If BTC closes today above MA200, bullmarket has startedWell, I might have been wrong after all. But then again I was always stating that there is a 20% chance that BTC surprises us, and does something crazy, like this pump here.

Now, what to make of the pump?

It entirely depends where the daily will close today. If above MA200/log resistance, at around 4600, then the chances are really good that we start the next bullmarket. Earlier than I expected. In this case, I will have to revisit

my longterm projections, since this might have some implications on the timeline and the height of the next peak. Could be sooner now, as early as 2021, but then probably not much above 100k as ATH target.

However, if we have a situation like on 15th of October 2018, you remember, the 1000USD pump from, 6500 to 7500. And then only a few weeks later the massive dump from 6500 to 3100.

Well, if we close today at 4500 or below, the chances for this candle being an epic bulltrap, are greatly increased.

In this case, the bearish target at 1800-2300USD remains intact and all longterm projections as well.

Let's see what will happen today, and I will update the longterm projections afterwards if necessary.

Rally

another one shitcoin which ready to bullish rallybullish consolidation after successful breakout from falling wedge.

weekly RSI forming bullish movement

volume rising organically, without pumps&dumps or pleb-FOMO

buy: now

sell: 0.00080-0.00087

profit calc: ~135% of gain

hodling duration: ~4 months

Rare crossing : huge move?I've never seen such a pattern in the S4W Horizon indicator. It's really a very tight

crossing that is happening. I think it's an ignition point to something big to occur.

So based on my analysis, I won't be surprised to see an important bullish move.

But I think also there is a correction, unfortunately to occur at 3850 USD.

Right now the S4W Horizon indicator is still bullish, let's see if that micro-crossing

is talking for a big up move or for something else.

Right now, as I said, I don't have a clue, since it's new. but I think it's an important

moment that occurs since that crossing is showing up.

I can't tell more. Let's watch.

Don't take my words for granted, analyze, analyze, then trade at your own risks

PS: if you like my analysis, join to get more analysis. I like to be Liked too (like/2/B/Liked/2)

The two possible paths I see for LTC in the coming weeksI have to admit that LTC is more bullish than I thought. Apparently everyone is anticipating the halving rally, therefore it takes place even earlier than in 2015. Now, I see two paths, depending on the behavior of BTC in the coming weeks.

1. Green path: BTC doesnt dump soon, instead goes sideways, or even upwards retesting the logarithmic resistance.

In this case, I think LTC will reach the top before the BTC dump, then the BTC dump will lead to LTC crashing, and ending the rally.

It will then bounce together with BTC and stabilize, leading to a longer accumulation phase.

2. Red path: BTC starts dumping soon

In this case, I see the LTC rally abruptly ending, LTC will dump together with BTC. As LTCBTC ratio will drop also, I see the low of LTC then being quite low, possible double bottom, or even lower.

But when BTC rebounds, this will lead to an epic rebound in LTC, and it will go from the low, directly to the top of the LTC halving rally. The top here however would not be so high as in the

green case.

Either way, if one would be to catch the BTC dump and accordingly LTC dump, this could generate a really good trade, because the bounce would be epic either way, and an x3-5 would be possible.

Of course now you can say, but what about BTC not dumping any more at all?

I still think the likelihood for that scenario is low, but if it were to happen, then LTC would crash at some point simply due to being overbought on all timescales, in LTCUSD and in LTCBTC.

The result would be similar to the green curve, albeit maybe the accumulation area might be a bit higher pricewise.

So these are my thoughts, I am examining LTC carefully, and seeing what BTC does.

USDJPY: The rally shows strength The USDJPY currency pair on the 4-hour timeframe has been following an uptrend since 3 February. The price reached 112.136 on 5 March (The highest level of 2019). The price action in the USDJPY is mainly driven by the strength in the US Dollar. Traders eagerly waiting for the Non-Farm payroll numbers from the US and clarity on the US-China Trade deal for clear direction.

The 4-hour chart of the USDJPY confirms the positive sentiment in the price movement as the pair is making successively higher tops and higher bottoms. The lowest value of the period under study was recorded on 3 February when the price registered the low of 109.441. Since then, Bulls are in full control of the market as the price reached the highest level of 2019 on 5 March (112.136)

By applying Oscillators analysis, all three indicators confirm the positive bias in the market. As the chart shows, price is well above the 200-period Moving Average. The MACD (Moving Average Convergence/Divergence) is recording values above the zero-line which shows positive sentiment in the USDJPY currency pair. RSI (Relative Strength Index) showing values above 50 which means strength in bullish movement.

