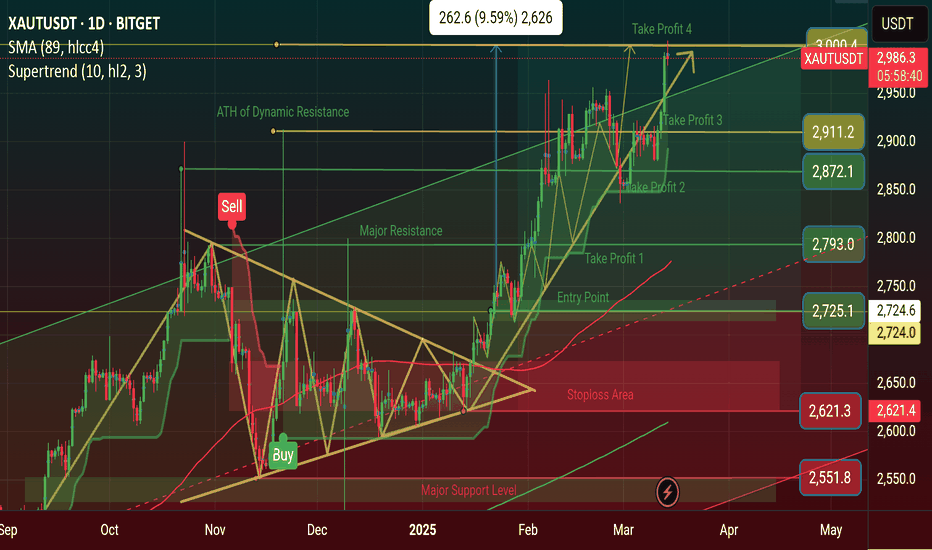

$XAU TAKE PROFIT 4 DONE & Price Serged 9.79% ~ $3005 ATH NOW TVC:XAU TAKE PROFIT 3 DONE & Price Serged 9.77% ~ $2,963 ATH NOW

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions. Digital asset prices are subject to high market risk and price volatility. The value of your investment may go down or up, and you may not get back the amount invested. You are solely responsible for your investment decisions and Binance is not available for any losses you may incur. Past performance is not a reliable predictor of future performance. You should only invest in products you are familiar with and where you understand the risks. You should carefully consider your investment experience, financial situation, investment objectives and risk tolerance and consult an independent financial adviser prior to making any investment.

Priceactionanalysis

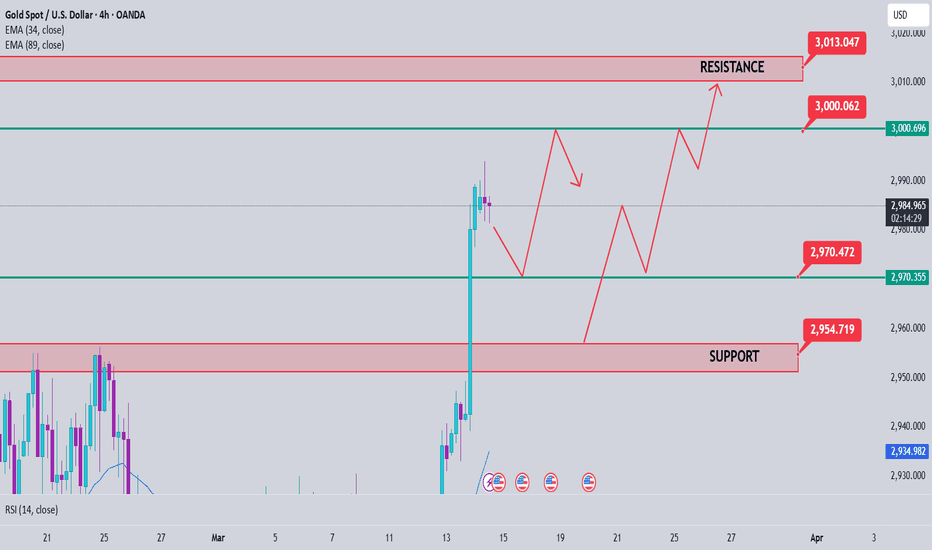

Gold Price Analysis March 14⭐️Fundamental analysis

Optimistic comments from the White House and Canada, along with news that enough Democrats have voted to avoid a US government shutdown, have boosted investor sentiment. However, gold's gains were capped by a stronger US dollar, which was bought for the third consecutive session.

However, expectations that the Fed will cut interest rates multiple times this year could limit the strong recovery of the US dollar. In addition, concerns about former President Trump's tough trade policies and their impact on the global economy continue to support gold prices. This suggests that any correction in gold could be a buying opportunity, helping the precious metal maintain its upward trend for the second consecutive week.

⭐️Technical analysis

any pullback today is considered a reasonable buy 2970 is the area where the European session Gold can find deeper and 2953 are the two BUY zones today. The sell zone is still noticeable around the 3000 round resistance and the 3015 border is considered resistance today. When gold has ATH, the FOMO is very high, so this is a difficult time to trade. Pay attention to volume and good capital management.

