$QQQ this might the spot. Hello and good night, evening, afternoon, or morning wherever you may be. I have been looking at names all day and I wanted to check the indexes: NASDAQ:QQQ and $SPY.

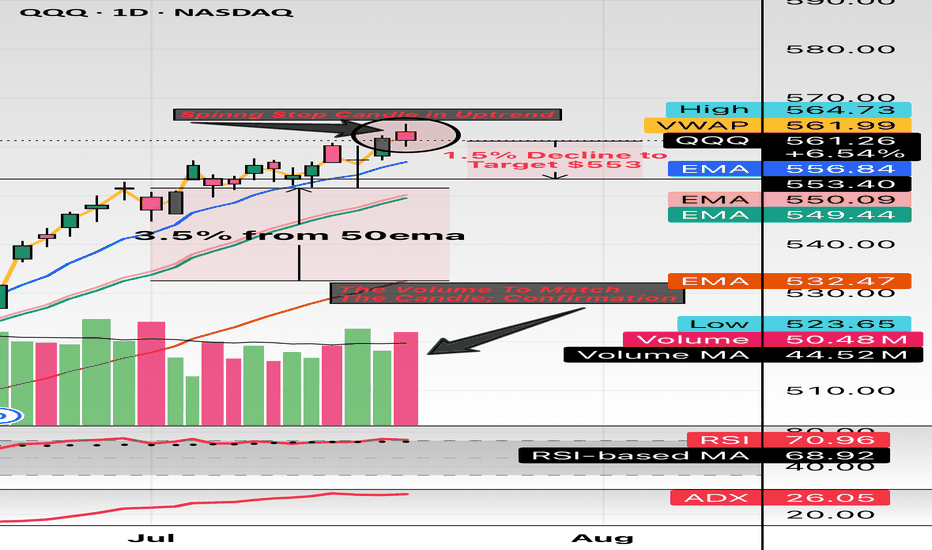

Here we have the indexes up almost 30% from the April lows and sitting about 10% YTD. The candle highlighted is the spinning stop candle and has volume to match. These candles usually take place (green or red) in downtrends or uptrends and provide pivotal indication. The market has major earnings this week (07/21/2025 to 07/25/2025) with names like Google, Tesla, General Dynamics, Verizon, Domino’s And so forth.

This week could be a catalyst to see some great volatility. I believe staying 3% from moving averages so I have noted 3.5% from the 50EMA and revisiting the 20EMA and 21EMA in the low $550 area. My target is $553 which is only a 1.4% move which can happen in one session in this environment while staying 3.5% above the 50EMA.

My trade idea will be $553p for 07/25/2025. Good luck!

WSL

Qqqforecast

2007 Top /2025 day 38td t-minus 2.5 days Major TOP The chart in focus is the 2007 chart we are now day 38 in the pattern and in 2007 we took 40td to make a new high And I have posted my models .I see the next rally to reach anywhere from 6035/on the low end to 6177 on the high end focus 6147 where Ax 1.618 = wave C or 3 Best of trades WAVETIMER

QQQ about to FLUSH?! Let's talk about it!I'm not saying it's over but you have to admit it does feel like we are going to see a decent size pullback...2-6% over the next few weeks on the NASDAQ:QQQ AMEX:SPY

- TVC:VIX back over 20

- US20Y hit 52 week high

- USDJPY starting to creep towards April lows

- $491.54 GAP to fill on NASDAQ:QQQ

- $447.58 Bigger GAP to fill on NASDAQ:QQQ

- Credit starting to become and issue

- Banks/ Credit companies tanked today

There is bullish pieces as well but we do look extended here and a healthy 2-6% would be welcomed...A break of $475 level spells trouble on QQQ.

THIS TIME IT'S DIFFERENT!🔥 THIS TIME IT'S DIFFERENT! 🔥

Can you see the shift?! VOLUME IS HERE—AND IT'S MASSIVE. 💪💰

Unlike those weak, fleeting rallies that got crushed under waves of red, this one is packed with bullish buyers and offside hedge funds READY TO SEND IT HIGHER. 🚀📈

Not to mention the last time we had this level of above average volume for this long was in October 2023 when we were coming out of a bear market and it was only the beginning of our ascent higher!

I'm not saying we can't have a pullback soon...I'm just simply saying the volume is here and it looks like dips will indeed be shallow.

ATH retest INBOUND!

