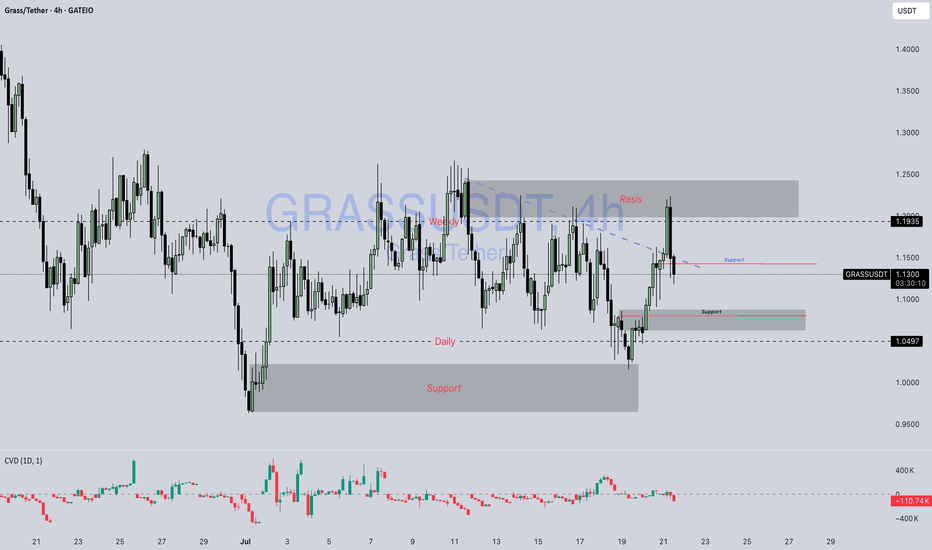

Grass / Usdt GATEIO:GRASSUSDT

📊 **Chart Overview – GRASSUSDT (4H):**

* 💰 **Current Price:** \$1.1362

* 🔻 **Previous Trend:** Downtrend has been challenged; price broke above the **descending trendline (blue dashed)**.

* 🟦 **Key Support Zones:**

* \$1.10 (recent demand area retest)

* \$1.05 (major support below, seen from earlier bounce zone)

* 🟥 **Key Resistance Zone:**

* \$1.19 – \$1.25 (major supply area where price got rejected again)

---

### 🔍 **Technical Breakdown:**

1. **Break and Retest Attempt:**

* Price **broke the descending trendline** and tapped into the \$1.19 resistance.

* Currently pulling back — possibly a **retest of the broken trendline** and the previous support near \$1.10–\$1.13.

2. **Supply Zone Rejection:**

* Strong rejection from **\$1.19–\$1.25**, which aligns with the upper supply zone.

* Sellers are actively defending this area.

3. **Bullish Case:**

* If GRASS holds above **\$1.10**, it may gear up for another push toward **\$1.19–\$1.25**.

* A clean break and hold above \$1.1935 could open room toward \$1.30+.

4. **Bearish Case:**

* Failure to hold \$1.10 or a breakdown below \$1.05 could invalidate bullish bias and revisit the lower demand zone near **\$0.95–\$1.00**.

---

📌 **Market Summary:**

GRASS is at a **critical zone**, attempting to flip trendline resistance into support. The reaction from \$1.10–\$1.13 will be key to deciding whether it can revisit higher supply levels or turn back toward major support.

---

⚠️ **Disclaimer:**

*This is **not financial advice**. All information provided is for **educational and informational purposes only**. Always perform your own analysis and manage your risk properly before trading.*