AUDUSD Price ActionHey traders! It's the last trading day of the week, so let's dive into some analysis on this pair.

We can see that price has grabbed liquidity on both the upside and downside. At the top, a new supply zone has formed, sweeping liquidity from the previous supply zone. On the flip side, there's also a demand zone where liquidity has been collected.

Right now, we’ve got internal liquidity on both sides, making this a solid area to look for trade opportunities. Aim for a 1:3 to 1:5 risk-to-reward ratio—stay disciplined and don't get greedy! Risk management is key.

Wishing you all a profitable day and a great weekend—use it to refine your analysis and come back stronger next week! 📊🔥 Happy trading! 🚀

Master Price Action Trading With Expedia Group StockExpedia Group NASDAQ:EXPE stock is dropping as expected. This decline highlights the importance of understanding supply and demand imbalances, particularly on larger timeframes like the monthly chart, which many traders often overlook. Ignoring these imbalances can lead to costly mistakes, as evidenced by the current bearish price action in $EXPE.

The strong imbalance at $195 per share is helping the stock price to drop as expected. We can see bearish price action being formed with room to drop much lower. There is room to reach the latest bullish impulse in the monthly timeframe.

GBPJPY Price ActionHello Traders,

As you can see, I have marked the liquidity levels on the left-hand side where a liquidity sweep has already occurred. Additionally, I have identified a new liquidity area where the price is expected to sweep next. I have also marked the take profit area.

Furthermore, you can see other liquidity levels, which I have highlighted with circles. This pattern is also known as the QM Pattern or Head & Shoulders (HS) Pattern .

Don't forget to manage your risk and protect your balance. Market structure repeats itself over and over again.

Wishing you all the best and happy trading!

Thank you.

#NIFTY Intraday Support and Resistance Levels - 13/03/2025Flat opening expected in index. After opening if nifty starts trading above 22500 level then expected upside rally upto 22650+ in today's session. 22650 level will act as an immediate upside resistance. Expected reversal from this level. Major downside expected if nifty not sustain above 22500 and starts trading below 22450 level.

[INTRADAY] #BANKNIFTY PE & CE Levels(13/03/2025)Today will be flat opening expected in index. Currently market consolidating in small range. Expected breakout of this consolidation zone in today's session. If banknifty sustain above 48050 level then possible upside move upto 48450. Also, In case banknifty starts trading below 47950 level can gives sharp downside rally of 400-500+ points. Downside 47550 level will act as a support for today's session.

Gold Price Analysis March 12⭐️Fundamental analysis

Gold prices are fluctuating in a narrow range due to cautious sentiment before the US inflation data is released. The USD has recovered thanks to investors selling positions after the recent decline.

If inflation is weaker than expected, the Fed may cut interest rates, weakening the USD and pushing gold prices up. Conversely, if inflation is higher than expected, the Fed may keep interest rates high, putting downward pressure on gold prices.

In addition, US-Canada trade tensions and US-Russia peace talks on Ukraine also affect the market, so the impact of inflation data on gold prices may not last long.

⭐️ Technical analysis

Gold is sideways in the Asian session with a small range from 2912-2920. Waiting for signs of breaking out of this range. When the price breaks 2912 to 2908, the US session's Buyer zone is very noticeable. By the end of the US session, the price was still trading above 2908, proving that the price wanted to increase and break 2920 to reach 2929 and 2943. Note that the support zone of 2880 will still be the boundary that gold will find difficult to break today.

$BTC Price Showing Head and Shoulder Pattern On Chart, CPI DATACRYPTOCAP:BTC Price Showing Head and Shoulder Pattern On Chart, CPI DATA, $95K Soon as Possible?

Bitcoin high-entry buyers are driving sell pressure, price may ‘floor’ at $70K

Bitcoin's “top buyers” are selling heavily, with onchain analytics firm Glassnode calling it a “moderate capitulation event.”

Bitcoin buyers who purchased around when it hit a $109,000 all-time peak in January are now panic-selling as the cryptocurrency declines, says onchain analytics firm Glassnode, which isn’t ruling out that Bitcoin could slide to $70,000.

Glassnode said in a March 11 markets report that a recent sell-off by top buyers has driven “intense loss realization and a moderate capitulation event.”

Short-term holders fled as Bitcoin dropped from peak

The surge in buyers paying higher prices for Bitcoin

BTC $82,482 in recent months is reflected in the short-term holder realized price — the average purchase price for those holding Bitcoin for less than 155 days.

In October, the short-term realized price was $62,000. At the time of publication, it’s $91,362 — up about 47% in five months, according to Bitbo data.

Meanwhile, Bitcoin is trading at $81,930 at the time of publication, according to CoinMarketCap. This leaves the average short-term holder with an unrealized loss of roughly 10.6%.

Related: Bitcoin slides another 3% — Is BTC price headed for $69K next?

On the same day, BitMEX co-founder Arthur Hayes said that Bitcoin may retest the $78,000 price level and, if that fails, may head to $75,000 next.

