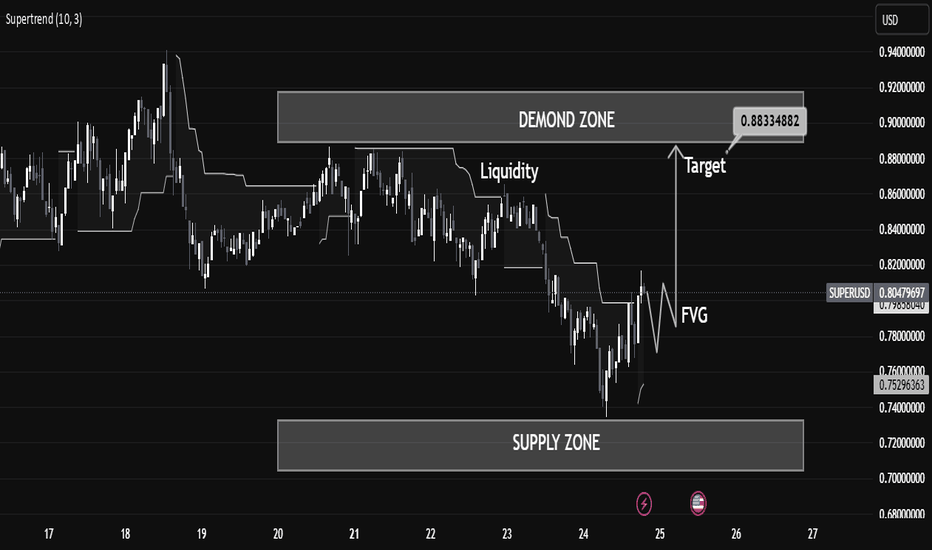

Smart Money Trap Identified! FVG + Liquidity Grab“Smart Money Trap Identified! FVG + Liquidity Grab Before Super USD Skyrockets to Target Zone ”

⸻

🧠 Technical Breakdown:

1. Liquidity Sweep (Manipulation Phase):

We see price aggressively sweep local liquidity around July 23, likely triggering stop-losses of early longs or breakout traders. This is a classic Smart Money trap, where big players induce volatility to grab liquidity before a move in the real direction.

2. Fair Value Gap (FVG):

A clear bullish FVG (imbalance) has formed post-liquidity grab, suggesting a potential institutional entry zone. This imbalance typically acts as a magnet for price and an entry point for Smart Money after manipulation.

3. Demand Zone & Target Projection:

• Price is now reacting from a well-defined Demand Zone, with clear rejection wicks indicating aggressive buying interest.

• The target zone (0.88334882) sits just below a previous supply zone, aligning with a potential distribution area where Smart Money may begin profit-taking.

4. Supertrend Indicator:

The supertrend has flipped bullish, confirming potential momentum shift, supporting the bullish bias as long as the FVG holds.

5. Confluence Factors:

✅ Liquidity Grab

✅ FVG Reaction

✅ Demand Zone Bounce

✅ Supertrend Confirmation

✅ High-Risk/High-Reward Entry Before Smart Money Run

⸻

🎯 Trade Idea (For Educational Purpose Only):

• Entry: On pullback into the FVG zone

• Stop Loss: Below the recent swing low or Demand Zone

• Target: 0.8833 (inside the upper supply/demand imbalance)

⸻

🧠 Educational Note:

This chart beautifully showcases how market makers operate — manipulate liquidity, fill imbalances, and target inefficiencies. Always think like Smart Money, not retail traders.

Professionaltrader

BTC short term Wave countAnalyzing a Bitcoin (BTC) form Wyckoff schema in a 4H chart.

We can’t determine if it’s an accumulation or distribution yet. Based on MACD and Elliott Wave Theory, I believe the chart will follow a similar pattern. However, time will determine the outcome. If BTC declines and accumulates within a shorter time frame of Elliot support levels, it could be a long trade opportunity.

(This analysis is not financial advice. Your actions are solely your responsibility.)

GOLD MONTHLY CHART LONG TERM ROUTE MAP ANALYSISMonthly Time Frame Analysis for GOLD

Dear Traders,

Attached is the Monthly Chart Route Map for GOLD. Since October 2023, we have consistently analyzed and traded GOLD with 100% target accuracy. The Golden Circle areas marked on the chart highlight our precise analysis and successful target achievements.

Key Highlights:

* After successfully hitting TP1 and TP2, the candle has closed above TP2.

* EMA5 has crossed and locked above the TP2 level at 2603, confirming upward momentum.

* The EMA5 detachment process has been completed successfully.

* As previously noted, the Fair Value Gap (FVG) provided robust support at 2535, facilitating the upward push.

What’s Next for GOLD?

Based on these confirmations, we anticipate hitting TP3 this month. However, we have identified two significant GOLDTURN levels at 2702 and 2603.

In the short term, we may see some bearish movements, but the monthly chart reveals the bigger picture: a sustained long-term bullish trend. This kind of temporary reversal strengthens the bullish trend and offers an excellent opportunity to buy at dips near support levels, reducing risk.

Recommendations:

To understand the support structure in greater detail, refer to our smaller time frame analyses, which will help you identify optimal dip-buying opportunities while keeping the long-term gaps in mind.

As always, we’ll keep you updated with daily insights. Don’t forget to check our analyses on weekly, daily, 12H, 4H, and 1H time frames.

We appreciate your continued support! Please show your encouragement by liking, commenting, and sharing this post.

