Priceactionanalysis

EUR/GBP - Bearish Rejection from Resistance

This 4-hour chart of EUR/GBP indicates a potential sell opportunity following a rejection from a key resistance level.

Key Observations:

Resistance Level: Price is struggling to break above 0.84200, suggesting strong selling pressure.

Bearish Structure: The price action shows a rejection at resistance, forming a potential lower high.

Target Support: The next major support level is around 0.83448, followed by 0.82562 for further downside.

Trading Plan:

📉 Sell Entry: After price confirmation below 0.84000

🎯 Take Profit: First target at 0.83448, second target at 0.82562

🔴 Stop-Loss: Above 0.84300 to minimize risk

Technical Indicators to Watch:

✅ Bearish Candlestick Patterns confirming resistance rejection

✅ RSI Divergence or overbought conditions

✅ Break & Retest Confirmation before entering a short trade

#NIFTY Intraday Support and Resistance Levels - 17/03/2025Expected gap up opening in nifty near 22500 level. After opening this is an important level for nifty. If nifty starts trading and sustain above 22550 level then expected upside rally upto 22700+ level. Downside reversal expected if nifty not sustain above level and starts trading below 22500. Downside 22350 level will act as a strong support for today's session.

[INTRADAY] #BANKNIFTY PE & CE Levels(17/03/2025)Flat opening expected in index. Currently banknifty giving consolidated movements. near 48000 level. Upside 48450 level is acting as a strong resistance. Any bullish side rally can reversal from this level. Downside possible below 47950 level. In case banknifty starts trading below this level then possible fall upto 47550 level. Any major trend movement only expected if banknifty starts trading above 48550 or below 47450 level.

BTC/USD Analysis & Trade Idea - Zooming Out

Market Structure & Key Levels

Bitcoin (BTC/USD) has recently faced a significant correction after reaching local highs, now testing a key demand zone. The structure indicates a potential reversal or further downside if support fails.

- Support Zones:

- $73,805 – Currently acting as support; a breakdown could trigger more downside.

- $68,997 – A strong demand area that previously led to a bullish breakout.

- $61,206 – A deeper retracement level and a key zone for long-term buyers.

- Resistance Levels:

- $84,304 – A critical resistance where price may face rejection.

- $93,401 – A major supply zone; breaking above would confirm bullish momentum.

Price Action & Potential Scenario

- BTC is testing $73,800 , a key inflection point. A strong bounce could push price toward $84,300 , while a breakdown may lead to $69,000 or lower.

- Price recently rejected from local highs, suggesting increased selling pressure .

- A confirmed reclaim of $84,300+ would be a bullish confirmation for another leg up.

Trade Outlook

📈 Bullish Scenario : If BTC holds above $73,800 and breaks $84,300 , a rally toward $93,400 could follow.

📉 Bearish Scenario : A breakdown below $73,800 could lead to a retest of $69,000 and possibly $61,200 in a deeper correction.

Conclusion

Bitcoin remains at a key decision point. Holding support could fuel a reversal, while failure to maintain $73,800 may trigger further downside. Watch for price action confirmation before taking positions.

---

Disclaimer

This analysis is for informational purposes only and reflects my personal views. It is not financial advice. I am not responsible for any trading or investment decisions you make. Always do your own research and consult a professional before investing.

$ETH PRICE RIDE TO $3K ON THIS BULL RUN 2025As of March 16, 2025, here are the latest developments in the Ethereum ecosystem:

Market Performance

Ethereum (ETH) is currently trading around $1,900, reflecting a 7.71% decrease over the past 24 hours.

Security Concerns

The FBI has accused North Korean-backed hackers, known as the Lazarus Group or TraderTraitor, of executing a $1.5 billion theft from Bybit, a Dubai-based cryptocurrency exchange. This heist, primarily involving Ethereum, is considered the largest in crypto history. The stolen assets are being laundered across multiple blockchains, raising significant security concerns within the crypto community.

Network Upgrades

The Ethereum community is anticipating the activation of the Pectra upgrade on the mainnet. This upgrade is expected to enhance network performance and could potentially drive ETH prices toward the $5,000 mark. However, the exact timeline for Pectra's implementation remains uncertain.

