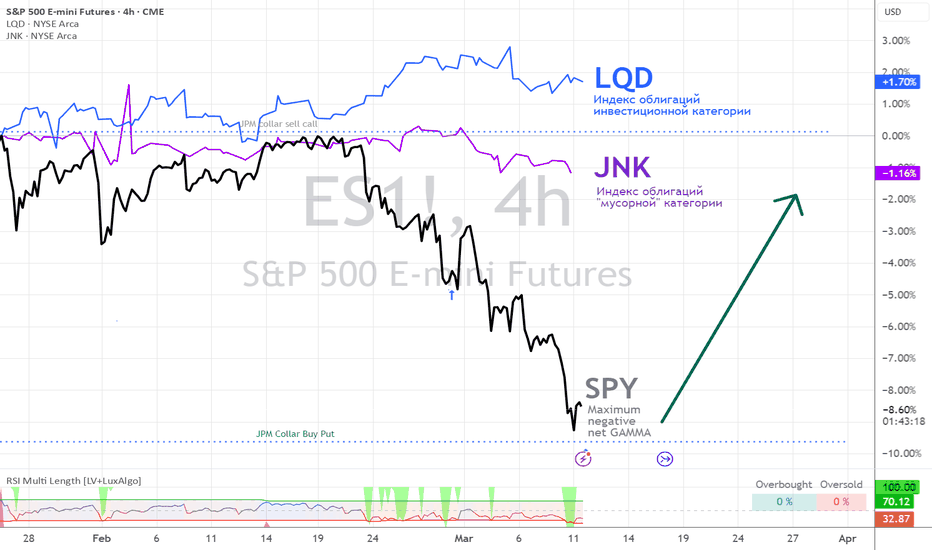

S&P500 Index Goes 'DRILL BABY DRILL' Mode due to Tariffs BazookaThe Trump administration's aggressive use of tariffs — we termed at @PandorraResearch Team a "Tariff' Bazooka" approach due to their broad, unilateral application — has exerted significant downward pressure on the S&P 500 index through multiple channels. These include direct impacts on corporate profitability, heightened trade war risks, increased economic uncertainty, and deteriorating market sentiment.

Direct Impact on Corporate Earnings

Tariffs raise costs for U.S. firms reliant on imported inputs, forcing them to either absorb reduced profit margins or pass costs to consumers. For example, intermediate goods like steel and aluminum—key inputs for manufacturing—face steep tariffs, squeezing industries from automakers to construction. Goldman Sachs estimates every 5-percentage-point increase in U.S. tariffs reduces S&P 500 earnings per share (EPS) by 1–2%. The 2025 tariffs targeting Canada, Mexico, and China could lower EPS forecasts by 2–3%, directly eroding equity valuations6. Additionally, retaliatory tariffs from trading partners (e.g., EU levies on bourbon and motorcycles) compound losses by shrinking export markets.

Trade Escalation and Retaliation

The EU’s threat to deploy its Anti-Coercion Instrument—a retaliatory tool designed to counter trade discrimination—could trigger a cycle of tit-for-tat measures. For instance, Canada and Mexico supply over 60% of U.S. steel and aluminum imports, and tariffs on these goods disrupt North American supply chains. Retaliation risks are particularly acute for S&P 500 companies with global exposure: 28% of S&P 500 revenues come from international markets, and prolonged trade wars could depress foreign sales.

Economic Uncertainty and Market Volatility

The U.S. Economic Policy Uncertainty Index (FED website link added for learning purposes) surged to 740 points early in March 2025, nearing levels last seen during the 2020 pandemic. Historically, such spikes correlate with a 3% contraction in the S&P 500’s forward price-to-earnings ratio as investors demand higher risk premiums. Trump’s inconsistent tariff implementation—delaying Mexican tariffs after negotiations but accelerating others—has exacerbated instability. Markets reacted sharply: the S&P 500 fell 3.1% in one week following tariff announcements, erasing all post-election gains.

