PEKAT CONT MARKING UPThis is a continuation of my prev thesis for Pekat

**Refer prev post

Since my previous position, Pekat has been always under my radar.

(This is a Stepping Stone Zone, Continuation from previous Mark Up Phase)

what caught my attention, the formation of BUEC consistenly unfolding in the background of reducing supply (red arrow)

With the formation : type #2 schematic of feather's weight (black line)

*No springboard here. difficult to see this kind of setup

although the entry point, a bit extended comparing to my average price entry, but it was still contained within the limit (not more than 2%)

Position intiated as attached

PureWyckoff

Purewyckoff

GAMUDA CONT MARK UPThis is a continuation of my prev post

**Refer link below

In Wyckoff Methode , The Formation of BUEC is a sign that further price advancement will continue

to the phase E (Marking up outside the Trading Range)

The BUEC in this formation, coincide with a Local Spring

On Top of that, with a Feather's weight & Springboard in it

With a Trigger Bar today, position initiated as attached

PureWyckoff

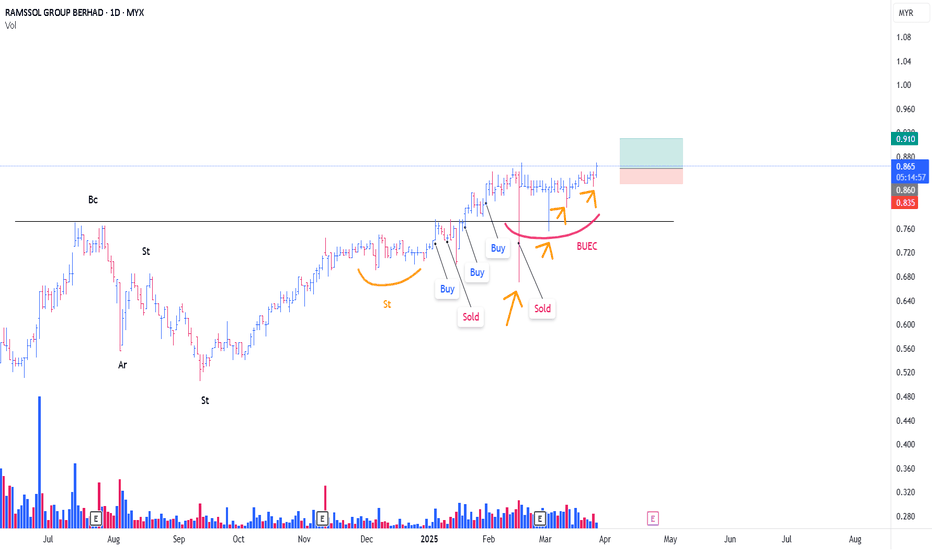

RAMSSOL MARKING UPA rising bottom type of re-accumulation

With the influx of demand (Red Arrow)

Followed by very short term SpringBoard (4/6/25, Black Arrow)

- #1 Springboard, absoprtion Type

**Atypical Type of Springboard

position initiated today based on the Trigger Bar with a very tight risk

Purewyckoff

MNHLDG GOING TO CONT MARK UPI maintained my previous thesis for MNHLDG

**please refer to my previous

Just need an addition, for the formation of new 'Local Spring' *black color word

i was knocked out on last position for this

market environment dragged MNHDLG despite with a positive surrpise earning

Based on Spring Setup,

looks like Test Of The Spring success at the moment

i initaited position as attached with tight cut loss

PureWyckoff

SUNWAY GOING MARK UPFor Sunway, This is an Atypical Re-ACcmulation Schematic #1

-I maintained my prev hypothesis

(Position triggered Stop Loss Level, probably i was too early for this)

*refer my prev post

I view sunway as a Top Competitor, which my no.1 pick would be Gamuda (Refer my prev post)

-Both of which are Insti. Fav

As for the dropping in earnings, the technical side is too beautiful to ignore

Formation of Feather's Weight (Blue LIne)

Along with Possible SpringBoard (Red Line) in action

Would be good sign, if today & upcoming Bars/Candlesticks, succesfully closing above the suply

on 10/6/25 (Red Arrow)

Position initiated with very tight Risk

PureWyckoff

SCGBHD WILL CONTINUE MARKING UPThis is just a continuation from my previous trading idea for SCGBHD

**Refer below

I was liquidated from the position yesterday

Now, looks like at the minimum, i was too early for this stock previously.

With the formation of Spring-Type Action ,

And the On-Going absoprtion especially supply from 28/5 (Black arrow)

I initiated my position as attached

PureWyckoff

SCGBHD TO CONT MARK UPThis is a continuation trade idea from my prev post

***refer to link below

Since the BUEC , Price advancing for about 45%..

