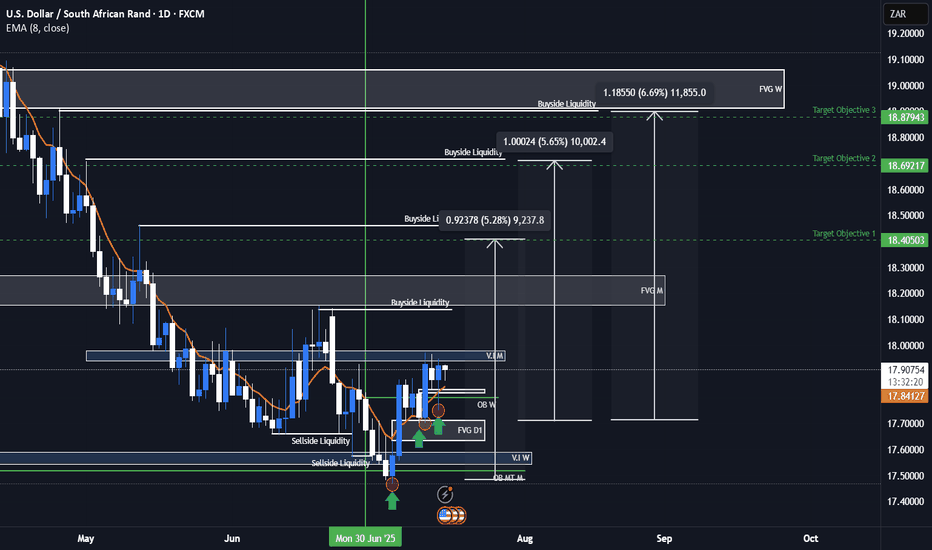

USDZAR Bullish ideaAs we can see this is our USDZAR quarterly shift idea were we are anticipating price to rally to the upside toward our draw on liquidity objectives. We had a weekly volume imbalance and monthly mean threshold order block show us support after we took out major liquidity points. We also showed more support on our daily FVG and a market shift taking place after a displacement. We are anticipating a rally for USDZAR and will be looking to see how price plays out.

USDZAR is an exotic pair that is part of the emerging markets and emerging markets/exotic pairs can usually lead ahead of major forex pair or lag between major forex pairs so this can also help us with our intermarket analysis of forex pairs when determining our dollar strength against other basket currencies.

RAND

I wish I was wrong with this but now it's looking better EUR/ZAROk so this was painful.

The W Formation neckline broke above and since then headed to the target at R22.00 a EURO!

For someone who travels to Europe a lot, it's not easy on the rands.

But since it hit the target, it turned down and hopefully will stay down for now.

We are currently at R20.34 with a first target at R20.00.

And if it breaks below that we COULD see R19.00 again.

But you'll be the first to know and I'll send the analysis.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDZAR sailing in turbulent Trump tidesLast week has been a rollercoaster for the ZAR after gaping up and touching a high of 19.00 in the early hours of Monday morning following the news of Trumps executive order. The rand however regained its footing as the news got digested which allowed the rand to pull the pair below the 50-day MA currently at 18.45. It seems as if an ABC corrective wave has taken place which is indicative of another 5-wave impulse higher for the pair.

The 50-day MA at 18.45 and the current yearly low of 18.30 serve as the critical levels to watch on the pair. A failed break below 18.30 will create a double bottom at this level which will leave the rand stranded ready to be pulled higher towards 19.22.

A break below 18.30 will however allow the rand to pull the pair out of the current upward channel and test the 200-day support at 18.12. This move will invalidate my current idea on the pair.

The main event to watch for the week is the US CPI print for January, which is expected to remain unchanged at 2.9%, just like it did back for the December print. US inflation has been ticking higher since October last year, almost right after the Fed started their cutting cycle and anything other than an inline or lower than expected CPI print will have the USDZAR packing and making its way above 19.00 since it will indicate that the Fed will stay higher for longer.

USD/ZAR choose your bets - Up or Down? Sadly I say up to R20 :( USD/ZAR has remained in a symmetrical triangle since January 2023.

This is a consolidation period of neither winning between the buyers and the sellers.

But we are now approaching the apex 3/4s. And a breakout is imminent.

NOw if we look at the pattern, it has a bullish flag pole which is favourable for the bulls to take the USD up to R20.00 against the ZAR.