Recession Fears and Sector-Specific Pressures

Tariffs have amplified concerns about a U.S. recession. By raising consumer prices and disrupting supply chains, they risk slowing economic growth—a fear reflected in the S&P 500’s 5% decline in fair value estimates under current tariff policies. Industries like technology (dependent on Chinese components) and agriculture (targeted by retaliatory tariffs) face acute pressure. For example, China’s tariffs on soybeans and pork disproportionately hurt rural economies, indirectly dragging down broader market sentiment.

Long-Term Structural Risks

Studies show tariffs fail to achieve their stated goals. MIT research found Trump’s 2018 steel tariffs did not revive U.S. steel employment but caused job losses in downstream sectors8. Similarly, the 2025 tariffs risk accelerating economic decoupling, as firms diversify supply chains away from the U.S. to avoid tariff risks. This structural shift could permanently reduce the competitiveness of S&P 500 multinationals.

Conclusion

In summary, Trump’s tariff strategy has destabilized equity markets by undermining corporate profits, provoking retaliation, and fueling macroeconomic uncertainty.

Overall we still at @PandorraResearch Team are Bearishly calling on further S&P 500 Index opportunities with further possible cascading consequences.

The S&P 500’s recent slump reflects investor recognition that tariffs act as a tax on growth—one with cascading consequences for both domestic industries and global trade dynamics.

--

Best 'Drill Baby, Drill' wishes,

@PandorraResearch Team 😎

QQQ

SPY/QQQ Plan Your Trade Update For 3-13-25 - Fear Settling InWith the US government only about 39 hours away from a complete SHUT DOWN, I want to warn everyone that metals are doing exactly what they are supposed to do - hedge risks. While the SPY/QQQ are continuing to melt downard.

I created this video to show you the Fibonacci Trigger levels on the 60 min SPY chart, which I believe are very important. Pause the video when I show you the proprietary Fibonacci price modeling system and pay attention to the fact that any upward price trend must rally above 563.85 in order to qualify as a new Bullish price trend.

That means we need to see a very solid price reversal from recent lows or an intermediate pullback (to the upside) which will set a new lower Bullish Fibonacci trigger level.

Overall, the SPY/QQQ are in a MELT DOWN mode and I expect this to last into early next week unless the US government reaches some agreement to extend funding.

This is not the time to try to load up on Longs/Calls.

The US and global markets are very likely to MELT DOWNWARD over the next 2 to 5+ days if the US government does SHUT DOWN.

FYI.

Gold and Silver may EXPLODE HIGHER.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade For 3-13-25: Carryover PatternToday's pattern suggests the markets may attempt to continue to find support and move into a sideways pullback (upward) price channel.

I believe the markets have reached an exhaustion point that will move the SPY/QQQ slightly upward over the next 5 to 10+ days - reaching a peak near the 3-21 to 3-24 Bottoming pattern.

This bottoming pattern near March 21-24 suggests the markets will move aggressively downward near that time to identify deeper support.

I believe metals will continue to move higher as risks and fear drive assets into safe havens.

Bitcoin should continue to slide a bit higher while moving through the consolidation phase.

Watch today's video to learn more about what I do and how I help traders find the best opportunities.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

QQQ - Nasdaq has reached it's firstPrice reached the Warning Line 1.

This is a natural support, because it's a standard deviation stretch. From here, price has a high tendency of mean-reversion.

How far?

Most of the time it shoots back to the Lower-Medianline-Parallel.

Beware of the potential resistnace zone.

This level is a good one to take partial profits.

As for a stop, I would put it below the last swing-long. I may play it with Options (for example a Risk-Reversal), giving me more leeway to the downside if it's not playing out immediately.

