TRUMP VS BIDEN 2020ADAM AND EVE BOTTOMING STRUCTURE, WITH A GOLDEN CROSS CONFIRMED. JUST IN THE NICK OF TIME..

Presidentialelection

Mercury Retrograde gaining influence now- 10/13 inbound Visible in this chart is the last retrograde and the growing influence of the current retrograde cycle. Compare the two. Transiting Mercury in retrograde is a regular cycle occurring three or four times a year for about 24 days. While this is more frequent than any other planet, Mercury is still only retrograde 19% of the time. This is far less than Jupiter outwards, but more than Venus and Mars.

The retrograde Mercury phase is just one part of the retrograde cycle. The whole cycle includes Mercury going direct, retrograde, and direct again over the same degrees, or the retrograde zone. The two direct phases are called the shadow periods. We are in a retrograde shadow period currently. This is by no means investment advice, it is simply useful as an illustration of something that a great deal of humanity irrationally "feels" affects their psychology and life across millennia and cultures. This is for fun and is not investment advice- Amor Fati fellow traders!

USDMXN Completing Wave CHi Fellow Traders,

Today USDMXN show a promising move which can completing Wave C for Higher TF. For low risk entry please wait for " Buying Zone".

If price breaking Invalidation Level, it will create a new impulsive move towards downtrend

My projection is that the USD will rally strong until US Presidential Election so I'm expecting that USDMXN will be bullish completing Wave 5 in Higher TF

FX:USDMXN

Likely Bearish Scenario for the following monthsIf we're before a yet unconfirmed bearish phase, this is a likely scenario.

You can trade within the bearish channel.

A minimal market run-up usually always follow the days prior a new POTUS election.

I think we can expect markets continue to fall whether Trump or Biden get elected.

It will only stop falling until long-term Bitcoin channel bottoms are hit.

This is hit or miss, don't take this a financial advice.

I post to see if my prediction ability is on point or too far off.

Cheers.-

Presidential Elections, Crisis & Stock MarketsPresidential Election Crisis & Crisis of Confidence

The next big macroeconomic event to happen is the US Presidential Election, and that got me thinking, "what happened in previous elections?"

The last two major crashes, the DOTCOM Crash 2000-2004 and the Financial Crisis 2007-2009, both occurred during a presidential election.

The DOTCOM crash was underway for eight weeks when George W. Bush took over the presidency. The ensuing carnage wiped out four years of gains . This equated to a 41.64% drop during George Ws' first three years.

The Financial Crisis was already well underway when Obama took over in November 2008. The total crash wiped out 52% of the value of the S&P500, 24% of that loss occurred under Obama's reign . In total, the Financial Crisis wiped out 8 years of gains .

The Corona Crash started during the last seven months of Trump's term and is ready to be inherited by Biden or continued to be managed by Trump, depending on the outcome of the election.

Crisis of Confidence.

Crashes and crises happen when confidence in a market is lost. Confidence is the difference between a functioning market and an economic disaster. Trump and the Federal Reserve have amazingly restored confidence in this market, despite the disastrous ongoing economic events.

Presidents Crisis & Confidence

The next election will be set in the middle of a crisis, a crisis that has not played out its full course.

The questions you have to ask yourself when betting on the market coming up to November are:

Which President, if any, will maintain the confidence in this current bubble market?

Which President, if any, can maintain the confidence in this market long enough so that the Fed can gently deflate the bubble over time?

The question is not what you think the answer is, the question is, "What do you think the market participants believe?"

Confidence Tricks

If the next President and the Fed cannot perpetuate these confidence tricks, we might expect 4 or 8 years of market gains to be wiped out.

Summary

This is not a political commentary or a prediction; it is observations based on the market's action during elections and crises.

Outlook: While this rally has been great and profitable for many, the coincidence of All-time Market Highs, Economic Carnage, and the Current Market Euphoria, suggest to me a Bubble Waiting To Burst. Outlook at this time - Neutral, in November Short.

Stock Market Crash Fall 2020Based On Video Recorded On Wednesday, September 2, 2020

At the time of writing this, the markets are at all-time-highs… but are we setting up for a Fall edition to the 2020 stock market crash?

If you’ve followed me for any length of time you’ll know I’m not one for making bold market predictions, based on gut feelings.

I take a systematic approach to trading.

So let’s just start by looking at the facts:

1.) This November, we have the Presidential Election. This is and has always been a significant event for the markets.

I’ve found a website (Isabelnet) that has charted what has happened over the last 23 elections.

Has The Stock Market Crashed The Fall Before An Election?

