The Leonardo (D)assaultIt is not a secret that Europe’s defence landscape has shifted dramatically to a pace unseen since the Cold War. In 2022, Central and Western Europe’s combined military outlays reached $345 billion, surpassing 1989 levels as the Cold War ended1. Where there is a commonly cited “peace dividend”, this is the era reaping the rearmament rewards. Even traditionally pacifist countries are upping their defence outlays, while frontline states like Poland and the Baltic nations are planning well above 2% of GDP (the NATO defence spending target) to bolster their militaries.

Of note, European officials, including the European Central Bank (ECB) (monetary) policymaker Olli Rehn, have explicitly called for joint EU programs to fund air defence and drone production to support Ukraine and strengthen Europe’s own defence, even if it means loosening fiscal rules2. When the monetary policy folks start weighing in on defence spending, it is best not to ignore it.

Dassault Aviation and Leonardo SpA, are integral to Europe’s defence-industrial base and they will be pivotal beneficiaries of the continent’s rearmament. Crucially, unmanned aerial vehicles (UAVs)—from surveillance drones to combat-capable systems—are an area where both firms are actively developing capabilities, aligning with Europe’s defence priorities.

Dassault Aviation, long synonymous with fighter jets, spearheaded Europe’s stealth unmanned combat air vehicle (UCAV) demonstrator nEUROn. Launched in the 2000s as a multinational project, nEUROn was led by Dassault Aviation with contributions from several European partners including Leonardo SpA (then Alenia)3. nEUROn combines many of the critical components of modern warfare systems including autonomous flight controls and low-observable (stealth) design. The project is also demonstrative of pan-European collaboration in UAVs. Not to be outdone, Leonardo SpA has developed its own family of medium drones (such as the Falco UAV series). Not to mention, its collaborations with companies like BAE Systems in the Eurofighter Typhoon and next-gen Tempest/GCAP fighter programs.

In essence, Dassault Aviation and Leonardo SpA are key enablers of Europe’s push for strategic autonomy in defence and are poised to benefit from the pivot to UAVs—a shift that began slowly at the beginning of the 21st Century and accelerated meaningfully with the experience gained from the conflict in Ukraine. European militaries have been paying attention; drones have proven their value for reconnaissance, target acquisition, and even precision strikes, fundamentally changing battlefield dynamics. It is a UAV world; legacy tech is just living in it.

While Dassault Aviation and Leonardo SpA aren’t major producers of small drones, it is not as though the two are going to be left behind. Leonardo SpA is developing anti-drone defences and electronic jamming systems. This makes sense. Increased drone usage increases demand for counter-UAV technologies, an area where Leonardo SpA’s electronics division is poised to benefit from radar and laser-based drone neutralisation4.

Alliances are the way forward

The surge in European defence spending is expanding the pie for industry, but it’s also intensifying both competition and collaboration among defence contractors. Interestingly, in the realm of UAVs, collaboration is often seen as the fastest way to close capability gaps. Both Dassault Aviation and Leonardo SpA have shown a willingness to team up with traditional competitors or even non-European firms when strategic.

To this point, Leonardo SpA embarked on a joint venture with Turkey’s Baykar Technologies to produce UAVs in Italy to exploit Baykar’s Ukraine combat-proven designs with Leonardo’s sensors and electronics. In a rapid turnaround, the venture plans to deliver its first product (based on Baykar’s Akıncı heavy drone) within 18 months5. And this is unlikely to be a one-off. Leonardo SpA’s CEO recently emphasised “alliances would be the way forward” to boost defence production without excessive new infrastructure6. The underlying theme is straightforward – making more stuff quickly is the goal.

Dassault Aviation and Leonardo SpA find themselves at the nexus of this transformation—bolstered by macroeconomic trends and political resolve and delivering the technologies that will define European security in the coming decades. The unfolding emphasis on UAVs is a microcosm of the broader story: drones have moved from peripheral acquisitions to must-have capabilities. UAV development, in particular, stands out as both a growth avenue and a strategic imperative. Dassault Aviation and Leonardo SpA are leveraging their deep expertise and forging new partnerships to ensure Europe’s militaries have the drones they require.

