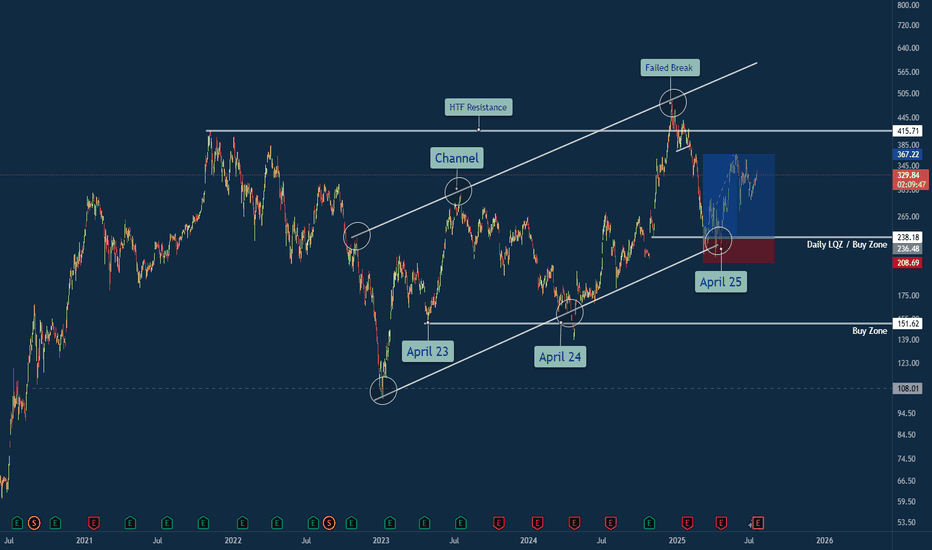

Tesla Trade Breakdown: The Power of Structure, Liquidity & ...🔍 Why This Trade Was Taken

🔹 Channel Structure + Liquidity Trap

Price rejected from a long-standing higher time frame resistance channel, making a false breakout above $500 — a classic sign of exhaustion. What followed was a sharp retracement into the lower bounds of the macro channel, aligning with my Daily LQZ (Liquidity Zone).

🔹 Buy Zone Confidence: April 25

I mapped the April 25th liquidity grab as a high-probability reversal date, especially with price landing in a confluence of:

Demand Zone

Trendline Support (from April 23 & April 24 anchor points)

Volume spike + reclaim of structure

🔹 Risk/Reward Favored Asymmetry

With a clear invalidation below $208 and targets at prior supply around $330+, the R:R on this trade was ideal (over 3:1 potential).

Lessons Reinforced

🎯 Structure Always Tells a Story: The macro channel held strong — even after a failed breakout attempt.

💧 Liquidity Zones Matter: Price gravitated toward where stops live — and then reversed sharply.

🧘♂️ Patience Beats Precision: The best trades don’t chase. They wait. This was one of them.

💬 Your Turn

How did you play TSLA this year? Were you watching the same channel? Drop your insights or charts below — let’s compare notes 👇

#TSLA #Tesla #SwingTrade #PriceAction #LiquidityZone #FailedBreakout #TechnicalAnalysis #TradingView #TradeRecap #ChannelSupport #SmartMoney

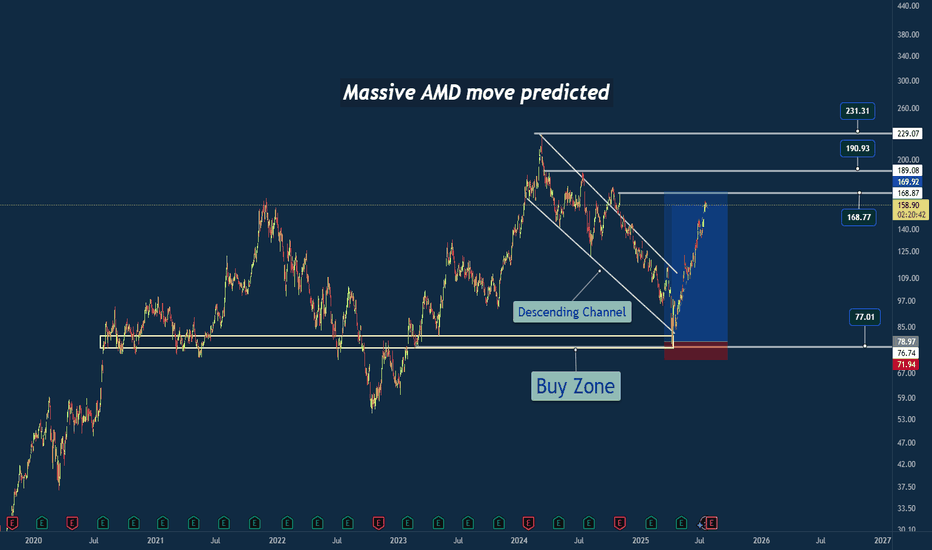

Priceaction

Why I Went Long on AMD Near the 2025 Lows🔍 Reason for the Trade

This wasn’t just a “buy the dip” setup — this was a calculated trade based on strong confluence:

✅ Multi-Year Demand Zone

Price returned to a massive support level that’s held since 2020. This zone had previously triggered multiple large bullish reversals.

✅ Falling Wedge Breakout

A textbook falling wedge pattern formed during the pullback. Once price broke out, the momentum confirmed a structural reversal.

✅ Risk/Reward Optimization

I positioned my stop just under key support, with targets set at prior structure highs. The setup offered a clean 2.5:1+ R/R ratio, perfect for swing conviction.

✅ Institutional Accumulation Area

The volume and wick rejections in this zone screamed smart money stepping in. It was a classic sign of fear-based selling into patient buyers.

🧠 Lessons Reinforced

- Wait for the Zone, Then Act: Patience paid off — the best trades come from the best levels.

- Structure Over Emotion: I trusted the technical, not the bearish headlines.

- R/R Always Wins: You don’t need to be right every time, but when you’re right — let it run.

#AMD #SwingTrade #TechnicalAnalysis #SupportAndResistance #WedgeBreakout #RiskReward #PriceAction #StockMarket #TradingView #TradeRecap

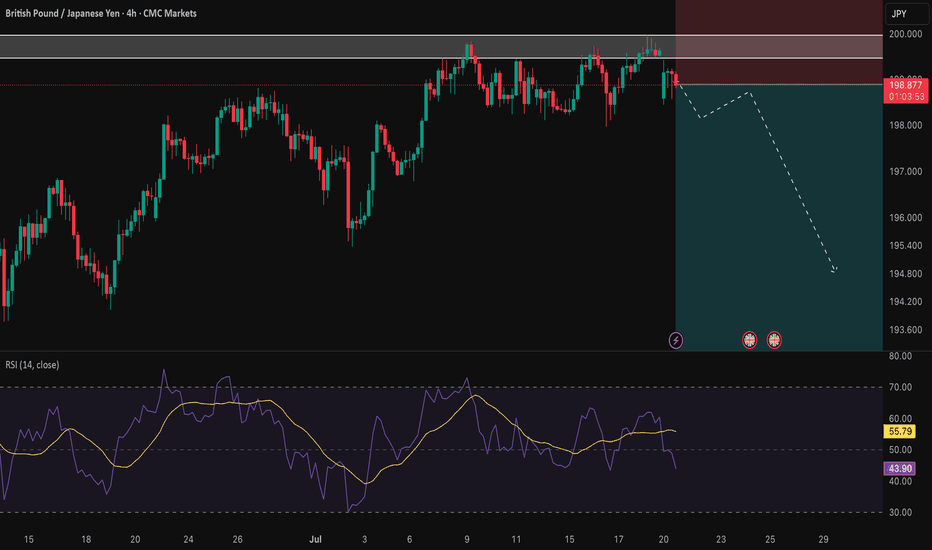

GBP/JPY: A Key Short Setup Forms as Momentum FadesHello traders,

Taking a look at GBP/JPY on the 4-hour timeframe. After a significant run, the price action has stalled, and we're seeing clear signs of fading momentum. This is creating a well-defined consolidation zone, which may present a key opportunity for a short position.