The Quantum Trading Mastery

GOLD WEEKLY CHART MID/LONG RANGE ROUTE MAP UPDATEDWeekly GOLD Analysis: February 2024

Hello Traders,

Here’s a weekly chart analysis of the GOLD, offering a comprehensive view of recent market trends and future predictions. Our diligent tracking since October 2023 has consistently delivered 100% target accuracy, as evidenced by the marked Golden Circle areas on the charts. Let’s dive into the highlights and what lies ahead.

Recap of Recent Successes

Weekly Chart Highlights:

Last week, the market flawlessly followed our predictions:

* Key Level 2735 ✅ DONE

* Entry Level 2735.88 ✅ DONE

* EMA5: Crossed and locked above Entry ✅ 2735 DONE

* Bullish Target TP1: 2877 ✅ DONE

* The FVG zone around 2735 sustained bullish momentum, while resistance was broken, leading to a new all-time high of 2886.

What’s Next for GOLD? Bullish or Bearish?

We anticipate continued bullish momentum with updated GOLDTURN levels and refined targets.

Key Level: 2735 remains critical.

EMA5 Behavior:

* If EMA5 holds above 2735 and crosses/locks above TP1 (2877), the next target is TP2 (3018), followed by TP3 (3160).

* A failure to hold above 2735 could indicate bearish momentum, prices will be retesting support at 2595 in the demand zone.

Recommendations & Strategy:

* Focus on EMA5: Its behavior near 2735 and TP1 will provide clear direction for short- and long-term trades.

* Support Levels: GOLDTURN levels at 2735 and 2595 are critical for identifying reversal zones and optimal dip-buying opportunities.

* For precise entry and exit points, review our daily, 12H, 4H, and 1H analyses to navigate the market confidently.

* Slight pullbacks may occur, with potential reversals near GOLDTURN levels.

* Long-Term Outlook: The monthly chart suggests sustained bullish momentum, offering excellent opportunities for dip-buying near key support zones.

Stay Updated:

We’ll continue to share daily updates, insights, and strategies on our TradingView channel and YouTube channel every Sunday. Don’t forget to like, comment, and share to support our work and help others benefit!

The Quantum Trading Mastery

GOLD WEEKLY CHART MID/LONG RANGE ROUTE MAP UPDATEDWeekly GOLD Analysis: 17th February 2025

Hello Traders,

Here’s a weekly chart analysis of GOLD, offering an in-depth look at recent market trends and future outlook. Since October 2023, our consistent tracking has achieved 100% target accuracy, as shown by the Golden Circle markers on the charts. Let’s break down the highlights and what’s next.

Recap of Last Week’s Successes

Weekly Chart Highlights:

* EMA5 crossed and settled above Entry ✅ 2735 reached

* Bullish Target TP1: 2877 ✅ Achieved

* GoldTurn Levels at 2875 activated twice ✅ Reached

What’s Next for GOLD? Bullish or Bearish?

After hitting ENTRY LEVELS at 2735 and TP1 2877, we saw a small close above 2877 last week, leaving 3018 open as a potential target. We mentioned that an EMA5 lock would confirm this movement.

While EMA5 hasn’t locked yet, the close from last week provided a solid push upward, gaining over 500 pips. The long-term gap remains open, with more movement likely after last week’s candle body close.

Key Level: 2735 remains a critical zone.

GoldTurn Levels at 2875 and 2735 are active, and the price may revisit these levels before bouncing back to reach TP1 and beyond.

Recommendations & Strategy:

* Focus on EMA5: Watch its behavior around 2877 for key signals on short- and long-term trades.

* Support Levels: GoldTurn levels at 2875 and 2735 are vital for identifying reversal points and prime dip-buying opportunities.

* FVG Support: A range between 2835 and 2850 is also supportive.

For precise entry and exit points, check our daily, 12H, 4H, and 1H analyses for clearer market guidance.

We’ll continue to provide daily updates, insights, and strategies on our TradingView and YouTube channels every Sunday. Don’t forget to like, comment, and share to support our work and help others benefit!

The Quantum Trading Mastery

GOLD DAILY CHART MID/LONG TERM UPDATEGOLD Daily Chart Update: 24th FEB 2025

Hi Everyone,

Here’s the latest update on the GOLD daily chart, which we've been closely monitoring and trading. Below, we break down recent price movements, updated key levels, and provide actionable insights for the days ahead.

Recap of Recent Chart Success!

Gold recently achieved a record high of $2,954.80. Our analysis has consistently highlighted that after reaching each target level, prices tend to reverse by over 40+ pips to the GoldTurn level. This pattern was evident when, after hitting TP3 at $2,933, the price retraced more than 40+ pips to the GoldTurn level at 2870, which acted as a support, before rebounding bullishly to surpass resistance and reach the all-time high of $2,954.81.

Current Outlook: Bullish or Bearish?

Presently, gold's price is oscillating between a resistance gap at $2,990 and a support gap at $2,933. The $2,990 level serves as a key resistance, while $2,933 acts as support. Additionally, the Fair Value Gap (FVG) offers support at $2,920.

In summary, while the long-term outlook remains bullish due to factors like central bank demand and economic uncertainties, short-term fluctuations between the $2,933 support and $2,990 resistance levels are expected. Traders should monitor these key levels and indicators closely to inform their strategies.

KEY LEVEL: 2870

Resistance Levels: 2990, 3052

Support Levels (GoldTurn Levels): 2933, 2870, 2801, 2744, 2671, 2595

EMA5 Behavior:

* Or If EMA5 crosses and locks above 2933, it strengthens the bullish case.

* If EMA5 fails to hold above 2933, cross and lock below this level 2933, expect a pullback to key GOLDTURN levels below.