I hope we broken down below the support which will take it to R16.00. And I hope I am wrong that it will be going to R20,00.

But unfortunately, I can't be biased and it looks like the next target above the resistance will be R20.00.

Trade Alerts: SA Rates and BoC Decision Trade Alerts: SA Rates and BoC Decision

South African Inflation

South Africa is expected to maintain its key interest rates at 8.25% and 27.25% on Thursday, citing persistent inflationary pressures. Central bank Governor Lesetja Kganyago has emphasized that rate reductions are unlikely until inflation sustainably returns to the 4.5% midpoint of the target range. Despite annual inflation holding at 5.2% in May, it has remained above this midpoint for over three years. Kganyago, in the central bank’s annual report last month, stressed the importance of restoring confidence in their ability to achieve this target.

Bank of Canada Decision

The Canadian Dollar (CAD) weakened on Wednesday as investors reassessed Consumer Price Index (CPI) inflation data released earlier in the week. While headline inflation figures showed a decline due to easing pressures in heavily weighted measures, core inflation gauges remained elevated. The Bank of Canada (BoC) is set to announce its latest rate decision next week.

Canada’s central bank is anticipated to cut interest rates next Wednesday in a bid to ease price pressures in the housing investment market. The real estate sector accounts for about 9% of Canada’s total economic output, nearly double the OECD average of 4.8%.

#GLD Newgold etf on the cusp of a massive breakoutNewGold ETF which tracks the rand price of Gold has been knocking hard on the R360.00 level. A breakout of this level should see an explosive move upwards which possibly supports the longs i am seeing in DRD and AngloGold. The break of the flat top triangle targets R386 which is an approximate move of 7% in the rand price of gold.. Good, especially for our local miners such as DRD, Harmony and Pan African #DRD #HMY #PAN

USDZAR to 13 rands per dollarBased on the chart, Im seeing nothing else but a sell from here. Weekly has a crazy divergence between the price and the RSI.

A Top was created in February 2016.

Range 19 to 20 rands is a liquidity area. from here if price does not break above 20 rands, then expect more price drops from here.

Based on my TA, from November 2023 till 22 January 2024 we were in a correction cycle to complete wave cycle 2, so from here im expecting a further drop for wave cycle 3 an Impulse down which always comes after correction, then once wave cycle 3 is complete then i will come with an update because we need to also have wave cycle 4 and 5.

So basically this year is gonna be changing for Rands against dollar. Im just here wondering on whats gonna happen with the S.A politics which is gonna lead to rand gaining strength against the dollar, but lets watch and we gonn see. Im just excited for this year man.

13 Rand per dollar is comingremember my previous rand idea, this is what it is based on.

Daily timeframe we sold around 19 rands, because we had just completed a correction cycle Y which is a top when looking on the weekly timeframe.

From 19.80 rands we have been in a sideways correction, so for the correction cycle to be complete, we need to break below 17.60 and break above it again, otherwise we will continue dropping till 13 rand, which is my hopeium target for rands.

#USDZAR stuck between 18.95 and 18.20. USDZAR some interesting developments for the Rand bulls. 50dma < 200dma (death cross). 3 lower highs forming what could be a potential flat bottom triangle with the base at 18.10-18.20.

Some bullish characteristics here which could be shifting sentiment in favour of the bulls but it's still too early too call. Range bound between 18.95 and 18.20 now. A convincing break above or below the two levels will be needed to force a move in either direction.

#USDZAR daily analysisUSDZAR saw a bearish reversal off the important 18.75 level which was strong support previously. Should we trade below friday's low at 18.61, i suspect we will see a re-test of 18.43. However if no follow through of the reversal occurs and price manages to gain traction above 18.75 i would then expect the 18.90 level to come into play where we find the 50dma and the downtrend resistance. My gut says back to 18.43 the more likely action given friday's candle structure

South African rand in trouble - Next target R21 :(Inv H&S has formed on the USD/ZAR since 6 June 2023.

The price has recently broken above the neckine, showing the US dollar is poised for upside.

The DIXIE (US Dollar Index) is also showing upside to come.

7>21>200 and confirms the US dollar is going up.

RSI>50 - Bullish

First target is R21.00

ABOUT THE DIXIE:

HOW IT’S CALCULATED

The USDX is calculated by the Federal Reserve Bank of New York and is based on the exchange rates of six major currencies: the euro (EUR) – Accounts for 57.6% - ,Japanese yen (JPY), British pound (GBP), Canadian dollar (CAD), Swedish krona ( SEK ), and Swiss franc (CHF) .

