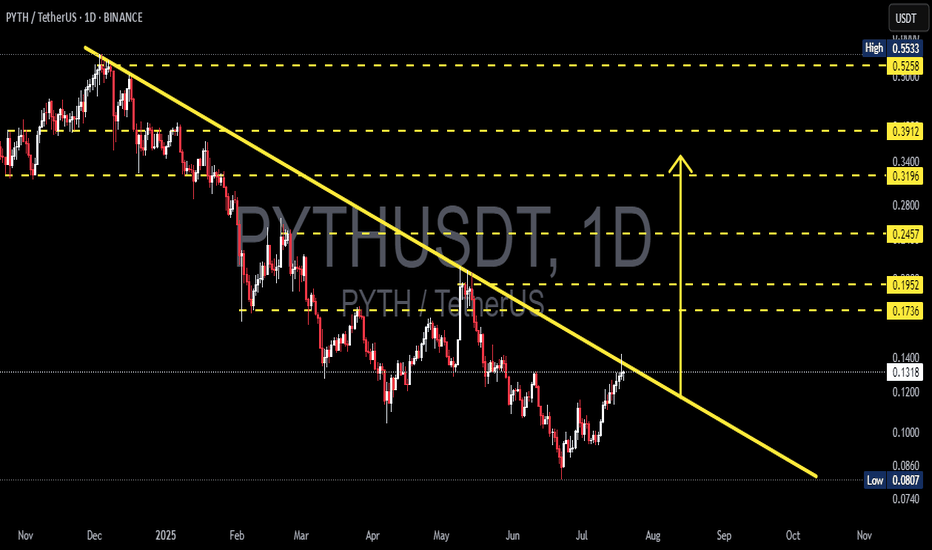

PYTH/USDT Breakout Watch Is the Accumulation Phase Finally Over?📌 Technical Overview:

After nearly 8 months in a strong downtrend, PYTH/USDT is now showing signs of a potential trendline breakout. Price action is testing a critical descending resistance that has been respected since late 2024. This could be the turning point for a major trend reversal.

📉 Historical Context:

PYTH reached a high of $0.55, followed by a consistent downtrend with a series of lower highs and lower lows.

Since June 2025, however, the structure has shifted to higher lows, signaling early accumulation and waning bearish momentum.

📐 Technical Pattern: Descending Trendline Breakout

Price is currently challenging a long-term descending trendline, which has held as resistance since November 2024.

The pattern resembles a falling wedge/descending triangle breakout, typically viewed as a bullish reversal pattern.

A recent bullish candle is attempting to break above the $0.13 level, indicating growing momentum.

🟩 Bullish Scenario: The Reversal is On

If price closes above $0.13–$0.14 and confirms the breakout:

1. Short-Term Targets:

🔼 $0.1736 (Minor resistance / previous demand zone)

🔼 $0.1952 (Breakout retest zone)

2. Mid-Term Targets:

🔼 $0.2457 (Strong consolidation area)

🔼 $0.3196 – $0.3912 (Pre-breakdown range highs)

3. Long-Term Target:

🔼 $0.5258 – $0.5533 (Previous market top)

> A successful breakout could trigger a rally of +200–300%, especially if supported by market-wide bullish sentiment.

🟥 Bearish Scenario: Fakeout Risk

If price fails to hold above the trendline and drops below $0.12:

Support zones to watch:

🔽 $0.1000 (psychological level)

🔽 $0.0860

🔽 $0.0807 (major bottom support)

This would indicate a bull trap, and the market could return to a distribution phase.

🔍 Additional Confluences:

RSI is rising toward 60–65, suggesting bullish momentum is building.

Volume is increasing near the breakout — a good sign of trader interest.

A Golden Cross (EMA 50 crossing EMA 100) could occur soon if upside holds.

✅ Conclusion: Critical Pivot Zone

PYTH is testing a major inflection point. If confirmed, this breakout could end the long-term downtrend and launch a new bullish cycle. A rejection here, however, keeps the bear case alive.

#PYTHUSDT #PYTHBreakout #CryptoAnalysis #AltcoinSetup #TechnicalAnalysis #BreakoutCrypto #TradingView #TrendReversal #CryptoSignals #FallingWedge #BullishMomentum

Pythnetwork

#PYTH/USDT pump to $ 0.1025soon!#PYTH

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.0938.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.0920, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.0950

First target: 0.0970

Second target: 0.0993

Third target: 0.1025

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

Pyth pump to $0.1018 soon! #PYTH

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 0.0895, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.085.