Recommendations:

* Capitalize on Dip Opportunities: Use smaller timeframes (1H, 4H) to trade around GOLDTURN levels, targeting 30–40 pips per trade.

* Stay focused on shorter trades in this range-bound market to manage volatility effectively.

Long-Term Bias:

Maintain a bullish outlook while viewing pullbacks as buying opportunities.

Accumulate positions near key support levels for a safer approach instead of chasing highs.

Final Note:

Trade with confidence and precision. Our analysis ensures you’re well-prepared to navigate the evolving market landscape. Stay updated with our daily insights across multiple timeframes for deeper clarity.

Thank you for your continued trust! Don’t forget to like, share, and comment to support our work.

Best regards,

The Quantum Trading Mastery Team

GOLD 4H ROUTE MAP TRADING PLAN / READ CAPTION CAREFULLYGOLD 4H Chart Analysis – 12th Feb 2025

Dear Traders,

Here’s the latest update on our 4H chart. It’s been a productive week! If you reviewed our previous chart on the 11th of February, today’s analysis should help guide your trading plan for the week.

Chart Color Codes:

* Red boxes (right): Support levels labeled as GOLDTURN LEVELS. A small red circle marks activation after short reversals.

* White GOLDTURN LEVELS (top): Not yet activated.

* Green boxes on the top(left): New Take Profit Targets.

* Green boxes with red outlines: Achieved targets.

* Grey button: Entry point from the 11th of February.

Review of Previous Chart:

Entry Level: 2814

Take Profit 1: 2850.15 ✅ (Hit)

Take Profit 2: 2876.95 ✅ (Hit)

Take Profit 3: 2903.76 ✅ (Hit)

Take Profit 4: 2925.85 ✅ (Hit)

We observed three reversals of 20–40 pips, highlighted with red circles.

New Take Profit Levels Added: TP5, TP6, TP7, and TP8

Key Focus Areas:

Identify Key Levels, Resistance, Support, and watch EMA5 closely. EMA5 behavior will determine the next price direction.

Key Levels:

Key Level: 2900

Resistance Levels: 2925, 2952, 2984, 3017, 3052

Support Levels: 2876, 2852, 2828, 2803, 2776, 2747

EMA5 Status:

Current EMA5: 2898.14

Bullish Targets

EMA5 cross and hold above 2900, will open the following bullish target 2925 again

EMA5 cross and lock Above 2925, will open the following bullish target 2952

EMA5 cross and lock Above 2952, will open the following bullish target 2984

EMA5 cross and lock Above 2984, will open the following bullish target 3017

EMA5 cross and lock Above 3017, will open the following bullish target 3052

Bearish Targets

EMA5 hold and cross Below 2900: will open the following bearish target 2876

EMA5 cross and lock Below 2876: will open the following bearish target 2852

EMA5 cross and lock Below 2852: will open the following bearish target 2828

EMA5 cross and lock Below 2828: will open the following bearish target 2803(Retracement Range)

EMA5 cross and lock Below 2803: will open the following bearish target 2747 (Swing Range)

Trading Plan:

* Stay bullish and buy pullbacks from key levels.

* Avoid chasing tops—focus on buying dips.

* Use smaller timeframes for entries at Goldturn levels.

* Aim for 30–40 pips per trade for optimal risk management.

* Each level can yield 20–40+ pips reversals.

Trade with confidence and discipline. Stay tuned for our daily updates! Please support us with likes, comments, and follows to keep these insights coming.

📉💰 The Quantum Trading Mastery

GOLD 1H CHAR ROUTE MAP & TRADING PLAN FOR THE WEEKGOLD 1H Chart – 12th Feb 2025

Dear Traders,

Here’s the latest 1H chart analysis, outlining key levels and targets for the week.

Gold is currently trading between two critical levels, with a gap above 2905 and below 2883. A confirmed EMA5 crossover and lock above or below these levels will indicate the next price direction. Until then, expect price fluctuations as these levels are tested repeatedly.

Keep in mind that Inflation and CPI data are due today and tomorrow. While fundamental analysis plays a role in predicting gold's movement, our advanced technical analysis is essential for precise entry and exit points during these volatile geopolitical times.

Our strategy remains focused on buying dips and monitoring key levels to identify potential bounce opportunities. Stay sharp!

Resistance Levels: 2905, 2920, 2942, 2963, 2982, 3001, 3021, 3043

Support Levels: Gold Turn Levels : 2883, 2852, 2837, 2817,

Retracement Range: 2802 - 2817

Swing Range: 2747

EMA5 (Red Line) Analysis:

* Currently fluctuating between 2886 and 2905

* EMA5 positioning will be crucial in determining the next trading direction.

Bullish Targets:

EMA5 cross and lock Above 2905 → will open the following bullish Target 2920 ✅Done

EMA5 cross and lock Above 2920 → will open the following bullish Target 2942 ✅Done

EMA5 cross and lock Above 2942 → will open the following bullish Target 2963

EMA5 cross and lock Above 2963 → will open the following bullish Target 2982

EMA5 cross and lock Above 2982 → will open the following bullish Target 3001

EMA5 cross and lock Above 3001 → will open the following bullish Target 3021

EMA5 cross and lock Above 3021 → will open the following bullish Target 3043

Bearish Targets:

EMA5 cross and lock Below 2883 → will open the following bearish Target 2852

EMA5 cross and lock Below 2852 → will open the following bearish Target 2837

EMA5 cross and lock Below 2837 → will open the following bearish Target 2817

EMA5 cross and lock Below 2817 → will open the following bearish Target 2802 (Retracement Range)

EMA5 cross and lock Below 2802 → will open the following bearish Target 2747 (Swing Range)

Trading Plan:

* Stay bullish and buy pullbacks from key levels.

