Proprietarytrading

Dax daily: 02 Sep 2019 Welcome to this first analysis of the month of September. Friday's session started by a relatively fast retest of our resistance zone at 11 899, which hasn't even slowed down the price momentum. The uptrend was seen until 15:00 when Dax corrected the bullish move by descending lower to retest the newly formed support at 11 899 which was our valid resistance at the beginning of the session. Dax closed in its upper range.

Important zones

Resistance: 12 037

Support: 11 868, 11 771

Statistics for today

Detailed statistics in the Statistical Application

Macroeconomic releases

09:15 - 10:00 CEST - Eurozone PMIs

Canada & USA - national holiday

Today's session hypothesis

Today's afternoon session might be slower than usual due to public holiday in the US and Canada. Morning session might be influenced by the series of PMI reports from the Eurozone. We also have an increased statistical probability for breaking Friday's high. We could see buyers jumping in at around 11 868 and if that scenario turns valid and the high will be broken, sellers are likely to correct the upside move at 12 037. Considering the fact we also have an increased probability of closing inside Friday's range, it is logical to focus our targets back into the range should the price get above or below the high/low from Friday.

Dax daily: 30 Aug 2019 We welcome you to this last Dax analysis of the week, month and summer holiday. Thursday's session appeared quite innocent in the first hour of trading. At 9 am, Dax shot firmly upwards and this momentum lasted till noon. At around 4:30 pm, Dax fell lower by some 90 points just to correct this volatile spike even above the initial fall.

Important zones

Resistance: 11 899

Support: 11 774, 11 700

Statistics for today

Detailed statistics in the Statistical Application

Macroeconomic releases

NIL

Today's session hypothesis

It appears today we could finally close the resistance at 11 899 where we hope to find some sellers at the first retest. If we target the first one lower, buyers could be seen at 11 774 or even lower at 11 700. Should the price really drop down to 11 700, all our hypothesis for a bullish move turn invalid as that level is now distanced some 150 points away.

Dax daily: 29 Aug 2019 Yesterday's session drew a nice 'V' shape. The price started to fall towards the support level of 11 561 right from the beginning of the session and this was the area where price marked its intraday low and bounced back upwards. The first support zone laying at 11 678 had little effect. The statistical probability about closing inside the previous day range was also fulfilled.

Important zones

Resistance: 11 772

Support: 11 608, trendline

Statistics for today

Detailed statistics in the Statistical Application

Macroeconomic releases

08:45 - 09:55 CEST - various Eurozone reports - refer to the Economic calendar

Today's session hypothesis

For today's price estimation, we need to monitor the Price Action around the slightly consolidated area formed around yesterday's close. If Dax goes above this zone, it is likely we see a retest of 11 772 and the return back to the range zone of the past few days. Contrary, should bears prove their presence, we can see the retest of our support level and the trendline around 11 600 which could serve as an interesting area for some bullish correction.

Dax daily: 26 Aug 2019 Friday's session started relatively innocent. As per our expectations, Dax descended to hit our support zone of 11 759 and closed the gap. We also saw buyers attempting to regain control before the storm hit the markets. News had it that China retaliated on the US import taxes and to no surprise, Trump's swift reaction on Twitter caused even more havoc when he lifted the existing tariffs even more (including services industry) and ordered american companies to withdraw from China. Dax bears started to jump out of the window and retested the subject S/R zone after the initial plunge. Next bearish target was the following support at 11 560 which slowed down the price for a few hours just to drop even lower to close the week at 11 532.

Important zones

Resistance: 11 645, 11 707, 11 611

Support: 11 404

Statistics for today

Detailed statistics in the Statistical Application

Macroeconomic releases

10:00 CEST - EUR - German Ifo Business Climate

All-day - G7 Meeting in France

Today's session hypothesis

For today, we estimate to see some correction of Friday's downfall. Ideally, the price could reach 11 611 - 11 645 levels which could work well for sellers to take the price towards the support around 11 404. Beware of today's news, especially some G7 Meeting after-tremors.

