Protrader

CHF/JPY CHART POSITION IF PRICE CAN BROKE THIS LINE (WE ARE IN DOWN TREND CHART) PRICE WILL MOVE FOR LOWER SUPPORTS AND THIS IS GOOD POSITION FOR SHORT, JUST BE AWARE IF YOUR POSITION TOUCH FIRST TAKE PROFIT YOU HAVE 2 CHOICE

1. CLOSE ALL OF YOUR POSITION AND OUT FROM DEAL

2. CLOSE HALF OF YOUR POSITION AND MOVE YOUR STOP LOSS AT ENTRY POINT AND WAIT FOR SECOND TAKE PROFIT.

POST WILL UPDATE...

HFTs Make a Mistake on CELGCelgene Corp has had 3 HFT gaps this year. The first was gigantic. Then HFTs made a mistake and gapped the stock down. This resulted in Pro Trader buying at that lower level. Recently it gapped up and is in a compression mode.

NVDA: Filled gap down, watch for pro trader pre-earnings runNVDA has filled the gap down from the negative earnings reaction in November 2018. The stock is likely to consolidate or shift sideways at this resistance level if it is to build energy to move higher. There is some Dark Pool accumulation in the bottoming pattern. HFTs have gapped this stock on earnings news in the past. Earnings will be reported May 9th. A month out is a good time to start watching for the pro trader patterns that lead to momentum in a pre-earnings run.

NKE: Early reporting stocks set the tone for earnings seasonNIKE is reporting earnings today AFTER the market closes. How the stock behaves will help determine how to trade this earnings season as we can begin to determine which of the HFT algorithms are being used and the expectations of the pro traders on how they are managing the pre-news they receive ahead of the retail crowd. Currently there is no viable pre-earnings run setup. The stock is bouncing around the previous all-time high area, without breaking to the upside.

HFTs have been in this stock on earnings report days in the past. The report needs to be very positive this time. The next few charts I use for analysis will be about studying these very early reporting companies and the HFT algo reaction. Stay tuned…

in depth of the euro dollarhere we see euro use was trending upwards in the daily for a pretty long time then faced a reversal, the s&p 500 had a correction on monthly time frame and now looking for another bullish impulse so the dollar is pretty bullish and it has impacted eur usd.

what I'm expecting from thus pair is a finish to the choppy and a continuation to the downside toon to hit a key level, on 4h and daily we are already seeing rejection of price going up, it has finished chopping and ready for a impulse downward

AKAM: Dark Pools & Pro Traders Patterns Ahead of Earnings TodayAkamai Technologies Inc. reports earnings today with a solid start to a bottoming formation with Dark Pools' and then Pro traders’ footprints. The stock is currently at a completion level for the short term bottom. A Shift of Sentiment™ pattern formed between October and January. AKAM moved lower before finding the final low support from a previous Dark Pool Buy zone while Accumulation/Distribution indicators exposed the positive divergence. The pattern is a setup for a swing trade, not a position trade opportunity yet.

UTX: Pros Set Up for Earnings Today While Dark Pools RotateUnited Technologies Corp Weekly Chart removes the white noise of the daily candlestick patterns, revealing a cleaner perspective of who controls price for this stock. UTX is bouncing up after hitting support levels AND with professional traders setting up for earnings news. The precision trading of the professionals is not impacted by the slow hidden rotation pattern revealed by the Accumulation/Distribution indicator on the weekly scale. As the stock price rose, large-lot Dark Pools sold (rotation), hiding their activity. The rotation is not about this report; those buying and selling adjustments occurred in November and December. This rotation is about the first quarter earnings report for 2019, which will come out in April. Dark Pools make decisions 1-3 months ahead of the earnings reports. Today UTX is reporting last year’s results, ancient history for the Dark Pools. The pro traders are gearing up for HFT action on this high-profile stock.

