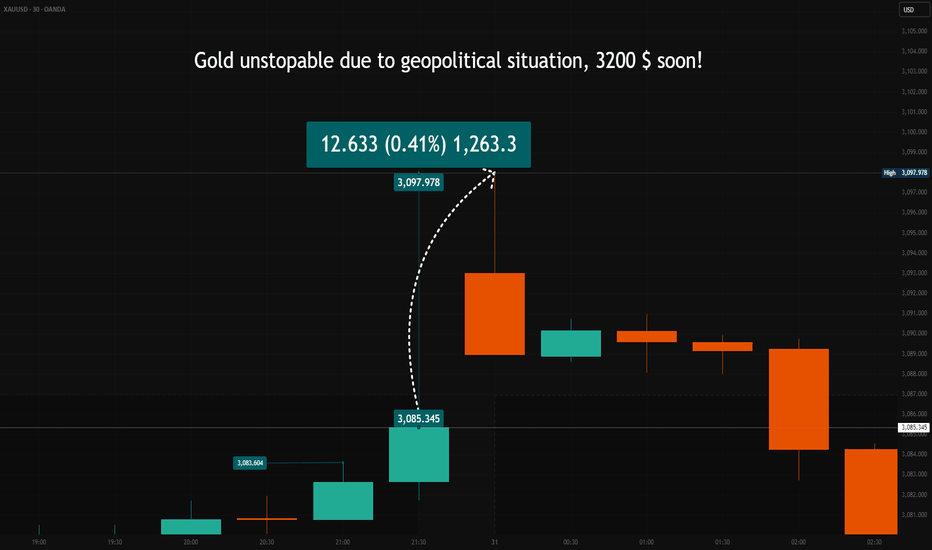

Gold Price Surges Amid Market Uncertainty – What’s Next?The late Friday session on March 28, 2025, ended with a strong rally in gold, as multiple price candles attempted to push higher. By 10 PM CET, gold had settled at $3,085.345, reflecting significant bullish momentum.

As the market reopened on Monday, the gold price gapped up by approximately +$12.5 , opening at $3,097.978 .

This type of price gap typically occurs when buyers are willing to pay more than the previous session’s close, signaling strong demand.

What’s Driving the Gold Rally?

The answer lies in a mix of tariffs, war, and recession fears. The global financial landscape remains highly unstable, and in times of uncertainty, gold historically acts as the preferred safe-haven asset. Investors are flocking to the precious metal as a hedge against economic instability.

Adding fuel to the fire, on April 2nd, additional U.S. tariffs imposed by President Donald Trump are set to take effect. This move could further disrupt markets, potentially driving even more capital into gold.

The Interest Rate Factor – A Hidden Risk?

While gold is surging, there’s a crucial factor to watch: Federal Reserve policy. So far, Fed Chair Jerome Powell has maintained a cautious stance on interest rates. However, if the situation deteriorates, the Fed might be forced to cut rates earlier than expected to stabilize the economy.

This could create a paradox for gold traders. While rate cuts typically support gold in the long run, a sudden policy shift could trigger a short-term sell-off as investors adjust their positions. If that happens, gold could see a sharp correction before resuming its trend.

Final Thoughts

Gold remains in a strong uptrend, but traders should stay cautious. If the Fed pivots and announces rate cuts sooner than expected, we could see a pullback in gold before the next leg higher. The coming days will be critical – keep an eye on April 2 and any shifts in Fed policy that could shake up the market.

👉 Will gold continue its rally, or are we facing a major pullback? Share your thoughts in the comments! 🚀

-------------------------------------------------------------------------

This is just my personal market idea and not financial advice! 📢 Trading gold and other financial instruments carries risks – only invest what you can afford to lose. Always do your own analysis, use solid risk management, and trade responsibly.

Good luck and safe trading! 🚀📊

Pricegap

XAUUSD Bearish Reversal: Double Top and Golden Pocket Breakdown!OANDA:XAUUSD - 2Hr

The analysis suggests the market is showing bearish signals, particularly after price rejected at key resistance zones during the Asian session. The Ascending Channel indicates an upward trend, but the breakdown from the channel signals that bullish momentum is weakening.

Key Elements Driving the Short Trade:

1. Golden Pocket (0.5–0.618 Fib):

The price has reached the Golden Pocket (between 0.5 and 0.618 Fibonacci levels), a strong reversal zone. Rejections in this zone often signal a potential change in trend, especially when combined with other bearish signals.

2. MML Major Resistance:

The MML Major Resistance suggests that the market is encountering a significant obstacle, further validating the potential for a reversal.

3. Strong Resistance:

The price is facing Strong Resistance at higher levels, which is causing the price to struggle and reject, confirming the reversal bias.

4. Double Top:

The Double Top pattern at the Golden Pocket indicates that the price has attempted to break higher twice but failed, signaling weakness and a likely bearish shift. This pattern often leads to a trend reversal.

5. Price Gap:

A Price Gap further confirms a shift in market sentiment, with a possible imbalance or sudden price movement that reinforces the bearish view.