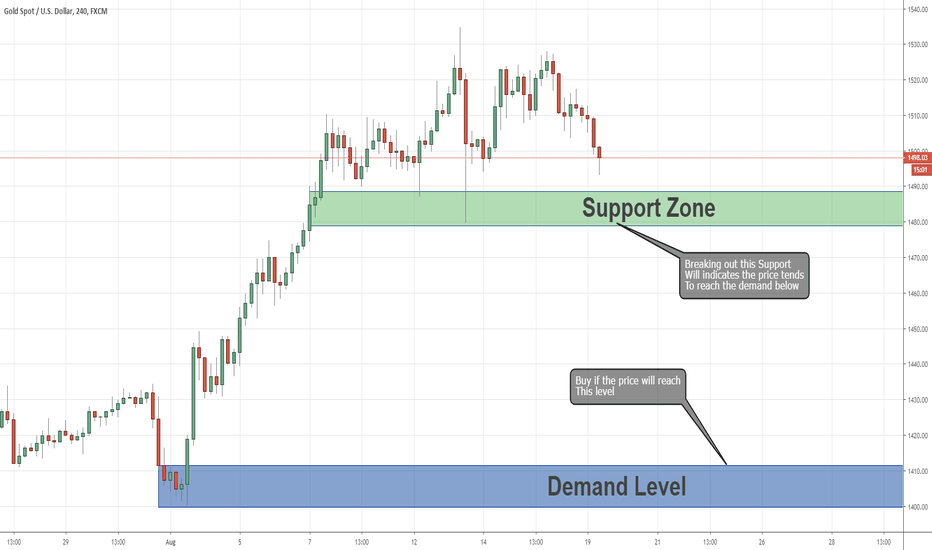

Price Action Analysis for XAUUSD 19/08/2019XAUUSD is in bullish momentum at the long/swing terms.

If the price will breakout the support below it indicates the price tends to reach the demand below,

In that case, I'll look for a price action setup to sell XAUUSD, the demand below will be the target.

This demand is also a great level to buy XAUUSD and join the bullish momentum.

The target for the buy position will be 1555.00 zones

Dax daily: 19 Aug 2019 Friday's session was relatively difficult to trade. It looked like the price might go down a few times, but bulls were stronger and took the price towards our resistance at 11 606. In the end, the gap between the sessions wasn't closed and the trendline wasn't even relevant. For today, we open with yet another ascending gap.

Important zones

Resistance: 11 899, 11 723

Support: 11 404, trend-line, 11 560

Statistics for today

Detailed statistics in the Statistical Application

Macroeconomic releases

NIL

Today's session hypothesis

We estimate a short correction towards Friday's close at 11 560 where bulls are likely to take over and take the price to retest the 11 723. The main target for this week lays at 11 899. If Dax goes well below 11 560, we are likely to see a slow down of Price Action and closing inside Friday's range.

Dax daily: 16 Aug 2019 Thursday's session turned as expected. Dax broke the previous day low, which had a statistical probability of 96%. Sellers were dominant right from the beginning and proved their strengths yet before 11 629 so the profit potential wasn't that exciting. Dax dropped some 300 points just to almost fully correct this drop later in the day. Thursday was a rollercoaster day and really hard to trade.

Important zones

Resistance: 11 606

Support: 11 404, trend-line

Statistics for today

Detailed statistics in the Statistical Application

Macroeconomic releases

NIL

Today's session hypothesis

For today, we'd like to see a drop towards yesterday's close and find some buyers there. Considering the Price Action, we see indications of yesterday's high. Yesterday's low looks pretty safe though. The upside correction could happen at 11 606.

Dax daily: 09 Aug 2019 The session yesterday started with an ascending gap which was closed yet in the morning trading hours. Sellers took Dax to retest the support level at 11 716 where we saw a power shift and buyers regained control of the further price development. The session was closed at 11 823.

Important zones

Resistance: 11 901

Support: 11 716

Statistics for today

Detailed statistics in the Statistical Application

Macroeconomic releases

NIL

Today's session hypothesis

Another gap opening but with a different situation today. It was quite probable yesterday that the gap was to be closed, just as we highlighted. Price opened above previous day's range and gap was at a strong S/R zone which was likely to be retested. Today we open in the middle of yesterday's session and it's not clearly defined who has the advantage. The statistical application indicates a 50% probability which is another undecisive information for a price estimate. We are left to wait for the price action and follow the mood of the market. We estimate today's trading ranging between 11 716 and 11 901.

