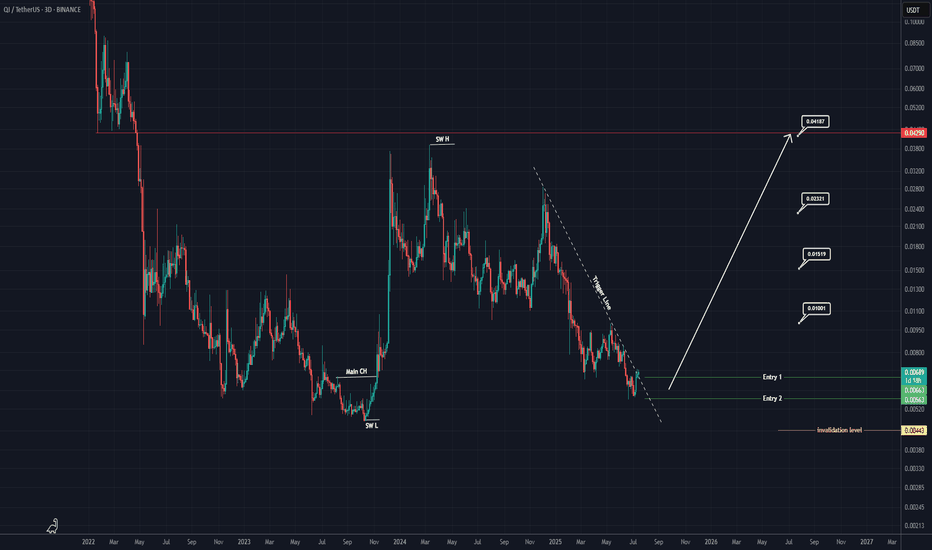

QI Looks Super Bullish (3D)The price has reached a significant zone on the higher timeframes and has failed to create a lower low. Additionally, a major Change of Character (CH) has formed on the chart.

There are signs indicating that the price is attempting to form a double bottom on the higher timeframes.

We have identified two entry points for taking a spot position.

The closure of a daily candle below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

QI

#QI (SPOT) IN( 0.01400- 0.01820) T.(0.13500) SL(0.01318)BINANCE:QIUSDT

#QI / USDT

Entry( 0.01400- 0.01820)

SL 1D close below 0.01318

T1 0.03700

T2 0.06300

T3 0.09900

T4 0.13500

1 Extra Targets(optional) in chart, if you like to continue in the trade with making stoploss very high.

______________________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

****************

My total posts

www.tradingview.com

**********************************************************************************************

#Manta #OMNI #DYM #AI #IO #XAI #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #VOXEL #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA #HIVE #ASTR #ARDR #PIXEL #LTO #AERGO #SCRT #ATA #HOOK #FLOW #KSM #HFT #MINA #DATA #SC #JOE #RDNT #IQ #CFX #BICO #CTSI #KMD #FXS #DEGO #FORTH #AST #PORTAL #CYBER #RIF #ENJ #ZIL #APT #GALA #STEEM #ONE #LINK #NTRN #COTI #RENDER #ICX #IMX #ALICE #PYR #PORTAL #GRT #GMT #IDEX #NEAR #ICP #ETH #QTUM #VET #QNT #API3 #BURGER #MOVR #SKL #BAND #ETHFI #SAND #IOTX #T #GTC #PDA #GMX #REZ #DUSK #BNX #SPELL #POWR #JOE #TIA #TFUEL #HOT #AVAX #WAXP #OGN #AXS #GALA #ONE #SYS #SCRT #DGB #LIT #QI

Establish a trading strategy that suits your investment styleHello traders!

If you "Follow" us, you can always get new information quickly.

Please also click “Boost”.

Have a good day.

-------------------------------------

(QIUSDT 1M chart)

The key is whether it can receive support and rise around 0.01550-0.01939.

If not, it is highly likely that the flow is to create a middle section in the form of a bottom.

(1W chart)

Since the HA-High indicator is formed at the 0.02464 point, it is highly likely that the price will continue its upward trend if it rises above 0.02464 and maintains the price.

However, since a psychological volume profile section has been formed up to the 0.03732 point, a full-fledged upward trend is expected to begin only when it rises above this point.

If it falls below 0.01550 and shows resistance, it is likely to fall near the HA-Low indicator.

Currently, the HA-Low indicator is formed at 0.00736.

However, as the price falls, there is a possibility that a new HA-Low indicator will be created, so support near the HA-Low indicator is important.

(1D chart)

The HA-Low indicator is formed at 0.01560.

Accordingly, the key is whether it can receive support and rise in the important area around 0.01550-0.01939.

