, we will analyze the GOLD & Silver Futures. We'll determine the bias for the upcoming week of April 14-18th, and look for the best potential setups.

Gold is still bullish, making new ATH's. Silver is not as strong, but had a very strong previous week after sweeping the range lows.

I would take valid buy setups in Gold, but not in Silver. I would prefer sells in Silver. Trade one, not both. The stronger for buys and the weaker for sells.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

XAUUSD (Gold) Technical Chart Analysis XAUUSD (Gold) Daily Chart Analysis

Current Price:

$3,011.89, up +0.96% today

High: $3,014.23 | Low: $2,978.59

*Technical Overview:

🔹 Trend:

Gold remains in a strong uptrend, forming consistent higher highs and higher lows since late 2023.

However, the recent price action shows a pullback after reaching new highs.

🔹 Stochastic RSI:

%K = 4.55, %D = 23.48 → Oversold zone

Indicates potential for a short-term bounce if momentum picks up.

🔹 MACD:

Bearish crossover in progress, histogram turning red.

Suggests short-term bearish pressure, though it's likely a healthy correction within a larger bullish trend.

🎯 Strategy Outlook:

🔸 Short-Term Strategy:

Wait for a bullish confirmation near the $2,975 support zone.

Watch for reversal signals from oversold Stoch RSI.

Consider short-term buys if price stabilizes above $2,980–$3,000.

🔸 Long-Term Strategy:

As long as the price holds above $2,900–$2,950, the overall uptrend remains intact.

Dips could be seen as buying opportunities in the long run.

Use pullbacks to scale in gradually with proper risk management.

*Thoughts :

Gold is currently in a technical pullback but still bullish in the bigger picture. Short-term traders should stay cautious, while long-term bulls can look for dips to buy.

$XAUUSD (Gold): Golden Rally or Gilded Pause?(1/9)

Good morning, everyone! ☀️ XAUUSD (Gold): Golden Rally or Gilded Pause?

With gold at $3,020.82, is this safe-haven surge a treasure or a tease? Let’s sift through the shine! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 3,020.82 per ounce as of Mar 25, 2025 💰

• Recent Move: Near $3,057 high from Mar 20, per data 📏

• Sector Trend: Precious metals up on tension, per posts on X 🌟

It’s a golden glow—let’s see if it holds! ⚙️

(3/9) – MARKET POSITION 📈

• Global Role: Top safe-haven asset ⏰

• Drivers: Central bank buying, geopolitical risks 🎯

• Trend: Bullish near $3,000, per data 🚀

Firm as a refuge, shining in uncertainty! 🏦

(4/9) – KEY DEVELOPMENTS 🔑

• Geopolitical Boost: Trade tensions linger, per data 🌍

• U.S. Data: PMI strength supports USD, caps gold, per posts on X 📋

• Market Reaction: Consolidating near $3,020-$3,030 💡

Simmering in a tense market! 🌩️

(5/9) – RISKS IN FOCUS ⚡

• Profit-Taking: Post-$3,000 sales loom 🔍

• U.S. Rates: Policy shifts could hit, per data 📉

• Oil Prices: CAD link affects broader forex ❄️

It’s a shiny tightrope—watch your step! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Safe Haven: Thrives in chaos, per posts on X 🥇

• Central Banks: Steady buying props it up 📊

• Green Demand: Key in renewables, per data 🔧

Got a golden backbone! 🌟

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Volatility from profit-taking 📉

• Opportunities: More tensions, rate cuts 📈

Can it gleam higher or dim out? 🤔

(8/9) – POLL TIME! 📢

Gold at $3,020.82—your take? 🗳️

• Bullish: $3,100+ soon, rally rolls 🐂

• Neutral: Steady, risks balance out ⚖️

• Bearish: $2,950 looms, correction hits 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

Gold’s $3,020.82 price tags a safe-haven rally 📈, but volatility’s in the mix 🌿. Dips are our DCA jackpot 💰—buy low, ride high! Gem or bust?

Breakout Confirmed! Gold’s Next Target Could Be $3,500+Gold has reached a new all-time high (ATH), signaling strong bullish momentum. The breakout above the long-term rising trendline, which previously acted as resistance, indicates a shift in market structure.

The resistance zone has now turned into support, confirming buyers' dominance. A minor pullback or retest of this breakout level could be expected before a stronger continuation to the upside.

