EURJPY Double Top - Bearish Reversal Ahead Toward Target!🔍 Chart Analysis: Identifying the Double Top Pattern

The EURJPY (Euro/Japanese Yen) 1-hour chart shows a classic Double Top pattern, which is a strong bearish reversal formation. This pattern occurs when the price reaches a significant resistance level twice but fails to break above it, indicating a potential shift from bullish momentum to bearish control.

1️⃣ Top 1: The first peak formed as buyers pushed the price higher, but strong resistance forced a pullback.

2️⃣ Top 2: The price attempted to break the same resistance level again but failed, forming a second peak at approximately 164.165, confirming that sellers are overpowering buyers.

3️⃣ Neckline (Support Level): The critical support level around 160.000 acted as a trigger for the bearish move. Once this level broke, the double top pattern was confirmed.

📌 Key Levels and Market Structure

🔹 Resistance (164.165): The highest level where sellers dominated, preventing further upward movement.

🔹 Support/Neckline (160.000): This level acted as a crucial pivot. Once broken, it signaled a trend reversal.

🔹 Take Profit Levels:

TP1 – 159.036: This serves as the first profit target, aligning with a prior demand zone.

TP2 – 157.200: The full projected downside move based on the double top pattern.

🔹 Stop Loss (SL): Above 164.165, ensuring a risk-managed approach in case of trend invalidation.

📉 Trading Strategy: How to Trade This Setup?

1️⃣ Entry Confirmation:

The ideal entry was after the price broke the neckline at 160.000 and retested it as resistance.

A breakdown candle with high volume confirmed seller dominance.

2️⃣ Stop-Loss Placement:

A stop-loss above 164.165 provides room for price fluctuations while protecting against false breakouts.

3️⃣ Profit Targets:

TP1: 159.036, securing partial profits.

TP2: 157.200, completing the double top measured move.

📊 Market Psychology & Price Action Insights

The double top pattern reflects a shift in market sentiment from bullish to bearish.

The repeated rejection at 164.165 signals a lack of buying strength, increasing the probability of a downward move.

The breakdown of the 160.000 neckline confirms that sellers have taken control.

The price action also shows a lower-high formation, reinforcing bearish momentum.

✅ Conclusion: Bearish Bias Until 157.200

This setup strongly favors short positions, as long as the price stays below 162.500.

A break above 164.165 invalidates the bearish setup, signaling a potential reversal.

Until then, the market remains bearish, with TP1 & TP2 as achievable downside targets.

💬 What’s your outlook on EURJPY? Drop your analysis below! 👇

Priceaction

2025-04-02 - priceactiontds - daily update - daxGood Evening and I hope you are well.

comment: This is the event bears have prayed for, full blown trade war and this market is not positioned for any downside risk. Let’s see where we close this week. Below 21500 would be amazing but let’s close below 22000 first.

current market cycle: trading range

key levels: 21800 - 23000

bull case: Tbh, best bulls can hope for, is to stay above 22000. I can’t see this going above 22800 for the near future. If bulls do it, I am clearly wrong.

Invalidation is below 21900.

bear case: Bears got the event gift and now it’s about how fast do they want to get out of this. I expect the worst but stops for now are 22800. First target is a strong move below 22300, then bears need to break 22000 and print a lower low. If they do that, we most likely freefall to 22000. If things become real bad, we hit the big bull trend line from August tomorrow, likely around 21800.

Invalidation is above 22800.

short term: LFG. Trade small with wide stops.

medium-long term from 2024-03-16: Germany takes on huge amount of new debt. Dax is rallying hard and broke above multi-year bull trends. This buying is as real as it gets, as unlikely as it is. Market is as expensive as it was during the .com bubble but here we are and marking is pointing up. Clear bull channel and until it’s broken, I can not pound my chest and scream for lower prices. Price is truth. Is the selling around 23000 strong enough that we could form a top? Yes. We have wild 1000 point swings in both directions. Look at the weekly chart. Last time we had this volatility was 2024-07 and volume then was still much lower. We are seeing a shift from US equities to European ones and until market closes consecutive daily bars below 22000, we can’t expecting anything but sideways to up movement.

current swing trade: None

trade of the day: Big up, big down. Triangle on the 4h chart and both sides made decent money today.

