Priceactionanalysis

DOGE/USDT Technical Analysis – Breakout AnticipationDOGE/USDT Technical Analysis – Breakout Anticipation

As of the current market structure, DOGE/USDT is showing signs of a potential bullish reversal from the demand zone (support), aiming toward the projected target at 0.27253 USDT.

🔍 Chart Structure & Price Action

Support Zone (0.21873 – 0.22568): The price has previously respected this area, making it a strong demand zone where buyers stepped in.

Resistance Zone (0.27756 – 0.29000): A key supply zone where previous rallies halted. This is the ultimate test for bulls after the breakout.

Current Price (0.23743) is showing consolidation above the support, suggesting accumulation before a move.

🧠 Technical Indicators

Supertrend Indicator: Currently flipping to bullish (10,3 settings), indicating potential upside continuation.

Volume Profile (VRVP): Shows high volume nodes around the support level, confirming strong interest from institutional players or large orders.

Market Structure: A higher-low is forming, indicating early signs of a bullish market shift.

🎯 Target

The projected move towards 0.27253 USDT aligns with previous price action and supply zone interaction. A clean breakout from the current consolidation could fuel momentum toward this level.

🎓 Educational Insight

This setup reflects the principles of Smart Money Concepts (SMC):

Price tapping into demand before impulse moves.

Liquidity grab at lows.

Break of structure (BOS) to the upside could trigger continuation.

Traders can learn the value of combining structure-based trading with volume analysis to improve entry precision and confidence.

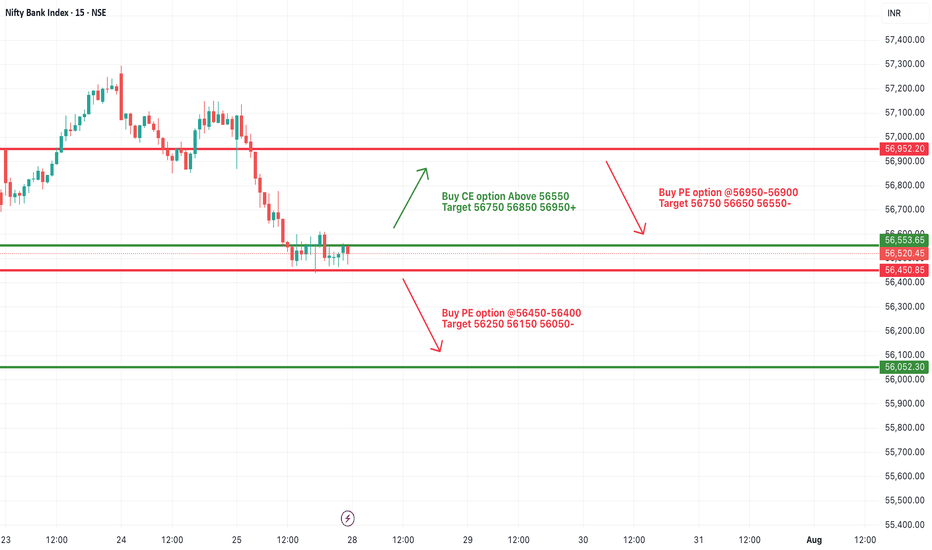

[INTRADAY] #BANKNIFTY PE & CE Levels(28/07/2025)Bank Nifty is expected to open slightly lower and is currently trading near a critical zone of 56,450–56,550, which may act as a key pivot for today's session. This narrow band will decide the next directional move.

If Bank Nifty sustains above 56,550, we can expect an upward move toward 56,750, 56,850, and 56,950+ levels. This zone could act as a breakout trigger for intraday momentum on the upside.

On the downside, if the index slips and trades below 56,450–56,400, it may indicate bearish pressure, with possible downside targets at 56,250, 56,150, and 56,050-.

Alternatively, a rejection near the 56,900–56,950 zone could also act as a reversal point and push the index back down.

For now, wait for a clear breakout or breakdown from the 56,450–56,550 range before taking directional trades.

#NIFTY Intraday Support and Resistance Levels - 28/07/2025Nifty is expected to open slightly lower and remains under selling pressure from higher levels. The key intraday zone to watch is 24,750–24,900, which may act as a trigger range for today's direction.

If Nifty sustains above the 24,750–24,800 zone, a short-covering rally may push the index toward 24,850, 24,900, and 24,950+. This zone may offer a reversal opportunity if supported by strong price action.

On the downside, if the index fails to hold above 24,900–24,950, further weakness may be seen below 24,700, opening downside targets at 24,600, 24,550, and 24,500-.

The broader price action suggests a narrow consolidation between 24,700–24,900, with either side breakout likely to lead to intraday momentum. Maintain strict risk management and avoid aggressive trades within this zone.