If the price sustains above this zone, potential targets lie at $3,100-$3,200 in the short term and $3,500+ in the medium term.

Important breakdown in the Gold & Silver ratio !!!This is a heads up that concerns the PM sector as well as all other assets.

An important breakdown just happened in the Gold & Silver ratio. This means precious metals bull resumes and SILVER will now overperform gold !! We are now in back test mode !

For the other asset classses this is good news also, because this breakdown in the ratio signifies the return of (asset) inflation. So this is good for stocks and crypto also.

It remains to be seen whether PM's will outperform stocks. My guess is YES.

Behind the Curtain: Unveiling Gold’s Economic Catalysts1. Introduction

Gold Futures (GC, MGC and 1OZ), traded on the CME market, are one of the most widely used financial instruments for hedging against inflation, currency fluctuations, and macroeconomic uncertainty. As a safe-haven asset, gold reacts to a wide range of economic indicators, making it crucial for traders to understand the underlying forces driving price movements.

By leveraging machine learning, specifically a Random Forest Regressor, we analyze the top economic indicators influencing Gold Futures on daily, weekly, and monthly timeframes. This data-driven approach reveals the key catalysts shaping GC Futures and provides traders with actionable insights to refine their strategies.

2. Understanding Gold Futures Contracts

Gold Futures (GC) are among the most actively traded futures contracts, offering traders and investors exposure to gold price movements with a range of contract sizes to suit different trading strategies. CME Group provides three types of Gold Futures contracts to accommodate traders of all levels:

o Standard Gold Futures (GC):

Contract Size: Represents 100 troy ounces of gold.

Tick Size: Each tick is 0.10 per ounce, equating to $10 per tick per contract.

Purpose: Ideal for institutional traders and large-scale hedgers.

Margin: Approximately $12,500 per contract.

o Micro Gold Futures (MGC):

Contract Size: Represents 10 troy ounces of gold, 1/10th the size of the standard GC contract.

Tick Size: Each tick is $1 per contract.

Purpose: Allows smaller-scale traders to participate in gold markets with lower capital requirements.

Margin: Approximately $1,250 per contract.

o 1-Ounce Gold Futures (1OZ):

Contract Size: Represents 1 troy ounce of gold.

Tick Size: Each tick is 0.25 per ounce, equating to $0.25 per tick per contract.

Purpose: Provides precision trading for retail participants who want exposure to gold at a smaller contract size.

Margin: Approximately $125 per contract.

Keep in mind that margin requirements vary through time as market volatility changes.

3. Daily Timeframe: Key Economic Indicators

Gold Futures respond quickly to short-term economic fluctuations, and three key indicators play a crucial role in daily price movements:

o Velocity of Money (M2):

Measures how quickly money circulates within the economy.

A higher velocity suggests increased spending and inflationary pressure, often boosting gold prices.

A lower velocity indicates stagnation, which may reduce inflation concerns and weigh on gold.

o Unemployment Rate:

Reflects the strength of the labor market.

Rising unemployment increases economic uncertainty, often driving demand for gold as a safe-haven asset.

Declining unemployment can strengthen risk assets, potentially reducing gold’s appeal.

o Oil Import Price Index:

Represents the cost of imported crude oil, influencing inflation trends.

Higher oil prices contribute to inflationary pressures, supporting gold as a hedge.

Lower oil prices may ease inflation concerns, weakening gold demand.

4. Weekly Timeframe: Key Economic Indicators

While daily fluctuations impact short-term traders, weekly economic data provides a broader perspective on gold price movements. The top weekly indicators include:

o Nonfarm Payrolls (NFP):

Measures the number of new jobs added in the U.S. economy each month.

Strong NFP numbers typically strengthen the U.S. dollar and increase interest rate hike expectations, pressuring gold prices.

Weak NFP figures can drive economic uncertainty, increasing gold’s safe-haven appeal.

o Nonfarm Productivity:

Represents labor efficiency and economic output per hour worked.

Rising productivity suggests economic growth, potentially reducing demand for gold.

Falling productivity can signal economic weakness, increasing gold’s appeal.

o Personal Spending:

Tracks consumer spending habits, influencing economic activity and inflation expectations.

Higher spending can lead to inflation, often pushing gold prices higher.

