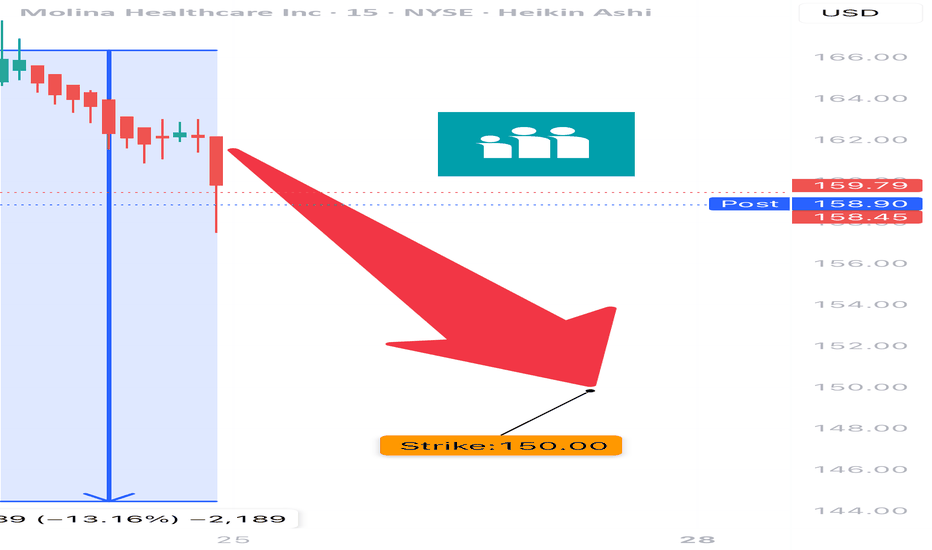

MOH PUT TRADE ALERT (07/24)

🚨 MOH PUT TRADE ALERT (07/24) 🚨

📉 Extreme Oversold. Institutional Selling. Setup is Real.

🧠 Key Stats:

• RSI: 13.2 = insanely oversold

• Volume: 🔺2.6x last week = institutions dumping

• Put/Call Ratio: 0.33 → heavy bearish bets

• VIX: Low → IV still cheap 💰

🔥 TRADE IDEA

🔻 Buy MOH $150 PUT exp 8/15

💰 Entry: $4.20

🎯 Target: $8.40

🛑 Stop: $2.50

📈 Confidence: 75%

📊 Why this works:

• Everyone’s selling, and the chart confirms it

• IV still low → great R/R for puts

• Only risk? Dead-cat bounce — use stop.

🧨 Execute at open — momentum is accelerating.

#MOH #PutOptions #BearishSetup #OversoldRSI #UnusualOptionsActivity #TradingView #InstitutionalSelling #SmartMoney #SwingTrade #WeeklyOptions #ShortTheBounce

Putoptions

KEY KeyCorp Options Ahead of Earnings If you haven`t sold KEY before the selloff:

Now analyzing the options chain and the chart patterns of KEY KeyCorp prior to the earnings report this week,

I would consider purchasing the 15usd strike price Puts with

an expiration date of 2024-8-16,

for a premium of approximately $0.21.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

JNJ Johnson & Johnson Options Ahead of EarningsIf you haven`t bought JNJ before the previous earnings:

Then analyzing the options chain and the chart patterns of JNJ Johnson & Johnson prior to the earnings report this week,

I would consider purchasing the 145usd strike price Puts with

an expiration date of 2025-1-17,

for a premium of approximately $7.55.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

SMPL The Simply Good Foods Company Options Ahead of EarningsAnalyzing the options chain and the chart patterns of SMPL The Simply Good Foods Company prior to the earnings report this week,

I would consider purchasing the 35usd strike price Puts with

an expiration date of 2024-4-19,

for a premium of approximately $1.90.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

GIS General Mills Options Ahead of EarningsIf you haven`t bought GIS before the rally:

nor sold the potential selloff:

Then analyzing the options chain and the chart patterns of GIS General Mills prior to the earnings report this week,

I would consider purchasing the 62.50usd strike price Puts with

an expiration date of 2024-4-19,

for a premium of approximately $0.60.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

SIRI Sirius XM Holdings Options Ahead of EarningsAnalyzing the options chain and the chart patterns of SIRI Sirius XM Holdings prior to the earnings report this week,

I would consider purchasing the 4usd strike price Puts with

an expiration date of 2023-11-17,

for a premium of approximately $0.32.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

LOGI Logitech International Options Ahead of EarningsIf you haven`t sold LOGI here:

Then analyzing the options chain and the chart patterns of LOGI Logitech International prior to the earnings report this week,

I would consider purchasing the 80usd strike price in the money Puts with

an expiration date of 2024-1-19,

for a premium of approximately $11.05.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

