"Gold (XAU/USD) Approaching 3,110 – Sell Setup in Play?"The price is in an uptrend, making higher highs and higher lows.

A potential reversal zone is identified around $3,110, marked as a possible sell entry.

The chart suggests that after reaching $3,110, the price may decline towards the support zone at $3,010 - $2,999.

Confirmation of the sell trade can be considered if price action forms a bearish structure around resistance.

Key support levels are at $3,010, $2,999, and $2,981, which could act as potential take profit targets for short positions.

Trading Strategy:

Sell Entry: Around $3,110, if resistance holds.

Target: $3,010 - $2,999 zone.

Stop Loss: Above $3,120 to manage risk.

This idea follows technical price action, making it crucial to watch for confirmation signals before executing a trade. 🚀📉

Priceactionanalysis

USDJPY analysis week 14🌐Fundamental Analysis

The Federal Reserve (Fed) kept interest rates unchanged in the 4.25% - 4.50% range and forecast core PCE inflation to average 2.8% by year-end. The higher-than-expected inflation data reinforced expectations that the Fed will maintain current interest rates for an extended period. Investors are concerned that these tariffs could add to global inflationary pressures and trigger a recession.

In Japan, the Tokyo CPI rose sharply in March, boosting expectations that the Bank of Japan (BoJ) will continue to raise interest rates this year. The hot inflation data also supported the Yen's appreciation against other currencies.

🕯Technical Analysis

USDJPY is still in a bullish recovery. The pair is facing support at 149.200, preventing further declines. The weekly high around 151.100 is still acting as key resistance before the pair breaks out to 152.000. Conversely, if the trend breaks at 149.200, weekly support is seen at 148.300.

📈📉Trading Signals

SELL USDJPY 151.300-151.100 SL 150.500

SELL USDJPY 152.000-152.200 SL 152.400

BUY USDJPY 149.300-149.100 SL 148.900

Gold Price Analysis March 28Fundamental Analysis

Gold (XAU/USD) continued its upward trend, hitting a record high of $3,086 during the European session on Friday. Global risk sentiment weakened due to concerns over US President Donald Trump's auto tariffs and uncertainty over upcoming tariffs, boosting safe-haven demand for gold.

In addition, expectations of an early Fed rate cut due to concerns over Trump's trade policies affecting US economic growth also supported gold's gains. Although the USD recovered slightly ahead of the US personal consumption expenditure (PCE) price index report, this did not reduce the appeal of XAU/USD.

Technical Analysis

Gold is quite difficult to trade around the ATH zone today. Note that the lower boundary zone of 3060 is converging with the EMA 34 zone and the SELL zone around the 3100 round-trip barrier. The basic trading strategy requires your patience as the market is not easy to trade at the moment.

BTC/USDT - The moment of truthThe BTC/USDT chart highlights a crucial moment as the price breaks out of a bearish trendline and tests a Fair Value Gap (FVG) zone. Key scenarios include:

- A potential continuation of the bullish trend if the price successfully holds above the FVG zone and confirms support.

- Alternatively, a rejection at this level could signal a return to bearish momentum.

Keep an eye on price action within the FVG zone for confirmation of the next move. Which way do you see BTC heading?

Gold Analysis March 27Yesterday's D1 candle is still a contested candle with no clear winner. If it maintains this, there may be a strong sell-off on Friday.

The wave structure is expanding in an upward direction after a push into the Asian session. The price is reacting around the 3028 area. If gold cannot break 3028, it is possible to BUY back to the peak of the Asian session in the morning around 3038. If this peak is broken, DCA will add an order towards the target of 3044. On the contrary, if the European session cannot break the peak of 3038, SELL to 3020 and if the US breaks 3020, DCA SELL to 3006. On the contrary, if it does not break, Buy back around 3020 and the gold margin will fluctuate around 3020-3028 until the end of the day.