Not qualified for a Power Play by the way

**(Or can consider Semi Power Play)

With a formation of Feather's Weight (Red Line)

SpringBoard sign prompted me to initiate position as attached

Tight Risk

PURE WYCKOFF

MNHLDG CONT TO MARK UPA rare schematic, of Type #1 Accmulation

This is a Power Play

-Since Spring, price soaring high with influx of demand (Green Arrow)

With a Possiblity of Feather's Weight ( Yellow LIne)

-Position initiated @ Spring Board (Red Line)

-Plus with additional Local Spring Type Action

Position intiated as attached

Tight Risk

PURE WYCKOFF

SUNWAY TO CONT MARK UPAs plotted , this is a rare Type #1 Schematic of Re-Accmulation

for a wyckoffian, our eyes are trained to spot any possible / confirmed Spring

Noticed the increase in Supply @ 9/5/25 (Black Arrow)

Despite that, Trigger Bar formed today

-This is A sign of SpringBoard that formed through absorption

As such, entry initiated as attached with a very tight SL

PureWyckoff

PEKAT MARKING UPA Type #2 of Re-Accumulation Schematic

previous entry as attached (not too much profit secured)

Past few days noticed the BUEC (phase D)

With that in mind, possiblity starting of the campaign for phase E, which is price to mark up outside the Trading Range (BOX)

With A Trigger Bar today, position initiated with tight risk

PureWyckoff

KPJ MARKING UPAn Atypical Re-Accmulation Scehmatic # 2 (The rising bottom)

Very Straighforward Chart

- BUEC in Action (yellow Line)

Noticed the formation of SpringBoard (Red Line)

-Position initiated @ 10/4/25 & 15/4/25

-interestingly, there is a an atypical local spring with huge vol,

that 'looks' like a success 'test' after that

Tight SL (Original SL moved up)

PureWyckoff

GAMUDA MARK UP CAMPAIGN

So, a rare schematic of wyckoff spotted. Finally.

A Type #1 Schematic of Accmulation

I have been started my position as attached, along with my clients (Red Line)

Technically :

1/ The Spring is very nice, Textbook Classic as mentioned by David Weiss

2/ The Feather's weight along with SpringBoard (Yellow LIne) prompted us to add position

With the QR, released yesterday showing an increase profit margin + revenue + earning.

PureWyckoff

PECCA MARKING UPPecca, an Atypical Type of Schematic #2 Wyckoff Re-Accmulation

Why Pecca?

technically =

1. Feather's Weight (red crescent)

2. Absoprtion (Red arrow)

3. fulfilling Wyckoff 9 Buying point

TriggerBar today, as a test, for a follow through in the upcoming days.

Position initiated as attached

PureWyckoff

WILL ECOMATE MARK UP?This is Schematic #2 Rising Bottom of Re -Accumalation

I am attracted to the TriggerBar on 11/3/25, which succesfully commit above the upper trading range

In which subsequently reacted with a very low supply (Arrow)

Made a decision for EP

Going to expose progressively, if things improving from here on wards

Bursa KLCI has been under massive selling

Im expecting a volatility in upcoming weeks

PureWcykoff

RAMSSOL CONTINUE MARKING UPI have been following ramssol since my last position

For ramssol, this is an Atypical Type #2 Re-Accumulation Schematic

The Rising Bottom

Based on the chart, I bought @ 6th Jan , i assumed that ramssol was at Phase D incoming to the phase E , awaiting for markup.

However somehow price plummeted (18th Feb) and i managed to secure some profits.

Since then, what interesting to me, is that, ramssol has 4 undercut (orange arrow) and price making uptrend

-These 'undercut' can be considered as 'Stepping Stone SPRING'

from the volume side, supply successfuly absorbed with succesful test of the 'Spring'

Position initiated as attached

Pure Wyckoff

Tight SL

JPG MARK UP CAMPAIGNFor JGP, This is a Typical Rising Bottom (Schematic #2 of Accumulation)

Few reasons, should be pointed out :

1/ Based on Comparative Analysis , JPG somehow shows interest from the CO (JPG did HH HL, While General Market did HL LL)

-- This is a sweet spot

2/ Supply Evaporating (black arrow)

3/ JPG so far fulfilling the Wyckoff 9 Buying Criteria

4/ TriggerBar (red arrow) shows relatively higher average intraday vol influx

**Red line = Creek

EP n SL as attached

pure wyckoff

WILL SIGNATURE MARKING UP?A typical Rising Bottom (Re-Accmulation Schematic #2)

Despite huge supply on 6th & 14th February, price still trending Up (Red Arrow)

In terms of price action, nothing to be pointing as it is very obvious to Wyckoffian

So, Based on presumption of BUEC :

Tried to get in around 1.63-1.64 , failed

Bursa Malaysia has been experiencing a very tough environment past few months,

With Foreign Inst became Net Sellers (Consecutively)

Ep with SL as attached, Tight Risk

Pure Wyckoff

WILL AUMAS MARKING UP?Based on the context of setup

Aumas probably in Phase B

I dont see any active Change of Character (Choch) yet

However im expecting Choch soon

With a Springboard in action (Black circle color) :

-A trigger bar today prompted me to intiate position (as attched)

-Supply evaporating (reducing vol)

Tight SL

Pure Wyckoff