TOTAL Q3 As Q2 closes, Q3 begins...

The 2nd quarter of 2025 made up for a lot of the losses of Q1 peaking at $3.5T in the middle of the quarter. Since the peak a steady downtrend channel has formed and continues to be the case going into Q3.

What can we expect to see in the next 3 months in the crypto market? For me there are two different scenarios that are bullish, and one that is bearish IMO:

Bullish scenario 1 - The most likely scenario I think is a breakout above the downtrend channel and a move towards the range top. My reasoning for this comes from what we know about the driving forces in the market. Just last week BTC ETFs had a $2.2B net inflow, MSTR bought another 4,980BTC for $531.9m, various ETFs on the way for other majors such as SOL. Crucially the M2 money supply is at a record ATH. What that means is huge demand and the means to purchase with a what feels like a deadline closing in.

Bullish scenario 2 - We see a trend continuation until the range midpoint which has provided support before. It would coincide with the bottom of the trend channel and therefor I believe would provide a good launchpad for long positions.

Bearish scenario - For me this is the least likely situation but one that must be prepared for, a loss of the range midpoint would be a major setback, one that would mean a potential revisit of the range low in a symmetrical move down mirroring Q2s move up. The reason I believe this is the least likely is there is just too much in favor of risk on assets like crypto currently, I've mentioned the fuel that is the M2 money supply piling up to be deployed. A US interest rate cut all but confirmed for September and the institutional race for acquiring these assets before it is too late.

In conclusion just keeping it simple on the chart, a breakout above the trend channel is a great long opportunity to target the highs.

If BTC continues the grind down a great place for it to turn bullish is the range midpoint as has happened previously.

In the event BTC loses the midpoint a retest of the weekly low would make sense to me.

Q2

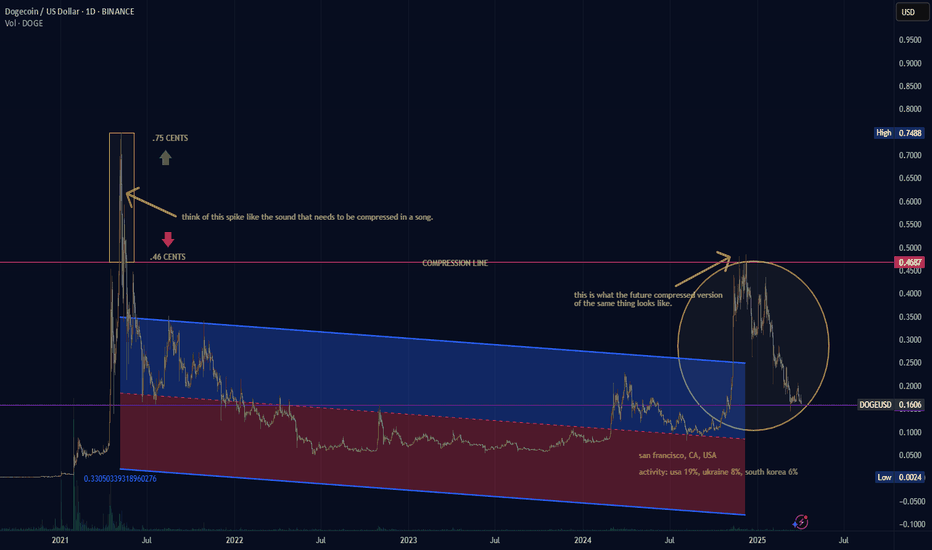

(DOGE) dogecoin "fantasy"is the fantasy over for Dogecoin? The future version versus the present tense, versus the past, is something to speculate over and theorize on whether what people say about what happened in the past versus the past few months, is worth taking a look at. All the time in music people compress music and think the music is better afterwards. By applying the same logic to this Dogecoin chart I am sure all of you would say that you would prefer the uncompressed version.

