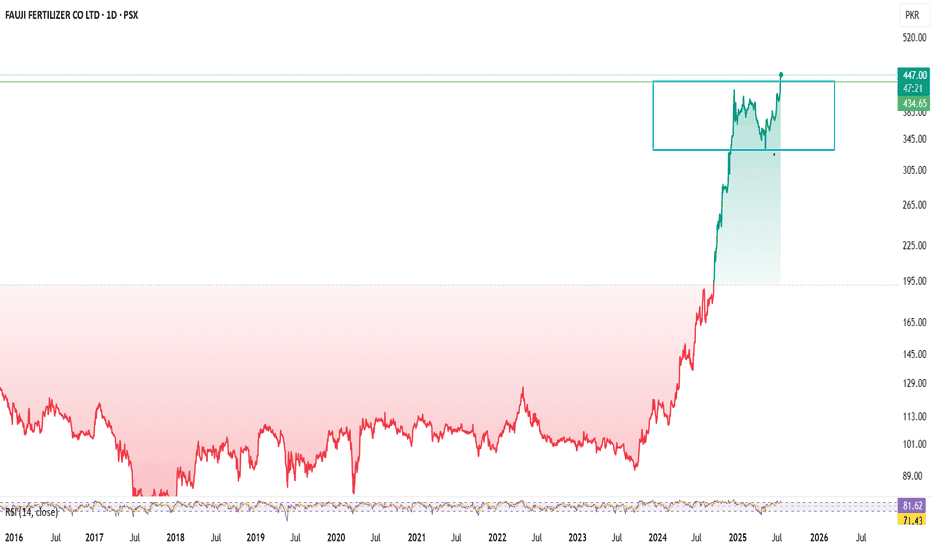

FFCFFC PSX STOCKs breakout Day Level Buy Call

Fundamental Strengths

Robust earnings growth:

FY 2024 net profit ~PKR 64.7 B vs ~PKR 29.7 B (2023) – EPS nearly doubled to PKR 45.49

Pakistan Stock Exchange

+15

StockAnalysis

+15

.

Q1 2025 EPS ~PKR 9.33 (Sep‑Nov on TTM ~PKR 66.6)

Pakistan Stock Exchange

.

Attractive valuation:

TTM P/E ~9.6× (TradingView shows ~6.6×—likely consolidated vs standalone) .

High dividend yield:

~8.7–9.9% yield in 2024, with a ~60% payout ratio

TradingView

.

Diversified portfolio:

Operations across fertiliser, power, food, banking (via Askari Bank), wind generation, phosphate JV – mitigating sector risk

TradingView

+1

+1

Strong ownership:

Backed by Fauji Foundation (~43% owner) – adds stability and governance credibility

