RAD - IdeaIdea for RAD showing large cup structures

These cup structures form after a strong bounce off a downtrend in orange

Right now price is testing this orange line, so expect a possible large upswing

RAD

Radicle (RAD) formed bullish Cypher for upto 30.50% pumpHi dear friends, hope you are well and welcome to the new trade setup of Radicle (RAD) coin with BTC pair.

On a 4-hr time frame, RAD has formed a bullish Cypher pattern.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade

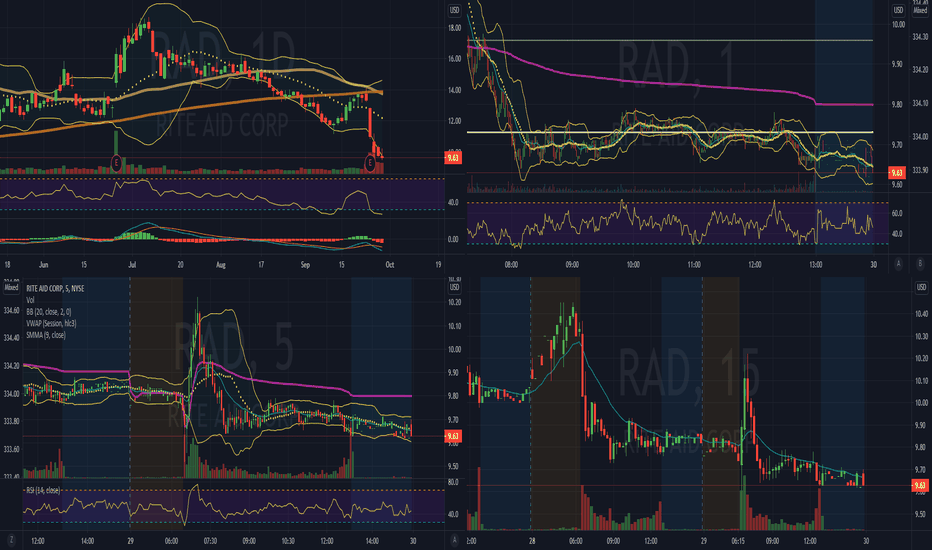

RAD Swing Trade Setup LongNYSE:RAD

RAD is the Rite Aid drug store chain0 being in healthcare and

consumer staples it is relatively resilient in a recessionary context.

On the Chart, RAD is at swing lows sitting on support with

25% upside potential. The RSI indicator shows an impending

K & D line cross under the histogram.

A recent triple top helps mark the resistance while an

earlier double bottom shows the support. The order block

indicator provides confirmation.

I see this as nearly ready for a swing-long entry.

What is your opinion?

Radicle (RAD) formed bullish BAT for upto 73% pumpHi dear friends, hope you are well and welcome to the new trade setup of Radicle (RAD) coin.

On a 2-hr time frame, RAD has formed a bullish BAT pattern:

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade

RAD - Strong Horizontal BottomA double bottom is forming on RAD which is aligning nicely with prior points of aggressive support

2W timeframe

RADUSDT(Radicle) Daily tf Range Updated till 27-07-22RADUSDT(Radicle) Daily timeframe range. This alt been in a very long consolidation, the pump from july 26 2022 make sense. and there are still lots of space for more progress, if retail interest picks up. Its been used heavily if you look closely you can see a loads of wicks here and there and out of place moves. of course the alt that moves it got more chance of profit. but big wicks can always trap peoples out without any problem. it makes it a high risk and reward alt.

🆓Radicle (RAD) Feb-08 #RAD $RAD

.