Competitive Landscape

Ethereum faces increasing competition from other layer-one blockchains. Notably, Solana (SOL) is reportedly forming a bullish setup that could lead to a substantial price surge, potentially impacting Ethereum's market dominance.

Investment Opportunities

For those interested in Ethereum investments, platforms like ICOminer offer cloud mining services with stable daily returns and principal refund guarantees. This presents an alternative avenue for earning passive income through Ethereum.

Privacy and Decentralization

Recent research has highlighted privacy issues within Ethereum's peer-to-peer network, revealing that validators can be deanonymized, which poses risks to decentralization. Additionally, studies indicate an oligopolistic trend in Ethereum's block-building auctions, suggesting increased centralization.

These developments underscore the dynamic nature of the Ethereum ecosystem, encompassing market fluctuations, security challenges, technological advancements, and competitive pressures.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions.

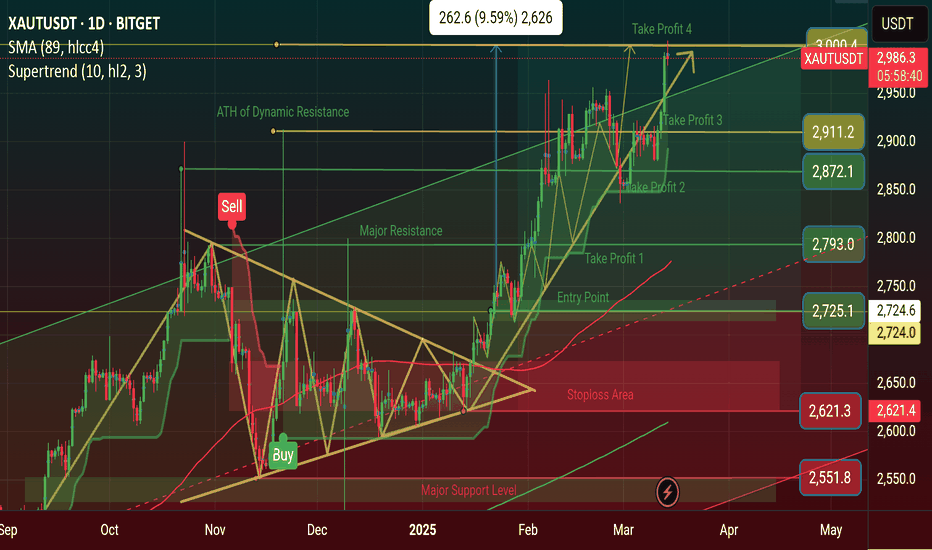

$XAU TAKE PROFIT 4 DONE & Price Serged 9.79% ~ $3005 ATH NOW TVC:XAU TAKE PROFIT 3 DONE & Price Serged 9.77% ~ $2,963 ATH NOW

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions. Digital asset prices are subject to high market risk and price volatility. The value of your investment may go down or up, and you may not get back the amount invested. You are solely responsible for your investment decisions and Binance is not available for any losses you may incur. Past performance is not a reliable predictor of future performance. You should only invest in products you are familiar with and where you understand the risks. You should carefully consider your investment experience, financial situation, investment objectives and risk tolerance and consult an independent financial adviser prior to making any investment.