Entry price: 0.0936

First target: 0.0968

Second target: 0.0993

Third target: 0.1018

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

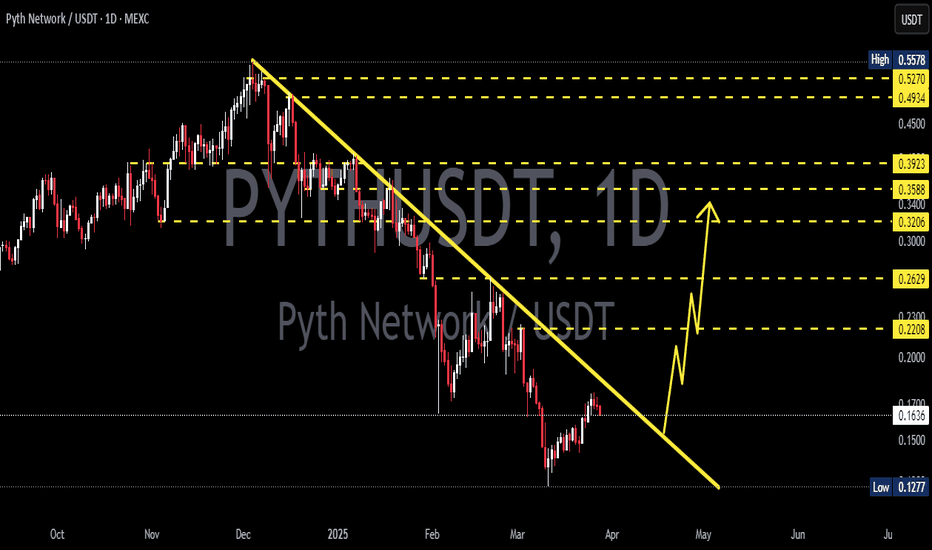

PYTHUSDT Forming Falling WedgePYTHUSDT is setting up for what could be a powerful bullish move, as it has recently formed a classic falling wedge pattern on the chart. This is widely recognized among crypto traders as a strong reversal pattern, often appearing near the end of a downtrend when selling pressure starts to lose momentum. As price action tightens within this wedge, it creates an ideal scenario for a breakout to the upside, especially with good volume providing solid confirmation of buyer interest.

The current volume levels on PYTHUSDT look promising and indicate growing accumulation among investors. When a falling wedge is accompanied by increasing volume near its breakout point, it significantly strengthens the likelihood of a sustained upward trend. Many traders will be looking for a decisive close above the wedge’s resistance line, which could open the door for a rally aiming for gains in the 90% to 100%+ range. This makes PYTHUSDT an attractive option for swing traders and mid-term holders seeking high-potential setups in the crypto market.

What adds to the bullish thesis is the rising interest from investors who are keeping a close eye on PYTHUSDT. As broader market sentiment begins to lean bullish, projects like PYTH that combine a reliable technical structure with growing investor confidence often become top picks. This creates the potential for not just technical buying but also FOMO-driven momentum, which can accelerate price targets once the breakout gains traction.

With all these factors aligning — a well-formed falling wedge pattern, supportive volume, and increased investor attention — PYTHUSDT could be one of the standout altcoins in the coming weeks. Keep watch for confirmation of the breakout and manage your risk wisely to capture the best possible move this pattern has to offer.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

#PYTH/USDT#PYTH

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.0860.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.0880

First target: 0.0903

Second target: 0.0927

Third target: 0.0950

#PYTH/USDT#PYTH

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.1030.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are heading toward stability above the 100 moving average.

Entry price: 0.1080

First target: 0.1111

Second target: 0.1140

Third target: 0.1180

#PYTH/USDT#PYTH

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.1270.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.1280

First target: 0.1322

Second target: 0.1350

Third target: 0.1400

PYTH still hasn't awakenedPYTH has not awakened yet despite the entire Solana ecosystem has been pumping following SOL itself. It's weird because we all expect it to be the new LINK. I wanna believe it will start late but will catch up.

I drawed the trendline and the resistance zone to show you that price is currently into a sort of ascending triangle. I'll consider this alts awakened when price will break out that resistance zone up there.

As you can see from weekly chart the recently closed candles was a bullish engulfing one, hopefully this is a sign price will hit the resistance soon although to be honest, on daily timeframe there's a clear bearish DIV on RSI

With current market cap around 1.5 bn PYTH can easily do 10x from here and this is a conservative target. I have a small bag already but I it's still in buy zone.

NOTE: this is a mid to long term TA.

Good luck

$PYTH is over accumulation, next is pumping and the distributionCollaboration of large investment funds with market maker Wintermute has always shown excellent growth of the asset. Pyth will be no exception. Accumulation is complete, everything is ready for pumping. The community issue is in the hands of the market maker!