Conclusion

The narrative? Reallocation and rearmament. The timeline might be best described as “defence for the long run”. The beneficiaries are those positioned to meet Europe’s capability gaps. Dassault Aviation carries the mantle of Europe’s aerospace prowess and is now backed by a strong wind of political will and funding.

Sources:

1World military expenditure reaches new record high as European spending surges | SIPRI

2ECB's Rehn calls for joint European investment in air defence, drones | Reuters

3Dassault nEUROn to fly again, driving France’s new combat drone development - AeroTime

4Leonardo projects €30 billion in revenue by 2029 | Shephard

5Italy's Leonardo, Turkey's Baykar to set up drone joint venture | Reuters

6Leonardo CEO denies talks with automakers on military production | Reuters

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees, or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Production

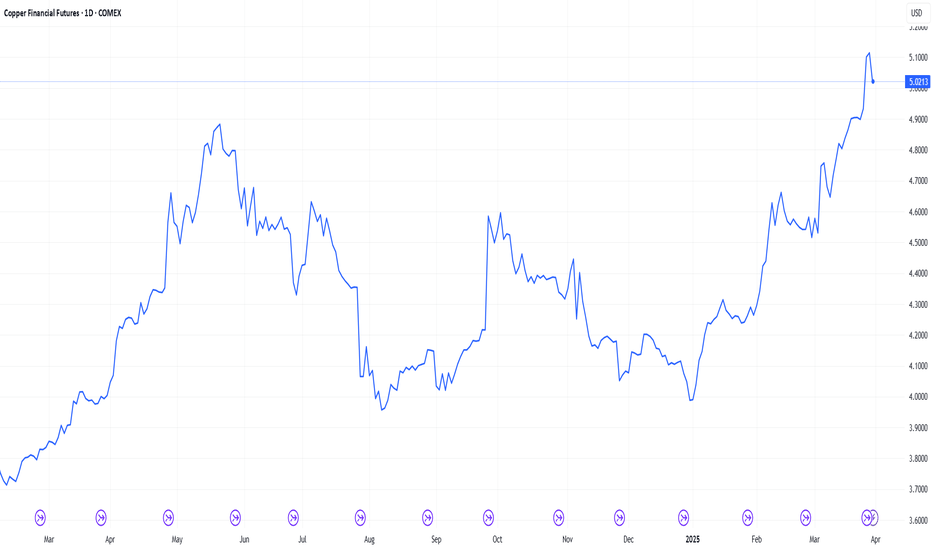

Copper is red hot right now. Here’s whyCopper’s COMEX price hit a new high on 26th March making the red metal red hot right now. The first three months of 2025 have seen industrial metals make noticeable gains with the Bloomberg Industrial Metals Subindex up 10.55% year to date1. Copper’s gains, however, stand out for numerous reasons.

Tariffs

The additional premium of COMEX prices over the London Metal Exchange (LME) prices reflects aggressive buying by US traders importing copper in anticipation of a possible 25% tariff on copper imports. This speculation has been fuelled by President Trump last month ordering a probe into the threat to national security from the imports of copper. As aluminium imports were also recently subjected to tariffs, markets are speculating that copper might be next.

This rush has triggered a shift in global flows, with metal moving out of LME warehouses and into US Comex facilities, where copper is held on a “duty paid” basis to avoid future levies. As traders front-run potential policy changes, this behaviour is tightening global supply and fuelling price gains, adding to a market already under pressure from rising demand and a looming supply squeeze.

Demand

China has given an additional boost to copper prices having announced a new action plan to boost domestic consumption by raising household incomes. The stimulus is seen as a positive signal for copper demand, especially as retail sales have already shown stronger-than-expected growth early in the year. China has also set itself a GDP growth target of 5% for 2025, and so far this year, its manufacturing Purchasing Managers' Index (PMI) has remained in expansionary territory — a sign that the economy is holding steady. With momentum building across consumption and manufacturing, copper is getting a fresh tailwind despite lingering weakness in the property sector.