---

Proshares

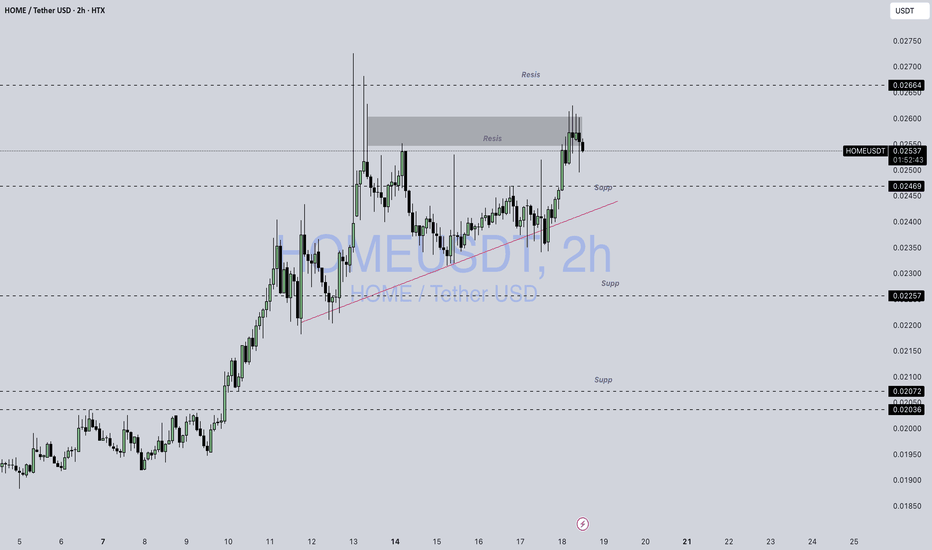

Home / UsdtHTX:HOMEUSDT

### 🧠 **Technical Breakdown of HOME/USDT (2h chart)**

#### 🔲 **Supply Zone (Resistance)**

* **Price Range:** 0.02550 – 0.02633

* This gray zone has previously caused multiple rejections.

* Several upper wicks indicate sellers are active here, absorbing buying pressure.

#### 📍 **Current Price Position**

* Price is **hovering at the edge of the supply zone** (\~0.02549).

* Candle bodies are struggling to close strongly above this region.

#### 🕳️ **Liquidity Wicks**

* A spike near **0.02664** signals liquidity hunts or stop-loss triggers.

* Repeated failures to close above this area suggest **supply dominance** for now.

#### 🔻 **Support Levels**

* **0.02469** – Weak intraday support

* **0.02257** – Strong structure support (tested and held)

* **0.02072 & 0.02036** – Deep support area; significant bounce occurred here previously

---

### 📌 Summary:

* The asset is **testing a known resistance** after recovering from lower levels.

* Behavior in the 0.02550–0.02633 zone is **critical**: either price gets absorbed and reverses, or buyers overpower and break higher.

* Support levels below are clearly defined in case of a retracement.

ORDI / USDTBINANCE:ORDIUSDT

### 📊 **Technical**###

* **Current Price:** \~8.377 USDT

* **Chart Type:** Candlestick (4H)

* **Trendline:** A long-term **downtrend line** has been broken, signaling a potential trend reversal or breakout.

---

### 📍 **Key Zones:**

1. **Resistance Zone (Red Box):**

* Located around **8.3 to 8.5** USDT.

* Price is currently testing this zone.

* A clean breakout with volume can send price toward the **next resistance at 9.43** USDT.

2. **Support Zone (Yellow Box):**

* Around **7.85** USDT.

* If price faces rejection from the resistance, it might pull back to this support and bounce from there.

3. **Next Major Resistance:**

* Marked at **9.430** USDT — likely the next target if the breakout sustains.

---

### 🧭 **Scenarios to Watch:**

* ✅ **Bullish Scenario:**

* Break and hold above the red resistance zone.

* Possible continuation toward 9.43 USDT.

* ⚠️ **Bearish Pullback Scenario:**

* Rejection from the red zone.

* Retest of the 7.85 support zone.

* A bounce here could still maintain a bullish structure.

Disclaimer : Not Financial Advice

BOIL in strong downtrendBOIL is in a strong downtrend.

The daily chart has hit a new low

But the 1-hour chart has now become "extended"

Remember there are 5 waves in an average trend. Once the trend becomes extended, the price likes to break above the 50 SMA to "recalculate" and continue or "recalculate" and reverse.

We love both right? The question becomes, which direction will the market choose?

No one knows. So all you can do is trade your strategy off of the current patterns and information that you see.

That's why 'risk management" is so important. Use 1% of your current total account value on each trade.

That's formula I use in my trade plan and it has served me well.

Link in profile :)

That's all you can do.