(ATOM) cosmos "wave count"Long form wave count would appear to be in trend with an entirely new cycle for Cosmos, potentially, although I did not go all the way back to the origin of the company which is necessary to get a true depiction of history. Is the history of a company based on short lived moments or is there any knowledge to keeping track of the trend of a company through the entire duration of the chart regardless of what trends occur based on major moments in society and the seasonal hype from December and end of year excitement,.

Many years in the making. . .

(APT) aptos "ahead of the game, or not"It is not use in being ahead of the price trend if the price is not going to recovery before Bitcoin, Ethereum, Dogecoin. Dogecoin used to be the one to measure between the big three cryptocurrency prices. Nowadays, Dogecoin is so popular with such a strong price hold and the fact that the unlimited coins means to measure Dogecoin is quite a bit more strange when compared to all the other limited circulating supply companies. Aptos appears to be closer to a neutral position, or will the price keep falling if Etherum and Bitcoin do not go flat? That is what I mean by this.

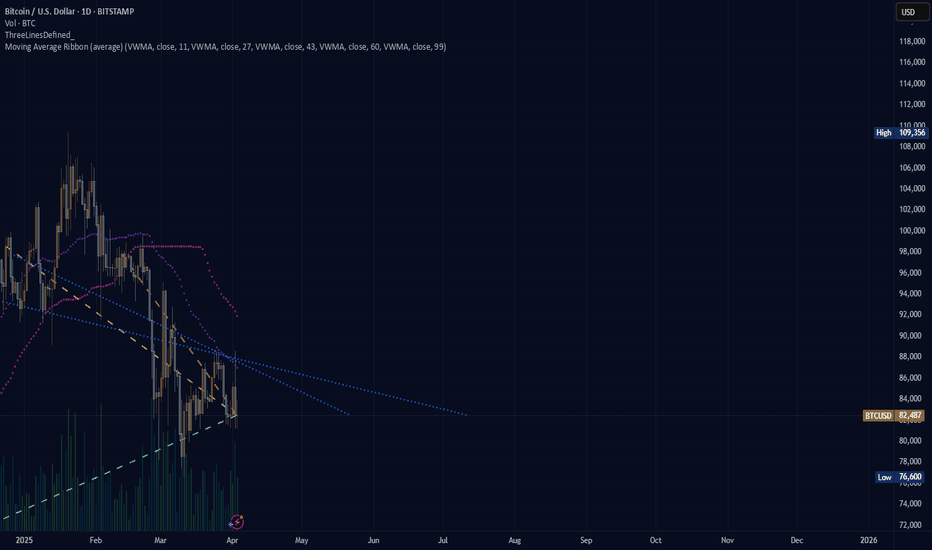

(BTC) bitcoin "the case for bitcoin"Where is bitcoin going to be during this 2025 year. The image shows a blank canvas. The drawing untold, unknown for now? Where will the price move and how long will it take to move through the pattern, bearish? bullish? neutral? fire? ice? greener pastures? The graph showing what is being seen tends to see a rise in price once the price moves past the crossing of the blue lines but the purple and pink dotted lines are facing down with no indication that the price is moving neutrally in a recovery effort.

(ETH) ethereum "update"Ethereum update. Nothing per se to analyze. More of an image to share with two indicators. Not much else to say here. It would be better if the average lines (pink and purple) had dots closer together. The further those dots become on a descent, the higher the likelihood there is of a big drop in price. We want the purple line to begin to curve in a reversal pattern for the price to recover from what is losing right now. Huge discount on Etheruem though, if you like that sort of thing, and Ethereum.

ADOBE: What is the stock doing before the Q2 earnings Adobe's stock price has been declining over the past month, currently trading below its 50, 100, and 200-day moving averages, with the chart drawing a "death cross" pattern around mid-April, which further confirms the bearish sentiment. The stock now trades at a 25% discount compared to the highs earlier this year.

The Volume Oscillator currently stands at 1.3%, suggesting some buying interest remains, but it's weakening compared to recent trading volume. This could signal a potential reversal, but the downtrend remains strong, with the neutral RSI not suggesting any bullish reversal either.