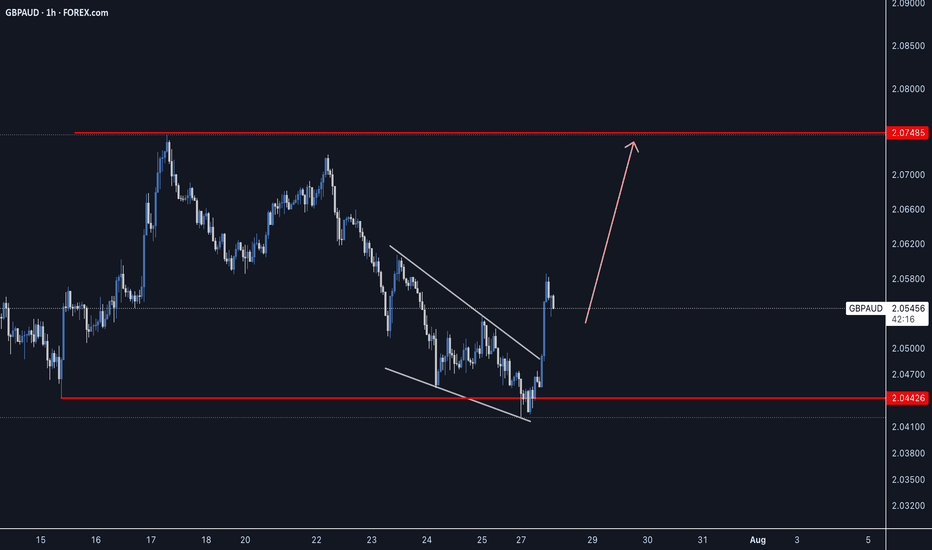

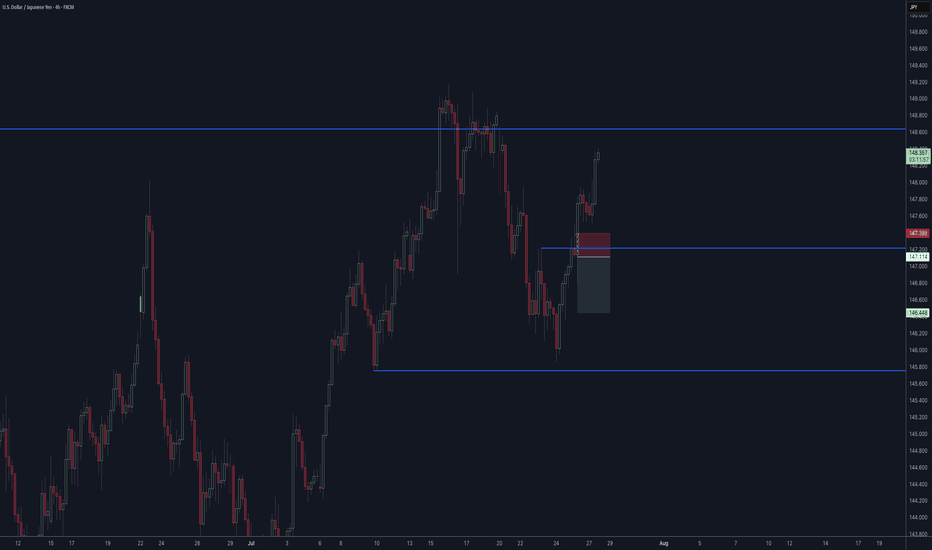

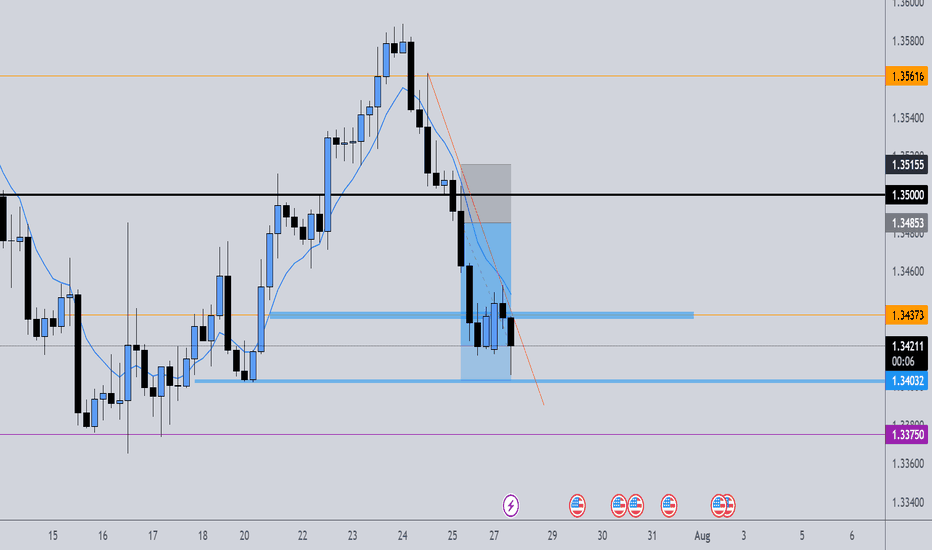

GBPUSD - GBPJPY - USDJPY Trade Recaps 28.07.25Three positions taken last week. Some vital findings within my self-review process which showed a stop loss error with GBJPY causing me to miss a solid 4% trade, and a manual close on GBPUSD to bank a little extra profit.

Full explanation as to why I executed on these positions and the management plan with both.