The Technical Picture 📊

1️⃣ Price Consolidation: GBP/JPY is currently trading sideways within a tight range, highlighted on the chart. This period of indecision and balance between buyers and sellers often precedes a significant directional move. The structure suggests a phase of distribution may be underway.

2️⃣ Fading Momentum: The Relative Strength Index (RSI) confirms this loss of momentum. A sustained reading below the 50 midline would signal that sellers are beginning to gain control and that the path of least resistance is shifting to the downside.

The Strategy 🧠

The core idea is to anticipate a bearish breakdown from the identified consolidation zone. A clean break and hold below this range would serve as confirmation that sellers have taken over, providing an opportunity to enter a short position targeting a continuation of the larger bearish move.

Trade Parameters 📉

👉 Entry: 198.895

⛔️ Stop Loss: 201.405

🎯 Take Profit: 192.872

Risk/Reward Ratio: approx. 2.4

This is my personal analysis and perspective, not financial advice. Always conduct your own research and manage your risk accordingly.

Good luck, and trade safe.

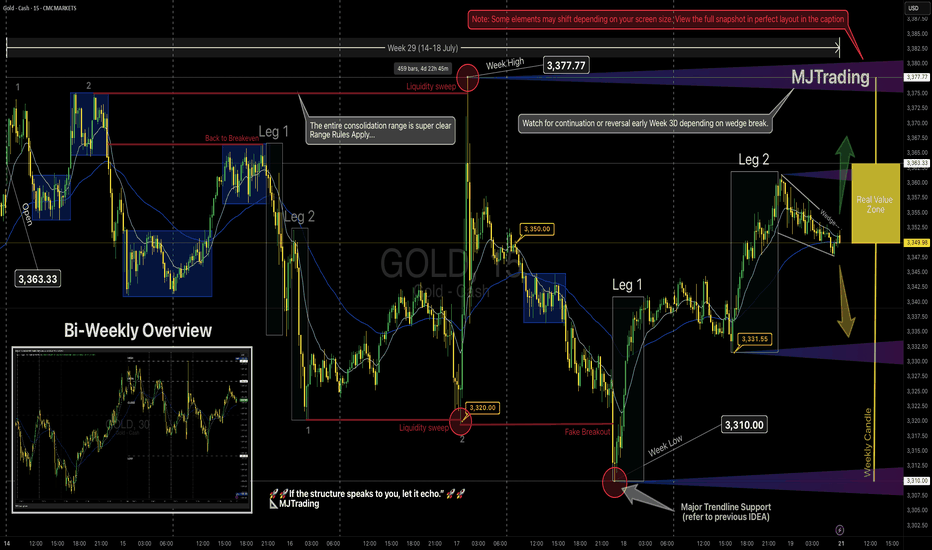

GOLD Weekly Recap (Week 29) – MJTrading View📸 Viewing Tip:

🛠️ Some layout elements may shift depending on your screen size.

🔗 View the fixed high-resolution chart here:

Now that you have got the perfect layout let's dive in...

📈 GOLD Weekly Recap (Week 29) – MJTrading View

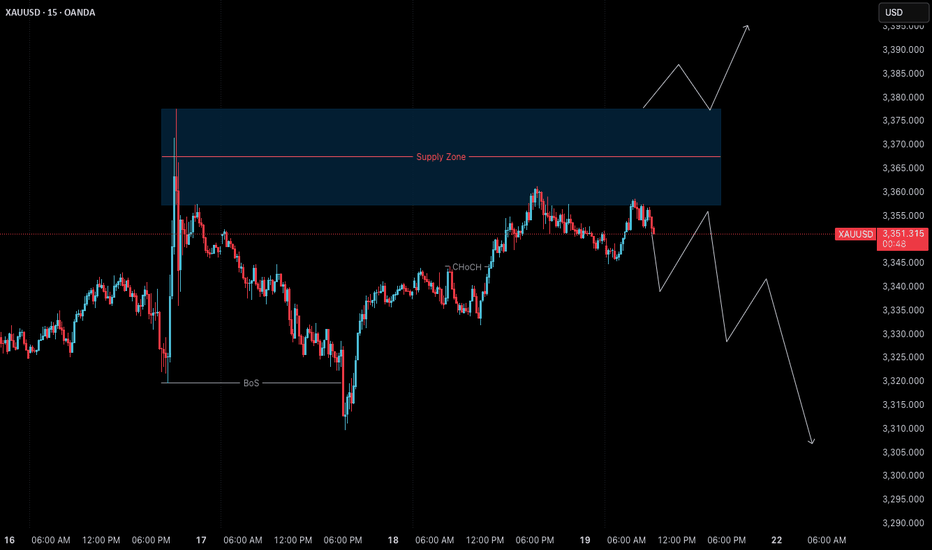

🕰 Timeframe: 15min chart with bi-weekly perspective

📅 Period Covered: July 14–18 (Week 29)

🎯 Visual Framework: Leg structure, range boundaries, liquidity sweeps, trendline holds, and Real Value Zone.

🔹 Weekly Summary

Open: 3,363.33

High: 3,377.77 (🔴 sweep: trapped buyers)

Low: 3,310.00 (🔴 sweep into key demand + touching the main ascending trendline )

Close: 3,349.98~3350 (lovely round level)

Structure: Entire week played inside a broad consolidation range, with sharp but failed breakouts on both extremes.

Range rules applied: traps, sweeps, compression — everything aligned for responsive trading.

📌 Key Observations

Early Week:

A double-top structure led to rejection from ~3,375 → slid into 3,350.

Price returned to breakeven but then flushed hard toward 3,320 via a clean 2-leg drop.

Midweek:

After forming a double bottom, price created a tiny liquidity sweep, then exploded to the weekly high.

The move above 3,377.77 was a textbook liquidity grab, immediately rejected.

This led to a slide toward the weekly low, tagging both the trendline and consolidation floor — forming a false breakout + reversal.

Late Week:

The low at 3,310 was swept cleanly (🔴), followed by a leg-based reversal:

Leg 1: Up to 3,331

Leg 2: Extended to ~3,360 before fading back inside the range.

Compression:

Price closed inside the Real Value Zone (weekly candle body) — just under the open, forming a tight wedge, hinting at breakout conditions for Week 30.

🟨 Weekly Candle Body

Open → Close of weekly candle reflects Real Value Zone .

Highs and lows were swept, but real commitment stayed within the body.

