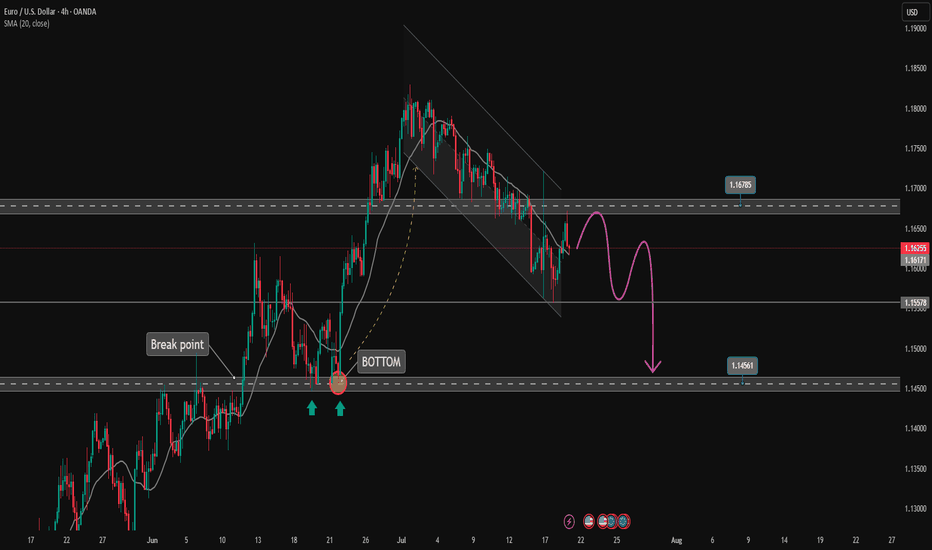

EURUSD Trading Price Channel, SELL Strategy✏️ OANDA:EURUSD H4 Timeframe EURUSD is trading in a bearish channel. This bearish channel may extend to the important support at 1.145. A break of this important support will form a Downtrend. Further upside recovery will remain limited by the channel, with the notable upper boundary at 1.16800.

📉 Key Levels

Sell trigger: rejection from 1.168 with bearish confirmation

Sell DCA: Break 1.155

Target: 1.145

Leave your comments on the idea. I am happy to read your views.

Prices

XAUUSD Weekly Trade Setup(14-18th July 2025) - Bullish StrategyIn the ever-volatile world of commodities, Gold (XAUUSD) has yet again presented a promising technical setup. For traders looking to capitalize on price action and structure-based strategies, the upcoming week (14th to 18th July 2025) offers a clean breakout and retest opportunity backed by a strong risk/reward ratio.

Let’s break down the trade plan in detail.

1. Overview of the Current Market Structure

As shown in the 4-hour chart, XAUUSD is approaching a key horizontal resistance zone around 3360–3370. Historically, this area has acted as a rejection point for buyers. However, the recent bullish momentum, supported by price trading above the 200 EMA, suggests a potential breakout.

This forms the basis of a Breakout-Retest-Continuation strategy – one of the most reliable setups in price action trading.

2. The Trade Plan

Here’s the structured plan for this setup:

🔵 Step 1: Wait for the Breakout

Price must break above the resistance zone (3360–3370) with a strong bullish candle.

Avoid chasing the breakout; instead, let the market confirm its direction.

🟠 Step 2: Look for the Retest

After the breakout, wait for the price to pull back to the broken resistance, now acting as support.

Confirm this retest with a reversal candlestick pattern (e.g., bullish engulfing or hammer) on the 1H or 4H timeframe.

🔴 Step 3: Entry and Stop Loss

Enter the trade after the confirmation candle closes.

Place a stop loss below the swing low of the retest zone.

This protects the trade in case of a false breakout.

🟢 Step 4: Set Your Target

The profit booking zone lies around the 3440–3450 region.

This setup offers a Risk/Reward Ratio of 1:4, targeting 1:2, 1:3, and potentially 1:4 if momentum continues.

3. Why This Setup Makes Sense

EMA Confirmation: Price is trading above the 200 EMA, showing bullish bias.

Clean Price Action: Well-defined structure makes it easy to identify breakout/retest levels.

Strong Risk Management: The stop is tight and logical, while the upside potential is considerable.