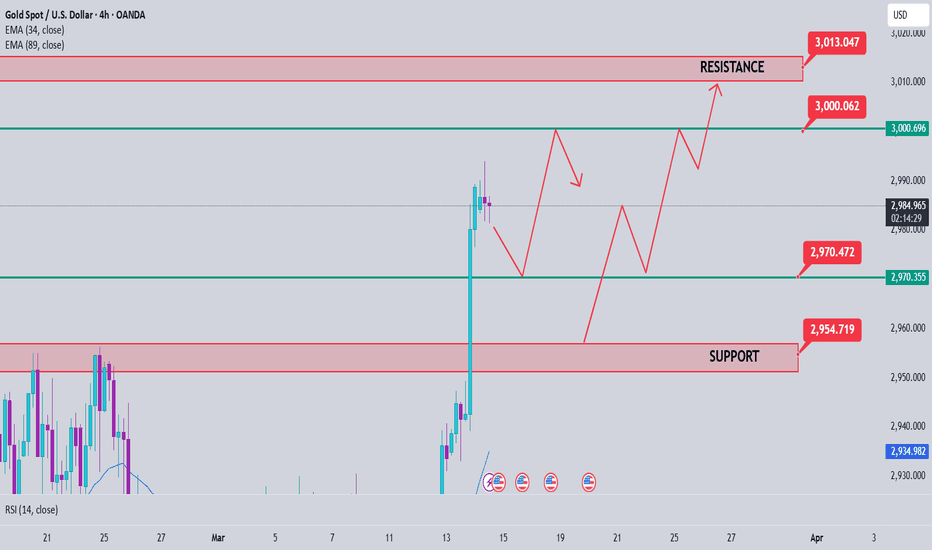

Gold Price Analysis March 14⭐️Fundamental analysis

Optimistic comments from the White House and Canada, along with news that enough Democrats have voted to avoid a US government shutdown, have boosted investor sentiment. However, gold's gains were capped by a stronger US dollar, which was bought for the third consecutive session.

However, expectations that the Fed will cut interest rates multiple times this year could limit the strong recovery of the US dollar. In addition, concerns about former President Trump's tough trade policies and their impact on the global economy continue to support gold prices. This suggests that any correction in gold could be a buying opportunity, helping the precious metal maintain its upward trend for the second consecutive week.

⭐️Technical analysis

any pullback today is considered a reasonable buy 2970 is the area where the European session Gold can find deeper and 2953 are the two BUY zones today. The sell zone is still noticeable around the 3000 round resistance and the 3015 border is considered resistance today. When gold has ATH, the FOMO is very high, so this is a difficult time to trade. Pay attention to volume and good capital management.

AUDUSD Price ActionHey traders! It's the last trading day of the week, so let's dive into some analysis on this pair.

We can see that price has grabbed liquidity on both the upside and downside. At the top, a new supply zone has formed, sweeping liquidity from the previous supply zone. On the flip side, there's also a demand zone where liquidity has been collected.

Right now, we’ve got internal liquidity on both sides, making this a solid area to look for trade opportunities. Aim for a 1:3 to 1:5 risk-to-reward ratio—stay disciplined and don't get greedy! Risk management is key.

Wishing you all a profitable day and a great weekend—use it to refine your analysis and come back stronger next week! 📊🔥 Happy trading! 🚀

Master Price Action Trading With Expedia Group StockExpedia Group NASDAQ:EXPE stock is dropping as expected. This decline highlights the importance of understanding supply and demand imbalances, particularly on larger timeframes like the monthly chart, which many traders often overlook. Ignoring these imbalances can lead to costly mistakes, as evidenced by the current bearish price action in $EXPE.

The strong imbalance at $195 per share is helping the stock price to drop as expected. We can see bearish price action being formed with room to drop much lower. There is room to reach the latest bullish impulse in the monthly timeframe.

GBPJPY Price ActionHello Traders,

As you can see, I have marked the liquidity levels on the left-hand side where a liquidity sweep has already occurred. Additionally, I have identified a new liquidity area where the price is expected to sweep next. I have also marked the take profit area.

Furthermore, you can see other liquidity levels, which I have highlighted with circles. This pattern is also known as the QM Pattern or Head & Shoulders (HS) Pattern .

Don't forget to manage your risk and protect your balance. Market structure repeats itself over and over again.

Wishing you all the best and happy trading!

Thank you.

#NIFTY Intraday Support and Resistance Levels - 13/03/2025Flat opening expected in index. After opening if nifty starts trading above 22500 level then expected upside rally upto 22650+ in today's session. 22650 level will act as an immediate upside resistance. Expected reversal from this level. Major downside expected if nifty not sustain above 22500 and starts trading below 22450 level.

[INTRADAY] #BANKNIFTY PE & CE Levels(13/03/2025)Today will be flat opening expected in index. Currently market consolidating in small range. Expected breakout of this consolidation zone in today's session. If banknifty sustain above 48050 level then possible upside move upto 48450. Also, In case banknifty starts trading below 47950 level can gives sharp downside rally of 400-500+ points. Downside 47550 level will act as a support for today's session.