If the price falls below the HA-Low indicator and shows resistance, there is a high possibility of a cascading decline, so a countermeasure is needed.

Since a volume profile section is formed at the 0.0122 point, you need to check whether you can receive support around this area.

The HA-High indicator is formed at 0.02715.

Since the HA-High indicator on the 1W chart is formed at the 0.02464 point, the 0.02464-0.02715 section is likely to be a resistance zone.

If it receives support in the 0.02464-0.02715 range and rises, it is likely that an upward trend will begin.

However, since the 0.03549-0.03732 section may again serve as a resistance section, a countermeasure is needed.

-------------------------------------------------- ----

To trade by looking at this chart, you need to choose what is most important to you and decide on an appropriate investment period.

If the investment period does not suit your investment style, it is better not to trade.

The reason is that once you start trading, your psychological influence is likely to have a big impact on your trading.

In day trading or short-term trading, it is recommended to buy when support is confirmed in the 0.01550-0.01939 range and sell around 0.02464-0.02715, the first split selling range.

At this time, you must decide whether to sell 100% and receive a cash profit, or whether to sell the purchase principal amount and leave the number of coins (tokens) corresponding to the profit.

For medium to long term trading, I don't think it's time to trade yet.

The reason is that, as mentioned earlier, if it falls below 0.01550-0.01939, there is a high possibility of creating an intermediate section in the form of a bottom.

Therefore, it is recommended to proceed with a split purchase when support appears near the HA-Low indicator of the 1M chart or the HA-Low indicator of the 1W chart.

Therefore, it is most important to create a trading strategy that suits your investment style.

1. Investment period

2. Investment size

3. Trading method and profit realization method

You need to create a trading strategy based on 1-3 above.

Numbers 1 and 2 are to determine the investment period and investment size according to your investment style, so you can make your decision by analyzing charts and checking other coin ecosystems.

Number 3 is to decide on the detailed trading method when you decide to trade, so you must select the buying, selling, and stop-loss method and decide how to realize profits accordingly.

It is useful when conducting mid- to long-term transactions to reserve the number of coins (tokens) corresponding to profit rather than 100% selling.

This is because the purchase price of the coin (token) corresponding to profit is 0.

Have a good time.

thank you

--------------------------------------------------

- The big picture

A full-fledged upward trend is expected to begin when the price rises above 29K.

This is the section expected to be touched in the next bull market, 81K-95K.

#BTCUSD 12M

1st: 44234.54

2nd: 61383.23

3rd: 89126.41

101875.70-106275.10 (when overshooting)

4th: 13401.28

151166.97-157451.83 (when overshooting)

5th: 178910.15

These are points that are likely to encounter resistance in the future.

We need to see if we can break through these points upward.

Since it is thought that a new trend can be created in the overshooting zone, you should check the movement when this zone is touched.

#BTCUSD 1M

If the general upward trend continues until 2025, it is expected to rise to around 57014.33 and then create a pull back pattern.

1st: 43833.05

2nd: 32992.55

-----------------

QIUSDT(Benqi) Daily tf Range Updated till 11-05-24QIUSDT(Benqi) Daily timeframe range. another alt trying for a retrace back. 0.02191 holding for now, not much retail interest. if it comes later maybe get over 0.02191 clean which will open its way till 0.03030. but that will require a healthy daily close.

BENQI (QI)BENQI is a decentralized noncustodial liquidity market as well as a liquid staking protocol built on the high-speed Avalanche smart contract network. The lending protocol allows users to lend, borrow, or earn interest using their digital assets. The Liquid Staking protocol provides a solution for capital efficiency, offering users the opportunity to unlock their staked AVAX to be used on Decentralized Financial protocols.

Anyway, the QI start was not bad, considering it went into a long downtrend afterward. Then QI broke the major downtrend line and then tried to make a reversal, which was successful when it broke the first minor horizontal area upward. QI went up, and now it seems oscillating in a big rectangular consolidation area (or some call it a sideways channel). Currently, at the bottom of this area and trying to start the next upward phase. Let's see if QI can break this area and reach the next horizontal resistance area.

QI analysisIt seems to be at the end of a triangle.

By maintaining the green range, the triangle can be completed and we can see another pump.

The targets are clear on the chart.

