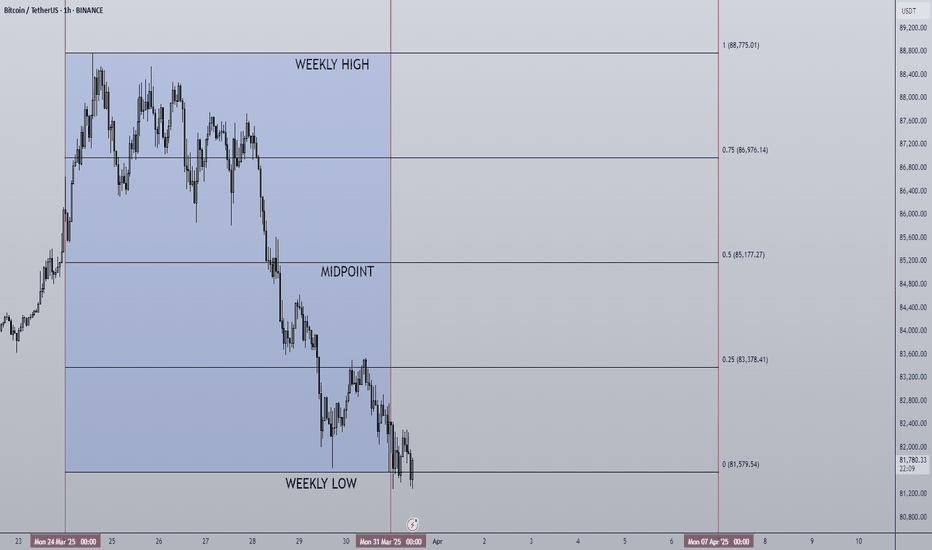

31/03/25 Weekly outlookLast weeks high: $88,775.01

Last weeks low: $81,579.54

Midpoint: $85,177.27

As Q1 2025 draws to a close, last week we saw a mirror image of the March 17th week with a swing fail pattern of the weekly high and a gradual sell=off throughout the week.

The reluctance for buyers to step into the market under the $91,000 resistance is telling me that the bulls are just not confident in current market conditions to bid into resistance. This may be because of the Geo-political factors, ongoing war, tariffs etc. Uncertainty does worry investors and so it's a valid reason.

From a TA standpoint however is a bigger worry in my opinion. Bitcoin failed to flip the 4H 200 EMA after the 8th time of trying since mid February and that is the biggest concern for me. As long as this moving average caps and reversal pattern then the trend is still bearish and should be treated as such.

$73,000 is still the target for a downward move IMO, a further -10% move from current prices. For the bulls a SFP of the weekly low could set up another bounce to weekly highs that have remained in approximately the $88,000 zone for two straight weeks. Major resistance around those levels and of course the dreaded 4H 200 EMA must be flipped too. Currently this is a tall order given how price action has been of late, sentiment is poor and altcoins are completely decimated in most cases. So I can't see the majority wanting to buy in until these criteria are met and we're trading back above $91,000.

This is still a traders environment, not a Hodler/investor.

Q1

(ETH) ethereumWhen can we expect to see reports on the new concepts about Ethereum in the future?

Buying mode, price of Ethereum well under the dotted line. Ethereum has not had a strong position for some time and is likely to find profits. One large drop in price does not usually follow another than another than another and especially not with such large volume and capital. Am I in control of the flow, no. Do I have billions to make heavy movements, no. Am I interested in the progress of Ethereum despite holding little to no value in Ethereum, yes.

Bitcoin compression into expansion?As one of the most historic weeks in crypto history draws to a close, it feels like the next leg in the Bullrun is upon us.

The reason for this is a clear Higher low pattern going into a resistance zone @ $106,000, buyers are willing to buy up any lower timeframe dips in price at progressively higher and high levels showing strength. The 1H 200 EMA also providing clear support since being reclaimed @ $94,000 and as it gets closer and closer to the resistance level something has to give way.

After all the bullish news coming out of the USA in relation to crypto and leaving the typical January dip and going into the historically bullish Feb-March months all is looking good. A bearish scenario would be a potential beartrap that punishes euphoric late longs thinking this is a simple trade, the truth is it's overcrowded and the market tends to aim for max pain at all times, max pain here is a sell-off but until this bullish structure is broken I am not worried.

Bitcoin Soars: January 3, 2025

Bitcoin has surged to an impressive **$102,870**, setting the stage for what could be a historic bull run! Experts predict it could hit **$120K by Q1** and even **$150K by mid-year**, driven by strong institutional interest and upcoming crypto policy shifts.

This is your moment to act! Whether you’re new to crypto or a seasoned trader, I’m here to help you maximize this opportunity.

HERE´S HOW YOU OUTPERFORM THE S&P500S&P 500 Index

4Hour Timeframe

RSI

Moving Average

Elliot Waves

Overall Summary

Hello and welcome back everybody!

I hope you are doing good at today's monthly close!

We are watching a 13$ S&P500 gain this month, which is absolutely crazy! Gains were possible, though the cliff to the downside looks scary as hell. Mixed feelings everywhere, uncertainty, fear but kind of hope- very ambivalent mental condition everywhere.

Since 22% of the whole SP500 Index is divided into the six FAANG companies (Facebook, Amazon, Apple, Netflix, Google(Alphabet)) and Microsoft, these are the drivers of the US markets right now.

Oil, as well as touristic, hotel, and accommodation markets took big hits, while a few made gains, which has led to the recent bull market/recovery from all-time high/coronadump.

Well, today I´d like to show you something I just have read about recently, it is the Elliot Wave counting technique. As you guys know, I do not give too much about technical analysis systems and techniques, but it is worth trying out and see why they have become such popular.