Let’s take a look at what historically happened in the 3 months leading up to the election.

Over the last 23 elections, 14 of those times the markets have gone up and 9 times it went lower.

The moves to the downside haven’t been what I would consider significant, with one exception: The 2008 Financial Crisis

But because that was a unique circumstance, I would consider it a bit of an anomaly.

Other than that, the losses are less than 3.5% and the gains are anywhere between 2.5 – 8%.

So over the last 92 years, the markets have gone up 61% of the time.

Based on this data alone, you could make the prediction that it’s very unlikely we will see a stock market crash this fall… at least before the elections.

And there’s one REALLY simple reason for it:

Trump wants to be re-elected.

And right now he has a great story to tell:

“Look at the markets. They are at all-time highs and I did that!”

And look, I could care less what political affiliation you have, this is just my take on it.

It seems that the stimulus packages as well as the Fed measures that they implemented seem to be working.

So Trump would be stupid to “rock the boat” right now.

Yes, we still have a conflict with China. But in reality, that’s ‘piddle – paddle’.

It’s like 2 girls in a sandbox saying:

“You’re mean!” – “No, you’re mean!” – “You’re ugly!” – “No, YOU are ugly!”

And right now I don’t think that Trump will do anything that could potentially send the markets sharply lower, because THAT would likely decrease his chances of being re-elected.

On the horizon, I don’t see any other major events that could potentially crash the markets.

Looking at the economic reports, for the most part, everything is being reported better than expected.

Some additional good news is that pretty much all companies in the S&P 500 have reported earnings for the past quarter.

And 84% of the companies reported better than expected earnings.

So all of this is positive news for the markets, and it seems that we are handling the pandemic well, at least economically.

So what COULD send the markets lower right now?

One thing: PROFIT TAKING.

No market can go up forever!

At some point, there will be some profit-taking and the markets will pull back.

The key question that remains is:

How Big Of A Drop Could The Markets See – Are We Talking Crash Or Pullback?

So there are 2 tools that I like to use to get an idea of how much the markets could potentially drop:

1.) Fibonacci Retracements : Now I’m the first to admit I’m not an expert in Fibonacci, and there are probably much better ways to do it, but here’s how I do it.

Grabbing the Fibonacci Retracement tool, I’m going to find the low from the Pandemic Crash and run from that low to the first high before a noteworthy pullback as you can see from the image below.

Looking at it, you’ll see that from the low to high swing the SPX found support around .50% retracement, or a 50 percent retracement of that swing.

Make sense?

For me, this is just an easy way to give me an idea of where we might find support during a pullback.

So let’s take a look at the most recent pullback. And we’ll run the tool from it to the current high, to give us an idea of where we could end up if we see some profit-taking:

From what I can see, I would expect the S&P to find support around the 3500 or 3400 levels.

2.) Missed Pivot Points : The second tool that I like to use is one created by my friend Rob called the “Missed Pivot Points.”

So if you’ve never heard of “Pivot Points” before, it’s the high + the low + the close, divided by 3.

So what he likes to look at are Monthly and Weekly Missed Pivots Points. In TradingView they’re available as a free indicator. When we plot them you’ll see that they align right around the same area of the Fibonacci Retracements we just ran.

So Are The Markets Going To Crash In The Next Three Months?

Everything is possible, but based on my analysis, it’s not likely we’ll see a full-blown stock market crash this fall 2020. But as we’re all aware at this point, 2020 has been full of surprises.

I do believe that we could see a correction to these levels I discussed (3400 or 3500), but based on the analysis that I’ve discussed, it’s more likely that we will keep drifting higher.

Drop It Like It's Hot ❗The S&P500 reached our target-box in yellow and dropped like a stone.

The impulsive sell-off confirms our primary scenario. Our next target now resides at 3262 points, bevor the bulls have a Chace to push back. We give the scenario in which the market stabilizes, in the range of 3262 - 3075 points, a probability of 38%.

Should the S&P500 reach the blue target box at 2883 points in our primary expectation, then this would be a tremendous long-term buying opportunity. Long-term, we see the S&P500 getting to 5000 points.

Feel free to share your thoughts.

Happy to discuss the next move.

29k succesfully reached! 🐂Despite the turbulent news regarding the upcoming presidential election and the uncertain economic recovery, the bullish scenario remains intact.

The index has hit the 29k region and is still going strong. The 29k points was the first target from the last Dow Jones Update.

Should the bulls break out of the yellow target box, above 29559 points, the path for a direct rally to 30500 points will be paved. This, however, is our alternative scenario that we give a probability of 35%.