Further support for industrial metals, including copper, has come from Germany’s recently unveiled €1 trillion infrastructure and defence spending plan — a move that will inevitably drive greater demand for base metals.

Supply

Supply tightness in the copper market is being driven by several structural and emerging challenges. Exceptionally low processing fees—caused by an oversupply of smelting capacity, particularly in China—have placed financial strain on global smelters, prompting companies like Glencore to halt operations at its facility in the Philippines. Looking ahead, Indonesia’s proposal to shift from a flat 5% copper mining royalty to a progressive rate of 10–17% risks discouraging future production growth. These supply-side pressures come as the International Copper Study Group reported a slight global copper deficit in January 2025. While a similar shortfall at the start of 2024 eventually turned into a surplus, this time the combination of weakening smelting economics, policy headwinds, and solid demand could make the current deficit more persistent and impactful.

Several major copper miners have recently downgraded their production estimates for 2025, adding further pressure to an already tight market. Glencore suspended output at its Altonorte smelter in Chile2, while Freeport-McMoRan delayed refined copper sales from its Manyar smelter in Indonesia due to a fire3. Anglo American expects lower output from its Chilean operations amid maintenance and water challenges, and First Quantum Minerals faces reduced grades and scheduled downtime4. These disruptions are likely to tighten global copper concentrate supply, potentially widening the market’s supply-demand imbalance just as demand continues to strengthen.

Sources:

1 Source: Bloomberg, based on total return index as of 28 March 2025.

2 Reuters, March 26, 2025

3 Reuters, October 16, 2024

4 Metal.com. February 14, 2025

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees, or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

A brewing storm for Arabica coffeeArabica coffee prices have experienced unprecedented volatility, with futures surpassing $4.30 per pound on February 10, marking the 13th consecutive record-setting session1. This surge is attributed to a confluence of climatic challenges, speculative trading activities, and inherent agricultural cycles.

Speculative trading and market volatility

The recent price escalation is significantly influenced by speculative trading. Increased margin requirements by the Intercontinental Exchange (ICE) have led traders to liquidate short positions, intensifying upward price momentum. The ICE raised margins by 10% to $10,410 per Arabica contract, nearly double from a year ago, requiring an initial daily payment of around $62,000 to trade 100 metric tons of Arabica2. This financial pressure has prompted some traders to exit the market, further reducing liquidity and amplifying price fluctuations. Over the past year, short positioning has declined by 64% while long positioning has risen only 1%3. Net speculative positioning is currently more than 1 standard deviation above the 5-year average evident from the chart below.

Drought conditions in Brazil

Brazil, the world's leading Arabica producer, has faced prolonged drought conditions since April 2024. These adverse weather patterns have significantly impacted coffee trees during their critical flowering stage, leading to concerns over reduced yields for the 2025/26 harvest. The drought-induced stress on coffee plants has been a primary driver behind the escalating prices.

According to the latest estimates by the United States Department of Agriculture (USDA), Brazil’s 2024/25 total coffee production is forecasted at 66.4mn bags4. Brazil’s coffee exports hit record highs in 2024 as they expanded their share of the global market, filling a gap left by other large producers such as Vietnam and Indonesia. According to USDA, ending stocks in 2024/255 are expected to be 1.24mn bags, marking a 26.4% decline versus 2023/24. As of 2025, the global coffee stocks-to-use ratio stands at approximately 12.42%, reflecting a constrained supply scenario6.

Biennial bearing cycle

Arabica coffee plants exhibit a biennial bearing cycle, characterised by alternating years of high and low yields. The 2024/25 season was an 'on-year', typically associated with higher production. However, due to the prevailing drought, even this 'on-year' did not meet expected output levels. Looking ahead, the 2025/26 season is an 'off-year', which traditionally yields lower production. Coupled with the current climatic challenges, this cyclical downturn is anticipated to exacerbate supply constraints, further influencing price trajectories.

