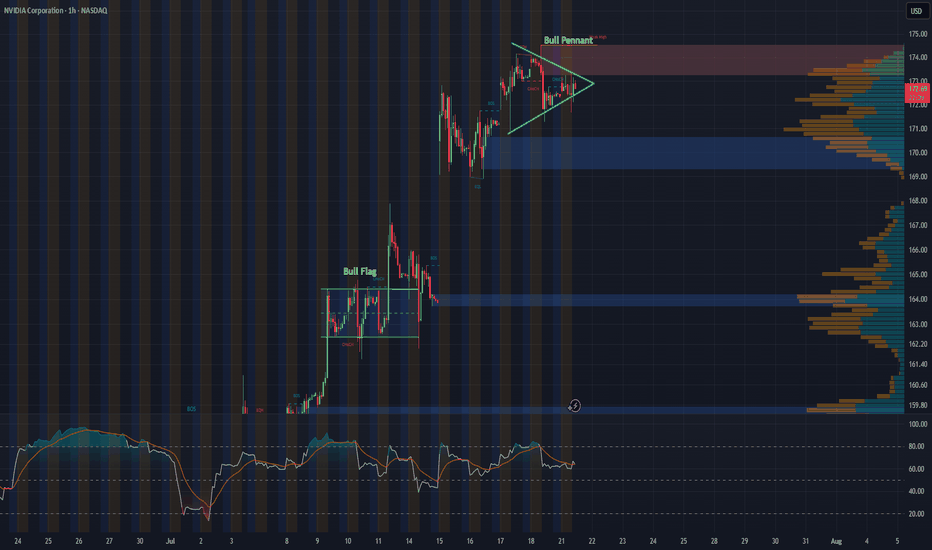

NVDA 1-Hour Chart UpdateHey everyone, just wanted to share a quick update on NVDA’s 1-hour chart. Following last week’s bull flag breakout, the stock appears to be consolidating into what looks like a solid bull pennant formation.

With major tech earnings on the horizon and the recent approval to sell H20 chips to China, this pattern could be setting the stage for another breakout. Will NVDA continue its impressive rally, or is this just a breather before the next move?

Rally

ARTY - Play-and-Earn Launch Poised to Ignite Rally Toward $1.80Hi guys, this is my overview for ARTYUSDT, feel free to check it and write your feedback in comments👊

After consolidating in a flat range between $0.36 and $0.74 for months, ARTY triggered a bullish breakout, climbing rapidly toward $1.83.

Following this surge, price corrected back to the $0.27–$0.36 support area, which absorbed selling pressure and formed a reliable accumulation base.

On June 30th, Artyfact will launch its inaugural Play-and-Earn mode, poised to attract hundreds of thousands of new users and significantly boost ARTY demand.

This upcoming catalyst underpins the bull case, reinforcing buyers’ confidence and justifying another leg higher from current levels near $1.62.

Key downside support remains at $1.00–$1.08, where any retracements could offer favorable long entries ahead of resumed uptrend momentum.

My three upside targets are $1.00 for the first level, $1.40 as intermediate resistance, and $1.80 near the previous all-time high.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Accumulation in BANKNIFTY? a rally to 60,000 in near future?Bank Nifty has completed its range of accumulation and is headed for a rally to approx. target of 60k (most likely in strength by this quarter).

The Index was in Spring pad at 13th March,

Broken the Stride at 18th March

24th March was entering into the accumulation zone again in strength,

this all started with a Preliminary Climax price texture on 4th June, followed by a buying climax on 27th June, then an automatic reaction largest to its other price texture which completed on 6th August

a Terminal shakeout from 6th Jan to 11th March, Volume is Increasing on Rallies and reducing on Reactions

A Potential Target of 60,000 is on Cards, won't be surprised if this happens in the coming 2 months too

US500 Historical Rallies & Pullbacks with a Potential ProjectionI’ve observed the US500’s performance over the years, marking rallies with a blue line and pullbacks with a yellow line. Looking at the chart, a systematic repetition of these movements emerges, which, at first glance, seems to follow a recognizable pattern.

Specifically, I’ve cloned the blue line from the rally that started on 03/23/2020 and ended on 12/20/2021, now represented by a green line, to hypothesize a potential future rally. This clone is based on the duration of previous pullbacks:

The first pullback, before the 2020 rally, began on 02/20/2020 and ended on 03/23/2020.