* Avoid chasing tops—focus on buying dips.

* Use smaller timeframes for entries at Goldturn levels.

* Aim for 30–40 pips per trade for optimal risk management.

* Each level can yield 20–40+ pips reversals.

Trade with confidence and discipline. Stay tuned for our daily updates! Please support us with likes, comments, and follows to keep these insights coming.

📉💰 The Quantum Trading Mastery

GOLD DAILY CHART MID/LONG TERM UPDATEGOLD Daily Chart Update: 17the FEB 2025

Hello Traders,

Here’s the latest update on the GOLD daily chart, which we've been closely monitoring and trading. Below, we break down recent price movements, updated key levels, and provide actionable insights for the days ahead.

Recap of Recent Chart Success!

Our recent analysis has proven highly accurate:

ENTRY LEVEL 2744: ✅ Achieved

TARGET TP1 (2807): ✅ Achieved

TARGET TP2 (2870): ✅ Achieved

TARGET TP3 (2933): ✅ Achieved

What’s Next for GOLD? Bullish or Bearish?

Last week, GOLD reached an all-time high of 2942.59. Currently, the price is fluctuating between the gap above 2933 and the gap below 2870. 2933 is acting as a key resistance level, and an FVG (Fair Value Gap) has formed to reinforce this resistance. As a result, our GoldTurn levels are now activated as key support zones.

KEY LEVEL: 2870

Resistance Levels: 2933, 2990, 3051

Support Levels (GoldTurn Levels): 2870, 2801, 2744, 2671, 2595

EMA5 Behavior:

* Or If EMA5 crosses and locks above 2933, it strengthens the bullish case.

* If EMA5 fails to hold above 2870, cross and lock below this level 2870, expect a pullback to key GOLDTURN levels below.

Recommendations:

* Capitalize on Dip Opportunities: Use smaller timeframes (1H, 4H) to trade around GOLDTURN levels, targeting 30–40 pips per trade.

* Stay focused on shorter trades in this range-bound market to manage volatility effectively.

Long-Term Bias:

Maintain a bullish outlook while viewing pullbacks as buying opportunities.

Accumulate positions near key support levels for a safer approach instead of chasing highs.

Final Note:

Trade with confidence and precision. Our analysis ensures you’re well-prepared to navigate the evolving market landscape. Stay updated with our daily insights across multiple timeframes for deeper clarity.

Thank you for your continued trust! Don’t forget to like, share, and comment to support our work.

Best regards,

The Quantum Trading Mastery Team

BTCUSD possible bullish returnFollowing a strong bearish presence in recent days of BTCUSD, it is anticipated that there will be bullish return in BTC in the HTF demand, Bullish failure in the HTF demand as marked in the chart may land bitcoin price to $66,000. Liquidity in the chart placed at $86,230 ia the the reason to watch for bullish return in the zone. I have two entry module in the zone and i will watch for possible buy trade in BTCUSD.

GOLD MONTHLY LONG TERM RANGE ROUTE MAP ANALYSISMonthly Chart Gold (9th Feb 2024)

Dear Traders,

Attached is the updated Monthly Chart Roadmap for GOLD, showcasing our meticulous analysis and 100% target accuracy since October 2023. The Golden Circle areas on the chart emphasize our precise predictions and successful target achievements over the months.

Previous Chart Highlights:

* GOLD successfully hit TP1 (2286.35) and TP2 (2603.46), with the monthly candle closing above TP2.

* EMA5 crossed and locked above the TP2 level at 2603.46, confirming strong upward momentum.

* The EMA5 detachment process was successfully completed.

* The Fair Value Gap (FVG) at 2790 provided robust support, facilitating a push toward higher levels.

What’s Next for GOLD?

This chart update includes revised entry levels, weighted target levels, and two critical GOLDTURN levels: 2742 and 2595. These levels act as strong support zones, where potential reversals may occur. If a reversal happens, prices are likely to retest any of these levels (marked in red) before bouncing back.

Pay close attention to EMA5 near the Entry Level of 2742.55. If EMA5 crosses and locks above 2742.55, it will confirm bullish momentum and make the target of TP1 (2961) achievable with ease. Although short-term bearish movements may occur, the broader picture on the monthly chart suggests a long-term bullish trend. Temporary pullbacks strengthen the trend and provide excellent dip-buying opportunities near support levels, minimizing risk.

Recommendations:

For a detailed understanding of support structures and to identify ideal buying opportunities, refer to our smaller time frame analyses, including weekly, daily, 12H, 4H, and 1H charts. These provide actionable insights while aligning with the bigger picture of long-term bullish momentum.

As always, we’re committed to keeping you informed with daily updates and insights. Don’t forget to show your support by liking, commenting, and sharing this post. Stay tuned for more updates on our Trading View channel.

Trade Safe with Confidence!

The Quantum Trading Mastery

GOLD 4H TECHNICAL ANALYSIS GOLD ATH / READ CAPTION CAREFULLY Dear Traders,

Please find our updated analysis of the 4H Chart (5th February):

Key Observations:

Orange Circles: Highlight previously achieved targets, showcasing the precision and effectiveness of our analysis.

Previous Chart Review:

TP1 (2788): Successfully hit.

TP2 (2815): Successfully hit.

TP3 (2841): Successfully hit.

Market Overview:

* TP1 (2850) Successfully Achieved

* GOLD is trading at an ATH of 2851, oscillating between the weighted level with a gap above 2850 and a gap below the 2823 Entry Level.

* EMA5 and FVG are offering strong support in this range.