La Niña phenomenon

The La Niña event, characterised by cooler-than-average sea surface temperatures in the central and east-central Pacific Ocean, has been in effect since January 2025. Historically, La Niña influences global weather patterns, often bringing drier conditions to South America. The National Oceanic and Atmospheric Administration (NOAA) projects a 66% chance of La Niña persisting through February-April 2025, with a transition to neutral conditions likely by March-May 20257. The phenomenon could lead to lower temperatures and frost in Southeast Brazil, intense rains in Indonesia and Colombia, and increased risks of tropical storms and hurricanes in Central America. In Southeast Brazil, lower temperatures and greater risks of frost threaten coffee crops. Indonesia may experience harvest delays or interruptions due to more intense rains, especially in Sumatra. Vietnam experiences negative temperature anomalies during the phenomenon, but their impact on yields remains uncertain. In Colombia and Guatemala, more intense rainfall can damage trees or increase susceptibility to disease.

Regulatory impact

The European Union's Deforestation Regulation (EUDR) aims to curb imports of commodities linked to deforestation, including coffee. Originally set for enforcement by the end of 2024, the regulation's implementation has been postponed by one year to December 2025. This delay offers producers additional time to adapt to stringent traceability requirements. Despite the postponement, the impending regulation has already influenced market dynamics, with European importers accelerating purchases to build inventories ahead of the compliance deadline. This pre-emptive buying has contributed to tightening global supplies and escalating prices.

Market outlook

While current prices reflect immediate supply concerns, market analysts anticipate potential easing in the longer term. A Reuters poll suggests that Arabica coffee prices could decline by approximately 30% by the end of 2025, contingent upon improved weather conditions and a resultant rebound in production8. However, this projection is predicated on the assumption of favourable climatic developments and the absence of unforeseen disruptions. In summary, the Arabica coffee market is navigating a period of significant volatility, driven by climatic adversities, speculative trading, and inherent agricultural cycles.

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees, or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

1 Bloomberg as of 19 February 2025.

2 Reuters as of 12 February 2025.

3 Commodity Futures Trading Commission from 6 February 2024 to 4 February 2025.

4 Coffee stocks-to-use ratio sourced from USDA reports.

5 Ibid.

6 United States Department of Agriculture as of December 2024. The stocks-to-use ratio is a critical metric in the coffee industry, representing the proportion of ending stocks relative to total consumption

7 National Oceania and Atmospheric Administration as of 13 February 2025.

8 Reuters Poll as of 13 February 2025

Caterpillar (CAT): Construction Strength Amid Industrial SlumpCharting Caterpillar can be challenging, given the complexity of its price structure, but it’s fascinating to see how well it respects Elliott wave theory and trend channels. Despite the difficulties, the adherence to these principles makes the analysis quite promising.

The construction sector for Caterpillar remains robust, while the true growth catalyst is expected from a recovery in the mining industry, driven by demand from China and other regions. However, it’s not all positive: industrial activity in the U.S. has been sluggish, with the Institute for Supply Management Purchasing Managers' Index falling below 50 in 21 of the last 22 months—marking one of the worst streaks on record. This industrial downturn certainly adds pressure.

On a higher time frame, there’s not much new to add. However, we are looking for Caterpillar to move higher to complete wave (3). As shown in the zoomed-in chart (the chart in the left frame), we can observe how accurately the price is moving within the trendline. The "best-case" scenario for us would involve a push above the channel, followed by a sell-off. If this happens, it will provide a clearer indication that a larger correction—wave (4)—is imminent.

Macro Monday 31 ~ Dallas Fed Manufacturing Index (Key Levels)Macro Monday 31

U.S. Dallas Fed Manufacturing Index

This Index is compiled from a monthly survey conducted by the Federal Reserve Bank of Dallas to assess the health of manufacturing activity in the state of Texas. It provides insight into factors such as production, employment, orders, and prices, offering a snapshot of economic conditions in the region.

Why is the Dallas Fed Manufacturing Index Important?

▫️ As stated above the index covers manufacturing activity in the state of Texas, the state of Texas ranks 2nd only to California in factory production & comes in at 1st as an exporter of manufactured goods, thus Texas is an important state for gauging manufacturing & production in the U.S. economy.

▫️ Texas also contributes an incredible c.10% towards the U.S. Manufacturing gross domestic product making the index an important metric to consider towards potential GDP trends in the U.S.

