#PYTH/USDT pump to $ 0.1025soon!#PYTH

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.0938.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.0920, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.0950

First target: 0.0970

Second target: 0.0993

Third target: 0.1025

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

Pyth

Pyth pump to $0.1018 soon! #PYTH

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 0.0895, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.085.

Entry price: 0.0936

First target: 0.0968

Second target: 0.0993

Third target: 0.1018

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

PYTH NETWORK (PYTHUSD) - (10X - 50X Potential)Pyth Network is an oracle protocol originally built for Solana, optimized for ultra-low latency and first-party data directly from exchanges and market makers. Unlike Chainlink’s node-aggregator model, Pyth enables real-time price feeds (as fast as 400ms) sourced directly from over 100 institutional providers, including Binance and Cboe.

🧩 Why Pyth?

DeFi apps need fast, accurate pricing to avoid exploits and ensure fair trading. Pyth delivers high-frequency, high-integrity data, especially valuable for derivatives, perpetuals, and high-speed DeFi protocols.

🌐 Massive Expansion

What started on Solana now powers 100+ blockchains, including Ethereum L2s, Cosmos, Sui, Aptos, TON, and more. As of 2025, over 420 protocols integrate Pyth, with over $48B+ monthly trading volume secured. It has become the #2 oracle in DeFi by usage, dominating ecosystems like Solana, Sui, and Injective.

📊 Tokenomics & Unlocks

Max supply: 10B PYTH

Circulating: ~5.75B (mid-2025)

Next major unlock: May 2026 (~2.1B tokens)

Utility: Governance, staking, publisher rewards, and oracle integrity

Pyth’s decentralized governance is growing, with a DAO now guiding key protocol parameters. It’s also expanding beyond price feeds, launching products like randomness (Entropy) and MEV mitigation tools (Express Relay).

Disclaimer: This is not financial advice. Always do your own research before making investment decisions.

Sol Strategies Inc (HODL) - Inverse H&S🚀 SOL Strategies (HODL) – Public Market Gateway to Solana Yield

SOL Strategies (CSE: HODL) is a publicly traded company laser-focused on the Solana ecosystem. With nearly 395,000 SOL held (most of it staked) and over 3.7 million SOL delegated to their validators, they generate consistent income through staking rewards and validator commissions.

Their business model is simple:

📌 Accumulate SOL → Stake it → Run institutional-grade validators → Earn yield

📌 Expand through partnerships (3iQ, Neptune, BitGo, Pudgy Penguins)

📌 Hold strategic Solana ecosystem tokens like JTO and jitoSOL

📌 Operate with SOC 2-certified infrastructure and pursue a Nasdaq listing

SOL Strategies is not just holding crypto – they are building core infrastructure for Solana, giving equity investors direct exposure to staking economics in one of the fastest-growing blockchain networks.

📊 For traders: HODL stock offers a pure-play vehicle for Solana exposure, with an income-generating twist.

⚠️ Always do your own investment research and make your own decisions before investing.

#PYTH/USDT#PYTH

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.0860.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.0880

First target: 0.0903

Second target: 0.0927

Third target: 0.0950

#PYTH/USDT#PYTH

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.1030.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are heading toward stability above the 100 moving average.

Entry price: 0.1080

First target: 0.1111

Second target: 0.1140

Third target: 0.1180

HUGE INCREASES Possible on PYT | Here's WhyPython is a fairly new altcoin with big upside.

From the earlier two charts on the left, we see that initial downturns shouldn't be feared. Historically, SOL and SUI started with downtrends and transitioned into massive upside alts.

Python might especially see parabolic increases, once ETH starts to move towards a new ATH. This will be due to the rotation of liquidity between altcoins in terms of larger and smaller market caps.

Don't miss yesterdays update on ETH!