PSX

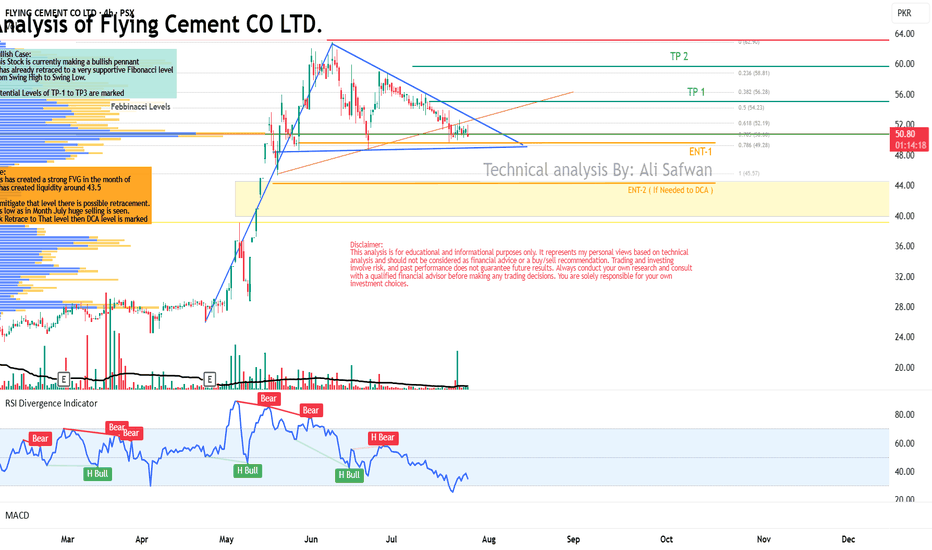

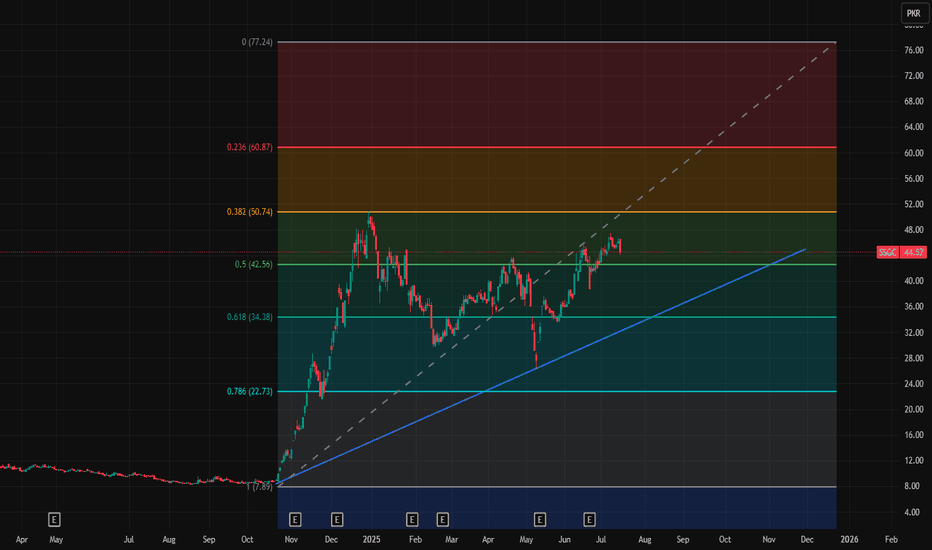

Technical Analysis of Flying Cement CO LTD.Bullish Case:

This Stock is currently making a bullish pennant

it has already retraced to a very supportive Fibonacci level

from Swing High to Swing Low.

Potential Levels of TP-1 to TP3 are marked

Bearish Case:

This Stock is has created a strong FVG in the month of

May which has created liquidity around 43.5

In order to mitigate that level there is possible retracement.

Possibility is low as in Month July huge selling is seen.