▫️ The Dallas Fed Manufacturing Index (DFMI) is one of several regional manufacturing surveys that feed into the national Purchasing Managers Index (PMI). The PMI is released later this week on Thursday 1st Feb thus the DFMI on Monday will give us an early indication of the potential direction of the PMI later in the week. FYI, I will be covering the PMI for you on Thursday so stay tuned for that.

How to read the index?

A reading above 0 indicates an expansion of the factory activity compared to the previous month; below 0 represents a contraction; while 0 indicates no change.

The Chart

The chart only dates back to 2005 so we have a limited dataset however we can still see definitive levels of importance and trends over this shorter historic backdrop.

A few findings from the chart:

The + 36.8 Level

Since December 2005 any time we have hit the +36.8 level on the chart it has typically represented a peak in manufacturing and production signaling that a decline would likely follow. This has occurred 3 times and each time within 20 – 23 months of this +36.8 peak we had a recession or a financial crisis.

1) December 2005

21 Months later we had the Great Financial Crisis.

2) June 2018

20 months later we had the COVID-19 Crash.

3) April 2021

23 months later the U.S Banking Crisis occurred in March 2023 resulting in 3 small to mid size banks failing.

- The remaining banks being saved by the Bank Term Funding Program (BTFP) which appears to have successfully contained the contagion for now. The BTFP is ceasing in March 2024 👀

▫️ We can see above that in the event we reach the +36.8 level in the future, history informs us that within 20 – 23 months major economic issues will likely present. If we had known this back in April 2022. After April 2022 the S&P500 fell 15% to its recent lows.

▫️ The National Bureau of Economic Research (NBER) could declare the current period we are in as a soft recession. For the last six recessions, on average, the announcement of when a recession started was declared 8 months after the fact meaning we will would only get confirmation of a recession once we are 6 - 8 months into it. Its worth noting that some recessions were confirmed by the NBER after the recession was over.

- 36.8 Level

A reading below the -36.8 level has historically confirmed a recession. We have not hit this level since the COVID-19 Crash with May 2020 being the last time we have been at this level.

Periods in Contractionary Territory

There have been 2 previous periods where we have remained in contractionary territory for greater than 6 months. These are worth reviewing as we have been in contractionary territory for the 20 months now (April 2022 - Present).

1) Sept 2007 – Nov 2009:

We fell into contractionary territory during the Great Financial Crisis for 26 months. From 2009 to 2016 the index seemed week oscillating around the 0 level and not really breaking out into persistent expansionary territory until 2017 forward.

2) Jan 2015 – Oct 2016:

We fell into contractionary territory for 21 months however there was no recession.

3) Apr 2022 – Present:

We are currently on month 20 of contraction. Now this could be just like point 2 above whereby we recover to expansionary territory in month 21 or 22 (Jan - Feb 2024) however if we do not, we are moving towards a timeline similar to point 1 which was the 26 month Great Financial Crisis. Q1 of 2024 will be very revealing in terms of what we can expect next. In the event we end up in contraction for 26 months or if we hit the -36.8 level we can presume, based on history, that we likely have a recession on our hands. And, if we recover into expansionary territory maybe we have got away with it this time 🙂

You can clearly see that the Dallas Fed Manufacturing Index is significant for assessing the U.S. economy because it provides timely insights into the health of one of the nation's key economic sectors: manufacturing & production. Since Texas is a major hub for manufacturing activity, trends observed in the Dallas Fed index can offer valuable indications of broader economic trends. It is one of several regional indices that contributes to a comprehensive understanding of the manufacturing landscape, aiding policymakers, investors such as ourselves, and businesses in making informed decisions about the state of the economy.

The current economic environment just gets more and more interesting every week

Thanks for coming along again folks 🫡

PUKA

BTC 2.0 PREDECTION From $0,10 TO NEW ATH $1.59 - 2023Thank you for taking the time to review our update. It's essential to emphasize that the following information is not intended as trading advice,

The max supply same as BTC 21M and the TA trends will make this coin able to break .