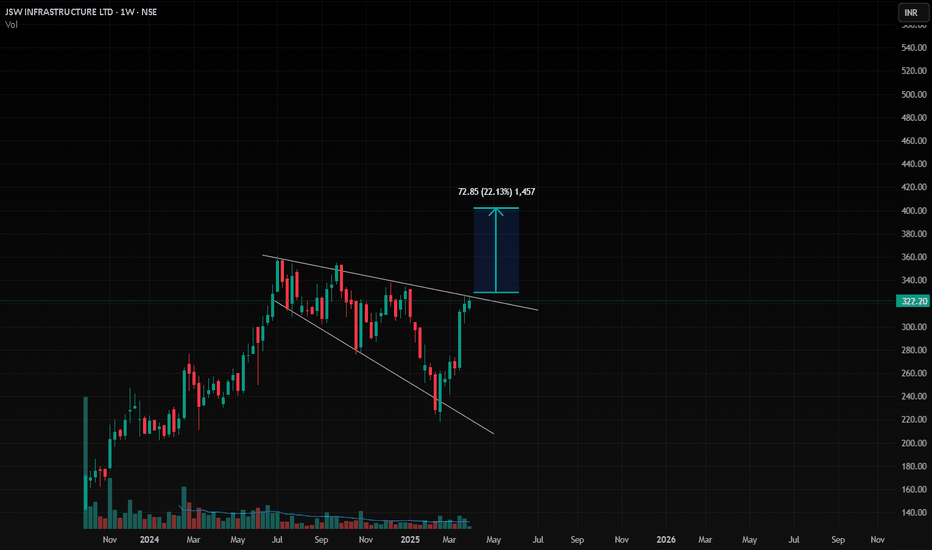

PhoenixLTD, 1W & 1DLooking very Good Channel Pattern and it is ready to Breakout

Enter into it after the upper trendline Breakout

it is Combination of Both Triangle and Channel Patterns , it can Break any time

so look an eye on it or make an Alert above trendline broke

Follow For More Swing Trade Ideas Like This

FluoroChem ,1WFirst Triangle Pattern is Breaked Out and Next Channel Pattern is Formed at Retest for Triangle Pattern .

Now Channel Pattern is Ready to breakout , SO look an Eye on it when Breaking

Only Enter after the breakout of upper Trendline of Channel Pattern .

Be Careful when entering at breakout

Follow for more Swing Trade Ideas Like This

BTC/USD Bullish Breakout from Rectangle PatternOverview:

The chart represents Bitcoin's price action against the US Dollar on the 1-hour timeframe, highlighting a Rectangle Pattern Breakout with a well-structured trade setup. This analysis will break down the pattern, key levels, and possible trading scenarios.

1️⃣ Chart Pattern Breakdown – Rectangle Consolidation

The price has been moving within a rectangle pattern (range-bound movement), where Bitcoin found support at lower levels and faced resistance at the upper boundary.

Rectangle Pattern: A continuation/consolidation pattern where price fluctuates between horizontal resistance and support before breaking out.

Curve Formation: The price action within the rectangle also forms a rounding bottom, indicating a potential shift from bearish to bullish sentiment.

Breakout Confirmation: BTC has broken out from the rectangle, suggesting bullish momentum.

2️⃣ Key Technical Levels

🔹 Support Level ($84,110)

This zone has acted as a strong demand area, preventing the price from falling further.

Buyers consistently stepped in at this level, making it a significant psychological floor for Bitcoin.

🔹 Resistance Level ($86,850 - $87,000 Zone)

This level had previously rejected upward movements, leading to multiple price pullbacks.

After the breakout, this area is expected to act as a new support level upon a retest.

🔹 Target Price ($89,931 – Next Resistance Zone)

If the breakout sustains, the next key target for bulls is around $89,931, based on prior resistance zones and technical projections.

🔹 Stop Loss ($84,110 – Below Support Zone)

A stop loss below the support zone ensures risk management in case of a false breakout.

3️⃣ Trading Strategy & Execution

📌 Entry Point – After price confirms the breakout above the rectangle’s resistance. Traders should wait for:

A pullback and retest of the broken resistance, which should now act as support.

A strong bullish candle confirming continuation.

📌 Take Profit (TP) – $89,931, based on historical resistance levels and price projection from the rectangle range.

📌 Stop Loss (SL) – Placed at $84,110, below the rectangle’s previous support zone to minimize downside risk.

📌 Risk-to-Reward Ratio (RRR) – The setup offers a favorable RRR, meaning potential profits outweigh the risks.

4️⃣ Market Sentiment & Additional Factors

✔ Bullish Outlook – The breakout signals strong buying interest and potential upside continuation.

✔ Volume Confirmation – Traders should monitor volume spikes during the breakout to confirm institutional participation.

✔ Economic Events & News – External factors like macroeconomic data or Bitcoin-related news can impact price action.

Conclusion – BTC/USD Trading Setup

Pattern Identified: Rectangle Pattern Breakout

Current Trend: Bullish breakout from consolidation

Trade Type: Long position (Buy setup)

Key Levels:

✅ Support: $84,110

✅ Resistance: $86,850 - $87,000

✅ Target: $89,931

✅ Stop Loss: $84,110

🔥 Final Thought : Bitcoin has broken out of a key consolidation range, signaling a bullish move towards $89,931. Traders should wait for confirmation and manage risk accordingly! 🚀📈

XAUUSD Head & Shoulders Breakdown – Bearish Target Ahead?This chart represents a detailed technical analysis of Gold Spot (XAU/USD) on the 1-hour timeframe with a structured trade setup based on a Head and Shoulders (H&S) reversal pattern. Below is an in-depth explanation of the chart components, price action, and trade strategy.

1️⃣ Key Chart Patterns and Analysis

A. Head and Shoulders Pattern (Bearish Reversal)

This is a well-known bearish reversal pattern that signals a potential trend change from bullish to bearish. It consists of three peaks:

Left Shoulder: A rise followed by a temporary pullback.

Head: The highest peak in the pattern, showing strong buying pressure before reversal.

Right Shoulder: A smaller rise compared to the head, indicating weakening bullish momentum.