BUY SIGNAL into spiral turn 3/10 to 3/13 panic cycle see dec 8thThe Market has fallen right into the cycle the Panic cycle see dec 8th forecast for 2025 . put/call and most every model is set for a min 3 week sharp rally that rally if it is a 3 wave rally then the cycle degree wave 5 of 3 is ended .. BUT I see the decline into the dates and near the call for 9.8 to 11.3 % decline and worst case as stated in the forecast is 16.3 But the cycles is VERY BULLISH from this week On . I am 125 % longs in dec 2026 in the money and at the money calls . best of trades WAVETIMER

$QQQ Looks to Be in a Do or Die AreaNASDAQ:QQQ For a bull case, I need to see this get above both the horizontal area of resistance and the downtrend line on this 65 minute chart.

It looks like it could be forming yet another bear flag. All TBD. If it breaks the flag down, I would expect another leg lower.

So what we have here is a case of do or die. Hope this helps

SPY/QQQ Plan Your Trade for 3-12-25 : Rally111 PatternToday's Rally pattern in Carryover mode may prompt a powerful base/bottom move in the SPY/QQQ.

In today's video, I explain in great detail how I read these charts and why the Excess Phase Peak (EPP) patterns are so important.

We are moving into the Consolidation Phase of the EPP patterns for the SPY/QQQ.

We are already into the Consolidation Phase of an EPP pattern for Bitcoin

Gold and Silver are a bit mixed. Yet Silver has already broken above the upper EPP Peak, rallying into a new EPP Peak level. Meanwhile, Gold is still struggling to find momentum for a bullish breakout.

While I don't believe the US markets are poised for a big downward price move, today's video shows you what may be likely 4 to 12+ months into the future.

So, pay attention to today's video. It clearly illustrates how to use the EPP patterns with Fibonacci and shows you what I believe could happen over the next 6 to 12+ months.

If the SPY/I continues to try to rally higher today, it will be interesting. This means we have potentially found our consolidation base and are now moving into a very volatile sideways consolidation phase.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Bearish & Boring? Maybe. Profitable? Definitely.Bearish & Boring? Maybe. Profitable? Definitely. | SPX Market Analysis 12 Mar 2025

You know that feeling when you wake up and wonder if you’re stuck in a time loop? Yeah, me too.

For what feels like the hundredth time, I’m reporting that the bear move is grinding lower. The difference? The profits keep stacking up—so I’m not complaining.

Yesterday’s rally was supposedly triggered by Canada pausing tariffs, but let’s be real—this market is looking for any excuse to bounce. Yet, the overall trend remains the same: a slow, stair-stepping drop. Based on this drop-pause-drop rhythm, I suspect we’re entering the next pause before another leg down.

My bear boots are full, my trade allocations are set, and I’m waiting for two tranches to exit profitably before considering any new plays. Until SPX clears 5850, the bullish setups stay on the shelf.

This is the good kind of waiting—the kind where the market moves for me instead of me chasing it.

---

Deeper Dive Analysis:

If it feels like Groundhog Day, you’re not alone. The bearish grind continues, slowly pushing lower, delivering small but steady wins. Unlike a panic-driven crash, this move is unfolding in slow motion, keeping traders on edge, wondering if a rally is lurking around the corner.

📌 A Market Looking for an Excuse to Bounce

Yesterday’s rally attempt was supposedly fueled by news that Canadian tariffs were being paused, but let’s be honest—this market is desperate for any reason to move higher. The reality? The larger bearish structure remains intact.

Every bounce so far has been short-lived.

The market keeps following a drop-pause-drop pattern.

We’re likely entering the next "pause" phase before another move down.

📌 My Trading Approach—Locked, Loaded, and Waiting

Right now, my bear boots are full, meaning I’m not adding new positions until my current tranches exit profitably.

Two tranches are set to exit with profits by the end of the week.

If we push lower or continue sideways, I’ll take my exits and reassess.

Until SPX clears 5850, I won’t even think about bullish setups.

📌 What’s Next? The Good Kind of Waiting

There’s no need to chase trades or force new entries. I’m simply letting my plan play out. If the market continues its slow-motion decline, I’ll collect my wins, reload selectively, and wait for the next prime setup.

For now, I sit back and enjoy the show—because this time, the market is working for me, not against me.