____________________________

BINANCE:SOLUSDT

COINBASE:SUIUSD

BINANCE:PYTHUSDT

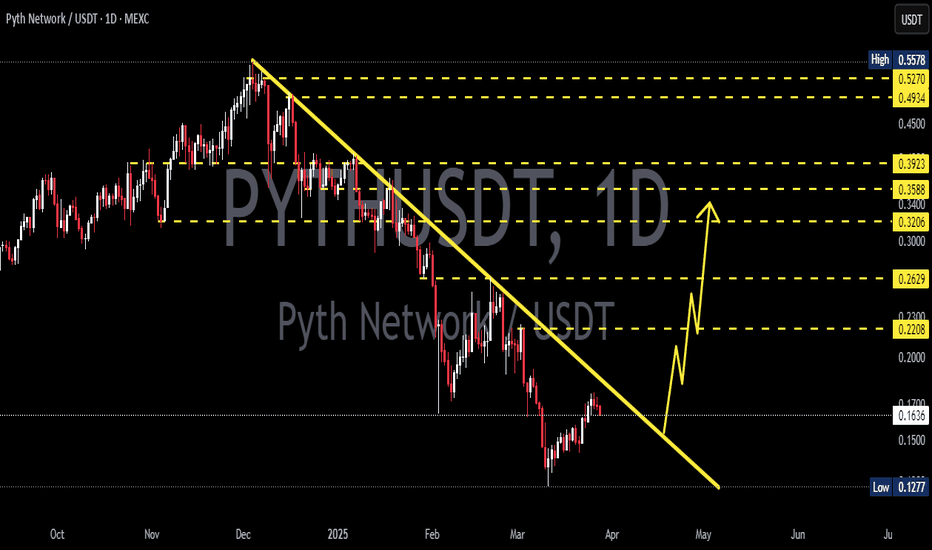

#PYTH/USDT#PYTH

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.1270.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.1280

First target: 0.1322

Second target: 0.1350

Third target: 0.1400

PYTHUSDT | Short Zone at the Blue Box—Proceed with Extra CautionPYTHUSDT is pressing lower with conviction, and the blue box marks our primary area to consider short entries. Although buyers are technically present, their support feels fragile; every test of this zone risks failing unless you have a strong appetite for heightened risk.

Why the Blue Box Matters

• Price has paused here before, making it a logical spot for sellers to reemerge.

• The current decline suggests sellers are in control and likely to defend this zone again.

Conditions for a Short Entry

Lower‑Time‑Frame Breakdown

Observe a clear breakdown pattern on shorter charts—whether a series of lower highs or a decisive support breach.

Volume Confirmation

Seek evidence that selling volume outpaces buying volume as price approaches the blue box.

CDV Divergence

Confirm that cumulative delta volume does not support the rally, indicating genuine exhaustion among buyers.

Entering here demands extra conviction and precise execution. If these confirmations line up, a short trade could offer favorable risk‑reward. Without them, it is wiser to watch from the sidelines until a clearer setup emerges.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

📊 Simple Red Box, Extraordinary Results

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

PYTH 4H ANALYSIS – Bullish Setup in PlayAfter completing a 5-wave impulse to the downside, PYTH has shown signs of a trend reversal. The first upward impulse displayed a clear 5-wave Elliott structure, breaking out of the descending channel — a strong bullish signal.

Following this, a classic A-B-C zig-zag correction occurred, which acted as a retest of the broken channel resistance, now turned support. This confluence increases the probability of a bullish continuation.

With market structure aligning and correction likely complete, PYTH is showing potential for a 50%+ move to the upside.

🟢 Entry Zone: 0.1400 – 0.1500

🔴 Stop Loss: 0.1272 (Below wave C & structural support)

🎯 Target Price: 0.2235

💡 Note: Always manage your risk and confirm with your own analysis before entering any trade.

#PYTH/USDT#PYTH

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 0.1800, which acts as strong support from which the price can rebound.

Entry price: 0.1860

First target: 0.1941

Second target: 0.2036

Third target: 0.2160

PYTH: Completed Double Combo#Pyth has been in a bearish trend since Mar 2024, partly due to poor tokenomics.