Any questions you have just drop them below 👇

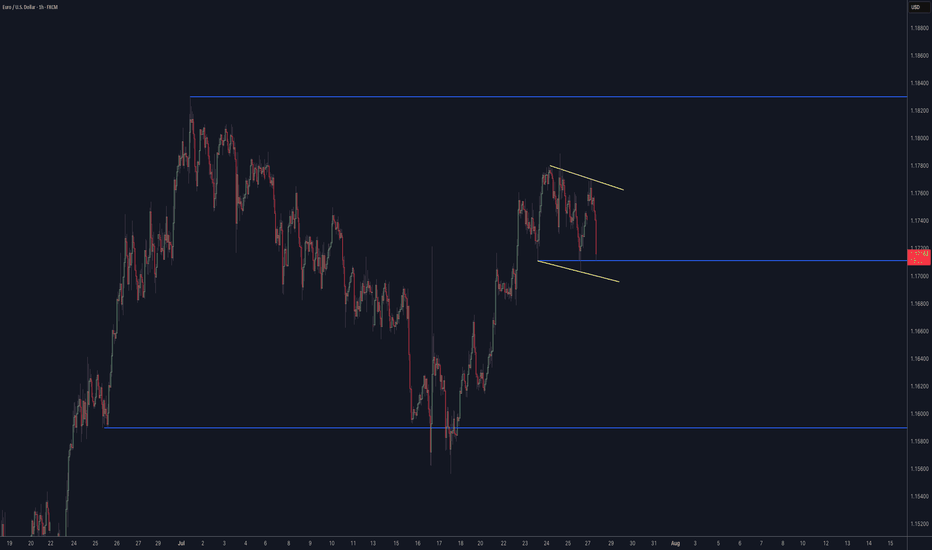

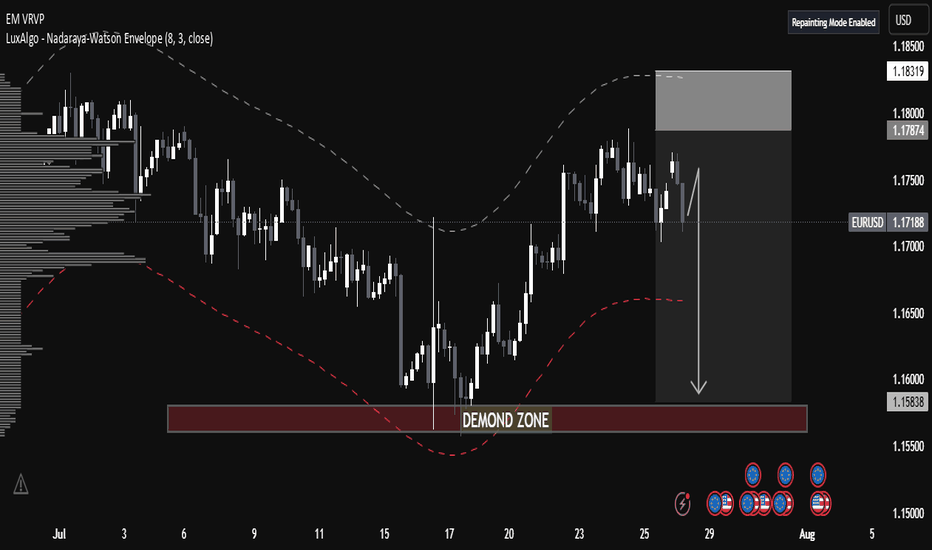

EUR/USD Technical Analysis📈 EUR/USD Technical Analysis

🔍 1. Market Structure

⚙ Trend Context

• The overall trend since mid-July has been bullish, with higher highs and higher lows forming after a bounce from a key demand zone (around 1.15380).

• However, recent candles show indecision and a potential reversal, suggesting weakening momentum.

⸻

🧱 2. Volume Profile Insight (VRVP)

• High Volume Nodes (HVNs):

• Significant trading activity occurred between 1.172–1.176, now acting as resistance.

• Low Volume Gaps:

• Thin liquidity zones exist between 1.165–1.158, which could result in swift price movement if selling pressure increases.

📘 Educational Insight: Thin volume areas on a profile typically allow for faster price transitions due to lack of order density.

⸻

📊 3. Envelope Indicator – Nadaraya-Watson (8,3)

• A mean-reversion tool estimating dynamic overbought and oversold areas.

• Price recently rejected the upper boundary, reinforcing the bearish outlook.

• The lower envelope, around 1.158–1.160, aligns with the projected bearish target.

⸻

🟫 4. Demand Zone Analysis

• Labeled “DEMAND ZONE” at 1.15380–1.15830

• Previously caused a strong bullish reversal, marking it as an area of institutional interest.

• A re-test of this zone may attract buyers once again, presenting a key support area.

📘 Educational Insight: Demand zones reflect

Bias is still Bullish However its month end Overall bias is still strong bullish, do note that its coming to end of month, either we pull back a bit or continues higher till end of month then pullback. Losing 23350 and 23300, probabilities of moving lower will higher since we had short squeeze move last Friday. Max Pain is 23020 can be use as a guide off futures movement.

Trend Exhaustion Detected – Bearish Structure AheadUS100 (NASDAQ) 30-minute chart as of July 26, 2025, with technical insights based on the visible elements.

🔍 1. Trend Analysis

Primary Trend: Uptrend (bullish structure)

The price has been respecting a rising parallel channel, marked by:

Ascending support (lower boundary)

Ascending resistance (upper boundary)

Market structure shows:

Higher Highs (HH)

Higher Lows (HL)

✅ This indicates continuation of bullish momentum until structure breaks.

📐 2. Market Structure Elements

Structure Type Label on Chart Price Zone (approx.)

Break of Structure (BOS) BOS (center-left) ~22,950

Higher Low (HL) HL (2x) ~22,700 (1st), ~23,050 (2nd)

Higher High (HH) HH (2x) ~23,150 and ~23,300

Resistance Labelled ~23,300–23,320

Demand Zones Labelled ~22,450–22,700

🔁 Break of Structure (BOS)

The BOS occurred after a prior swing low was broken, followed by a new higher high, confirming a bullish shift.