🧭 Key Levels to Watch – Week 30

Level Role

3,377.77 Weekly High / Liquidity Sweep (🔴 rejection)

3,363.33 Weekly Open (break & hold = bullish bias) / Previous Weekly High

3,350.00 Micro resistance / Mid-structure cap / Round Level

3,331-3 Leg 2 low & first reaction zone / Round Level

3,320.00 Breakdown support / Flush origin

3,310.00 Weekly Low / Major Demand (🔴 sweep)

3,400.00 Next possible main target

3,282.00 Previous Weekly Low

Dynamics: Both Uptrend and Downtrend Lines...

🧠 MJTrading Notes

Bias remains neutral inside the range.

A break & acceptance above 3,363 could trigger a re-test of the sweep zone (3,377+).

A breakdown below 3,331 puts 3,320 → 3,310 back on the map then 3,282.

Don’t force direction — let expansion confirm itself.

🧭 “If the structure speaks to you, let it echo.”

– MJTrading 🚀

#MJTrading #ChartDesigner #GOLD #LiquiditySweep #PriceAction #StructureTrading #Weekly #Chart #Consolidation #2legs

🧠 Psychology always matters:

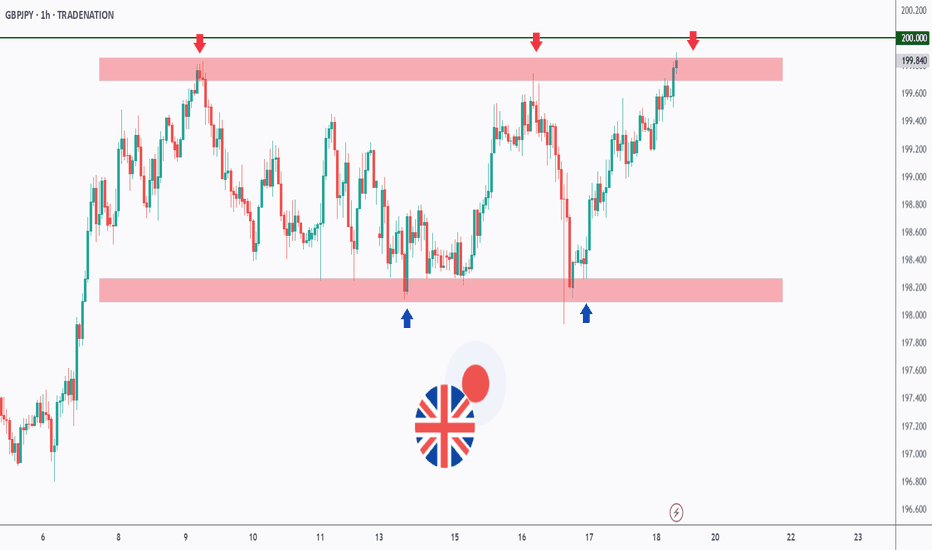

GBPJPY - Trading The Range!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈GBPJPY has been hovering within a big range.

This week, GBPJPY is retesting the upper bound of the range and $200 round number.

As long as the resistance holds, we will be looking for shorts on lower timeframes, targeting the lower bound of the range.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

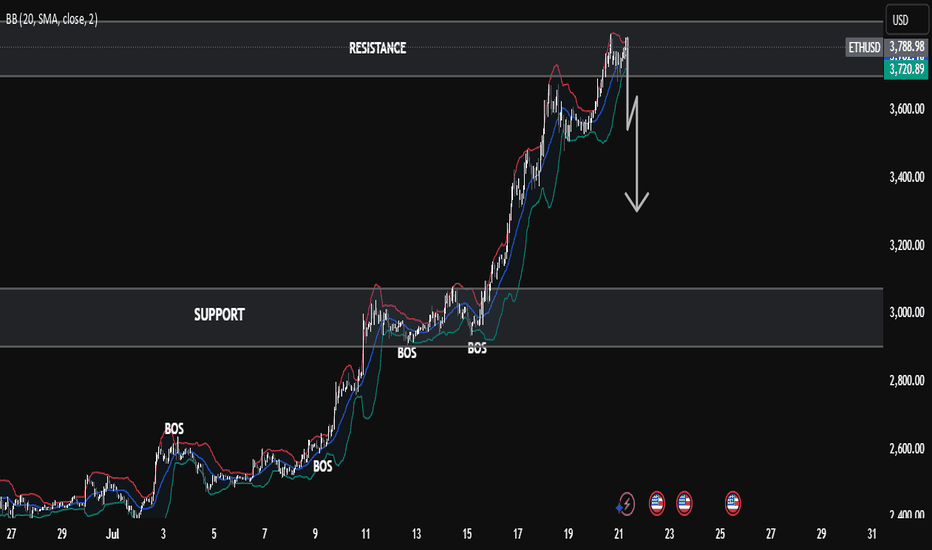

Ethereum at Crucial Resistance – Will the Bulls Hold or Fade?Ethereum at Crucial Resistance – Will the Bulls Hold or Fade?”

Ethereum is currently trading near a key resistance zone around $3,800, as marked on the chart. After a strong bullish rally with clear Break of Structures (BOS) along the way, ETH has now reached an extended point where price may face selling pressure.

The Bollinger Bands are stretched, showing overextension, and the marked arrow suggests a possible correction or pullback from this level. A retest of previous support zones (~$3,400–$3,200) could be expected if the resistance holds.

⸻

Key Levels:

• 🔼 Resistance: ~$3,800

• 🔽 Support: ~$3,400 / ~$3,000

• 🔄 Price Action: Watching for rejection or breakout confirmation

This is a textbook case of price approaching a strong resistance level after a bullish wave, where caution and confirmation are key for the next move.

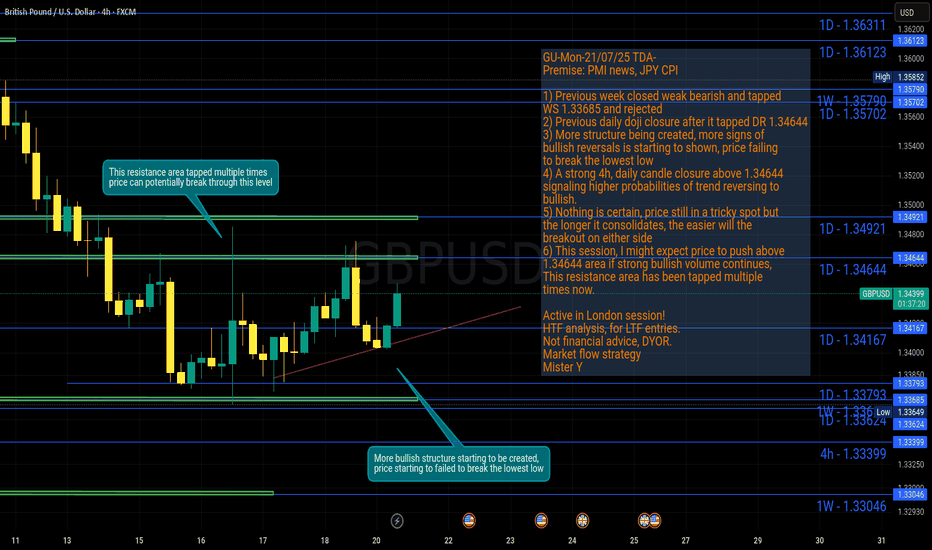

GU-Mon-21/07/25 TDA-More consolidation,are we about to breakout?Analysis done directly on the chart!

Nothing lasts forever, the longer it consolidates

the easier the breakout will be.