Despite of the recent pullback in USDJPY, the rally shows strength because of the strong US Dollar. First resistance level lies at 112.136, once the price break this level, bulls will be able to push the price to register fresh high of 2019.

Disclaimer:

This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

FOMO is coming. If you don't have ETHEREUM, you are missing outAs I previously mentioned in the previous analysis (check the related idea!), Ethereum is moving the market up.

The good thing is that there is a big chance, this is not over.

Last resistance sitting in the 160 area, but I'd bet we will break also that one soon.

After that, Ethereum could rally in a short period of time over 200$, and then sitting in the 200$ area for some time.

If you don't have some, this is the right time to buy.

If you don't like risk, buy after 160$ is broken, but it could be too late.

Bitcoin and 4kBitcoin today faced rejection at 4k , which is a strong psychological barrier. Many bought in high , close to that 4k point or we wouldnt have peaked there. It is my unprofessional opinion That if BTC does NOT breach 4k by Friday and stay there , that Sunday will be a day of a massive selloff , as is often normally the case with crypto market cycles - however this time is different as those people who bought in at 3990 and higher, lower even are going to have stop loss measures in place or simply want to minimize their losses. This especially if BTC dips below 3900 for a sustained period of time during the week.

I am not a professional financial adviser , and this is not to be construed as the predictions of one. Rather , it should be viewed as for entertainment only ;), but be careful. Unless you have the money to HODL , still have faith in that strategy , I would keep a close eye on these levels if you have an open trade with BTC, and this extends to the alts as well; we all know what BTC does to alts, however - if it is to fall to 2k or less, at some point people will seek a safer harbor , and alts may eventually, in my opinion, benefit from a BTC crash.

BTC can only drag alts with use cases down so far until they emerge from the potential carnage.

Fortis Fortuna Adiuvat - and to wit , the market seems very timid, and very scared , otherwise Bitcoin would be rocketing right now. Nobody was willing to commit at >4k.

In my humble opinion, that speaks volumes.

There are several actions that could obviate the above- Bitcoin steady in the 3900 range for more than a couple of days; the further commitment of whales who kept buying as the price rose etc..

Good luck and play it safe.

BOUNCE TO 4900 BTC/USD ?We just bounced of the 200 weekly MA. Therefore we will likely see a bounce to the upside. Question is how high we will go?

I have 4900 BTC/USD in sight over the next couple of weeks. There will most likely be a retest of the 200 weekly MA once we have had the counter rally, so don't chase it if you entry isn't good.

MTL : Ready for the MID term Profit OpportunitiesAs stated below MTL achieved all our short term targets and now is ready to rally for the mid term profit upto 100% profits. We will update the status soon. Stay tuned.

#SignalAchievement #TargetsReached

#Pair : #MTL / #BTC

All our MTL short term targets are achieved within 6 days.

A total of 20% profits for short term traders.

Reached : 7120 sats

Total Profits : 20%

Total Duration for Achievement : 6 Days

With Regards.

Team TWA.

Target 1 : 6320 sats

Target 2 : 6550 sats

Target 3 : 6740 sats

Target 4 : 6920 sats

Target 5 : 7190 sats

EW ANALYSIS: Bitcoin Cash Ready To Fly?!Hello Crypto traders!

Let's talk about Bitcoin Cash!

Bitcoin Cash was one of the first in which a rise occurred at the end of December in 2018. And now, it could be the first one that can complete a correction since we see both, BCHUSD and BCHBTC at important support area between 61,8% and 78,6% Fibonacci retracement!

But, the most important from EW perspective is that we can clearly see a three-wave a-b-c corrective structure from highs, where wave "a" is a leading diagonal, wave "b" is a triangle and motive wave "c" ended by five waves!

That said, we really like Bitcoin Cash for a potential bullish turn here, but we need confirmations, so if we see a sharp bounce or a five-wave rally away from current support area, followed by a break above previous wave "b" (BCHUSD above 167 and BCHBTC above 0.043), only then we can confirm a completed correction and we can start considering bullish scenarios!

