Qualcomm: Beyond the Smartphone Storm?Qualcomm (NASDAQ:QCOM) navigates a dynamic landscape, demonstrating resilience despite smartphone market headwinds and geopolitical complexities. Bernstein SocGen Group recently reaffirmed its "Outperform" rating, setting a \$185.00 price target. This confidence stems from Qualcomm's robust financials, including a 16% revenue growth over the last year and strong liquidity. While concerns persist regarding potential Section 232 tariffs and Apple's diminishing contribution, the company's strategic diversification into high-growth "adjacency" markets like automotive and IoT promises significant value. Qualcomm currently trades at a substantial discount compared to the S&P 500 and the Philadelphia Semiconductor Index (SOX), signaling an attractive entry point for discerning investors.

Qualcomm's technological prowess underpins its long-term growth narrative, extending far beyond its core wireless chipmaking. The company aggressively pushes **on-device AI**, leveraging its Qualcomm AI Engine to enable power-efficient, private, and low-latency AI applications across various devices. Its Snapdragon platforms power advanced features in smartphones, PCs, and the burgeoning **automotive sector** with the Snapdragon Digital Chassis. Further expanding its reach, Qualcomm's recent acquisition of Alphawave IP Group PLC targets the data center market, enhancing its AI capabilities and high-speed connectivity solutions. These strategic moves position Qualcomm at the forefront of the **high-tech revolution**, capitalizing on the pervasive demand for intelligent and connected experiences.

The company's extensive **patent portfolio**, encompassing over 160,000 patents, forms a critical competitive moat. Qualcomm's lucrative Standard Essential Patent (SEP) licensing program generates substantial revenue and solidifies its influence across global wireless standards, from 3G to 5G and beyond. This intellectual property leadership, combined with a calculated pivot away from its historical reliance on a single major customer like Apple, empowers Qualcomm to pursue new revenue streams. By aiming for a 50/50 split between mobile and non-mobile revenues by 2029, Qualcomm strategically mitigates market risks and secures its position as a diversified technology powerhouse. This assertive expansion, alongside its commitment to dividends, underscores a confident long-term outlook for the semiconductor giant.

QCOM

$SOXL Inverted Cup and Handlel (SELL NOW!)Grasping chart patterns is essential for market participants. This article explores the inverted cup and handle formation, a bearish signal that suggests potential downward movement.

The inverted cup and handle, also known as an upside-down cup and handle pattern, is a bearish chart pattern that can appear in both uptrends and downtrends. It is the reverse of the traditional bullish cup and handle pattern. The inverted formation consists of two main components: the "cup," an inverted U-shape, and the "handle," a small upward retracement following the cup.

SELL NASDAQ:NVDA AMEX:SOXL NASDAQ:AMD NASDAQ:AVGO NASDAQ:QCOM NASDAQ:MRVL NASDAQ:MU $TXN.

Lets BUY it again WHEN IT'S LOW guys.

Mark my word

OH NO! $SOXS is primed for a significant rise.The concept of a multiple bottom suggests that the stock has already experienced a significant decline, creating a buying opportunity at a lower price over time.

Plus, Trump is coming= BYE semidocutor stocks!

Stricter trade policies and tariffs on imported semiconductors could disrupt global supply chains, leading to higher costs and potential shortages.

During his previous presidency, Trump focused on "America First" policies, which included promoting domestic manufacturing and reducing reliance on foreign supply chains

Additionally, there were concerns about the potential mismanagement of federal initiatives like the CHIPS and Science Act, which aimed to boost domestic semiconductor manufacturing.

AMEX:SOXL , NASDAQ:NVDA , NASDAQ:AMD , NASDAQ:AVGO , NASDAQ:QCOM : Sell now to take the profit.

IT'S COMING

QCOM cautiously bullish 4h timeframe multi timeframe confirmation just dropped in my lap.

I see strong BUY confirmation based on our momentum framework.

🔹 **Trade Direction:** Long (Bullish Reversal)

🔹 **Entry:** $156 - $157 (Current zone)

🔹 **Stop Loss:** $152 (below recent swing low)

🔹 **Target 1:** $164 (short-term resistance)

🔹 **Target 2:** $171.50 (previous support-turned-resistance)

📊 **Probability & Justification:**

- **Momentum Shift:** Price stabilizing after a steep sell-off, potential for mean reversion.

- **Indicators:** Stochastic RSI heavily oversold across all key timeframes, strong buy signals on multiple intervals.

- **Moving Averages:** 9/21 EMA still bearish, but price attempting to reclaim key levels.

- **Volume Profile:** Increasing buy-side pressure indicates accumulation.

⚠️ **Risk Considerations:**

- A break below $152 invalidates the setup.