* Price action will test these levels side-by-side until a decisive break and lock above/below the weighted levels confirm the next directional move.

Resistance Levels:

2850, 2876, 2903

Key Support: 2776

Support Levels (GOLDTURN Levels):

2828 (Critical Weighted Level)

2803 (Critical Weighted Level)

2776 (Major Support Level)

2747 (Lower Major Demand Zone)

EMA5 (Red Line):

* Currently below TP1 (2850), indicating sustained bullish momentum.

* EMA5’s behavior will be pivotal in determining the next price action trajectory.

Recommendations

* Focus on EMA5 Behavior:

Bearish Case:

* If EMA5 holds below TP1 (2850) and resistance levels remain intact, bearish momentum may drive prices to retest GOLDTURN weighted levels.

* Scenario 1: If EMA5 crosses and locks below Entry 2823, expect further bearish movement toward GOLDTURN 2803.

* Scenario 2: If EMA5 crosses and locks below GOLDTURN 2803, anticipate another decline toward the major support at GOLDTURN 2776.

Bullish Case:

Scenario 1: If EMA5 crosses and locks above TP1 (2850), the next bullish target is 2876.

Scenario 2: If EMA5 crosses and locks above TP2 (2876), the subsequent bullish target will be 2903.

Scenario 3: A crossover and lock above TP3 (2903) will set the stage for the next target at 2925.

Short-Term:

Utilize 1H and 4H timeframes to capture pullbacks at GOLDTURN levels.

Target 30–40 pips per trade, focusing on shorter positions in this range-bound market.

Each Level allows 30 -40 pips bounce, buy at dip level for proper risk management

Long-Term Outlook:

* Maintain a bullish bias, viewing pullbacks as buying opportunities.

* Buying dips from key levels ensures better risk management, avoiding the pitfalls of chasing tops.

Final Thoughts:

Trade with confidence and discipline. Our detailed and accurate analysis equips you to navigate market movements effectively. Stay tuned for daily updates and multi-timeframe insights to stay ahead in the game.

Please support us by likes, comments, boosts and following our channel

Best regards,

📉💰 The Quantum Trading Mastery

GOLD DAILY CHART ANALYSIS MID/LONG TERM UPDATEGOLD Daily Chart Update

Hello Everyone,

Here’s the latest update on the GOLD daily chart we’ve been closely monitoring and trading. Below is a breakdown of recent movements and what’s next:

Previous Chart Review

* Key Resistance: We identified 2,790 as a critical resistance level and anticipated a potential reversal.

* Buy Signal: Recommended waiting for EMA5 to cross and hold above the ENTRY LEVEL (2,744) as a signal for a bullish move toward TP1 (2,807).

* Dynamic Support: Highlighted the FVG zone (2,720–2,740) as a key support area.

Outcome:

* EMA5 crossed above KEY LEVEL (2,744).

* Resistance at 2,790 was broken.

* TP1 (2,807) was successfully achieved, confirming the accuracy of our analysis.

What’s Next for GOLD?

* Candle Behavior: The daily candle didn’t close above TP1, suggesting a short-term reversal may occur.

Key Levels:

* Support: Strong support likely from the FVG zone and Gold Turn Levels (2,744 and 2,686).

* Downside Risks: If EMA5 crosses and locks below 2,744, the target shifts toward 2,686.

* Bullish Path: A bounce from support could retest TP1 (2,807) and further extend to TP2 (2,870.8) and TP3 (2,933.93).

Recommendations

Short-Term Trades:

* Use smaller timeframes (1H, 4H) to capitalize on dips at the Gold Turn Levels for 30–40 pips per trade.

* Focus on shorter positions in this range-bound market to avoid getting caught in volatility.

Long-Term Bias:

* We remain bullish and view pullbacks as opportunities to accumulate.

* Buying dips from our marked levels enables us to manage swings safely, rather than chasing tops.

Final Note:

Trade confidently and safely. Our precise analysis ensures you’re equipped to navigate the market effectively. Stay tuned for daily updates and insights across all timeframes.

Best regards,

The Quantum Trading Mastery

GOLD 12H CHART ROUTE MAP ANALYSIS FOR THE WEEK Dear Traders,

Here is our 12H chart analysis and target update:

Previous Chart Review:

Outcome:

✅ All targets and entry levels (marked with Golden Circles) were achieved as predicted.

TP1 2745 - DONE

TP2 2786 - DONE

TP3 2826 - DONE

Market Overview:

* ENTRY LEVEL: 2814

* Target TP1 successfully hit already at 2858

* GOLD is trading at an ATH of 2858, oscillating between the weighted level with a gap above 2858 and a gap below the 2814 Entry Level.

* FVG are offering strong support in this range.

Resistance Levels:

2858, 2903, 2948

Key Support: 2618

Support Levels (blue GOLDTURN Levels are activated):

2813 (Critical Weighted Level)

2770 (Critical Weighted Level)

2710 (Critical Weighted Level)

2664 (Major Support Level)

2618 (Lower Major Demand Zone)

EMA5 (Red Line):

* Currently below TP1 (2858), indicating sustained bullish momentum.

* EMA5’s behavior will be pivotal in determining the next price action trajectory.

Recommendations

* Focus on EMA5 Behavior for further confirmation

Bearish Case:

* If EMA5 holds below TP1 (2858) and resistance levels remain intact, bearish momentum may drive prices to retest GOLDTURN weighted levels.

* Scenario 1: If EMA5 crosses and locks below Entry 2813, expect further bearish movement toward GOLDTURN 2770.

* Scenario 2: If EMA5 crosses and locks below GOLDTURN 2770, anticipate another decline toward the major support at GOLDTURN 2710.