B. Neckline (Support Level) and Breakdown Confirmation

The neckline (horizontal support level) is drawn across the lowest points between the shoulders.

A break below the neckline confirms the reversal, triggering a bearish move.

The chart suggests price is at the neckline zone, preparing for a breakdown.

2️⃣ Trendline and Support/Resistance Analysis

A. Uptrend Trendline Break

The price was following a strong ascending trendline (dotted black line).

A trendline breakout has occurred, indicating potential trend reversal.

This supports the bearish bias further.

B. Resistance and Support Levels

Resistance Level: Marked at the top of the Head region, which aligns with previous price rejection zones.

Support Levels:

First support (TP1 - 3,053.269): This is the first potential take profit level.

Second support (TP2 - 3,030.556): The next target if price continues downward.

3️⃣ Trade Setup & Risk Management

A. Entry Point (Short Position)

Sell (Short) after the neckline breakout, ensuring bearish momentum is confirmed.

B. Take Profit (TP) Targets

TP1: 3,053.269 (Initial support target).

TP2: 3,030.556 (Stronger support zone, deeper profit target).

C. Stop Loss Placement

Stop Loss: 3,150.726 (Above the resistance zone).

This is a logical stop-loss placement, allowing price fluctuations without prematurely stopping the trade.

4️⃣ Overall Market Sentiment & Trade Bias

Bearish Bias: Due to the formation of the Head and Shoulders pattern, trendline breakout, and weakening bullish momentum.

Confirmation Needed: A strong bearish close below the neckline increases probability of downward continuation.

5️⃣ Final Thought – A High-Probability Trade Setup

If neckline breaks, the trade is valid with potential for a 3%+ downside move.

If price holds above the neckline, the pattern may fail, leading to reconsidering trade execution.

This structured risk-managed approach ensures a strategic entry, controlled risk, and maximized profit potential. 📉🔥 Let me know if you need further refinements! 🚀

Gold (XAU/USD) Bullish Breakout: Next Target $3,181?"Key Observations:

Current Price: Gold is trading at $3,127.450 at the time of the chart.

Trend: The chart exhibits a strong uptrend, with higher highs and higher lows.

Support Levels: Several support levels are marked in the $3,010 - $2,999 range, extending down to around $2,906.

Resistance and Target:

The immediate price range is highlighted, suggesting possible consolidation.

A breakout above this range could lead to a target around $3,181.

Chart Annotations:

A retracement (red structure) indicates a short-term correction before continuation.

A breakout structure (black lines) suggests a previous significant upward movement.

The range and possible continuation are marked, indicating that the price may consolidate before attempting to reach the target.

Trading Perspective:

If price holds above the range, we may see bullish continuation towards $3,181.

A break below support levels could signal a deeper pullback towards $3,010 or lower.

This chart suggests a bullish outlook, with potential for more upside if momentum continues. Traders might look for confirmations before entering long positions.

Trend Changing Pattern (TCP) ExplainedIntroduction

One of the most important skills in forex trading is learning how to read price action and understand what the market is telling you. Price is not just numbers — it’s the collective perception of traders, making it the most reliable leading indicator available.

Today, I want to explain a powerful concept known as the Trend Changing Pattern (TCP) — a crucial tool for identifying potential market reversals and shifts in trend direction.

📈 What Is a Trend Changing Pattern?

In any trending market, whether it's an uptrend or downtrend, the trend won’t change easily. The strength of the trend and the timeframe you're trading on will determine how long it takes for a true reversal to occur.

One key signal of a trend change is a shift in momentum:

In an uptrend, when a momentum low forms during a pullback, it can be a sign that the trend is beginning to reverse.

In a downtrend, a momentum high during a pullback can signal a potential bullish reversal.

These are what we refer to as Trend Changing Patterns (TCPs) — moments where the structure of the market starts to shift.

⚠️ Watch for Manipulation After the TCP

After a TCP appears, it's common to see price manipulation before the new trend fully takes hold:

In an uptrend, price may return to manipulate the previous high before continuing down.

In a downtrend, price often dips to manipulate the previous low before reversing higher.

Being aware of this common liquidity grab helps traders avoid being trapped and instead position themselves in alignment with the new trend.

🧠 Final Thoughts

Understanding how to spot and interpret a Trend Changing Pattern gives you a major edge in forex trading. It helps you stay ahead of the market and make informed decisions based on price action, not emotion.

🎥 In the video, I go into more detail about momentum highs and lows, and how to recognize these key patterns in real time. Be sure to check it out if you want to sharpen your trend reversal strategy.

Wishing you success on your trading journey! 🚀

JPMorgan at a Crossroads Bullish Surge or Bearish Retreat ? Hello, fellow traders!

Today, I’m diving into a detailed technical analysis of JPMorgan Chase & Co. (JPM) on the 2-hour chart, as shown in the screenshot. My goal is to break down the key elements of this chart in a professional yet accessible way, so whether you’re a seasoned trader or just starting out, you can follow along and understand the potential opportunities and risks in this setup. Let’s get started!