---

Fun Fact

📢 Did you know? In 2008, Porsche trapped hedge funds in one of the greatest short squeezes in history, briefly making it the most valuable company in the world—all thanks to a secretive stock manoeuvre.

💡 The Lesson? Markets don’t just move up and down—they can also turn traders inside out. The wrong bet at the wrong time can be devastating… unless, of course, you have a system that keeps you on the right side of the trade. 🚀

SPY/QQQ Plan Your Trade For 3-11-25: BreakAway PatternToday's Breakaway pattern offers a fairly strong potential the SPY/QQQ will attempt to find support today. I know I've been telling everyone the markets should find support and are seeking support for the past 3+ trading days. But, the SPY has recently crossed the 50% Fibonacci pullback level and the QQQ has recently crossed the 61.8% pullback level.

These levels will act as moderate support. So, I'm urging traders to patiently wait out the early morning volatility. Today could be incredibly volatile while the markets attempt to hammer out critical support.

BTCUSD has moved to consolidation lows and will likely attempt a moderate rally up to consolidation highs.

This is another reason I believe the SPY/QQQ are attempting to base/bottom near current lows.

Gold and silver have recovered from recent lows very aggressively and are moving into a CRUSH pattern. I believe that the CRUSH pattern will resolve to the upside for metals.

At this point, I believe the markets are relatively well exhausted to the downside. But, we must let price be the ultimate dictator of trending and opportunity.

Thus, it is essential to let the markets FLUSH OUT this potential base/bottom in early trading today before getting aggressive with any trades.

Ultimately, we need to see the markets identify support in this downtrend. If we don't find any support before the end of this week, then we are going to see a very large downward price move that will invalidate many of my expectations, potentially leading to a very large breakdown in US/global markets.

Buckle up. The markets are nearing the DO or DIE phase due to how these Excess Phase Peak patterns are playing out.

I see support setting up and a base/bottom building. If I'm wrong, we'll see a continued downward price trend.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

$SPY Short Term Bullish atm.. idea for BullsWell... seeing is we hit my target, I thought I might bless the Bulls with a little bit of Eye Candy.... This is what you want...

The Fib breakdown of the Golden Pocket above at the 1.61... we hit the retracement... and now back to the .78

We hold here and it can get bullish quick.

Bearish Path in Next post... otherwise we make a lower high and fall to $525 and fast.

QQQ long term trend is down with short-term relief rallyI am guessing a bit more downside before we see a relief rally. The AI bubble is starting to unwind, and that falling knife is sharp. I am patiently waiting for some version of a short-term bottom. You can see in the chart that price is has several key support lines within near reach. I would expect testing and hopefully finding some support in the coming days. If it is like the COVID bubble unwind, then we could see a strong reverse rally out of this range. However, I think it is pretty clear QQQ is in correction with a convincing loss of the 200 day SMA.

NASDAQ: Correction or Crash?!If this Monthly Chart for March holds then the NASDAQ:QQQ is COOKED!

Next Level: $450

Crash level: $370-$400 🥶

- Breaking out of WCB Trend

- Volume is WAY less than 202 Market Crash (Can get worse)

- Breaking out of Bullish Channel

- Topping tail wicks

Not financial advice

$1.51 to $3.25 casually DOUBLED while rest of the market crashes$1.51 to $3.25 casually DOUBLED today after being mentioned in chat many times

Sweet catch on NASDAQ:HMR 👏🤑

All while the rest of the market continues to hits new lows on a big red day NASDAQ:TSLA NASDAQ:NVDA AMEX:SPY NASDAQ:QQQ AMEX:DIA NASDAQ:META NASDAQ:AMZN NASDAQ:GOOG

Got to love these type of stocks

AEON 1.26 - 1.33 (+5.5%)

HMR 3.02 - 3.16 (+4.6%)

Total profit today: +10.1%

Nice profit today again while the rest of the market goes into deeper red.

Bulletproof strategy delivers again, no matter the overall market conditions.

Congrats!

See you in the morning!