Psychological Support Zone: 3360–3370 has repeatedly acted as a key decision level.

4. Trade Management Tips

Trail your stop loss once 1:2 R:R is achieved.

Consider partial profit booking at 1:2 or 1:3 to lock in gains and reduce risk.

Be patient – the key to this strategy is waiting for the retest confirmation.

5. Final Thoughts

Trading XAUUSD can be both rewarding and risky. This weekly setup gives you a disciplined approach to enter the market at a high-probability point with excellent reward potential. Whether you’re a swing trader or an intraday scalper on lower timeframes, this strategy adapts well with proper confirmation.

Stay tuned for live updates, and as always – plan your trade, and trade your plan.

Happy Trading!

=================================================================

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

=================================================================

LTTS Weekly Trade Setup(14th-18th July 2025) – Parallel ChannelThis week, L&T Technology Services (LTTS) is showing a potential breakout opportunity that requires patience and precision. As the stock approaches a key resistance zone near ₹4445, traders should resist the urge to jump in early and instead wait for a breakout and confirmed re-test before entering any long positions.

Let’s break this down.

1. Why the Breakout is Important

- LTTS has been consolidating within a parallel channel between ₹4280 (support) and ₹4445 (resistance). Breakouts from such structures often trigger significant moves — but only when confirmed.

- A false breakout can trap early traders. Hence, waiting for the price to break above ₹4445 and then re-test this level is critical.

2. The Strategy – Wait and React

📌 Step 1: Watch for Breakout

Monitor price action as it approaches and breaches the ₹4445 resistance.

Look for strong bullish candles with volume to validate the breakout.

📌 Step 2: Wait for Re-test

After breakout, price may pull back to test the previous resistance.

This re-test acts as a confirmation that bulls are defending the breakout.

📌 Step 3: Look for Confirmation

Enter only when you see a bullish candlestick pattern (like a bullish engulfing or hammer) near the re-test level on 15-min or 1-hour charts.

🛡️ Stop Loss:

Place your stop below the swing low of the re-test.

This protects you if the breakout fails.

🎯 Target:

Profit booking zone is near ₹4580–₹4600.

Risk/reward ratio: 1:2, 1:3, 1:4+

3. Why Re-test Entries are Powerful

They allow low-risk entries with a tight stop loss.

You avoid chasing price and reduce emotional trading.

Confirmation helps you filter out false breakouts.

4. Final Words

In trading, discipline often beats speed. This LTTS setup is all about timing and structure.

🔔 Watch for the breakout.

🧘♂️ Wait for the re-test.

🎯 Enter only with confirmation.

If executed properly, this trade offers a clean, high R:R opportunity with a clearly defined setup.

Gold Price Analysis July 10🔹 XAUUSD Analysis – D1

Yesterday's D1 candle showed a strong recovery, closing above 3313, thereby significantly weakening the previous downtrend structure. Currently, the price is reacting very strongly at the trendline around 3284. Buying pressure is clearly appearing, pushing gold back to trading in a wide range.

In the short term, the 3328 area will play an important resistance role. If the price cannot break this area, the possibility of a correction down to the Gap price area this morning is quite high. The peak-bottom trading method is still giving suitable signals in the current market context.

🔹 Important zones:

Support: 3312 – 3295 – 3279

Resistance: 3328 – 3339 – 3349 – 3363

💡 Strategy:

Confirm the trading signal when the price clearly rejects the resistance zones to ensure the highest winning rate.

Gold Trading Strategy February 7✏️As expected from the analysis, after the D1 candle showed buying pressure again, the price continued its uptrend yesterday and reached 3357.

Currently, the price is consolidating within a relatively wide sideways range, extending from 3328 to 3344.

A trend-following trading strategy will be set up when the price breaks out of this range.

The BUY signal is expected to bring good profits if the price retests the support.

The SELL signal at resistance is considered to look for rebound points in an uptrend.