As you can see, in the ABC-Correction, which is part of the wave counting, the number A marks the all-time high, number B marks the bounce, and C marks the very last low the SPX at 2190.

As you already noticed, the price is coming near the 200MA (Moving Average of the past 200 candles). Historically the top has been a little lower of it, but a few times it actually broke it for a short period of time, after which a massive decline/selloff followed.

RSI looking good, not oversold, but testing the market strength of all-time high. So the market is strong basically, even though volume declines since the bull market started. Spikes here and there happen, but nothing which delivers serious information about it respectively to make predictions out of it.

What does it mean for us?

1. The top might have been reached already, though tonight after market close Apple and Amazon gonna present their earnings, which possibly leads to a temporary boost of the market while looking at the monthly close and the end of the reporting season! :)

At that point, when the bull market of the last month started, we set our first wave up to the number 1, which continues to 5.

We do not know how high 5 will be nor if we already hit the "fifth Wave". Afterward, in most cases, people count ABC and call that an ABC-Correction - whatever it is. You know, in technical analysis, if you wanna fit something to a chart, you fit it. Since lines, shapes, and whatever seem to be fit perfectly, in most it is not. So look at them, but do not trust them too much.

Furthermore, Elliot waves and other techniques are instruments, to describe what happened and make predictions out of it. Nobody can tell the future, nobody knows what is gonna happen in the coming days, weeks, and months.

Personally I am bearish since Q1 might have been "still ok" when talking about earnings, even though many took big losses, but I think upcoming reporting seasons of Q2 and Q3 will be a devastating disaster.

That is it already for today, hope it brightened up your view on the market :-)

Keep you, safe guys, make sure to wash hands and whatever, you know what you gotta do! Be careful with your funds and I´d like to know what do you think?

Will we see a bearish Q2 and Q3 or did the new bull market of the decade already kick in? Just tell me in the comment section!! If the content pleased you, make sure to hit the like button or leave a follow, would help a lot!

Best, Roman

Bullish Q1 2023 thesis for BTCSince mid-December many psychological parameters started to make me think that we were going to have a rise in BTC for the first quarter of 2023.

Many people are waiting for lows, 14, 12, 9k.

Many people are predicting that the bottom of the market will come in the first quarter of 2023.

The right way of thinking is now to be bearish, otherwise you don't understand anything about macro or trading.

We have a window until the next FED meeting. It would appear, despite all that has been said, that we are getting closer to their target this year.

Technical analysis can show us some nice things, the analysis of the volume profiles, the share price and the order flow could play in this favour.

Shorting TSLA until Q1 2023 EarningsAfter a detailed and extensive analysis I conclude TSLA will drop at least to $140.50 before Q1 2023.

Factors include:

Additional Vehicle Recalls

Continued Overvaluation compared to competitors that are catching up in the EV Space

Ongoing international litigation concerning various fatal crashes

Declining Retail Sentiment due to CEO drama with Twitter

We could go as low as 7.4k! Bulls absolutely need to defend We have little to no support below these levels, we just pumped through them without spending much time, considering the traditional markets will probably be in a turmoil for about a year or so, expect bitcoin to drop as low as 8k! I do see a falling wedge, but we broke through too many support levels, we need a bounce now or it is over! Greetings from Dia

Bitcoin Dealers/Intermediaries Massive shorts (CME) Explained Everyone wondering about the Dealers and Intermediaries adding massive shorts on the 29th of March.

We can explain this from the very overbought Price Action as well as it being the end of Q1.

This push accomplished the Q2 Open under the Q1

Watch out: Cup & Handle forming and Q1 Results!Tesla is still trading within the profit area I identified on March 19th, 2018. It's currently trading BELOW the 200 days EMA as well consolidating the bear tendence.

On the other hand there has been an adding up of long positions lately, probably in the hope of a bounce right after the Q1 earning report scheduled for May the 2nd.

The movement on the hourly chart shows a probable cup & handle formation taking place. It might be a burst but it is worth taking a close look at it.

If, and I highlight the IF, this formation completes I would set a TP at around 305$ more or less. Still within the profit area I highlighted on March 19th.

It is important to notice that on May the 2nd the company scheduled the Q1 financial reporting and Q&A webcast. I personally do not expect a lot from this. And all I expect is no good news.

The company missed production targets for the Model 3 and we already know that. The company closed down the production lines recently due to various issues and all I expect is a confirmation of all these problems (and much more) in the financial results too.

***As usual, not a trading advice, merely my idea for educational purposes only***

DAX 2017 Q1 PREDICTION ! SHORT 10950 TILL 9800 IN 4 MONTHS!!!*Hello traders, I make this chart because I see that all Indices were pumped after the US election and Italy referendum.

*In my opinion this is a bubble that will eventually burst when Donald Trump official came president of the USA.

*Entering 10950 - think that is a good LVL to enter short because 11000 is a psychological LVL like 10k 12k 9k ect.

SL- is 1/5 of the TP which is good i think

*1st, 2nd, 3rd TP how to trade ???

1st profit release the 50% of all short positions

2nd profit release the 25% of all short positions or the rest 50% of the 50% :)

3rd profit the rest

*if 1st target is reached what to do:

1st profit release the 50% of all short positions

could wait for pull back 600-650 even 700 and sell again

*if 2nd target is reached 2nd profit release the 25% of all short positions or the rest 50% of the 50% :)

don't sell after pull back " psychological LVL like 10k 12k 9k ect."

*if 3rd target is reached we can say to losers GOOD GAME WELL PLAYED!

*about the SL - it depends of the trader i dont use SL but i see that most of the people are making SL orders, I think that 11200 is a good SL order if you are scary like lil pu$$y

GOOD LUCK TO EVERYONE