Premise:

A simple idea plan (like Tradingview public posts) won't describe everything.

No one can predict how market will move, it's always good to react to how it moves.

It gives an idea of how price might move, but no one come from FUTURE.

So I always encourage people to openly and actively discuss in real time.

I don't give signals blindly, people should learn

and understand the skill.

Following blindly signals you won't know how to

manage the trade, where precisely put sl and tp,

lot size and replicate the move over time.

That's why you need active real time discussions.

Trading is not get rich quick scheme!

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

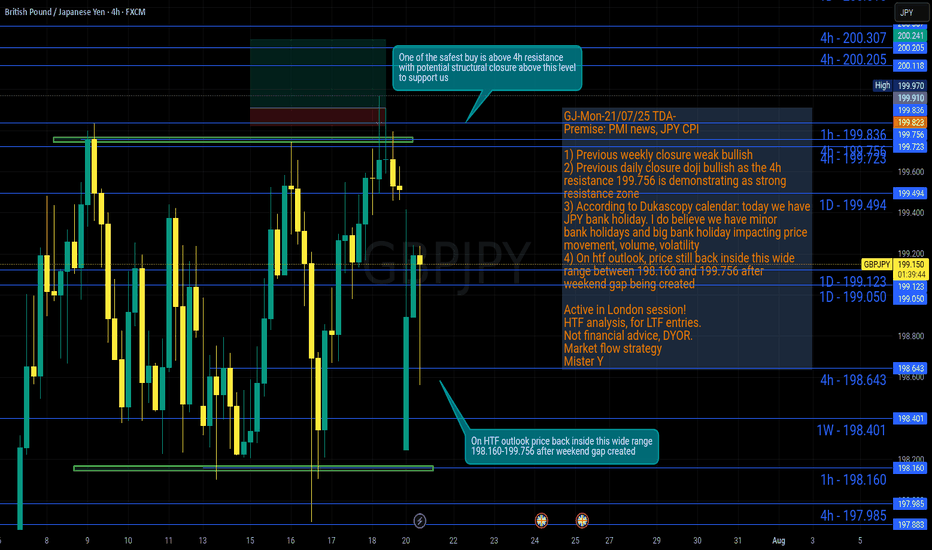

GJ-Mon-21/07/25 TDA-Wide range GJ, weekend gap at open!Analysis done directly on the chart!

We have big bank holidays and minor bank holidays.

Surely minor bank holidays impact less the price

Premise:

A simple idea plan (like Tradingview public posts) won't describe everything.

No one can predict how market will move, it's always good to react to how it moves.

It gives an idea of how price might move, but no one come from FUTURE.

So I always encourage people to openly and actively discuss in real time.

I don't give signals blindly, people should learn

and understand the skill.

Following blindly signals you won't know how to

manage the trade, where precisely put sl and tp,

lot size and replicate the move over time.

That's why you need active real time discussions.

Trading is not get rich quick scheme!

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

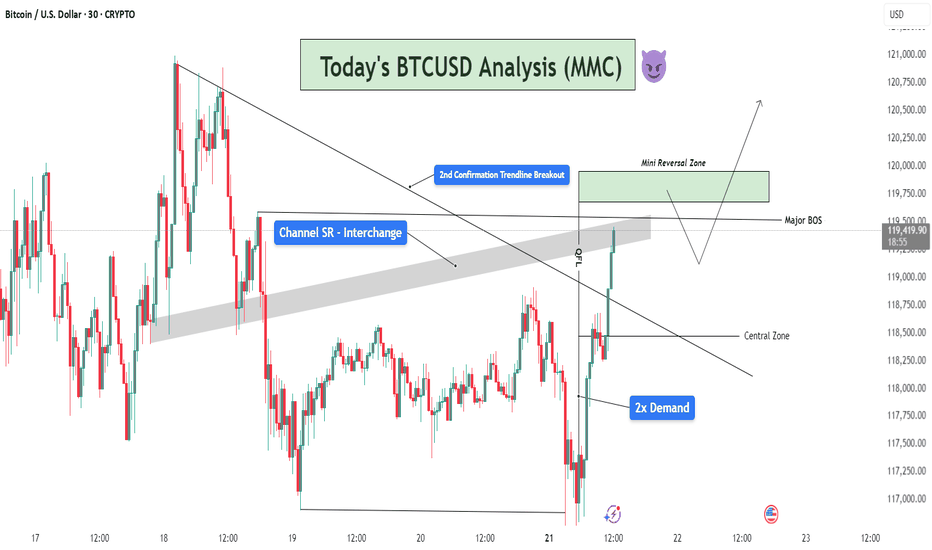

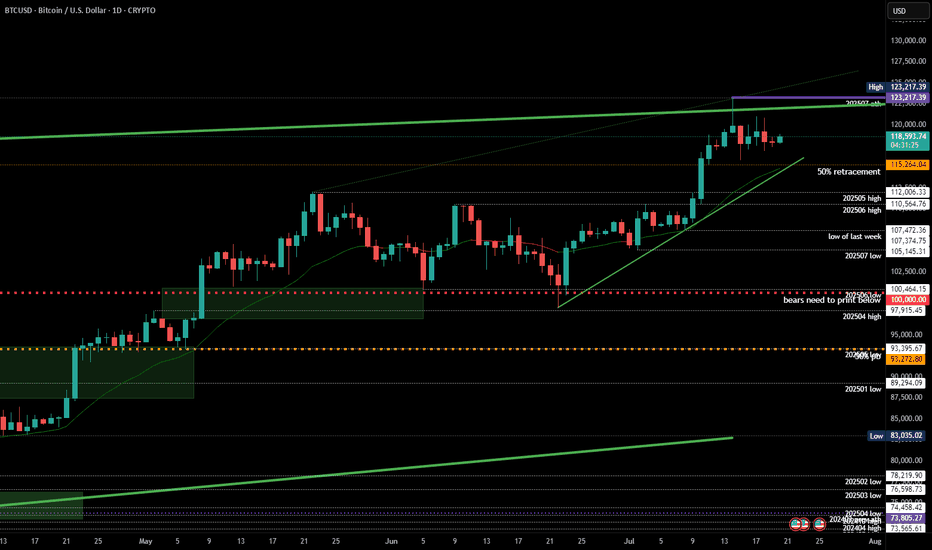

BTCUSD MMC Analysis - Breakout Confirmation + Reversal + TargetWelcome back to another deep-dive analysis powered by MMC (Mirror Market Concepts), where precision meets market psychology. In today’s BTCUSD setup, we’re observing a textbook confluence of structural breakouts, demand rejections, and liquidity zone engagements. Let’s break it down step by step.

📊 1. Market Context & Background

The market recently showed a prolonged bearish trendline structure, with lower highs compressing price into a wedge. The prior days have been consolidative, hinting at an accumulation phase. This forms the foundation for reversal setups we often identify in MMC-style analysis — where liquidity, not just structure, determines the next move.

🔍 2. Demand Zone Dominance – 2x Tap Confirmation

At the bottom of the chart, BTC created a strong 2x Demand Zone (117,250–118,000 area), a region where buyers aggressively stepped in. This zone had already been tested once, and the second tap confirmed demand strength — a key MMC signal.

This dual-tap created a spring effect, launching price upward and rejecting all downside liquidity grabs. It also showed clear absorption of sell-side volume.

