Learn What is PULLBACK and WHY It is Important For TRADING

In the today's post, we will discuss the essential element of price action trading - a pullback.

There are two types of a price action leg of a move: impulse leg and pullback.

Impulse leg is a strong bullish/bearish movement that determines the market sentiment and trend.

A pullback is the movement WITHIN the impulse.

The impulse leg has the level of its high and the level of its low.

If the impulse leg is bearish , a pullback initiates from its low and should complete strictly BELOW its high.

If the impulse leg is bullish , a pullback movement starts from its high and should end ABOVE its low.

Simply put, a pullback is a correctional movement within the impulse.

It occurs when the market becomes overbought/oversold after a strong movement in a bullish/bearish trend.

Here is the example of pullback on EURJPY pair.

The market is trading in a strong bullish trend. After a completion of each bullish impulse, the market retraces and completes the correctional movements strictly within the ranges of the impulses.

Here are 3 main reasons why pullbacks are important:

1. Trend confirmation

If the price keeps forming pullbacks after bullish impulses, it confirms that the market is in a bullish bearish trend.

While, a formation of pullbacks after bearish legs confirms that the market is trading in a downtrend.

Here is the example how bearish impulses and pullbacks confirm a healthy bearish trend on WTI Crude Oil.

2. Entry points

Pullbacks provide safe entry points for perfect trend-following opportunities.

Traders can look for pullbacks to key support/resistances, trend lines, moving averages or Fibonacci levels, etc. for shorting/buying the market.

Take a look how a simple rising trend line could be applied for trend-following trading on EURNZD.

3. Risk management

By waiting for a pullback, traders can get better reward to risk ratio for their trades as they can set tighter stop loss and bigger take profit.

Take a look at these 2 trades on Bitcoin. On the left, a trader took a trade immediately after a breakout, while on the right, one opened a trade on a pullback.

Patience gave a pullback trader much better reward to risk ratio with the same target and take profit level as a breakout trader.

Pullback is a temporary correction that often occurs after a significant movement. Remember that pullbacks do not guarantee the trend continuation and can easily turn into reversal moves. However, a combination of pullback and other technical tools and techniques can provide great trading opportunities.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Priceactiontrading

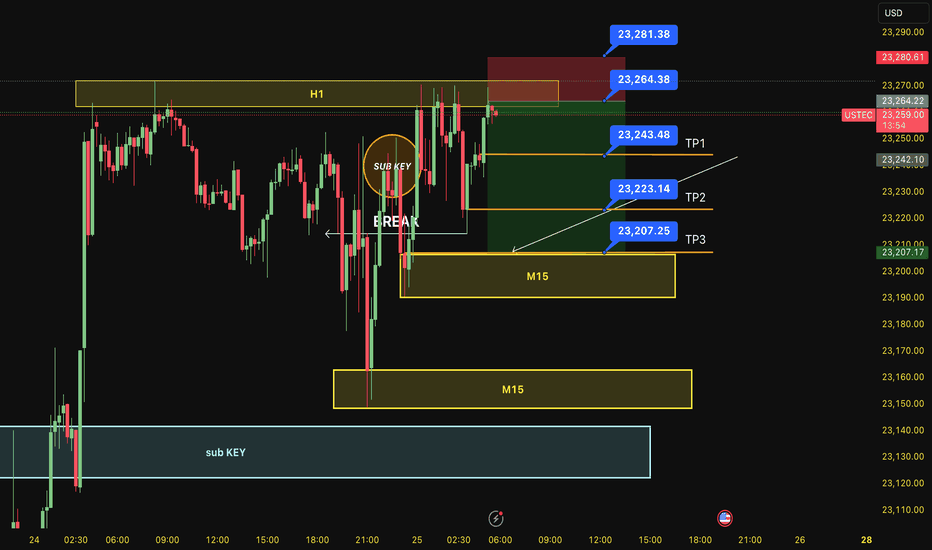

SELL USTEC 25.7.2025Reversal trade order: SELL at H1~M15 (all-time high - ATH)

Type of entry: Limit order

Reason:

- The price breakout the sub key of M15, confirming it will hit the main key M15.