Current Price Action:

During the Asian session, price broke down from the Ascending Channel, signaling a shift from an uptrend to a potential downtrend. The breakdown occurred near Equilibrium and the 50% Fib retracement, reinforcing the idea of a reversal as this is where price typically finds resistance in a trend. The Double Top at the Golden Pocket suggests a strong potential for a downward move as the price has failed to continue higher. Currently, the price is above a Strong Pivot Point, which is acting as support, potentially leading to a short-term pullback or consolidation before the bearish move continues.

Interpretation:

The combination of the Golden Pocket, Double Top, and rejection at key resistance levels gives a strong bearish signal. The ideal entry point would be after confirmation of price breaking below the Strong Pivot Point or failing to sustain above it, with a target near the next support or at Price Gap, as mentioned Price target. Place the stop loss just above the Double Top or near the Strong Resistance zone to limit risk in case the market reverses back up.

In conclusion, the market is showing signs of a bearish reversal after rejection at multiple key levels, and the analysis points toward potential short opportunities with proper risk management.

"Stick to Your Plan and Manage Risk, Happy Trading!"

USD/JPY Long Setup: Gap Fill in Focus

A recent price gap on the USD/JPY chart suggests potential for a long position. Given the price gap, we expect a possible gap fill scenario similar to last week, where the price moved to close the gap. This provides an opportunity to enter a long trade, anticipating upward movement with a careful stop loss.

Support Zone : 151.650 - 151.752

Stop Loss: 151.596

Take Profit : 152.878

11/26/23 DXY Daily Outlook11/26/23 DXY Daily Outlook

#DXY #DailyOutlook

We tapped into the 4H-FVG(L), into the YOP again, and took out the PDL PWL with the move up during the over night sessions and into the NY session. We left a new 4H-FVG through the lows taken out, a new 4H-OB, a Price gap on the 1H LTF and in the process of trading down into the PWH from 8/30.

This will be our biggest news release, however, we do have a few #FOMC speakers but not Powell. We also have Richmond Manufacturing Index numbers #RMI and the S&P/CS Composite-20 HPI y/y at 9:00am.

10:00am

USD

CB #ConsumerConfidence

101.0 102.6

XXX/USD bullish

USD/XXX bearish

#BullishCase: A bullish move on Dollars means that we are seeing a LTF move through the 4H-FVG. Once we move through it we see that price uses the 4H-FVG as an IFVG setup to the upside. We then target the previous -POIs, the PDH from Monday and back into the 4H-IFVG range.

#BearishCase: A bearish scenario is a bit more probable at the moment still. We left fresh -POIs and we can look to take setup off of each of these, the Price Gap, the 4H-FVG, 4H-OB, and as you can see on the 1H TF these same POIs are available as well.

1H chart

4H chart

D chart

11/28/23 SPX Daily Outlook11/28/23 SPX Daily Outlook

#SPX #DailyOutlook:

We made the low of the day during the over night sessions. There was a NWOG that was left on Sunday and this is where price has been reacting during the NY open session. The PM sessions fell down into the 4H+FVG(H), TDO and D+OB(H) then pushed into the NWOG. There was also a bounce in the London/ Pre Market Session off of the D+OB(H) again. On the open the price rejected the PG but then held the D+OB(H) again and ranging through the NY open until the close.

This will be our biggest news release, however, we do have a few #FOMC speakers but not Powell. We also have Richmond Manufacturing Index numbers #RMI and the S&P/CS Composite-20 HPI y/y at 9:00am.

10:00am

USD

CB #ConsumerConfidence

101.0 102.6

#BullishCase: The bullish case will be our response to the NWOG (New Week Open Gap) which we have reacted off of and sold off from but, at the current price we are sitting near the low again. We could use the PG to push through and buy from and the aim will be the PDH/PWHs. Look for an impulse through and a return to it.

#BearishCase: The PDL from Monday is our POI for the sell setup. We need to watch the LTFs for an impulse through the low and on the LTFs once we trade through the low wait for a fresh -POI for a LTF setup.

1H chart

4H chart

D Chart

Quantstamp Delayed A Pump Still WaitsI think we can retest this upper price gap on QST as long as BTC goes up or sideways. We are oversold but price seems to have bottomed and the price is gently moving up. Not financial advice, DYOR.

Adobe Rebounds Following a Sharp DropThe market’s recent bounce has lifted some technology stocks mired in downtrends. One example is Adobe.

The software company plunged on September 15 after a double dose of unwelcome news. ADBE not only missed revenue estimates. It also announced the $20 billion takeover of Figma in a deal Wall Street considered too rich.

The stock soon found itself under $280 for the first time since March 2020. It proceeded to rebound and yesterday tried to enter the bearish gap. But it couldn’t hold. Will the high from last month’s big negative day turn into new resistance?

Second, there was also a bearish outside day versus Tuesday. That’s a potential reversal pattern.

Next, stochastics returned to an overbought condition.

Finally, the 50-day simple moving average (SMA) is approaching from above. Will sellers look for the stock’s downtrend to continue from this line?

