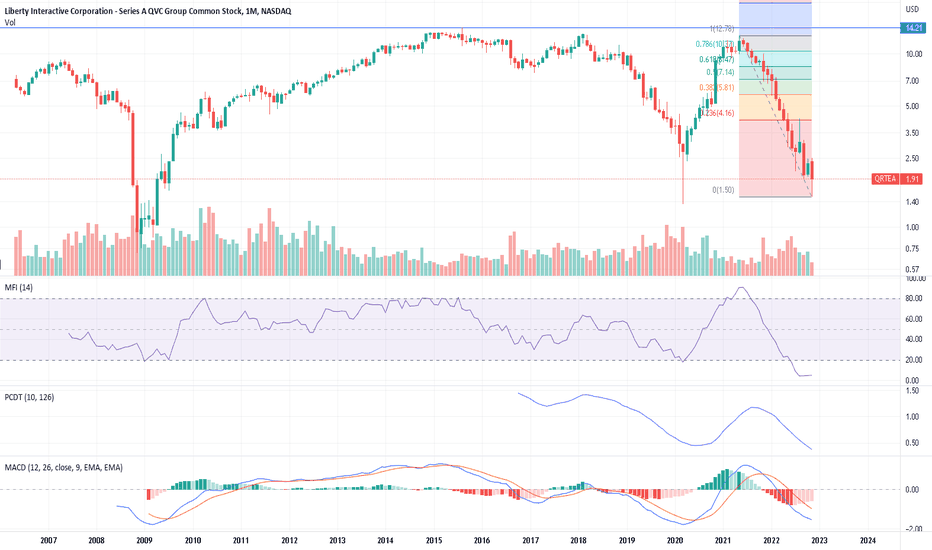

BUY QRTEAOpening a long here in QRTEA, unknown micro cap that the big shorts Micheal Burry has just bought $10 million shares in

It's a micro-cap company (market cap just $750MM) which engages in engages in the video and digital commerce via television networks and e-commerce sites. Technical's look good here for a bounce at least and i expect the weekly MACDH to turn divergent bullish either this week or next.

Could be a good ride up.

QRTEA

QRTEA, another cyclical peak?Since 2015 this stock has reached a peak every 3 years approximately, as it happened in 2018 and 2021, this time it could happen again around mid 2024 as the price has plumbed drastically, reaching an all-time low.

If this is true, then price could be around 7 to 10 dollars during 2024. If "Project Athens" is succcesfful and the company is able to regain profitability, generate cash, keep good levels of revenues and make a sound transition to streaming and ecommerce, then this stock could recover and gain a strong terrain as before.

How long do you think this downtrend will continue?

QRTEA daily looks yummy! - US MARKETQurate Retail, Inc. is engaged in the video and online commerce industries in North America, Europe and Asia. The Company operates through its subsidiaries, QVC, Inc. (QVC), which includes, HSN, Inc. (HSN), Zulily, LLC (Zulily), and Cornerstone Brands, Inc. (Cornerstone). Its segments include QxH, QVC International, and Zulily. QxH segment consists of QVC U.S. and HSN, which offers a variety of consumer products in the United States, primarily by means of their televised shopping programs and through their Websites and mobile applications (app). QVC International segment offers a variety of consumer products in several foreign countries, primarily by means of its televised shopping programs and through its international Websites and mobile apps. Zulily segment markets and sells a variety of consumer products in the United States and several foreign countries through flash sales events, primarily through its app, mobile and desktop experiences.

According to IBKR

Consensus Recommendation: Hold

Target Price: 5.88

Price to EPS: 2.76

Sales (Quarterly): 3,096.66

If this is the Deep then this would be a good choice

My opinion is Long, again if this is the deep!

The more closer to deep the more profit you make

It's matter of phycology as usual

Many thanks

QRTEA double or triple bottomEntry point long here is a no brainer in my opinion. This is how wealth is made. Not investment advice...

Trade safe and have fun!

Follow for more and comment!

Journey from 1k to 10mil!

Qurate Retail - QRTEA PENNY STOCK - If not now.. then when ? Qurate Retail, Inc. owns and operates seven leading retail brands in the U.S. and abroad, including QVC®, HSN®, Zulily®, Ballard Designs®, Frontgate®, Garnet Hill® and Grandin Road® (collectively, "Qurate Retail GroupSM").

The cheapest stock in the market!

Qurate Retail Inc Series A

Qurate Retail (USA: $QRTEA) Looking Like A Steal Of A DealQurate Retail, Inc., together with its subsidiaries, engages in the video and online commerce industries in North America, Europe, and Asia. The company markets and sells various consumer products primarily through live televised shopping programs, Internet, and mobile applications to approximately 218 million households. It also operates as an online retailer offering women's, children's, and men's apparel; and other products, such as home, accessories, and beauty products through its app, mobile, and desktop applications. The company was formerly known as Liberty Interactive Corporation and changed its name to Qurate Retail, Inc. in April 2018. Qurate Retail, Inc. was founded in 1991 and is headquartered in Englewood, Colorado.

QRTEA Ready to climb UpQRTEA based on monthly has chance to continue up. Already hit weekly support and potentially climb up from current price.

QRTEA on buy zoneQRTEA is already insert into buy zone and has potential for continuing UP. Weekly chart analysis with monthly support and resistance analysis.

[QRTEA] phase 2 -> Buy!The price broke important resistant in 23- If the price breaks again the resistant (and you see a high volume!) You should buy!