XPD/Palladium Profit Raid: Steal Gains with This Blueprint!🔥 Chart Heist Blueprint: Snag Profits in XPD/Palladium! 🚀💰

Crafted for sharp traders ready to raid the XPD/Palladium market, this sleek strategy fuses razor-sharp technicals with savvy fundamentals to maximize your gains. 📊🕵️♂️ Surf the bullish surge, but watch for traps in the White Moving Average Zone where bears could strike! 🐻 Lock in your loot before the tide turns. 🌊

- 🎯 **Entry Tactics: Hit the Sweet Spot**

- Long on pullbacks near 1020.00 or the Market Makers Zone at 980.00. 🏹

- Set alerts for breakouts or pullbacks to strike in real-time. 🔔

- 🛡️ **Stop Loss Hacks: Guard Your Gains**

- Place stops below the nearest 4-hour swing low or candle wick. 🔧

- Tailor stops to your risk and lot size—precision over recklessness! ⚡

- 💸 **Profit Goals: Cash In Big**

- Bullish traders aim for 1070.00 or exit early if momentum dips. 📈

- Scalpers focus on long-side quick wins, trailing stops behind big players. 🚀

- 📡 **Market Edge: Why This Plan Wins**

- XPD/Palladium is charging bullish, driven by COT data, macro shifts, sentiment outlook, and intermarket flows. 🔍

- Check the linkss for deeper insights. 🌐

- ⚠️ **News Alert: Dodge the Chaos**

- Skip new trades during major news releases. 📰

- Use trailing stops to secure profits on active trades. 🔒

- 🤝 **Join the Profit Crew**

- Boost this plan, share the vibe, and let’s raid the markets together! 🤑

- Stay sharp for the next big score in the XPD/Palladium heist! 💥

Happy trading, chart bandits! 🎭📉

Preciousmetalsforecast

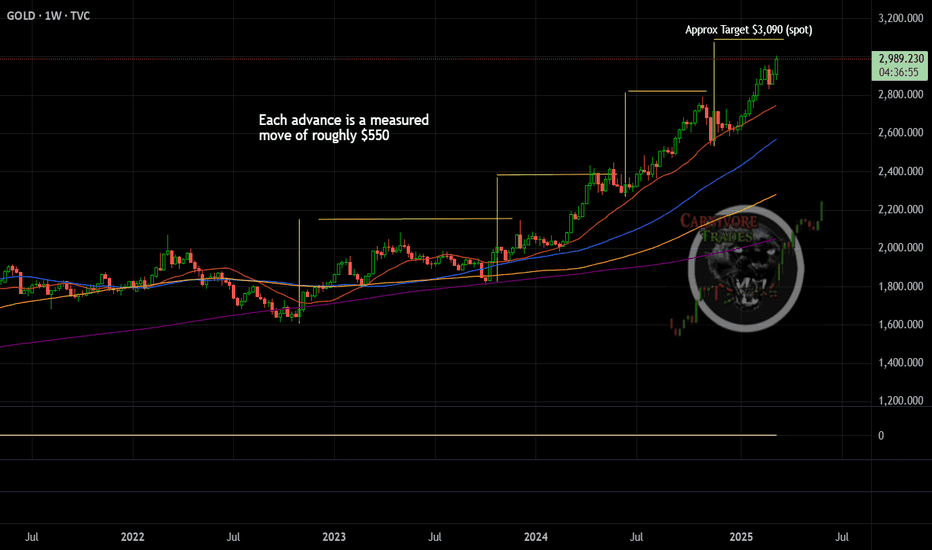

Gold Measured Move Target (Spot)Gold has finally climbed to over $3,000/oz for the first time in history however the yellow metal may not be done quite yet. Based on this repeated measured move of roughly $550 on each bull advance, we should expect the price of spot to get close to the $3,100 handle sometime soon. Seasonally, gold likes to rally into early/mid April before a cool off period so it is likely coming in the next 2-4 weeks.

Oceania trading week about to commence NZ. USD, Gold, Bitcoin

*

The USD could see some weakness this week, probably not coming until mid-week price possibly propelled by double/bottom structures on mid-timeframes, however the Daily timeframe is indicative of some weakness with price below the moving averages. It's possible later in the trading week the USD could retreat to the 100.60 - 100.85 zone where there is support. Let's see how that play out.