🧱 3. Support / Resistance Analysis

🔼 Resistance Zone

The price is testing strong resistance around 23,300–23,320

Multiple rejections in this area

Trendline resistance also aligns here

A rejection arrow is drawn, indicating potential bearish reaction

🔽 Support Zone (Immediate)

23,180–23,220: highlighted green box is a local support block

If broken, likely to revisit 23,000–23,050, or even down to 22,900 range

🟩 4. Demand Zones

Zone 1:

22,450–22,600: Strong bullish reaction historically — likely to act as a key demand if a deeper pullback occurs

Zone 2:

22,850–22,950: Validated with prior accumulation & BOS event

🧠 5. Key Observations

Price is at a critical inflection zone:

Testing a resistance zone

At the upper trendline of an ascending channel

A bearish reaction is projected (black arrow)

Possibly targeting the green support zone around 23,180–23,220

If that fails, demand at ~23,000 will likely be tested

Ichimoku Cloud:

Currently price is above the cloud → still bullish

Cloud is thin → potential weakness or upcoming consolidation

⚠️ 6. Trading Bias & Setup Ideas

✅ Bullish Bias (if price holds above ~23,180)

Long entries can be considered on bullish reaction from support

Target: retest of 23,300–23,350 or even breakout continuation

❌ Bearish Bias (if breakdown below support)

Short entry valid below 23,180 with:

TP1: 23,050

TP2: 22,900

A breakdown from the ascending channel would signal trend exhaustion

🔚 Conclusion

Current Price: 23,298.4

Trend: Bullish, but at resistance

Next move: Watch for reaction at resistance and support box below

Bias: Neutral-to-bullish unless the structure breaks below ~23,180

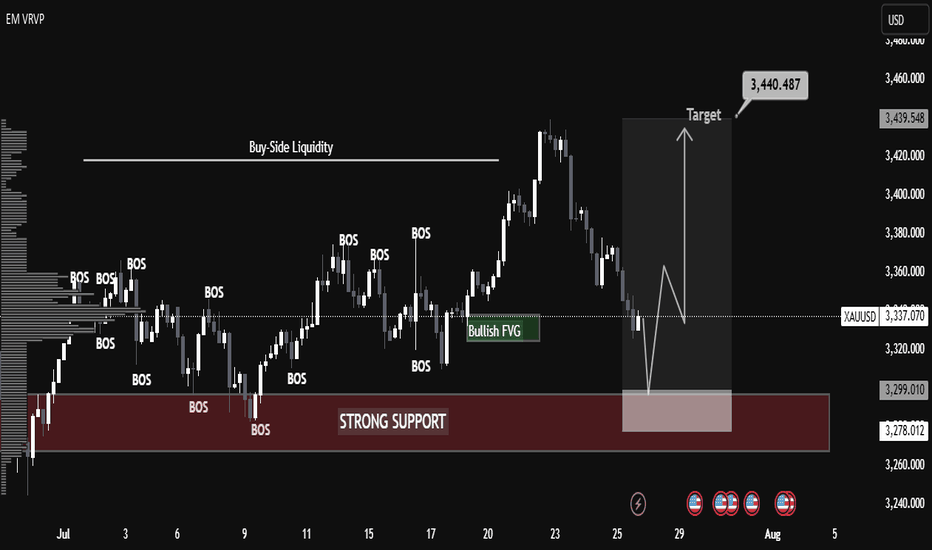

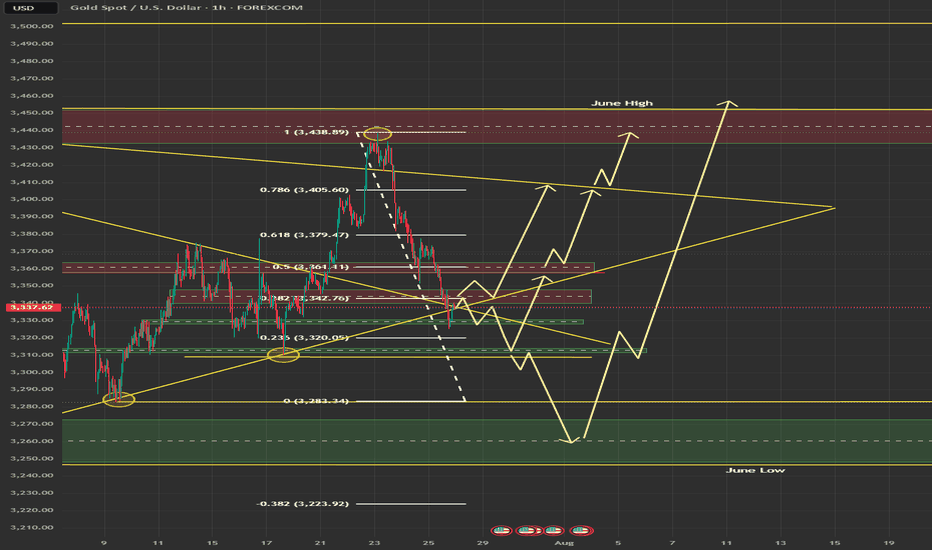

XAUUSD Technical Analysis – Educational Insight Key Observations:

🔴 Strong Support Zone (3,278 – 3,299 USD)

This zone has been highlighted as a key institutional level where buyers have consistently stepped in.

It aligns with previous Breaks of Structure (BOS), confirming its historical significance.

📉 Recent Price Action:

Price is retracing from the highs of around 3,439 USD and is approaching the strong support zone again.

A possible liquidity grab near the support is anticipated before a bullish reversal.

🔄 Break of Structure (BOS):

Multiple BOS marked indicate shifts in market direction and the presence of aggressive buying/selling phases.

These BOS events help identify trend continuation or reversal points.

🟢 Bullish Fair Value Gap (FVG):

A bullish FVG is present, indicating imbalance in price movement where institutions may look to fill orders.

Price previously reacted positively to this zone, indicating unfilled demand.

📈 Target Area:

A clearly marked target at 3,440.487 USD, which aligns with Buy-Side Liquidity, suggests a potential liquidity run.

This implies smart money may drive price upwards after collecting liquidity below support.

Volume Profile (VRVP):

The horizontal volume bars show the highest traded volume areas, providing confirmation for key support zones and BOS reactions.

🧠 Educational Insights:

BOS (Break of Structure) is used by institutional traders to spot shifts in trend. It typically signals continuation or reversal when aligned with liquidity concepts.