📈 Key Levels

Breakout Range: 3344-3328

Support: 3310-3298

Resistance: 3368-3386

📊 Recommended Trade Setups

BUY: 3310-3308 | SL: 3305

SELL: 3368-3370 | SL: 3373

USD/JPY Consolidation Triangle – Breakout WatchThe USD/JPY pair is currently trading inside a well-formed symmetrical triangle pattern on the daily chart. This structure typically forms when the market is in a phase of consolidation, with neither buyers nor sellers able to break the range. Price is compressing between a horizontal resistance zone (~146.50) and a rising support line (~143.50), indicating that a breakout in either direction may be imminent.

This triangle has formed after a sharp downtrend, followed by a broad base formation. Such setups often precede a decisive move, especially if accompanied by volume.

🔼 Upside Breakout Scenario

If price breaks and closes above the resistance zone (above 146.50–147.00) with bullish confirmation, we can expect momentum to shift in favor of buyers. A confirmed breakout would open the path toward 150.00+, possibly even retesting the highs of 2024 near 152.00. This would be seen as a bullish reversal after a prolonged downtrend.

🔽 Downside Breakdown Scenario

Alternatively, if price fails to hold the rising trendline and breaks below the 143.00–142.50 support zone, it may confirm a bearish breakdown. This would suggest a continuation of the earlier downtrend with fresh bearish momentum targeting 140.00 and lower levels.

🧭 Trade Strategy Consideration

Bullish Plan: Buy breakout above 147.00 with SL below 145.50 and TP near 150.50–152.00

Bearish Plan: Sell breakdown below 142.50 with SL above 144.00 and TP near 140.00–138.00

Neutral Bias: Wait for breakout confirmation; no trade inside the triangle

This is a tight volatility setup where breakout traders should stay alert. The longer the consolidation, the stronger the breakout move tends to be.

=================================================================

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

=================================================================

AUD/USD Parallel Channel Setup – Breakout or Pullback in PlayThe AUD/USD pair is trading within a clearly defined ascending parallel channel, with consistent rejections from both the upper resistance zone near 0.6550–0.6560 and repeated bounces from the rising support area near 0.6390–0.6400. This structured price movement indicates strong channel discipline, which traders can use for high-probability breakouts or reversal plays.

The current price action is approaching the upper boundary of the resistance, and a decisive breakout here could lead to a bullish rally toward the projected target.

📈 Bullish Breakout Scenario

If the price breaks and closes above the resistance zone (above 0.6560), it will confirm a bullish breakout from the channel. Based on the height of the channel, the projected breakout target is 0.67365, which is derived by measuring the vertical distance between support and resistance and projecting it upward from the breakout point. This could signal a major trend continuation in favor of the bulls.

📉 Bearish Rejection Scenario

If the price once again gets rejected at the resistance zone, a corrective move is expected toward the support area around 0.6400. The structure suggests that unless a breakout occurs, price may continue to oscillate within the rising channel. The next bearish leg could form a lower high and test the trendline support again.

🧭 Trading Strategy Outlook

Buy Breakout Strategy:

Entry: Above 0.6560

SL: Below breakout candle

TP: 0.67365 (projected target)

Sell Rejection Strategy:

Entry: Near 0.6550 resistance

SL: Above 0.6570

TP: 0.6400 support zone

This is a neutral-to-bullish setup, with a potential for continuation if the resistance breaks with strength. Traders should wait for confirmation before entering.

=================================================================

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

=================================================================

#NIFTY Intraday Support and Resistance Levels - 26/06/2025Nifty is set to open slightly gap up today near the 25,250 mark, signaling a continuation of the ongoing consolidation phase. The market has been hovering around this zone for the past couple of sessions, making it a key inflection point. A sustained move above 25,300 can trigger bullish momentum, leading to targets of 25,350, 25,400, and 25,450+. This level also coincides with previous intraday highs, making it a potential breakout zone for aggressive buyers.

On the flip side, if Nifty faces rejection from this resistance zone and slips below the 25,250–25,200 levels, a downside move could emerge. In that case, short positions can be considered with immediate support levels at 25,150, 25,100, and 25,050. The opening hour will be crucial—traders should monitor for either a breakout above 25,300 or a breakdown below 25,200 to determine intraday direction. Volatility may increase due to expiry, so a wait-and-watch approach with tight stop-losses is advisable.

US Unemployment Rising: How Is This NOT a Recession?The U.S. unemployment numbers are steadily climbing, as indicated by recent Bureau of Labor Statistics data. Typically, significant rises in unemployment correlate directly with recessions, which are shaded gray in historical data charts.