Invalidation levels remain at December 2018 lows!

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All of our work is for educational purposes only.

Rally done or just pullback? Maybe bear trap: too soon to short?Caution is in order, this rally has faked us out twice already, looking near pivot, then jumping higher. Bears been expecting a double bottom formation and still are waiting.

On the daily chart Sand P has an Elliott Wave bullish impulse form developing, rather than the ABC many contributors have suggested. The segment labeled (3) is quite a bit longer than the (1). In an ABC countertrend, if these were A & C segments, we'd expect them to be nearly identical in length; these are not, and (3) has both broken above the 0.50 Fibo and exceeded the previous downtrend low price of higher order (1) from October, violating EW principles for an ABC.

If this pans out, we can expect a Fifth rally wave to touch the 0.618 Fibo. Today's price turned back from the TL reaching back to 3 Sep. A lower order TL from Nov suggests a Fifth wave could get to near 2712 price. Any positive news in a market pounded with worrisome tweets will do it. The EOD pivot on 1/22 also implies a bullish undertone.

Market index has closed the gap up from Friday's enthusiastic runup. Was this an exhaustion gap? It may have just a bit left to run, perhaps within 2-3% of the rally top now.

Still too early to short IMHO.

In my other idea on Dow I suggested the TL and Fibo both coincide at price $25040, just a bit over 2% above today's close. Let's see if the bulls can get it up there.

As always, this isn't advice, just another crackpot idea, trade at your own risk; GLTA!

PS I labeled this idea "Neutral" as it is a study of price near a pivot, which may have come, or may still be yet to come soon.

H & S Pattern on Daily WTI US OIL Chart. Oil Rally Ahead ?We are already shorting the USDCAD that is driven mostly by the prices of OIL. the chart just confirms that US OIL is set make significant gains soon as the head and shoulders patterns is nearly set for completion. Should the pattern complete we can expect the USDCAD to fall as well to around 1.3000 level.

Its a great opportunity to trade OIL at the moment however let the neckline break and the daily 50 EMA too and let the price retrace slightly before going LONG on this commodity. have a look at the related link to the trade and analysis behind the OIL related USDCAD Pair.

cheers

Earnings for C, Citigroup Bank: HFT Gap ExpectedCitigroup reported ahead of open today which indicates it hoped that the market open would inspire buying of its shares of stock. HFTs are set to trigger on earnings news. How it might gap depends on the algorithm focus, retail crowd reactions, retail broker expectations, and the triggers set ahead of open. C has the same negative divergence as AAPL has on the weak “rally run” up after bouncing off of technical support levels best seen on a weekly chart. Today’s chart is a daily chart to show that the run is weak and poised for a potential gap.

Bitcoin : Bull Flag Creation - A chance to see a light.Bitcoin has been in consolidation during the holiday weeks and showed some improvement by the end of the weekend. And it showed a good uprise and is now testing its resistance and support levels. We might see bearish influence downwards upto 3850-3900 USD area and if bears can continue pentrating and broke the resistance we might see another leg down movement in the following week. But if Bulls can hold their strength and can broke the 4150 USD for sure and close above that resistance area around 4200 USD we might see a good upward move. This could also be a good thing for the alts which are not doing totally good for the last 1 month and a half. In the 4H chart both EMA50 and EMA89 are way lower than the price and RSI is at 61 showing a balanced chance for an upward move. If the bull flag creation is going to be confirmed our short to mid term targets given in our earlier call can be achieved very soon.

Good Luck.

Legal disclaimer:

Information on this channel is our team's analyst's "opinion" based on data available at this point in time. These opinions are not recommendations to buy or sell securities/commodities and cryptocurrencies. Trading and investing is a risk and you should not rely on this data to make any financial decisions. You must consult a financial advisory licensed by regulatory agencies in your legal jurisdiction. All information stated here and in our reports don't guarantee any possible profits or losses. Please do consider to do your own due diligence and research when making any kind of a transaction with financial implications.

With Regards. TeamTWA.

You can give us your feed backs and suggestions on our effort in addition to this your questions here in trading view or in our telegram channel by the same name togetherweaccumulate.

Bitcoin Reverse H&S ConfirmedEngulfing candle confirms bitcoins short term rally and time to setup distribution targets.