Lower spending suggests economic slowing, which may either weaken or support gold depending on inflationary outlooks.

5. Monthly Timeframe: Key Economic Indicators

Long-term trends in Gold Futures are shaped by macroeconomic forces that impact investor sentiment, inflation expectations, and interest rates. The most influential monthly indicators include:

o China GDP Growth Rate:

China is one of the largest consumers of gold, both for investment and jewelry.

Strong GDP growth signals robust demand for gold, pushing prices higher.

Slower growth may weaken gold demand, applying downward pressure on prices.

o Corporate Bond Spread (BAA - 10Y):

Measures the risk premium between corporate bonds and U.S. Treasury bonds.

A widening spread signals economic uncertainty, increasing demand for gold as a safe-haven asset.

A narrowing spread suggests confidence in risk assets, potentially reducing gold’s appeal.

o 10-Year Treasury Yield:

Gold has an inverse relationship with bond yields since it does not generate interest.

Rising yields increase the opportunity cost of holding gold, often leading to price declines.

Falling yields make gold more attractive, leading to price appreciation.

6. Risk Management Strategies

Given gold’s volatility and sensitivity to macroeconomic changes, risk management is essential for trading GC Futures. Key risk strategies may include:

Monitoring Global Liquidity Conditions:

Keep an eye on M2 Money Supply and inflation trends to anticipate major shifts in gold pricing.

Interest Rate Sensitivity:

Since gold competes with yield-bearing assets, traders should closely track interest rate movements.

Higher 10-Year Treasury Yields can weaken gold’s value as a non-yielding asset.

Diversification and Hedging:

Traders can hedge gold positions using interest rate-sensitive assets such as bonds or inflation-linked securities.

Gold often performs well in times of equity market distress, making it a commonly used portfolio diversifier.

7. Conclusion

Gold Futures remain one of the most influential instruments in the global financial markets.

By leveraging machine learning insights and macroeconomic data, traders can better position themselves for profitable trading opportunities. Whether trading daily, weekly, or monthly trends, understanding these indicators allows market participants to align their strategies with broader economic conditions.

Stay tuned for the next "Behind the Curtain" installment, where we explore economic forces shaping another key futures market.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

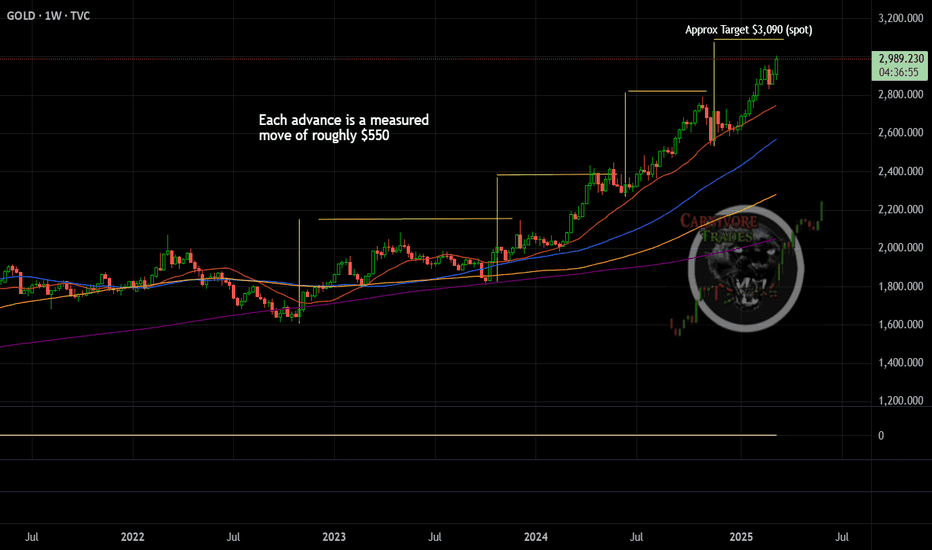

Gold Measured Move Target (Spot)Gold has finally climbed to over $3,000/oz for the first time in history however the yellow metal may not be done quite yet. Based on this repeated measured move of roughly $550 on each bull advance, we should expect the price of spot to get close to the $3,100 handle sometime soon. Seasonally, gold likes to rally into early/mid April before a cool off period so it is likely coming in the next 2-4 weeks.