BTC 2.0 demonstrating significant changes in trading volume, representing a new cryptocurrency with inherent high-risk However, if BTC 2.0 manages to sustain a value of $0.08 or higher, there is the potential for upward momentum and a potential break on low time frame.

We expect that BTC 2.0 is able to gain from the target $0,10 to $1.59 in 2023

Our low time frame with the first TARGET $0,20 and main update.

#Nottradingadvice

#For day traders take always profits when market increase

RSI AND VOLUME FLOW POINT TO DIRECTION SHIFT IN XOPXOP

Using $XOP as representative of the Oil and Gas Exploration Industry.

Pearson's R^2 = 0.95 indicating strong tendency for signal to centralize around its multi-year linear mean (LM, 150.22).

Signal currently resides just above the lower third standard deviation (-3) off the linear mean(LM).

Statistically speaking it would be tough to hold this position for very long and I would expect for signal to either breakdown below the (-3) or mean revert upward toward the LM in the next couple weeks.

In this case a mean reversion up to the LM at 150.22 would be necessary for the current multi-year trend to be maintained at its current trajectory.

Trend breaks down with signal below the -3 (119.06).

Price declining into stronger relative strength and positive volume flow (VFI) can be a sign of the market 'absorbing' price at these levels.

This can be indicative of 'seller exhaustion' and often precedes an 'increased potential' for a directional change in price trend.

(NOT FINANCIAL ADVICE)

Heating oil and gasoline supply remain tightOil demand, driven by China is an area of strength, but a slowing Chinese economy could weaken this. However, OPEC’s resolve to keep markets tight is strong. Petroleum product markets – heating oil and gasoline – are especially tight with inventory significantly below normal and prices have hit ‘golden crosses’ : technical analyst parlance for bullish conditions. Positioning in heating oil futures is a standard deviation above 5-year average after rising by 49% last month1. A combination of rising longs and contracting shorts drove the trend amid a 17% rally in heating oil in the past month1.

Heating oil inventory has fallen 15% and inventory is now than a standard deviation below 5-year average2. While not as steep as last year, the 0.8% positive roll yield on heating oil futures marks a break from the pre-2022 historic trend of contango in August3. At 8.6%, the positive front month roll yield on gasoline futures appears larger than seasonally normal (although a positive front month roll is expected at this time of the year)3.

According to the International Energy Agency (IEA), world oil demand is scaling record highs, boosted by strong summer air travel, increased oil use in power generation and surging Chinese petrochemical activity. Global oil demand is set to expand by 2.2 mb/d to 102.2 mb/d in 2023, with China accounting for more than 70% of growth. With the post-pandemic rebound running out of steam, and as lacklustre economic conditions, tighter efficiency standards and new electric vehicles weigh on use, growth is forecast to slow to 1 mb/d in 2024. Russian oil exports held steady at around 7.3 mb/d in July, as a 200 kb/d decline in crude oil loadings was offset by higher product flows. Crude exports to China and India eased month on month but accounted for 80% of Russian shipments.

Global observed oil inventories declined by 17.3 mb in June, led by the OECD. Non-OECD stocks and oil on water were largely unchanged. OECD industry stocks fell by 14.7 mb, in line with the seasonal trend, to 2,787 mb. Industry stocks were 115.4 mb below the five-year average, with product inventories particularly tight. Preliminary data observed by the IEA suggest global inventories drew further in July and August.

Refiners are struggling to keep up with demand growth, as the shift to new feedstocks, outages and high temperatures have forced many operators to run at reduced rates. Tight gasoline and diesel markets have pushed margins to six-month highs. Heating oil (Ultra Low Sulphur Diesel) prices rose 17% in the past month, reflecting this tightness.

OPEC+’s aggressive cuts are continuing to tighten the oil market. Saudi Arabia’s voluntary supply cuts have helped oil curves remain in backwardation.