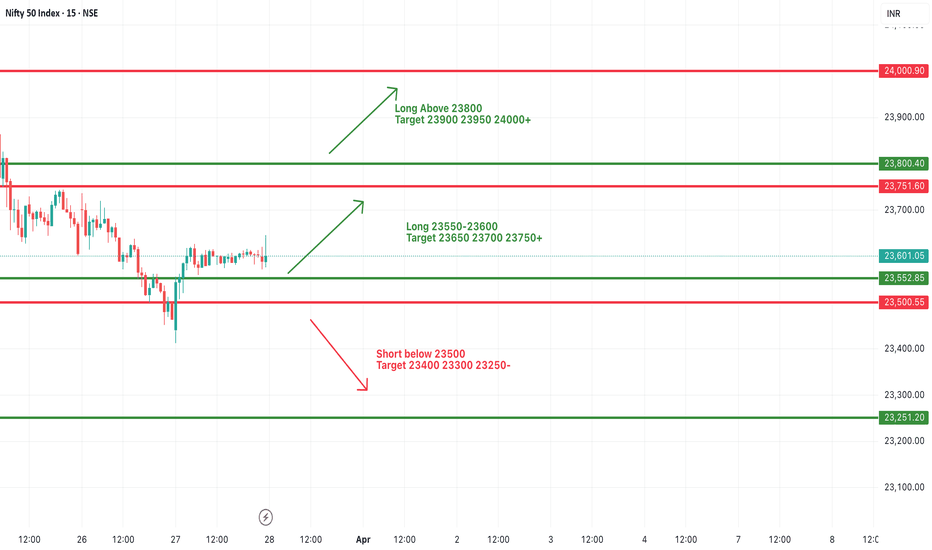

#NIFTY Intraday Support and Resistance Levels - 28/03/2025Gap up opening expected in nifty. After opening if nifty starts trading and sustain above 23800 level then possible upside rally continue upto 24000+ level. 23550-23750 zone is the consolidation zone for nifty. Any major downside expected below 23450 level.

WhiteBIT Coin $WBT: Getting Ready for a New ATHMarkets often react to major events, whether political statements or high-profile initiatives in the crypto industry. For instance, the impact of Donald Trump’s economic policies and regulatory decisions on asset prices and the market capitalization of crypto exchanges has been widely discussed - coinmarketcap.com

In particular, market volatility following such developments has led to a decline in the market value of leading crypto exchanges. However, beyond global factors, internal ecosystem growth drivers also play a crucial role.

One such trigger could be the International Crypto Trading Championship (ICTC)—WhiteBIT’s trading tournament, which will be the first-ever global live-streamed trading competition.

What does this mean for WhiteBIT Coin?

Increased platform activity → higher demand for internal assets.

Greater trader engagement → potential impact on trading volumes and liquidity.

Media exposure of the event → attracting global attention to the WhiteBIT ecosystem.

Currently, WBT is trading at $29.20 (-0.26% over the past 24 hours), down 6.29% from its ATH of $31.16. However, given the growing interest in the platform and the impact of market supply dynamics, this tournament could act as a catalyst for reassessing current price levels. If exchange activity intensifies, it’s reasonable to expect that WBT could retest its ATH zone or even break through it.

Whether this scenario plays out remains to be seen. But one thing is certain—ICTC will be a key indicator of WBT’s momentum and overall market sentiment. 🔥

What are your thoughts? Will this tournament give WBT a new boost?

US100 - Bullish Continuation Inside Ascending ChannelThis TradingView post showcases a technical analysis of the US100 (Nasdaq 100 Index) on the 4-hour timeframe. The chart highlights a well-defined ascending channel, reflecting the current bullish structure. Price action is seen retracing after touching the upper boundary of the channel, moving towards a key region of interest labeled as "IFVG" (Imbalance Fair Value Gap), where potential demand is expected.

The analysis predicts a retracement to the 0.618–0.65 Fibonacci retracement zone, aligning with a confluence of support levels within the channel. A potential bullish reversal is anticipated at this level, aiming for a continuation towards new highs near the upper boundary of the channel. The green projection line illustrates the anticipated path of price action.

This setup combines channel dynamics, Fibonacci levels, and market structure concepts to identify a favorable trade opportunity.

Gold Price Outlook: Key Fair Value Gap (FVG) and Potential PriceThis 4-hour chart of Gold/USD highlights a critical Fair Value Gap (FVG) zone in the $2,960 - $2,980 range. The chart outlines two potential scenarios:

1. A bullish reaction with a price push toward the $3,040 resistance level.

2. A bearish move breaking below the FVG, targeting the $2,880 support zone.

Traders should monitor price action within the FVG for confirmations, with upcoming economic events marked at the bottom as potential catalysts.

Gold Analysis March 26Candle D still shows that the battle between buyers and sellers has not yet been defeated.

3033 Plays an important role in the current downtrend structure. H4 Closes above the 3033 zone, officially breaking the wave and giving priority to the BUY side.

Gold is pushing up and wants to break the dynamic resistance of 3027. Closes above 3027, gold is heading towards 3033-3035. If it does not break this zone, you can SELL to 3005 and if the US breaks 3005, hold to 2983. If the 3033 zone is broken, wait for BUY to break 3033, the daily target is towards 3045.