- There is a key H1 support at the entry point.

Note:

- Management of money carefully at the price of bottom of M15 (23,343)

Set up entry:

- Entry sell at 23,264

- SL at 23,281

- TP1: 23,243

- TP2: 23,223

- TP3: 23,207

Trading Method: Price action (No indicator, only trend and candles)

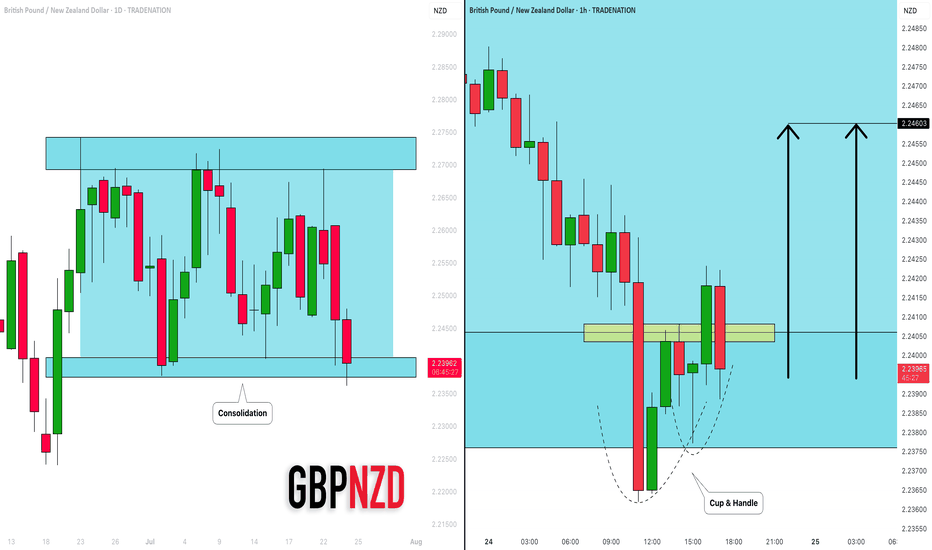

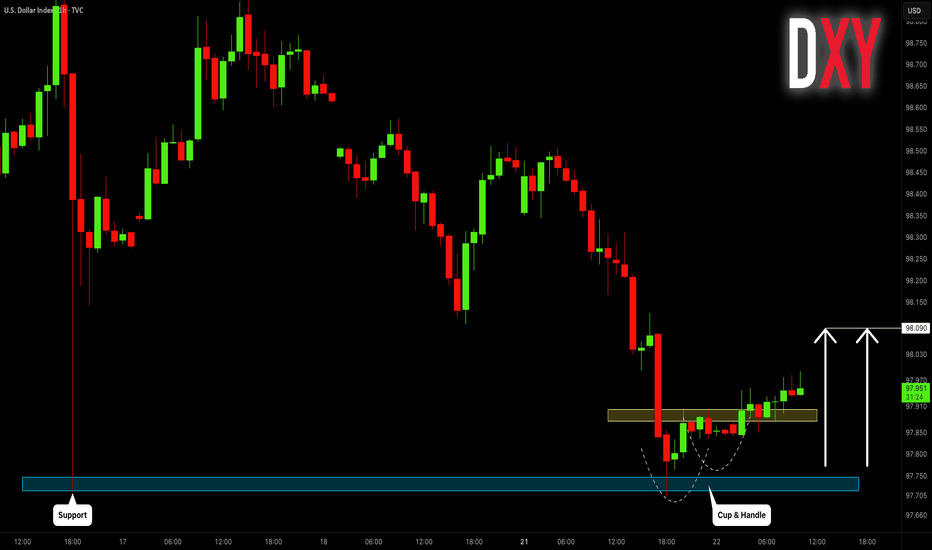

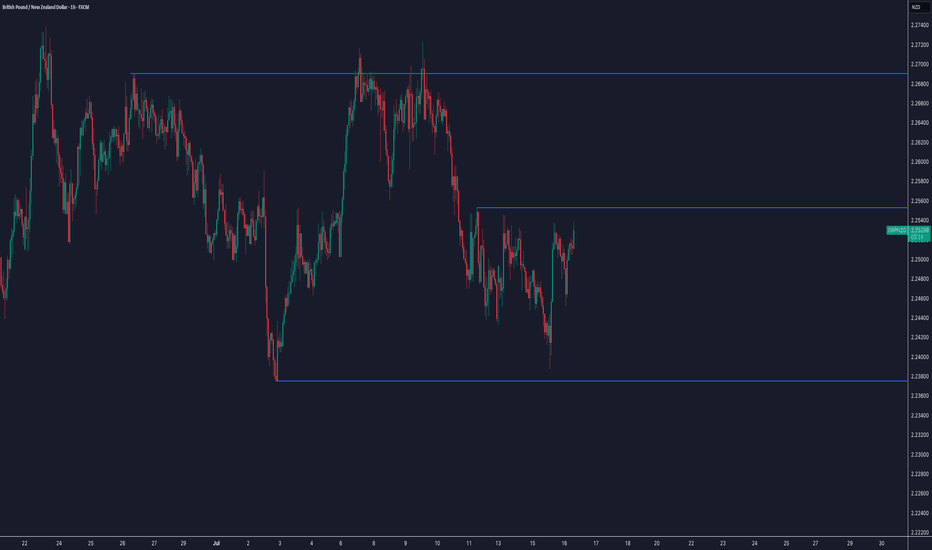

GBPNZD: Bullish Move in a Channel 🇬🇧🇳🇿

I see a horizontal parallel channel on GBPNZD on a daily.