Short Term Distribution Targets

Target 1 : 4093 USD

Target 2 : 4370 USD

Target 3 : 4648 USD

Target 4 : 5043 USD

Stop Loss : 3340 USD

Good Luck.

Legal disclaimer:

Information on this channel is our team's analyst's "opinion" based on data available at this point in time. These opinions are not recommendations to buy or sell securities/commodities and cryptocurrencies. Trading and investing is a risk and you should not rely on this data to make any financial decisions. You must consult a financial advisory licensed by regulatory agencies in your legal jurisdiction. All information stated here and in our reports don't guarantee any possible profits or losses. Please do consider to do your own due diligence and research when making any kind of a transaction with financial implications.

With Regards. TeamTWA.

You can give us your feed backs and suggestions on our effort in addition to this your questions here in trading view or in our telegram channel by the same name togetherweaccumulate.

DAX: Swing-Setup! THE RETEST of 11.000! Nice chance to BUY!Hey tradomaniacs,

welcome to another free signal!

Important: Wait for a breakout of the yeeloq resistance and buy the retracement!

The market is very volatile so keep your risk low!

-----------------------------

Type: Swingtrade

Buy-Limit: 10.875

Stop-Loss: 10.700

Target 1: 11.075

Target 2: 11.263

-----------------------------

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)

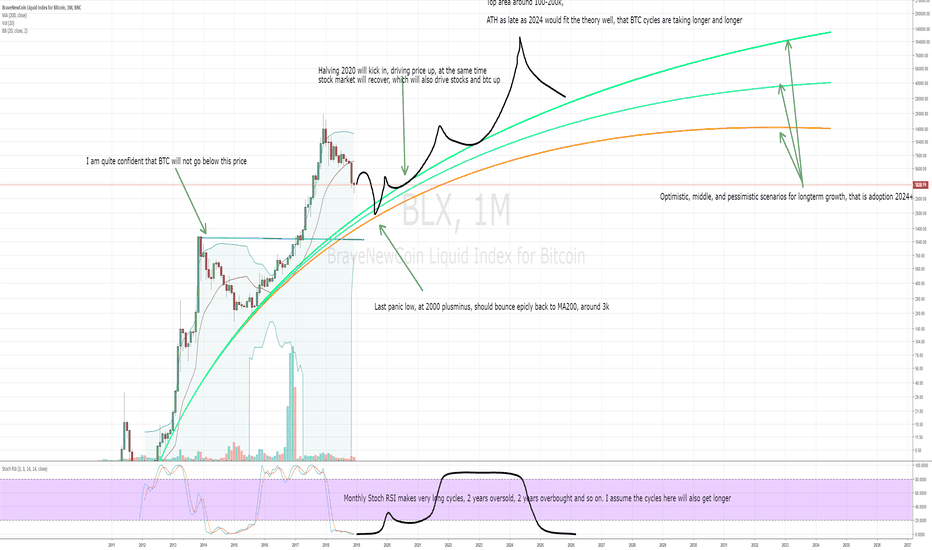

BTC monthly view and possible future scenarioIt's time for another view at the longterm picture, and for that, we must zoom out again to the monthly timeframe.

It is apparent that this structure here is a bit different from the last bearmarkets.

The subsequent bullmarket could therefore also be different.

I think that BTC cycles are getting longer.

One must think of BTC as a physical pendulum. The more mass it acquires, the more people are in it if you will, the more inertia it has, and the slower

it reacts to changes.

Therefore, I think that the next ATH might be as late as 2024 (latest possible date), but I don't see it make new ATHs before 2022, that is for me the earliest possible date

for prices well above 20k.

I still am convinced that another shakeout will occur, this would also fit the theory that BTC is currently coupled to the stock market.

Stocks will probably see a brutal sell-off sometime in 2019, and that could co-incide with the BTC low.

If it goes to the 2k area, it should bounce strongly.

So for me, everything significantly below 3k is a very strong buy and longterm hold.

Halving 2020 WILL come, and WILL drive up the price again, I am absolutely certain of that.

Look at daily transactions, they are rising again, and will make new ATHs too. Rising Tx, rising users, plus halving will drive up price. This is like a law of nature, hehe.

Since I am a physicist, I tend to see BTC as a physical system, with certain laws. And for me, these are laws, which will push BTC up again, no matter what.