#PROS/USDT | Ready to rise strong#PROS

The price is moving in an ascending triangle on a 4-hour frame

The triangle is expected to be breached to the upside in a strong manner, with stability above Moving Average 100

Supported by oversold on the MACD indicator

And upward momentum for the market

Entry price is 0.5300

First target 0.5593

Second target 0.5895

Third goal 0.6229

BOIL: Boiling up and down 🥘Still a bit tentatively but visibly, ProShares Bloomberg Natural Gas (aka BOIL) is starting to boil up, quite in accordance with our expectations. As the first part of a three-part counter movement, the ETF should climb further upwards to finish wave a in magenta, before wave b in magenta should return it to its current level. From there, BOIL should rise into the yellow zone between $7.11 and $19.05 to complete wave c in magenta as well as wave (4) in yellow, whose high should then initiate the overarching downwards trend’s final step: wave (II) in white.

DUG | Bearish Oil | Inverse 3x ETFThe fund invests in financial instruments that ProShare Advisors believes, in combination, should produce daily returns consistent with the fund's investment objective. The index is designed to measure the stock performance of U.S. companies in the oil and gas sector. The fund is non-diversified.

Oil And Gas Ultrashort Shorting. DUGWe are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in purple with invalidation in red. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe

$REK Volume & Upside Potential As the economic outlook degrades in the face of persistent and widespread inflation and GDP projection revision for Q1 was worse than expected, real estate will take a hit. Currently seeing record prices while the beginning of rate hikes and slowing sales appears.

A short opportunity exists and is currently reflected in a massive volume uptick in anticipation of a significant market correction appears imminent in the Dow Jones Real Estate Index.

Near-term ~20% to 25% price target with a substantive longer-term potential quite a bit higher if the macroenvironment doesn't turn around and the economic headwinds don't soften.

This is an inverse short play, so market retraction provides impetus to long $REK.

TQQQ could be a KANG in time! When the whole market is looking to make their way to the down side....the hopium chart projections is where the fun is at!

Will take a little bit of patience for a nice entry to ride up. The closer we get down to the $15-$20 range will be able to see things a bit more clearly on when we could be seeing pivot back up. I feel like making it down to it's C19 low is of course on the probability list for its 3 bottom touches...

ProShares split all ETFs w/ 3wks notice This is TQQQ-SQQQ chart.

I warned of the ProShares split, and it got little mention in the news since the announcement. This is one of the most popular ETF companies in the NYSE, with $550bn in ETFs. This is a big deal. They decided to split ALL ETFs, on short notice (3 weeks) , right before the biggest pullback since covid? Impeccable timing or what? The norm for announcement-to-split is 2-3 months out, but they split within 3 weeks!?

For example, AMZN recently announced a 5/27 split; and GOOG who announced 7/15 split in December.

The 22nd phenomenon is just when new contracts start for the next month; but looking at it from an ETF Giant's point of view you may glean something from the moves here.

Did they know there was a problem? When? Did this help cause it? Any theories welcome. I'm not 100% sure what to make of it, but ProShares seemed to know exactly when to reset the books; and didn't give retail much notice.

TQQQ Split History Table

Date Ratio

02/25/2011 2 for 1

05/11/2012 2 for 1

01/24/2014 2 for 1

01/12/2017 2 for 1

05/24/2018 3 for 1

01/21/2021 2 for 1

01/13/2022 2 for 1

Bullish Crypto News for 15.2M Investors Who Use the Acorns AppAcorns — which has an estimated 15.2 million users and $15 billion in assets under management — says its customers can allocate a percentage of their portfolio to a BTC exchange-traded fund.

Explaining the rationale behind its decision, the company said BTC gives investors the opportunity to diversify their holdings — and claimed cryptocurrencies and the stock market have a low correlation. (However, BTC and the Nasdaq 100 have traded in lockstep for most of this year.)

Setting out its new stance in a manifesto, Acorns revealed it has been keeping its eye on cryptocurrencies since it went mainstream — with executives asking themselves whether BTC would be beneficial for the "financial wellness" of their users in the long run.