Currently, unemployment has reached over 7 million, significantly higher than recent lows. Historically, every similar increase has coincided with or preceded an official recession declaration. Yet, mainstream economic narratives have avoided labeling this a recession.

What does this data tell us, and is the market accurately pricing in the risk? Are we already in a recession, or is this time different?

Share your thoughts below. Let's discuss the disconnect between the unemployment reality and official recession narratives.

Berger Paints at Make-or-Break Point:Descending Triangle PatternBerger Paints is currently testing the upper boundary of a long-term Descending Triangle on the weekly chart — a pattern known for sharp breakouts or breakdowns.

📊 Resistance Zone: 600 – A breakout above this level could trigger a powerful upside rally towards 825+, supported by the pattern's height projection.

🔻 Support Level: 543 – A breakdown below this level may lead to a sharp fall towards 400 levels.

⚠️ Bearish Pin Bar Candle at resistance signals caution; confirmation is key before entering any trade.

📌 Watch closely for a decisive move – this zone is critical for trend reversal or continuation.

This setup offers a high-reward opportunity for positional traders, with clear entry and exit zones. Manage your risk wisely and follow with volume confirmation.

#NIFTY Intraday Support and Resistance Levels - 16/04/2025Today will be slightly gap up opening expected in nifty. After opening if nifty sustain above 23300 level then possible upside rally upto 23500 in opening session. This rally can be expected for further 200+ points in case nifty gives breakout and starts trading above 23550 level. Any major downside only expected below 23250 level.

Gold Price Analysis March 4⭐️Fundamental Analysis

The market is concerned about the risk of a global tariff war that seems inevitable. US President Donald Trump affirmed to impose 25% tariffs on Canada, Mexico and increase tariffs on China to 20%, leading to retaliatory measures from China and Canada, which could escalate into a full-blown trade war.

In addition, Trump suspended military aid to Ukraine, causing tensions with European allies. The market continues to monitor the upcoming US employment data, which could impact the Fed's interest rate policy, affecting the USD and gold prices.

⭐️Technical Analysis

Today's price range is focused on 2905 and 2877. The Dow trend will still be prioritized when Gold finds it difficult to close above important resistance zones. The Sell zones of 2905 and 2918 are heavily concentrated by sellers today. The furthest target of the week for gold will be to touch the bottom of last week around 283x. Pay attention to important price levels to have a reasonable BUY and SELL strategy.

Gold Price Analysis February 12⭐️Fundamental Analysis

Asian and European traders were cautious ahead of Fed Chairman Jerome Powell's remarks to Congress. Powell said he was in no rush to adjust monetary policy and wanted to see more progress on inflation, saying the economy was in a "pretty good place." His remarks helped stabilize financial markets, helping Wall Street trim losses and the dollar recover.

Powell will continue his testimony on Wednesday, and investors are also awaiting January CPI data, which is forecast to have risen 2.9% year-on-year, with core annual growth of around 3.1%.

⭐️Technical Analysis

Gold is accepting the 2941 area as a top, and the decline has created quite clear structures. 2873-2871 is an important support zone in pushing gold prices to increase again. If gold prices cannot close the h4 candle above 2890, it will be considered a confirmation of a dow breakout and a downtrend wave that can extend to 2833. In the direction of gold going up again, 2807 and 2827 will be the zones that the SELL side will pay attention to in order to participate in the market.

GOLD DUMP ... POSSIBILITY OR NAH?Hello everyone, hope you're all having a wonderful day !

Price is currently heading to a block of orders just around 70 and that's why M5 was used to sharpen entries for a tighter Stop... kindly use proper risk management if you're comfortable using a stop of 20 pips !

Happy new year everyone !

#NIFTY Intraday Support and Resistance Levels - 07/01/2025Expected nifty will open gap up in today's session near 23800 level. After opening any bullish movement expected if it's starts trading and sustain above 23800 level. Below 23750 downside rally expected upto the 23550 and this rally expected for further 200-250+ points movements in case nifty gives breakdown of 23450 level. 23450-23550 in this range possible some consolidation movements in market.