📈RED PLAN

♻️Condition : If 1-Day closes ABOVE 6$ zone

🔴Buy : 6

🔴Sell : 7 - 8 - 9

📉BLUE PLAN

♻️Condition : If 1-Day closes BELOW 6$ zone

🔵Sell : 6

🔵Buy : 5 - 4

❓Details

🚫Stoploss for Long : 10%

🚫Stoploss for Short : 5%

📈Red Arrow : Main Direction as RED PLAN

📉Blue Arrow : Back-Up Direction as BLUE PLAN

🟩Green zone : Support zone as BUY section

🟥Red zone : Resistance zone as SELL section

RAD AnalysisHere's a quick look at RAD 4hr chart . As we can see, the price has been showing a formation of CUP &HANDLE ,also Symmetrical triangle.

Breakout done and retested .

Now its time to wait and hold it

Definitely one to keep an eye on .

The best entry at Support level, also on trend support and after breakout and retest.

TARGETS

12.0119$

13.0834$

14.5476$

16.447$

Final target 28-30$

Buy rad now before it's become too lateIn 4h timeframe rad has a falling wedge form and the upper breakout has conformed making about 35% since the break we expect it'll raise more in the few next days..

We expect it will be raise about 75% from this point

Don't forget to support this idea with ur like , comment , follow🌐

Good luck💙

🆓Radicle (RAD) Dec-28 #RAD $RAD

.

📈RED PLAN

♻️Condition : If 1-Day closes ABOVE 10$ zone

🔴Buy : 11 - 10

🔴Sell : 14 - 18

📈BLUE PLAN

♻️Condition : If 1-Day closes BELOW 10$ zone

🔵Sell : 10

🔵Buy : 8

❓Details

🚫Stoploss for Long : 10%

🚫Stoploss for Short : 5%

📈Red Arrow : Main Direction as RED PLAN

📉Blue Arrow : Back-Up Direction as BLUE PLAN

🟩Green zone : Support zone as BUY section

🟥Red zone : Resistance zone as SELL section

RAD inverted head and shoulders#RAD/USDT

$RAD is below a descending resistance that can be the upper line of a triangle pattern, also there is an inverted head and shoulders pattern that price is below the neck line.

possible price drop to ascending support, that is the same with support zone around $10.7 and then head up to break out descending resistance and then try to break out from resistance zone and increase to $13.6 and even $15 to touch the target of reverse head and shoulders.

RAD (Rite Aid) AnalysisIn this analysis I am suggesting that the downward channel that has formed will break down

This breakdown may end at the dotted black line under the channel

The green rectangles are historical points of support, currently price is very close to this level

I think it will go lower, briefly.

RAD - WEEKLYRAD

ENTRY = 13.35 - 13.70

1st Target = 14.25

2nd Target = 15.75

3rd Target = 16.90

4th Target = 17.87

HODL Target = 20+

______________________________________________________________________________________________________________________

This content is for informational, educational and entertainment purposes only. This is not in any way, shape or form financial or trading advice.

Good luck, happy trading and stay chill,

2degreez

oversold, possible reboundPlease note: I'm just sharing my view. its not a recommendation for buying or selling.

It is a $RAD WIN! Hi everyone, to follow up from my last video what an awesome trade. If you held RAD from the mid $9.50's and got in today's announcement with the acquisition we got a 8% upside move. Acquiring a company for 90+million just demonstrates the strength of the company. I mentioned the $10.50s-$11 would come and I would be looking for an exit. I still expect the stock to rebound here back to $11 in the coming days. NYSE:RAD

Good time to accumulate Rite Aid $RAD? Rite Aid got double whammed last week. First with terrible earnings and the next day with a downgrade. The stock has traded the last three sessions with a floor around $9.60s. At open at the stock flushed and quickly hit the high from yesterday before selling off. If you are one for a long, I would hold RAD for a $11 move within the next week. At this price level which we saw in the March lows, we should start to see a recovery this week. I bought a bunch of $11 Calls for the end of November.

$RAD Rite Aid approaching inflection point$RAD Rite Aid approaching an inflection point. Risk/reward here looks enticing. Downside risk appears limited.

Betting on the trendline holding with 7/17 $15.00 calls for ~$0.80

Target: $16.00 by mid-July

Note: Educational analysis, not investment advice.