Prosignal

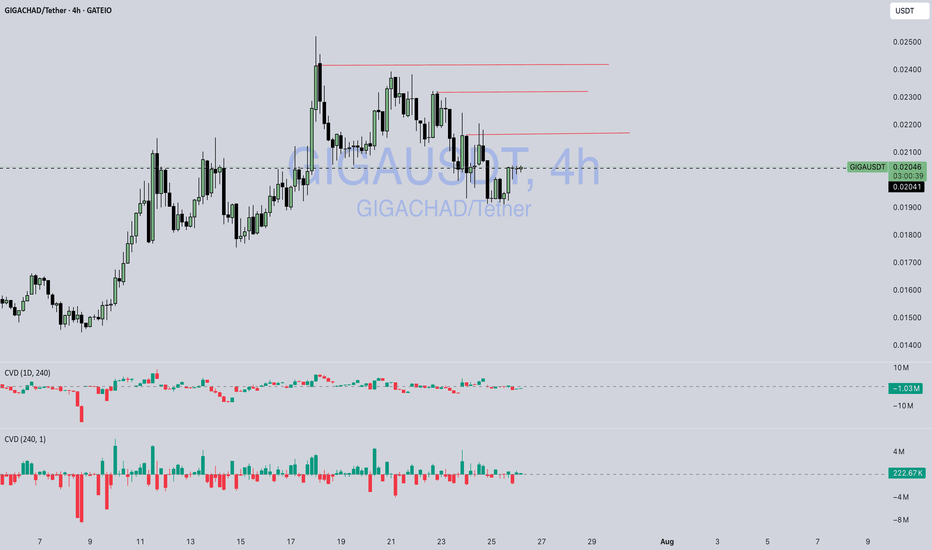

Launchcoin / UsdtBITGET:LAUNCHCOINUSDT

📊 **Technical Analysis – LAUNCHCOIN/USDT (1H, Bitget):**

* 💰 **Current Price:** \$0.10578

* 🟥 **Major Support Zone:** \$0.09000 – \$0.09800 (gray box)

* 🟩 **Resistance Levels:**

* \$0.11037 → short-term resistance

* \$0.14429 → major breakout target

* \$0.19350 → extended resistance zone

---

### 🔍 **Chart Insights:**

1. **Falling Wedge Formation**

A visible falling wedge (marked by dashed trendlines) typically signals a **potential bullish reversal**. Price is currently near the lower end of the pattern.

2. **Projected Scenarios (Red Arrows):**

* 🔁 **Scenario A:** Retest of the **support zone (\$0.090–\$0.098)** before a possible bounce.

* 🚀 **Scenario B:** Immediate breakout from \$0.110 → rally toward \$0.144 if bulls step in strongly.

3. **Key Confirmation Levels:**

* Holding above \$0.098 = Bullish interest.

* Break and close above \$0.110 = Momentum shift.

* Below \$0.090 = Breakdown risk increases.

---

📌 **Conclusion:**

Market is in a **make-or-break zone**. Structure favors a rebound if buyers protect the demand area, but confirmation via volume or a bullish candle close is crucial.

---

⚠️ **Disclaimer:**

*This analysis is for educational and informational purposes only. It is **not financial advice**. Always conduct your own research and use proper risk management before making any trading decisions.*