Incase Stock Retrace to That level then DCA level is marked

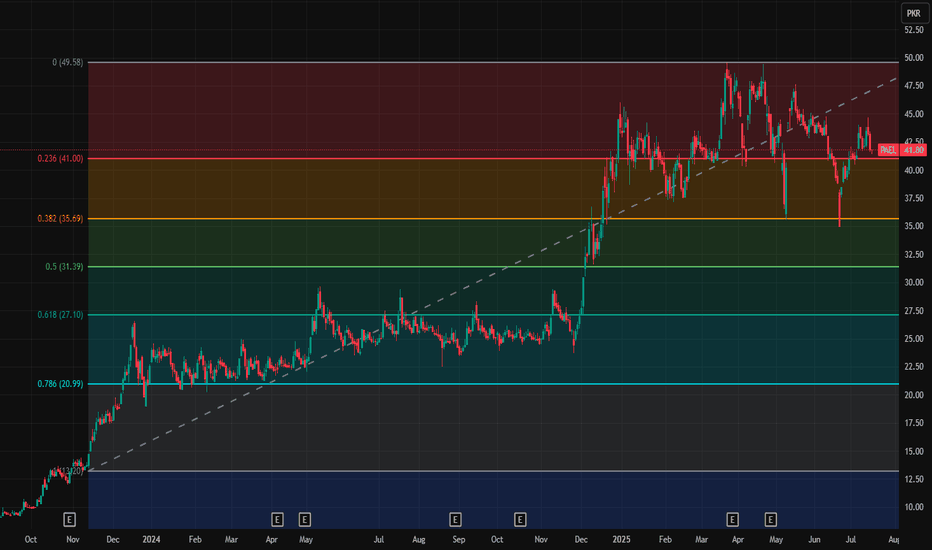

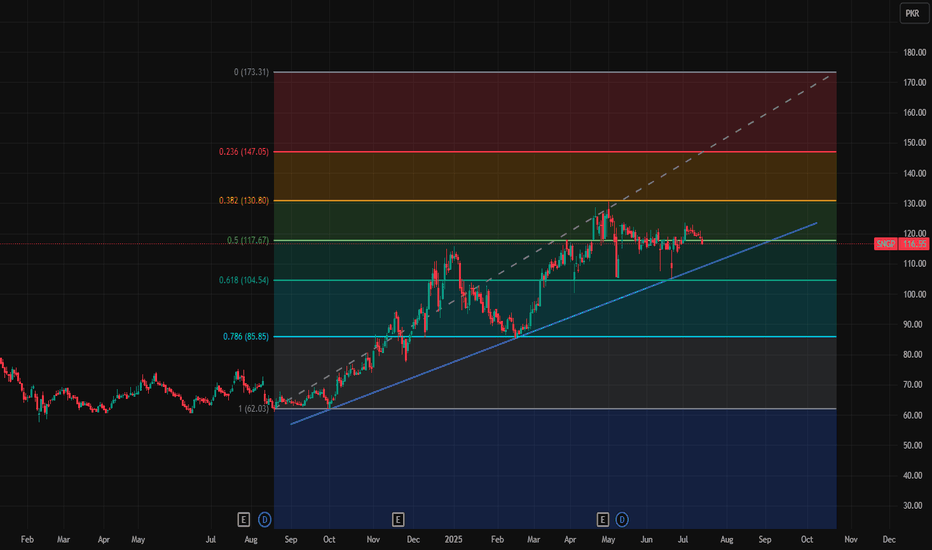

GAL Technical Analysis: Bullish OpportunityGAL (Ghandhara Automobiles Ltd.) is showing a strong bullish setup. Price is holding above its trendline after bouncing off solid horizontal and rectangle support zones. On top of that, GAL has a history of performing well in July, which adds a seasonal boost to the setup.

Fresh entries can be considered at the CMP, while for averaging or pullbacks, 375 and even 350 could offer attractive buy zones if the price dips.

For risk management, there are two stop-loss options: a conservative one below 318 to guard against broader breakdowns or gap fills, or a more aggressive one on a closing basis under 350, just beneath key structure.

Take Profit 1 at 490 lines up with rectangle resistance. A strong close above this opens the door to the next projection around 630. If price manages a firm close above 630, momentum could drive it further, with the AB=CD pattern pointing toward a stretch target near 700.

Trading Recommendations:

Buy 1 (CMP): 404

Buy 2: 375

Stop-Loss (Aggressive): Closing below 350

Stop-Loss (Conservative): Closing below 318

Take Profit 1: 490

Take Profit 2: 630

Take Profit 3: 700

Happy trading!

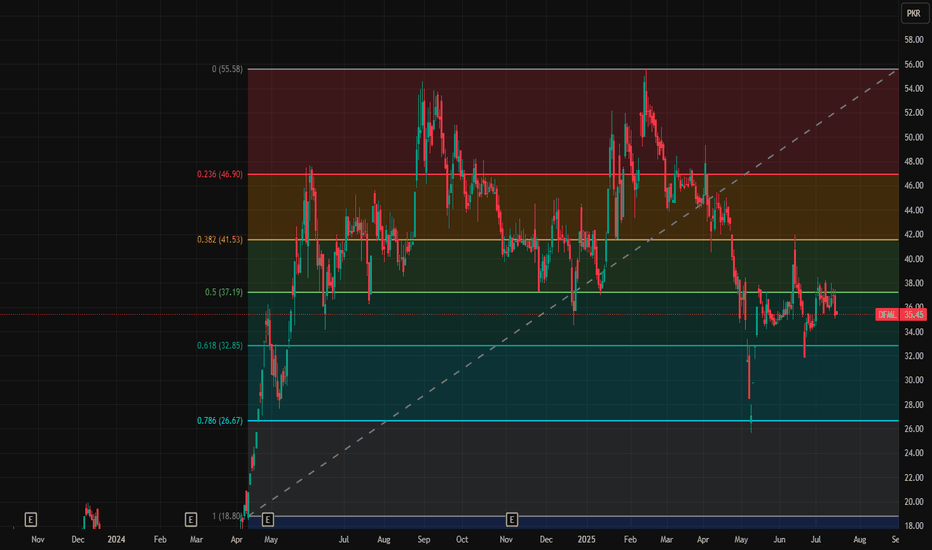

Fresh entry for CSAPAs you can watch it is now below 50 days moving average (green line) and it is also near to 200 days moving average (red line).

Buying conditions:

1) if it cross above green line (117.74)

2) If it fall below from red line (108.47) and cross above it

3) If it fall more red line then wait for its strong support of 105.87 and if it fall below it then wait for cross over above 105.87 level to take fresh entry.

SL is 84.8 and TPS are 118.87 and 139.88

Note: This is not a buy/sell trade call.