- Price action must confirm a higher low before strong upside.

- Volatility at 31.5%—expect swings; patience required.

📉 **Bias:** Cautiously bullish—confirmation needed for continuation above $164.

Qualcomm: Target Zone Active!QCOM is still trading outside our blue Target Zone, which spans from $159.57 to $121.52. While the stock has fulfilled the technical minimum requirement for the blue wave (IV) by reaching this range, we primarily expect further sell-offs and lower lows before the correction is complete. A premature breakout will only be confirmed if the price sustainably surpasses the $182.08 mark (37% likely).

Breaking: QUALCOMM ($QCOM) Shares Dip 5% In Premarket tradingShares in Qualcomm fell more than 5% in Thursdays premarket trading as a disappointing forecast for no growth in its patent licensing business overshadowed a higher-than-expected outlook for sales and profits.

The shares fell 4.2% in extended trading on Wednesday, having closed up 1.6% on the day in regular hours. Qualcomm stock is up 14.5% this year.

Despite the poor results It is pertinent to note that In 2024, QUALCOMM's revenue was $38.96 billion, an increase of 8.77% compared to the previous year's $35.82 billion. Earnings were $10.14 billion, an increase of 40.24%.

Analyst Forecast

According to 27 analysts, the average rating for QCOM stock is "Buy." The 12-month stock price forecast is $207.25, which is an increase of 17.85% from the latest price.

Technical Outlook

As of the time of writing, (NASDAQ: NASDAQ:QCOM ) stock is down 5.11% in Thursday's premarket trading with recent trading session closing with a moderate RSI of 66 however there will be an impediment today on the growth of NASDAQ:QCOM as a gap down is inevitable which is a bearish pattern that leads to further dip.

In the case of extreme selling pressure, immediate support lies in the 61.8% fib retracement level. A dip to this could set NASDAQ:QCOM on a bullish course as liquidity has being swept on recent dip.

AMD: A Once-in-a-Lifetime Opportunity!**🔥 AMD: A Once-in-a-Lifetime Opportunity!**

In pre-market, AMD briefly touched **$125** following earnings. You all know how this works—sooner or later, the algos will bring it back to that level. No hesitation, I’m **quadrupling my bet—going in MASSIVELY!** 🚀💰

MOBILEYE - A Merger & Acquisitions target! Downside limitedNASDAQ:MBLY - M&A Target 🎯🚘

Here's my thoughts of what I believe to be limited downside on Mobileye with my thesis that they could be a prime M&A target for a slew of Mega-Cap companies with the new administration pegged to be more lax in this area of business. More details in this post. 👇

I personally love Mobileye - NASDAQ:MBLY as a fundamentally undervalued company with great tech. I believe its a great investment with great technicals as well.

My thesis is that the downside is limited at this point due to this M&A realm we are about to step into here shortly.

Jensen just clarified what I had already perceived to be true which is the AV and Robotaxi market is a multi-trillion TAM over the next decade. These words alone increase any M&A price targets of any company in this space to include a robust Top 3 player such as $MBLY.

They currently sit at a 13.75B Mkt Cap after the massive 25% flush the last two days due to no new news. Not actually based off of fundamentals or the technology.

I would put a MINIMUM M&A target on this name of 15B and Maximum of 30B IMO.

A lot of big tech getting into this space and are way behind the Top 3 players in this realm of Mobileye/ NASDAQ:TSLA / NASDAQ:GOOGL (Waymo). It's obvious who would get gobbled up by a deal that is too good to resist which I believe personally is north of 20B as they are already on a solid path forward with headwinds turning into tailwinds (interest rates/ inflation/ china recovery/ auto-market recovery)

My personal theory of the companies most likely to take their shot are as follows in order:

NASDAQ:QCOM - Big chip player who is partnered with majority of legacy car brands. (Did a write-up in the past when they were thinking of acquiring/ merging with Intel in which own 80% share in Mobileye)

NASDAQ:NVDA - Announced there ambitions in this sector and have already been working within it. They've recently lost Hyundai though which tells me they aren't so close to having solid breakthroughs. But I believe they have the money and will to throw at M&A and take short-cut.

NASDAQ:GOOGL - Their robotaxis use very expensive lidars and I could see them make this purchase to get Mobileyes much cheaper technology that can be fitted to cars a lot simpler and with a cheaper price tag.

Others that I'm less confident on but have the money and could become a player: NASDAQ:META $APPL NASDAQ:AMZN

Great post Za! I hope I was able to add something for any Mobileye investors/ traders. Have a great market day off friend.

Not financial advice.

