Qtum

#QTUM/USDT#QTUM

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 2.25, acting as strong support from which the price can rebound.

Entry price: 2.30

First target: 2.35

Second target: 2.41

Third target: 2.47

QTUM is almost ready...NASDAQ:QTUM -@qtum

Qtum is a smart contract platform forked from Bitcoin Core and Ethereum.🔐

#QTUM rejected the $2 support level and round number.

For the bulls to take control in the medium term, a break above the inverse head and shoulders neckline marked in orange at $2.47 is needed.🚀

QTUM for a LONGQTUM looking good today on a pullback to FVG on the 4H chart at $3.00, maybe even to $2.95 , for a LONG. aVWAP's (Purple and White Lines) are at 3.60-3.68 but I would be looking for a take profit at ~4.23

Need to see volume and open interest at these levels though - sentiment is good for QTUM with hard fork success this week.

Important support and resistance zones: 2.950-3.403

Hello, traders.

If you "Follow", you can always get the latest information quickly.

Please also click "Boost".

Have a nice day today.

-------------------------------------

(1D chart)

The M-Signal indicators of 1D, 1W, and 1M charts are concentrated in the 2.950-3.403 section.

Accordingly, when the StochRSI indicator shows a downward trend in the overbought section, whether there is support near this section is an important issue.

-

(30m chart)

In order to change the trend, the MS-Signal indicator must rise above the price and maintain the price.

If the MS-Signal indicator rises above the price, the BW (100) indicator is formed at the 3.922 point and the HA-High indicator is formed at the 4.033 point, so the point to watch is whether this section can be broken upward.

When the StochRSI indicator enters the oversold zone and then rises, you should check for support near the 2.950-3.403 zone.

When you meet the HA-Low and BW(0) indicators, it is natural to enter a buy (LONG) position because there is a high possibility of an increase.

However, as I mentioned earlier, you should respond based on whether there is support near this area because you need to break through the MS-Signal indicator upward.

-

Rather than deciding how far it will fall or rise, it is important to consider which points are important support and resistance points and create a trading strategy based on whether there is support at those points.

Then, if you have traded according to the price movement, you can respond with a split transaction.

We are not analyzing charts, but trading to make profits, so you can respond appropriately and go with the flow.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Big picture

I used TradingView's INDEX chart to check the entire range of BTC.

(BTCUSD 12M chart)

Looking at the big picture, it seems to have been maintaining an upward trend following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year upward trend and faces a 1-year downward trend.

Accordingly, the upward trend is expected to continue until 2025.

-

(LOG chart)

Looking at the LOG chart, you can see that the upward trend is decreasing.

Accordingly, the 46K-48K range is expected to be a very important support and resistance range from a long-term perspective.

Therefore, I expect that we will not see prices below 44K-48K in the future.

-

The Fibonacci ratio on the left is the Fibonacci ratio of the uptrend that started in 2015.

That is, the Fibonacci ratio of the first wave of the uptrend.

The Fibonacci ratio on the right is the Fibonacci ratio of the uptrend that started in 2019.

Therefore, this Fibonacci ratio is expected to be used until 2026.

-

No matter what anyone says, the chart has already been created and is already moving.

It is up to you how to view and respond to it.

Since there is no support or resistance point when the ATH is updated, the Fibonacci ratio can be appropriately utilized.

However, although the Fibonacci ratio is useful for chart analysis, it is ambiguous to use it as a support and resistance role.

The reason is that the user must directly select the important selection points required to create the Fibonacci.

Therefore, it can be useful for chart analysis because it is expressed differently depending on how the user specifies the selection point, but it can be seen as ambiguous for use in trading strategies.

1st: 44234.54

2nd: 61383.23

3rd: 89126.41

101875.70-106275.10 (when overshooting)

4th: 134018.28

151166.97-157451.83 (when overshooting)

5th: 178910.15

-----------------

Quantum Computing vs. TechIntroduction:

Technological advancements continue to reshape markets, with artificial intelligence (AI) dominating headlines in recent years. However, the next major frontier appears to be quantum computing. The ratio between the quantum computing sector NASDAQ:QTUM and technology AMEX:XLK provides a unique perspective on this emerging trend.

Analysis:

Key Breakout: The QTUM-to-XLK ratio has recently broken out of a rounding bottom formation, a classic bullish reversal pattern. This breakout signals growing investor enthusiasm and capital flow into quantum computing, suggesting it may be the next major growth story in tech.