The whole idea is a bit counter-indicative of a short I am expecting on EUR/USD which is very overbought at the moment.

* In other developments, Bitcoin BTCUSD showed some strength during Sunday's session but is since off its' highs in the weekend session. However, BTCUSD is getting support on the 200 EMA on the Daily. I would not be surprised to see some bullishness in Cryptocurrency this week, with the shine perhaps coming off Gold which is overextended and overbought across all timeframes. The Silver price has further to run but will generally follow Gold's lead.

* In precious metals, as I point out above I see a short in XAUUSD very soon probably today, there is more buying demand on the higher timeframe for Platinum XPTUSD, XAGJPY, XAGUSD, XAUJPY whereas XAUGBP, XAUAUD & XAUUSD look over-bought. As I point out above, it's always tricky because I find they all mostly track the gold-price.

Have a good trading week, Oceania trading in NZ commences in 30 minutes (6pm New York time) and the Australian ASX kicks off in just over 2 hours time.

Chris

$XAGUSD Bearish to $26I think generally metal prices are having a pullback at the moment including $XAUUSD. Silver on the weekly timeframe has a support zone @25-26 and if that wont hold then there is a chance to hit 21-22{Least likely though}

Entry now

29.500

SL 30.100

TP1 27.500

TP2 26.100

Alternatively upto 22.

Timeframe : weeks to months

Gold slows down in downtrendHello everyone, let's explore the price of gold!

Regarding the developments and outcomes of the news on January 22nd: The price of gold has experienced significant fluctuations, mainly fluctuating in a downward trend, and the EMA continues to be the dominant support for gold. Currently, the price is consolidating. This is due to the strengthening of the US dollar as the Federal Reserve is unlikely to cut interest rates in March. As a result, investing in gold becomes more expensive due to higher interest rates.

Conclusion on gold and trends: Gold attracted some buying activity on Tuesday and recovered most of its modest overnight losses. Political tensions in the Middle East, along with concerns about China's weak economic recovery, have supported some safe-haven precious metals. However, in the long run, the price is still negatively impacted by the previous downward trend, evidenced by the price remaining below the strong resistance level of $2050.

My target is for the price to pull back to the resistance levels around $2040 and $2050 before being influenced by the market's strong downward trend, with an expected decline to $2000. Any breakthrough below this level of $1980 will be the last line of defense for the bullish camp.

Can Gold Rising Wedge Be Bullish? Bearish Pattern Break Up?Fellow Traders,

I marked the resistance lines I identified with red, and I identified a rising wedge pattern in white color on the chart. Behind the lines, gold has been accumulating a strong demand within the wedge. The chart pattern itself is a kind that tends to break downwards. In general, a rising wedge is a bearish setup. However, general rules don't work as much in trading as they do in other areas like biology. There's significant statistics for rising wedges to break in either direction.

With gold's growing demand and valuation, I think

the rising wedge could break upwards and trigger an elevated rally.

Or if it breaks down, as this pattern usually does, the wedge allows a steep bounce to retest the wedge before any reversal to bearish.

I can see a conflicting trend and chart pattern, but my two cents say a profitable long position more likely.

- Essa

Gold Break Down : Hitting 7 Month Low. Crucial Support zoneGOLD(US$/Oz) stands at a 7 month low ever since March 2023. The precious metals commodity is standing at a crucial support levels of the channel ever since April 2023.

Although the charts shows momentum bottoming but the supply constraints and Macro factors may pull it down to levels of 1833,1806 post which we can see it pulling back to channel Trendlines again. The worst case scenario is still open for 1784 but for now that looks a less probabilistic from technical point of view.

$XAU - NATH's Ahead ? LONG opportunities incoming for Gold *W (tf) (wave 5)

Wave 4 completed ?

Long Confirmation is anticipated with the red trendline resistance breakout and CHoCH's on smaller time

frames.

Current support trendline support on green and 20EMA on *W

TA speaking, Gold is sitting at a very sweet spot until the uptrend is invalidated

- Looking ahead for New All Time Highs for Gold in the midst of this troubleshooting

frenzy Economic Enviroment

US's Debt Ceiling Crisis and governments not trusting any longer The US Dollar

in their balance sheets.