Price Action Overview

At the time of this analysis, JPM is trading at 243.62, down -1.64 (-0.67%) on the 2-hour timeframe. The chart spans from late March to early May, giving us a good look at the recent price behavior. The price has been in a strong uptrend, as evidenced by the higher highs and higher lows, but we’re now seeing signs of a potential pullback or consolidation.

The chart shows a breakout above a key resistance zone around the 234.50 level (highlighted in red on the Volume Profile), followed by a retest of this level as support. This is a classic bullish pattern: a breakout, a retest, and then a continuation higher. However, the recent price action suggests some hesitation, with a small bearish candle forming at the current price of 243.62. Let’s dig deeper into the tools and indicators to understand what’s happening.

Volume Profile Analysis

The Volume Profile on the right side of the chart is a powerful tool for identifying key price levels where significant trading activity has occurred. Here’s what it’s telling us:

Value Area High (VAH): 266.25

Point of Control (POC): 243.01

Value Area Low (VAL): 236.57

Profile Low: 224.25

The Point of Control (POC) at 243.01 is the price level with the highest traded volume in this range, acting as a magnet for price. Since the current price (243.62) is just above the POC, this level is likely providing some support. However, the fact that we’re so close to the POC suggests that the market is at a decision point—either we’ll see a bounce from this high-volume node, or a break below could lead to a deeper pullback toward the Value Area Low (VAL) at 236.57.

The Total Volume in VP Range is 62.798M shares, with an Average Volume per Bar of 174.44K. This indicates decent liquidity, but the Volume MA (21) at 165.709K is slightly below the average, suggesting that the recent price action hasn’t been accompanied by a significant spike in volume. This could mean that the current move lacks strong conviction, and we might see a consolidation phase before the next big move.

Trendlines and Key Levels

I’ve drawn two trendlines on the chart to highlight the structure of the price action:

Ascending Triangle Pattern: The chart shows an ascending triangle formation, with a flat resistance line around the 234.50 level (which was later broken) and an upward-sloping support trendline connecting the higher lows. Ascending triangles are typically bullish patterns, and the breakout above 234.50 confirmed this bias. After the breakout, the price retested the 234.50 level as support and continued higher, reaching a high of around 248.02.

Current Support Trendline: The upward-sloping trendline (drawn in white) is still intact, with the most recent low around 241.50 finding support on this line. This trendline is critical—if the price breaks below it, we could see a deeper correction toward the VAL at 236.57 or even the 234.50 support zone.

Key Price Levels to Watch

Based on the Volume Profile and price action, here are the key levels I’m watching:

Immediate Support: 243.01 (POC) and 241.50 (recent low on the trendline). A break below 241.50 could signal a short-term bearish move.

Next Support: 236.57 (VAL) and 234.50 (previous resistance turned support).

Resistance: 248.02 (recent high). A break above this level could target the Value Area High at 266.25, though that’s a longer-term target.

Deeper Support: If the price breaks below 234.50, the next significant level is 224.25 (Profile Low), which would indicate a major trend reversal.

Market Context and Timeframe

The chart covers 360 bars of data, starting from late March. This gives us a good sample size to analyze the trend. The 2-hour timeframe is ideal for swing traders or those looking to capture moves over a few days to a week. The broader trend remains bullish, but the recent price action suggests we might be entering a consolidation or pullback phase before the next leg higher.

Trading Strategy and Scenarios

Based on this analysis, here are the potential scenarios and how I’d approach trading JPM:

Bullish Scenario: If the price holds above the POC at 243.01 and the trendline support at 241.50, I’d look for a bounce toward the recent high of 248.02. A break above 248.02 could signal a continuation toward 266.25 (VAH). Entry could be on a strong bullish candle closing above 243.62, with a stop-loss below 241.50 to manage risk.

Bearish Scenario: If the price breaks below 241.50 and the POC at 243.01, I’d expect a pullback toward the VAL at 236.57 or the 234.50 support zone. A short position could be considered on a confirmed break below 241.50, with a stop-loss above 243.62 and a target at 236.57.

Consolidation Scenario: Given the lack of strong volume and the proximity to the POC, we might see the price consolidate between 241.50 and 248.02 for a while. In this case, I’d wait for a breakout or breakdown with strong volume to confirm the next move.

Risk Management

As always, risk management is key. The 2-hour timeframe can be volatile, so I recommend using a risk-reward ratio of at least 1:2. For example, if you’re going long at 243.62 with a stop-loss at 241.50 (a risk of 2.12 points), your target should be at least 248.02 (a reward of 4.40 points), giving you a 1:2 risk-reward ratio. Adjust your position size to risk no more than 1-2% of your account on this trade.

Final Thoughts

JPMorgan Chase & Co. (JPM) is showing a strong bullish trend on the 2-hour chart, with a confirmed breakout above the 234.50 resistance and a retest of this level as support. However, the recent price action near the POC at 243.01 and the lack of strong volume suggest that we might see a pullback or consolidation before the next move higher. The key levels to watch are 241.50 (trendline support), 243.01 (POC), and 248.02 (recent high).

For now, I’m leaning slightly bullish as long as the price holds above 241.50, but I’ll be ready to adjust my bias if we see a break below this level. Stay disciplined, manage your risk, and let the market show its hand before taking a position.

What are your thoughts on this setup? Let me know in the comments below, and happy trading!