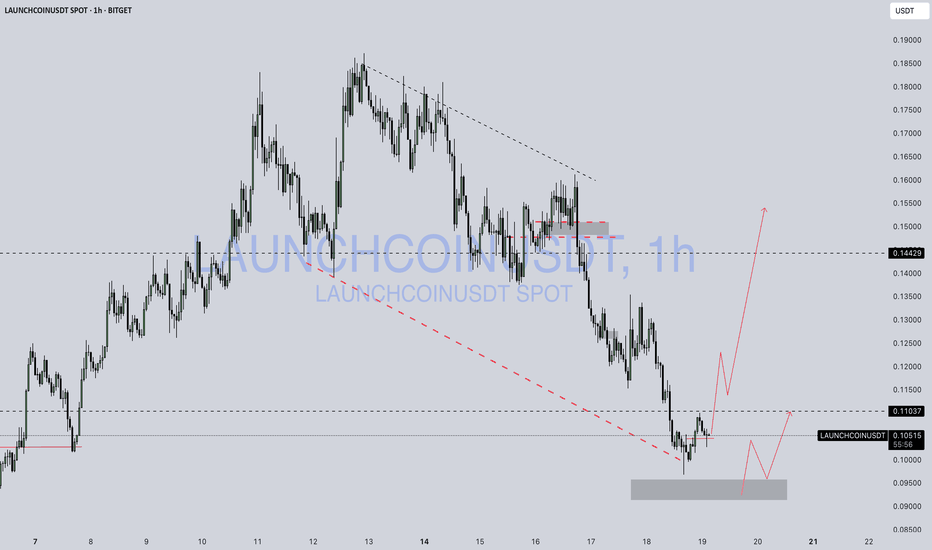

LQTY / USDTBINANCE:LQTYUSDT

📊 **Chart Overview – LQTY/USDT (4H, Binance):**

* 📍 **Current Price:** \$1.134

* 🔻 **Downtrend Line:** Strong descending trendline still acting as resistance.

* 🟥 **Demand Zone (Support):** \$0.91 – \$0.96

* 🟢 **Scenario Projection:** Price might **retest the demand zone** before attempting a bullish reversal (marked by the black curved arrow).

---

### 🔍 Key Observations:

1. **Trend Structure:**

* Price has been respecting a **descending trendline** since the \$1.65+ top.

* Recent rejection from the trendline suggests **sellers are still active**.

2. **Price Reaction Zone:**

* The highlighted **support zone (\$0.91 – \$0.96)** has a history of strong buying and breakout behavior.

* If price drops into this region again, it may trigger a **bullish reversal or bounce**.

3. **Bullish Opportunity:**

* If price **taps into the demand zone with a long wick / strong candle close**, it could be a **high-probability entry** for long setups.

* Potential upside: **\$1.20 – \$1.30** range.

4. **Invalidation:**

* A **clean break below \$0.91** would invalidate the bullish scenario and signal further downside.

---

📈 **Trade Idea (Hypothetical):**

* **Entry Zone:** \$0.94 – \$0.96

* **Stop Loss:** Below \$0.89

* **Target 1:** \$1.15

* **Target 2:** \$1.25

---

⚠️ **Reminder:** This is **not financial advice** – always use your own risk tolerance and confirmation tools (volume, candle close, etc.)