Glassnode explained that a similar sell-off Bitcoin pattern was seen in August when Bitcoin fell from $68,000 to around $49,000 amid fears of a recession, poor employment data in the United States, and sluggish growth among leading tech stocks.

#BTC☀ #BinanceAlphaAlert #BinanceSquareFamily #Write2Earn #SUBROOFFICIAL

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions.

[INTRADAY] #FINNIFTY PE & CE Levels(12/03/2025)For a bullish trade setup, traders can consider buying above 23300, as a breakout beyond this level may push the index towards 23400, 23450, and potentially 23500+. This level acts as a key resistance, and if breached, it could trigger an upside momentum.

Conversely, for a bearish trade setup, traders can sell in the 23250-23200 range. If the index sustains below this level, it may witness a downward move, targeting 23100, 23000, and possibly 22950. This zone represents an important support area, and a breakdown could lead to further downside.

The immediate resistance stands at 23300, while the key support is at 22950. The market’s movement within the 23250 - 23300 range will determine the next directional move, making it a crucial zone for traders.

#NIFTY Intraday Support and Resistance Levels - 12/03/2025Flat opening expected in nifty. After opening if nifty sustain above 22500 level then possible upside rally upto 22750+ level in today's session. Any major downside only expected if nifty not sustain above level and starts trading below 22450. This downside rally can goes upto 22300 level after the breakdown.

[INTRADAY] #BANKNIFTY PE & CE Levels(12/03/2025)Today will be flat or slightly gap up opening expected in banknifty. 48050-47950 zone will act as a resistance for banknifty. Any bullish side rally only expected above this zone. Currently market consolidating in small range any downside rally possible below 47950 level this downside movement can goes upto the 47550 in today's session. If banknifty gives breakdown of consolidation zone.

Gold price analysis March 11⭐️Fundamental Analysis

Gold prices are struggling to capitalize on a modest intraday rebound from a one-week low and remain below $2,900 in Asian trading on Tuesday. Uncertainty surrounding US President Donald Trump’s trade policies and their impact on the global economy continues to weigh on investor sentiment. This, in turn, has supported the safe-haven bullion, attracting some intraday dip buyers near the $2,880 region.

Furthermore, the prevailing US Dollar (USD) selling bias, fueled by speculations that a tariff-driven slowdown in US growth could force the Federal Reserve (Fed) to cut interest rates multiple times this year, further underpins the non-yielding gold price.

⭐️Technical Analysis

Gold price is approaching the resistance level of session 2909 when breaking this zone waiting for the SELL zone in the European session at 2915-2918, the SELL margin is relatively wide. Support 2880 is still an important support level that gold needs more momentum to break this zone.

GBPJPY Price ActionHello Traders, Today's setup is based on the 4H timeframe. I identified a clear Quasimodo (QM) or Head-and-Shoulders (HS) pattern visible on both the H4 and 1H charts. After patiently observing market movements, I noticed that the price left behind liquidity and established a demand zone.

I'm now waiting for the market to sweep the liquidity and retest the demand zone before anticipating an upward move. Always ensure you practice strict risk management.

Wishing you the best of luck and happy trading!

#NIFTY Intraday Support and Resistance Levels - 11/03/2025Slightly gap down opening expected in nifty. After opening if nifty starts trading below 22450 level then possible downside rally upto 22300 in opening session. This downside rally can extend further in case nifty gives breakdown of 22250 level. Any bullish side rally only expected if nifty starts trading and sustain above 22500 level.

[INTRADAY] #BANKNIFTY PE & CE Levels(11/03/2025)Today will be slightly gap down opening expected in banknifty. After opening if it's sustain above 48050 and give reversal then possible some bullish rally in index. Upside 48450 level will act as a strong resistance for today's session. Any strong bullish side rally only expected above 48550 level. In case banknifty starts trading below 47950 level then there will be sharp downside rally possible in index upto 47550 level.

Gold Analysis March 10⭐️Fundamental analysis

The main reason for this weakness is the US dollar (USD) recovering slightly after hitting its lowest level since November. The USD's recovery was due to the market's reaction to the weaker-than-expected US jobs report, creating some pressure on the precious metal.

However, growing expectations that the US Federal Reserve (Fed) will conduct more interest rate cuts this year have pushed US Treasury yields lower. This could limit the USD's upside momentum, thereby helping gold prices avoid a deep correction.

In addition, concerns about the negative economic impact of former US President Donald Trump's trade tariff policies have also contributed to strengthening gold's safe-haven role. Therefore, investors may be more cautious before making a strong trading decision following the downtrend

⭐️Technical analysis

Gold price at the beginning of the week traded sideways in the range of 2899 and 2929, with the fluctuations at the beginning of the week, it is quite difficult for gold to break through this price range. If there is a break from the lower range, gold will find the next strong support zone of 2882. In the immediate future, pay attention to buying around 2899 when there are signs that the candle has not closed above this range. When breaking 2899, just wait to sell today