This analysis is for educational purposes only and not financial advice. Always do your own research before making any trading decisions.

Bitcoin Rejection from Resistance – Short Setup with Bullish PotBitcoin is currently testing a key resistance zone around $85,500, where previous price action showed strong selling pressure. A rejection from this level could lead to a short-term pullback towards $83,750 - $83,250 , aligning with a retest of the broken trendline before a potential bullish continuation.

🔹 Entry: $85,200 - $85,500

🔹 Stop-Loss (SL): $86,000

🔹 Take-Profit (TP): $83,750, with potential long re-entry from this zone targeting $86,000+

📊 Watch for price action confirmation within the resistance zone before entering. If BTC holds above $85,500, the bullish breakout could accelerate. 🚀

2025-04-01 - priceactiontds - daily update - nasdaq

Good Evening and I hope you are well.

comment: Bear trend line from 20536 broken again and market is probing higher to remain in a trading range at the lows. Bears need lower lows below 19300 tomorrow and bulls want to continue with the higher highs and higher lows. As long as the big bear trend line from 20452 holds, bears remain in control and see this as a more complex W2. To keep this possibility alive, the bounce has to stay below 20000.

current market cycle: strong bear trend but currently in W2

key levels: 19000 - 20600

bull case: Bull wedge, stairs pattern, doesn’t matter what you want to call this, it’s not strong buying. We have deep pullbacks that retrace more than 60% of the move and we are barely making higher highs. If bulls want to hit 20000, they need a stronger breakout above this wedge and for now I doubt it. Bulls did good in trapping late bears hoping for bigger selling already but as long as bears can scale in higher and make money because we stay low, bulls are not winning this. Their next target is the big bear trend line around 20000 which is also close enough to the daily 20ema.

Invalidation is below 18960.

bear case: Bears can argue this is a retest of the breakout but they need to print a strong down day again soon. Otherwise this could lead to more sideways to up movement and break the bear trend line. For now the pullback is still minor, compared to the move from 20500 to 19000 and bears remain in full control until the bear trend line is broken. Problem for the bears is the weekly tf. We are at prior bigger support since market has not closed below 19000 since 2024-04. Bears don’t want to repeat the pattern from last year, where we went straight down for 4 weeks, to then rally 25% form low to high.

short term: Slightly bearish around 19600 for trading back down to 19500 or maybe 400. Bull wedge is valid until clearly broken and as of now I think the odds for either side to break out are even. The closer we get to the big bear trend line, the better they become for the bears again.

medium-long term - Update from 2024-03-16: My most bearish target for 2025 was 17500ish, given in my year-end special. We don’t know if we have printed the W1 of the new bear trend or repeat the pattern from 2024, where we sold of very strong to reverse even more strongly and make new all time highs. Market needs a bounce and around 20000/20500 we will see the real battle for the next weeks.

trade of the day: Big down, big up, big confusion. Buy low, sell high and scalp. Market clearly is not in trending mode since the pull-backs are too deep and every decent follow-through buying & selling is followed by disappointment. Best trade was buying near 19300, since it was bigger support yesterday and just a breakout-retest from Monday.

GOLD(XAUUSD) -Weekly Forecast,Technical Analysis & Trading IdeasMidterm forecast:

2772.38 is a major support, while this level is not broken, the Midterm wave will be uptrend.

We will close our open trades, if the Midterm level 2772.38 is broken.

OANDA:XAUUSD TVC:GOLD

Technical analysis:

A trough is formed in daily chart at 2832.55 on 02/28/2025, so more gains to resistance(s) 3100.00, 3150.00, 3200.00 and more heights is expected.

Take Profits:

2833.00

2879.11

2955.00

3000.00

3057.40

3100.00

3150.00

3200.00

__________________________________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . . . . Hit the 'BOOST' button 👍

. . . . . . . . . . . Drop some feedback in the comments below! (e.g., What did you find most useful? How can we improve?)

🙏 Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

CHFJPY: Move Down Ahead! 🇨🇭🇯🇵

CHFJPY broke and closed below a key daily horizontal support.

We see a strong bearish reaction to that after its retest.

I think that the pair will drop and reach at least 168.75 support soon.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

