Quantrsi

It's not over, just pullback. Bids @ 7150 and up #BTCUSDDaily + weekly volatility is in the bullrun phase for both BTC and "TOTAL" Marketcap.

If BTC flags out in this 6.0 HVQ Volatility Index area, retesting the trend support, bingo = consolidation before megamoon

But, that consolidation could go on for awhile.

I have an overall LONG narrative, but am not buying at these levels. Looking to YOLO/FOMO a breakout, or get in around daily cloud support.

Looking for retest of the Daily cloud top, volatility consolidation, and QRsi trend test and/or build new qrsi flag. 7150-7400 is where I guess support will be depending on the velocity if / when we dip.

HVQ + QRSI + Clouds - Setting up a narrative; market structureThis video goes through my charting process using the trio of indicator's I've developed to work in concert with each other.

This is the process I use to explore historical price action and develop a narrative to use during my near-future trading activity for that asset.

Just as important as entries and exits, understanding market structure and being aware of potential changes to this structure, before price plays out it's new role, is extremely important.

These visualization tools make it possible to find structural influences within an asset that do not necessarily exist, in a classical sense, on a typical price candlestick chart.

Not explored in this video is how to further use these tools to build risk distribution profiles for any trade, long or short, as well as the use of compound tickers to determine individual asset allocations.

Most technical indicators focus too much on entries and exits while not providing nearly enough insight for aligning those buy or sell conditions with the current market structure and meta-analysis. Take a step into my workflow for setting up a trading environment that focuses more on working with the structure of an asset rather than against it. In this video I build rules for potential entries, stop-losses, and set up a narrative for an asset on some historical data (cheating, I know, but this is "educational" content ;)

QuantRsi, Heffae Clouds, and the HVQ Volatility Index are available via PM, there is also a link with access information in my sig.

For your education and entertainment!

M2 Inverse HnS; Inflation rate increase - QuantRsi 1M From investopedia:

"Generally speaking, inflation occurs if M2 money supply expands faster than the rate of productive growth in the overall economy"

What I'm looking at here is a classical charting pattern painted by the QuantRsi:

With the QuantRsi applied to the Monthly M2 chart, a pattern is painted which can be used for technical analysis and classical charting.

Looking at the indicator as well as fibs drawn (log scale chart, correct fib tool used to prevent this issue:

getsatisfaction.com )

the M2 money stock looks like it is ready for a large increase sometime around 2020-2021.

This, coupled with slowed economic growth from rising interest rates, will result in increasing dollar inflation.

Because HnS patterns often have continuation when the neckline is broken, a QRsi value of +7 for M2 on the Monthly chart would confirm this idea.

Based solely on technicals, I believe that the inflation velocity will increase well in to 2025-2030. This coincides with fundamental analysis and other economic forecasts.

Salient indication and evidence for a massive rally: XMR/MoneroBINANCE:XMRBTC

Finding chart patterns in the QRsi candles and combining those signals with Heffae Clouds trading rules results in a highly successful trading strategy. See my prior published ideas for examples of these patterns in use.

You can see prior HnS / IHnS formations on XMR/BTC playing out on the QRsi candles, with one epic failure to rally after the clear reversal signal.

In that failure instance, the price was below daily cloud resistance which made the rejection very harsh taking out that volume node. This breakdown becomes the target for current position.

Unlike the prior IHnS patterns, the current reversal pattern is much larger in scale. Stretching to over 160+ days from shoulder to shoulder, the chart seems to represent the possibility for a larger and longer impulsive move to the upside for this asset.

The current daily candle is at horizontal and trend QRsi resistance, but it is also making an attempt to close above the Daily Cloud, which would be the 2nd cloud rule confirmation of an imminent long-trending reversal.

Consolidation following such reversal signals can take some time, with impulsive moves to the downside expected while big players push index around in order to grab liquidity and fill bags for the coming move.

XMR/USD is a safe bet, but in my case I am blending 3parts BTC pair to 1 part USD pair in order to have a position proportional to R/R estimates, and the USD pair shows less likelihood of a straight-shot move up where I can spend the least amount of time in a position to target.

I will try and keep this updated, feel free to post or message me with any questions.