📈 3. QFL Behavior + Break of Structure

We see a QFL (Quick Flip Liquidity) reaction just after price bounced from demand — this is a behavior unique to MMC models. Here, price flipped structure rapidly after breaking a local high near 118,500, suggesting aggressive buyer entry.

This QFL event served as the first warning for a major trend shift.

Right after that, we got a major BOS (Break of Structure) above 119,250, further confirming the bullish transition.

🪜 4. Trendline Breakout – Second Confirmation

The descending trendline — connecting several swing highs — was breached with strong bullish momentum. Importantly, this was the second confirmation breakout, not just a fakeout spike.

The breakout candle closed strongly above the trendline and above the SR channel zone (gray area), confirming trend reversal intent.

This aligns with MMC's multi-stage breakout logic, where price gives one trap, pulls back, and then breaks cleanly with intent.

🛡 5. Channel SR Interchange Zone (Support-Resistance Flip)

The gray horizontal SR Channel played a crucial role. Initially acting as resistance, it became support once the breakout was confirmed.

This interchange behavior — a principle where support turns into resistance or vice versa — is critical in MMC. Price flipping this zone and holding above is a strong continuation signal.

🧠 6. Targeting & Forward Outlook

Price is now approaching the Mini Reversal Zone (119,750–120,250). This is a low-timeframe liquidity zone where short-term traders may take profits or where institutional orders may reverse temporarily.

Here are two potential scenarios:

Bullish Continuation: If price pulls back slightly and holds the channel SR as support, we may see a continued leg upward, breaking above 120,250.

Temporary Rejection: A sharp reaction from the Mini Reversal Zone could lead to a retracement into the Central Zone (~118,800), where buyers might reload.

📌 Key MMC Takeaways:

✅ 2x Demand Zone reaction confirmed bullish interest.

✅ QFL + BOS + Trendline Break = High-conviction reversal signal.

✅ SR Flip adds MMC-style structural layering.

✅ Price is now navigating final supply zones before expansion.

👑 Join the Candle King Community

If you find value in these advanced MMC analyses, join the Candle King server — a professional community focused on refining trading journeys through advanced market theory like Mirror Market Concepts, QFL, and real-time price logic.

📢 We don’t just trade levels — we trade behavior.

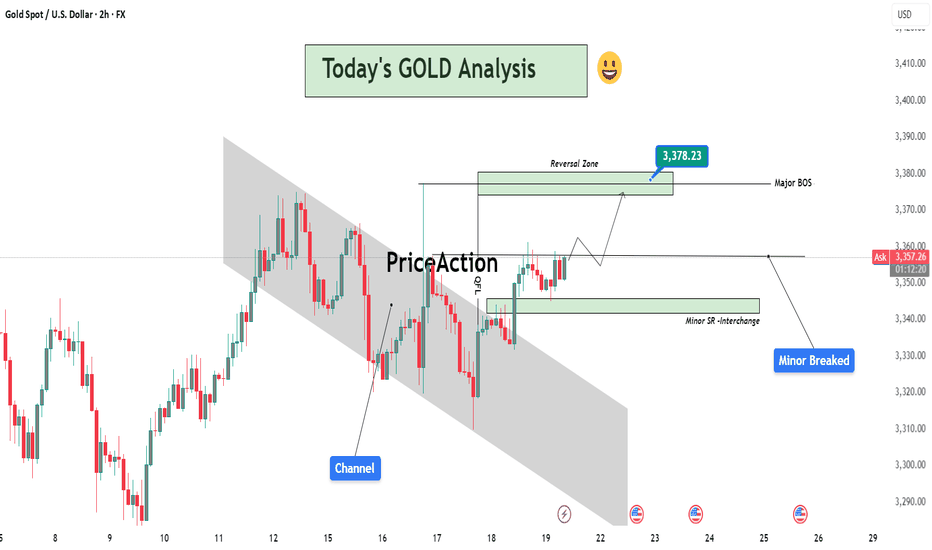

Today's GOLD Analysis – Structural Breakout and Bullish Setup🔷 1. Descending Channel – End of Bearish Phase

The chart initially shows Gold trading inside a well-defined descending channel, where price was consistently respecting both upper and lower trendlines. This movement reflected short-term bearish pressure, likely driven by fundamental uncertainty and lower time frame liquidity grabs.

However, the price broke above the channel with a strong bullish candle, which is a clear sign of momentum shift. Breakouts like these usually signify the end of a corrective phase and the beginning of a trend reversal or impulsive leg.

🔷 2. Minor Break of Structure (BOS) – First Confirmation

Following the channel breakout, price broke through a minor structure zone around 3,345–3,350, confirming a short-term change in market direction. This zone, previously acting as resistance, is now functioning as support (noted as “Minor SR - Interchange” on the chart).

This BOS is important because it represents the first break of a lower high in the previous downtrend, which is an early sign that buyers are stepping in with strength.

🔷 3. Retest and Clean Reaction – Support Validated

After breaking structure, the market retraced back into the broken zone, validating it as new support. This is a classic market behavior where price retests previous resistance to gather liquidity before moving higher — a key concept in Smart Money Concepts (SMC).

The bullish rejection from this zone further confirms the validity of the breakout and indicates that institutional buyers may be active in this region.

🔷 4. Current Price Action – Building Momentum

Price is now hovering near 3,355, building bullish structure with a series of higher highs and higher lows. This setup aligns with a continuation move toward the next liquidity target or resistance zone, which is:

✅ Reversal Zone: 3,375–3,380

This zone is marked as the next high-probability area where price might:

Face short-term resistance

Grab liquidity above previous highs

Possibly react with a pullback

The highlighted reversal zone (target: 3,378.23) is crucial because:

It aligns with previous supply

It could act as a decision point for larger time frame traders

It’s where a Major Break of Structure might occur if price breaks and holds above it

🔷 5. Projection & Scenario Planning

Here’s how the next move could play out:

Bullish Scenario: If price maintains support above the 3,350 zone, a rally toward 3,378 is expected. A strong close above this level would shift the larger structure bullish, confirming a major trend reversal.

Bearish Scenario (Short-Term): If price fails to break 3,378, we could see a pullback into the 3,345–3,350 area again. However, as long as this support holds, the bullish bias remains intact.

🔐 Key Technical Concepts Used:

Channel Breakout

Minor BOS & SR Flip

Liquidity Sweep

Reversal Zone (Supply Area)

Trend Structure Shift

📌 Conclusion:

Gold has broken out of its bearish channel and confirmed a short-term bullish structure. The recent breakout and retest give buyers a strong foundation to push toward the 3,378 zone. This is the key reversal area, and the reaction from here will define whether Gold continues to rally or faces a temporary pullback. For now, bulls are in control, and the market structure supports a continuation move.

Gold (XAUUSD) – 21 July | M15 Pullback Within Bearish Structure🟠 Gold (XAUUSD) – 21 July Analysis | M15 Pullback in Bearish Trend

Gold is currently in a pullback phase within a bearish M15 trend .

The market structure is defined between the M15 lower high at 3377.650 and the previous low at 3310 .

On Friday, price retested the M15 supply zone near the lower boundary, and again today, it has reacted from the same area. This repeated rejection suggests that sellers are still defending this level.

🔍 Trend Context:

– M15: Bearish (Lower High → Lower Low structure intact)

– H4: Currently in a pullback phase

Unless the price breaks above the key 3377.650 level, the bearish structure remains valid. As such, our directional bias continues to favour shorts.