Noting that Bitcoin is volatile — doubling its value in 2021 but erasing most of these gains in January 2022 alone — Acorns explained that it believes the ProShares Bitcoin Strategy ETF, which offers exposure to BTC futures, is the best approach

The Santa rally came on the new year.SQQQ I was waiting and waiting on this one and we all knew it was going to come and it finally did.

My last charts are now useless now that they did a reverse split on the thing 5:1.

Well if they did not do that then it would have dropped past a buck and been delisted eventually so they had no choice.

Maybe I am a broken clock who is right twice a year but I will chalk this one up asa win.

A 45% gain in 16 trading days is pretty amazing for SQQQ - I usually expect a win of 7% or maybe 12% but 45% is unreal.

Double Top on #Bitcoin? No. Room to go up.Upper Bollinger Bands have more than two thousand to the upside on todays band

and the stochastic's are firmly locked in

3 days of wall St trading remain for the week.

Don't be too cute

as the old adage says,

the trend is your friend.

obvious I know, but the basics are what keep u in the game for as long as possible.

UVXY Daily TimeframeSNIPER STRATEGY

This magical strategy works like a clock on almost any charts

Although I have to say it can’t predict pullbacks, so I do not suggest this strategy for leverage trading.

It will not give you the whole wave like any other strategy out there but it will give you huge part of the wave.

The best timeframe for this strategy is Daily, Weekly and Monthly however it can work any timeframe above three minutes.

Start believing in this strategy because it will reward believers with huge profit.

There is a lot more about this strategy.

It can predict and also it can give you almost exact buy or sell time on the spot.

I am developing it even more so stay tuned and start to follow me for more signals and forecasts.

UVXY: UpdateBears are out to play, seems the winter is over. I'm not looking to dump my position in UVXY just yet, however. I thought I might update the community that Business wire reported that Proshares plans on doing a 1:10 reverse split on May 26th before opening bell that day for their UVXY security. Trade accordingly. I expected a reverse split once it touched the 3's, but with its sharp spike this week I am a little surprised by the announcement and wonder if it will hold tbh.

Not advice, not recommendation.

AGQ - a Proshares Ultra ETF with potential to 'fly'ProShares Ultra Silver (AGQ)

ProShares Ultra Silver seeks daily investment results, before fees and expenses, that correspond to two times (2x) the daily performance of the Bloomberg Silver SubindexSM.

This leveraged ProShares ETF seeks a return that is 2x the return of its underlying benchmark (target) for a single day, as measured from one NAV calculation to the next. Due to the compounding of daily returns, holding periods of greater than one day can result in returns that are significantly different than the target return and ProShares' returns over periods other than one day will likely differ in amount and possibly direction from the target return for the same period. These effects may be more pronounced in funds with larger or inverse multiples and in funds with volatile benchmarks.

ETF SQQQ Established in February 2010 by ProShares, the UltraPro Short QQQ (SQQQ) is an inverse-leveraged exchange-traded fund (ETF) that tracks the Nasdaq-100 Index. This index is composed of the largest companies, both domestic and international, listed on the Nasdaq stock market, but excludes financial institutions

MAX 2020 : 162,13

SUPPORTS: 153,61 107,76 73,08 46,62 34,39

Minimun : current , 25,06

if someone can give me more information please:::

Sincerely L.E.D

PROSHARES - The triangle is a tough offense to get used to.Hi, today we are going to talk about PROSHARES and its current landscape.

We have a symmetrical triangle in the process of formation. If this triple top doesn't be overcome, the most adjusted movement for the asset its the continuation of this triangle. If a breakout occurs the next lonely top will be aimed by the bulls.

Thank you for reading and leave your comments if you like.

PSQ Proshares Trust: Short opportunity on monthly.PSQ is trading inside a 1M (monthly) Channel Down (RSI = 36.191, MACD = -3.690, Highs/Lows = 0.0000) which last December made its Lower High. A Death Cross (MA50 under MA200) formation occurred in March on 1D and after a 27.60 bottom, the price has been rebounding towards the MA200.

Last time the same pattern occurred was in 2016. The rebound resulted in testing and even marginally breaching the MA200 before collapsing to a new Lower Low and continuing to a very prolonged bearish sequence to October 2018.

We expect a similar price action and our short target is 25.00.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.