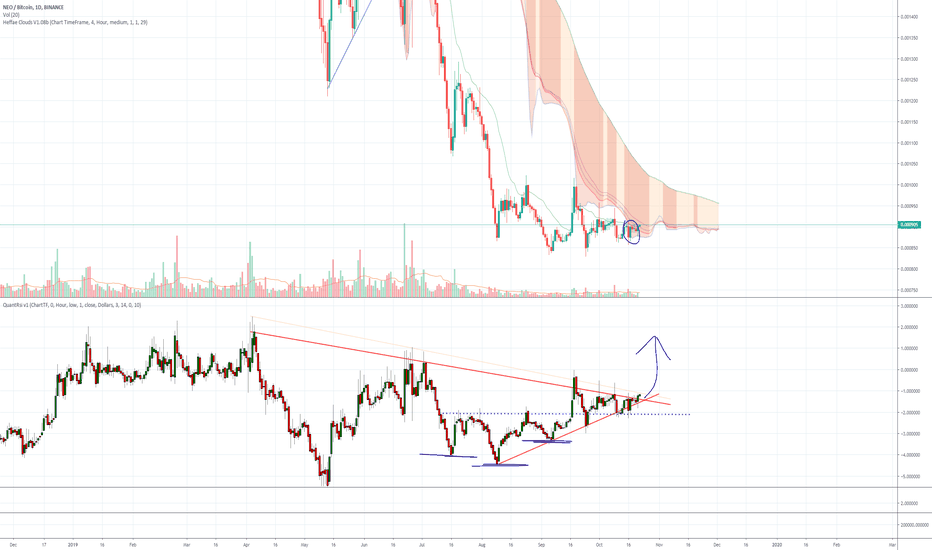

NEO/BTC worth a look - Bullish reversal situation QuantRsi 1DAt first glance this NEO chart looks like consolidation with dwindling volume, however the QuantRsi and Heffae Cloud indicators paint a potential bullish scenario.

First there is the Daily cloud entry, which is a sign of bullish reversal. The inter-cloud paths still pose a threat of heavy resistance, but historically, high timeframe cloud entries like the one here can lead to bullish reversals more often than not.

Second, the QuantRsi has an inverted HnS chart pattern with a clear step above neckline. These QuantRsi chart patterns often lead price reversal.

Third, the QuantRsi trendline that forms a triangle of sorts has crossed, but without confirmation. The prior candles that did cross failed the re-test, as well as Sept 17th rejecting off the daily cloud.

I plan on buying a retest of the QuantRsi trend, with a stop below the daily cloud bottom.

This is a perfect storm for bullish reversal. First takeprofit / re-evaluation level is at the top of the daily cloud around .00103

Apologies for the botched title screenshot, the way TradingView handles chart preview for published ideas is abysmal

XMRBTC 4Hour- QRsi + HeffaeCloudPlay by play, from left-to-right

Price dumps to QRsi - 10 levels

Consolidation at -7 to -10

Volatility Gap on escape candle from -7 consolidation pattern

First trend resistance is a big rejection

Second Trend interaction crosses now as support

Price re-tests this breakout R2S trend while making a lower low, completing

BULL DIVS on the QRsi

Price breaks the last 4H trend acting as resistance in this consolidation pattern, which is also the bottom of 4H Cloud

Once price escapes 4H cloud, I expect minimum 7.9% increase to next QRsi trend.

***Confirm levels with other timeframes***

QuantRsi Tutorial - trends, templates and alerts on EOSQuick tutorial on QuantRsi - drawing the trends with QuantRsi on EOS/BTC Daily and 4Hour charts.

Set up drawing templates so your trends only show on the applicable timeframe

Create an alert on the QuantRsi trend you want as support / resistance

(note, in current version of QuantRsi, use "alert trigger" instead of "plotcandle Close"

QuantRsi Trading System Tutorial, Part 1This is part one of a tutorial on the basic principles, techniques, and features of the QuantRsi trading system.

This is Part 1 of the tutorial, and does NOT discuss how the QuantRsi can be used for trading decisions.

Please see part 2 for instructions for how to use these tools for trade entries, exits, risk analysis and more.

We start by building a trading workspace from scratch, loading the indicators, and the first steps of drawing trends on QuantRsi to define market structures.

Begin by familiarizing yourself with the the asset by charting on the QuantRsi candle structure to define larger structures within the asset.

Define the validity that QuantRsi has, and the quality / tradability of the interactions by flipping the QuantRsi preset, and going back through the drawing / definition process.

The preset that results in a clearer definition of that asset's structure is discovered, and now is preferred for that asset.

Typically preset 1 has a higher affinity of valid interactions with most assets, but the QuantRsi is set to preset 0 as default.

The discovery process of fitting trends of asset behaviour to QuantRsi structures, while changing the preset and choosing the most robust configuration is extremely important.

Higher quality and / or a greater number of trend incidents a particular QuantRsi configuration and an asset has, the more certainty that future interactions will coincide with developing market structures, and tradable decisions can be made based off of QuantRsi trend structure definitions.