Next week's Q2 earnings announcement could be a significant catalyst for Adobe. Positive earnings could potentially reverse the current downtrend, but the recent controversy surrounding Adobe's terms and conditions update could weigh on investor sentiment.

The T&Cs update has sparked concerns among users, particularly creatives worried about their creations being used to train AI models, and professionals concerned about the privacy of their data. This could potentially impact Adobe's reputation and customer base, particularly since Adobe remains relatively silent on the issue. This uncertainty adds another layer of risk to the stock in the near term.

01/04/24 Weekly outlook (Q2)Last weeks high: $71771.20

Last weeks low: $69088.87

Midpoint: $66406.55

Q2 BEGINS!

BTC saw a 91.35% increase from yearly open and closed out Q1 at ~71K . A very strong first quarter on the lead up to The Halving now less than 20 days away we have only a few more weeks to get set for the event which historically brings new highs after.

Now that we have ended the month of March and begun Q2 , we can see that the bulls really pushed for a strong monthly close above the '21 ATH level of 69K, a very important S/R level and now we have closed above on the monthly it's confirmed as new support.

Almost instantly after the monthly close price did drop back down to the previous weeks Midpoint of the range and the important support level. I do think we range for a while and build a base in the lead up to the Halving, any dip is probably a good entry point for long a long term hold as historically new highs come soon after the halving.

For now I think we'll see a continuation of select alts having double digit days with BTC & ETH staying relatively flat . In my opinion we're at the low cap/memecoin stage of the cycle and just waiting for the next big BTC rally to start the whole cycle again and have money flow back into BTC. Next rally should target 86K (1.272 FIB extension) and with supply halving and ETF backing I do believe it's achievable this year perhaps even this quarter.

$TSLA -The Best to ever Race- Tesla Inc. ( NASDAQ:TSLA ) beat Earnings Report Date of Fiscal Quarter Q2/23 on 19th of July.

So far so good fundamentally speaking for Tesla Inc. ( NASDAQ:TSLA )

Moreover, jumping to the charts *3D(tf);

we can spot a Triangle being formed with its Apex approaching end soon.

Note how the red Trendline Resistance managed to reject the price by a lofty -12%

negative

Moving on the *Daily (tf)

short-term momentum is biased to the downside.

On the *Daily (tf) we can see a Bearish Pattern having formed (rising wedge)

which has broken to the downside with strong selling volume momentum above average.

(VRVP's POC sitting at 230-225$)

*D(tf)

Looking back at Equity Factors in Q2 with WisdomTreeMarkets in Q2 2022 continued to suffer from entrenched inflation and aggressive rate hikes from central banks. They also reacted to the slowdown of the global economy and the increased risk of a recession in developed economies. These changing market conditions impacted equity factors differently.

In this instalment of the WisdomTree Quarterly Equity Factor Review1, we aim to shed some light on how equity factors behaved in Q2 2022 and how this may have impacted investors’ portfolios.

-High dividend continued to dominate, followed by a revival of min volatility

-Value started to show signs of slowing down due to its cyclical nature

-Momentum and size continued to suffer

-Quality strategies continued to deliver mixed results depending on their portfolio’s overall valuation

Over July, central banks aggressive tightening continue to slow down the global economy, raising the probability of a global recession.The impact of this slowdown has been clear with rate hike expectations lowering leading to a factor rotation in favor of quality and size.

Looking forward, uncertainty around recession and economic growth will continue to rise. Investors are facing the need to balance their portfolio between building wealth over the long term and protecting their portfolio during economic downturns. This environment could therefore favour high dividend and quality stocks.

Performance in focus: high dividend continues to lead, but min vol is catching up

In the second quarter of 2022, equity markets suffered from a deep drawdown, leading to the worst first half year in decades. The MSCI World lost -16.2%. Unusually, the US underperformed European markets with -16.9% versus -9%. Emerging markets suffered as well with -11.4%.