* Scenario 2: If EMA5 crosses and locks below GOLDTURN 2710, anticipate another decline toward the major support at GOLDTURN 2664.

* Scenario 2: If EMA5 crosses and locks below GOLDTURN 2664, anticipate another decline toward the major support at GOLDTURN 2618.

Bullish Case:

Scenario 1: If EMA5 crosses and locks above TP1 (2858), the next bullish target is 2903.

Scenario 2: If EMA5 crosses and locks above TP2 (2903), the subsequent bullish target will be 2948.

Short-Term:

* Possible Reversal at the weighted GOLDTURN levels

* Utilize 1H and 4H timeframes to capture pullbacks at GOLDTURN levels.

* Target 30–40 pips per trade, focusing on shorter positions in this range-bound market.

* Each Level allows 30 -40 pips bounce, buy at dip level for proper risk management

Long-Term Outlook:

* Maintain a bullish bias, viewing pullbacks as buying opportunities.

* Buying dips from key levels ensures better risk management, avoiding the pitfalls of chasing tops.

Final Thoughts:

Trade with confidence and discipline. Our detailed and accurate analysis equips you to navigate market movements effectively. Stay tuned for daily updates and multi-timeframe insights to stay ahead in the game.

Please support us by likes, comments, boosts and following our channel.

Best regards,

📉💰 The Quantum Trading Mastery

GOLD 1H CHART TRADING PLAN FOR THE DAY / READ CAPTIONAnalysis of the 1H Timeframe Chart for Gold (XAU/USD)

Previous Chart Review

The bearish move from the ENTRY LEVEL at 2,796 reached Take Profit 1 (TP1) at 2,778, validating the support at GOLDTURN levels AT 2,778.

GOLDTURN acted as a critical support level, rejecting lower prices and triggering a bullish rebound.

The upward move successfully achieved:

TP1: 2,798 ✅

TP2: 2,807 ✅

TP3: 2,817 ✅

Current Market Structure

Key Resistance Levels:

Supply Zone: 2,830.57 (Highs above TP3)

Bullish targets identified at:

2,837 (TP2)

2,856 (TP3) for extended upward momentum.

Support Levels:

Immediate support: GOLDTURN levels at 2,813

Additional supports:

2,803

2,793

2,783

2,774

Retracement range: 2,732–2,740

EMA Analysis:

The EMA5 (2,815.20) is a key pivot zone, indicating short-term trends:

A break and hold above 2,817 it suggests continuation of bullish momentum.

A break below it signals a possible test of support levels.

Trend Analysis:

Current candles reflect a potential pullback to the 2,813 level.

A bullish continuation above 2,817 could confirm upward momentum toward 2,837 and beyond.

A failure to hold above 2,813 may test lower GOLDTURN levels.

Trading Plan:

Bullish Strategy:

Monitor EMA5 crossing and holding above 2,817 for:

Immediate targets: 2,837, followed by 2,856.

Buy dips at support levels (2,813, 2,803, 2,793) targeting 30–40 pip gains.

Bearish Risks:

Downside triggers include:

EMA5 crossing below 2,817 leading to a test of 2,798.

Sustained moves below 2,798 may target 2,744 and 2,732–2,740.

Range Confirmation:

Await confirmation through a break and lock above/below key levels:

Bullish continuation: Above 2,837.

Bearish momentum: Below 2,813.

Long-Term Outlook

The bullish bias remains intact, with pullbacks offering opportunities to accumulate positions.

Focus remains on risk management by entering at support levels and exiting at predefined targets (20–40 pips per level).

Final Thoughts

Confidence and discipline are essential to navigate market fluctuations effectively.

This structured approach ensures traders are prepared for both bullish and bearish scenarios.

Check out further updates and multi-timeframe for more insights!

Please support us by liking, comments and boosting if you think our analysis is worth it.

The Quantum Trading Mastery

GBPUSD Technical Analysis and OutlookPrevious Observations:

Long-term Downtrend: Confirmed downtrend from mid-2021.

Major Support Breach: Below 1.2000 in late 2022.

Recent Recovery Attempt: Above 1.2400, buying pressure still evident.

Key Resistance Zones (1h): Current level @ 1.2450

Key Resistance Zones (4h): 1.2500-1.2600.

Key Support Zones (Weekly): 1.2000 and 1.1800 - There's room to keep pushing lower.

Potential Buying Climax (Daily, 4h, 1h): Steepness of recent rise hints at possible pullback.

Additional Bearish Confirmations for Potential Shorts :

- Price tested and bounced off the 200 EMA several times in Dec 2024 (4h).

- The pair is currently hovering around the 50% retracement level of the recent short-term decline, a common area for price reversals.

- Bearish divergence confirmations have already presented this week on the hourly time frame. This is a tell-tale sign of institutional orders being filled at specific levels and generation of further supply. (This may be the conclusion of a 'PHASE C' in a redistribution cycle).

- The dollar shows no signs of weakening against the GBP both in technicals as well as fundamentals (Recent data shows the U.S. economy added 256,000 jobs in December, surpassing forecasts and reinforcing a strong dollar narrative).

Conclusions:

Considering that we see a trendline breakout followed by strong bearish reactions which are ideally happening at HTF supply levels, we can assume that the fractal nature of the markets will play out accordingly. We should not ignore the fact that price has reacted from LTF demand or that we saw a recent bullish imbalance filled- entering shorts off the current supply level should only be done with sufficient confirmations (we may have to look at how the London session open influences price action).

