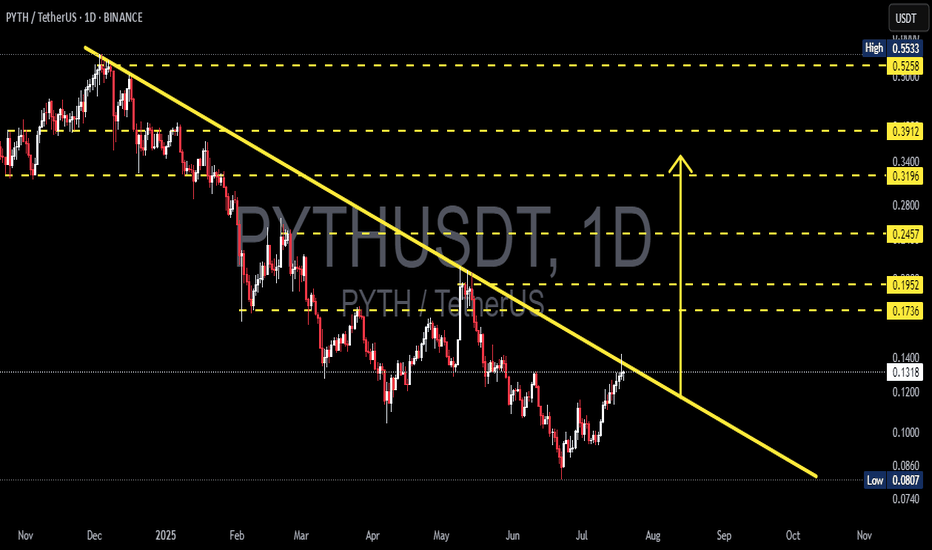

PYTH/USDT Breakout Watch Is the Accumulation Phase Finally Over?📌 Technical Overview:

After nearly 8 months in a strong downtrend, PYTH/USDT is now showing signs of a potential trendline breakout. Price action is testing a critical descending resistance that has been respected since late 2024. This could be the turning point for a major trend reversal.

📉 Historical Context:

PYTH reached a high of $0.55, followed by a consistent downtrend with a series of lower highs and lower lows.

Since June 2025, however, the structure has shifted to higher lows, signaling early accumulation and waning bearish momentum.

📐 Technical Pattern: Descending Trendline Breakout

Price is currently challenging a long-term descending trendline, which has held as resistance since November 2024.

The pattern resembles a falling wedge/descending triangle breakout, typically viewed as a bullish reversal pattern.

A recent bullish candle is attempting to break above the $0.13 level, indicating growing momentum.

🟩 Bullish Scenario: The Reversal is On

If price closes above $0.13–$0.14 and confirms the breakout:

1. Short-Term Targets:

🔼 $0.1736 (Minor resistance / previous demand zone)

🔼 $0.1952 (Breakout retest zone)

2. Mid-Term Targets:

🔼 $0.2457 (Strong consolidation area)

🔼 $0.3196 – $0.3912 (Pre-breakdown range highs)

3. Long-Term Target:

🔼 $0.5258 – $0.5533 (Previous market top)

> A successful breakout could trigger a rally of +200–300%, especially if supported by market-wide bullish sentiment.

🟥 Bearish Scenario: Fakeout Risk

If price fails to hold above the trendline and drops below $0.12:

Support zones to watch:

🔽 $0.1000 (psychological level)

🔽 $0.0860

🔽 $0.0807 (major bottom support)

This would indicate a bull trap, and the market could return to a distribution phase.

🔍 Additional Confluences:

RSI is rising toward 60–65, suggesting bullish momentum is building.

Volume is increasing near the breakout — a good sign of trader interest.

A Golden Cross (EMA 50 crossing EMA 100) could occur soon if upside holds.

✅ Conclusion: Critical Pivot Zone

PYTH is testing a major inflection point. If confirmed, this breakout could end the long-term downtrend and launch a new bullish cycle. A rejection here, however, keeps the bear case alive.