Higher Highs and Higher Lows: The ratio is printing a series of higher-highs and higher-lows, confirming a bullish trend. As long as this structure remains intact, quantum computing warrants serious attention.

Healthy Consolidation: After the recent surge, a pause or slight pullback would be a healthy consolidation within the broader uptrend. Such moves often precede the next leg higher.

Implications for Investors:

The breakout highlights quantum computing's increasing importance and potential. This sector could mirror the early stages of AI adoption, suggesting substantial long-term growth opportunities for QTUM-related investments.

Trade Setup:

Bullish Scenario:

Entry: Look for pullbacks to support levels or a continuation of higher-highs for confirmation of trend strength.

Target: Watch for the ratio to continue trending upward, signaling outperformance of QTUM over XLK.

Stop Loss: Place stops below recent lows to manage risk in case of a deeper correction.

Bearish Scenario:

A breakdown below the trendline or failure to print higher-highs would signal potential weakness, warranting caution.

Conclusion:

Quantum computing is emerging as the market’s next big focus, with the QTUM-to-XLK ratio breakout suggesting robust momentum in the sector. While a pullback could offer better entry opportunities, the long-term growth story for quantum computing remains compelling. Are you ready for the quantum revolution? Let’s discuss in the comments below!

Charts:

(Include charts showing the QTUM-to-XLK ratio breakout, the rounding bottom formation, and key levels of support and resistance. Highlight the trendline and any recent consolidation zones.)

Tags: #QuantumComputing #Technology #QTUM #XLK #EmergingTrends #TechnicalAnalysis #GrowthInvesting

Is Quantum Computing the next Big Boom? QUBT, QBTS, QTUM, IONQQuantum Computing ( NASDAQ:QUBT ) rose 65% yesterday. QUBT is only around $11. Is this the start of a boom for quantum computing? Google came out with news of the Willow Quantum computing chip. Did this news swing the focus over to quantum computing? Will the big trade houses start to invest? We will see? Add QUBT to your watchlist along with GOOGL, QBTS, IONQ, QTUM. This could be the start of something big?

3 Altcoins Pumping Again Soon!Since you enjoyed my previous post about 3 Altcoins Rejecting the $5 mark!

Here's an interesting one about altcoins in a deep correction phase after an aggressive pump:

BINANCE:NEOUSDT

After a 200% surge, NEO is currently in a correction phase and rejecting the $15 demand zone.

As long as the $15 support holds, a expect a bullish continuation towards the $21 supply and then $25.5 previous major high.

BINANCE:TRXUSD

After a 180% surge, TRX is currently in a correction phase and rejecting the $0.25 mark.

As long as the $0.25 holds, a expect a bullish continuation towards the $0.33 supply and then $0.43 previous major high.

BINANCE:QTUMUSDT

After a 180% surge, QTUM is currently in a correction phase and rejecting the $3.5 demand zone.

As long as the $3.5 holds, a expect a bullish continuation towards the $4.8 supply and then $5.7 previous major high.

Which altcoins would you like me to cover next?

All Strategies Are Good; If Managed Properly!

~Rich

QTUMUSDT Approaches Rectangle Pattern ResistanceQTUMUSDT Technical analysis update

QTUMUSDT has been trading within a rectangle pattern for the last 150 days at the bottom yearly support. The price is now moving toward the rectangle resistance, and once a breakout occurs, a strong bullish move can be expected. The price is trading above the 100 and 200 EMAs, and there has been a noticeable rise in volume over the past few days.

Regards

Hexa

#QTUM (SPOT- Investing ) entry (1.880- 2.370). SL (1.784)BINANCE:QTUMUSDT

entry range (1.880- 2.370)

Target1 (3.290) - Target2 (4.960) - Target3 (7.740) - Target4 (10.499) - Target5 (13.199)

1 Extra Targets(optional) in chart, if you like to continue in the trade with making stoploss very high.

SL .1D close below (1.784)

** This coin may take long time to achieve all targets **

*** collect the coin slowly in the entry range ***

*** No FOMO - No Rush , it is a long journey ***

**** #Manta ,#OMNI, #DYM, #AI, #IO, #XAI , #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #Voxel #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA #HIVE #ASTR #ARDR #PIXEL #LTO #AERGO #SCRT #ATA #HOOK #FLOW #KSM #HFT #MINA #DATA #SC #JOE #RDNT #IQ #CFX #BICO #CTSI #KMD #FXS #DEGO #FORTH # AST #PORTAL #CYBER #RIF #ENJ #ZIL #APT #GALA #STEEM #ONE #LINK #NTRN #COTI #RENDER #ICX #IMX #ALICE #PYR #PORTAL #GRT #GMT # IDEX #NEAR #ICP #ETH #QTUM ***

QTUMUSDT BULL?this pair on 1h time frame was break a structur of hight and now this price stil a make correction, potential buy on the deep its can happen cause we look before the price make its the same. im believe the price can break the high and if this price break potential to green line its coming.