Are you positioned for the move? 👀

AMEX:SPY NASDAQ:QQQ

$QQQ Inverse H&S ready to GO!NASDAQ:QQQ

We’ve spotted an Inverse Head & Shoulders breakout on the 1-hour chart, and we’re currently in the retest phase.

- Measured Move (MM): $483.55

- Measured Timeframe (MT): May 1st @ 7 PM

Let’s see if we can maintain momentum tomorrow and steer clear of any unexpected news or market shocks tonight.

Not financial advice

$QQQ Poised for Lift-Off: Flipping Resistance, Eyeing $470-$475!🚀 NASDAQ:QQQ Poised for Lift-Off: Flipping Resistance, Eyeing $470-$475! 🚀

As mentioned in my recent post, we’ve successfully flipped the $443.14 resistance into support—a key technical shift!

🔹 Momentum Building:

- Wr% Indicator: Making higher lows and advancing steadily towards the Red Barrier.

- Volume Gap: Still in play and ready to be filled.

With a higher low now established, I believe we’re set up for a potential move to $470-$475 next week.

📈 Let’s see how this plays out—exciting times ahead!

💡 Have an amazing weekend, friends!

Not financial advice

Island Bottom CONFIRMED on $QQQ IF we GAP up tomorrow!Island Bottom CONFIRMED on NASDAQ:QQQ IF we GAP up tomorrow!

I only believe we GAP up tomorrow IF there is news of China coming to the negotiation table with the U.S after they have raised the Reciprocal Tariffs to 104%.

If this doesn't happen then this isn't confirmed and we see a retest of $400 IMO!

I'm not playing this as a trade until we get confirmation! Too dangerous!

Not financial advice

How bad will it get? Let's talk about it!🌟 My Market Probabilities: 🌟

1⃣ 15% chance of a V-Shape recovery with a bottom at $410–$425

2⃣ 45% chance of a COVID-like Flash Crash resolving at

$385–$400

3⃣ 33% chance of a 2022-level bear market down to

$330–$350

4⃣ 5% chance of a 2008-level crash hitting $250–$260

5⃣ 2% chance of a crazy Dot.com-level crash dropping to $90–$110

💡 No matter which scenario unfolds, it’s a blessing in disguise! These dips create incredible opportunities to invest in great companies or indexes like the AMEX:SPY or NASDAQ:QQQ paving the way for massive, life-changing wealth over the years and decades to come.

🚀 Think long-term as an investor, friends, and stay focused on the bigger picture!

Nasdaq updated forecast with sell-side & buy-side targetsNQ futures aiming at 18900 level off these last highs. Now seeing developing weakness... expecting sellers to take it down for one more low as we approach the implementation of Trump's tariffs on 4/2.

Look for renewed buyer strength after the next set of lows as we approach the next FOMC rate decision into first half of May 2025.

This is a great swing trade setup for TQQQ, if desired, or long dated in-the-money QQQ call options.

I'll be honest here friends it's not looking good...I'll be honest here friends it's not looking good...

This may have been a Dead Cat Bounce on the NASDAQ:QQQ and AMEX:SPY friends.

GAP fills in both names lead to Bear Flag Breakdowns which in my mind leads to the next leg down.

Rejecting 200DMA on the NASDAQ:QQQ and losing control on the AMEX:SPY

Markets are hanging on slightly, lets see what happens the rest of the week.

Not financial advice

MASSIVE $QQQ BOUNCE INCOMING!MASSIVE NASDAQ:QQQ BOUNCE INCOMING!🚀

I believe we are setting up for a run to the 200DMA around $494ish🎯

- Wr% is uptrending after breaking out of Bearish WCB

- MACD is uptrending with the histogram rising

- RSI uptrending and broke out of bearish box

- Stochastic uptrending into the sweet spot after

breaking out of bearish box

We keep rejecting off the H5_S by wicking off it, which is bearish, but all other indicator show bullishness...

I could be wrong, but it's what the probabilities of everything and my GUT tell me.

Not financial advice

NASDAQ: Correction or Crash?!If this Monthly Chart for March holds then the NASDAQ:QQQ is COOKED!

Next Level: $450

Crash level: $370-$400 🥶

- Breaking out of WCB Trend

- Volume is WAY less than 202 Market Crash (Can get worse)

- Breaking out of Bullish Channel

- Topping tail wicks

Not financial advice