Source:

1 Commodity Futures Trading Commission as of 15 August 2023

2 change in inventory over the past 3 months, United States Department of Agriculture as of 15 August 2023

3 Calculated as difference between front month and second month futures prices as of 15 August 2023

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

go long Desktop Metal $DMTechnical Thesis:

-double bottom

-20 day MA on the verge of a steep cross up through the 50 day MA

-average volume is trending upwards

-it broke out with significant volume

Fundamental Thesis:

-YoY Profit margins are trending upward

-from 2018 to 2020 their debt to assets has fallen significantly

-on the Macro side, with the ability of large-scale production and companies now needing to diversify their suppliers, Desktop Metal should benefit from growing their amount of clients, increasing cash flow allowing for more R&D, paying off debt, and improving margins.

-possibility of being acquired, possibly by an automaker to improve the speed that they can produce. (like Tesla trying to acquire Velo3D)

-currently the 2nd largest holding in Cathie Wood's PRNT ETF at the time of this post. in-flows will help the stock

-they are figuring out a way to 3D print synthetic wood, which would make them an ESG play since it would reduce the need to cut down trees. Becoming an ESG play will only result in more in-flows.

-Oppenheimer and Credit Suisse initiated coverage. The street is starting to take notice.

Price Targets:

Credit Suisse: $14

Oppenheimer: no target

Sources:

www.forbes.com

www.dailyadvent.com

www.streetinsider.com

$CINR october update*This is not financial advice, so trade at your own risks*

*My team digs deep and finds stocks that are expected to perform well based off multiple confluences*

*Experienced traders understand the uphill battle in timing the market, so instead my team focuses mainly on risk management*

Recap: My team first began diving into the soda ash industry when a data report which detailed an increasing demand for sodium carbonate was released earlier this year. During our research we stumbled across $CINR. $CINR is engaged in the production and sales of soda ash. $CINR has a facility located in Green River, Wyoming where the compound is resourced.

My team first entered $CINR at $14.28 per share.

$CINR currently sits at $16.38.

Next earnings are expected to be released on 11/1/21.

Our first take profit remains $18.28.

If you want to see more, please like and follow us @SimplyShowMeTheMoney

Overproduction, greed and a lack of shippingThis is a production chart and the last of my economic charts. I want to take a second to think back to 2020 here. The world shut down, when it reopened the Suez Canal got blocked, shipping is still no where near recovered. The rich are pulling PMs off the Comex as a silver squeeze happened, and a lack of shipping on top of this and scalpers lead to SO MUCH tech not being available. Is till can't get a new GPU or PS5 AT ALL. then you had massive food issues, droughts, oil pipeline attacks in America and the middle east, incompetent world leaders and fighting between nations and soooooo much more. It's of no surprise to me that bond investors my be getting spooked, on the other hand, with great risk comes the potential for great reward. Just something to think about the next time you order fast food and find only one person working 60+ orders or order something from amazon and find it got lost in that black hole never to be seen until you get on their case.

My next charts will be a few TA on some of my favorite crypto, MEME coins and stocks and what I have been looking at for trades afterwards

Oil has strongly broken through the $60 lvlOil has risen strongly above the $60 level. The price action has been very bullish with closes near the highs of the day.

I believe the reasons for this is anticipation of demand rising again as nations opens back up and vaccines are distributed again, followed by stimulus being distributed.

The market is pricing in Texas production cuts as this will curtail supply.

"As much as 1 million barrels a day of crude oil production has been affected by the winter storm, Bloomberg reported, while power outages have also had an impact on pipeline flows and refinery operations."

In addition, there was not great investments made in increasing production which will hamper supply as well.

As far as I can tell, I anticipate us trending higher and perhaps attempting to penetrate the $65 level. If the price were to pull back I think we will see an attempt to defend $60 followed by strong support at $55.

Pivot examples of support can be viewed here:

Lastly we can see strong bullish volume, followed by the oscillators clearly displaying a rise into overbought territory. Even in a bull market, we typically see some sideways chop as the price tends to meet the mean before heading higher. This process is often why bull flags form. That tendency for mean reversion.

Good luck trading the widow maker friends! Hope you make a million.

Bitcoin ChinaI have updated the values of the bitcoin production cost indicator for the Chinese province of Sichuan (35% of hashrate share) where the cost of electric current does not exceed 1 cent per kilowatt hour. For a miner located in this Chinese province the cost to produce a whole bitcoin does not exceed 4000 dollars, this price falls within the support area of my kama bands on the monthly chart.