Dax daily: 08 Aug 2019 Yesterday's session didn't offer any excitement exactly as we thought. What is important is that our resistance level at 11 702 functioned pretty well. Dax also broke neither low nor high of previous day range and this was corresponding with a very low statistical probability given by our application. Today we open with a significant ascending gap.

Important zones

Resistance: 11 901

Support: 11 716

Statistics for today

Detailed statistics in the Statistical Application

Macroeconomic releases

NIL

Today's session hypothesis

Does it look like another calm session? It seems to be, yet it's important to bear in mind that markets are always unpredictable and anything can happen. We could see the initial move to the downside to retest yesterday's close and close the gap too. Buyers might appear around 11 716 and lift the price towards 11 901. Should Dax descend below 11 716, we might see a slow down of the price action and close inside yesterday's range.

Two Fresh Supply Levels for Sell Position as a Continuation For the long terms, as we can see on the W1 chart on the left side of the chart, the USD/JPY tends to reach the demand at the bottom.

On the H1 chart, we can see how the price creates 2 fresh supply levels above.

Each one of the supply is a potential level for continuation sell trade.

I'll sell at the supply above and the stop loss will be few pips above this level,

If the price will break the supply and hit the stop loss order, it indicates the price on his way to reach the supply level 2.

In that case, we can look for a price action setup for intraday buy position and the final target for this buy position will be the supply level 2 at the top.

Supply level 2 is the next level where i'll try to sell again as a long term position,

The target for this position will be 102.50 zones.

Dax daily: 29 Jul 2019 Welcome to the first analysis of the 31st week. Friday's session turned out really nice. We found buyers at a good Thursday close support level and there was an intraday low formed there as well. Besides only one significant short candle at 2pm, Dax was drifting upwards for the whole intraday trading. The price then closed near its high.

Important zones

Resistance: 12 421, 12 479

Support: 12 354

Statistics for today

Detailed statistics in the Statistical Application

The statistical probability of breaking Friday's high is 87%

Macroeconomic releases

NIL

Today's session hypothesis

For today, we have a high statistical probability of breaking Friday's high, which is also distanced relatively far away. Long trades then have a clear target. Contrary, should the Friday's low be broken, then the previous hypothesis becomes invalid. The chances of having both swings retested are as low as 7%. Taking advantage of shorting today's price, we can use a pullback around 12 421 and then 12 479.

Dax daily: 25 Jul 2019 Yesterday we had a clear bullish bias as the statistics suggested the retest of previous day high and the gap closure. Both of these statistics were successfully fulfilled and those who took advantage of this might have scored nice profits. The beginning of yesterday's session started with a slight downward move caused by French and German PMI reports, before the price reversed to the upside as expected.

Important zones

Resistance: 12 576, 12 645

Support: 12 437, 12 470

Statistics for today

Detailed statistics in the Statistical Application

The statistical probability of closing the gap is 70%

Macroeconomic releases

13:45 CEST - ECB Main Refinancing Rate

14:30 CEST - ECB Press conference

Today's session hypothesis

Today's open started with a small ascending gap sized 17 points. Once again, this one has a good statistical probability of being closed. We've had two uptrending days in a row and the momentum is weakening. The price is currently at 12 576, which is a resistance level. It will be interesting to see the initial move out of here. Should Dax head even higher, then the next resistance area of our focus is 12 645. On the other hand, if bulls stay calm, we anticipate the slow down in yesterday's range. However, needless to say it's a super Thursday for ECB. The interest rate is expected unchanged and Mario Draghi needs to address some measures with regards to economic stagnation.

A Bullish Outside Bar Pattern Likely Change the Long Term MomentA Confluence of Bullish Outside Bar Candlestick Pattern and a Significant Support Zone

GBP/USD has formed a bullish outside bar candlestick pattern in the H4 time frame.