QUALCOMM DEEP DIVE (DD): A Trillion dollar Market Cap InboundQUALCOMM DEEP DIVE (DD):

A Trillion-dollar Market Cap Inbound

In this video, we will be doing a DEEP DIVE into:

1.) NASDAQ:QCOM H&S Pattern

2.) Why Qualcomm is a great investment, 6/6 score

3.) Implications for NASDAQ:INTC & NASDAQ:MBLY if they're acquired by Qualcomm. BULLISH MOBILEYE!

4.) Combining fundamental & technical analysis into investing

I worked really hard to prepare this video; if you enjoy it, please consider sharing. 🙏

NFA

#investing

QUALCOMM (QCOM): Diversified Growth Amid DowntrendQualcomm ( NASDAQ:QCOM ) presents an intriguing setup as we believe the wave I and a larger cycle might have concluded. Following its peak, NASDAQ:QCOM has dropped nearly 30%, retracing back to the range high. To finalize wave (A), we expect an additional leg down to complete the intra 5-wave structure. The likely target lies between $143 and $133, a range that aligns well with the Point of Control (POC) from March 2020 to now. This adds confluence to its significance as a potential support zone.

Despite the technical setup, we caution that the risk for a long position remains high. A more favorable entry could arise once NASDAQ:QCOM reclaims the range, validating the start of a potential bullish wave.

For the current quarter, Qualcomm projects revenues between $10.5 billion and $11.3 billion, with automotive sales anticipated to rise 50% year over year. CEO Cristiano Amon’s strategy to diversify Qualcomm beyond smartphones into chips for PCs, cars, and industrial machines underscores the company’s adaptability.

The next financial results release is scheduled for January 29, 2025, offering further insights into Qualcomm’s trajectory.

The $143-$133 range is a key zone for potential support, bolstered by its alignment with the POC. A decisive break below this zone could invalidate the bullish outlook, while a breakout above the range high may provide an opportunity to long this stock with lower risk. The completion of wave (A) would ideally coincide with a structural turnaround.

We are closely monitoring NASDAQ:QCOM for any signs of a reversal. Should the stock confirm a reclaim of the range, we may consider initiating a long position with a more precise stop-loss strategy. Until then, patience and vigilance are essential.

Qualcomm: Target Zone Ahead!While many tech-sector stocks are aiming for new highs, QCOM remains locked in a narrow range around the $170 level. Last week, the stock initially reacted to the 23.60% retracement and now hovers near the edge of our blue Target Zone (coordinates: $159.57 to $121.52). Our primary expectation is for the blue wave (IV) to extend further below the support at $151.39, where we anticipate its low point. Technically, a direct breakout to the upside is also possible, as our Target Zone – and thus the minimum correction threshold – has already been reached. If the price decisively breaks above the resistance levels at $193.84, an overarching alternative wave count will come into play (probability: 33%).

Focus on demand in semiconductors, NVDA leading the way.While there are minor disputes among smaller semiconductor firms, the real focus should be on demand. NVDA is making tremendous strides in the data center space. My long-term target is around $171, but in the short term, we need a weekly close above $140.76 for confirmation. I'm a buyer near $141, with $136.15 standing out as the most attractive entry point in the support zone. Falling below this level could lead to short-term frustration.

QCOM (QUALCOMM Incorporated) BUY TF M30 TP = 172.60On the M30 chart the trend started on Oct.8. (linear regression channel).

There is a high probability of profit taking. Possible take profit level is 172.60

This level, which I have outlined above, is certainly not a “finish” level. But it is the level that has the “highest percentage of hits on target.”

Using a trailing stop is also a good idea!

Please leave your feedback, your opinion. I am very interested in it. Thank you!

Good luck!