USD/ZAR upside to R21.72 after a resistance breakout Rev C&H has formed on the USD/ZAR.

If we get a slight retracement back it could be forming a Right shoulder to an Inv H&S.

Regardless, this looks bearish for the ZAR and bullish for the USD.

Other indicators are showing upside to come for the greenback.

7>21>200

RSI>50

Target 1 will be R21.72. Ouch for the rand.

The government and load shedding is really messing with the economy of this beautiful country of opportunities and diversification.

EUR/ZAR C&H to R17.32 - with a warningCup and Handle has formed over the last few months with EUR/ZAR.

We got a break down below R19.65.

Now it looks like there is further downside to come for the EUR which is good for the rand.

21>7

Price >200

RSI<50

Target R17.32

The big warning technically is that the EUR/ZAR is flirting with the 200MA. Until the price breaks down, then I'll feel more comfortable with this analysis.

USDZAR analysis with the rand to strengthen to R15.90?Right off the bat, I normally get short analyses wrong with USD/ZAR.

But the system is the system, so I have to keep to the rules.

Since the trade hit my first target at R18.90, it's been forming an Inverse Cup and Handle.

Now the price has broken below, which means the USD is likely to weaken from here.

The indicators however are conflicted.

7>21 (about to cross)

Price >200 - But the price could also drop below it entering a downtrend

RSI<50

Target 1 for this analysis is an absurd R15.90.

Let's see how this plays out. For argument sake, I hope it's right this time. Paying 27 US Dollars for 2 Prime cans was not the best investment of my life. And I know, I got ripped off!

3Q2023 USDZAR weekly timeframeBack in January I predicted that the USDZAR pair will climb to the 2020 high of 19.35 if the rand fails to hold the pair below the critical support rate of 16.80. We’ve seen this move play out, and then some, which saw the rand slide to an all-time low of 19.90 this week as the pair completed its 5th major impulse wave. Now it’s time to look at what lies ahead for 2H2023.

The critical rate to watch is at 18.66, the blue 38.2% Fibo retracement rate…

Based purely off the Elliot wave theory I predict that the pair will fall into an ABC corrective pattern in 3Q2023, similar to the corrective pattern we saw in the 4Q2022. The first support range (S1) for the pair sits between 19.15 and 19.35 (the blue 23.6% Fibo retracement rate and the 2020 high). A break below this range will allow the rand to pull the pair onto the blue 38.2% Fibo retracement rate of 18.66. A move into support range 2 (S2) will complete wave A of the ABC corrective pattern. Support range 2 coincides with the bottom of the blue upward channel that the pair is currently trading in as well as the top of the previous third impulse wave. I don’t see the rand gaining enough momentum to pull the pair below support range 2 at this stage.

Thereafter, the pair will retest S1 as it flips from a support to a resistance and the ABC corrective pattern will be complete after the pair falls back onto the critical support rate of 18.66. A break below 18.66 in the 4Q2023 will allow the rand to pull the pair out of the current upward black parallel channel and into support range 3 (the blue 61.8% Fibo retracement rate at 17.92 and the bottom of the ABC corrective wave at 17.67) which coincides with the 50-week MA currently at 17.64. This scenario is the best-case scenario for the rand in my opinion. For the rand to pull the pair below S3 we would need to see another strong bull market in the commodity cycle.

Conversely, if the critical support at 18.66 holds its ground the pair will remain in the upward black channel which will send the pair higher in the 20.00’s.

Weekly technical indicators: The weekly RSI suggests that the rand is heavily oversold at the moment which will allow the rand some breathing room, on paper. The weekly MACD is still holding a strong buy signal, but it is showing signs of fizzling out and rolling over. Overall, the technical indicators are supportive of a rand pullback into S1 and possibly deeper into S2. We have to wait to see how the market digests the NFP’s print later today but as it stands the pair could generate a hammer candle which will indicate the top of the current wave, which is also supportive of some relief for the battered rand.

Fundamental factors: The fundamental factors are unfortunately stacked against the rand. I’ll start with the factors I deem as rand positive.