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options, futures and cryptocurrencies. See our Overview for more.

Important Information

TradeStation Securities, Inc., TradeStation Crypto, Inc., and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., all operating, and providing products and services, under the TradeStation brand and trademark. You Can Trade, Inc. is also a wholly owned subsidiary of TradeStation Group, Inc., operating under its own brand and trademarks. TradeStation Crypto, Inc. offers to self-directed investors and traders cryptocurrency brokerage services. It is neither licensed with the SEC or the CFTC nor is it a Member of NFA. When applying for, or purchasing, accounts, subscriptions, products, and services, it is important that you know which company you will be dealing with. Please click here for further important information explaining what this means.

This content is for informational and educational purposes only. This is not a recommendation regarding any investment or investment strategy. Any opinions expressed herein are those of the author and do not represent the views or opinions of TradeStation or any of its affiliates.

Investing involves risks. Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options, futures, or digital assets); therefore, you should not invest or risk money that you cannot afford to lose. Before trading any asset class, first read the relevant risk disclosure statements on the Important Documents page, found here: www.tradestation.com .

Bitcoin Price Gaps - Will They Get Filled?Traders,

Price Gaps: Do you believe in them? Not all price gaps are filled. It depends on the market's behaviour. If in past, a market has been filling gaps, it is likely to do it again. These are are price gaps in Bitcoin Futures from CME.

So far all CME Futures price gaps on bitcoin has been filled. Do you think if they will be filled? 🙂 Put your thoughts in comments below and save this post for reference.

Rules:

1. Never trade too much

2. Never trade without a confirmation

3. Never rely on signals, do your own analysis and research too

✅ If you found this idea useful, hit the like button, subscribe and share it in other trading forums.

✅ Follow me for future ideas, trade set ups and the updates of this analysis

✅ Don't hesitate to share your ideas, comments, opinions and questions.

Take care and trade well

-Vik

____________________________________________________

📌 DISCLAIMER

The content on this analysis is subject to change at any time without notice, and is provided for the sole purpose of education only.

Not a financial advice or signal. Please make your own independent investment decisions.

____________________________________________________

Riot Blockchain Breaks the 50-day SMABitcoin miner Riot Blockchain has been skidding lower since February, but now it could be ready to move again.

The main feature on its chart is its jump above the 50-day simple moving average (SMA) on July 26. It’s formed a tight consolidation pattern above the line since. The current action differs from a moment like early July, when it failed to hold above that line.

Next, RIOT’s 8-day exponential moving average (EMA) just crossed above the 21-day EMA.

Third, prices recently tested and held the 200-day SMA.

The other question for RIOT is obviously your outlook for Bitcoin, which just had its biggest two-week gain since March. It’s now making higher lows as it consolidates around $40,000. If prices continue higher from here, RIOT could break its five-month downtrend and head back toward their 2021 highs.

TradeStation is a pioneer in the trading industry, providing access to stocks, options, futures and cryptocurrencies. See our Overview for more.

Netflix Staggers After Bearish GapNetflix was an early beneficiary of coronavirus as stay-at-home orders boosted demand. That makes today’s news of potential vaccine success from Pfizer a clear negative.

NFLX has other issues. In particular, a bearish gap on October 21 after subscriber growth missed estimates. Management warned that would happen in July because the pandemic was essentially cannibalizing future growth.

Second, NFLX never made new highs in early September – even as the broader the S&P 500 and Nasdaq-100 hit new highs.

Third, the most recent high on October 14 was slightly below its July peak. That’s resulting in a double-top (potential bearish reversal pattern).

Finally, the current failure occurs at the 50-day simple moving average (SMA).

TradeStation is a pioneer in the trading industry, providing access to stocks, options, futures and cryptocurrencies. See our Overview for more.

CADCHF possible shortAnalysing on a bigger timeframe, the area of resistance is formed from a price gap (which makes for a strong resistance area), and has been repeatedly tested. To lookout for a bearish formation around this resistance, then wait for confirmation. It's a trade with a great risk to reward ratio

Target Clings to Support, With Gap Looming BelowTarget reported decent earnings this week, but not a lot of buyers showed up. Now traders may want to watch for a potential breakdown with the big-box retailer near a key price zone.

TGT gapped from $86 to $100 last August on signs that its big digital push had paid off. It followed that with another strong quarterly report on November 20.

Since then, however, things haven't been so hot. TGT peaked around $130 a week before Christmas. It then announced in mid-January that the key holiday-shopping season missed estimates. The shares gapped down, bounced feebly and then continued lower to a potentially important level around $105.

This zone could be crucial because it's near the 200-day simple moving average (SMA) and the price area shortly after the August gap.

The recent price action is also potentially bearish because TGT tried to rally after earnings three days ago, but hit resistance around the old $111 support area from January 31.

Relative strength has been poor over the course of 2020, with TGT trending lower even as the S&P 500 hit new highs in January and February. It also faces potential risk from the spread of coronavirus.

Still, there isn't confirmation yet. Traders shopping for downside in TGT may want to wait for a close below the 200-day SMA.