Liquidity Zones (like buy-side or sell-side liquidity) often serve as magnets for price; smart money aims to trigger orders and trap retail traders.

Fair Value Gaps represent imbalances where price moved too fast; institutions may return to these zones to execute pending orders.

Volume Profile Analysis helps in understanding where the most buying/selling occurred—confirming support and resistance zones.

📌 Strategy Suggestion (For Learning Only):

Entry Idea: Wait for price to tap the strong support (ideally sweep liquidity slightly below).

Confirmation: Look for bullish engulfing or BOS on lower timeframe to confirm reversal.

Target: 3,440 area where buy-side liquidity resides.

Stop Loss: Below the strong support (near 3,270 level) to protect against deeper liquidity grabs.

📢 Disclaimer (Educational Use Only):

This analysis is for educational purposes and not financial advice. Trading involves significant risk; always do your own research or consult a financial advisor.

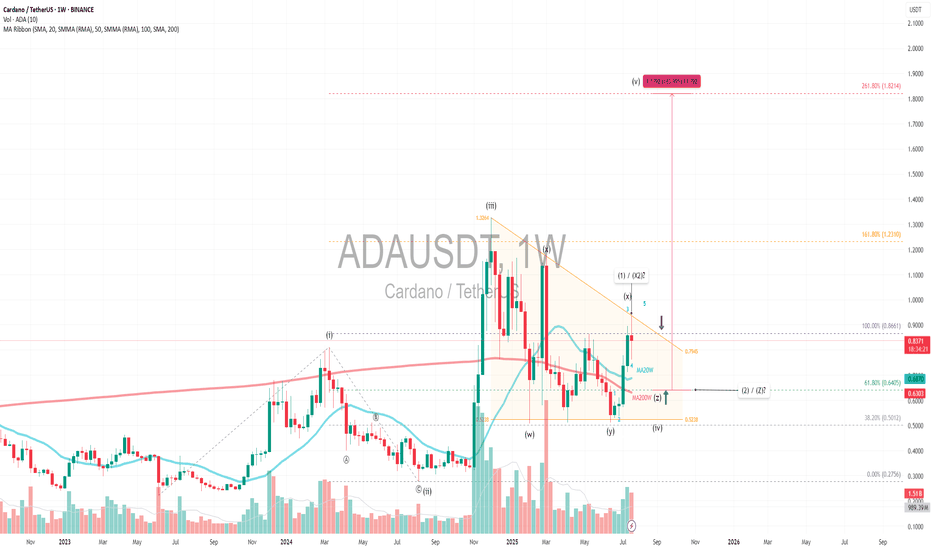

ADAUSDT|Triangle Setup WXYX2Z (1-2) +180% - Revisit $1.82 TargetPrimary Pattern: A contracting triangle within a larger corrective structure, likely wave 4.

Wave Count: A diagonal 5-wave impulse (i–v), followed by a WXY (X2) Z complex correction, suggesting wave 4 is still unfolding, possibly nearing completion.

Current Price: $0.83 with volume and SMA ribbon golden crosses showing bullish signal and near completion of accumulation phase.

Fibonacci Extension:

Targeting diagonal wave 5 at 261.8% extension from the base of wave 1 aligns with the projected target of $1.82, which matches the height of the triangle target. This also coincides with a +180% move from the possible upcoming wave Z or wave 2 —technically ambitious, but plausible if wave 5 kicks off with momentum.

Wave 4 Triangle Context:

The WXY(X2)Z structure implies a complex sideways correction which is typical of wave 4 behavior 1.6x - 2x wave 2 time extension

Key Support:

Entry: If X or 1 is nearing completion, and triangle support holds at key support MA20W Fibonacci 61.8%, the breakout into wave 5 could be explosive—especially with diagonal structure suggesting a leading diagonal pattern.

SL: Triangle Support is the last liquidity / smart money entry

Always trade with affordable risk and respect your stoploss!

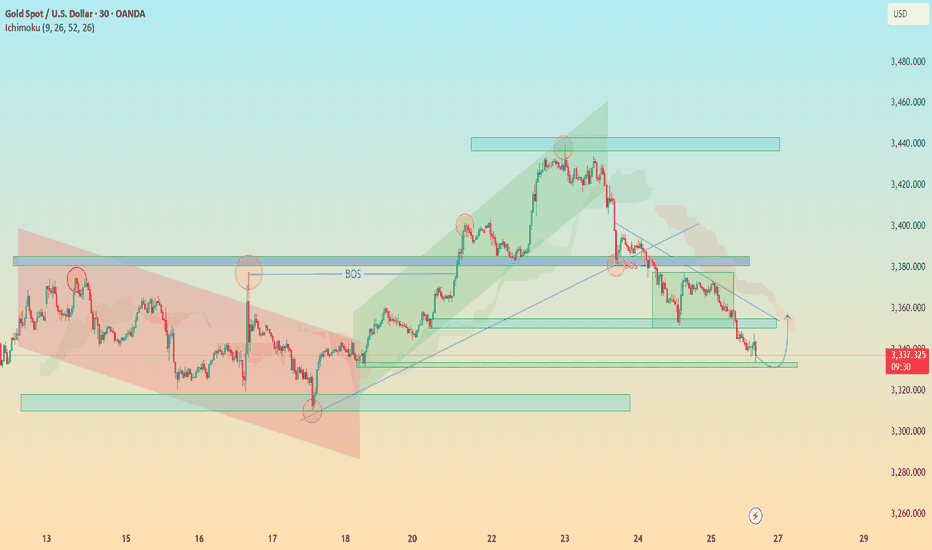

"XAU/USD Hits Major Demand – Is a Relief Rally Brewing?"🟡 XAU/USD (Gold) – Demand Zone Rejection in Play | Bullish Correction Ahead?