🟥 Key Supply Zone: 3358–3377.650

– Recent rejections seen from this zone

– Acts as the active short-term supply zone

– Watching for internal M15 bearish shift for possible entry

Preferred Scenario:

As price has already retested the M15 supply zone, if we now see a downside shift in internal M15 structure (e.g., ChoCH + BoS), we will look for a potential short entry aligned with the dominant M15 trend .

No confirmation, no entry. Always follow structure.

Alternate Scenario:

If the market breaks above the 3377.650 lower high, it would signal a potential bullish structure shift . In that case, we will step back from the short bias and re-evaluate long opportunities accordingly.

📌 Trade Plan:

– Wait for M15 internal structure to shift (ChoCh) bearish, followed by a Break of Structure (BoS)

– On the retest, mark the Point of Interest (POI) for potential short setup

– Only act on confirmation (e.g., M1 ChoCH + BoS)

– SL: 40 pips | TP: 120 pips | Risk-Reward: Always 1:3

Summary:

– Gold is in a pullback phase within a bearish M15 trend

– Key levels to watch: 3377.650 (lower high) and 3310 (previous low)

– Bias remains bearish unless structure flips

– Watch for internal structure shift for short opportunity

– Stay patient and aligned with the dominant trend

📘 Shared by @ChartIsMirror

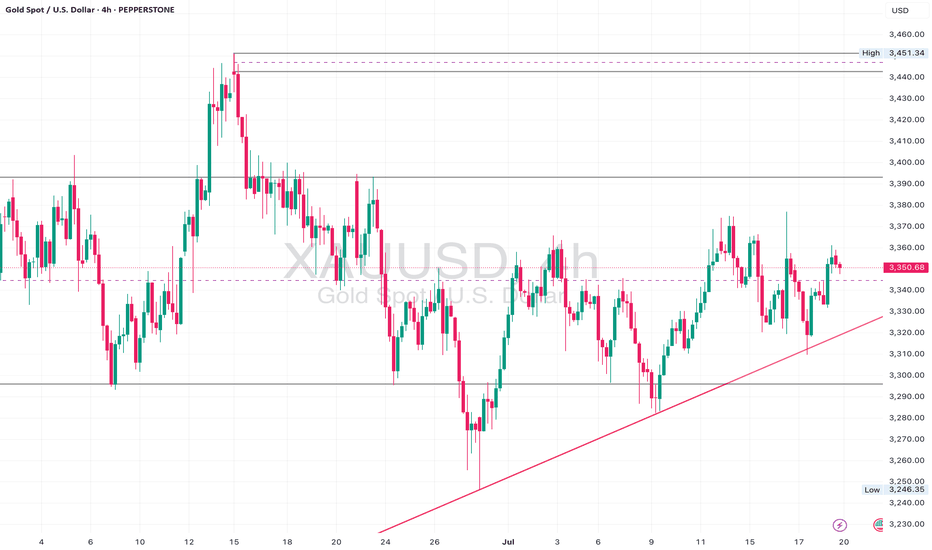

Gold. - Bullish (structure still valid) • Daily: Maintaining higher lows along the trendline. Strong support at 3,300.

• 4H: Still respecting the diagonal, and showing strength despite short-term pullbacks.

• 1H: Breakout from descending trendline and now retesting the breakout zone at 3,350.

⚠️ Watch For:

• Clean bullish break above 3,365 confirms new impulse wave toward 3,400+.

• Support at 3,335 must hold to avoid flipping neutral.

• Patience required if price consolidates between 3,340–3,360.

#202529 - priceactiontds - weekly update - daxGood Day and I hope you are well.

comment: Prior weeks close was 24332 and this was it was 24386. Bulls need to continue with higher lows and bears need to break below 24000 for lower prices. Not more magic to.

current market cycle: bull wedge

key levels for next week: 24000 - 25000

bull case: Bulls are still in control until we print lower lows again. We have 2 potential bull trend lines close to the daily ema and that’s around 24200 and will be my line in the sand for bulls next week. Below, chances of 24000 go up big time. If we stay above 24300, there is no reason we can not test back up to 24500 and above that we will likely try 24700+ again.

Invalidation is below 24000

bear case: Bears need a lower low below 24000. That’s really all there is to it. As of now the selling on Friday was decent but it’s not enough to expect follow-through selling. Below 24000 I think we can test the 50% retracement at 23900 but I’d be surprised if we go lower. Only an event could trigger that. Lower targets would be as marked on the chart.

Invalidation is above 24749

short term: Neutral. I want follow-through selling but will likely won’t get it. It’s still a bull wedge until we have a daily close below 24000.

medium-long term from 2025-06-29: Bull surprise last week but my targets for the second half of 2025 remain the same. I still expect at least 21000 to get hit again this year. As of now, bulls are favored until we drop below 23000.

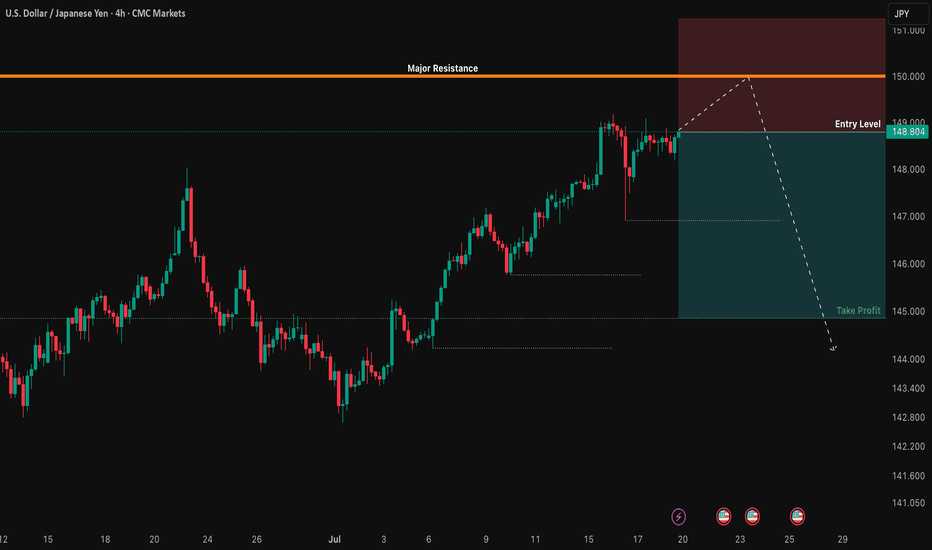

USD/JPY: The 150.00 Rejection SignalThe chart for USD/JPY looks like a simple one-way street going up. But underneath the surface, my quantitative models are in a state of conflict, and that's a high-clarity signal that something is about to change.

This isn't a signal to short right now. This is a signal to be patient and watch for a very specific setup that the "smart money" models are anticipating.

The Quant Conflict 🤖

My analysis involves several different mathematical models. Here's the situation:

One model, which is great at tracking trends, is still signaling BUY , following the obvious upward momentum.

However, two other, more complex models that analyze the relationships between economic data are now flashing a SELL signal. They are detecting underlying weakness that the price chart isn't showing yet.

When the simple trend model and the complex structural models disagree, it often means a major turning point is near. We are siding with the smarter models, but we need price action to confirm their warning.