Q2 2022 factor performance continued to be driven by inflation surprises on the upside and the hawkish stand of developed countries' central banks. However we also saw two new entrants this quarter with heightened volatility and the fear of recession rocking markets further. Faced with such a brutal landscape, some factors continued to do well, and some did not:

-High dividend dominated in most regions. This factor finished first in all developed geographies

-Pushed by increasing volatility and heightened fears of recession, min volatility followed closely: second in developed markets and first in emerging markets (EMs)

-Value is the last factor that managed to outperform consistently this quarter thanks to rate hikes and despite the volatility increase

-Momentum, size and growth suffered the most over the quarter, delivering underperformance across regions

-Quality sat between those two groups, delivering mild underperformance in European and global equities but outperforming in US equities. However, like in Q1, the definition of quality and the criteria used would have hugely impacted the result. Quality, left unattended, tends to tilt toward growth (investors pay for quality, after all) and would have suffered from that tilt. For example, highly profitable companies and dividend growers have fared better over the period using their value/high dividend tilt to outperform.

Looking at the outperformance of factors over the last six months, we notice that:

-After a very strong start, value showed signs of slowing down in Q2. Value is a mostly cyclical factor, and an inflationary environment with aggressive rate hikes is very supportive. Fear of recession and increased volatility are not

-High dividend is the overall winner for the 2022 first half and went from strength to strength

-Min volatility started a bit slower in Q1 but has picked up speed in Q2 on the back of recession fears

-Size and momentum suffered across the full six months in an environment that was not supportive of cyclical stocks

-Finally, quality suffered the most in the first six weeks of the year and has hovered around the same level since then. With the market turning more defensive toward the end of Q2, quality is showing signs of life. Here again, highly profitable companies and dividend growers, for example, have fared better.

It is worth noting that since the end of June, markets expectation of a recession has continued to grow. This has led to a revision downward of the expectation on future rate hikes. Equity factors have reacted to this change pretty strongly, with quality and size taking the lead for that month while value and high dividend released some of their performance. This rotation has been particularly strong in Europe where economic predictions are the most dire. Having said that, the performance difference in the first 6 months were so high that the full year to date picture remains similar.

Valuations continue to come down across the board

In Q2 2022, valuations continued to decrease across the board for factors. Momentum and quality saw the largest drop in valuations in all geographies. On a relative basis, high dividend stocks and value stocks got more expensive versus the market on the basis of lower drop in their price to earning ratios.

The re-opening trade in 2021 has evolved into the ‘recession trade’ in 2022, owing to a tardy start to the hiking cycle by central banks. Their aggressive tightening plan is slowing the global economy, raising the probability of a global recession. Leading economic data (LEI) shows economic momentum is fading quickly. The impact of this slowdown has been clear in July with rate hike expectations lowering leading to a factor rotation in favor of quality and size. However, this risk of recession only adds to the uncertainty for investors. They need to carefully balance the risk in their equity allocation. All-weather assets continue to be best positioned, delivering balance between building wealth over the long term whilst protecting the portfolio during economic downturns. This environment could therefore favour high dividend and quality stocks.

World is proxied by MSCI World net TR Index. US is proxied by MSCI USA net TR Index. Europe is proxied by MSCI Europe net TR Index. Emerging Markets is proxied by MSCI Emerging Markets net TR Index. Minimum volatility is proxied by the relevant MSCI Min Volatility net total return index. Quality is proxied by the relevant MSCI Quality net total return index.

Momentum is proxied by the relevant MSCI Momentum net total return index. High dividend is proxied by the relevant MSCI High Dividend net total return index. Size is proxied by the relevant MSCI Small Cap net total return index. Value is proxied by the relevant MSCI Enhanced Value net total return index.

Sources

1 Definitions of each factor are available below

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Pro Traders Take Profits on EarningsWhat happened today on the earnings announcement by PEP? Pro traders took profits against the retail crowd's buying on the news headlines that suggested an earnings "beat" for Q2. The retail buying causes the gap up at open, which is a prime cue to take profits on swing trades.