Timeframe: 30-Minute | Date: July 25, 2025

Created by: AllyPipsExpert

Indicators: Ichimoku Cloud, BOS (Break of Structure), Dynamic S/R, Trendlines

---

🔍 Technical Analysis & Key Insights:

🔸 1. Market Recap – Distribution & Downtrend Confirmation:

After the Break of Structure (BOS) near 3385, gold confirmed a bearish reversal following the distribution phase at the top resistance zone around 3445–3460.

Bearish momentum was sustained by a descending trendline, paired with a bearish Kumo (Ichimoku cloud) crossover.

🔸 2. Major Zone Tagged – Key Demand Area Tested:

Price has now reached the critical demand block at 3320–3340, a zone that previously initiated bullish impulse on July 18–19.

The current bullish projection (in blue) reflects potential short-term recovery or correction phase, following oversold conditions and historical support strength.

🔸 3. Bullish Reversal Potential – Short-Term Retracement?

The blue arrow reflects a likely bullish retracement toward 3360–3380, aligning with trendline retest and potential Kumo rejection.

Expect sellers to re-enter if price retests former BOS/imbalance zone, creating scalp or swing sell setups on confirmation.

---

🔧 Confluences & Technical Highlights:

Confluence Point Description

Demand Zone Strong previous accumulation at 3320–3340

BOS Retest Area Key liquidity level now acting as resistance

Ichimoku Cloud Price below cloud = bearish bias maintained

Descending Trendline Reinforces bearish structure unless broken

Price Action Rejection wick at demand + potential short squeeze

---

🎯 Trade Outlook:

🧭 Bias: Short-Term Bullish Rebound → Long-Term Bearish Continuation

🟩 Support: 3320 – 3340

🟥 Resistance: 3360 – 3385 (BOS & Trendline zone)

🔁 Scenario: Bounce → Retest → Continuation lower (unless breakout confirmed)

---

📘 Why This Chart Could Be Featured:

✅ Multi-layered Analysis: BOS, zones, cloud, price action, and psychological zones used together.

✅ Forward-Looking: Projects the next logical market reaction instead of just explaining the past.

✅ Clean, Structured, Educational: Layout and visuals guide the viewer through logical trade steps.

✅ Value-Packed: Provides actionable levels and flexible scenarios — helpful to traders of all levels.

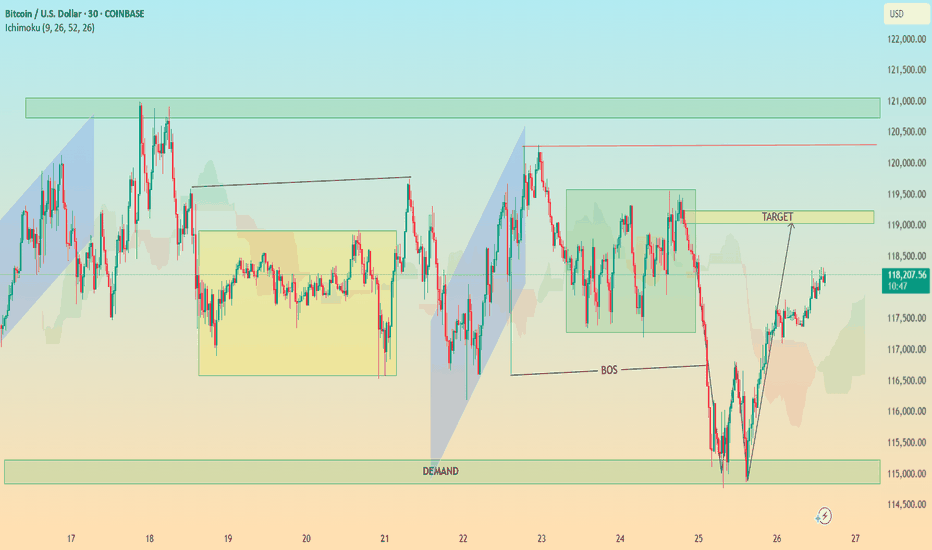

BTC In-Depth Technical Analysis: BTC/USD (30-Min Chart)🔍 In-Depth Technical Analysis: BTC/USD (30-Min Chart)

🟩 1. Demand Zone Reaction

Location: ~$114,500 – $115,500

Significance:

Price sharply reversed after a strong move into this demand zone.

This zone coincides with a liquidity grab below previous lows — textbook Smart Money trap.

Volume (if checked) would likely spike here, indicating institutional interest.

✅ Interpretation: Institutional demand stepped in, absorbing sell orders and triggering a reversal.

📉 2. Break of Structure (BOS)

Zone: Around July 24–25

Price broke below a key higher low, signaling temporary bearish structure.

However, this was quickly reclaimed after demand zone reaction — suggesting a fakeout BOS or a liquidity sweep.

✅ Interpretation: BOS caused shorts to enter, but reversal suggests a bear trap and continuation higher. The BOS served to fuel a more aggressive bullish rally.

🎯 3. Target Zone

Marked Target: ~$118,900–$119,200

Why This Area?

It aligns with a previous consolidation zone / supply before the sharp drop.

Also overlaps with Ichimoku cloud resistance and previous highs — strong confluence.

✅ Interpretation: Price is likely to face resistance here. If broken with strong momentum, bullish continuation to the next supply zone (~$121K) is possible.

⛓️ 4. Market Structure Analysis

Higher Lows Forming after demand reaction.

Price is forming a bullish market structure with an ascending wave pattern.

A break and retest of the $119K zone could lead to a mid-term rally.