The price is currently testing its support.

On an hourly time frame, a cup & handle pattern was formed on that.

Its neckline was violated with the today's high impact news.

I think that the price may bounce at least to 2.246 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

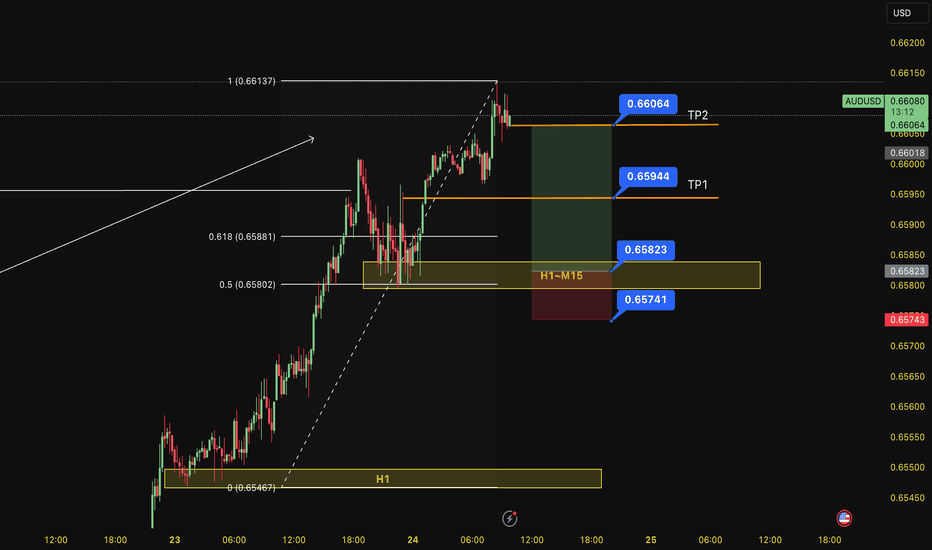

BUY AUDUSD 24.7.2025Confluence order: BUY at H1~M15

Type of order: Limit order

Reason:

- The price breakout H4 (the last top) confirming the uptrend.