This was what we call a pre-earnings run. The earnings results don't matter as much as the technical setup a few weeks ahead of the earnings release. Swing trades were initiated at the reversal from the support at 155, confirmed by price and volume patterns at that time.

Now, with resistance overhead, where the initial target for this earnings play was, and the retail crowd causing a gap up at open on the earnings announcement, this is where professional short-term traders close long positions. This should not be construed as a good opportunity to short swing-style, however. It is an example of the execution of a long swing-style earnings strategy.

This is an example of TechniTrader's Relational Technical Analysis techniques for planning better trades.

Ugly Markets - Embrace the TrendsThe trend is always our best friend in markets across all asset classes. While many investors and traders waste their time interpreting the new cycle and other factors, the path of least resistance of market prices is a real-time indicator of the current sentiment.

Stocks and bonds fall in Q2

Four of six commodity sectors post losses

Rising interest rates and a strong dollar

Economic contraction- Copper tells a story

Go with the flow

Market prices rise when buyers are more aggressive than sellers and fall when sellers dominate buyers. The current price of any asset is always the correct price because it is the level where buyers and sellers agree on value in a transparent environment, the marketplace.

The results for Q2 were ugly in most markets. Stocks and bonds fell, the dollar index rose, and four of six commodity sectors posted losses. The best performing sectors reflect the supply-side issues created by the war in Ukraine, sanctions on Russia, and Russian retaliation.

Uncertainty in markets creates price variance, and markets reflect the economic and geopolitical landscapes. As we move into the second half of 2022, uncertainty is at the highest level in years. Meanwhile, market liquidity tends to decline during the summer vacation months. Lower participation only exacerbates price variance as bids can disappear during selloffs and offers often evaporate during rallies. It is a time for caution in markets across all asset classes, but the trends on a simple price chart tell us all we need to know about the path of least resistance of prices.

Stocks and bonds fall in Q2

The stock market was ugly in Q2:

The DJIA fell 11.25%

The S&P 500 declined 16.45%

The tech-heavy NASDAQ dropped 22.45%

Over the first half of 2022:

The DJIA was down 15.31%

The S&P 500 fell 20.58%

The NASDAQ plunged 29.51%

As the Fed began increasing the Fed Funds Rate and reducing its swollen balance sheet, the US 30-Year Treasury bond futures fell 8.19% in Q2 and were 13.75% lower over the first half of this year as of June 30. The long bond fell below its technical support level at the October 2018 136-16 low and reached 132-09 in June before bouncing.

Four of six commodity sectors post losses

While the energy and animal protein sectors posted gains in Q2, base and precious metals, grains, and soft commodities moved to the downside. The quarterly results by sector were:

Energy- +6.77%

Animal proteins- +3.31%

Gains- -3.46%

Soft commodities- -4.12%

Precious metals- -12.91%

Base metals- -27.24%

Over the first half of 2022, four of six sectors were higher than at the end of 2021:

Energy- +43.86%

Grains- +14.65%

Animal proteins- +10.96%

Soft commodities- +1.46%

Precious metals - -5.43%

Base metals- -13.07%

The results reflect the economic and political landscapes. Energy and food prices rose as the war in Ukraine threatens the global supply chains. Metal prices declined because central bank policies and economic conditions led to rising rates and a strong US dollar.

Rising interest rates and a strong dollar

The US Federal Reserve blamed rising prices and inflation on “transitory” pandemic-related factors throughout most of 2021. The central bank waited far too long to address inflation and is now playing catch-up when the war in Ukraine and geopolitical tensions impact the global economy’s supply side. Central bank monetary policy can affect the demand-side, but they have few tools to manage supply-side shocks. The rise in energy and food and the decline in metal prices tell us that central banks are struggling to address the current economic landscape.

The US 30-Year Treasury bond futures chart shows the pattern of lower highs and lower lows. While the long bond bounced from the June low, the bearish trend remains intact in early July.