#PYTHUSDT #PYTHBreakout #CryptoAnalysis #AltcoinSetup #TechnicalAnalysis #BreakoutCrypto #TradingView #TrendReversal #CryptoSignals #FallingWedge #BullishMomentum

PYTHUSD

#PYTH/USDT pump to $ 0.1025soon!#PYTH

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.0938.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.0920, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.0950

First target: 0.0970

Second target: 0.0993

Third target: 0.1025

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

Pyth pump to $0.1018 soon! #PYTH

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 0.0895, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.085.

Entry price: 0.0936

First target: 0.0968

Second target: 0.0993

Third target: 0.1018

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

#PYTH/USDT#PYTH

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.0860.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.0880

First target: 0.0903

Second target: 0.0927

Third target: 0.0950

#PYTH/USDT#PYTH

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.1030.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are heading toward stability above the 100 moving average.

Entry price: 0.1080

First target: 0.1111

Second target: 0.1140

Third target: 0.1180

HUGE INCREASES Possible on PYT | Here's WhyPython is a fairly new altcoin with big upside.

From the earlier two charts on the left, we see that initial downturns shouldn't be feared. Historically, SOL and SUI started with downtrends and transitioned into massive upside alts.

Python might especially see parabolic increases, once ETH starts to move towards a new ATH. This will be due to the rotation of liquidity between altcoins in terms of larger and smaller market caps.

Don't miss yesterdays update on ETH!

____________________________

BINANCE:SOLUSDT

COINBASE:SUIUSD

BINANCE:PYTHUSDT

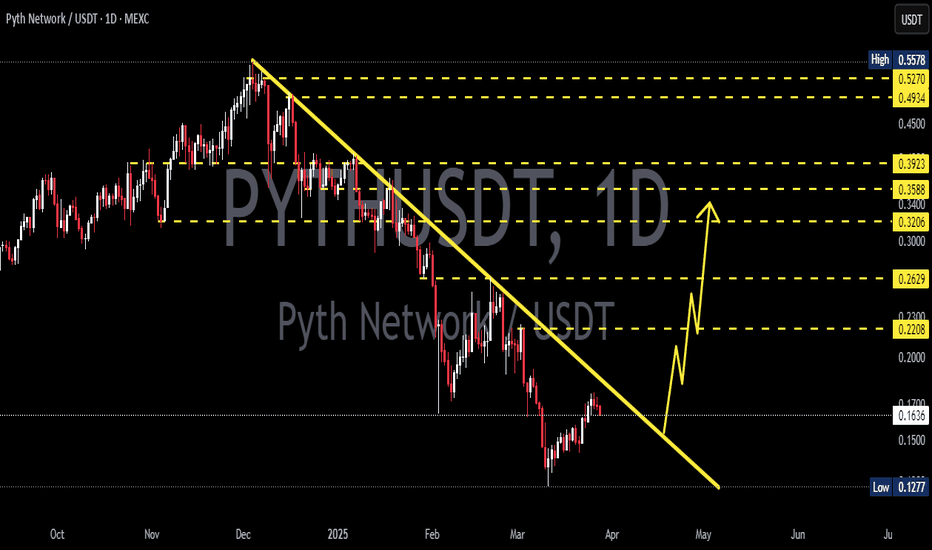

#PYTH/USDT#PYTH

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.1270.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.1280

First target: 0.1322

Second target: 0.1350

Third target: 0.1400

PYTHUSDT | Short Zone at the Blue Box—Proceed with Extra CautionPYTHUSDT is pressing lower with conviction, and the blue box marks our primary area to consider short entries. Although buyers are technically present, their support feels fragile; every test of this zone risks failing unless you have a strong appetite for heightened risk.

Why the Blue Box Matters

• Price has paused here before, making it a logical spot for sellers to reemerge.

• The current decline suggests sellers are in control and likely to defend this zone again.