I believe that if this fall there will be a second wave of the virus combined with a new lockdown there could be panic in the markets again. Personally, I'm going to increase my bullish position by buying in the $2,500 / $4,000 price range.

Long Term UpdateThe situation hasn't changed much since the last update apart from the halving that brought the average cost of mining 1 btc to $13500, it's an average world value but it means that at the moment few miners are at profit. Considering the minimum possible value of the CBEI index the cost to mine a single bitcoin drop to 7400$. Few miners are at profit at the moment, for more info about the CBEI go to www.cbeci.org

This will be the most brutal Bitcoin Halving in history.Production cost is about to double to $14,000.

70% above the current price.

Last halving, price was just 10% below Production cost, and Price & Hash Rate collapsed -20%.

Bitcoin Production Cost script just updated with the latest data:

- CBECI electrical data as at 11 May 2020

- Now uses 2 week rolling data for finer granularity (while balancing TradingView load time).

- Uses 4c/kWh (lower end of CBECI and Coinshares global average Mining electrical cost estimates).

Without FOMO now (large price appreciation over next week), expect a big miner capitulation: 30%+ reduction in Hash Rates.

EGO $EGO Eldorado Gold 158M Shares O/S - Strong 32% Ego with a Strong move out of the ascending triangle after a earnings surprise. Gold is looking like an excellent hedge here against the spreading corona virus and slowdown of economic growth. EGO has a heavier position with me due to its smaller share structure, a lot of these miners have really high share counts and wanted to be better positioned in one that could move strong on some serious momentum. Another notable mention I Like is HMY Harmony Gold a strong position there aswell. Stocks are overvalued and I don't see any better place to be than gold... Please drop a like and follow guys feel free to reach out in my message box Aswell. Goodluck. Long $12 Calls.

Soybean Futures Momentum BearishThis week price closed with strong bearish momentum after hitting the reversal zone.

With production estimated up, and uncertainty with China trade, the bearish momentum may push further to 854 - 820 level in coming weeks.

Looking to complete the downward range to -27.2% level of the weekly Fibonacci retracement range.

OSCI ready to mine gold?It has been a long road and you can see part of that under the $PYHH idea I previously published. $OSCI has filed a large number of financials in the past 2 days and I'm expecting them to go current on OTCMarkets.com followed by some news and hopefully production ramping up. We've seen a lot of activity over the past few months on the property, mostly posted to www.facebook.com

starting to fall , brace your sellit might only be the begining Texas oil , is as much as ever tide very closely to political event and oversupplie problemes . Cut of production have almost run there course and price action has never been able so far to go above the 54 55 area .Cut did not produce the push in price action and shelloil producer are still pomping a lot and are not planing to cut production , more like the oposite . So the plane is still , has it's been for some time now to let it run higher , wait for buyer to tired and thell suck it back down . Opening will be very interresinting because for all purpuse curent are decent to short from there (52.9) to 53.75 above that mark long can be swept in at least to the 55 ish area .

and as always if you want to talk more in detail about oil and other we are here posting daytrading to longterm analysis

www.facebook.com

DATA VIEW: US INDUSTRIAL PRODUCTION UPDATE - STALLING TRENDSSituation at industrial production in the US hints of a stalled recovery around 2008 highs, which is a risk, considering the fact that current base year for the indices was recently updated to 2012 (so there is no base effect in the index now)

Total industrial production has recovered past its 2008 highs, but stalled somewhat at current levels since about a year ago.

Manufacturing, on other hand, did not yet recover completely, however also stalled at current levels together with total index.

Thus overall the situation in the indices hints of a slowdown in growth, which is not a crisis situation, but is already a risk factor to watch.

DATA VIEW (NOT A FORECAST): US INDUSTRIAL PRODUCTION GROWTH FINEIndustrial Production Index has been trending within its relevant ascending range since 2011 and has restored all the losses of the 2008-2009 financial crisis back in mid-summer 2013.

Thus overall the Industrial production in the US is developing at a good pace, in line with the lateral uptrend in S&P 500.