- M15~FIBO 0,5-0,618 (same position)

Note:

- Management of money carefully at the price of sub key M15 (0,65944)

Set up entry:

- Entry buy at 0,65823

- SL at 0,65741

- TP1: 0,65944

- TP2: 0,66064

Trading Method: Price action (No indicator, only trend and candles)

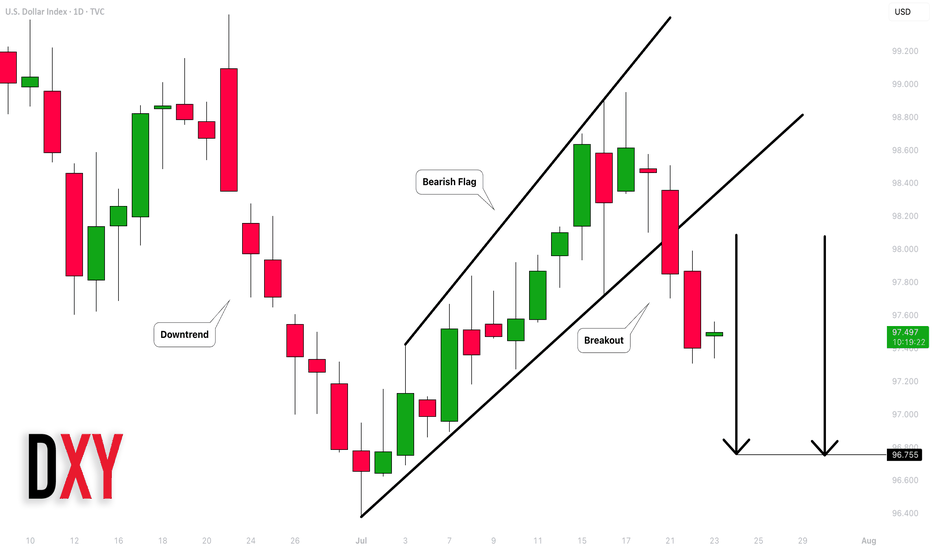

Dollar Index (DXY): Strong Bearish Price Action

Dollar Index broke and closed below a support line

of a bullish flag pattern on a daily.

Because the market is trading in a bearish trend,

this violation provides a strong bearish signal.

I expect a bearish movement to 96.75

❤️Please, support my work with like, thank you!❤️

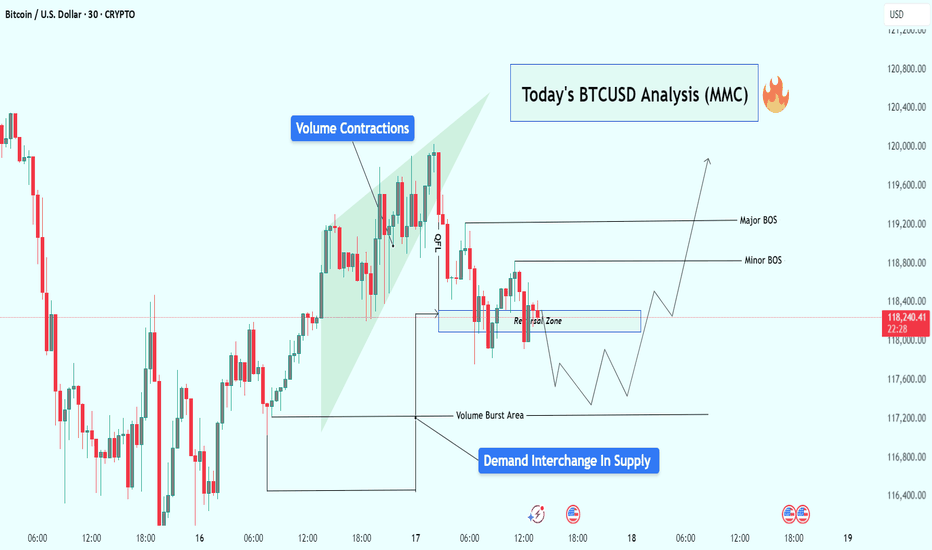

BTCUSD Analysis : Reversal Brewing from Volume Burst Demand Zone🧠 Overview:

Bitcoin is currently showing signs of a potential bullish reversal, following a classic Market Maker Cycle (MMC) pattern. The price action has been clean, respecting both volume dynamics and structural levels, setting the stage for a possible breakout above key areas of interest.