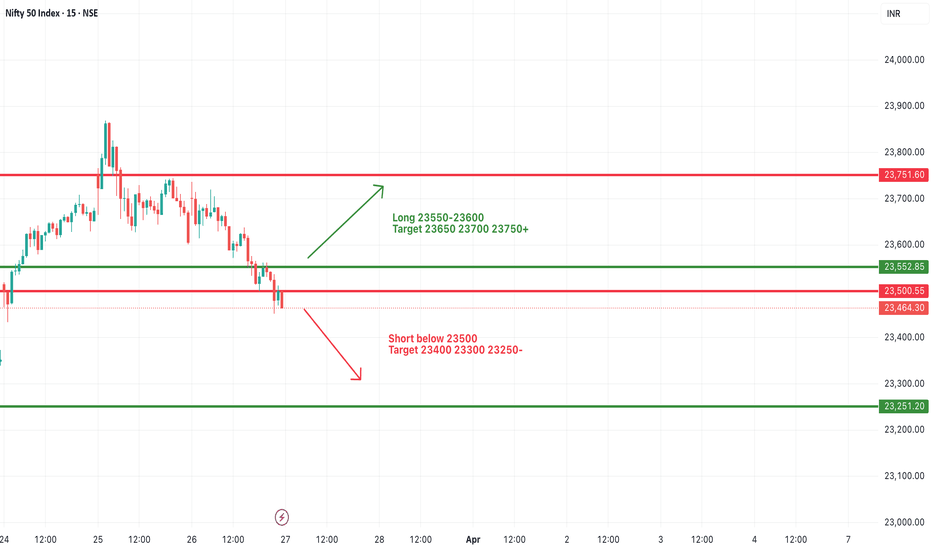

#NIFTY Intraday Support and Resistance Levels - 27/03/2025Flat opening expected in nifty. After opening if nifty starts trading and sustain above 23550 level then expected upside movement upto 23750+ level in today's session. Major downside expected below 23500 level. This downside rally can goes upto 23250 in today's session.

[INTRADAY] #BANKNIFTY PE & CE Levels(27/03/2025)Today will be slightly gap down opening expected in index. After opening possible banknifty consolidate in between the 51050-51450 level in today's session. Any upside rally only expected if banknifty starts trading and sustain above 51550 level. Major downside expected in index if it's give breakdown of 50950 level. This downside rally can goes upto 50550 level.

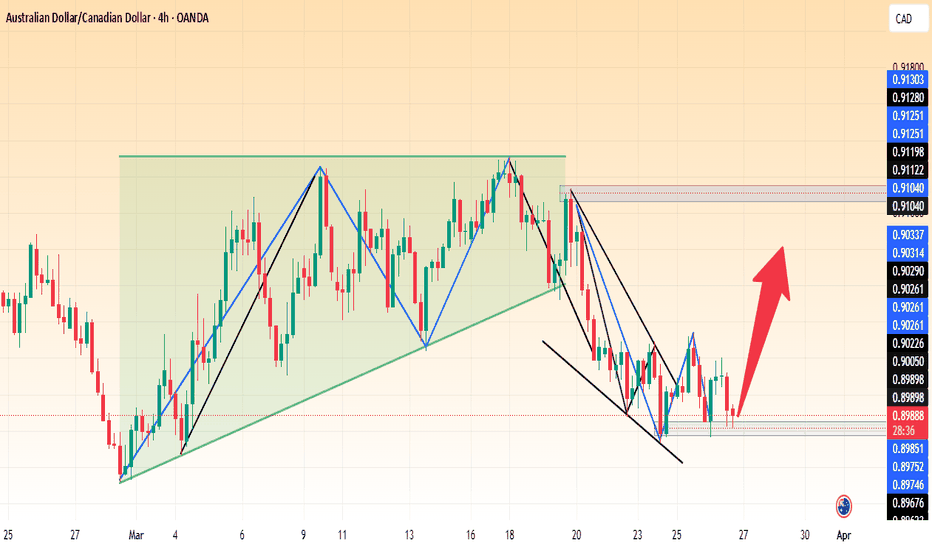

AUD/CAD – Potential Bullish Reversal from Key Support📊 Chart Analysis

1️⃣ Accumulation Zone : The price previously traded within a rectangular consolidation range before breaking down.

2️⃣ Bullish Reversal Pattern : A falling wedge has formed, indicating a possible breakout to the upside.