Please continue to Part 2!

ETHUSD Meets the 4Hour Cloud - Heavy ResistanceETHUSDhas come up nicely off of support; I was in a long position from ~130 based off the 3Day QRsi trend support here:

However, I'm currently FLAT due to the massive interruption the 4H cloud brings to the rally.

This particular 4H cloud path has proven it's strength, and price will need to push it's way through this level with energy left to clear the top of the cloud as well.

Trading Ideas; Scalp the pullback (short) until trend support levels are established and confirmed on 30Min QRsi trend; at which point go long and target the 3D QRsi resistance or 3D HeffaeCloud bottom, whicherver comes first. This is likely to be $164-175 depending on when it moves.

30Min QRsi trend structure on bitmex quanto:

Note lower QRsi Trend paints to the stop-run wick as support

(this looks bullish to me, and screams continuation!)

Short a failed rally! Don't close until QRsi trend support is established and tested! Don't get stuck in one sentiment :D

Long the support area of this pullback with stops under clear breaks from QRsi trends as well as lazy candle closes under support. Chart ETHUSD on different exchanges, right now FINEX, GDAX, and BMex Quanto are all charting differently on the lower timeframes.

As well as the 30Min QRsi trend pointing to bottom of stop-run wick as support, the 3H did the same. Multiple timeframes showing confluence with SnR levels == winning trades!

QuantRsi trendlines functioning as Support / Resistance:

Finding "Trend Genesis" with QuantRsi - NASDAQ Winding upBuilding a chart to identify trading opportunities with the Quant Rsi.

Here is a quick & dirty (and really ugly) chart as an example for setting up a trade or series of trades with QuantRsi.

Don't let the messy chart turn you off... , this is an overdrawn example to show all interactions. Also, once you set up templates for every timeframe in your drawing tools menu , (this will hide any trendline you draw on one timeframe, so it is visible on that timeframe only. The trendlines drawn here will disappear when I switch to the 4Hour chart.)

The "mess" of trendlines you see here are an example of how to identify nodes in the QuantRsi indicator and use those nodes to draw trendlines which function as DYNAMIC support and resistance levels for future price movement.

The entire QuantRsi system is continually dynamic and adaptive.

The trend you draw from time 1 to time 2, the location of that level relative to price at time 3 is DYNAMIC, so this rigid plot you've drawn serves as an active, moving level relative to price. The future interaction changes based on the adaptive support and resistance maths interpretation of price action, volatility, time, etc, HOWEVER this "dynamic" movement relative to price decays as price time and volatility stabilize towards your trend line interaction, and becomes fixed at candle close. So... as the price approaches your trend, the dynamic characteristics of QuantRsi are reduced and the candle acts as a function of "Price Per 1.0" at close. The "looseness" of this dynamic action is also continuously variable (based on a render of 500+ periods of prior price action), so there may be times when the QuantRsi trend exactly matches a similar trend on the price candles, where the dynamics are flat.

Suddenly these trends become a powerful quick-reference tool to instantly assess and identify the turning points, divergence, and hidden support and resistance levels that may be completely invisible with traditional charting.

Dozens of validations and profitable trades later, the QuantRsi is by far the most profitable tool I have ever developed. It has given me access to trading on timeframes I would normally ignore, and shows opportunities for entries on setups that I would normally "slice the ham" suffering intraposition drawdown.

Swing trades on Daily timeframes, zoom in to the 4H and the :30 Min to assess Support&Resistance, quickly plot trends, set an alert, and execute your trade closer to the real turning point and capturing an ideal entry. Use the "Show % per 1.0" to calculate the estimated distance to a particular SnR level. Excellent as a tool for calculating limit order spreads, complex spread orders, and building positions in assets with low liquidity. Stack orders in a particular range to extract the maximum available liquidity without getting left behind or run over.

XRP Bullish trend cross on 4H QRsi, long TF's signal *a move*XRP is getting tighter, and as much as I fundamentally dislike the coin, I will trade it.

There is a bullish trend cross on the 4H QRsi. First target is ~2.15% up from here. SL is ~ 1.25% down.

There is a good chance of continuation here, this trade might be worth holding.

LTC/BTC - QuantRsi + Heffae Cloud, weak LONG signal, no confirm

LTC/BTC has had quite the selloff, however all hope is not lost yet.

On the 4Hr chart, there are some signs of life as LTC/BTC makes a weak bounce on the 4Hr Cloud as well as vauge QuantRsi support. The 4Hr Cloud interaction has broken through the bearish side and is signaling that the levels we came from won't be revisited anytime soon... but this could change after some consolidation.