Let’s dive into the detailed breakdown:

🔍 Key Technical Elements:

1️⃣ Volume Contractions – Early Sign of Momentum Shift

At the top left of the chart, we observe a sharp upward move, followed by volume contraction within a rising wedge. This typically represents:

Absorption of orders

Reduced volatility

Market indecision

This kind of structure often precedes a reversal or aggressive breakout, depending on how price behaves near liquidity zones.

2️⃣ Fakeout/Trap Above – Classic MMC Manipulation Phase

After the rising wedge formed, BTC experienced a quick fakeout (stop hunt) just above the highs, then dropped sharply. This was the manipulation leg — a clear signal that liquidity above the wedge was taken and smart money is now repositioning.

🧠 Market makers love to trap breakout traders before moving the opposite way. The drop confirms manipulation is complete.

3️⃣ Reversal Zone + Demand Interchange into Supply

Price then entered a marked reversal zone which was previously an area of demand — now interchanging into supply. This zone is critical because:

It aligns with volume burst zones

It acted as support turned resistance

Multiple rejections confirm order flow shift

This tells us smart money is now testing this area to accumulate or trap sellers.

4️⃣ Volume Burst Area – Institutional Involvement Confirmed

We can clearly identify a Volume Burst Area, where price spiked with strong momentum — this is not retail trading. This zone is now being revisited for a potential bullish re-accumulation.

Expect reaction from this area, as it likely contains unmitigated buy orders from institutions.

5️⃣ Break of Structure (BOS) Mapping:

Minor BOS: Breaks short-term lower highs, showing early intent.

Major BOS: Breaks significant structure, confirming shift in trend direction.

A successful retest of demand and then break of both BOS levels will likely lead to a strong bullish continuation.

📈 Trade Plan & Potential Price Path:

There are two potential bullish entry strategies forming:

✅ Scenario 1: Clean Breakout Plan

Price holds the current reversal zone

Breaks Minor BOS, then Major BOS

Retest of BOS confirms continuation

📍 Target: $119,600+

✅ Scenario 2: Liquidity Sweep Entry

Price dips lower into Volume Burst Area

Sweeps liquidity below and prints a bullish reaction

Enters from discount zone

Same upside targets apply

🧠 This would be a smart money entry — entering from the lowest point of pain for retail traders.

🧵 Final Thoughts:

BTC is setting up beautifully for a reversal continuation pattern within the MMC framework. We’ve seen:

📉 Initial drop (accumulation phase)

🎭 Fake breakout (manipulation phase)

📈 Upcoming expansion (breakout phase)

All signs point to a high-probability move upward, especially if price confirms with BOS + retest. Be patient, wait for price action to align with structure and volume clues.

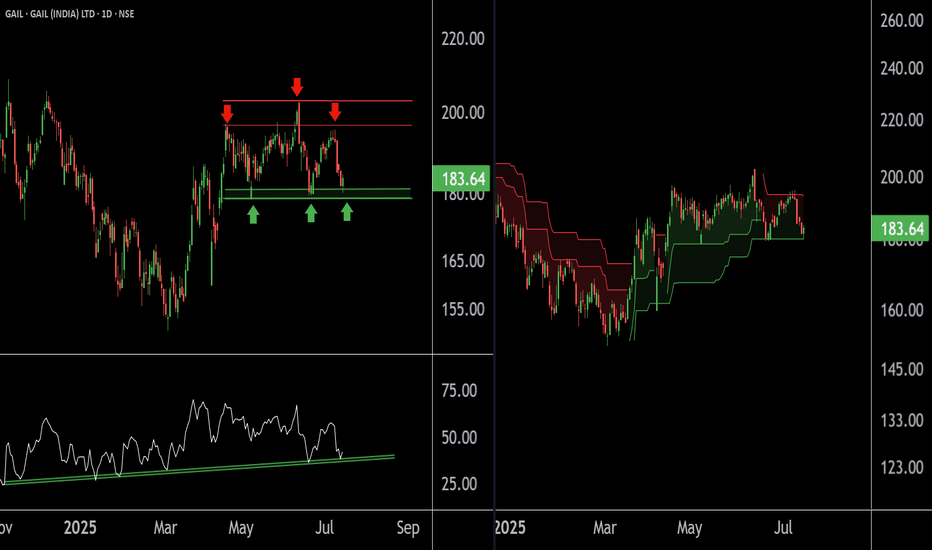

GAIL at Best Support zone !! There are two chart of Gail on Daily timeframe.