Gold Price Analysis March 12⭐️Fundamental analysis

Gold prices are fluctuating in a narrow range due to cautious sentiment before the US inflation data is released. The USD has recovered thanks to investors selling positions after the recent decline.

If inflation is weaker than expected, the Fed may cut interest rates, weakening the USD and pushing gold prices up. Conversely, if inflation is higher than expected, the Fed may keep interest rates high, putting downward pressure on gold prices.

In addition, US-Canada trade tensions and US-Russia peace talks on Ukraine also affect the market, so the impact of inflation data on gold prices may not last long.

⭐️ Technical analysis

Gold is sideways in the Asian session with a small range from 2912-2920. Waiting for signs of breaking out of this range. When the price breaks 2912 to 2908, the US session's Buyer zone is very noticeable. By the end of the US session, the price was still trading above 2908, proving that the price wanted to increase and break 2920 to reach 2929 and 2943. Note that the support zone of 2880 will still be the boundary that gold will find difficult to break today.

$BTC Price Showing Head and Shoulder Pattern On Chart, CPI DATACRYPTOCAP:BTC Price Showing Head and Shoulder Pattern On Chart, CPI DATA, $95K Soon as Possible?

Bitcoin high-entry buyers are driving sell pressure, price may ‘floor’ at $70K

Bitcoin's “top buyers” are selling heavily, with onchain analytics firm Glassnode calling it a “moderate capitulation event.”

Bitcoin buyers who purchased around when it hit a $109,000 all-time peak in January are now panic-selling as the cryptocurrency declines, says onchain analytics firm Glassnode, which isn’t ruling out that Bitcoin could slide to $70,000.

Glassnode said in a March 11 markets report that a recent sell-off by top buyers has driven “intense loss realization and a moderate capitulation event.”

Short-term holders fled as Bitcoin dropped from peak

The surge in buyers paying higher prices for Bitcoin

BTC $82,482 in recent months is reflected in the short-term holder realized price — the average purchase price for those holding Bitcoin for less than 155 days.

In October, the short-term realized price was $62,000. At the time of publication, it’s $91,362 — up about 47% in five months, according to Bitbo data.

Meanwhile, Bitcoin is trading at $81,930 at the time of publication, according to CoinMarketCap. This leaves the average short-term holder with an unrealized loss of roughly 10.6%.

Related: Bitcoin slides another 3% — Is BTC price headed for $69K next?

On the same day, BitMEX co-founder Arthur Hayes said that Bitcoin may retest the $78,000 price level and, if that fails, may head to $75,000 next.

Glassnode explained that a similar sell-off Bitcoin pattern was seen in August when Bitcoin fell from $68,000 to around $49,000 amid fears of a recession, poor employment data in the United States, and sluggish growth among leading tech stocks.

#BTC☀ #BinanceAlphaAlert #BinanceSquareFamily #Write2Earn #SUBROOFFICIAL

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions.

[INTRADAY] #FINNIFTY PE & CE Levels(12/03/2025)For a bullish trade setup, traders can consider buying above 23300, as a breakout beyond this level may push the index towards 23400, 23450, and potentially 23500+. This level acts as a key resistance, and if breached, it could trigger an upside momentum.

Conversely, for a bearish trade setup, traders can sell in the 23250-23200 range. If the index sustains below this level, it may witness a downward move, targeting 23100, 23000, and possibly 22950. This zone represents an important support area, and a breakdown could lead to further downside.

The immediate resistance stands at 23300, while the key support is at 22950. The market’s movement within the 23250 - 23300 range will determine the next directional move, making it a crucial zone for traders.

#NIFTY Intraday Support and Resistance Levels - 12/03/2025Flat opening expected in nifty. After opening if nifty sustain above 22500 level then possible upside rally upto 22750+ level in today's session. Any major downside only expected if nifty not sustain above level and starts trading below 22450. This downside rally can goes upto 22300 level after the breakdown.

[INTRADAY] #BANKNIFTY PE & CE Levels(12/03/2025)Today will be flat or slightly gap up opening expected in banknifty. 48050-47950 zone will act as a resistance for banknifty. Any bullish side rally only expected above this zone. Currently market consolidating in small range any downside rally possible below 47950 level this downside movement can goes upto the 47550 in today's session. If banknifty gives breakdown of consolidation zone.