The second pullback, the current one, started on 02/17/2025 and might conclude around 04/07/2025, potentially paving the way for a new rally.

the angle of those pullbacks is almost identic

This "snapshot" observation suggests we could be nearing a turning point. Of course, this is just a hypothesis based on historical patterns, and I encourage cross-referencing it with other indicators or analyses. What are your thoughts?

"Bitcoin's Bullish Reversal: Projected Pullback Before Surging TBitcoin has begun a downward trend from March 24th that could last 49 days, with a projected low near $75,000. This area may offer a strong entry point for swing traders aiming for the next leg up. If support holds, BTC could rally over the following 149 days toward a profit target of $154,000 — a potential 100%+ gain. Traders considering this move should watch for signs of reversal near $75K and manage risk with a stop loss just below $70,000 to protect against deeper downside.

Dogecoin - New All Time Highs Will Come!Dogecoin ( CRYPTO:DOGEUSD ) still remains bullish:

Click chart above to see the detailed analysis👆🏻

If you look at the chart above, you can see almost only green mark ups. That's because despite the recent drop, Dogecoin remains in a very bullish market and is overall clearly heading higher. If this break and retest now plays out, we will even see new all time highs in the future.

Levels to watch: $0.2, $0.5

Keep your long term vision,

Philip (BasicTrading)

Future Nearing.Been peeped Silver since 2023, watch as price rally above $42 soon. Especially with Gold topping out above $3K. The future, full of robotics and humanoids, is nearing. Who’s ready? Who’s scared? Who’s taking advantage of this opportunity?

Whatever happens, do not fomo, stay calculated.

Live Trade Unfiltered: Real-Time Breakout, Strategy & Market PsyWatch me execute a live trade in COINBASE:B3USD breaking down price action, trend lines, and market psychology in real time. I also guide a fellow trader through the trade via text. Whether you're new to day trading or a seasoned pro, this is a raw look at how I navigate fast-moving markets. No financial advice—just live insights!

Key Takeaways

Trade Type: Bull flag breakout, intraday scalping, ahead of huge multi day rally.

Indicators Used: Trend lines, Bollinger Bands, price action.

Exit Strategy: Momentum signals, clearly defined criteria for price behavior.

Psychological Tip: Don’t chase trades—wait for price to come to you.

Live Trading Lesson: Limit vs. market orders for optimal exits.

I'll update this post with the trade outcome and lessons learned. Let me know in the comments if you’d like to see more live trading breakdowns!

CRYPTO:B3USD CRYPTO:BTCUSD CRYPTO:XRPUSD

As always this is not investment advice, I would never place myself in such a liable situation, and you shouldn't take advice from a stranger on the Internet, do your own research and CY your own A and trade at your own risk.

CELO LONGCelo has bounced every time it touched the lower range around $0.40, usually reaching at least $0.25.However, given the current market conditions, I expect either more downside or a sideways movement in the next few days.

The Stoch RSI is gearing up for a bullish cross on the weekly, but historically, the first cross is often followed by a negative one, before a second bullish cross that truly pushes the price higher. So while we might see some short-term upside, we should also be prepared for lower prices before a more significant rally kicks in.

CRASH - CRASH - CRASH - Don't believe a word of it...I created this video because I'm seeing a bunch of content/videos where everyone is suddenly calling for a CRASH. and I laugh about it.

If you want to believe the markets are going to CRASH - go for it.

Sell everything. Bet the farm on the CRASH. Leverage your house and everything you own to bet on the CRASH.

It's not going to happen soon.

My research is very clear. I believe the first opportunity for a deep (more than 25-35%) market pullback will happen after late 2029 and into 2030.

Until then, we are going to see moderate pullbacks in a very solid uptrend.

Watch this video and learn why real research and modeling systems don't react to the Crash-Dummies that continually push out CLICK-BAIT.

It's time to get real about your trading and investing.

If you are following someone who continually calls for a market crash - good luck.

At some point, you are going to come to the realization they are wrong 90% of the time. Try to find someone you trust who provides clear, timely, and ACCURATE forecasts.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

LTC/USDT Short-Term Breakout Confirmed !LTC/USDT has broken above a key descending trendline resistance, signaling a bullish breakout. The price is now retesting the $115-$116 zone, flipping it into support. A successful hold above this level could lead to a rally toward the next resistance at $140-$147. Traders should monitor the $100-$105 support zone in case of a pullback. This breakout shows strong potential for upward momentum in the short term.