However, it seems to have completed a double combo correction, that potentially ended with a bounce from the trend-based Fib extension at $0.10 which could be a possible bottom for this token.

Pyth: Your Altcoin ChoicePyth hit a new All-Time Low 7th April 2025, this is likely the market bottom. There is truly no need for the market to continue lower and lower. Remember, the market cannot kill itself nor has any intention to do so. The market always looks for balance.

Now that many players are down and in the red, the market will seek balance by growing and producing gains. At one point, the market takes everything away. At a later stage, the market gives and gives, you'll see... We are about to enter the bullish phase.

» PYTHUSDT just hit bottom recently and conventional analysts would read this as bearish. To me, bearish is when there is potential for lower prices. Bullish when there is potential for growth.

» PYTHUSDT is bullish in the sense that there is huge growth potential. It isn't bearish because the potential for it to go lower is so small, so small that it is almost irrelevant or not worth our attention. If there were to be anymore bearish action, it would be short-lived. Bullish action on the other hand, can go for years to come. A new All-Time High and beyond.

» PYTHUSDT is showing an ending diagonal pattern in Elliott terms, this is a reversal pattern. This pattern is combined with a bullish divergence with the RSI. Both these signals are combined with a very strong volume rise. The RSI reading is relatively strong.

All these signals combined tells us that the market is ready to turn. Not all happens in a single day, remember. It grows slowly, the momentum, and after several months we get a strong advance, a bullish jump. Think back of late 2024.

August 2024 was the bottom, relate this to April 2025.

From August 2024 the market went sideways and started to build up strength while printing higher lows. 2 months, in November, the market produced a very strong bullish jump.

The same again. Two months, April and May, or May and June and then a strong bullish jump. Allow for variations, but regardless of the fluctuations between pairs and projects, overall, we are going up. We are about to experience massive growth. Just watch!

Thanks a lot for your continued support.

Another great project & Altcoin Choice.

Namaste.

$PYTHIA Set to Surge 40% Amidst A Bullish Engulfing PatternThe Solana memecoin Pythia known as the world's first rat connected to AI that represents a symbiosis of biology and technology, resulting from merging a live brain with a neural interface and AI, is set to breakout with a 40% surge amidst a bullish engulfing pattern.

The memecoin recently broke out of a falling wedge pattern that resorted to this engulfing move.

In the case of a pullback, the 61.5% Fibonacci retracement level is serving as key support point for $PYTHIA. similarly, a breakout above the 1-month high pivot could pave the way for massive surge in the long term.

Pythia Price Live Data

The live Pythia price today is $0.016800 USD with a 24-hour trading volume of $915,707 USD. We update our PYTHIA to USD price in real-time. Pythia is up 13.27% in the last 24 hours with a live market cap of $16,799,482 USD. It has a circulating supply of 999,982,135 PYTHIA coins and a max. supply of 1,000,000,000 PYTHIA coins.

PYTHUSDT: A Massive Move Incoming? Watch This Level Closely! Yello, Paradisers! Is PYTHUSDT about to break out, or is a deeper drop still on the table? Let’s break it down.

💎PYTHUSDT has formed a well-structured descending channel with a corrective wave pattern and bullish divergence, signaling a strong probability of an upcoming bullish move. However, confirmation is key.

💎If PYTHUSDT breaks out and closes candle above the resistance zone, this will validate the descending channel and could trigger a bullish move.

💎In case of panic selling or a deeper retracement, we may see a temporary bounce, but the real focus should be on the resistance zone and a confirmed breakout for a high-probability setup.

💎On the flip side, if PYTHUSDT breaks down and closes candle below the key support level, the bullish setup will be invalidated, and waiting for better price action would be the smarter approach.

🎖 The key here is patience and precision—don’t jump in blindly. Watch for confirmation, trade with discipline, and always wait for the best setups. The market rewards those who stay ahead of the herd!

MyCryptoParadise

iFeel the success🌴