SPY/QQQ Plan Your Trade For 3-10-25: Gap/BreakawayToday's Gap Breakaway pattern suggests the markets will attempt to gap at the open, then move into a breakaway trending phase.

Given the downward price trend currently in place, I believe the markets will gap downward, then possibly attempt to move higher as we pause above the 568 (pre-election) support level.

Ultimately, I see the markets entering a brief pause/sideways price trend (maybe 2 to 5 days) before rolling downward again into the April 14 and May 2 base/bottom patterns.

I see very little support in the markets right now - other than a potential BOUNCE setup this week and into early next week.

I'm not suggesting this bounce will be a very big bullish price reversion. My upper levels are still in the 590 to 600 area for the SPY. But I do believe the markets are likely to try to find support near the 565-575 level.

Gold and silver will move into a Harami Pattern today (sideways consolidation). I don't expect much related to a big move in metals today.

Bitcoin is still consolidating in a very wide range. I expect the next move for Bitcoin to be a bit higher over the next 3-5+ days, so I believe the SPY/QQQ may trend a bit higher for about 3-5 days.

Overall, I suggest traders stay very cautious of volatility this week. Obviously, the trend is still bearish and the current EPP phase setups suggests we are consolidating into a sideways channel before moving downward seeking the Ultimate Low patterns.

Therefore, any bounce/pause in price will be very short-lived.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

QQQ Trading Opportunity! BUY!

My dear friends,

QQQ looks like it will make a good move, and here are the details:

The market is trading on 491.81 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 509.46

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

———————————

WISH YOU ALL LUCK

SPY - support & resistant areas for today March 7, 2025The key support and resistance levels for SPY today are provided above.

Understanding these levels in trading can offer valuable insights into potential market movements. They often indicate where prices may reverse or consolidate, serving as important signals for traders considering long (buy) or short (sell) positions.

These levels are calculated using complex mathematical models and are specifically tailored for today’s trading session. They may change as market conditions evolve.

If you find this information helpful and would like to receive these insights every morning at 9:30 AM, I invite you to support me by boosting this post and following me @OnePunchMan91. Your engagement is greatly appreciated! However, please note that if this post does not receive more than 10 boosts, I will have to reconsider providing these daily updates. Thank you for your support!

SPY/QQQ Plan Your Trade For 3-7-24 : Rally PatternAs many of you know, I've been expecting the SPY/QQQ to find support (seeking a base/bottom) for the past 3+ days. The amount of selling has been somewhat extreme. We are currently in a downtrend.

So, my expectation of a base/bottom is related to the breakdown of the Excess Phase Peak pattern and the previous support levels (pre-election and recent lows) that suggest price will attempt to hold/base/bottom near recent support.

As of yesterday's close, price had broken downward, still within the support range.

So, again, I urge caution as I believe price will be very volatile while attempting "hammer out a base/bottom" (if it happens).

Overall, my bias is to the downside because of the current trend. Yet, The RALLY pattern today suggests we may see a recovery above 577 on the SPY which may lead to a rally targeting 580+.

Gold and Silver are holding up well and should setup a base/bottom today on the Counter-Trend Top/Resistance Pattern. I don't expect Gold and Silver to rally very strong today. I expect more of a melt-up in trend for metals.

Bitcoin is still consolidating and moving into a very tight Flag Apex range. As I pointed out in today's video, a shorter-term Flag apex will be reached on Sunday (3-9). I believe Bitcoin will become very volatile over the next 3+ days - attempting to break away from a GETTEX:13K consolidation range.

This apex volatility could drive the SPY/QQQ into extreme volatility as well.

Unless you are very skilled at targeting short-term price swings - stay very cautious of this volatility as it could end up turning and biting back.

It's Friday. I'm planning on watching and only trading when I believe there is a very clear opportunity for profits.

I got dinged around (took some lumps yesterday) trying to trade while driving and handling family issues. Lesson learned - don't force it.

The markets will settle into a trend next week. So, be prepared to sit and watch if you don't like what you see on the charts today.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #es #nq #gold