Rand positive:

• For those familiar with my USDZAR ideas, I always look at the price of precious metals, particularly platinum as SA is the world’s largest platinum producer by a country mile (I’ll do a separate idea on platinum and link the idea in the comments). The platinum price topped out around $1130/ounce this year in April and has fallen roughly 12% since then. The metal is however finding support around the $1000/ounce level which is positive for the rand and platinum. The price of platinum looks set to remain supported by the fact that the platinum market is expected to remain in a substantial deficit this year, largely due to the sanctions imposed on Russia and SA’s mining production constraints largely caused by the current electricity uncertainties. (www.reuters.com)

• Regarding the liquidity landscape and US monetary policy, it seems as if global financial conditions are easing, and excess liquidity is rising, which will allow the rand to hopefully attract some foreign fiat given the rand’s carry trade appeal. Short-term rates seem to be peaking not just in the US but globally. Once global rates have peaked, it will allow the market to price in a future cyclical upturn for the US economy. Longer-term yields will capture this sentiment by moving higher as investors will prefer riskier assets (such as the rand and SA bonds) to reap the rewards on buoyant liquidity conditions. The US debt ceiling debacle will also be resolved soon which will bring investors at ease that more fresh liquidity will hit the markets.

Rand negative:

• The rand negative factors are largely due to the ongoing geopolitical factors, but before we get into that I’d just like to touch on SA’s trade balance. Earlier this week SA’s latest trade balance results were released, and the trade surplus is fizzling out. The last three trade balance totals were R10.71 billion, R6.30 billion and the latest balance stands at R3.54 billion. This decline in SA’s trade surplus is rand negative.

• In terms of the geopolitical landscape and SA’s electricity uncertainties things aren’t looking pretty for the rand. The SARB’s Financial Stability Report from May 2023 did not make for pretty reading. The major idiosyncratic risk, which is still fresh to market participants, is the deterioration of SA’s diplomatic relations with the US following the comments by the US Ambassador to SA on 11 May 2023. Despite the claims being baseless, SA’s non-alignment stance in the conflict in Ukraine is hugely rand negative. The SARB highlighted the risk of secondary sanctions which could be imposed on SA due to the neutral stance. US Secretary of the Treasury, Janet Yellen, also explicitly warned SA when she visited back in January this year, to take the sanctions imposed on Russia seriously. Coupled with the Financial Action Task Force grey listing of SA financial institutions in February this year the potential implications for the SA economy are severe. If secondary sanctions are imposed on SA, it will make it impossible to finance any trade or investment flows, or to make or receive any payments from correspondent banks in US dollars. Furthermore, more than 90% of SA’s international payments, in whichever currency, are currently processed through the Society for Worldwide Interbank Financial Telecommunication (SWIFT) international payment system. Should SA be banned from SWIFT because of secondary sanctions, these payments will not be possible.

• Additionally, the SARB highlighted SA’s electricity uncertainty and deteriorating rail and port infrastructure. In connection with the declining infrastructure is the amount of State-Owned Enterprise (SOE) debt relative to SA’s emerging market peers. SA has one of the highest SOE debt among emerging market currencies and as the government takes over the SOE debt the local tax payer and bond investor will have to foot the bill.

• The above-mentioned factors have led to a mass exodus of funds out of SA and as mentioned earlier, local investors will have to absorb the sell-off from foreign investors. The proportion of SA Government bonds held by foreign investors has declined from 42% in April 2018 to 25% in February2023.

If you got to here, I highly appreciate you taking the time to read and review my idea <3. I’ll update this idea as 3Q2023 progresses.

USD/ZAR pre SA GDP printThe rand has now posted convincing gains in the past three sessions off the back of an increase in global investor risk appetite following a strong US NFP’s print on Friday and the conclusion of the US debt ceiling debacle. An ABC corrective pattern seems to be the most likely move for the pair at the moment as per my previous idea linked below. The rand has managed to pull the pair into the first support range (S1 on the chart) and the 23.6% Fibonacci retracement level is now firmly in the rand’s crosshairs. A break below S1 will allow the rand to pull the pair onto the psychological rate of 19.00. The rate at 19.00 is will probably show some strength but I expect the rand to pull the pair lower onto the 50-day MA rate of 18.64 which coincides with the 38.2% Fibonacci retracement level and the bottom of the current upward channel.