Disclaimer:

This analysis is for informational purposes only and should not be considered financial advice. Trading involves significant risk, and it's essential to conduct your own thorough research and analysis before making any investment decisions. Past performance is not indicative of future results. Always use appropriate risk management techniques and trade responsibly.

12H GOLD CHART ANALYSIS ROUTE MAPHello Traders,

Here’s our 12H chart analysis and target updates, which we’ve been tracking closely. To provide a comprehensive view, we also have 15M, 1H, 4H, 12H, and Daily chart analyses.

We utilize smaller timeframes (15M, 1H, and 4H) to buy dips from the weighed levels, targeting clean 30–40 pip moves. Ranging markets are ideal for this strategy, as they allow for consistent gains without the risk of getting caught in the swings associated with holding longer positions.

Previously, after the EMA5 crossed and locked above 2655, opening 2695, we consistently bought dips into 2686, completing this gap. We then noted that a candle body close above 2695 opened TAKE PROFIT 1, with further confirmation required from the EMA5 lock. This played out perfectly, and TAKE PROFIT 1 (2735) has now been achieved.

To reach TAKE PROFIT 2, the candle body must close above 2735, with the EMA5 locking above this level for confirmation. This would open the path to our next target at TAKE PROFIT 2 (2774).

To simplify your trades, we’ve added entry levels and take profit targets (TP1, TP2, TP3). These levels are aligned with the EMA5 crossing and holding above each, determining the subsequent targets.

For example, when the EMA5 crosses and locks above the ENTRY level, you can take a bullish position and aim for TAKE PROFIT 1 (TP1). If EMA5 fails to lock above TP1, the price may reverse and retest the bottom level, presenting another opportunity to buy dips. Conversely, if EMA5 crosses and locks below the bottom level, it’s best to wait for confirmation, as this could signal a shift in direction.

Our long-term bias remains bullish, and we view price drops as opportunities to leverage smaller timeframes for dip-buying using our defined levels and setups.

Buying dips allows for safer trade management by capitalizing on swings without chasing the bullish momentum from higher levels.

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

TheQuantumTraders

GOLD WEEKLY CHART MID/LONG TERM ROUTE MAP UPDATEDHello Everyone,

Here’s the latest update on the GOLD weekly chart we’ve been closely monitoring and trading. Below is a detailed overview of the current range we've been tracking for an extended period.

Previously, we identified a strong resistance level at 2790, which we highlighted as a potential trigger for a reversal. At that time, we recommended holding off on trades since the price was prone to reverse at any moment. Additionally, we mentioned that if EMA5 crosses and holds above the ENTRY LEVEL at 2735.35, it would signal a buy opportunity with a target at TP1. However, the EMA5 has not crossed this level yet, and we are still waiting for confirmation.

Our analysis played out perfectly. There were multiple break attempts into the channel, but EMA5 failed to cross the ENTRY LEVEL, confirming rejection as anticipated.

This week started with a significant bounce on Monday, with the FVG providing solid support in the 2730-2735 range. This support could potentially help the price make another attempt to cross the resistance level. However, we will wait for confirmation by seeing if EMA5 crosses and holds above 2735.

For more details, check our smaller timeframes for a deeper insight.

Please follow our channel, and don’t forget to show your support by liking, commenting, and following.

The QUANTUM Trading Mastery

GOLD MONTLHY CHART LONG ROUTE MAP ANALYSISDear Traders,

Attached is the Monthly Chart Route Map for GOLD. Since October 2023, we have been consistently analyzing and trading GOLD with 100% accuracy in our targets. The Golden Circle Area marked on the chart clearly reflects our precise analysis and targets achieved.

The EMA5 has crossed the ENTRY LEVEL, leading to the successful achievement of TP1, followed by TP2. We are now anticipating TP3.

What’s Next for GOLD?

The FVG has provided strong support at 2535 level that caused the price to push upward to 2785 and also the monthly chart confirms that EMA5 has crossed and locked above TP2 (2603), signaling the next bullish target at TP3 (2920). While external market factors may slow momentum or cause temporary reversals, we are confident that TP3 will be reached in due time.

Once TP3 is hit, a significant correction to lower weighted levels is expected before the bullish trend resumes, as indicated on the chart.

Key Levels:

Support: 1969

TP1: 2286 ✅ (Achieved)

TP2: 2603 ✅ (Achieved)

TP3: 2920 ⏳ (Pending)

Short-Term Strategy:

We will utilize smaller timeframes (1H and 4H charts) to buy dips at key weighted levels, targeting clean 30-40 pips per trade. This strategy is most effective in ranging markets, avoiding extended holds that may be exposed to high volatility.

Long-Term Bias:

Our outlook remains bullish, viewing market drops as buying opportunities. We will continue to leverage predefined levels and setups for optimized entries in smaller timeframes.

🔺 THE QUANTUM TRADING MASTERY 🔺

15M CHART ANALYSIS UPDATEDear Traders,

We are very happy we provided you accurate analysis earlier.

In our previous 15M Chart analysis we shared, If EMA5 cross and lock above 2761, then you can enter bullish. Otherwise stay away. There could be a small correction downward.

That is what exactly happened.

Please see our new analysis for today Friday 24 Jan 2025

Key Update:

ENTRY LEVEL: 2754.200

Bullish Target: 2762, 2771, 2780

Bearish Target: 2738, 2720

To achieve these targets, follow these steps.

