Puts

NFLX Netflix Options Ahead of EarningsIf you haven`t bought NFLX before the previous earnings:

Now analyzing the options chain and the chart patterns of NFLX Netflix prior to the earnings report this week,

I would consider purchasing the 1260usd strike price Puts with

an expiration date of 2025-9-19,

for a premium of approximately $71.10.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NVDA NVIDIA Corporation Options Ahead of EarningsIf you haven`t bought NVDA before the previous earnings:

Now analyzing the options chain and the chart patterns of NVDA NVIDIA Corporation prior to the earnings report this week,

I would consider purchasing the 131usd strike price Puts with

an expiration date of 2025-6-20,

for a premium of approximately $7.00.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

I`m overall bullish long term on NVDA.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Potential HSNot confirmed yet but I'm jumping in anyways. I bought some puts of GLD for May 23 strike 304. My SL triggers if the price breaks up the resistance shown and closes above in the daily timeframe. Might be some turbulence, bulls will try to push the price higher. too much noise in the political arena, but Gold is overbought and needs a healthy correction.

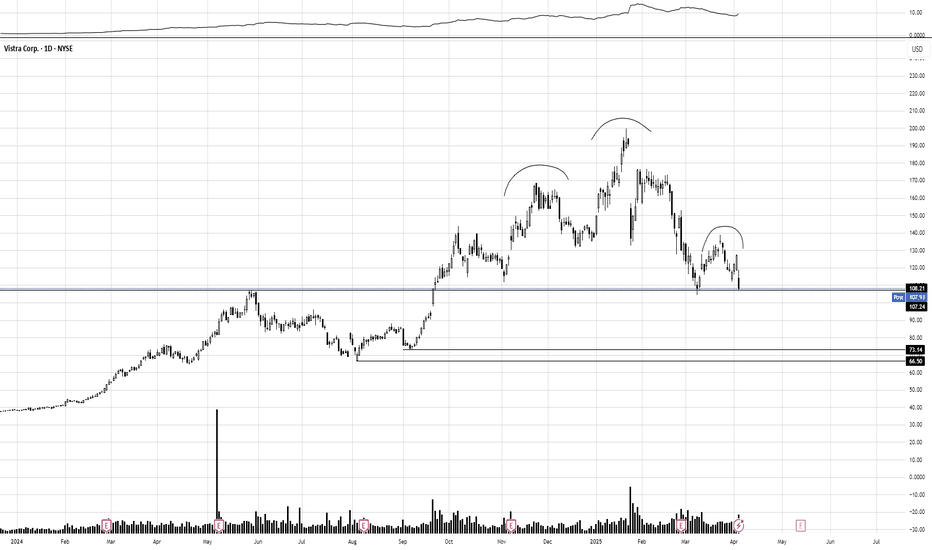

OptionsMastery: Looking at a H&S on VST! 🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

OptionsMastery: H&S on JPM! Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

OptionsMastery: 2 scenarios on CSCO. 🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

OptionsMastery: Breakout Setup on SBUX!🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

OptionsMastery: H&S on XLC!🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

Looking for a bearish swing on META! H&S!🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

LULU Lululemon Athletica Options Ahead of EarningsIf you haven`t bought LULU before the previous rally:

Now analyzing the options chain and the chart patterns of LULU Lululemon Athletica prior to the earnings report this week,

I would consider purchasing the 337.5usd strike price Calls with

an expiration date of 2025-4-17,

for a premium of approximately $20.75.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

FDX FedEx Corporation Options Ahead of EarningsIf you haven`t sold FDX before the previous earnings:

Now analyzing the options chain and the chart patterns of FDX FedEx Corporation prior to the earnings report this week,

I would consider purchasing the 240usd strike price Calls with

an expiration date of 2025-3-21,

for a premium of approximately $12.00.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Breakout on DIS! 🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

IOT Samsara Options Ahead of EarningsIf you haven`t bought IOT before the previous earnings:

Now analyzing the options chain and the chart patterns of IOT Samsara prior to the earnings report this week,

I would consider purchasing the 40usd strike price Puts with

an expiration date of 2025-3-7,

for a premium of approximately $1.85.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Breakout to the downside on BA?🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

SPY - support & resistant areas for today Feb 28, 2025Here are the key support and resistance levels for SPY today, indicating potential reversal or consolidation points. A bounce off these levels may signal long (buy) or short (sell) positions.

These levels are calculated using mathematical models relevant for today's trading session. They may change in the future.

If you find this helpful and want daily insights at 9:30 AM, please boost this post and follow me. Your engagement supports continued updates. Thank you!