Our primary scenario projects a slow and steady sell-off in Wave 4 in Green to at least 27900 points, before the bulls push the Dow Jones toward new all-time highs.

If you are Long, since 27600 points, you can use this area to take home some profits and reload after wave 4 in Green has completed.

Feel free to share your thoughts.

Happy to discuss the next move.

Pharma looks fugly on a relative basisBreaking down through support, this is what kept me out of trading PFE to the long-side even though it looked bullish. With the elections coming up and democrats leading the polls, I'd stay away from pharma and insurers. Lean towards medical devices if you need healthcare exposure.

Quick idea 12 years of trending is faced today. that graphic kinda good looking too uptrend. maybe break that squeezing around @1.2 or 1.9 than a pullback again to down. In the United States presidential election comes soon at the door.

Then Election after no matter who the president selected after EURUSD will figure out the create pattern to up.Just idea FX:EURUSD

China problems, Central Banks & euro riseThis week begins to give a first idea of the economic consequences of the epidemic (so far in the context of China). We are talking about the manufacturing PMI index for China, which fell to 35.7 in February (compared to 50 in January). The non-manufacturing index came out even worse, showing a value of 29.6 (the lowest in history). Recall that any value below 50 indicates a decrease in economic activity. And this is only the first swallow. Then there will be new indicators, and each of them will plunge financial markets into an ever greater depression, at least for some time.

Meanwhile, in China itself, the epidemic continues to decline rapidly. In Wuhan (the epicenter of the epidemic), they even began to close the first temporary hospitals due to the lack of patients. But the relay race in China is confidently intercepted by the world as a whole. South Korea, Italy, Iran - current epicenters, which are also not localized, but, on the contrary, spread the virus to other countries. If we draw an analogy with China, then at best for the next month we will find exclusively disappointing news. So you should not count on something good from March.

Accordingly, the outcome from risky assets is likely to continue, respectively, gold and other safe-haven assets will find fundamental support. This week we will continue to use the bundle of buying gold - buying USDJPY as a promising medium-term position. In our opinion, the strengthening of the yen, if it continues, will be limited, but the opportunities for gold growth look much more extensive in this regard. Our disbelief in the significant strengthening of the yen is due to the fact that Japan is experiencing serious economic difficulties and traditionally one of the components of the equation to solve them was the devaluation of the yen, so the Bank of Japan is either around 107 or about 105, but most likely it will intervene and prevent the yen from strengthening.

In general, central banks are again in the spotlight. Everyone expects salvation from them. As it was during the crisis of 2007-2009. So far, they live up to expectations, since all key central banks have noted rather aggressive statements about their readiness to act.

Markets traditionally focus on the Fed. This is mainly due to the current difficulties of the dollar and the frank success of the EURUSD pair. With each new hundred growth points of EURUSD, our desire to sell a pair grows stronger, as does our desire to increase transaction volumes for sale.

Part of the dollar’s problems lies in the plane of the presidential election. We try to minimize the analysis of the political plane, focusing on the economy. But today is the so-called Super Tuesday. The day when 1344 of the 1991 Democratic Party delegates cast their ballots for a particular candidate. So far, Sanders is the undisputed leader (probability of victory = 57%), but Biden still has chances (probability of victory = 31%). So the day for the US political sphere is very significant.

The pound was under pressure yesterday due to the negotiation process between the UK and the EU on a trade agreement. There is already a familiar game of tug of war and trade for the best conditions, tied to mutual threats. As in the case of Brexit, we prefer to see not the current noise, but the perspective. And it is such that the parties are likely to agree in one form or another.

Accordingly, the pound will receive its positive sooner or later. So in the medium term, we do not see any problems for medium-term purchases of the British pound. Rather, on the contrary, we see good shopping opportunities. In current conditions, sales of the EURGBP pair seem ideal to us.