On the first chart Gail is moving in well defined parallel channel with support near at 178-180 zone.

Daily RSI is also taking support and bouncing back, indicating a revival in short-term momentum and strengthening the overall bullish setup.

On the second chart , the stock is bouncing from the supertrend support around ₹180, reinforcing bullish sentiment. However, on the shorter timeframe, the supertrend indicator is acting as resistance near ₹192, which needs to be breached for further upside continuation.

Thank You !!

Is Gold Ready for a Breakout or Pullback? | Weekly ForecastIn this video, we dive deep into the gold market analysis for the week of July 7 to July 11, 2025. I break down everything you need to know from last week’s price action — including the surge to $3,360, the impact of the U.S. tax cut and spending bill, and the 2.2% weekly gain despite consolidation.

We also look ahead at what to expect this week, including:

📅 July 9 Trade Tariff Deadline

📉 Key U.S. labor data (Initial Jobless Claims)

🏦 Market sentiment around Fed rate cut speculation

📊 Strategic insights based on technical and macro confluence

👉 If you find this content valuable, don’t forget to Vote, Comment, and Subscribe for weekly market breakdowns.

💬 Drop your thoughts in the comments:

Do you think gold will break above $3,360 this week? Or are we gearing up for a deeper pullback?

Disclaimer:

Based on experience and what I see on the charts, this is my take. It’s not financial advice—always do your research and consult a licensed advisor before trading.

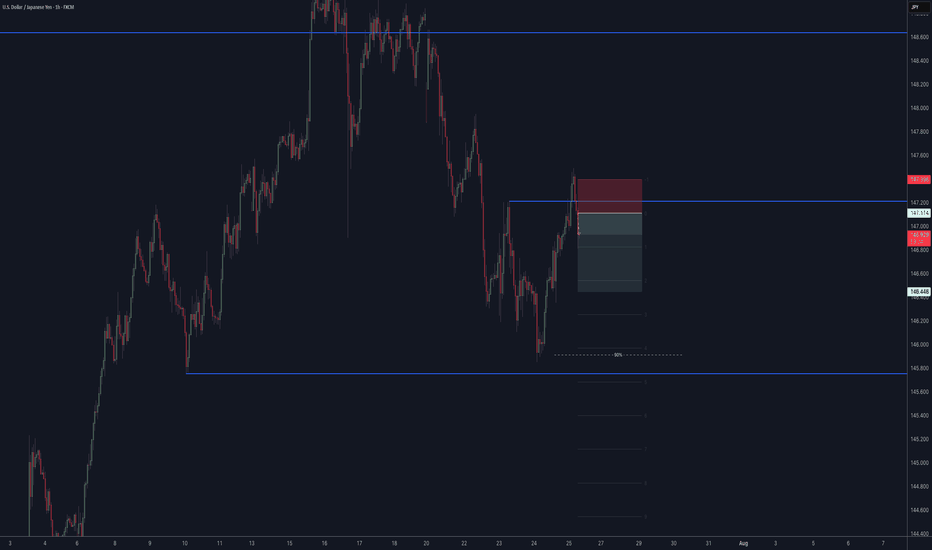

11.07.25 USDJPY Trade Recap + Re-Entry for +2.5%A long position taken on USDJPY for a breakeven, followed by a premature re-entry that I took a loss on. I also explain the true re-entry I should have taken for a 2.5% win.

Full explanation as to why I executed on these positions and also more details around the third position that I did not take.

Any questions you have just drop them below 👇

EURUSD: Strong Bullish Confirmation?! 🇪🇺🇺🇸

There is a high chance that EURUSD will move up from the

underlined intraday support.

An ascending triangle formation and a violation of its neckline

indicate a strength of the buyers.

Goal - 1.1705

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.