[INTRADAY] #BANKNIFTY PE & CE Levels(06/12/2024)Slightly gap up opening expected in banknifty. After opening expected it will continue the bullish rally towards the 53950+ level and this rally can extend for further 400-500 points in case banknifty starts trading and sustain above 54050 level. Downside 53550 will act as a support for today's session. Any major downside only expected below this support zone.

Bitcoin price Must surpass $100KBitcoin's price is seeing increased volatility around GETTEX:97K , and some crypto experts believe it’s on track to surpass $101K in the near term. Renowned analyst *PlanB* recently highlighted that Bitcoin’s current trajectory aligns with historical post-halving trends, suggesting significant upside potential. Similarly, a prominent advocate for Bitcoin, emphasized that growing institutional interest and adoption could fuel BTC’s rise past $101K. Our forecast anticipates Bitcoin reaching $100K by the end of 2024, driven by strong market sentiment following the halving event, with a potential to touch $270,593 by 2030 as institutional investments gain momentum.

BTC IN UP MOVEMENT + TRADE PLANTrend Identification:

Descending Channel: Bitcoin is currently in a descending parallel channel after an uptrend, indicating a potential bullish continuation if it breaks out of this channel.

Previous Uptrend: The price came from an uptrend, and descending channels often serve as continuation patterns, suggesting a higher probability of an upward breakout.

Key Support and Resistance Levels:

Support Levels:

$68,556.87: Major support near the recent low in the channel.

$66,333.98: Secondary support zone that could act as a cushion in case of a downside move.

$64,591.15: Historical support level providing a safety net if the price dips further.

Resistance Levels:

$72,198.87: Immediate resistance that BTC needs to overcome for a continued uptrend.

$73,655.67: Key resistance area that, if broken, could trigger a strong bullish move.

Indicators Analysis:

RSI (Relative Strength Index): The RSI is close to the midpoint, indicating a neutral zone. However, an upward movement in RSI could signal increasing bullish momentum.

Stochastic RSI: Currently near the overbought zone. It indicates potential upward pressure, but caution is needed as it may signal short-term exhaustion.

Volume: Noticeable increase in volume around the support levels, indicating buying interest. Volume confirmation on breakout above the resistance line would strengthen the bullish case.

Moving Averages:

HMA (Hull Moving Average): Showing a slight upward trend, aligning with the potential breakout from the descending channel.

Trading Plan

Entry Strategy:

Aggressive Entry: Enter a long position upon the breakout of the descending channel, ideally with a confirmed volume increase above $72,198.87. This would signal a possible continuation of the previous uptrend.

Conservative Entry: Wait for a confirmed breakout and retest of the $72,198.87 level. If the price holds above this level after retesting, it indicates stronger bullish confirmation.

Stop Loss:

Place a stop loss slightly below $68,556.87 to limit downside risk. This area aligns with recent support, and a drop below it may indicate invalidation of the breakout pattern.

Take Profit Levels:

Primary Target: $73,655.67 (first resistance level). Partial profits can be taken here to lock in gains.

Secondary Target: $76,000, if Bitcoin gains strong momentum after breaking through the primary target. This level could be achieved in a continued bullish scenario.

Final Target: $80,000 as a psychological target, if there is sustained bullish momentum and no major resistance above.

Risk Management:

Position Size: Limit the position size to manage risk exposure, especially with the potential volatility in cryptocurrency markets.

Trailing Stop: Consider using a trailing stop after reaching the first target to lock in profits while allowing for potential upside.

Monitoring Indicators:

Volume: Continuously monitor the volume as the price approaches resistance zones. Higher-than-average volume would support the breakout, whereas weak volume could lead to a false breakout.

RSI and Stochastic: Keep an eye on these momentum indicators. If the RSI and Stochastic enter overbought territory and start to diverge, it could signal a potential reversal.

Timeframe:

This setup appears on a 4-hour chart, suggesting a medium-term trading perspective. Reassess positions if the breakout fails to materialize within the next few days.

#NIFTY Intraday Support and Resistance Levels - 22/10/2024Flat opening expected in nifty. After opening if nifty nifty will face resistance at 24900 level and expected downside from this level. If nifty gives breakdown of 24700 level then possible strong downside fall upto 24450 level. Any major upside only expected above 25000 level.