3️⃣ Key Support : The price has tested the 0.8980 - 0.8970 zone multiple times and is showing signs of rejection.

4️⃣ Potential Upside : A breakout above 0.9030 - 0.9050 could confirm further bullish momentum.

🚀 Trading Plan:

📌 Entry : On a breakout above 0.9025

🎯 Targets :

First target : 0.9100

Extended target : 0.9130

🛑 Stop Loss : Below 0.8965 to minimize risk.

🔔 Confirmation Needed: Wait for strong bullish price action before entering long trades. 🚀🔥

NAS100 Price ActionHey traders!

Looking at the current market structure, we can see that the price failed to make a new higher high , which is often the first sign of a potential trend reversal. This was followed by a break of two key structure levels, confirming a shift in momentum from bullish to bearish.

Interestingly, a supply zone was formed during this shift, but price didn’t even retest it — instead, it dropped right after its creation, showing strong bearish pressure. There's also an internal candle (IFC) marking the transition point.

With this kind of price action, it’s likely that the market is heading toward the next demand zone below. This could present a solid short opportunity, but always remember to manage your risk wisely and wait for clean confirmations.

Bitcoin (BTC/USD) Rising Wedge BreakdownMarket Structure & Analysis:

Rising Wedge Formation: Price has been moving within a rising wedge pattern, which is typically a bearish reversal pattern.

Bearish Breakdown Expected: BTC is testing the lower boundary of the wedge, indicating a potential breakdown.

Resistance Zone:

$89,649 – Key resistance level preventing further upside.

$88,336 – Local resistance that price failed to sustain above.

Support Levels:

$86,852 - $85,335 – Intermediate support range.

$80,402 – Main target for a bearish move.

$76,725 – Secondary support in case of further decline.

Trading Plan:

Sell Setup:

Wait for confirmation of a breakdown below the wedge.

Enter short if price closes below $86,852 with volume confirmation.

Stop Loss: Above $88,336 to avoid false breakouts.

Take Profit Targets:

TP1: $84,474 (first support level).

TP2: $80,402 (main target).

TP3: $76,725 (extended bearish target).

Risk Factors:

If BTC finds strong support at $86,852, a bounce could invalidate the bearish setup.

Macro events (ETF approvals, institutional buy-ins, Fed rate decisions) may impact price action.

XAUUSD – Bullish Breakout from Triangle | 3,090+ in SightGold (XAUUSD) has broken out of a symmetrical triangle consolidation on the 1H chart, signaling bullish continuation. With solid technical structure and momentum building, the path toward 3,093+ remains firmly in play.

📊 Technical Breakdown

1. Symmetrical Triangle Formation

Price coiled within a classic symmetrical triangle, forming higher lows and lower highs—typically a continuation pattern in trending markets.

A breakout has now occurred to the upside, confirming bullish bias.

2. Breakout Projection

The measured move from the triangle projects a 2.62% upside, targeting the 3,093 zone.

3. Clean Market Structure

Bullish impulse followed by healthy consolidation reflects market strength.

Expectation: Price will print higher highs and higher lows on its way to upper targets.

🎯 Bullish Targets

TP1: 3,047.652

TP2: 3,058.038

TP3: 3,093.957

These levels are based on recent structure highs and the measured move from the breakout.

📌 Trade Plan

Entry Idea: On triangle breakout retest or momentum continuation above 3,025

Stop Loss: Below triangle support (~3,000)

Risk-to-Reward: Favorable on breakout continuation setups

🔎 Confluences

✅ Symmetrical Triangle Breakout

✅ Strong Bullish Trend

✅ Measured Move & Clear Targets

✅ Consistent Market Structure

Gold bulls are stepping in with strength. As long as price holds above the breakout zone, expect further upside toward 3,090+.

Want a version with SL-to-BE logic or trailing TP adjustments? Just let me know!

#NIFTY Intraday Support and Resistance Levels - 26/03/2025Gap up opening expected in nifty near 23750 level. After opening 23750 level will act as a resistance for the opening session. In case nifty starts trading and sustain above 23800 level then expected upside rally upto 24000+ level. Major downside expected below 23500 level.

[INTRADAY] #BANKNIFTY PE & CE Levels(26/03/2025)Today will be slightly gap up opening expected in index. After opening if banknifty sustain above 51550 level then expected upside movement upto 51950+ level in opening session and this rally can extend for further 400-500+ points in case banknifty starts trading above 52050 level. Any major downside expected below 51450 level.