Regards, WeBelievelnTrading

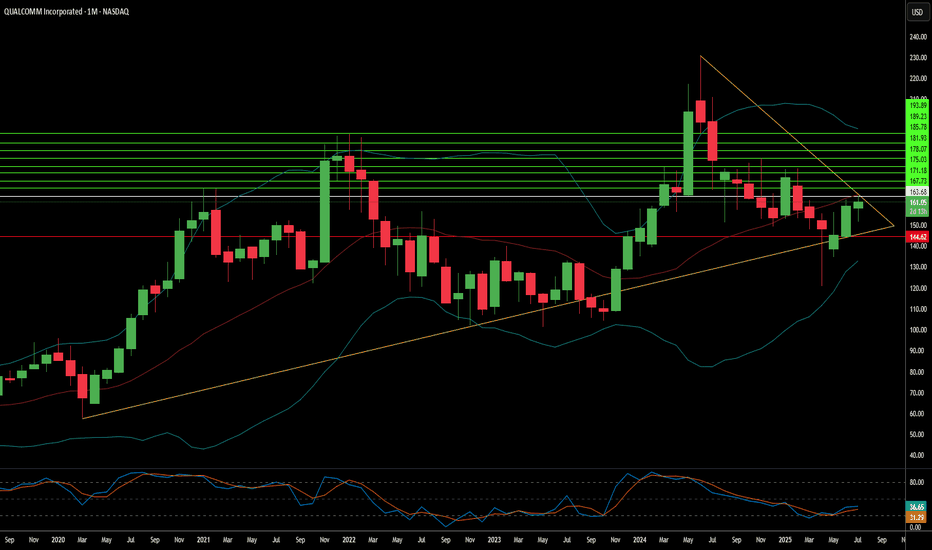

QCOM DOWNWARD TREND BREAKOUT TO THE UPSIDE! 20% MOVE NASDAQ:QCOM DOWNWARD TREND BREAKOUT TO THE UPSIDE! 20% MOVE INBOUND!

NASDAQ:QCOM IS ON THE UP AND UP!

- Symmetrical Triangle Breakout

- Stochastic Curling Upward

- MACD Crossing Zero Line

- RSI Higher Highs

CATALYST: SEMIS ON THE RUN AGAIN!

Not Financial Advice!

Approaching some nice support on QCOM!🔉Sound on!🔉

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

QCOM -- riding the "MicroChip/AI" growth era. UPSIDE in order!QCOM is signaling a BIG BUY ALERT as big news recently came up -- with Meta and Qualcomm teaming up to run big A.I. models on phones.

Qualcomm and Meta will enable the social networking company's so-called new large language model, Llama 2, to run on Qualcomm chips on phones and PCs starting in 2024. The chipmaker says the technology will enable applications like intelligent virtual assistants.

On our monthly data, long term price shift has already commenced. The stock bounce of a 61.8 FIB level with precision. The 120ish price area has been a reliable major order block support for quite sometime. On histogram, higher lows has been created conveying the current price range as the new base for the incoming series of ascend.

Volume has been surging in an impressive fashion. Net positive volume is up by 154% from 9.32M to 23.7M. This shows significant buyer's positioning on the company's prospective fundamental and technical growth.

If you think NVDA is too high now -- and want a similar growth prospect within the same industry, QCOM will no doubt fit the bill. The room for growth for this tech stock is unbounded.

Expect some notable price growth from here on for QCOM -- as the world enters a new era of technical innovations.

Spotted at 124.0.

TAYOR

Safeguard capital always.

Qualcomm- TSMC Production Amidst Geopolitical UncertaintyQualcomm's (QCOM) decision to leverage TSMC's production for its new Snapdragon X Elite chip presents a compelling opportunity, but geopolitical tensions and market competition necessitate careful consideration.

Long Potentia l

Superior Chip Performance: The Snapdragon X Elite boasts superior AI capabilities and battery life compared to current offerings, potentially capturing significant market share.

TSMC Production Efficiency: TSMC's advanced production capabilities ensure efficient chip manufacturing, potentially boosting Qualcomm's profitability.

Short Potential

Geopolitical Risk: Rising tensions between China and Taiwan threaten to disrupt TSMC's production, jeopardizing Qualcomm's supply chain and production timelines.

Market Competition: Intel's neuromorphic processors and Apple's M-series chips pose a significant competitive threat, potentially hindering market adoption of the Snapdragon X Elite.

Indicators

Geopolitical Developments: Closely monitor news and pronouncements regarding the China-Taiwan situation for potential disruptions to TSMC's operations.

Stock Price Movements: Track the stock price movements of QCOM, INTC (Intel), and AAPL (Apple) to gauge market sentiment towards the competing chip technologies.

Market Adoption: Analyze sales figures and market adoption rates of Snapdragon X Elite-powered laptops to assess the chip's performance.

Catalysts

* **Positive Market Reception:** Strong reviews, high sales figures, and widespread adoption of Snapdragon X Elite laptops would significantly improve Qualcomm's market position.

* **Strategic Partnerships:** Increased partnerships with major OEMs for Snapdragon X Elite integration would bolster market share and revenue potential.

* **Geopolitical De-escalation:** De-escalation of tensions between China and Taiwan would mitigate supply chain risks and boost investor confidence.

Risk Factors

Military Conflict: A Chinese invasion of Taiwan causing a TSMC production halt would have a devastating impact on Qualcomm's production and stock price.

Technological Disruption: Superior performance of Intel's neuromorphic processors could render the Snapdragon X Elite obsolete.

Lower-than-Expected Demand: Lower-than-expected market demand for Snapdragon X Elite chips would negatively impact Qualcomm's revenue and profitability.

Conclusion

Qualcomm's strategic shift hinges on navigating geopolitical uncertainties and a fiercely competitive market. By closely monitoring these factors and potential catalysts, traders can make informed decisions to capitalize on potential opportunities or mitigate risks.