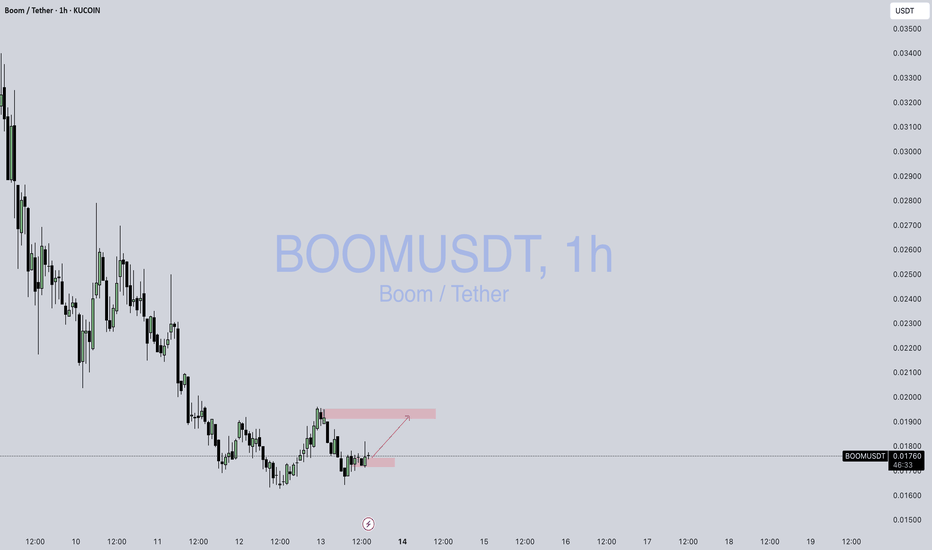

Boom / Usdt KUCOIN:BOOMUSDT

📊 **Technical Outlook – BOOM/USDT (1H):**

* 🟢 **Current Price:** \$0.01760

* 🟩 **Support Zone:** Around \$0.01700 (highlighted in the lower red box) – price recently bounced from this zone.

* 🟥 **Resistance Zone:** Around \$0.01900 – \$0.01950 (upper red box) – price has previously rejected here.

* 📈 **Short-Term Bias:** Bullish attempt – the chart suggests a **potential move upward** toward the resistance area, as shown by the red arrow.

---

🔍 **Key Observations:**

* Recent **higher low formation** suggests bullish interest.

* If momentum holds and volume confirms, price may **retest the \$0.019+ level**.

* However, if the price fails to hold above \$0.01720, the upward setup could be invalidated.

---

⚠️ **Note:** This is **not financial advice** – always manage risk with proper stop-loss levels.

ORDI / USDTBINANCE:ORDIUSDT

### 📊 **Technical**###

* **Current Price:** \~8.377 USDT

* **Chart Type:** Candlestick (4H)

* **Trendline:** A long-term **downtrend line** has been broken, signaling a potential trend reversal or breakout.

---

### 📍 **Key Zones:**

1. **Resistance Zone (Red Box):**

* Located around **8.3 to 8.5** USDT.

* Price is currently testing this zone.

* A clean breakout with volume can send price toward the **next resistance at 9.43** USDT.

2. **Support Zone (Yellow Box):**

* Around **7.85** USDT.

* If price faces rejection from the resistance, it might pull back to this support and bounce from there.

3. **Next Major Resistance:**

* Marked at **9.430** USDT — likely the next target if the breakout sustains.

---

### 🧭 **Scenarios to Watch:**

* ✅ **Bullish Scenario:**

* Break and hold above the red resistance zone.

* Possible continuation toward 9.43 USDT.

* ⚠️ **Bearish Pullback Scenario:**

* Rejection from the red zone.

* Retest of the 7.85 support zone.

* A bounce here could still maintain a bullish structure.

Disclaimer : Not Financial Advice

HBAR / USDTBYBIT:HBARUSDT

### 📉 **HBAR/USDT 4H Chart Analysis**

*(As of 0.15684 USDT)*

---

### 🔼 **Resistance Zones:**

1. **0.158–0.160 (Local Resistance):**

* Multiple rejections in this zone.

* Price currently struggling to break through.

2. **0.17548 (Major Resistance):**

* Strong historical level.

* Acted as a turning point previously.

---

### 🔽 **Support Zones:**

1. **\~0.150 (Local Support):**

* Recent reaction area.

* Price found temporary stability here.

2. **0.14241 (Major Support):**

* Strong reversal zone in previous sessions.

* Significant demand was seen historically.

---

### ⚙️ **Price Behavior:**

* Market is in a **sideways consolidation** phase.

* No breakout or breakdown confirmed.

* Structure is developing between support and resistance boundaries.

---

### 📌 **Key Observations:**

* Lower highs forming near resistance may suggest hesitation.

* Consolidation can often lead to stronger moves once direction is confirmed.

* Watching volume and reaction near key levels is critical.

---

> **Disclaimer:**

> This analysis is for educational and informational purposes only. It is **not financial advice**. Always do your own research (DYOR) and consult a professional before making any trading decisions.