The Game Plan 📊

We will use the 150.00 level as our "line in the sand." We are waiting for the market to fail at this level and then break down, which would confirm the bearish quant signal. This is our high-probability entry trigger.

Here is the exact setup we are waiting for:

📉 THE SETUP: A patient short position, waiting for confirmation of a breakdown.

👉 ENTRY: We enter only on a confirmed daily close below 148.00.

⛔️ STOP LOSS: Place the stop just above the psychological wall at 150.25.

🎯 TAKE PROFIT: Our primary target is the major support level at 145.00.

This is a setup where patience pays. We are letting the market do the hard work and show its hand before we commit. Let's watch this one closely.

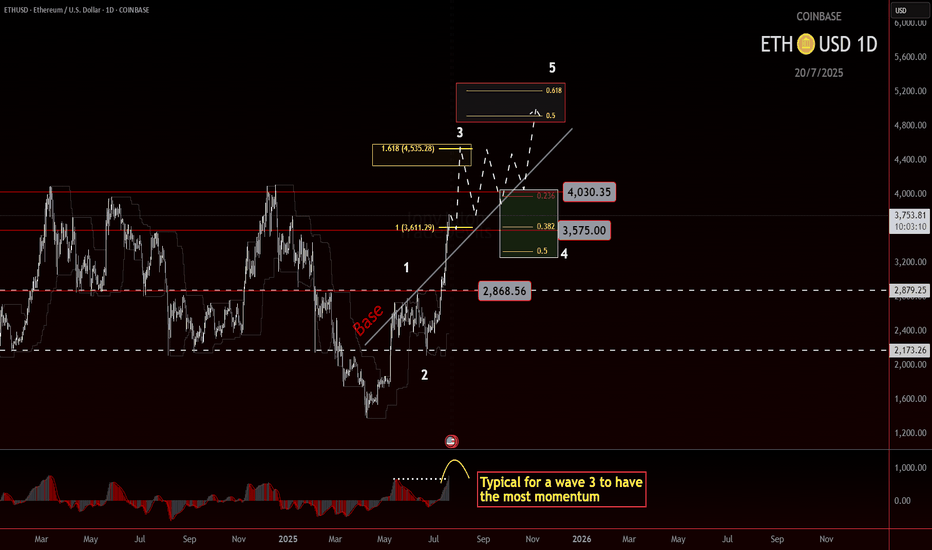

ETH roadmap to 5000!Ethereum Wave 3 in Play? Eyes on the $4500 Target

Ethereum may currently be progressing through a wave 3, which is often the strongest leg of an impulse. The structure so far supports that idea, and based on standard projections, the most likely target sits near $4500.

If price can break and hold above the 4k level, we could see a consolidation forming above the previous high. That would be a constructive sign and might set up the next leg higher.

But there’s still a chance ETH struggles to clear that level. If that happens, consolidation could form just underneath, which would still be acceptable within a wave 3 framework. What matters next is the shape and depth of the pullback.

Wave 4 will be the key. A shallow or sideways correction would keep bullish momentum intact. A deeper pullback doesn't ruin the structure, but it does mean we’ll need to watch support zones more closely.

If wave 4 behaves well and broader market conditions stay supportive, then a final wave 5 could bring ETH into the $5000 region. That’s the upper edge of this current roadmap, based on conservative assumptions.

Stay flexible. Let the structure guide the bias.

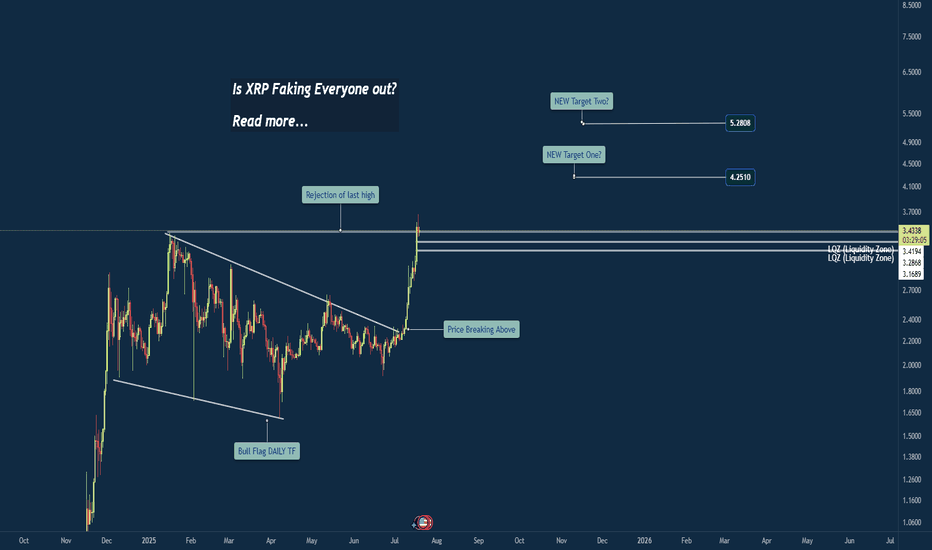

Breakout or Bull Trap? XRP at Critical Weekly LevelWeekly Chart Insight: XRP Closing Above Previous High

XRP has just closed above its previous weekly high—a significant development that could signal a shift in market sentiment. Historically, when price closes above such a critical level on the weekly timeframe, it often leads to continuation, unless a sharp rejection quickly follows.

At this stage, the focus shifts to the 4-hour timeframe for confirmation. An impulsive move above the current consolidation zone could indicate that this breakout is legitimate, potentially leading to another bullish weekly candle.

However, caution is warranted. If the next two daily candles close weakly or fail to maintain structure above the breakout level, it could hint at a fakeout or liquidity grab before a deeper correction.

My Current Bias:

I remain neutral-to-bullish, contingent on:

An impulsive continuation on the 4HR

Strong daily closes above the key range

Price not falling back and closing below the weekly breakout level

If price begins to consolidate and hold this level, that would reinforce the bullish case. But if we see immediate selling pressure and a re-entrance below the breakout, I’ll reconsider the bias based on developing structure.

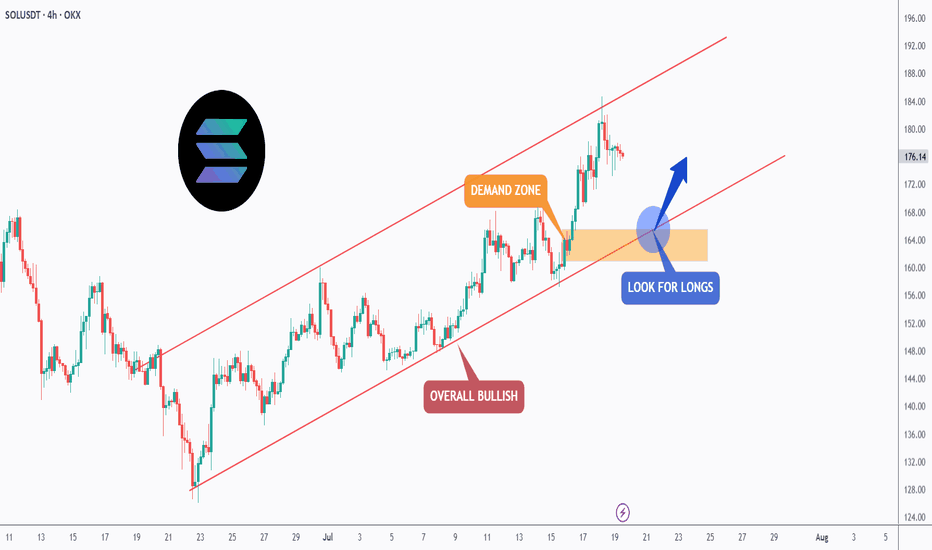

SOL - Trend-Following Longs in the making!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈SOL has been overall bullish trading within the rising channel in red.