The US dollar index, which measures the US currency against other world reserve foreign exchange instruments, rose 6.21% in Q2 and was 9.28% higher over the first half of 2022. The dollar index settled at the 104.464 level on June 30 and rose to a new two-decade high of 107.615 on July 8. Since the US dollar is the world’s reserve currency and the pricing benchmark for most commodities, a strong dollar caused raw materials to rise in other currencies, putting downward pressure on dollar-based prices.

Economic contraction- Copper tells a story

The US remains the world’s leading economy. In Q1, US GDP fell, and it likely declined in Q2. The textbook definition of a recession is two consecutive quarterly GDP declines.

Copper is a base metal that trades on the London Metals Exchange and the CME’s COMEX division. Copper has a long history of diagnosing the economic climate, earning it the nickname Doctor Copper. In Q1, COMEX and LME copper prices rose by around 6.5%. In Q2, they plunged, with the COMEX futures falling 21.82% and the LME forwards dropping 20.41%. COMEX and LME copper prices were down over 15% over the first half of 2022.

The chart of COMEX copper futures shows the move to an all-time $5.01 per pound high in March 2022 and a decline to a low below $3.40 in early July. The descent below technical support at the August 2021 $3.98 low and nearly 30% drop as of July 8 are signs that recession is not on the horizon; it has already gripped the economy.

Go with the flow

Inflation remains at a four-decade high, and while raw material prices have declined, the economic condition is far higher than the current Fed Funds rate. The central bank has pledged to fight inflation with monetary policy tools. Higher interest rates could put more downward pressure on raw material prices and the stock market as the economy contracts. Time will tell if the Fed continues its hawkish path or reacts to current market conditions. Waiting far too long to address inflation in 2021 suggests the central bank will likely remain hawkish regardless of market conditions in 2022.

It is impossible to pick tops or bottoms in any market as prices often rise or fall far beyond where logic, reason, and rational analysis dictate. A market participant’s most effective tool is to follow the trends until they bend. The path of least resistance of asset prices can be the most significant factor for future performance. In these troubled times, where uncertainty is at the highest level in years, don’t fight the trends and go with the flow. In early Q2, it remains bearish in many markets across all asset classes. Stocks, bonds, commodities, cryptos, and other asset classes are making lower highs and lower lows, while the dollar index is moving in the opposite direction.

Markets are ugly, but nothing lasts forever. Trend following can be the best route for capturing the most significant moves. You will never buy the lows or sell the highs when following trends, as they will cause short positions at bottoms and long positions at market tops. However, trend-following allows for extracting a substantial percentage from a significant price move. Embrace those trends until they change.

--

Trading advice given in this communication, if any, is based on information taken from trades and statistical services and other sources that we believe are reliable. The author does not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects the author’s good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice the author provides will result in profitable trades. There is risk of loss in all futures and options trading. Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the potential complete loss of principal. This article does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein, or any security in any jurisdiction in which such an offer would be unlawful under the securities laws of such jurisdiction.

Bitcoin Dealers/Intermediaries Massive shorts (CME) Explained Everyone wondering about the Dealers and Intermediaries adding massive shorts on the 29th of March.

We can explain this from the very overbought Price Action as well as it being the end of Q1.

This push accomplished the Q2 Open under the Q1

Will AAPL break out on Thursday, the day after Q2 ER ?A lot of the trends look like a short-term move is possible. I'm adding $2500 in AAPL, nonetheless, but I'd like to jump on one of these runs. I haven't been free during market hours so I haven't had time. I'll be free Thursday!

1hr Chart:

Double-Bottom: trend reversal (bullish); Green Ichimoku Cloud: support going forward/ahead (bullish); Green Candles above 5-day and 200-day moving averages (bullish); Higher lows following Double-Bottom (bullish); Moving average ribbon positively upwards and clearly defined: indicates all moving averages are in concensus

4hr Chart:

Moving average ribbon and candles positively ascending and broke through red Ichimoku Cloud (resistance) with little effort, only 3.5 days; candles forming support at $131.94 (yellow rectangular box above parallel level on Ichimoku Cloud)

(the "buy" and "sell" indicators don't mean anything on 1hr + (long-term) charts)