Failure to break could result in:

A pullback to the $117,000 area

Or a deeper retest of the demand zone

✅ Trading Plan Options:

Bullish Bias: Buy pullbacks above $117,000 with $119,000 as target

Bearish Bias: Wait for strong rejection at $119,000 to short back to $115K

☁️ 5. Ichimoku Cloud Insight

Price has moved above the cloud, suggesting momentum shift to the upside.

The cloud is twisting bullish, supporting short-term bullish trend.

However, flat Kumo tops around $119K = likely rejection zone.

✅ Interpretation: Ichimoku confirms bullish potential, but price must close above the cloud + $119K zone to sustain trend.

📌 Key Takeaways for Publishing

Chart Idea Title:

“BTC/USD Demand Zone Reversal | Break of Structure & $119K Target in Sight”

Summary Description:

Bitcoin has reclaimed bullish momentum after a sweep into the $115K demand zone. A break of structure triggered shorts, but demand absorption led to a sharp reversal. Now, price is approaching the key $119K supply zone — a critical level that could determine if this is a short-term rally or the beginning of a new trend. Watch for either a clean breakout or a rejection for a possible retest of $117K or lower. Confluence from Ichimoku, BOS, and market structure support the analysis.

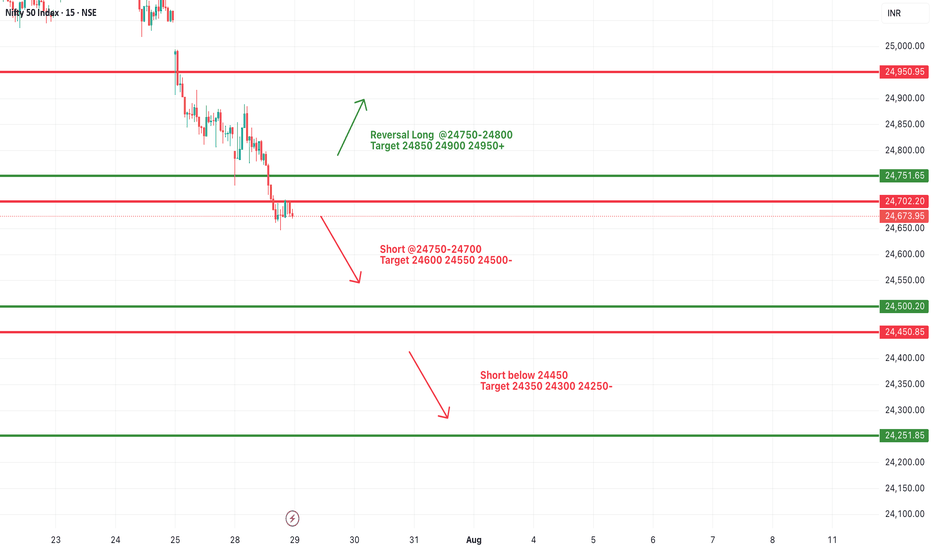

#NIFTY Intraday Support and Resistance Levels - 29/07/2025Nifty is expected to open with a gap-down today, continuing its bearish momentum seen in recent sessions. The index is now trading well below the key resistance zone of 24,750–24,800, with a visible weakness on the chart.

A short opportunity may arise if Nifty stays below the 24,750–24,700 zone. Any pullback toward this level may face selling pressure, and fresh shorts can be considered with downside targets of 24,600, 24,550, and 24,500-.

If the index breaks below the 24,450 level, the selling momentum may intensify, targeting 24,350, 24,300, and 24,250- levels intraday. This level marks a critical support, and traders should closely monitor price action here.

On the other hand, a reversal can only be expected if Nifty reclaims the 24,750–24,800 zone with strength. In that case, a bounce toward 24,850, 24,900, and 24,950+ is possible, but the reversal is only valid if strong bullish price action sustains above 24,800.

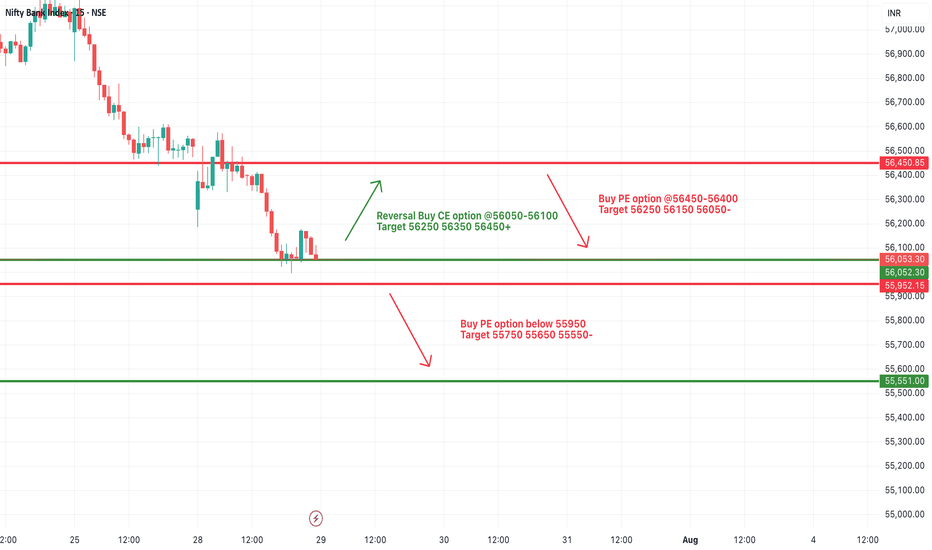

[INTRADAY] #BANKNIFTY PE & CE Levels(29/07/2025)Bank Nifty is expected to open with a gap-down, continuing its downside pressure from the previous sessions. The index is now hovering near an important support zone around 56,050–55,950.