Closing a daily candle below the invalidation level will violate the analysis

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

QIUSDT Surges by 251%, Reaching $0.3749! 🚀BoooooooOOOOOOOM 🚀🚀

VIP Spot 🔥🎯

All Targets: done✅

Entry price: 0.01067$✅

Price reached :0.03749$ ✅

Profit: 251% ✅🚀🚀🤑

In a noteworthy rally, the cryptocurrency QIUSDT has experienced an impressive surge of 143.55%, reaching a significant price of $0.3749. This remarkable uptick has captured the attention of traders, indicating substantial potential for gains. Stay tuned for further market insights as QIUSDT continues to ride the wave of positive momentum in the dynamic digital currency landscape. #QIUSDT #CryptoSurge 📈

🔥 QI Huge Risk Reward Signal: RSI Reversal PlayQI has been one of the major movers of the last two weeks. Two hours ago, the RSI has hit oversold on the hourly for the first time since several weeks.

This signal is based on the idea that bulls will be hopping back into this token and push it upwards. Furthermore, the oversold RSI has occurred at the support level, further reinforcing the reversal narrative.

Stop under the oversold-RSI-low. Target at the recent top. This allows us to create an amazing trade with a huge potential pay out.

QI/USDT - BENQI: Failure_Swing◳◱ We've detected a Failure Swing pattern on the $QI / CRYPTOCAP:USDT chart. This pattern is a bullish indication and could indicate a potential trend reversal. The next resistance key levels are at 0.00556 | 0.00594 | 0.00666 and the major support zones are respectively at 0.00484 | 0.0045 | 0.00378. It is a bullish indication and we may consider buying at the current price zone of 0.0055 and targetting higher levels.

◰◲ General info :

▣ Name: BENQI

▣ Rank: 604

▣ Exchanges: Binance, Kucoin, Mexc, Hitbtc

▣ Category/Sector: Financial - Lending

▣ Overview: BENQI was launched on August 19, 2021, on the Avalanche C-Chain, and as the first recipient of the Avalanche Rush Initiative, received $3 million to be allocated as liquidity incentives for the users. The project is led by Dan Mgbor, who has over seven years of experience in project management, as well as various consultancy roles. BENQI is a Liquidity Market Protocol focused on approachability, ease of use, and low fees.

◰◲ Technical Metrics :

▣ Mrkt Price: 0.0055 ₮

▣ 24HVol: 4,574,476.852 ₮

▣ 24H Chng: -1.961%

▣ 7-Days Chng: 8.59%

▣ 1-Month Chng: 6.61%

▣ 3-Months Chng: -12.80%

◲◰ Pivot Points - Levels :

◥ Resistance: 0.00556 | 0.00594 | 0.00666

◢ Support: 0.00484 | 0.0045 | 0.00378

◱◳ Indicators recommendation :

▣ Oscillators: NEUTRAL

▣ Moving Averages: BUY

◰◲ Technical Indicators Summary : NEUTRAL

◲◰ Sharpe Ratios :

▣ Last 30D: -22.15

▣ Last 90D: -21.87

▣ Last 1-Y: -16.11

▣ Last 3-Y: -16.86

◲◰ Volatility :

▣ Last 30D: 0.32

▣ Last 90D: 0.34

▣ Last 1-Y: 0.73

▣ Last 3-Y: 1.06

◳◰ Market Sentiment Index :

▣ News sentiment score is N/A

▣ Twitter sentiment score is N/A

▣ Reddit sentiment score is 0.77 - V. Bullish

▣ In-depth QIUSDT technical analysis on Tradingview TA page

▣ What do you think of this analysis? Share your insights and let's discuss in the comments below. Your like, follow and support would be greatly appreciated!

◲ Disclaimer

Please note that the information and publications provided are for informational purposes only and should not be construed as financial, investment, trading, or any other type of advice or recommendation. We encourage you to conduct your own research and consult with a qualified professional before making any financial decisions. The use of the information provided is solely at your own risk.

▣ Welcome to the home of charting big: TradingView

Benefit from a ton of financial analysis features, instruments and data. Have a look around, and if you do choose to go with an upgraded plan, you'll get up to $30.

Discover it here - affiliate link -

✳️ BenQi (Fast ALTSBTC #6 - Finale)

Fast Altcoins vs Bitcoin pairs with confirmed bullish signals; breakout confirmed, volume confirmed, RSI strong, MACD bullish, above MAs, etc.

This will be the last one for this series. 😉

Fast ALTSBTC | Altcoins vs Bitcoin #6

---

Altcoin (PAIR): BenQi (QIBTC)

Trend: Bullish breakout

Potential: 41% to 116%

---

Wishing you great profits and success.

This is not financial advice.

Namaste.

QIUSDT#QIUSDT

we are in over sold area as you can see at the chart in daily chart time-frame and we have powerful support zone buy and hold it to the next targets at the chart dont's miss up this opportunity MACD is showing bullish RSI showing bullish EMAs showing a bullish move ZELMA is neutral Parabolic SAR is bullish Fib retracement is neutral i expect there will be a correction move