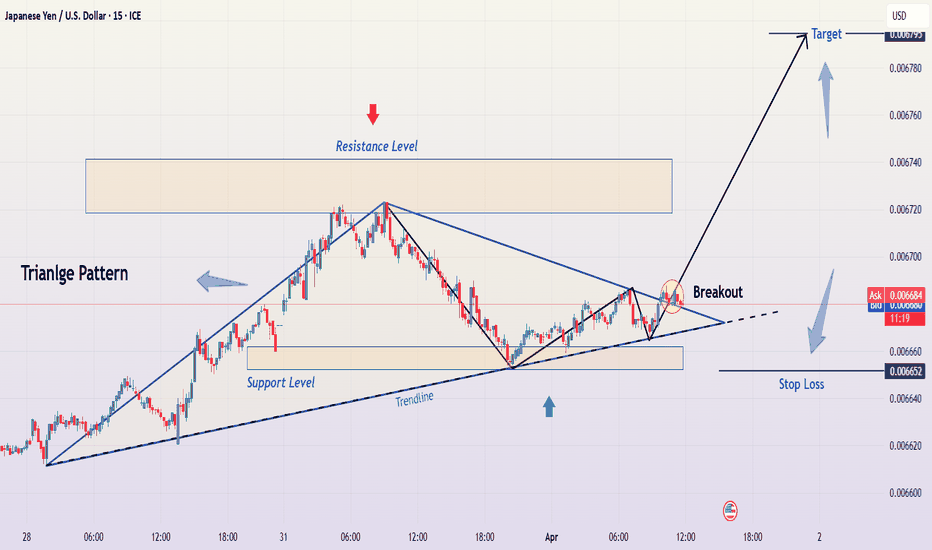

Triangle Breakout in JPY/USD – Bullish Move Ahead?This TradingView chart represents a detailed technical analysis setup for the Japanese Yen (JPY) against the U.S. Dollar (USD). The main focus of the chart is a symmetrical triangle pattern breakout, a common formation that signals potential price movement.

In this detailed breakdown, we will analyze the following aspects:

Technical Pattern: Symmetrical Triangle Formation

Support and Resistance Levels

Breakout Confirmation

Trading Setup Explanation

Risk Management Strategy

Market Expectations (Bullish & Bearish Scenarios)

Conclusion & Trading Plan

1. Technical Pattern: Symmetrical Triangle Formation

The chart showcases a symmetrical triangle, which is a continuation pattern that typically occurs in trending markets. It indicates a period of consolidation where buyers and sellers struggle for dominance, leading to an eventual breakout.

Characteristics of the Symmetrical Triangle in This Chart:

Converging Trendlines:

The upper trendline (resistance) is sloping downward, showing lower highs.

The lower trendline (support) is sloping upward, showing higher lows.

Apex Formation:

As the price moves closer to the triangle's apex, volatility decreases, creating a squeeze effect.

Breakout Possibility:

Once price reaches a critical point, a breakout is expected in either direction.

Why is This Pattern Important?

Symmetrical triangles suggest that the market is indecisive, but once a breakout occurs, it can trigger a strong price movement.

Traders wait for the breakout direction to confirm the trade before entering a position.

2. Key Support and Resistance Levels

Support and resistance levels are crucial for identifying potential entry, stop-loss, and target areas.

Resistance Level:

A horizontal resistance zone (highlighted in beige) is drawn at the top.

This zone represents historical price rejection levels, where sellers have previously stepped in.

A confirmed breakout above this level would indicate strong bullish momentum.

Support Level:

The lower support zone (marked in blue) acts as a buying interest area.

Price has bounced off this zone multiple times, confirming it as a strong support level.

A break below this zone would signal a bearish reversal.

Trendline Support:

The lower boundary of the symmetrical triangle also acts as dynamic support.

If price respects this trendline, it suggests bullish strength leading to a breakout.

3. Breakout Confirmation & Market Reaction

The most important part of the setup is the breakout, which occurs when the price successfully moves beyond the triangle's trendline resistance.

Key Observations from the Chart:

Breakout Zone:

The breakout occurs near the right edge of the triangle (circled in red).

The price breaks above the upper trendline, confirming a bullish breakout.

Confirmation Candle:

A bullish candle follows the breakout, confirming buying pressure.

Traders should wait for a retest of the trendline before entering.

Volume Consideration:

Strong breakout moves are typically accompanied by a rise in volume, increasing the likelihood of follow-through.

4. Trading Setup Explanation

This trade follows a trend-following breakout strategy, where traders capitalize on price momentum after confirmation.

Entry Point:

The ideal entry is just above the breakout candle.

Traders can also wait for a retest of the broken trendline before entering.

Stop Loss Placement:

The stop loss is placed slightly below the previous swing low at 0.006652.

This prevents excessive drawdowns in case of a false breakout.

Profit Target Calculation:

The profit target is set at 0.006795, which is calculated based on:

The height of the triangle formation projected from the breakout point.

The next major resistance level, aligning with historical price action.

5. Risk Management Strategy

Risk management is a critical component of any trading strategy. Here’s how it is applied in this setup:

Risk-to-Reward Ratio (RRR):

A good trade setup maintains an RRR of at least 2:1.

If the stop loss is 33 pips (0.000033) and the target is 112 pips (0.000112), the RRR is 3:1, making this a high-probability trade.

Position Sizing Consideration:

Risk per trade should be limited to 1-2% of the total account balance.

Leverage should be used cautiously, as breakouts can sometimes retest the breakout zone before continuing.

6. Market Expectations (Bullish & Bearish Scenarios)

Bullish Scenario (Successful Breakout):

✅ If price sustains above the breakout level, it will likely continue to rally toward the target at 0.006795.

✅ A strong bullish momentum candle would confirm further buying pressure.

✅ If volume supports the breakout, trend continuation is highly probable.

Bearish Scenario (False Breakout or Reversal):

❌ If price falls back inside the triangle, it indicates a false breakout.

❌ If price closes below 0.006652, bears take control, and price may drop further.

❌ A breakdown below the support level would shift the market sentiment bearish.

7. Conclusion & Trading Plan

This chart presents a classic symmetrical triangle breakout trade with a clear entry, stop-loss, and target strategy.