We can see in the H4 chart how the last big green candle in the picture attached engulfed the previous four candles and closed at the highest.

If we look at the high time frames charts (W1 or D1), we can see that the price is bearish in the last one and a half years, since April 2018.

At the moment, the price just arrived into the support zone which originally was a demand that formed in April 2017.

The confluence of the bullish outside bar candlestick pattern and the significant support is a very powerful one.

It creates a great opportunity for buy position.

Below, there is a fresh demand created earlier today.

If the price retraces this demand, it will be the right time to open a buy position for GBP/USD.

The resistance above will be the first target for this position.

The source of this resistance is a supply level which formed on 04/07/2019.

After the price tested this supply three times it became a resistance zone.

The final target for this trade will be the fresh supply at the top.

The supply at the top is a very significant one, if the price will break this supply it means that the long term momentum has changed from bearish to bullish.

Dax daily: 23 Jul 2019 Yesterday's session was fully dominated by bulls. They managed to grab the momentum taking Dax slightly above the resistance level of 12 330 that we highlighted yesterday. This zone functioned with a slight delay as the price corrected shortly after. The session was closed in black numbers priced 12 293.

Important zones

Resistance: 12 380

Support: 12 234, 12 200, 12 330

Statistics for today

Detailed statistics in the Statistical Application

The gap has 50 points and the statistical probability for closing is only 38%

Macroeconomic releases

London session - new Prime Minister of the United Kingdom will be announced. This might affect mainly GBP, EUR and potentially DAX too.

Today's session hypothesis

This morning started with an ascending gap. Sized 50 points, this one has a low probability for being closed as the statistics suggest the 38% rate chance from the historical occurrence. We can speculate to see rather a bullish domination. In such a scenario, we'll await the retest of 12 380 which could also function as the buyers target zone and the reversal level for sellers.

Bearish Engulf Candlestick For USOIL in W1 Time FrameDespite The “Ships War” in Strait of Hormuz, USOIL Keep Falling Down

In the W1 chart on USOIL, the last candlestick ended as a bearish engulfing candlestick which engulfed the three previous bullish candles.

We can see how the big red candle on the picture closed below the low of the three previous bullish candles.

That bearish Engulf Candlestick is a signal to look for a sell position on USOIL.

In the H4 chart, we can see the fresh supply above at 56.60 zones.

This fresh supply can be a great continuation level for a sell position.

If the price retraces the fresh supply above we can sell there.

The target for this sell position will be the demand below which also a great level for buy position.

A few days ago, Iran seizes a British ship in the Strait of Hormuz.

The situation between Iran and western countries is very explosive these days.

If the relationship between Iran and western countries will keep roll down it can really lead to war.

So, although the fresh supply above and the engulfing bearish candlestick, we should be really careful while selling USOIL.

If the relationship will roll down between Iran and western countries, the USOIL price might fly up and all this technical analysis will become irrelevant.

Will GBP/USD Breakout the Support? Or, it Will Rise Up From TherA Confluence of MACD Divergence in W1 Chart and Fresh Demand in H1 Chart

If we look at the W1 chart of GBP/USD, we can see the price just arrived into support zone.

The source of this support is a demand level from April 2017.

In December 2018 the price tested this demand twice, and now, it's the third time the price reaches there.

A demand level that tested a few times becomes a support zone.

Still in the W1 chart, we can see a significant divergence between the MACD indicator and the price lows.

While the price creates a lower low in the W1 chart the MACD creates a higher low.

In the H1 chart, the price created a fresh demand two days ago which is a great demand for buy position.

The target for this buy position is 1.2680.

If the price will breakout the demand there is a high probability it will break also the support on the W1 chart.

In that case, the price most likely will tend to reach the support at the bottom (support 2 at the picture).

This situation can create an opportunity for a sell position and we should look for a price action setup for sell position.

The confluence of MACD divergence on W1 chart and a fresh demand on the H1 chart, convince me that the price had a great chance to rise up from the demand.

But, it always better to be ready for another scenario.

This analysis is relevant for long term forex traders.