The next trend incident LTC/BTC must cross will paint a clear picture as to whether this dump is over, we go sideways, or if we can find a bullish channel.

The 8Hour has clear signals on the entry and a little late on the exit, showing some weak trend support here:

The trendline that's drawn from the lower high wicks might not be as valid, since the interactions aren't as clear.

On Longer timeframes, the trend has been broken; but this horizontal level is strong.

Weak buy signal on 4Hr QRsi trend interaction & Heffae Cloud path. Heffae cloud violated, QRsi signal still holds, pending next interaction.

The majority of this TA is pointing towards a longer period of consolidation - sideways.

BTC to $3550 - Inverse Chart comparisonLeft is current BTC price action on the daily timeframe, on the right is BTC on the 12H Timeframe.

Using the QuantRsi to find hypothetical Support targets, and Heffae Clouds as a guide for price movement. In this case, both indicators align to paint the same target.

Showing a prior instance of similar setup on the right pane.

WTI trade to $51, 3Day RT Bottom, Inverse HnS 1D QRsiWTI paints some impressive bullish signals on Heffae Clouds + QuantRsi longer timeframes. The idea of this trade is driven purely by technicals, I am not in the loop on fundamentals whatsoever.

Daily chart shows inverse HnS on the QuantRsi as well as a new trend developing that shows upside potential:

As warning, The last time Qrsi ran -7 on the 3Day QRsi, there was a small bounce, but there was significant continuation to the downside.

Compared to our current levels, the potential for a further slide is possible:

Regardless of this, I think a long trade has decent risk / reward as long as best practices are used when setting stops and take-profit.

ETH Bullish and Bearish scenario TA and targets- QuantRsi 1D+12H- I apologize for the chart formatting, TradingView needs to add a preview button and allow chart manipulation during a preview stage. I'm using multiple monitors and the charts looks great until it gets published...

I feel like any bearish sentiment will be wildly unpopular, however the technicals indicate that ETH may be on the brink of slipping into a bearish formation with the potential for a big slide.

That said, there is also the possibility of consolidation and continuation to higher highs, with some pretty bullish short term targets.

Here are my targets and some narrative into how I'm using the QuantRsi and Heffae Cloud indicators to establish these levels.

Refer to the chart and related ideas for reference! Happy trading!

M2 Inverse HnS - Inflation Rate set to increase - 1M QuantRsiFrom investopedia:

"Generally speaking, inflation occurs if M2 money supply expands faster than the rate of productive growth in the overall economy"

what I'm looking at here is a classical charting pattern painted by the QuantRsi:

Applied to the Monthly M2 chart.

Looking at the indicator as well as the fibs (log scale chart, correct fib tool used to prevent this issue:

getsatisfaction.com )

the M2 money stock looks like it is ready for a large increase sometime around 2020-2021.

This, coupled with slowed economic growth from rising interest rates, will result in increasing dollar inflation.

Because HnS patterns often have continuation when the neckline is broken, a QRsi value of +7 for M2 on the Monthly chart would confirm this idea.

Based solely on technicals, I believe that the inflation velocity will increase well in to 2025-2030. This coincides with fundamental analysis and other economic forecasts.

BTCUSD flirting with bearish path, Heffae Cloud 4H pathfittingCurrently 4H cloud top is acting as resistance. Price needs to close above 8190 (BitFinex) in order to emerge on the bullish side of 4H cloud.

In these situations, the price does tend to flip back-and-forth between channels before taking off strongly in either direction. |

NOTE -User pointed out that 4H cloud is GRAY meaning that it has very little influence on price.

4H Cloud top - Resistance until close > $8190 and then support - NOTE -User pointed out that 4H cloud is GRAY meaning that it has very little influence on price.

4H Cloud QRSI - Resistance (bounce zone) until close > $8323

4H QRSI - Support until close < $8100

The price break-down through 4H color-change was expected, but the strong inter-cloud support (also support on Daily real-time path) shows that the price is not necessarily resigned to the bearish channel. The next 8-12H are absolutely critical in determining which direction price will go long-term.

Keep an eye on the Cloud top, this is where the flirting between Support/Resistance will happen.

I AM FLAT right now!!!

Side Note:

It looks like market-making BTCUSD dominant influence shifting, different market influencers have gained an important leverage point in BTCUSD price movement. Recent path interactions show that the local trend in Bitcoin is now shifting and we should start seeing new patterns emerging in price over the next several weeks.

This means that trendlines, T/A and charting will be invalidated, predictive paths and cloud interactions will not be reliable until the predictive algo adapts to new price movement patterns. Hold on to your hats, I think crypto market is going for a ride!