*disc On

#QTUM/USDT#QTUM

The price is moving in a descending channel on the 12-hour frame and is sticking to it very well and is expected to break it upwards

We have a bounce from a major support area in green at 2.05

We have a downtrend on the RSI indicator that was broken upwards which supports the rise

We have a trend to stabilize above the 100 moving average which supports the rise

Entry price 2.28

First target 2.60

Second target 2.85

Third target 3.16

QTUM's long term is bearishFrom where we put the red arrow on the chart, the correction of QTUM has started.

This correction seems to be a double or multiple correction.

Recently, wave X seems to have ended and we have entered the second correction.

The least risky place to buy on large time frames in the medium term is the green range.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

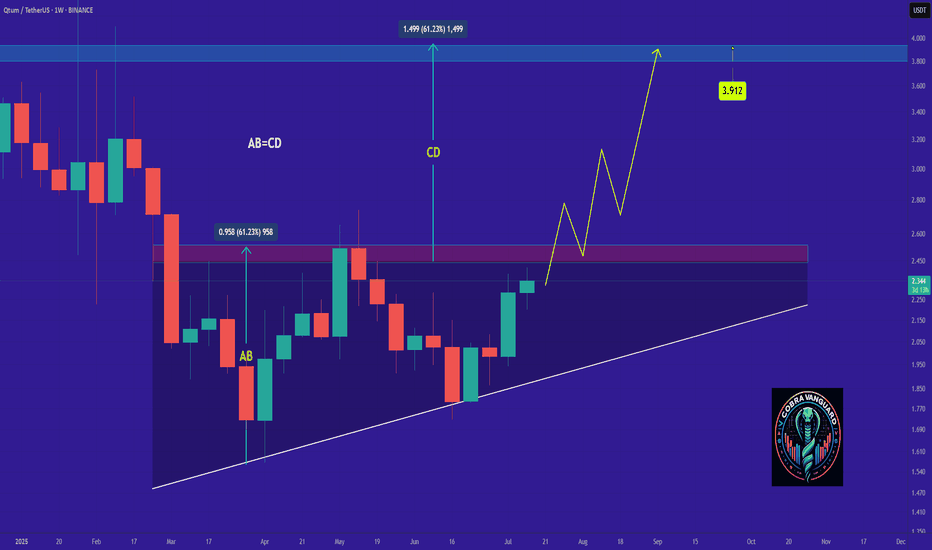

QTUM/USDT Weekly Update!Hello everyone, I’m Cryptorphic.

For the past seven years, I’ve been sharing insightful charts and analysis.

Follow me for:

~ Unbiased analyses on trending altcoins.

~ Identifying altcoins with 10x-50x potential.

~ Futures trade setups.

~ Daily updates on Bitcoin and Ethereum.

~ High time frame (HTF) market bottom and top calls.

~ Short-term market movements.

~ Charts supported by critical fundamentals.

Now, let’s dive into this chart analysis:

QTUM is holding the supporting trendline at $2.5. This is a crucial juncture for QTUM to determine whether it will continue the downtrend or make a rebound from the current support level.

Key Observations:

~ Primary Support: $2.5.

~ Lower Support: $1.11.

~ Primary Resistance: 50 SMA at $3.15.

~ Long-term Target: $27-$30.

~ Bearish Move: Breakdown below the primary support.

~ Bullish Move: Price holding the primary support and rebounding above the 50 SMA.

The price speculation is in a higher time frame and for educational purposes only. Please do not consider it for scalp trading and futures trading.

DYOR. NFA.

Please hit the like button to support my content and share your thoughts in the comment section. Feel free to request any chart analysis you’d like to see!

Thank you!

#PEACE

QTUM buy/long setupFrom where we placed the red arrow on the chart, it seems that the correction of QTUM has started.

This correction looks like a triangle or diametric as we are now at the end of wave E.

The targets are clear on the chart.

Closing a daily candle below the invalidation level will violate the analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You