Expectations for an Interest-rate Cut Push SPX500 to New High ReAfter SPX500 Reach New High Record, What are The Signals For Reversal Opportunity?

last week ended with new high records for the US indexes.

The main reason for the stock market to keep rising up is the high expectations for an interest-rate cut from the Federal Reserve.

these expectations came after Federal Reserve Chairman Jerome Powell testified before the Congress.

Usually, when the price is in a new high record it’s the time to look for a reversal signal.

If we look in H1 chart on the SPX500, we can see a significant divergence between the price and the CCI indicator.

The CCI divergence indicates that the uptrend becomes powerless.

Combining two signals together is always a safer way to trade, so in addition to the CCI divergence, we should wait to see if the price will breakout the support below.

If that happens, we can start looking for price action setup of a sell position.

If this prediction will come true, the target for this sell position will be the demand at the bottom.

EUR/AUD: Does The Long Term Momentum is About to ChangeA Confluence Between Head & Shoulders and CCI Divergence

If we look at the long term charts (D1 or W1) we will see the EUR/AUD is in bullish momentum.

The recent technical correction which starts about three weeks ago created a Head and Shoulders pattern.

Head and Shoulders pattern that came after a long trend usually indicates a reversal opportunity.

At the moment, the price supporting by support zone which is also the Head and Shoulders’ neckline.

In the D1 chart, we can also see a significant between the price and the CCI indicator which indicates a

weakness at the end of the recent uptrend.

Also, we can see that the right side of the pattern, which are the sellers, is more powerful, the red Candles are bigger and seems more aggressive.

For now, we should wait and see if the price will breakout the support which is the neckline.

If that happened, the next step is to look for a price action setup for a sell position.

The first target will be the support 2, and the final target will be the demand at the bottom.

Dax daily: 10 Jul 2019 Yesterday's session turned out to follow our hypothesis only partially. Dax started its decline towards 12 391, but buyers didn't use this level to enter the market. Following was a descend towards the second support zone in a row, laying at 12 326, yet this price wasn't reached and Dax reversed upwards. In the end, Dax closed approximately in the middle of its range. The support level of 12 391 functioned properly after a pullback at 2:30pm.

Important zones

Resistance: 12 500

Support: 12 326

Statistics for today

Detailed statistics in the Statistical Application

Macroeconomic releases

USA - 20:00 CEST - FOMC Meeting Minutes

Today's session hypothesis

Today we have a very high statistical probability for closing the gap. We could also expect the resistance at 12 500 being retested and attracting sellers. Yesterday's high breakout has a probability of 64% . Another nice zone nearby is the support level at 12 326 where we might see a bullish correction. Also, we have a higher probability of 77% for closing inside yesterday's range.

EURUSD: POTENTIAL FOR STRONG BUY WE HAVE SPIKE CHART PATTERN AND HAVE VERY LEGAL CHART AND BEST RISK/REWARD.

THE U.S SAYS WANT DECREASE THE BAKE RATE AND IT IS NOT GOOD NEWS FOR US.D BUT BEFORE NEWS IT WILL MUST GO DOWN, SO THERE IS NO WORRY FOR TAKE A SHORT POSITION WITH VERY LOW RISK AND LOW PIP LOSE

The Reason Why it’s Safer to Trade against CompressionToo Risky to Sell EUR/CAD with this Supply Above?

At any time frame, the EUR/CAD seems to be in bearish momentum.

In the H1 chart, the price is in a downtrend of almost 300 pips. While yesterday a fresh supply was created by the price above.

Most of this downtrend was a compression which meant that the price compressed down while picking up all the sell orders along the way.

Compression indicates a powerless movement in the price. In other words, it seems the last downtrend of the price was powerless and it’s safer to look for a reversal signal and trade against the compression.

Usually, a supply level is a great level for a sell position, but this supply is created after the price had already decreased about 250 pips and divergence has occurred between the MACD indicator and the price.

So, instead, I will use this supply as a confirmation zone and not as a level of sell position to sell this supply as is too risky now.

If the price will break out the supply, it will be a signal for reversal opportunity and we should look for a price action setup for a buy position.

Breaking out the supply above will change the momentum in the H1 chart from bearish to bullish.