Looking at the fundamentals there is not much supporting the rand but the expected increase in debt issuance from the US following the raising of the debt ceiling will allow risk assets such as the rand to soak up some fresh dollar bills. The 1Q2023 South African GDP results will be released tomorrow and expectations are for a year-on-year 2.2% growth print, up from the disappointing results of 0.9% in the 4Q2022. A print in line or higher than expectations will boost the heavily oversold rand, but we’ll have to wait and see how the SA economy fared given the low electricity supply in the 1H2023.

In terms of the technical indicators, there is a cross over sell signal on the daily MACD and the RSI is trending lower with plenty of room to drop before hitting oversold levels.

1H2023 USD/ZAR (weekly timeframe)Background (a quick look back): The rand's covid recovery, on the back of the Fed’s QE infinity policy and a strong commodities rally, ended in June 2021 after the rand managed to pull the pair to a low of 13.40. The rand got hit by a quick one-two in the middle of 2021 as the DXY found support around 90.00 and the local riots in July which saw the local unit tumble to 16.40 by November. This created the first major impulse wave.

The rand managed to pull the pair to a low of 14.40 in 1Q2022, but the party ended when the Fed started its current interest rate hiking cycle at the end of the quarter. Platinum prices also topped out at $1156/oz in the beginning of March 2022. The hiking cycle, external geo-political, global recession, local energy uncertainties and a 28% decline in platinum prices (from March to September) pulled the pair into a 5-wave rip tide (orange channel) to a yearly high of 18.60.

The final quarter of 2022 saw the rand stage an ABC corrective pattern which allowed the local unit to pull the pair onto the 38.2% Fibo retracement rate of 16.86. The main factors which supported the rand’s recovery was the DXY which fell off its high of 114 in September and the price of platinum which bottomed at $825/oz in the same month. Platinum has since gained roughly 32% and closed on a high of $1088/oz in the first week of January 2023.

Present (where to next): The rand managed to pull the pair onto the critical 61.8% Fibo retracement level of 16.80 from the covid recovery (green) in the first week of January 2023 after a stronger than expected non-farm payrolls report sent the DXY and US 10-year yields tumbling. The critical support range between 16.40 (top of impulse wave 1 and 50% orange Fibo retracement) and 16.80 will give an indication for the rand’s trajectory in 1H2023. The 50-week MA rate of also sits satisfyingly in this range at 16.47.

Support: A break below 16.80 will allow the rand to test the 50-week MA and the bottom of the support range at 16.40, the top of the major first wave. A break below the support range will invalidate the major 5-wave impulse wave which could see the pair fall between the orange 61.8% Fibo retracement rate of 15.88 and the 50% green retracement rate of 16.09. The best-case scenario for the local unit in my opinion is an appreciation onto the 200-week MA rate of 15.61 (this move does not seem highly likely now since the Fed is only expected to ease/pause its hiking cycle in the 2H2023).

Resistance: The first resistance rate which needs to give way for continued rand weakness sits at 17.30, the top of the orange third wave. A break above 17.30 will allow the pair to climb to the top of the corrective wave B at 17.96 and the psychological rate of 18.00. A close above 18.00 will confirm the fifth impulse wave to the covid high of 19.35.

Technical indicators: The weekly RSI is still trending upwards since hitting the oversold range in June 2021 and is current at a neutral level of 49.21 which is rand negative. The weekly MACD is currently holding a sell signal which is rand positive but the gap between the 12 and 26 EMA’s seems to be closing.

(SA is the world's leading platinum producer and the rand behaves like a commodity currency hence the emphasis on platinum price action in the description)

GBPZAR UPDATE Still on the way to R25.00 to the poundThe charts never lie!

I posted this trade alert in October 2022 with the massive Falling Wedge on the Weekly.

It broke above the R20.35 and it showed the next strong resistance at R25.00.

target will be R25.00.

I called it a long term analysis but changing it to a MEDIUM term analysis because of how quickly it's accelerated.

I guess we can only wait for the target to reach until the next trade alert is given.

Poor Sout Africa and those holding rands (Including myself).

JSE ALSI setting itself for downside to 67,985 due to the bad RInverse Cup and Handle has formed on the JSE ALSI 40.

We need the price to break below the brim level and all hell will break loose.

MA 21>7

RSI < 50

Target 67,985

FUNDAMENTALS.

The rand is majorly in trouble, R19.80 to the US Dollar and R23.90 to the pound.

Is this because of load shedding. Is this because people are leaving the country due to the inefficiencies of the government. Is this because of the world markets coming down? Or is it a combination of all.

Whatever it is, we are seeing downside to come.