QANX weekly bullish wave hanging by a threadAfter two successful Fibonacci retracements on the daily chart QANX has lost support for the third wave up. However it has just performed a Fibonacci golden zone retest of a potential second wave up on the weekly chart.

0.02 - 0.022 was a potential buy zone, which - for now - seems to have triggered some buys.

Now QANX is a low-volume and short-history token. Very risky to try and use Technical Analysis on it. If we see a confirmed break of the downward sloping trendline (meaning one candle closing above the trendline and the following one opening AND closing above it - on the weekly timeframe of course) then we might have a good chance of a wave up on the weekly timeframe.

Please note that such a move may take months and is not guaranteed!

There is a higher probability (ie ~67%) of price reaching the range between 0.067 - 0.104 USD if the aforementioned confirmed break occurs.

Chances are reinforced by the fact that 0.021 has acted as strong resistance this summer and we are now coming back to retest it. There is a high likelihood that it will act as support for further price growth.

There is also an upward supporting trendline that could act as a secondary support (though weaker in itself than the horizontal support). These two potential supports together with the potential Fibonacci retracement suggest that this my be a good overall buy level.

Further reinforcement may be the all-time low daily RSI level (just entering below 30) and the low stochastic RSI levels - these are daily levels, not weekly so these do not strengthen the weekly buy case in themselves)

All in all, risk-seekers might pull the trigger today while more cautious traders may want to wait 1-2 weeks for a confirmed break of the trendline.

I may buy 33% of my intended position today and wait for a confirmation with the rest. If the breakout fails my next potential support to spend the remaining 66% may be 0.014 USD.

QAN

QAN - Is the pullback Over?QAN had been retracing lower since the last two months and have found support just at the lower edge of the Parallel Channel (Trendline) ($4.40 - $4.50 Zone), coupled with Above Average Volume and a MACD Cross. It has retraced to exact 50% Fib Retracement and is showing some Bullish Price Action. This Bullish price action off Support suggests that the current pull back may be over and it could move higher to towards the Strong Resistance Zone of $5.20 - $5.30 for a potential 10% gain.

Please note these are my own notes, by no means trading advice. Please do your own research before entering into any trade.

QAN - Nothing goes up in a straight line - Buying Opportunity QAN - another stock to suffer during the pandemic, but recent price action has confirmed a reversal by rocketing upwards and forming a higher high.

1. Price has formed a higher high

2. It has formed a Golden Cross

3. Recent sessions' price action, (Bearish Candles) indicates a pullback

4. I will be confident to buy in the $4.97 - $4.49 region (Buy Zone) as it is the 50% Fib Retracement Zone.

5. There is a gap window between 4.95 - $4.68 region (another confluence of Support)

6. There is a trendline support in the same region which is the third confluence.

Please note these are my own notes, by no means trading advice. Please do your own research before entering into any trade.

FLT PredictionAs predicted from my last post, FLT took a big dive all the way down to $11.26 last week. If you bought FLT at $11.26 last week you would be up 27%. It has passed previous resistance however last time it reached the resistance line, it bounced up and plummeted down to $11.26. Due to increasing COVID cases in America and Biden's plan to tackle COVID-19 it may begin a downtrend. However, Australia itself has recovered and hopefully positive news for the Australian economy will come out soon. It the meantime, except FLT to begin a downtrend.

Profit taking time for Qantas? $QANTopped on a green 9.

We are on red 1 right now and if we get a red 2 below the red 1 on Monday.

It is a good shorting opportunity.

The RSI, MACD, and CMF are showing the bulls are running out of energy.

I am bullish on Qantas long term and therefore I am expecting the bulls to take back control on the trendline or near the moving averages.

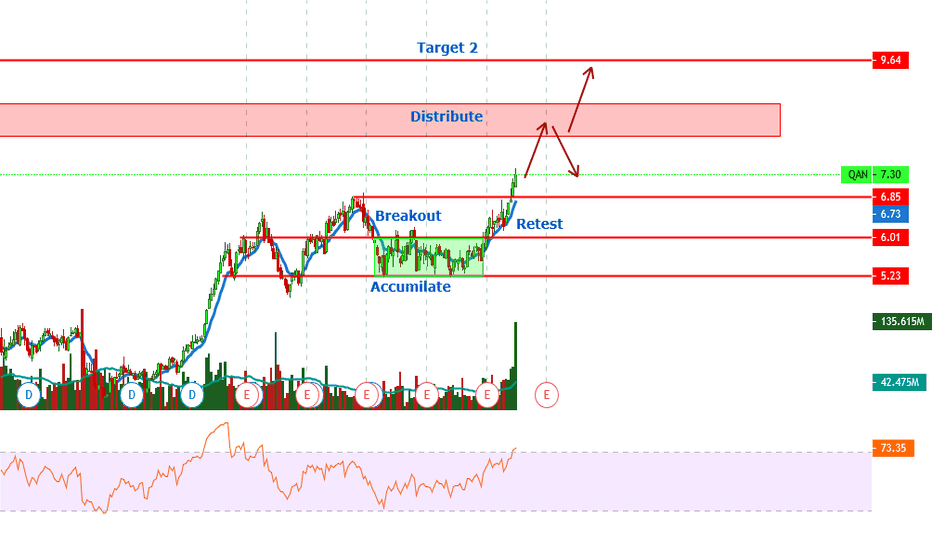

QANTAS - Wait and watchHey guys welcome to my back. This week we are looking at QAN. If your liking the charts so far show some support and give me a follow. Likes and comments are also appreciated.

Currently I have QAN as a wait and watch. The reasoning, I believe we have just entered our fifth wave. that being said and to put if frank there is no clear sign of when we can expect a pull back. Momentum is looking strong for the bulls on the weekly and monthly and I have marked two potential targets that sellers and ETF's would use to distribute their holdings (remembering this has to be done slowly over time because it's dependant on volume). However it is to early to tell if the fifth wave will end at denoted targets or we will have a pull back slightly and continue on for a extended fifth wave.

If you would like to request a chart for me to look at comment them below!

If you want to learn more about market cycles, Elliot wave or company investing check out the books below! Use my link and support me directly!

www.amazon.com.au

www.amazon.com.au

$QAN Qantas trade set-up long off optimal entry fib zoneDouble click the price column to see the chart. Here's my trade setup for today, $QAN : ASX long off bullish momentum and.382-.618 fib zone. This has been profitable of late with some nice s/r swings and stock holding up well during the recent downturn. Not financial advice. As always, trades can go against us no matter how good a chart looks, risk management is king.

ASX:QAN 189 days ascending triangle BREAK ?ASX:QAN The 189 day ascending triangle is nothing short of exciting for me. When such a long trend happens, it happens for a reason and usually the break out will be 'intense'.

Watch out for it.

Earnings announcement coming on the 23 Feb. Keep a lookout for it. Conservative target at $8.28.

A break below $6.19 will invalidate this bullish outlook.

ASX: QAN Qantas trading in an ascending triangleQantas ASX:QAN has been quite stable and experiencing low volatility for the past few weeks. The bollinger band seems to be squeezing as a result. A squeeze means a swing in the price is coming. We have to break out of the ascending triangle otherwise, we are not going anywhere.

Wait for breakout and confirmation. Price has to close above $6.45 on the daily.

Target: $7.50 if break out is confirmed.

Otherwise wait for pullback to the EMA55 level at $6.11