Moreover, the orange zone is a strong demand.

🏹 The highlighted blue circle is a strong area to look for buy setups as it is the intersection of the orange demand zone and lower red trendline acting as a non-horizontal support.

📚 As per my trading style:

As #SOL retests the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

TRX Approaching Cup Breakout – Market Decision Imminent

TRX/USDT – Daily Chart Analysis

TRX is shaping a textbook Cup Pattern on the daily timeframe — a strong bullish continuation signal if confirmed. Price has gradually curved upward, and we are now testing the key resistance area at 0.29–0.30.

📌 Key Scenarios:

🔹 Bullish Breakout Scenario:

A confirmed breakout and daily close above 0.30 would validate the cup formation and set the stage for a rally toward the next target zones at 0.35 and 0.45 — measured based on the cup’s depth.

🔹 Bearish Rejection Scenario:

If the resistance holds, expect a pullback toward the midline (~0.24) for potential accumulation and base-building before the next move.

💡 Volume confirmation and breakout momentum are critical to watch here. The market is approaching a decision point.

🟢 Our directional bias remains bullish — we anticipate the breakout to occur, leading to an upward continuation. However, we’ll wait for confirmation of the breakout and completion of the pattern before entering a long position.

US30 Rejection at Channel Resistance US30 is showing a repeated pattern of rejection at the upper boundary of the descending channel. Price has now tapped this trendline for the fourth time, forming a consistent bearish structure.

Price rejected again at the top of the descending channel (marked by orange circles)

Clear sell setup with stop above the most recent swing high, targeting the lower channel boundary around 44,200, aligning with past demand.

Short below 44,685

Target: 44,200

Stop: Above recent highs near 44,913

Risk/Reward: Favourable if structure holds. If this pattern plays out as before, we can expect another push to the downside within the channel.

A break and retest of the midline could add extra confirmation.

#US30 #DowJones #PriceAction #SellSetup #BearishRejection #ChannelTrading #TechnicalAnalysis

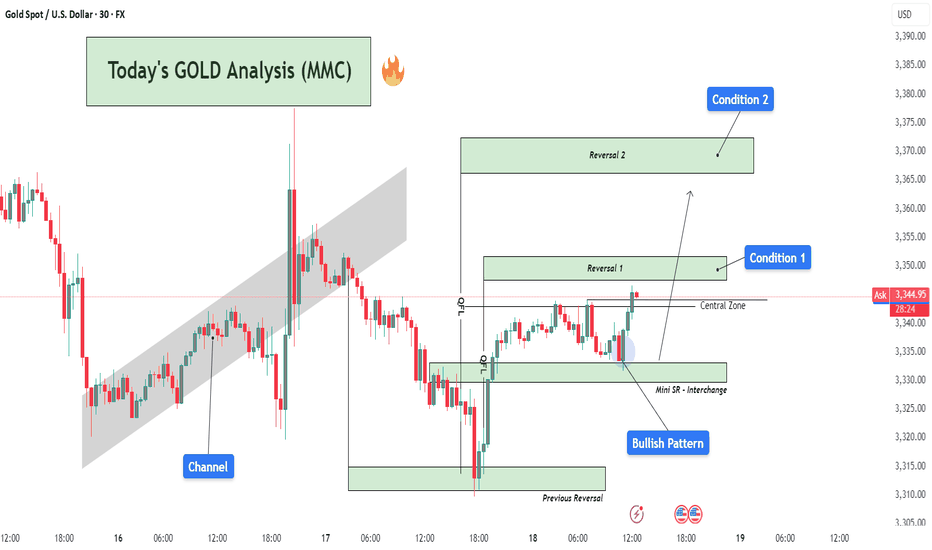

Today's GOLD Analysis (MMC) – Bullish Momentum Building Ahead🔍 Market Overview:

Gold is currently showing signs of a bullish reversal structure after experiencing a downward correction. Price action has reacted strongly from well-defined demand zones, suggesting institutional buying activity at key levels. The current setup highlights a clear accumulation phase transitioning into a potential markup phase, driven by buyers regaining control.

🧱 Chart Structure Breakdown:

1️⃣ Initial Channel Formation (Left Side of Chart)

After a major downtrend, price began consolidating within a rising channel, indicating a retracement or correction phase.

This ascending channel showed a short-term bullish effort, but eventually broke to the downside, resuming the dominant bearish flow temporarily.

2️⃣ Previous Reversal Zone ($3,312 – $3,322)

This is the origin of the recent bullish move, where price strongly reversed after heavy selling.

The reversal formed a long bullish wick and an engulfing candle—clear signs of buying absorption.

This level has historical confluence, acting as both support and prior demand.

3️⃣ Mini SR - Interchange Zone ($3,327 – $3,335)

This zone is a mini structure level where previous resistance has now become support (SR Flip).

The area acted as a platform for the recent bullish reaction.

This zone also aligns with the interchange of order blocks, adding more confluence to the bullish argument.

4️⃣ Bullish Pattern Formation

Price formed a micro double bottom/inverse head and shoulders structure just above the Mini SR.

The pattern suggests strong base-building and provides momentum for the current bullish move.

Confirmation came after the neckline breakout and retest within the Central Zone.

5️⃣ Central Zone ($3,340 – $3,345)

This is an intraday pivot area, acting as a decision-making zone between buyers and sellers.

Price is currently testing this zone with strong bullish candles.

A clean break above this level increases the probability of further upside.

6️⃣ Reversal Zone 1 ($3,345 – $3,353) – ✅ Condition 1

Price is now entering this zone, where previous price rejections occurred.

If buyers can maintain momentum and break above this zone on strong volume, it will validate the bullish continuation thesis.

This zone is also an ideal area to monitor for partial profit-taking or potential short-term rejection.

7️⃣ Reversal Zone 2 ($3,365 – $3,375) – ✅ Condition 2

This is the next significant resistance block.

If price reaches this level, it could face heavy resistance and profit-booking from swing traders.

However, a breakout above this zone could lead to a much larger bullish wave, targeting $3,390+.

🎯 Trade Setup Idea:

Long Bias: Above $3,335 with targets at $3,353 (TP1) and $3,370 (TP2)

Risk Invalidation: Break below Mini SR zone ($3,327) may invalidate bullish thesis

Aggressive Entry: At retest of Mini SR after pattern breakout

Conservative Entry: On breakout and close above Reversal Zone 1 with confirmation

🧠 Trader’s Mindset:

The market is showing a clear shift in momentum, but buyers must sustain control above key levels.

Stay patient at resistance zones; avoid chasing.

Watch for rejection wicks or bearish divergence near Reversal Zone 2 if you're looking for a counter-trade.

📌 Summary:

📈 Bias: Bullish (as long as $3,335 holds)

💡 Opportunity: Breakout from Mini SR with structure support

📉 Risk: Failure to hold central zone could trigger retest of lower support

🚀 Potential: If momentum continues, gold could revisit July highs near $3,390–$3,400