Horban Brothers!

PYTH Network Looking for Breakout1. Pattern

Symmetrical Triangle: The price is forming a symmetrical triangle, which is characterized by a series of higher lows (ascending trendline) and lower highs (descending trendline). This is typically a neutral pattern, meaning the breakout direction is uncertain, but it often leads to a strong price movement.

2. Breakout Potential

The price is currently approaching the apex of the triangle, which suggests that a breakout is imminent. The chart shows a projection of a bullish breakout, where the price could rise toward the next key resistance level near 0.4800-0.5000 USDT.

3. Support and Resistance

Support: The ascending trendline, which has been holding since the lows of mid-September, currently provides support near 0.3300 USDT.

Resistance: The descending trendline has been acting as resistance and could break around 0.3800 USDT. If this resistance breaks, it could trigger the expected bullish movement.

4. Volume

The volume bar shows increased trading activity, which is often a sign of preparation for a breakout. If the breakout is accompanied by a volume surge, it would add more conviction to the move.

5. Bullish Scenario

Breakout Target: The chart projection suggests that if the price breaks out upwards, it could reach the resistance level at 0.4800-0.5000 USDT. This area could act as a strong resistance where the price might consolidate or reverse.

6. Bearish Scenario

Breakdown: If the price fails to break out to the upside and falls below the ascending trendline (around 0.3300 USDT), the next support could be found near 0.2750 USDT. A breakdown from the triangle could shift the momentum to the downside.

7. Key Levels to Watch

Immediate Resistance: 0.3800 USDT (descending triangle resistance)

Next Resistance: 0.4800-0.5000 USDT (upper resistance zone)

Immediate Support: 0.3300 USDT (ascending triangle support)

Next Support: 0.2750 USDT (previous swing low)

Conclusion

The price of PYTH/USDT is consolidating within a symmetrical triangle and is nearing a breakout point. A bullish breakout could lead to a rally toward the 0.4800-0.5000 USDT resistance level, while a bearish breakdown could target lower levels around 0.2750 USDT. Watch for volume confirmation during the breakout for a stronger signal.

PYTHUSDT 1DPYTH ~ 1D

#PYTH Very confusing

Whether to buy or worry.

we will give a conclusion.

in a bull market all bearish patterns may be easy to validate or fail structurally.

Losing this Support Block will make this bearish Pattern real, or if SEED_DONKEYDAN_MARKET_CAP:PYTH manages to defend this Support Block, We will say this bearish Pattern will fail.

Alikze »» PYTH| Descending channel failure🔍 Technical analysis: Descending channel failure

- It has been moving in a downward channel in the 8H time frame and daily.

- Currently, with the failure of the channel roof, it is around the supply area and neck line.

- Therefore, in case of a negative reaction, it can be broken into the channel with pullback and touch the specified targets by maintaining the 0.29 area.

💎 Alternative scenario: In addition, if it stabilizes below the 0.29 area, it can retest the green box.

🛑 Targets: 0.39 - 0.44 and supply area or red box.

🟩 Support: 0.29

»»»«««»»»«««»»»«««

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support.

Best Regards,❤️

Alikze.

»»»«««»»»«««»»»«««

OKX:PYTHUSDT

PYTH Is Currently At Strong SupportAfter a massive sell-off, PYTH is now testing the trendline after a breakour and trading above the daily level, we might get a push down to the Value Area Low, and if that does happen and price reclaims the daily, this is a good sign to continue higher.

Calculate Your Risk/Reward so you don't lose more than 1% of your account per trade.

Every day the charts provide new information. You have to adjust or get REKT.

Love it or hate it, hit that thumbs up and share your thoughts below!

This is not financial advice. This is for educational purposes only.

Pyth Network PYTH price prepares something interestingThe #PYTH price is probably tamping the bottom after a several-month correction.

🔼 To continue its growth, #PYTHUSDT needs to consolidate above $0.50

⚠️ The critical level from below is $0.44,

Fixing the price of the Pyth Network token below this level will indicate that the correction will continue for some time.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

Pyth Network (PYTH)The Pyth Network is the largest and fastest-growing first-party oracle network. Pyth delivers real-time market data to financial dApps across 40+ blockchains and provides 380+ low-latency price feeds across cryptocurrencies, equities, ETFs, FX pairs, and commodities.

Anyway, Pyth is still young and few candles are availabel. However, it seems Pyth is moving in an ascending channel and recently Pyth broke the minor downtrend line. Let's see what happens.