BULLISH TARGETS:

EMA5 CROSS AND LOCK ABOVE 2755 WILL OPEN THE FOLLOWING BULLISH TARGET

2762

EMA5 CROSS AND LOCK ABOVE 2762 WILL OPEN THE FOLLOWING BULLISH TARGET

2771

EMA5 CROSS AND LOCK ABOVE 2771 WILL OPEN THE FOLLOWING BULLISH TARGET

2780

BEARISH TARGETS:

EMA5 CROSS AND LOCK BELOW 2750 WILL OPEN THE FOLLOWING BEARISH TARGET

2738

EMA5 CROSS AND LOCK BELOW 2738 WILL OPEN THE FOLLOWING BEARISH TARGET

2720

please support us by leaving our comments and boost the charts.

TheQuantumTradingMastery

GOLD WEEKLY CHART MID/LONG TERM ROUTE MAPHello Everyone,

Here’s the latest update on the GOLD weekly chart we’ve been monitoring and trading, offering a detailed overview of the current range.

On the weekly timeframe, a strong resistance level is identified at 2790, which could trigger a reversal. As of now, we recommend holding off on trades since the price could reverse at any moment. Let’s wait for the NY session and keep our positions light.

To streamline your trades, we’ve outlined ENTRY LEVELS and TAKE PROFIT (TP) targets (TP1, TP2, TP3) based on the EMA5. The EMA5 crossing and sustaining above these weighted levels will determine subsequent targets.

Key Update:

ENTRY LEVEL: 2735

If a candle closes above this level and the EMA5 crosses it for confirmation, we will consider bullish entries.

First Target (TP1): 2877

To achieve the second target (TP2: 3018), wait for the EMA5 to close and lock above 2877.

Use the same strategy to target TP3: 3160

Rejection Scenario:

For ranging markets, focus on smaller timeframes (15M, 1H, 4H, 12H, Daily) to buy dips from weighted levels.

Target 120–140 pip moves, which are effective in these conditions while minimizing the risks associated with longer-term positions.

Dip-Buying Strategy:

Continue buying dips at support levels, aiming for 120 - 140 pips per trade.

Each level structure typically provides 60 - 80 pip bounces, making it ideal for accurate entries and exits.

Keep an eye on the EMA5 crossing and locking above or below the ENTRY LEVEL to confirm the next directional range.

Stay sharp and trade smart!

TheQuantumTraders

Increase the difficulty level on yourself. Often, traders like to make things a lot harder for themselves than they need to. Everyone is seeking a silver bullet, truth is "less is actually more".

Dow Theory is actually the Grandfather of technical analysis.

If you have never heard of this, or even if you have and brushed over it, you are missing out.

Some people will say things like "it's over 100 years old it can't work in today's market"

Yet, humans have changed very little in those last 100+ years. Sentiment driven by fear and greed is where the secret is hidden.

Let me explain by saying Dow theory has 6 "rules" (tenets).

1) Market Moves in Trends Markets have three types of movements: primary trends (long-term trends that last for years), secondary trends (medium-term trends that retrace parts of the primary trend), and minor trends (short-term trends that are typically noise).

You will notice I used the weekly for the larger and the daily for the second.

When I journal my trade setups; I simply use a traffic light system red lines size 4 for primary, then orange line 3 for secondary and green size 2 for the trigger phase. In addition to that, I mark the trends with 3 boxes and arrows pointing up down or sideways.

The second rule;

Each trend has three phases:

Accumulation Phase. In this phase, informed investors start buying or selling, counter to the general market opinion.

Public Participation Phase, more investors notice the trend after it is already underway, and media coverage expands, driving the trend further. (Wyckoff called this a mark-up or mark-down phase)

Excess Phase (or Distribution): At this point, speculation is rampant and detached from actual value, leading informed investors to prepare an exit.

This is where a lot of Wyckoff, Elliott and other tools such as Smart money concepts all overlap.

Then, the 3rd rule.

The market reflects all available information, such as economic conditions and sentiment. Therefore, movement in the market averages considers and reflects this information. (in simple terms, discount the news).

4) For a trend to be validated, different market averages must confirm each other. For example, the trend in the Dow Jones Industrial Average should be confirmed by the Dow Jones Transportation Average. If one index moves to a new high or low, the other should follow suit to confirm the trend.

(I like this one less, but in some instances it can make the next move very obvious.)

Rule 5) The trend is your friend, until the end. Until you see a clear change in the direction, a market shift. The trend is still in play. This one, I feel most just can't comprehend.

As you can see below, I have marked up the extreme high and low, I know both my primary and secondary trends are down. So now, I can use my EW bias or start looking for a Wyckoff schematic. (if I believe we are about to see a shift in the trend.)

You can start to look for information for areas of interest, look into volume and volume profiles.

The last rule. Confirming the trend volume expanding in the direction of the primary trend. For an uptrend, volume should increase as prices rise and decrease during corrections. In a downtrend, volume should increase as prices fall.

In this example, the Fibonacci levels line up, the volume is slowing, the EW count makes some sense and zoomed out you can see a shift.

Now, with all of this info - we could look at "areas of interest"

We are in a demand zone on the higher time frame.

At this stage, there is no trade entry, but if we were to view a change in the character we could simply take a trade as a pullback on the primary trend down.

Something like this;

You see, all you are doing is following the trend and taking a look at other tools, auction areas, fib extensions, an EW bias, and hints of a Wyckoff schematic. But under the hood, the 3 trend principle is a simple-to-follow process.

Disclaimer

This idea does not constitute as financial advice. It is for educational purposes only, our principle trader has over 20 years' experience in stocks, ETF's, and Forex. Hence each trade setup might have different hold times, entry or exit conditions, and will vary from the post/idea shared here. You can use the information from this post to make your own trading plan for the instrument discussed. Trading carries a risk; a high percentage of retail traders lose money. Please keep this in mind when entering any trade. Stay safe.