Bitcoin Year 2025Market analysts and crypto experts anticipate that Bitcoin could soar to $600K this year, fueled by supportive policies and growing institutional adoption. Key drivers include deregulation efforts and pro-crypto measures under the current administration. President Trump has also reshaped the political landscape by appointing lawmakers who strongly advocate for cryptocurrency, setting the stage for a potential rally.

Cardano - Starting The 10x Parabolic Rally!Cardano ( CRYPTO:ADAUSD ) is perfectly following the break and retest:

Click chart above to see the detailed analysis👆🏻

With an incredible +200% pump in November, Cardano is finally coming back to life after creating the bullish double bottom break and retest just a couple of months ago. Looking at previous cycles, this seems to be just the beginning of another +3.000 rally.

Levels to watch: $3.0, $10.0

Keep your long term vision,

Philip (BasicTrading)

Nvidia - Launching The Final Bullrun!Nvidia ( NASDAQ:NVDA ) can still rally another +40%:

Click chart above to see the detailed analysis👆🏻

After rejecting the channel resistance in June, July and August of 2024 and correcting about -40%, buyers immediately stepped in and pushed Nvidia much higher. There is a quite high chance, that we will see a final blow off rally, squeezing out the last remaining bears.

Levels to watch: $200

Keep your long term vision,

Philip (BasicTrading)

SEI FOLLOWING SUI??SUI has been on a great run in the last few months being a first mover in the altcoin space while BTC has been chopping for 6 months, now SUI is on the very edge of pushing above above the local high.

The chart on the right is SEI and looks like the chart lines up perfectly just lagging behind by a month. This could be a great trade opportunity going into the end of the year/Q4. If the trajectory is the same as SUI we could look to expect a +218% move, and structurally even without a comparison to SUI the chart TA suggests a new higher high and higher low bullish structure which will naturally want to climb back up the chart.

Bitcoin generally has a big part to play in the altcoin world, however SUI has made this rally on its own without the pulling power of BTC, could SEI do the same???

Shopify (SHOP): Riding the 130% rally after the earnings surgeShopify kicked off the earnings week with a significant surge, rising 130% since our entry. We’ve taken additional profits at this level and canceled our second limit order. The stock has reached the 161.8% Fibonacci target at $111, aligning with our strategy.

In its third-quarter earnings report, Shopify reported revenue that exceeded Wall Street’s expectations, with double-digit gross merchandise volume growth. Looking ahead, the company forecasts a mid-to-high-twenties percentage growth in revenue for Q4, supported by the same factors driving its strong performance this year.

While Shopify continues its upward momentum, there’s no clear indication of when this rally might lose steam. The RSI is currently overbought, suggesting a potential pullback in the near future. If we spot a wave 4 correction, we will reassess and update the chart for a potential new entry.

Bitcoin projection for this bull runLooking for short positions at the upper limit , that is when i usually enter short.

Around the 91k region there is a resistance.

I expect a 25-30% correction from that region. After that bull run will resume its run and stop at around 115k .

It can go higher ,nobody knows how high it can go but this is what trendlines are telling us.

AVAX vs BTC | ALTCOINS | Life Changing IF This Pattern Plays OutFractals have been used for years as possible suggestions to map how money moves in the financial market.

This is what gives them significance; they draw out a sort of map. The hard part about fractals though, is that they often appear cross markets and it is no easy feat to spot similarities on large scale. However, to the seasoned eye, fractal-spotting becomes easier over time.

There is a misconception that fractals can only be used in the same timeframe. This is simply because, as with Bitcoin, there is a large history of candles (data) that plays out in an elaborate pattern. Daily candlestick patterns become lost in weekly patterns, even though the general direction / macro is the same.

In the case for AVAX, a similar pattern has been observed in BTC before the COVID pandemic - and it has been playout out perfectly, so far.

______________________

BINANCE:BTCUSDT

COINBASE:BTCUSD

BINANCE:AVAXUSDT

Silver - Just Starting The Parabolic Rally!Trading update on Silver ( TVC:SILVER ):

Click chart above to see the detailed analysis👆🏻

Silver just perfectly completed the bullish break and retest and is about to reject the next horizontal resistance level. However everything is still significantly bullish and I honestly do expect a breakout soon. Following the previous cycle, Silver might rally another +35% from here.

Levels to watch: $34, $45

Keep your long term vision,

Philip (BasicTrading)