Summary of Trading Plan:

Component Details

Pattern Symmetrical Triangle

Breakout Direction Bullish

Entry Point Above the breakout confirmation candle

Stop Loss 0.006652 (below support)

Take Profit (Target) 0.006795

Risk-to-Reward Ratio Favorable (3:1)

Market Bias Bullish (if price sustains above breakout)

Final Considerations:

Always wait for confirmation before entering.

Monitor volume and price action for additional validation.

Stick to the risk management plan to minimize losses.

If executed correctly, this setup offers a high-probability trade with a strong risk-to-reward ratio, making it a profitable trading opportunity in the JPY/USD market.

Silver (XAG/USD) Rising Wedge Breakdown – Bearish SetupMarket Overview & Context

Silver (XAG/USD) has been in a strong uptrend, forming higher highs and higher lows over the past few weeks. However, recent price action suggests a potential shift in momentum as a bearish Rising Wedge pattern emerges. This technical pattern often signals a possible trend reversal or correction.

This analysis focuses on a 4-hour (H4) chart, which provides a medium-term perspective for traders. The market has recently encountered a strong resistance zone, and multiple price rejections indicate a potential downward move.

Chart Pattern: Rising Wedge Formation

The Rising Wedge is a bearish reversal pattern that occurs when the price moves higher within two converging trendlines. This structure suggests that while buyers are still in control, their momentum is weakening.

Key Characteristics of the Rising Wedge in This Chart:

Uptrend with Weakening Momentum:

The price has been rising, but the higher highs are becoming less aggressive.

The slope of the highs is flatter compared to the lows, which indicates declining bullish strength.

Converging Trendlines:

The price is getting squeezed between support and resistance.

This tightening range typically precedes a breakout, with a higher probability of a bearish breakdown.

Bearish Implications:

A breakdown below the wedge’s lower trendline confirms bearish sentiment.

The price could drop sharply toward the next major support level if sellers gain control.

Key Technical Levels & Trading Strategy

1️⃣ Resistance Zone (Supply Area) – $34.50 to $34.60

The price has repeatedly tested but failed to break above this zone.

This confirms that sellers are active in this area, leading to multiple rejections.

A strong supply zone, making it an ideal stop-loss placement for short trades.

2️⃣ Support Level (Demand Area) – $30.50 to $30.60

This level has acted as major support in previous price action.

If the breakdown occurs, this is the primary downside target for sellers.

3️⃣ Stop Loss – $34.61

Positioned just above resistance to minimize risk exposure.

Ensures that if price moves against the trade, losses are contained.

Trading Plan & Execution

📉 Short (Sell) Setup – Bearish Breakdown Expected

✅ Entry: A confirmed breakout below the rising wedge’s support trendline (~$33.50 - $33.80).

✅ Stop Loss: Placed slightly above $34.61, ensuring risk control.

✅ Target: $30.56, aligning with previous support zones and technical projections.

Risk-Reward Analysis

Entry at breakdown (~$33.50)

Stop loss (~$34.61) – Risk: ~1.1 points

Target (~$30.56) – Reward: ~2.9 points

Risk-to-Reward Ratio: ~1:3, making this a highly favorable short setup.

Confirmation Signals to Watch Before Entering a Trade

📉 Break and Retest of Support as Resistance

If price breaks below wedge support and retests it as new resistance, it strengthens the bearish case.

📉 Volume Spike on Breakdown

A sharp increase in volume when breaking support confirms strong selling pressure.

📉 RSI Divergence (Bearish Signal)

If the Relative Strength Index (RSI) shows lower highs while the price makes higher highs, it suggests momentum weakness and a pending breakdown.

Potential Trading Scenarios

📌 Bearish Scenario (High Probability) – Breakdown Confirmation

If the price breaks below the wedge’s lower trendline and closes below $33.50, it will likely accelerate downward toward $30.56. Traders should enter short positions and hold for the target while managing risk with stop-loss levels.

📌 Bullish Scenario (Low Probability) – Invalidating the Pattern

If the price breaks above $34.60 and holds, the rising wedge pattern is invalidated. This would signal continued bullish strength, and traders should avoid short positions.

Conclusion & Final Thoughts

✅ The Rising Wedge Pattern suggests a potential bearish reversal in Silver (XAG/USD).

✅ If the price breaks the lower trendline, a drop toward $30.56 is highly probable.

✅ Traders should wait for confirmation signals before entering a trade.

✅ Risk management is crucial, with a stop-loss above $34.61 to minimize exposure.

🔹 This setup presents a strong risk-to-reward opportunity, making it ideal for traders seeking short positions in Silver.

XAUUSD Bearish Breakdown: Riding the Rising Wedge to Profit1. Chart Pattern: Rising Wedge (Bearish Reversal)

The Rising Wedge is a technical pattern that occurs when price makes higher highs and higher lows within converging trendlines. This pattern is considered bearish, as it usually precedes a breakdown when price fails to sustain the higher levels.

The pattern is clearly visible as price moves within two upward-sloping black trendlines.

The narrowing range suggests that buying pressure is weakening, and sellers are gaining control.

A confirmed breakdown occurs when price breaks below the lower trendline, indicating potential further downside.