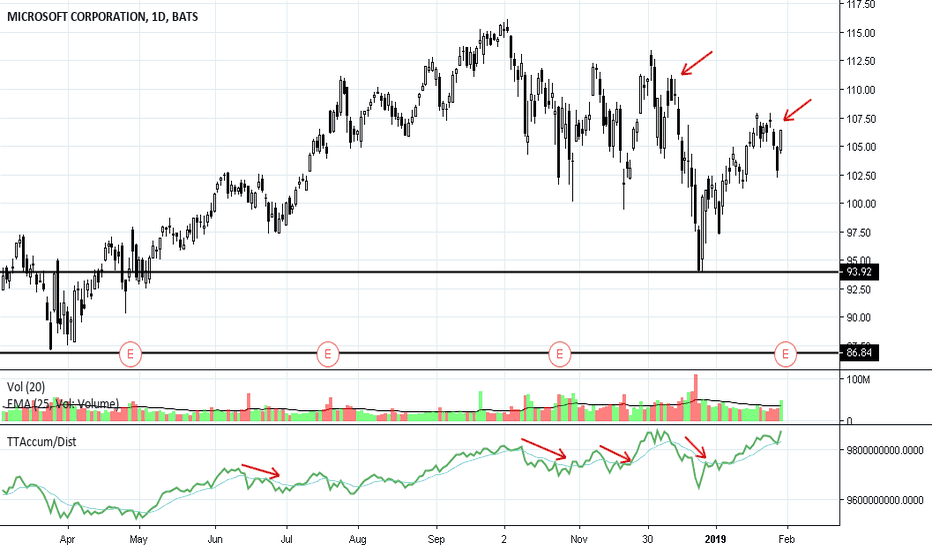

MSFT: No Pre-Earnings RunMicrosoft reported today after the market close. Unlike many other big blue chip companies, MSFT didn’t have a pre-earnings run up by professional traders. There was no tight compression or consolidation in the technical patterns. There were no strong white candles forming a run ahead of the earnings report. This is a stock traded mostly by retail traders right now, so a negative reaction to missing bottom line targets is par for the course. There is also the pressure of heavier than average rotation in this stock’s trend, best seen with Accumulation/Distribution indicators.

$OMG Short Term and Mid Term Gains Idea. Whale Incoming...The trade that match with my criteria, one of them at the moment is OMG!

You can see the indicators at the moment are so tempting, plus, OMG haven't have it's return to bounce, so it could be it's time soon as the chart looks bottomed out for days now.

If you wanted to play, I already put short term targets on white line and mid term target on Yellow.

If all of these ideas I posted helps you, give them thumbs up, shares, comments and follow me. If you have a suggestion, just fill in the comment sections or message me. Looking forward to hear from you all. Thanks a lot!

-----------------------------------------------------

Blockchaindedi Rules:

#1 Always obey tradingview.com house rules

#2 Always read the description

#3 Don't spam on the comment section

#4 If you wanted to request my opinions about a coin/token just give 10 likes on my published charts and I will do it the day or two after

#5 My opinions are not financial advice, follow it at your own will and your own risk

#6 Together, let's build a better community on this platform

-----------------------------------------------------

4 Golden Nuggets of Trading BitcoinHey guys, YoungShkreli here, I am going share with you four lessons that, if mastered, will help you a become a successful trader, so pay attention

1) Use the daily chart. Look at this 4hr chart. This s**t only happens on low timeframes. If the daily did things like this, it would a be followed by like a 20% rally every single time, but on the lower time-frames, you can get stopped out to the downside. This happens all the time and it's why I NEVER use any low time-frame for Bitcoin... and I never will. My strategy works really, really f**king well on the daily, but it's completely ineffectual on the low time-frame and I believe every strategy will be the same. The RSI means NOTHING on lower time-frames, the macd means NOTHING on lower time-frames, so don't trade it. It's that simple. Be patient, don't over trade, and use the daily chart. You will make all the money you want doing these things.

2) Think ahead. Before you make any trade you need to consider two things: a) at what price you are wrong and need to exit the trade and b) how much you are willing to lose. For example, let's say bitcoin is at $7,000 and the prior high was $7,500 and you want to short it; the amount you're willing to risk is $1,000. To calculate how many bitcoins you can short you take 1000/(7500-7000)=2 The MAXIMUM amount of bitcoin you can short is 2. Why? because if the price of bitcoin rises $500 and you were short 2 then you lost $1,000 which was your risk limit. Notice that $7,500 is your stop loss. Never trade without a stop-loss.

3) Program your trading. You don't necessarily have to use an API to automate your trades, you can manually carry out your trades, but you need to be methodical. Write down specific criterion that bitcoin must meet before you buy or short it: this is your strategy. Follow your strategy ALWAYS. you can only become a better trader once you have a better strategy, you can only improve your strategy if you have one, you can only have one if you write it down. This is a lesson that I took more seriously after reading Principles: Life and Work by Ray Dalio. Ray Dalio is the CEO of one of the greatest hedge funds ever and this is exactly what he says (always listen to those better than you - be humble).

4) Always evolve your strategy. Your strategy is never done growing. There is always work to be done and always gains to be had. I am a good trader, you will come to see this as we become more acquainted, but I am still ALWAYS growing. I learned quite a bit of Python this year and that has been invaluable to me for trading. I have learned how to automate my trading and have written code that calculates all kinds of things regarding minimizing risk while maximizing exposure, data analyis etc. Even the most skilled trader will not have the best gains with his/her brain alone. You need a computer to help you make sure you are right with your calculations and you need it to understand more clearly where your strategy can be improved.

These are lessons I have learned that have helped me immensely and will get you started towards whatever financial goals you may have. These are amazing things to master, if you do, you are on the way to being financially independent. You can really become rich doing this. Trading the markets is one of the best ways to make money because it is a multi TRILLION dollar industry. If you are at the top of it, you WILL become a billionaire if you start a business doing it. That is my goal, one day I will start my own hedge fund and I will become a billionaire. I hope if that is anyone's goal here, I help you towards that goal as well.

If my post has been useful to you, please like my work and follow me, it will help both of us.

-YoungShkreli