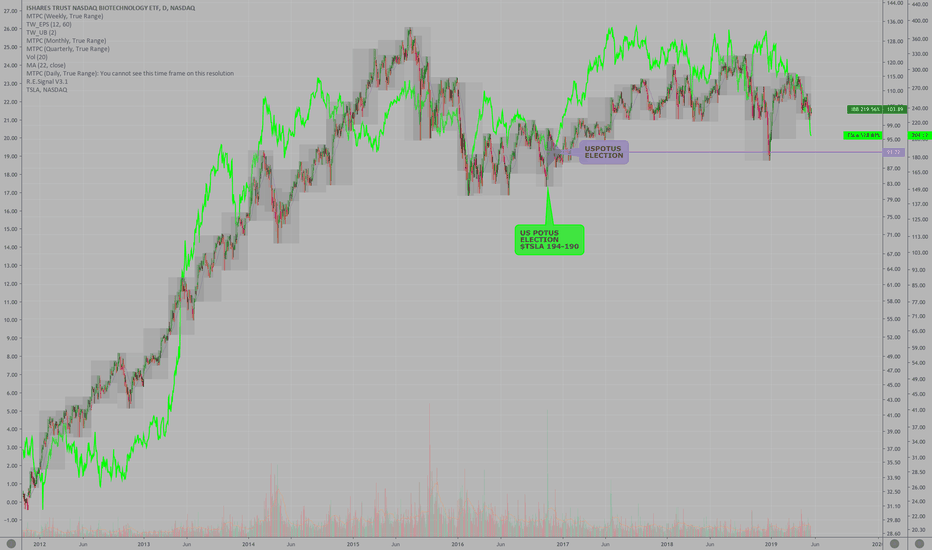

$TSLA Tesla vs $IBB Biotech over 7 years The pioneers in medicine ($IBB Biotech) vs the pioneer in automobile, battery and automated driving ($TSLA, Tesla).

Notice the wave of investor recognition of the future of biotech from 2011 to 2015 matches quite well to the wave of investor recognition of the future of energy storage and EV vehicles in the stock price of Tesla.

Biotechs returned to the US Presidential Election level and Tesla has also pulled back to the level this week in the low 190's (chart to follow of the exact level). The US President supported faster drug approvals if lower drug pricing was on the table.

The President of the US hasn't done anything to support the efforts of EV's and in fact hasn't been a believer of solar and alternative energy.

It's curious that $TSLA is pulling back to the Presidential election price level in the low 190's were we have seen the lows this week on the various Wall Street downgrades. Oddly, Wall Street was upgrading $TSLA at the highs near $370-$380 last year . If you want to make money in stocks long term, be aware that Wall Street tends to get it wrong more than most people think. If you follow Wall Street recommendations, realize that analysts are typically reacting to old news and not regarding or weighting the potential for positive future news which will weigh more in the minds of investors. Wall Street is more concerned about having another Enron (fraud) and melt-down on their hands, so any company having short term difficulties is sold out of fear.

Full disclosure: I follow Tesla on an intraday basis and have for many years. I have positions in $TSLA and will trade in and out of shares as I see opportunities to enter on bad news and exit on good news.

We discuss Tesla quite often in the Key Hidden Levels chat room where we discuss "EARNINGS LEVELS", "NEWS LEVELS", "TIME@MODE TREND" and assorted sentiment and liquidity indicators like $SKEW and $VIX to pinpoint entry/exit levels for stocks and the market overall.

Tim West

12:04PM EST, May 21, 2019

US PRESIDENTIAL ELECTION NOV 8TH - OUTLOOKA Clinton victory will be good for the dollar, but for all the wrong reasons. Hillary is bought and paid for so we will see her wage war against Syria/Russia on behalf of Saudi Arabia & Qatar. A Trump victory will be exactly the opposite and a move back to isolationist, which will be far more positive for the domestic economy and a 15% corporate tax rates would see $3 trillion in cash pour back into the USA. The dollar will soar for economic reasons. So it appears that no matter who wins, the dollar will rise and that will aid the stock market.

Nevertheless, the markets appear to be manipulated for they are desperately trying to sell the share market down under the theory Trump might win. This certain would not even hold up fundamentally given our models and the trend in capital flows. Clearly, the powers that be are trying very hard to press the market down to say see what Trump would do. The logic is completely opposite whereas Clinton will get us into war and Trump would be more isolationist.

Our models show more of a reaction than a change changer. Just watch the 160150 level in the 30-year bond futures. A monthly closing below that level will signal the Bond Bubble has burst. In the Dow Jones Industrials, the number to watch will be a monthly closing below 17330 . These are the numbers to pay attention to that would signal a change in trend mid-term. Meanwhile, a closing in gold on a monthly basis below 1242 will also signal a change in trend to the downside is likely. - Martin Armstrong

Soruce: ArmstrongEconomics.com

USD PRESIDENTIAL ELECTION - SELL MXNJPY - RISK & SENSITIVITYPresidential Election - Trump wins - MXN more sensitive than USD, Yen to pick up the risk-off shift:

1. Positioning for a trump win is much more interesting than a hilary win but nonetheless both should be profitable at some level. My number 1 position will be SHORT MXNJPY for a number of reasons 1) MXN has been very sensitive to the USD election given trade claims made by trump which would likely have a greater than brexit effect on the Peso. This in mind however MXN has been rallying recently as Trump winning odds have filtered into more of a tail probability. Nonetheless this just opens up great opp for profit in the even he does win (e.g. MXNJPY has rallied from 5 to 5.5 in the past few weeks as trump winning is being discounted, this opens up a whole 500pips of reward in the event he does win and MXN is shorted due to its sensitivity).