2. Key Technical Levels

Resistance Level (Highlighted in Beige, Top Box)

This area represents a strong supply zone where price has struggled to move higher.

Each time the price reaches this level, selling pressure increases, pushing the price lower.

The chart labels this as the Resistance Level, suggesting a potential reversal zone.

Support Level (Highlighted in Beige, Lower Box)

This is the previous demand zone, where price has rebounded multiple times.

Once price reaches this level, buyers may attempt to push it higher.

However, if this level fails to hold after the breakdown, further downside is expected.

Stop Loss Level (~3,150)

The stop loss is placed just above the recent highs.

If price moves beyond this level, it would invalidate the bearish setup.

Traders use stop losses to limit risk in case the market moves against the position.

Target Level (~3,080)

This is the projected downside target based on the height of the wedge.

A measured move (calculated from the highest to the lowest point of the wedge) aligns with this target.

It represents a potential 1.78% decline from the breakdown level.

3. Price Action & Trade Setup

Breakout Confirmation:

The price broke below the lower trendline, confirming a wedge breakdown.

The bearish momentum suggests sellers are in control.

Entry Zone:

A good short-selling opportunity is identified after the breakdown and potential retest of the lower trendline.

Risk Management:

Stop loss at 3,150 (above resistance).

Profit target at 3,080 (expected support).

This gives a favorable risk-to-reward ratio.

4. Market Psychology Behind the Pattern

Rising Wedge Psychology:

The pattern forms as buyers push price higher, but each new high has weaker momentum.

Eventually, selling pressure outweighs buying interest, leading to a breakdown.

Resistance & Support Psychology:

The resistance area acts as a supply zone where big traders sell their positions.

The support zone may hold temporarily, but if it breaks, panic selling could accelerate the decline.

5. Possible Scenarios After the Breakdown

Bearish Case (Most Likely Outcome)

Price continues downward after breakdown.

It reaches the 3,080 target with increased selling momentum.

Confirmation of a bearish reversal pattern.

Bullish Case (Invalidation of Setup)

Price reclaims the wedge and moves back above resistance.

It invalidates the bearish breakdown, stopping out sellers.

A potential bullish continuation toward new highs.

Final Thoughts

This chart presents a high-probability short trade based on the Rising Wedge breakdown and resistance rejection. Traders can manage risk by setting a tight stop loss above resistance while aiming for a target at the next key support zone. The pattern suggests a bearish sentiment in the short term, favoring sell setups over buying opportunities.

Would you like me to add further insights, such as Fibonacci levels or RSI analysis, to strengthen the trade idea? 🚀

2025-03-31 - priceactiontds - daily update - dax

Good Evening and I hope you are well.

comment: Not much to add on top of the tl;dr. Bear trend line is the do or die moment for bears tomorrow. Has to stay below 22600 or we go higher again. Very important day tomorrow, which will set the impulse for the next weeks. News could somewhat help the bears, since the global trade war is raging.

current market cycle: trading range

key levels: 22000 - 23700

bull case: Bulls want to break above the bear trend line around 22550. The reversal today was strong enough at prior support that this could get a second leg up, depending if we get a pull-back down and how deep it will be. Bulls are not favored at the bear trend line, so buying 22500 is bad for now.

Invalidation is below 22400.

bear case: Bears better hold that bear channel or we go to 23k again. The selling was amazing but then bears tried to stop the bulls but failed multiple times. Bulls just overwhelmed the bears and above 22400 they mostly gave up. Bears have hope now. We are still low enough that this buying can be seen as a retest of the breakout but for that market has to keep the bear gap up to 22700 open. Right at the bear trend line, bears are somewhat favored but since the channel up was so tight, most bears will wait for bigger confirmation which they might not get.

Invalidation is above 22700.

short term: Neutral. Bears need to sell near the bear trend line or we go higher again. I would want big confirmation before I join the bears again, since the buying today was so strong. Above 22600 bulls are favored for 22700 or higher. Below 22400 bears want to retest 22300 and the bull trend line (below is 22000 but I can’t see this going below that, at least for now).

medium-long term from 2024-03-16: Germany takes on huge amount of new debt. Dax is rallying hard and broke above multi-year bull trends. This buying is as real as it gets, as unlikely as it is. Market is as expensive as it was during the .com bubble but here we are and marking is pointing up. Clear bull channel and until it’s broken, I can not pound my chest and scream for lower prices. Price is truth. Is the selling around 23000 strong enough that we could form a top? Yes. We have wild 1000 point swings in both directions. Look at the weekly chart. Last time we had this volatility was 2024-07 and volume then was still much lower. We are seeing a shift from US equities to European ones and until market closes consecutive daily bars below 22000, we can’t expecting anything but sideways to up movement.

current swing trade: None

trade of the day: Selling the open was reasonable since market kept below the breakout 22600.

LEAP: GBPUSD Week 14 Swing Zone/LevelsWe'll stick with the same calculations as last week and before.

Price should follow the same logic as any mathematical principle—calculable, predictable, and consistent. The key variables are the broader market factors and the strength of the trend.

With that in mind, swing zones and levels are marked on the chart, and price will ultimately decide between option A or B.