Did you know that through-out 2022 and the on-going of 2023 amongst many countries,

Russia and China, two Global Superpowers,

have been stacking Gold up as their

State Reserves in heavy amounts !

Do they know something we don't !?

TRADE SAFE !

*** Note that this is not Financial Advice !

Please do your own research and consult your own Financial Advisor

before partaking on any trading activity based alone in this idea

Gold Support Level on Weekly TimeframeGold started to correct after a small bull run. We can determine how long this correction will last using both the indicator and the price action method. Looking at the moving average, the $1786 level is a clear support. When we apply the Fibonacci correction to the distance he ran, the 0.5 region appears to be $ 1780 in the same way. And finally, when we pulled FRVP since 2021, we clearly see that around $ 1780 is support.

So this level is a buying opportunity for me.

Silver more precious than goldSilver performed better than Gold in percentage term during each crisis.

We will study into the history of Silver and Gold. And during each crisis, Gold and Silver always performed exceptionally well compare to many other markets.

Content:

. Its price behavioural leading to each peak

Price behavioural studies provide us a fundamental reason for every price movement. Especially the significant ones.

Micro Silver Futures

Minimum fluctuation

0.001 = $1

0.005 = $5

0.01 = $10

0.1 = $100

1 = $1,000

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Silver - SHORT; SELL it here!!All the PMs but especially Silver is a Major SHORT here, with a Low-risk Entry!

A Bullish G/S and a likely USD reversal here - even if potentially limited in scope - should underpin a substantial decline in all the metals, from these levels.

Charts like this are no help, either! (Stock market forced liquidations have a tendency to spare nothing and no one, not even the PMs - at least initially.)

Technical analysis update: XAUUSD (17th May 2021)As all our previous price targets for gold were reached we would like to upgrade our short term price target for XAUUSD to 1875 USD per ounce. Bullish RSI and MACD support bullish case for gold. Also rising inflation plays in favor of gold. Furthermore, we think that the downtrend in cryptocurrency market will further support rotation into gold.

Disclaimer: This analysis is not intended to encourage buying or selling of any particular securities. Furthermore, it should not serve as basis for taking any trade action by individual investor. Your own due dilligence is highly advised before entering trade.

XAU/USD going as planned, could the bottom be in? @SmileyTradesHello Traders!

Hoping to provide a short term update for you as opposed to the Longer Timeframe analysis I did previously potentially signaling a bottom.

So far, Gold has been trading the Nested MMs beautifully, but we are still waiting for the 2nd Traditional Series setup will reach target. With recent price action being a consolidation above previous resistance, we can start to feel confident in Longs.

Key levels are on the chart...there is, of course, the Opposing MM series in play and we must pay attention to that. I am expecting we break the Short Series and have some strong resistance in between $1,875 - $1,925 at the ATWHWB.

I'll link my previous analysis of the larger timeframe to this post for your reference!

Happy Trading, always manage risk.

Quality in trading is the ability to react to one's own psyche

WPM - It's Do-or-Die TimeFor WPM , it's getting very close to do-or-die time.

A break above the red resistance range (with at least one daily close) would be SUPER bullish for WPM and the whole precious metals sector. However, should WPM break below the green support range (with at least one daily close), we would expect a lot more downside pressure to come to the precious metals sector. Which direction will it be? Are you prepared?

The featured content is intended to be used for informational purposes only. Everything shared here is my own opinion. It is very important to do your own analysis before making any investment based on your own personal circumstances. Please subscribe to our channel if you like what you are seeing!

PLG - Bull Flag OpportunityAs a continuation from my first post, we have such a great opportunity for a 150% gain in AMEX:PLG from where we are right now. TVC:PLATINUM has broken out of it's long-term resistance (shown here: ) and we are seeing capitulation within the precious metals sector. I don't expect us to stay here long! Don't miss out!

The featured content is intended to be used for informational purposes only. Everything shared here is my own opinion. It is very important to do your own analysis before making any investment based on your own personal circumstances.

Silver: Buy the Dip or More Downside Risk Ahead?The bias for TVC:SILVER remains to the upside. The recent slight bounce in the dollar, which has occurred sooner than originally expected, has contributed to last Friday's selloff in commodities. Until proven otherwise on the chart, this recent shakeout remains a buy the dip opportunity and a great place for new buyers to establish initial positions.