Conditions for a Short Entry

Lower‑Time‑Frame Breakdown

Observe a clear breakdown pattern on shorter charts—whether a series of lower highs or a decisive support breach.

Volume Confirmation

Seek evidence that selling volume outpaces buying volume as price approaches the blue box.

CDV Divergence

Confirm that cumulative delta volume does not support the rally, indicating genuine exhaustion among buyers.

Entering here demands extra conviction and precise execution. If these confirmations line up, a short trade could offer favorable risk‑reward. Without them, it is wiser to watch from the sidelines until a clearer setup emerges.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

📊 Simple Red Box, Extraordinary Results

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

#PYTH/USDT#PYTH

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 0.1800, which acts as strong support from which the price can rebound.

Entry price: 0.1860

First target: 0.1941

Second target: 0.2036

Third target: 0.2160

PYTHUSDT - Rounding bottom patternBINANCE:PYTHUSDT stands out as a strong investment opportunity, often considered an improved version of $LINK.

While sharing similarities with LINK, it surpasses it in certain key areas. Being a new project with low market saturation, it offers significant potential for growth ✅️

The med-term targets are outlined in the chart.

Accumulation is recommended now up to 0.236 fibo level .

Best regards Ceciliones🎯

#PYTH/USDT#PYTH

The price is moving in a bearish channel on a 4-hour frame and is holding it strongly and is about to break it upward

We have a bounce from the green support area at 0.3400

We have a tendency to stabilize above the Moving Average 100

We have a downtrend on the RSI indicator that is about to break higher and supports the rise

Entry price is 0.3500

The first target is 0.3970

The second target is 0.4400

The third goal is 0.4855

PYTH medium term is bearishBy examining the chart data, we found that PYTH has completed a large degree pattern. This pattern is related to wave A. This pattern has lasted for about 250 days.

It is expected that wave B is also a pattern of the same degree as wave A. It means about 200-250 days.

The supply range is the best range for sell/short positions.

Note that in order to take a position, one must have a trading setup and this is only a medium-term view for PYTH.

Closing a daily candle above the invalidation level will violate the analysis

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

PYTHUSDT 1DPYTH ~ 1D

#PYTH Very confusing

Whether to buy or worry.

we will give a conclusion.

in a bull market all bearish patterns may be easy to validate or fail structurally.

Losing this Support Block will make this bearish Pattern real, or if SEED_DONKEYDAN_MARKET_CAP:PYTH manages to defend this Support Block, We will say this bearish Pattern will fail.

PYTH NEW UPDATENow that we have more data on the chart, the PYTH scenario is clearer.

It seems to be completing a descending triangle which is now in wave D of this triangle.

Wave D appears to be a diametric.

From the red box, we expect the price to move towards the green range and then react to the green box.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

Pyth Network PYTH price prepares something interestingThe #PYTH price is probably tamping the bottom after a several-month correction.

🔼 To continue its growth, #PYTHUSDT needs to consolidate above $0.50

⚠️ The critical level from below is $0.44,

Fixing the price of the Pyth Network token below this level will indicate that the correction will continue for some time.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

Pyth Network (PYTH)The Pyth Network is the largest and fastest-growing first-party oracle network. Pyth delivers real-time market data to financial dApps across 40+ blockchains and provides 380+ low-latency price feeds across cryptocurrencies, equities, ETFs, FX pairs, and commodities.

Anyway, Pyth is still young and few candles are availabel. However, it seems Pyth is moving in an ascending channel and recently Pyth broke the minor downtrend line. Let's see what happens.

#PYTH/USDT#PYTH

The price is moving in a bearish channel pattern on the 4-hour frame, and it adheres to it well, and it is expected to break to the upside

The price rebounded well from the lower border of the channel at the green support level of 0.4220, which is a strong level

We have a trend to hold above the Moving Average 100, which is strong support for the rise

We have very strong oversold saturation on the RSI indicator to support the rise, with a downtrend about to break higher

Entry price is 0.4380

The first target is 0.5146

The second target is 0.5747

The third target is 0.6550