- Further the reason i have chosen XXXJPY rather than XXXUSD as a denominator for the MXN short is because JPY is likely to rally as risk sentiment sours given trump is likely to create great global geopolitical tensions, thus risk-off demand is likely to trade through the roof. Not to mention being long USD vs MXN also will have muted gains given USD is also likely to be a political-economic victim of trump win volatility.

- Term structure for the MXNJPY shorts imo will play much like GBPXXX downside has, the Trump uncertainty is likely to weigh on both the USD and MXN until at least the end of the year given policy intervention/ settling in will take this time. Thus i will be running this position for several weeks after election (i dont think we will see anyone buying the dip this side of 2017.

Presidential Election - HIlary wins - Long MXNJPY possible but USDJPY bids perhaps makes better sense:

1. The inverse of the above is obviously to buy MXNJPY in the event of a Hilary win. HIlary imo is the neutral decision given her lust to be in the pockets of corporations. MXNJPY bids make equal sense however i think USDJPY will be better suited since MXNJPY forgo's the added topside USDJPY will gain through the FOMCs likely Dec hike plus MXNJPY has already rallied 10% in recent months into the election so calls for futher topside will likely be limited. USD on the other hand has remain relatively neutral in terms of Presidential flows. Yen will devalue in both cases as risk-off demand is flushed out.

Trading Strategy - Trump SHORT MXNJPY, Hilary LONG USDJPY:

1. Short MXNJPY at mrkt as soon as the news is heard, perhaps 50% TP at 5.00 and 50% hold for a few days/ weeks.

2. Long USDJPY at market as soon as the news is heard, targeting 108,109,111.

USD PRESIDENTIAL ELECTION - SELL MXNJPY - RISK & SENSITIVITYPresidential Election - Trump wins - MXN more sensitive than USD, Yen to pick up the risk-off shift:

1. Positioning for a trump win is much more interesting than a hilary win but nonetheless both should be profitable at some level. My number 1 position will be SHORT MXNJPY for a number of reasons 1) MXN has been very sensitive to the USD election given trade claims made by trump which would likely have a greater than brexit effect on the Peso. This in mind however MXN has been rallying recently as Trump winning odds have filtered into more of a tail probability. Nonetheless this just opens up great opp for profit in the even he does win (e.g. MXNJPY has rallied from 5 to 5.5 in the past few weeks as trump winning is being discounted, this opens up a whole 500pips of reward in the event he does win and MXN is shorted due to its sensitivity).

- Further the reason i have chosen XXXJPY rather than XXXUSD as a denominator for the MXN short is because JPY is likely to rally as risk sentiment sours given trump is likely to create great global geopolitical tensions, thus risk-off demand is likely to trade through the roof. Not to mention being long USD vs MXN also will have muted gains given USD is also likely to be a political-economic victim of trump win volatility.

- Term structure for the MXNJPY shorts imo will play much like GBPXXX downside has, the Trump uncertainty is likely to weigh on both the USD and MXN until at least the end of the year given policy intervention/ settling in will take this time. Thus i will be running this position for several weeks after election (i dont think we will see anyone buying the dip this side of 2017.

Presidential Election - HIlary wins - Long MXNJPY possible but USDJPY bids perhaps makes better sense:

1. The inverse of the above is obviously to buy MXNJPY in the event of a Hilary win. HIlary imo is the neutral decision given her lust to be in the pockets of corporations. MXNJPY bids make equal sense however i think USDJPY will be better suited since MXNJPY forgo's the added topside USDJPY will gain through the FOMCs likely Dec hike plus MXNJPY has already rallied 10% in recent months into the election so calls for futher topside will likely be limited. USD on the other hand has remain relatively neutral in terms of Presidential flows. Yen will devalue in both cases as risk-off demand is flushed out.

Trading Strategy - Trump SHORT MXNJPY, Hilary LONG USDJPY:

1. Short MXNJPY at mrkt as soon as the news is heard, perhaps 50% TP at 5.00 and 50% hold for a few days/ weeks.

2. Long USDJPY at market as soon as the news is heard, targeting 108,109,111.