Everything shared here is only my opinion and no results are guaranteed. Good luck!

Is Silver Breaking Down?In my opinion, we are experiencing one final shakeout of silver holders before the next big leg up. I'm still looking at this as a great place to add to my position and for new buyers to establish initial positions. Notice we are right at support (~$25.65) and I don't expect us to close below this level today.

However, if we do close below, then all bets are off!

Everything shared here is only my opinion and no results are guaranteed. Good luck!

TVC:SILVER

Quickpost: Big Picture on DXY and anti-fiatsThere is a pretty well understood relationship between fiat, like the dollar, and anti-fiats, like precious metals and crypto. With some trend lines we can see that when DXY bases out on long term support more likely than not anti-fiats are either on the verge of topping or in the process of selling off. Well established by now. That base-ing out can be viewed as faith being restored to the dollar and less need to hedge against whatever instability caused the dollar weakness/cheapness.

KEY POINT DXY has decisively broken an uptrend of support in orange. The price action at the break suggest this was a major area of distribution and that area either bisects or trisects the complete move down. The falling support in fuscia gives an area where price action could land and bounce off. This fuscia line meets rising support in purple at the blue cross in mid-2022.

The big picture plan is simple... I am going to be investing in my preferred anti-fiat for the next year and a half and when price action reaches the blue cross I will see if there is topping behavior on the anti-fiat and if I should pivot out into some other asset. If the triangle starts to perform bearishly I look for price action to go to the base of the channel which it hasn't visited in over 10 years. There may be a 10 year bull market in anti-fiats should this triangle break down which makes investing rather easy.

This isn't the whole picture because interest rates, real and nominal come into play but so long as they stay low. No telling how that long will be but eventually this falling wedge on the effective federal funds rate will have to perform. I have a strong suspicion it will be around the time DXY finds support at the blue cross.

Please review the linked ideas for my other thoughts on DXY. The bearish one is the latter, and therefore more mature and accurate post. the DXY target setting one was before I had a wider view on DXY and was a wrong call to the upside.

Silver follows after GoldFirstly, please support our work by clicking like button or following! These really assist us to reach more investors & traders like you!

Silver comes slightly short of $19.00 / ounce as precious metals sets new highs. Bulls have got plenty of support as prices remain upbeat

in an ascending pitchfork.

Gold - $1400/ ounce on the Cards? - Prices to WatchAfter a quiet few weeks on gold, the yellow metal appears to be failing in this most recent breakout attempt that was observed on the daily time frame.

Weekly Time frame:

This is not at all surprising when you zoom out to the weekly chart, which clearly shows excessive exuberance to the upside, rallying quite substantially outside of the 3 ATR channel (the red bands), this set gold up for a nice period of profit-taking and consolidation, a period that we are still in currently.

Monthly Time frame:

This trend is also observed on the monthly time frame, with gold tagging the top of the 3 ATR channel before retreating, the 8 period ema

is also significantly detached from the most recent price action, sitting around $1420/ ounce.

Targets:

Watch the weekly time frame for a retracement back into the 1 ATR channel (the shaded purple region), at a minimum i would expect a tag of the channel mid point (white line) at around $1460/ ounce, but the greater likelihood is a move below the mid point to tag the lower half of the 1 ATR channel, closer to $1425/ ounce.

At this point gold would have sufficiently reset it's price action to become attractive again to traders (who are still the primary near-term price drivers).

Silver Cup and Handle - $90.00 USD Target?Silver has a clear cup and handle formation present (and looking to be resolving) on the monthly chart.

Given the price action in silver recently (check out my earlier analysis which predicted this most recent surge as well as the move up in gold in July) it is worth looking at the longer-term trajectory for silver to determine whether we should be selling, buying or staying on the sidelines.

It is worth noting that pattern analysis is an art, not a science, however it is a fact that the longer the time frame the pattern is observed (e.g. monthly vs. daily patterns) the more validity is tends to have.

The measured move from the base of the cup to the ridge of the cup pattern projects an eventual target of close to $90.00 USD (well north of 300% from present levels)

With this in mind, this pattern will likely resolve over YEARS, not weeks or months, but given the strong tailwind that this could provide for silver and silver associated investments, it is worth considering how you will play (if at all) this market.