If Bank Nifty sustains above the 56,050–56,100 zone after the gap-down open, a reversal rally can be seen with potential upside targets of 56,250, 56,350, and 56,450+. This zone may offer a low-risk long opportunity, provided price action confirms strength.

However, if Bank Nifty remains below 56,050 and especially breaches 55,950, fresh short positions can be initiated with downside targets of 55,750, 55,650, and 55,550-. A close below this support zone can accelerate the selling momentum further.

The market remains in a bearish tone unless a clear reversal structure forms above 56,050.

Gold 29 July – H4 Demand Holds, M15 Structure ShiftsGold (XAUUSD) Analysis – 29 July

The Mirror is Forming at 3310: Structure + Reaction in Focus

The market has successfully held the H4 demand zone, particularly near the critical level around 3310. This level is not just another number on the chart — it’s an inflection point. A possible first higher low or swing low, from which the next directional leg in gold could emerge.

Yesterday’s price action swept liquidity beneath this zone and then showed a strong bullish reaction. This isn’t just a bounce. It’s a behavioral shift — one that hints at absorption of selling pressure and the re-entry of aggressive buyers.

🔍 Structure Alignment: H4 + M15

On the H4 timeframe, price has stabilized within the demand zone.

Zooming into M15, we now see internal price action beginning to shift:

• First, a Change of Character (ChoCH) — the earliest clue that momentum is starting to turn.

• Then, a Break of Structure (BoS) to the upside — signaling potential bullish intent.

This multi-timeframe alignment — H4 support holding + M15 structure shifting — builds a strong case for a potential reversal and continuation of the uptrend.

📍 What Next?

The next step is to mark a refined M15 Point of Interest (POI) — a zone where price may pull back before making its next move upward.

We don’t chase price. We let it come to us.

✅ Look for Lower Timeframe Confirmation

Once price returns to your POI, it’s time to observe.

You’re not looking for obvious signals. You’re watching for subtle behavior —

a sharp reaction, a psychological flush, or a precise candle footprint that reveals intent.

The deeper signals aren’t always visible to the untrained eye — but they’re there for those who’ve studied the mirror.

( For those who know what to look for — this is where the sniper entry reveals itself. )

🎯 Summary

• Bias: Bullish — structure and reaction support long setups

• Plan: Wait for price to retest the M15 POI

• Execution: Only enter on confirmed lower timeframe intent and confluence

• Target: 120 pips (fixed, as per system)

• Stop Loss: 40 pips (always 1:3 R:R minimum)

📚 This is the kind of structure-based clarity we teach in The Chart is the Mirror .

Let the chart speak.

Let the structure guide you — not your emotion.

📘 Shared by @ChartIsMirror

Gold Weekly Outlook (XAUUSD) -28th JulyGold Enters a High-Stakes Week

This week sets the stage for major moves in gold. The charts are signalling liquidity grabs, premium compression, and volatility driven by upcoming macro catalysts.

Key events ahead:

Tuesday: ADP Employment Data

Wednesday: The Fed

Gold is currently consolidating beneath a critical supply zone, suggesting potential for a breakout or rejection. We'll align macro drivers with Smart Money Concepts, ICT methodology, Fibonacci levels, EMAs, RSI, and Fair Value Gaps to craft a precise trading framework.

Technically, price action reflects a corrective phase within a broader uptrend. Confluence support from the ascending trendline and a key horizontal level is in play. As long as price remains above 3342, a bounce toward 3400 remains the preferred scenario.

The broader bullish structure and underlying momentum suggest that once this retracement completes, the uptrend may resume with strength.

🟡 – Summary

🔹 Macro & HTF View:

Bias: Bullish but weakening under premium supply

Key Events: ADP (Tue), FOMC (Wed) → potential for liquidity grabs

Indicators:

RSI divergence (75 → 66)

EMAs flattening

Unfilled FVGs above (3365–3405) and below (3280–3320)

Key Fib targets: 3405 (127%) and 3439 (161.8%)

🔸 Weekly Key Zones

Supply (Short Trap): 3350–3439 → heavy confluence, short bias unless W1 closes above 3439

Primary Demand: 3220–3285 → ideal for news-driven long

Deep Discount (Long Only if Panic): 2960–3050

🎯 Strategy Summary

Short Setup:

Target 3350–3439 → wait for rejection after news

Long Setup:

Target 3220–3285 or deeper

Look for wick rejections + bullish structure reclaim

Avoid: 3285–3350 → indecision zone

🧭 Daily Zones

Sell Zone: 3345–3415 → trap area with FVG + Fib + EMA confluence

Buy Zones:

3290–3320 (primary)

3240–3270 (deeper)

3000–3140 (only if USD spikes)

⏱ H4 + Intraday Bias

Bias: Bearish below 3350

Short Zones:

3365–3405 (rejection only)

3355 (flip zone)

Buy Zones:

3290–3310 (reclaim setup)

3250–3280 (panic flush)

📌 Key Intraday Levels

Resistance: 3405, 3385, 3375–3350, 3350–3340

Support: 3314–3302, 3289–3272, 3260, 3240

⚠️ Final Execution Notes

Stay out of 3340–3326 zone – it’s chop

Wait for confirmation candles (engulfing, pin bars, OB reactions)

Discipline over prediction. Sniper mode only.

Disclaimer: For educational context only.

JINDALSTELNSE:JINDALSTEL

Note :

1. One should go long with a Stop Loss, below the Trendline or the Previous Swing Low.

2. Risk :Reward ratio should be minimum 1:2.

3. Plan your trade as per the Money Management and Risk Appetite.

Disclaimer :

>You are responsible for your profits and loss.

>The idea shared here is purely for Educational purpose.

>Follow back, for more ideas and their notifications on your email.

>Support and Like incase the idea works for you.