THO THOR Industries Options Ahead of EarningsAnalyzing the options chain and the chart patterns of THO THOR Industries prior to the earnings report this week,

I would consider purchasing the 105usd strike price Calls with

an expiration date of 2023-10-20,

for a premium of approximately $0.97.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

FDX FedEx Corporation Options Ahead of EarningsIf you haven`t bought FDX here:

or ahead of the previous earnings:

Then analyzing the options chain and the chart patterns of FDX FedEx prior to the earnings report this week,

I would consider purchasing the 220usd strike price Puts with

an expiration date of 2023-11-17,

for a premium of approximately $1.96.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

PSTG Pure Storage Options Ahead of EarningsAnalyzing the options chain and the chart patterns of PSTG Pure Storage prior to the earnings report this week,

I would consider purchasing the 36usd strike price Puts with

an expiration date of 2023-9-15,

for a premium of approximately $2.25.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

TLYS Tilly's Options Ahead of EarningsAnalyzing the options chain and the chart patterns of TLYS Tilly's prior to the earnings report this week,

I would consider purchasing the 7.50 usd strike price in the money Calls with

an expiration date of 2023-10-20,

for a premium of approximately $1.55.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

TTC The Toro Company Options Ahead of EarningsAnalyzing the options chain and the chart patterns of TTC The Toro Company prior to the earnings report this week,

I would consider purchasing the 105usd strike price Calls with

an expiration date of 2023-9-15,

for a premium of approximately $1.52.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

YEXT Options Ahead of EarningsAnalyzing the options chain and the chart patterns of YEXT prior to the earnings report this week,

I would consider purchasing the 10usd strike price Calls with

an expiration date of 2023-11-17,

for a premium of approximately $0.65.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

SNOW Snowflake Options Ahead of EarningsIf you haven`t sold SNOW on this Head and Shoulders Bearish Chart pattern, on Disappointing Growth Forecast:

or reentered here, ahead of earnings:

Then analyzing the options chain and the chart patterns of SNOW Snowflake prior to the earnings report this week,

I would consider purchasing the 145usd strike price Puts with

an expiration date of 2023-8-25,

for a premium of approximately $7.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

URBN Urban Outfitters Options Ahead of EarningsAnalyzing the options chain and the chart patterns of URBN Urban Outfitters prior to the earnings report this week,

I would consider purchasing the 35usd strike price Calls with

an expiration date of 2023-9-15,

for a premium of approximately $2.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

ALT Altimmune Options Ahead of EarningsAnalyzing the options chain and the chart patterns of ALT Altimmune prior to the earnings report this week,

I would consider purchasing the 3.00usd strike price Puts with

an expiration date of 2024-1-19,

for a premium of approximately $0.99.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

WOLF Wolfspeed Options Ahead of EarningsAnalyzing the options chain and the chart patterns of WOLF Wolfspeed prior to the earnings report this week,

I would consider purchasing the 45usd strike price Puts with

an expiration date of 2023-11-17,

for a premium of approximately $3.05.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

A Agilent Technologies Options Ahead of EarningsAnalyzing the options chain and the chart patterns of A Agilent Technologies prior to the earnings report this week,

I would consider purchasing the 125usd strike price Puts with

an expiration date of 2023-9-15,

for a premium of approximately $3.45.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

ET Energy Transfer Options Ahead of EarningsIf you haven`t seen this pattern play out:

Then analyzing the options chain and the chart patterns of ET Energy Transfer prior to the earnings report this week,

I would consider purchasing the 15usd strike price Calls with

an expiration date of 2024-1-19,

for a premium of approximately $0.17.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

ENPH Enphase Energy Options Ahead of EarningsIf you haven`t sold ENPH here:

Then analyzing the options chain and the chart patterns of ENPH Enphase Energy prior to the earnings report this week,

I would consider purchasing the 170usd strike price Puts with

an expiration date of 2024-1-19,

for a premium of approximately $22.15.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

ROKU Options Ahead of EarningsIf you haven`t sold ROKU`s double top:

Or bought the dip here:

Then analyzing the options chain and the chart patterns of ROKU prior to the earnings report this week,

I would consider purchasing the 75usd strike price puts with

an expiration date of 2023-8-25,

for a premium of approximately $7.45.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

STT State Street Corporation Options Ahead of EarningsAnalyzing the options chain of STT State Street Corporation prior to the earnings report this week,

I would consider purchasing the 75usd strike price Puts with

an expiration date of 7/21/2023,

for a premium of approximately $1.75.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

ASTL Algoma Steel Group Options Ahead of EarningsAnalyzing the options chain of ASTL Algoma Steel Group prior to the earnings report this week,

I would consider purchasing the 7.50usd strike price in the money Calls with

an expiration date of 2023-8-18,

for a premium of approximately $0.77.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.